SignalPlus Macro Research (20230918): Probability of rate hike in September to 1%, new Ethereum proposal to slow down staking growth

Last Friday, the Chinese economic data improved slightly (industrial added value increased by 4.5% YoY, higher than the expected 3.9%), while the European Central Bank warned that it may raise interest rates again in December in an attempt to guide market expectations. In addition, the New York Fed's manufacturing index rebounded nicely (1.9 points), mainly due to a 25-point increase in new order projects, while the trend of import price inflation slowing down has slowed down, with a YoY decline of 3%, smaller than the previous 4.4%.

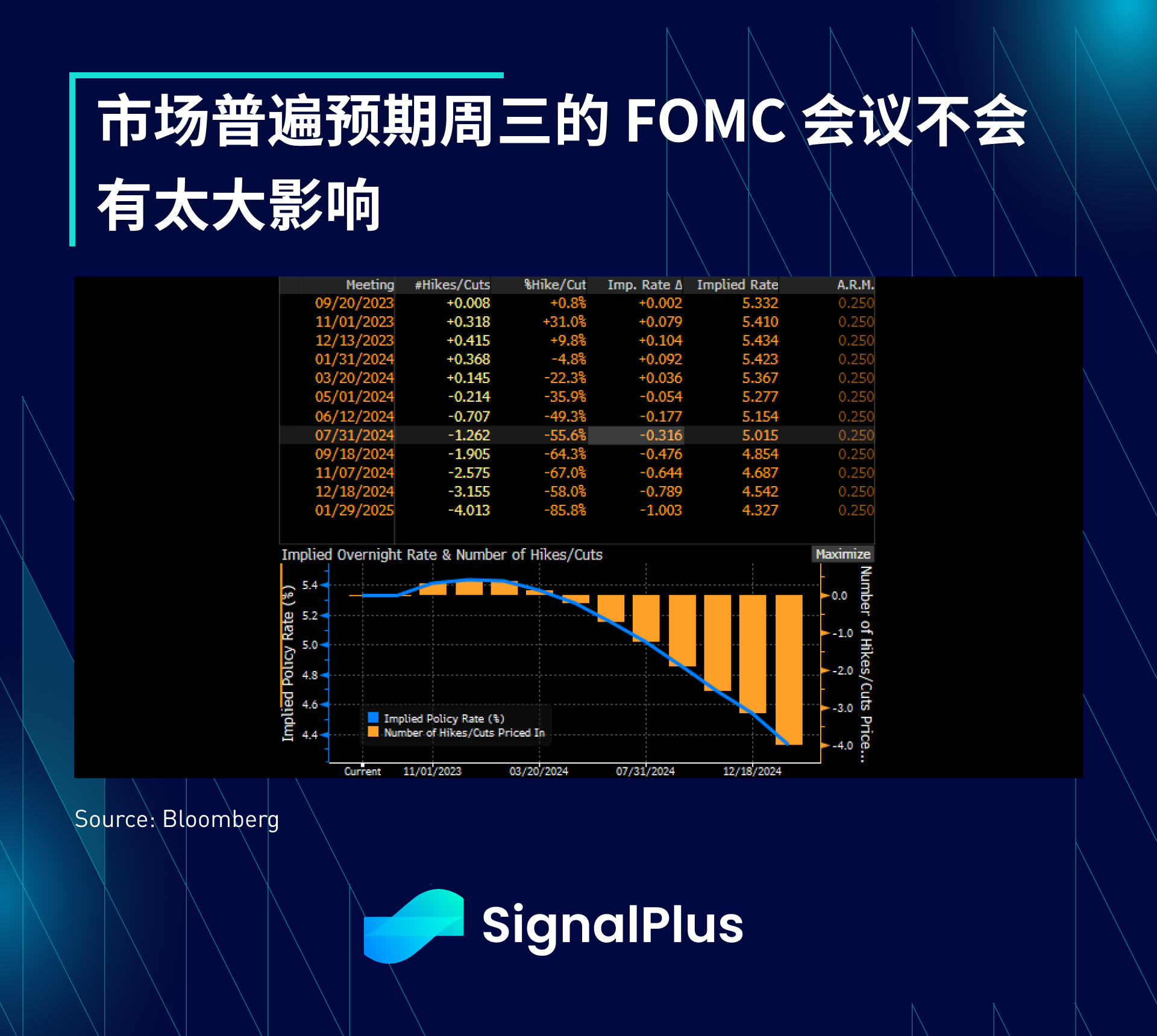

The US Treasury market did not see any relief throughout the week, with the 2-year yield closing above 5.03% on Friday, and the 10-year yield returning to recent highs of 4.33%; market pricing indicates a 99% probability of a pause in rate hikes at the meeting on Wednesday, while the probability of rate hikes in November has returned to recent lows, with only 30%.

