Weekly Editors' Picks (0722-0728)

"Editor's Picks" is a "feature-oriented" column of Odaily. Based on the coverage of a large amount of real-time information every week, many high-quality in-depth analysis contents will also be released, but they may be hidden in the information flow and hot news, being missed by you.

Therefore, our editorial department will select some quality articles worth reading and collecting from the content published in the past 7 days every Saturday, bringing you new insights from the perspectives of data analysis, industry judgment, and viewpoint output in the encrypted world.

Now, let's read together:

Investment and Entrepreneurship

In the early stages, the protocol itself is difficult to attract multiple developers, so developers usually release a matching application to promote activities. If you are an independent application, you are likely to be replaced by other applications. The team builds a moat in two ways: building brand reputation through distribution and creating network effects generated by liquidity sent to them through multiple applications.

In other words, in the field of digital assets, applications can evolve into protocols (or platforms). With Rollup making it easier for applications to disguise themselves as L2, we will see more and more applications claim to be protocols in hopes of increasing their valuation.

When you are not a trading network but an application, requiring users to hold your native asset becomes a barrier. Applications like Uniswap and OpenSea generate much more revenue than the average protocol. This may conflict with the idea that protocols should be more valuable than applications because value flows downward (towards the infrastructure that supports it). That is why citing "fat protocols" alone as a basis for supporting new Layer 2 solutions is wrong. Mature applications on Ethereum can generate more fees than relatively young protocols.

For protocols, forcing an increase in the fee ratio as usage increases will undermine network effects unless use cases can justify it.

In Web 3, the only real moat is the community. Capital incentives or product utilities keep early community participants engaged. The allocation of users' capital needs to go beyond sharing culture. Protocols cannot operate solely on atmosphere; you need people to build on them. Developers are a way of combining culture and capital and provide tools to help retain users in the long run. Protocols need a large amount of user liquidity to support emerging applications on top of them.

DeFi

UniswapX: Opening the Door to Uniswap V4 DeFi Experimental Base

UniswapX is essentially a non-custodial trading protocol based on Dutch auctions.

The protocol allows third-party fillers to perform trades (act as takers). Fillers can be on-chain or off-chain liquidity providers, such as market makers, MEV searchers, DEX, etc. The competition between fillers is achieved through Dutch auctions, a way to parameterize the initial price of Dutch-style orders. The starting price of the Dutch auction is determined through RFQ, an off-chain inquiry system, where some fillers are voted on (market makers are incentivized to use private transaction relays to route orders to on-chain liquidity pools). At the same time, to incentivize fillers to provide the best prices, UniswapX allows orders to specify a filler who has the exclusive right to fill the order for a brief period of time, after which the Dutch auction begins and any filler can execute the order.

The RFQ+Dutch auction model, similar to Cowswap's Coincident of Wants, has been implemented for quite some time. 1inch Fusion also implemented the integration of professional market makers for off-chain order matching last year. UniswapX chooses to integrate professional market makers, combined with later V4 composability, to offer more diversified options in the market.

In terms of the marginal change in revenue growth, UniswapX will not fundamentally change the revenue of Uniswap itself in the short term, but it will have a greater impact on other protocols in the same market. However, Uniswap's expansion into wallets, NFT markets, aggregator markets, etc. in the stock market to squeeze other protocols has not been widely accepted by the market.

Guiding Small Boats with Big Ships, UniswapX Sets a New Paradigm for AMM Protocols

UniswapX has created a new paradigm for AMM protocols. It provides traders with the best market prices by aggregating on-chain and off-chain liquidity sources. It also effectively prevents MEV attacks and offers gas-free transactions, and even extends to support cross-chain gas-free transactions, indicating the direction for the future development of DEX.

Conversation with Uniswap Founder: Handing Routing Issues to the Market through UniswapX

UniswapX is a competitive routing marketplace that achieves higher efficiency through decentralization, allowing more people to participate in finding the best routes and discovering the best liquidity pools.

In the long run, users will be able to get better prices.

The complexity issue is left off-chain and allocated to off-chain service providers who can manage complexity.

We hope that MEV market participants continue to compete with each other and return most of the value to traders.

