"Fatty Penguin" CEO's Personal Essay: Six Key Points of NFT Development

On August 5th, Twitter KOL Gary posted, stating that investors should be aware that the commercial expansion of PFPs-like NFTs will only help the project creators generate revenue, but will not bring any earnings to the holders. Therefore, PFPs should not be regarded as stocks.

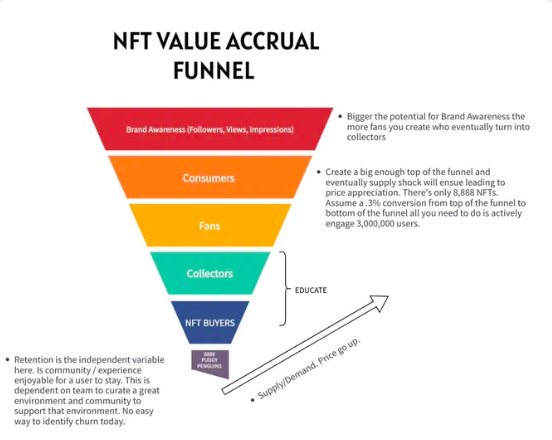

In response to this, Luca Netz, CEO of NFT project "Pudgy Penguins," published a lengthy article to refute it. In the article, Luca Netz systematically elaborated on the importance of brand commercialization for the development of NFT projects from six perspectives. This includes explaining how income will ultimately flow to NFT holders through the "funnel" model and combining supply and demand relationships to explain why some blue-chip NFT projects will gradually return to zero.

As one of the most prominent NFT projects during the bear market, since Luca Netz took over the project in February last year, "Pudgy Penguins" not only emerged from the historical gloom but also once refreshed the historical peak of ETH when other PFPs-like projects' floor prices continued to decline. It is because of this that Luca Netz's reputation has continued to rise in the NFT industry, and many project creators regard him as a role model, hoping to replicate the success of "Pudgy Penguins" through imitation and learning from his operations.

Considering that Luca Netz has thoroughly outlined his thoughts on NFT development in this recent article, the content may be of reference value to practitioners in the same field. The following is the original content by Luca Netz, compiled by Odaily Sunday Edition.

Gary's perspective is very bad.

In the following text, I will explain why this way of thinking is fundamentally wrong and why this viewpoint is very bad.

To clarify my views, I will list six points directly supporting "why building a globally recognized brand is the best way for NFT holders to accumulate value."

Point 1: Marketing

NFT is a limited resource, and as interest and demand grow, the NFTs you hold will naturally accumulate value.

NFT needs to be marketed for success. Everyone wants instant value conversion, but during the bear market, it is not possible. When NFT is in the hype stage, some announcements may generate massive interest and demand, ultimately accumulating significant value for NFT. However, the same measures may not be as effective today.

Is this unique to NFT? Not really. Many excellent Layer 2 projects are releasing major announcements that could have rapidly increased the project's market value two years ago. But today, the same important announcements hardly have any impact on the secondary market.

In a bear market, every asset class has the same characteristics. We are not an exception.

From the "funnel" model in the figure below, it can be seen that marketing can amplify the top of the funnel, which is the starting point for NFT demand and value accumulation. Over time, the value will flow down the funnel from the top, ultimately reaching NFT holders.

Key Point 2: Emotional Connection

Before we start, there is a data point about collectibles worth mentioning. The total size of the global collectibles market has reached 426 billion US dollars to date. This market is built not based on liquidity or instant dopamine release but on emotional connection.

To increase the value of your NFT, you need to optimize two things:

First is demand, which can be achieved by implementing various marketing activities to gradually increase project awareness.

Second is holding, which is driven by emotional connection. This includes emotional connection with community members, as well as emotional connection with interactive experiences, content, and characters. If we can establish enough emotional connection between the holder and the NFT, the emotional value will ultimately surpass monetary gains, making it priceless.

