A look at the latest developments of Wormhole: After a long silence, can it "regain its former glory"?

Original Writer: Jiang Haibo, PANews

Wormhole is one of the most well-known cross-chain interoperability protocols. It was acquired by Jump Trading in 2021 and was later stolen in 2022. Jump Crypto invested 120,000 ETH (approximately 326 million US dollars) for compensation. It has also surpassed competitors like LayerZero in the competition for the official governance bridge of Uniswap.

After the collapse of Terra, the development of Wormhole has been lukewarm. In fact, the Wormhole team has been continually updating the project. Recently, there have been some developments, such as the announcement of the establishment of the Wormhole Foundation and the timely support for new public chains Aptos, Sui, and Sei. They have also developed automated relays to help developers build dApps. Wormhole hopes that these measures will break the deadlock.

Supporting 23 Chains, TVL Stable around 324 Million Dollars

According to data from the Wormhole official website, as of August 31st, Wormhole has supported 23 chains.

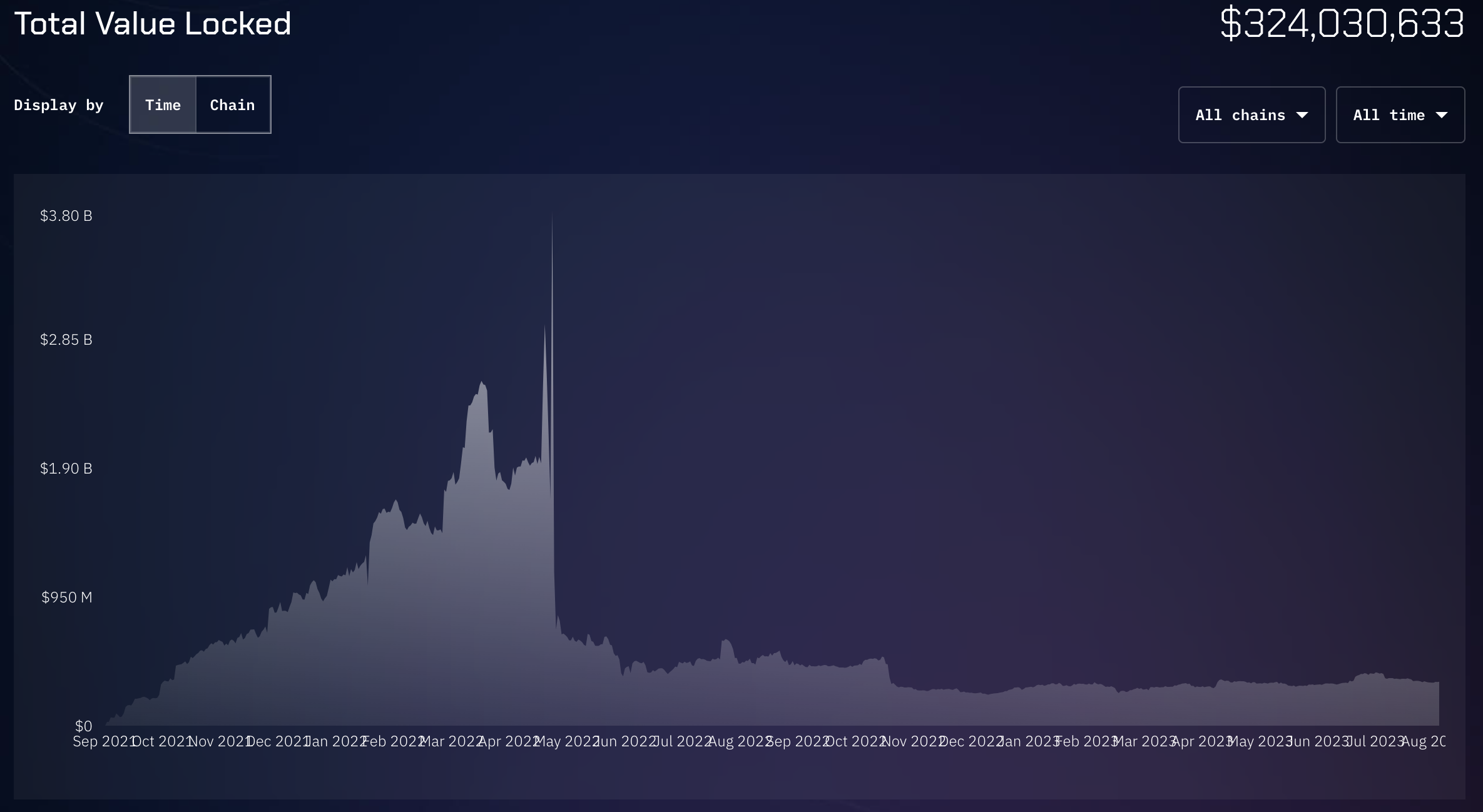

Since Wormhole adopts the locking and minting method for cross-chain transactions, it is meaningful to track the TVL on the source chain. As of August 31st, the total TVL on various chains for Wormhole is around 324 million dollars. The highest historical value was 3.8 billion dollars on May 12th, 2022. Recently, the TVL has been relatively stable.

Subdividing to each chain, the chains with the highest locked underlying assets are Ethereum with a value of $259 million, Solana with $23 million, Binance Smart Chain with $16 million, Terra Classic with $8 million, and Near with $8 million. The assets with high value locked on Ethereum are USDC with $62 million, HXRO with $49 million, WETH with $45 million, USDT with $20 million, and WBTC with $17 million. The majority of them are mainstream coins, relatively more reliable.