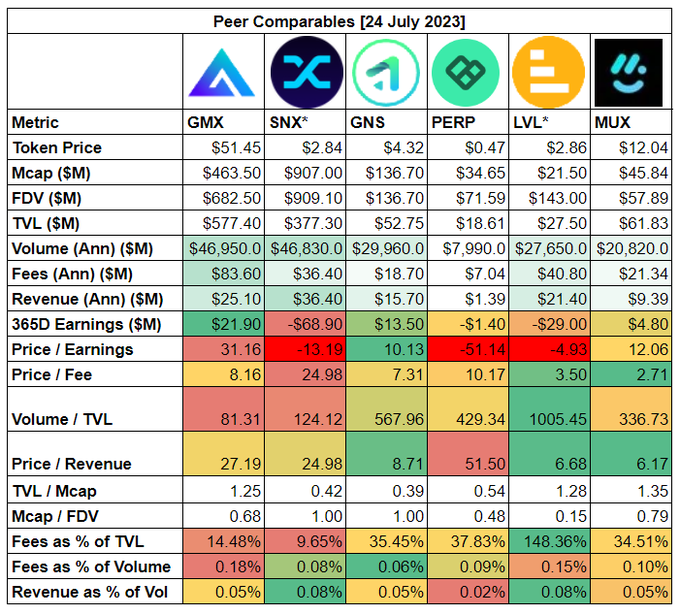

Comparison of 6 key indicators of on-chain derivative protocols

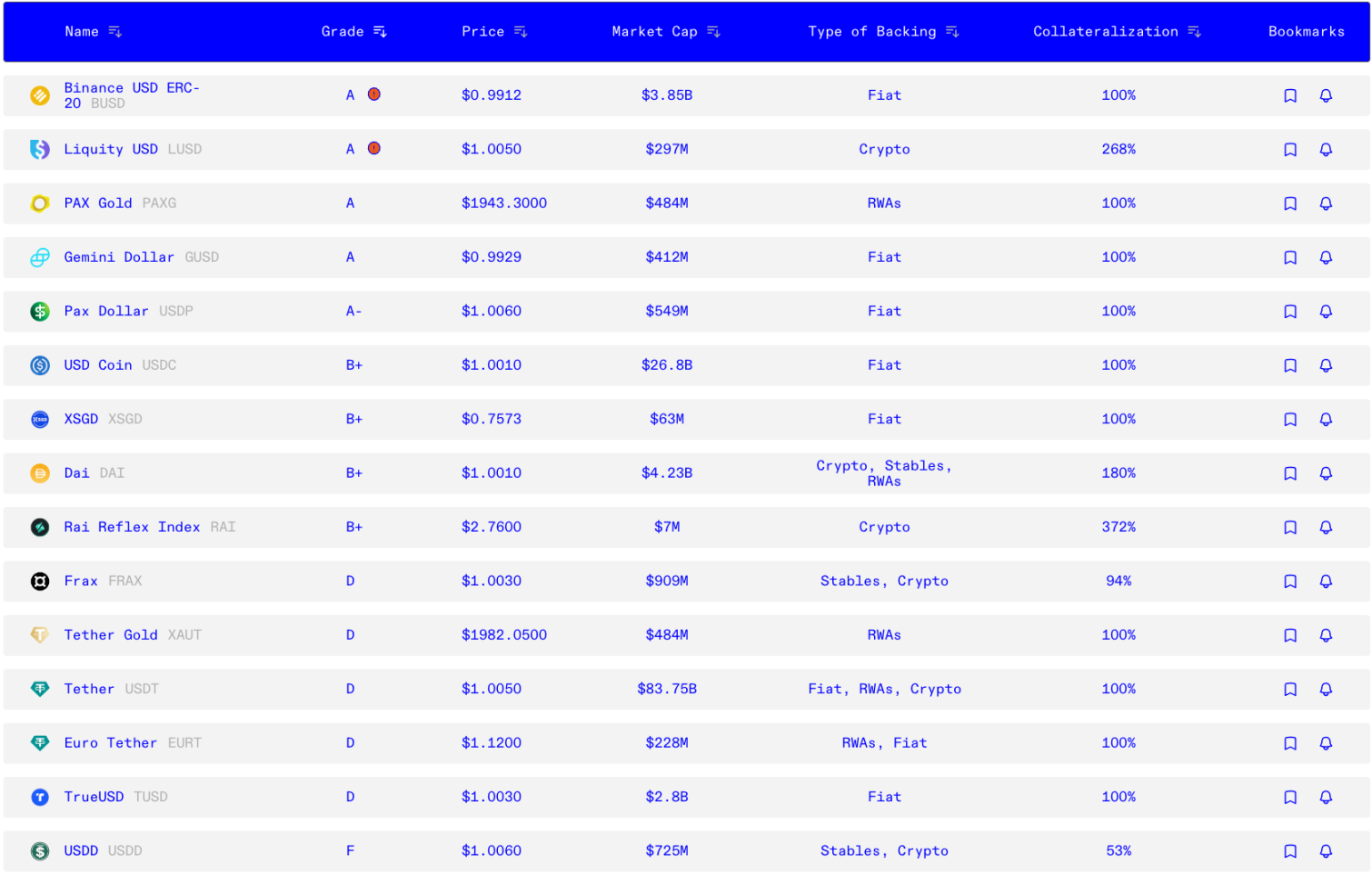

Bluechip's economic security rating for top stablecoins released this week

The article further introduces Lybra (eUSD), Liquity v 2 (LUSD), Synthetix (sUSD), MakerDAO (DAI), Frax v 3 (FRAX), Aave (GHO), Cruve (crvUSD), Beanstalk, Reserve Protocol, and Reflexer.

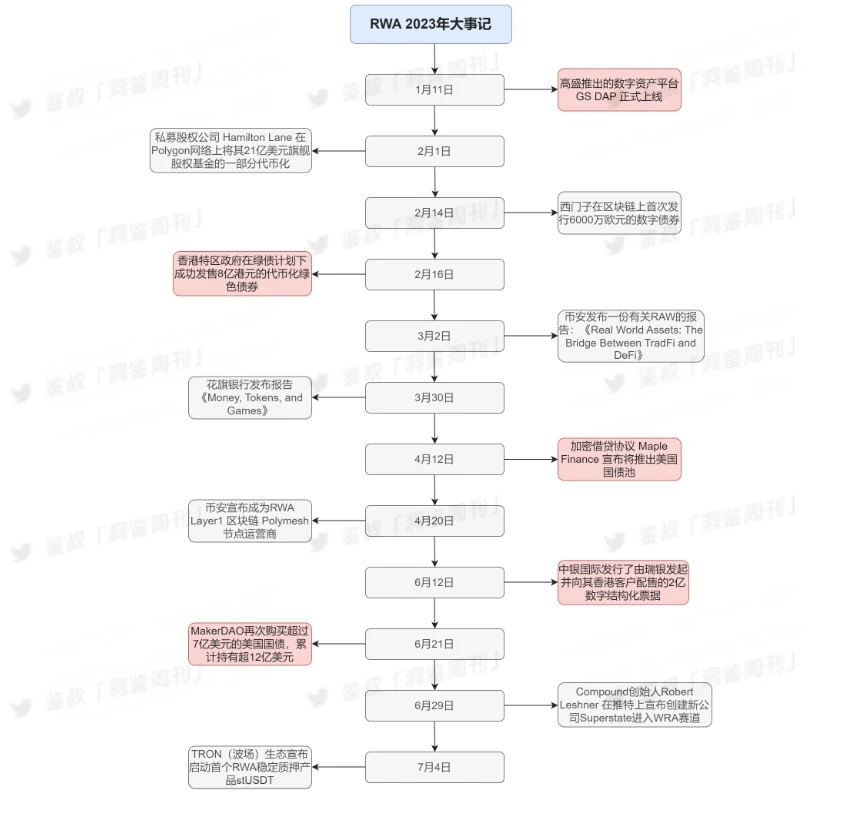

Interpreting RWA, speculation or opportunity?

Institutional entry, DeFi yield decline, low-risk bond rates rise, deep bear fear, the encryption industry urgently needs a new narrative - all on fire with RWA.

Institutional entry, DeFi yield decline, low-risk bond rates rise, deep bear fear, the encryption industry urgently needs a new narrative - all on fire with RWA.

The challenges facing the RWA track include regulation, the need for improvement in technological infrastructure, valuation and authenticity issues of real assets, uneven development of RWA track projects, potential default risks, and excessive centralization.

Binance Research: Overview of the RWA ecosystem

Currently, investments in tokenized government bonds exceed $600 million and earn an annualized yield of approximately 4.2%.