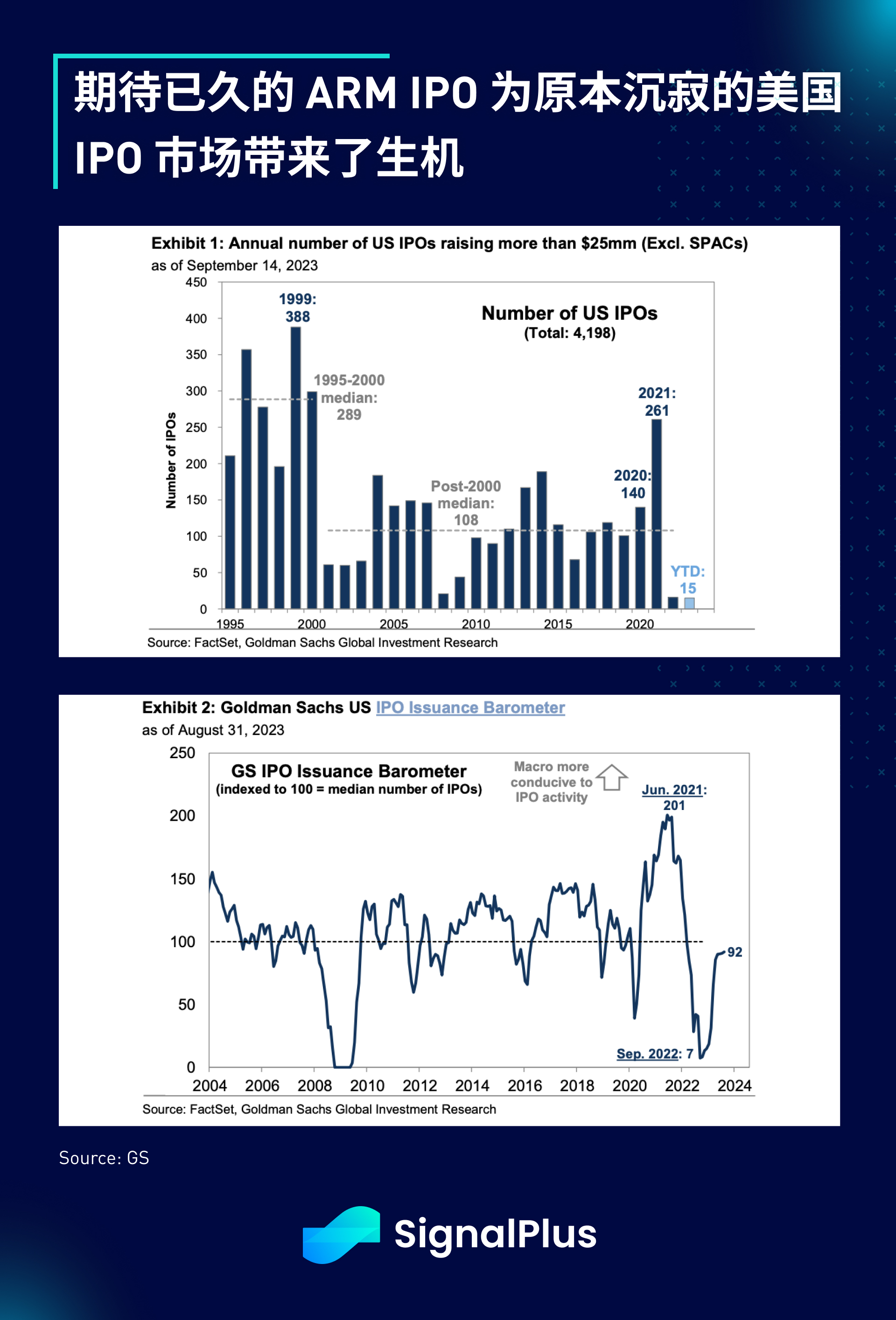

The stock market was quite active in the last 48 hours of last week. First, on Thursday, the long-awaited ARM IPO broke the long-standing stagnation in the US IPO market. The company's stock price rose 25% at the opening, bringing its market value to about $60 billion (PE ratio of about 110 times), making it the most successful IPO since 2021 and prompting the SPX to close at the highest level in nearly a month. The positive response from the market should revive the dormant IPO market, with some companies aiming to go public by the end of the year (Instacart, VNG Ltd., Birkenstock, Klaviyo, etc.).

However, the stock market took a turn on Friday and dropped nearly 1.2% since the New York opening bell, with concerns over the massive strike action by the United Auto Workers (UAW) in the US. This is the first time in the union's 88-year history that it has simultaneously targeted the three major automakers. The shortage of vehicles could exacerbate inflationary pressures in the medium term. The UAW's demands are quite radical, calling for a 40% wage increase over four years, reducing working hours to four days a week, 32 hours in total, and seeking adjustments to living costs and pension benefits, all of which would increase labor costs and decrease profitability for automakers. In addition, President Biden's apparent support for union workers has also raised market concerns. However, considering that the UAW is the only major union that has not given its support for the upcoming 2024 presidential election, this move is not surprising.