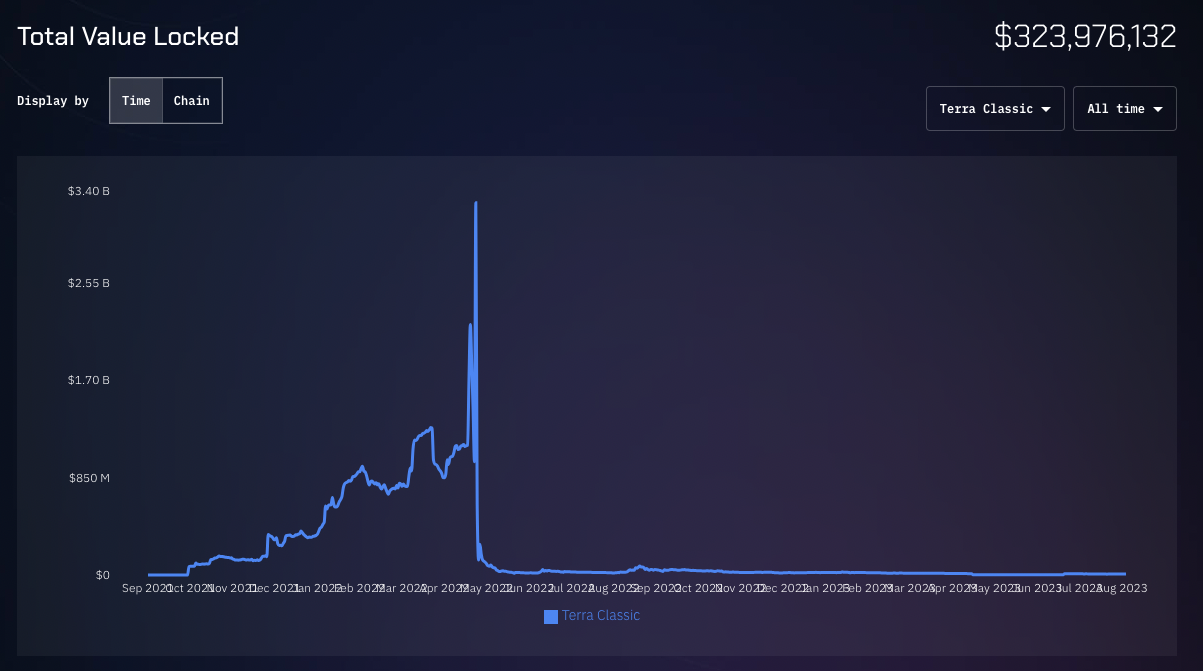

Looking back at the historical data of Terra Classic, during the peak period on May 12, 2022, out of the total TVL of 3.8 billion in Wormhole, 3.25 billion USD came from Terra Classic. The crash of LUNA/UST started on May 8, so the surge in TVL displayed on May 12 may be due to the delayed update of UST price by the oracle, resulting in inflated data. Before May 8, the TVL on Wormhole in the Terra Classic chain increased significantly. On May 6, the TVL was 1.13 billion USD, and it remained stable before this date. On May 7, the TVL rose to 1.71 billion USD, and on May 8, it further increased to 2.18 billion USD. After that, possibly due to the drop in LUNA's price, on May 9, the TVL decreased to 1.84 billion USD, and on May 11, it dropped to 0.988 billion USD.

Is the cross-chain funds from Terra Classic that experienced an abnormal increase in Wormhole two days before the crash of LUNA/UST the culprit behind the crash of LUNA/UST? This is quite possible.

Recent Progress of Wormhole

The development of interoperability protocols is not an overnight process. With the continuous launch of new public blockchains, it is necessary to support these blockchains as quickly as possible to seize the market. In terms of feature iteration, in addition to the initial asset cross-chain functionality, it is necessary to have cross-chain message transmission and cross-chain App, and simplify these functions as much as possible. According to recent official updates from Wormhole, the team has made the following progress.

Establishment of Wormhole Foundation

On August 15th, the Wormhole Foundation was officially announced, led by Robinson Burkey and Dan Reecer from the Wormhole team. The plans of the Wormhole Foundation include three directions:

xGrants: Provide resources for open-source software development and research, with a special focus on cross-chain protocols and applications.

Cross-chain ecology fund: Launch a $50 million fund to support Web3 applications integrated with Wormhole.

Wormhole Association: Establish a global Wormhole active community, contribute to technology, develop educational content, translate, organize online and offline events, etc.

