一条假新闻,一场爆仓过亿美元的牛市幻影

原创 | Odaily星球日报

作者 | Loopy

刚刚,BTC 完成了历史上最短的一次“牛熊转换”。

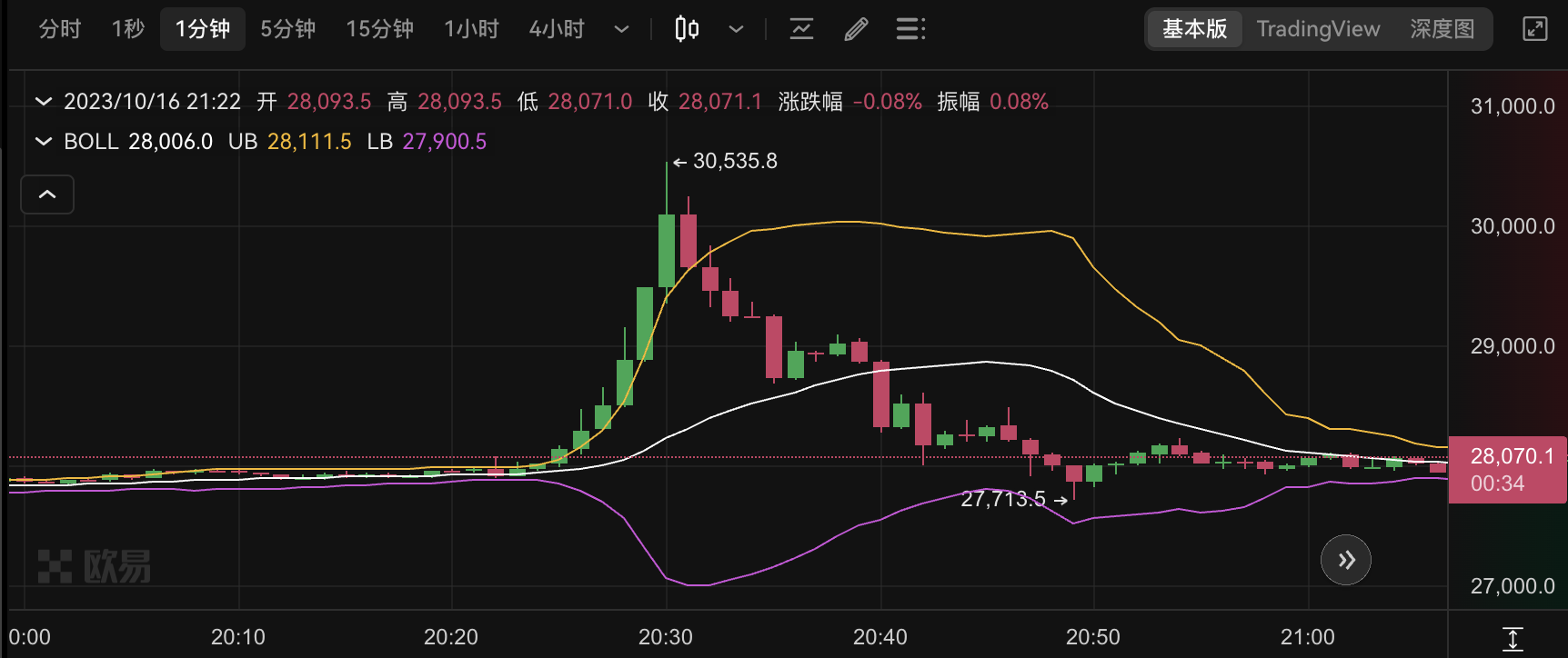

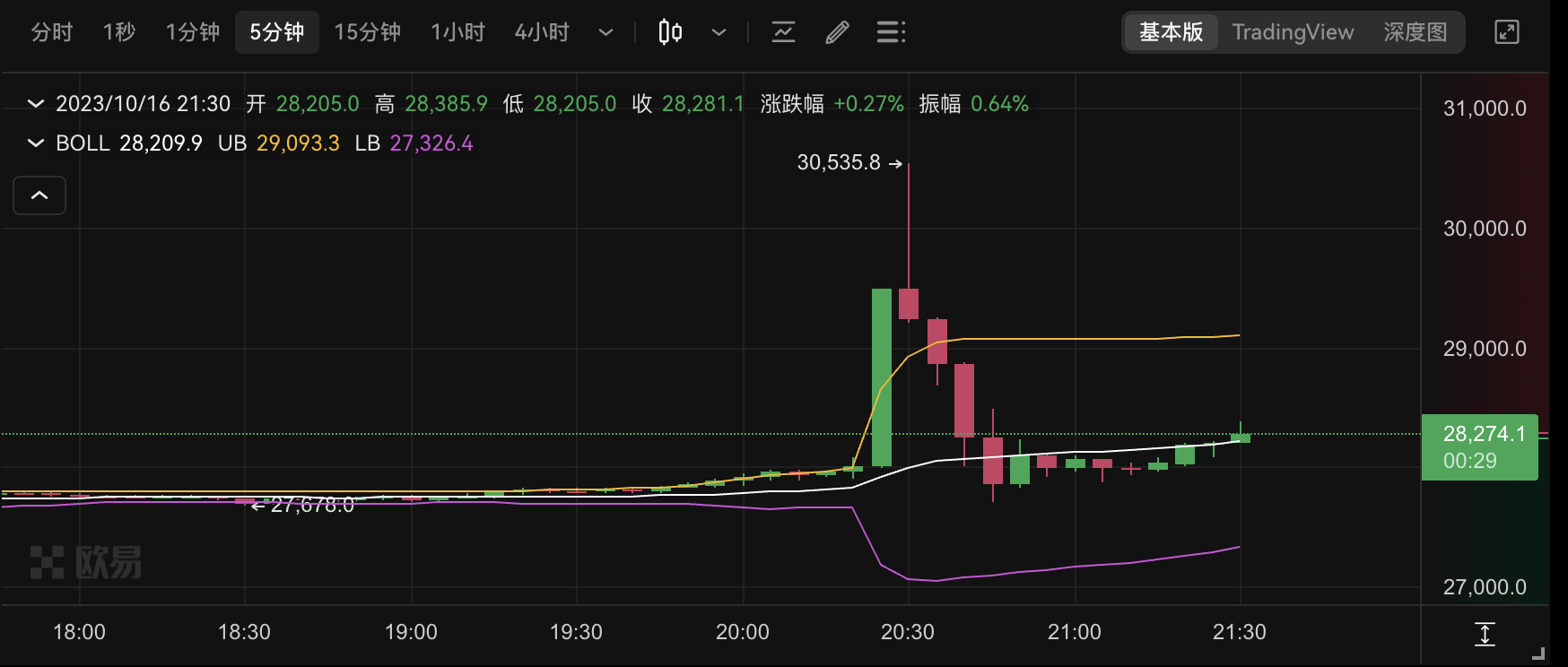

本次的爆拉急跌,短到走势可在 1 分钟 K 线上清晰可见。在短短数分钟内,BTC 快速走出多根阳线,且涨势愈发汹涌。欧易 OKX 行情显示,BTC 最高触达 30535 美元。

(图片横坐标为东 7 区时间)

在仅 10 分钟时间内,BTC 从不足 2.8 万美元,快速突破 3 万美元关口, 10 分钟涨幅高达 8.9% 。

但在触顶之后,价格迅速急转直下。牛熊转换,只在弹指一挥间。

(行情上下波动之快,甚至无法画出“门”字)

而这一切的起因,则来自于 Cointelegraph 在 X 平台(原推特)发布一则虚假新闻。

“假新闻”的一小时里,发生了什么?