If you can create sufficient demand and have compelling emotional connections, you can create the best value-adding mechanism in the world.

Take a look at the image below. If you see your child reacting like this to a "Fat Penguin" toy, would you sell it and rush to other shitcoins? Would this reaction make you believe more in the project's long-term vision?

Point 3: Sustainability

This point is often the most overlooked.

Understanding sustainability helps you understand what killed your favorite blue-chip projects during 2020-2021, and the answer lies in "dilution." "Dilution" stems from a project being unable to generate external revenue, leading to them issuing more NFTs.

Unfortunately, when the growth in demand cannot match the growth in supply, the ecosystem tends towards zero.

Creating a sustainable brand can effectively mitigate the biggest risk of holding NFTs - unnecessary "dilution" to maintain and progress the business.

Demand > Supply = NFT value rises;

Supply > Demand = NFT tends towards zero.

Establish a sustainable revenue model -> invest in marketing -> create more demand -> NFT value grows.

This is not difficult to understand.

Point 4: Touchpoints

Essentially, this is just basic work, but I believe that if you can create enough touchpoints (opportunities for users to interact with the project's IP), this will convert into the greatest upward momentum when market conditions turn positive.

Let's take Pudgy Toys as an example. I often hear doubts about Pudgy Toys: "Luca, no one will buy your toys and then go buy your NFTs, so what's the benefit for the holders?"

It's true that they won't do it today, but I don't need them to do it now either. But when the bull market of NFTs returns and traders start building their collections, which NFTs do you think they are most likely to buy? I think they are most likely to choose the NFTs they see most often. Once they have a lot of funds, they will buy them.

More brand collaborations, more products and content, these are all excellent ways to create more touchpoints.

Point 5: Experiences

Within the NFT culture, everyone desires various free benefits, but unfortunately, these are no longer sustainable with the consumption of royalties.

If I can't create real external cash flow through building a successful brand, then I won't be able to create more and better experiences for the holders without diluting their interests. However, if I can establish a successful brand that generates consistent income to supplement the treasury reserves, I can use these reserves to provide more and better experiences for the community.

The entire value transmission process is as follows:

Create free memorable experiences for holders -> FOMO sentiment among non-holders -> They want to participate -> They purchase NFTs -> Increase in the value of NFTs -> Growth in holders' interests.

Point 6: Game

One thing is obvious to me, that 90% of NFT traders do not understand what is happening in this field and where the real potential lies.

It is both a game for institutions and retail investors. If you think the 150 ETH floor for BAYC is driven by retail demand, then you are clearly mistaken.

What most people don't know is that the largest funds in the world have made massive investments in intellectual property. Intellectual property is a good tool to resist economic downturns and has been proven to be a good asset class for fund diversification.

You need to ask yourself, how can your project attract funds that are currently or will be seeking to incorporate NFTs into the next generation of intellectual property portfolios? Do you really think game theory and Ponzi economics will excite institutional capital? If you think so, then you don't truly understand the potential of these assets and this game.

Attracting arbitrageurs = short-term success;

Attracting institutions = long-term success.

In my opinion, the future funds will seek to meet existing intellectual property needs and create a new model of Web 3 IP that can leverage blockchain technology.

Attracting one institution is far superior to attracting 500 speculators.

Summary

I understand that these arguments may seem biased because I am defending my own position. But you must remember that we bought the "Fat Penguin" project for $2.5 million with the sole purpose of being the first and setting the benchmark in the NFT field.

With this in mind, we have spent many months critically thinking about the best approach to achieve this goal. Ultimately, this is the conclusion we have reached.

If you want a Ponzi shitcoin, go create a better one.

If you want to be part of the new era of culture, community, and intellectual property, then NFT is your battlefield.

The reason for publishing this article is to refute the claim that "brand commercialization does not benefit NFT holders." I believe that over time, the NFT field will realize that this is the right way to incubate the next generation of NFTs.