In addition, although it is not mentioned officially, usually foundations like this will launch governance tokens and reserve a portion of the tokens to promote ecosystem development. This also implies that Wormhole may issue governance tokens. Currently, Wormhole lacks revenue and provides free services to users. When evaluating cross-chain bridges on Uniswap, the Uniswap Cross-Chain Bridge Evaluation Committee also suggested that Wormhole implement "in-protocol mechanisms" to address the issue of "validator passivity". Incentivizing validators (aka Guardians in Wormhole) through governance tokens is a common practice.

Launching Automatic Relayers

Current cross-chain protocols are no longer limited to asset cross-chain, but also include cross-chain information transmission and cross-chain Apps built on top of cross-chain protocols. Wormhole has also started to be applied in cross-chain Apps, such as Wombat using Wormhole's relayers for cross-chain message transmission and constructing cross-chain liquidity pools. This functionality is expected to launch on September 6th.

Wormhole has also introduced Automatic Relayers. In order to build cross-chain Apps, developers usually need to build on-chain components and off-chain relayers to transmit messages from one chain to another. Building, managing, and maintaining off-chain relayers can be challenging, so Wormhole has separated this part of the work and developed automatic relayers. Developers can use the pre-configured relayer network without the need to set up, run, or maintain relayers, simplifying the development of cross-chain Apps.

Support for Cosmos, Polkadot, Base, etc.

For application chains in the Cosmos and Polkadot ecosystems, although there are XCMP and IBC to facilitate cross-chain operations internally, the security of cross-chain transactions from other networks like Ethereum to Cosmos and Polkadot still poses issues. Several projects in the Polkadot ecosystem have been affected by the transfer of funds through Multichain.

For the Cosmos ecosystem, Wormhole recently launched the Wormhole Gateway to connect liquidity from supported blockchains to Cosmos through IBC. As for Polkadot, Wormhole introduced the Moonbeam router which allows easy transfer of Wormhole assets to the Polkadot ecosystem.

Current Issue: daily cross-chain fund limitations and inconsistent cross-chain liquidity

Wormhole was acquired by Jump Trading and relies on Jump's investment and market value management. Wormhole can deeply integrate with certain emerging or existing projects on public chains, but its recent development has been moderate.