北京时间 10 月 16 日晚间约 9 时 30 分,Cointelegraph 一则“比特币 ETF 获批”的新闻迅速传遍整个市场。

(“SEC 批准贝莱德的 iShares 比特币现货 ETF”)

而后,比特币立刻开始了快速拉升。整个市场迅速进入了狂热的牛市情绪。

但盘面的走向却似乎并没有那么乐观。正如前文所言,如此重磅的利好消息仅仅只让涨势持续了几分钟,走势快速的掉头,让人们对行情感到困惑——正如每一次“乌龙”事件一样,虚假信息并不能支持持久的盘面走向。

短短数分钟后,人们终于发现事情正在起变化:彭博 ETF 分析师 James Seyffart 在 X 平台发文表示,Cointelegraph 的“SEC 批准 BTC ETF”消息疑似为假新闻,除 Cointelegraph 外,没有任何其他公开第二信源可以佐证 Cointelegraph 的说法。

Odaily星球日报也在第一时间更新了这一进展。

Odaily星球日报查证 iShares 官网以及社交媒体,均未发布相关消息。

在质疑的声音发出 6 分钟后,确凿的信息终于出现。

福克斯记者 Eleanor Terrett 在社交平台表示,贝莱德刚刚向其证实 Cointelegraph 此前独家发布的「美 SEC 批准贝莱德的 iShares 比特币现货 ETF」是错误消息,他们的申请仍在审查中。

至此,比特币历史上最快速的一次牛熊转换正式走完,从不足 2.8 万美元,在十分钟内快速拉升超 2000 美元,又立刻跌回原位。而受到最多伤害的,恐怕就是合约用户的钱包了。

Coinglass 数据显示,在暴涨暴跌的 1 小时内,全网爆仓 1.05 亿美元,BTC 爆仓 6649.01 万美元,ETH 爆仓 1740.36 万美元,多单爆仓 3208.47 万美元,空单爆仓 7311.42 万美元。

Cointelegraph 做了什么?

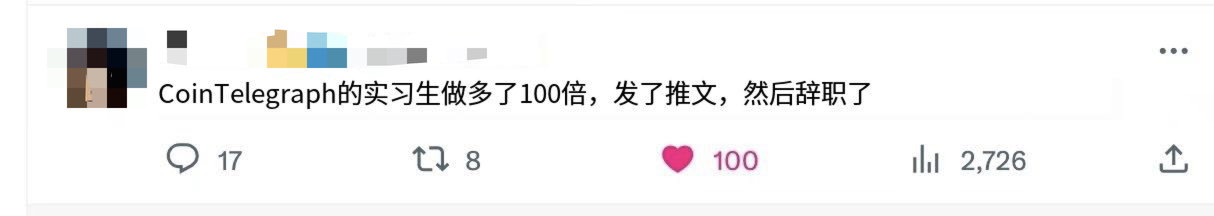

作为老牌知名媒体,许多交易者对 Cointelegraph 发出的新闻深信不疑。最后证实为假消息,让不少人感叹“莫非是实习生乌龙”。

(网友们对其动机进行调侃式推测)

而在这一新闻被辟谣之后,Cointelegraph 在事件发酵约 20 分钟后(即接近 22: 00 时),又重新发布了一条几乎完全相同的推文,仅多出了一个单词——REPORTEDLY。

“据报道,SEC 批准 iShares 比特币现货 ETF。”

第二条推文仅仅存在了数分钟,随后,两条 ETF 相关推文均已删除。此外,Cointelegraph 只在 X 平台上发布了假新闻,没有在自己的网站和其它渠道发布。

假新闻来自于何处?

彭博 ETF 分析师Eric Balchunas 发现,Benzinga 终端也曾出现了比特币现货 ETF 这一新闻。

Benzinga 一家专注于财经突发新闻的新闻公司。其产品定位与彭博终端机高度相似,并与之进行竞争。其内容来源涵盖各大主流财经媒体,聚合了大量第三方新闻。

而聚焦到本次“ETF 事件”,Benzinga终端上的信息显示,本消息的来源为路透社。

但目前为止,Benzinga 或路透社均未对该事件做出进一步解释。我们仍未知道这一消息的源头究竟是 Benzinga、路透社、还是 Cointelegraph。是否有人操纵市场。

最新消息,Cointelegraph 官方表示,对关于“贝莱德的比特币现货 ETF 获批”的错误信息传播感到抱歉,目前团队正在进行内部调查,调查将于 3 小时内结束,之后将与公众分享调查结果。

Odaily星球日报也将持续关注本次事件进展,后续相关内容将在本文中持续更新。