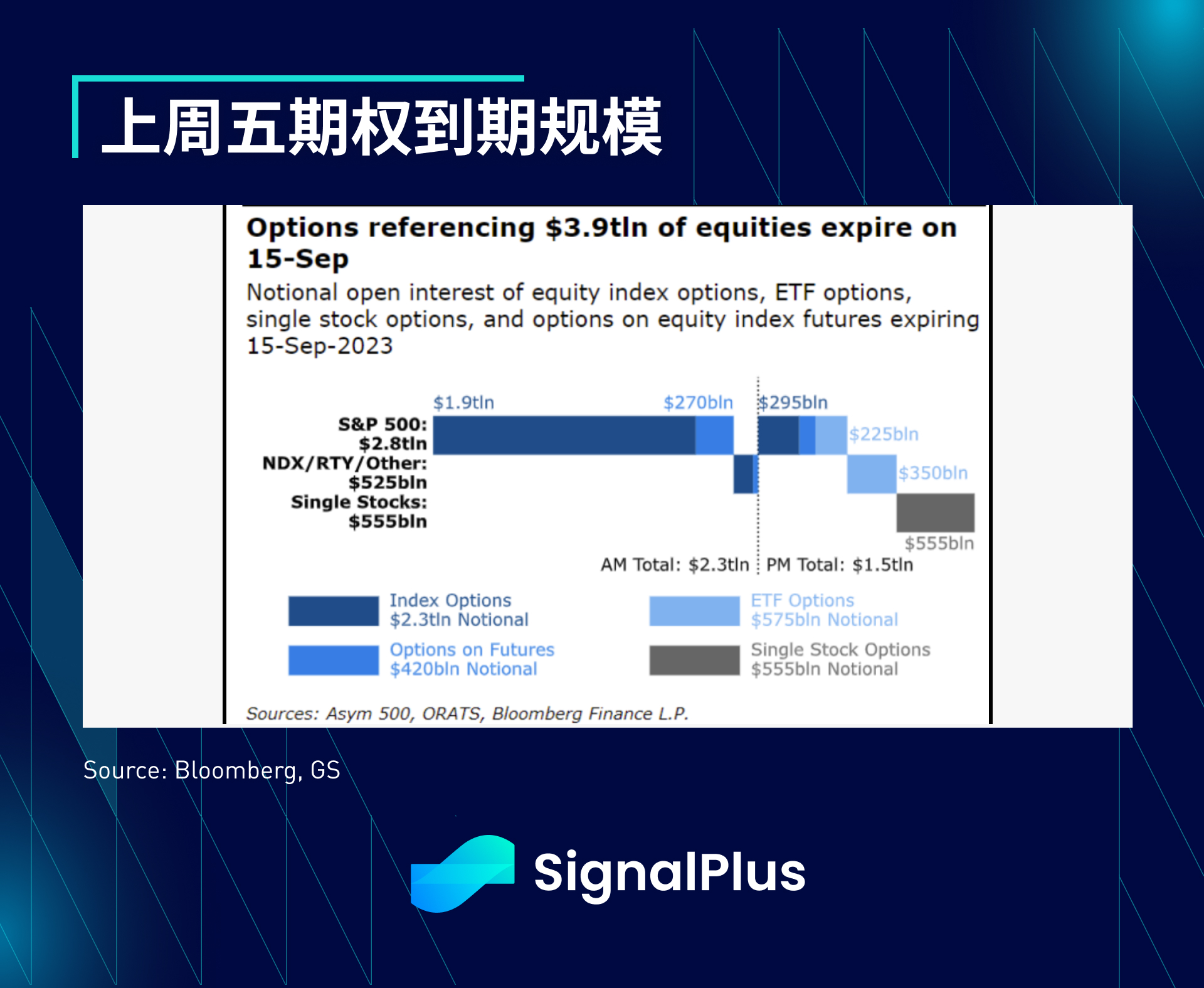

We expect the second half of September to be more volatile than the first half. In addition to the hidden worries about the UAW strike and the seasonal negative impact on stocks, last Friday's options expiration date saw about $4 trillion in options expire. Over the past few weeks, due to the market's long gamma, SPX has basically remained within a certain range of volatility. Therefore, we are more inclined to take a negative stance on risk exposure before the end of the month.

In the cryptocurrency sector, Japan has received some positive news. Reports indicate that the Japanese government will allow start-ups to sell tokens to special types of investment funds ("LPS") instead of equity. Additionally, German banking giant Deutsche Bank has partnered with Swiss cryptocurrency company Taurus to provide custody services to institutional clients, although cryptocurrency trading is still not in the bank's "immediate plans."

On the other hand, currently about 20% (41 billion dollars) of Ether's circulation is locked up for long-term returns. According to some Ethereum developers' estimates, at the current rate, nearly 50% of Ether's circulation will be locked up by May next year, and this percentage may reach 100% by December next year. To address this situation, they have introduced a new EIP-7514 proposal as part of the next major upgrade. It aims to slow down the pace of staking by setting a new number of validators ("churn change"). This can postpone reaching 100% staking until 2030, serving as a temporary solution and buying time for the community to find a longer-term solution.

Similar to the "chasing yield" narrative seen in TradFi for the past 15 years, cryptocurrencies also seem to exhibit the same phenomenon in the short term. While we wait for this prolonged bear market to end, the investment narrative will primarily revolve around generating returns.

This proposal aims to mitigate the negative effects brought by a high proportion of ETH staked before implementing a proper solution. In other words, the proposal understands the complexity of changing the reward mechanism and its purpose is solely to slow down the growth of staking.

If the current pace continues, the staking ratio of ETH supply will reach 50% by May 2024, 75% by September 2024, and 100% by December 2024.

Source: EIP-7514

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time crypto news. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web3 or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com