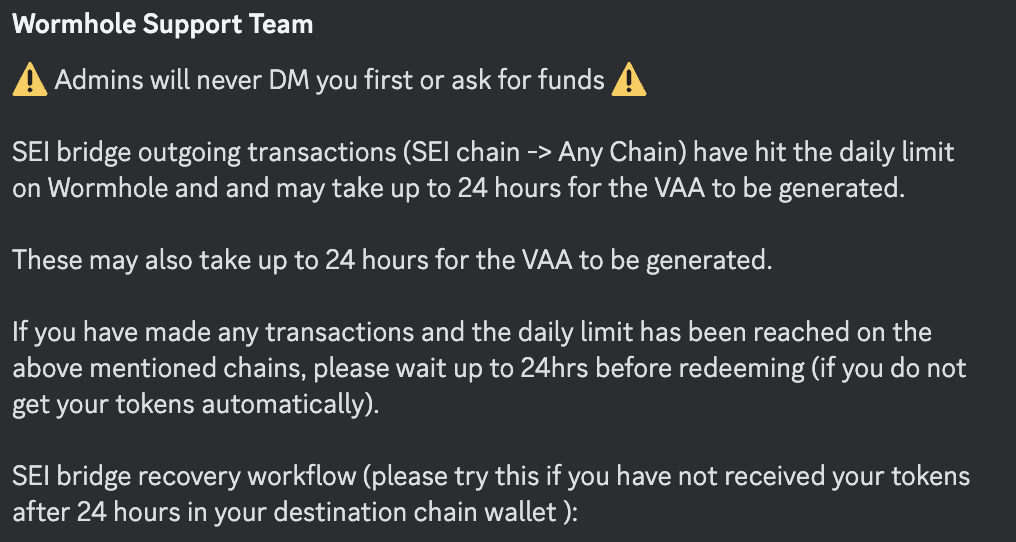

With the launch of Sei Network and the formulation of airdrop rules, the issues with Sei and Wormhole have been exposed. According to Sei's airdrop rules, the more assets cross-chain to Sei, the higher the probability of receiving rare treasure chests and more SEI airdrops. As a result, many users choose to cross-chain more than $100,000 in a single transaction from Wormhole to Sei. However, when withdrawing funds, Wormhole imposes a daily funding limit for each chain, which has resulted in many users being stuck in the process of withdrawing funds from Sei through Wormhole, requiring a wait time of more than 24 hours.

According to the Wormhole 2022 Year-End Review, the security feature known as Governor was introduced in August 2022 after being hacked. It allows Wormhole Guardians to limit the cross-chain value for each chain. Currently, the daily withdrawal limit for underlying assets extracted from Ethereum is $50 million, and for Solana, it is $25 million, with even lower limits for other chains.

Within the Wormhole community, there have been reminders about reaching the cross-chain amount limit, as shown in the following image. The speed of fund arrival is also an important evaluation criterion for cross-chain protocols. In general, the daily limits set by Wormhole are sufficient to meet demand and the arrival speed is fast. However, due to the increased cross-chain demand caused by Sei's airdrop rules, the experience of waiting for withdrawals for 24 hours has been poor.