NFT, GameFi, and Metaverse

Explaining the 6 Profit Strategies of NFT and 19 Trader Addresses Worth Paying Attention to

The six strategies that whales use to profit in a bear market include: strategically buying in bulk and buying on dips, bottom-fishing undervalued NFTs, strategic selection and diversification, exploring multiple platforms, bulk minting NFTs, and prioritizing project characteristics.

Tracking the real-time activities of these influential investors, predicting market trends, and increasing the probability of identifying potential opportunities can maximize profits and minimize risks in the volatile NFT market.

Bitcoin Ecosystem

Bitcoin Lightning Network + Nostr: A New Paradigm for Decentralized Social Payments

The Bitcoin community has divergent opinions on the choice of scaling technology paths:

1. The radical miner faction supports increasing transaction capacity through Layer 1 large blocks (Bitcoin Cash)

2. The conservative developer community advocates for a combination of Layer 1 technology upgrade and Layer 2 scaling (Bitcoin Core).

Lightning Network is more suitable for its fast payment and small payment functions, embedded in other dApps to play a role. The combination of Nostr and Lightning Network sets a benchmark for the native integration between social applications and Bitcoin.

Ethereum and scalability

LD Capital: LDO, RPL token supply and demand comparison

In the absence of major changes in Lido's fundamentals and a lack of incremental funds in the market, the secondary price performance of LDO will continue to be suppressed before the primary market investors' shares are cleared.

RPL does not have the selling pressure from primary market investors; as long as no decline in RPL business is observed, buying brought by the protocol will continue to exceed token inflation.

New ecosystem and cross-chain

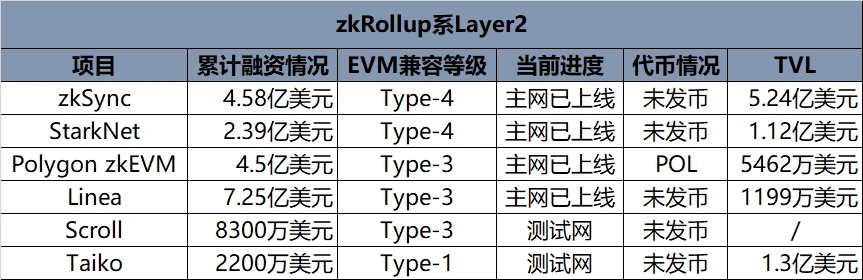

Comprehensive review of the latest progress of 11 major Layer 2 networks

Recap of hot topics this week

Last week, Worldcoin's iris recognition device, The Orb, was launched in Hong Kong, Worldcoin will mint and distribute WLD to qualified users participating in the beta testing, Worldcoin has released token economics, with a total circulation of 143 million, 75% of which is allocated to the community, World App is now open for use, and the Genesis Grant round will be open for redemption from July 24th to 31st;

In addition, in terms of policies and macro markets, the U.S. House Financial Services Committee has passed the "Payment Stablecoin Transparency Act" and "Preserve Token Act", the U.S. House Agriculture Committee has passed the "21st Century Financial Innovation and Technology Act", and Twitter's official account has changed its avatar to the X Logo;

Regarding opinions and voices, the Prime Minister of Japan: Web 3 is part of the new capitalism, Elon Musk: In the next few months, X will increase its ability to communicate and manage the entire financial world, Paradigm: Stablecoins should not be included in the banking and securities regulatory framework, Grayscale urges US SEC to treat all Bitcoin spot ETF applications equally, CME releases ETH/BTC exchange rate research report, with the trend of technology stocks, the strength of the US dollar, and the supply of BTC as key factors, Founder of DeFiance Capital: Currently, the primary market does not have enough opportunities to match billions of dollars in fund size, Vitalik Buterin discusses "evidence of personality biometrics": There is no ideal form, but it can be combined with different methodological paradigms;

Regarding institutions, major companies, and leading projects, FTX and Genesis reach a preliminary agreement on bankruptcy disputes, requesting court approval of the settlement, dYdX proposal to reduce LP rewards and increase market maker rebates passes voting, Avalanche Foundation allocates $50 million to purchase its on-chain tokenized assets, Lending protocol EraLend targeted in a hacker attack... um, it's been a turbulent week.

Attached is the "Weekly Editor's Choice" series link.

Until next time~