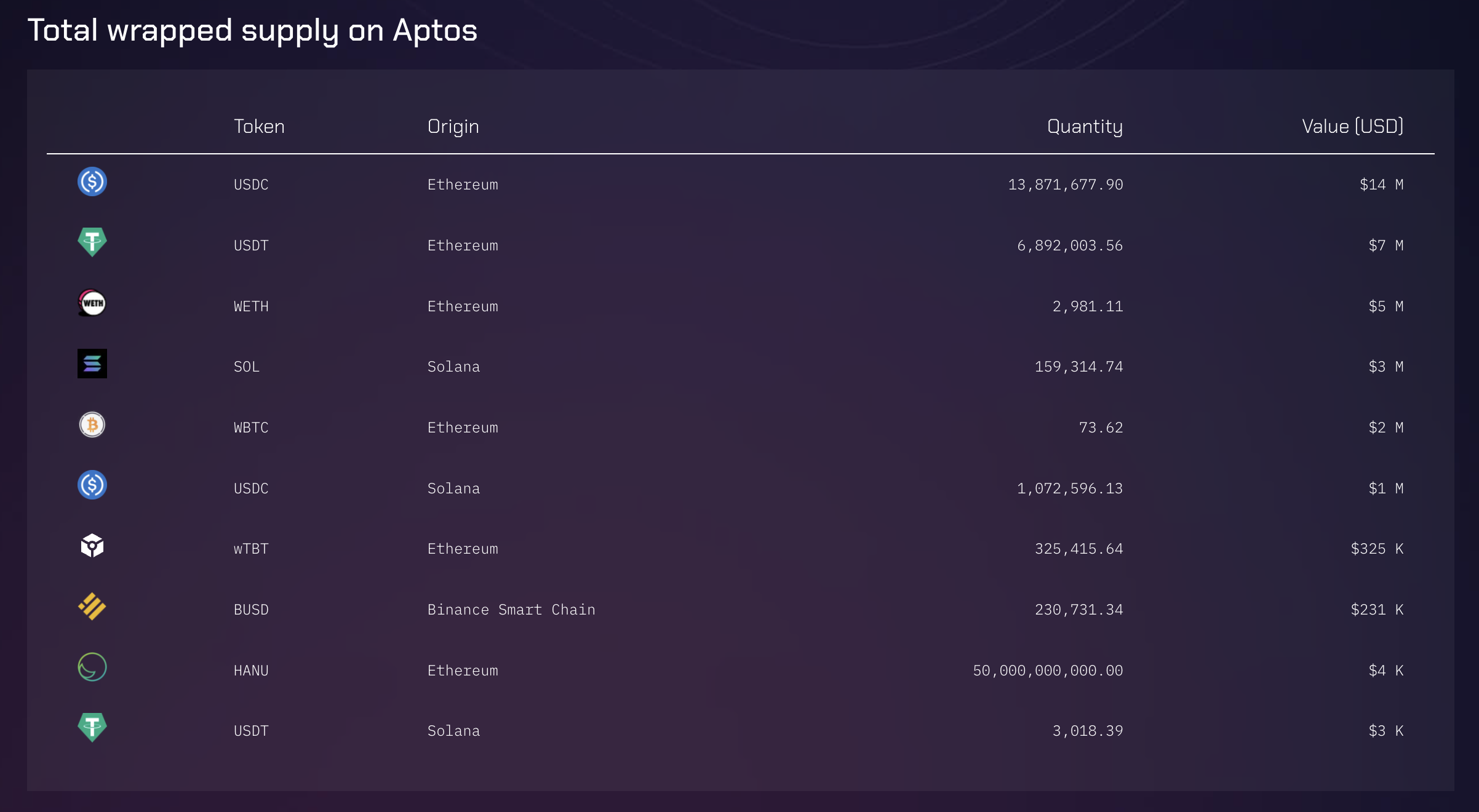

In addition, the cross-chain assets on Wormhole are too complicated. For example, although the USDC on each chain can be cross-chained to Aptos, only the USDC cross-chained from Ethereum to Aptos is supported by Pancakeswap and Thala on Aptos. Does this mean that Ethereum mainnet must be used to meet the conditions? Actually, no. On Solana, there is also cross-chained asset USDCet minted by Wormhole from Ethereum mainnet, and the DEX has sufficient liquidity for the USDC/USDCet trading pair. For ordinary users, withdrawing USDC to Solana and then exchanging it for USDCet through an aggregator can achieve the same effect with lower fees. It is also worth noting that although Aptos supports cross-chained USDC from Ethereum or USDCet minted on Solana, Sei needs to use native USDC on Solana for cross-chain calculation when airdropping on Solana. Different assets can be easily confused. The competitor LayerZero handles this better, as only supported assets can be seen on the front end.

In March of this year, Wormhole integrated Circle's Cross-Chain Transfer Protocol (CCTP). The underlying assets cross-chained to Aptos from different chains such as Ethereum and Solana are theoretically the native USDC issued by Circle. If Wormhole can unify liquidity, the user experience will be improved.

With the collapse of Terra, the glory of Wormhole has also disappeared, and Swim Protocol, an ecological project that provides cross-chain liquidity, has announced a suspension after a series of subsequent events. However, the Wormhole team has recently been frequently updating product features, hoping that Wormhole can once again achieve glory.