Giải thích RWA: Sự cường điệu hoặc Cơ hội

Gần đây, mức độ phổ biến của RWA đã dần tăng lên và nó thậm chí còn được gọi là động cơ của thị trường tăng giá tiếp theo, có thể nâng cao thị trường trị giá 10 nghìn tỷ nhân dân tệ. Nhưng RWA không phải là một khái niệm mới. Đã có một làn sóng FOMO ngay từ năm 2020 và 2021, nhưng thời gian theo dõi diễn ra khá trầm lắng. Vậy tại sao RWA lại được chú ý trong năm nay? Các sự kiện phổ biến tại đường đua RWA là gì? Sự phát triển của đường đua RWA trong tương lai phải đối mặt với những thách thức gì? Bài viết này sẽ đi sâu vào những câu hỏi này và làm sáng tỏ RWA.

chữ

danh hiệu cấp một

RWA hoạt động như thế nào

Cơ chế hoạt động của RWA về cơ bản là suy nghĩ về cách định giá hợp lý các tài sản ngoài chuỗi và đưa chúng vào chuỗi, sau đó cung cấp tính thanh khoản cho các giao dịch.

Cơ chế hoạt động của RWA có thể được chia thành ba bước, tài chính hóa tài sản ngoài chuỗi, độ tin cậy của dữ liệu tài chính và mã hóa dữ liệu đáng tin cậy.

Tài chính hóa tài sản ngoài chuỗi: Trước khi đưa tài sản ngoài chuỗi vào chuỗi, phải làm rõ giá trị kinh tế, quyền sở hữu và tính hợp pháp của tài sản, đồng thời sau khi thực hiện việc này cần xem xét cách token hóa quyền sở hữu và sử dụng tài sản Phương thức phân phối quyền và tài sản cho phép tài sản thực thích ứng với hệ thống tài chính được mã hóa, thay vì chỉ quét một vài tệp PDF hoặc tài liệu pháp lý trên chuỗi.

Độ tin cậy của dữ liệu tài chính: Số hóa dữ liệu tài sản rõ ràng và tải nó lên chuỗi và ghi vào hợp đồng thông minh. Đối với RWA, dữ liệu bên ngoài phải được tham chiếu và theo dõi để mô tả giá trị của tài sản thực trên chuỗi theo thời gian thực. Tuy nhiên, vì blockchain chỉ có thể truy cập và xử lý dữ liệu trên chuỗi nên cần có một oracle để nhận ra kết nối dữ liệu. Cung cấp dữ liệu như giá trị tài sản trong chuỗi để làm cho dữ liệu giá trên chuỗi trở nên đáng tin cậy. Đồng thời, do blockchain mở và minh bạch nên dữ liệu liên quan đến tài sản trên chuỗi cũng hoàn toàn công khai và minh bạch, mặc dù điều này có thể làm cho giao dịch trở nên đáng tin cậy hơn nhưng tính công khai và minh bạch hoàn toàn không tốt cho các giao dịch tài chính. hoặc các cá nhân không muốn công khai các giao dịch riêng tư của mình. Do đó, cần phải sử dụng bằng chứng không kiến thức (ZKP) để giải quyết các vấn đề về quyền riêng tư ở trên, cung cấp cho chúng tôi giải pháp có cả hai cách, đồng thời sử dụng khả năng xác minh công khai của blockchain, nó không ảnh hưởng đến Bảo mật và quyền riêng tư dữ liệu độc quyền của tổ chức hoặc cá nhân.

Mã thông báo dữ liệu đáng tin cậy: Bước cuối cùng là hỗ trợ giao thức RWA phát hành mã thông báo cho thị trường hoặc các nhà đầu tư cụ thể hoặc có thể là NFT để RWA có thể có được thanh khoản.

Điều khó khăn nhất trong hoạt động của RWA không phải ở chuỗi mà là trước và sau chuỗi. Dữ liệu trên chuỗi ban đầu là minh bạch và xác thực, nhưng tài sản ngoài chuỗi được kết nối với chuỗi có thể là gian lận, đồng thời, việc thanh lý tài sản thế chấp ngoài chuỗi phức tạp hơn nhiều so với tài sản thế chấp trên chuỗi. Làm thế nào để giải quyết những vấn đề này và thu hẹp khoảng cách giữa chuỗi và chuỗi là chìa khóa cho hoạt động thành công của RWA.

Tại sao RWA lại phổ biến?

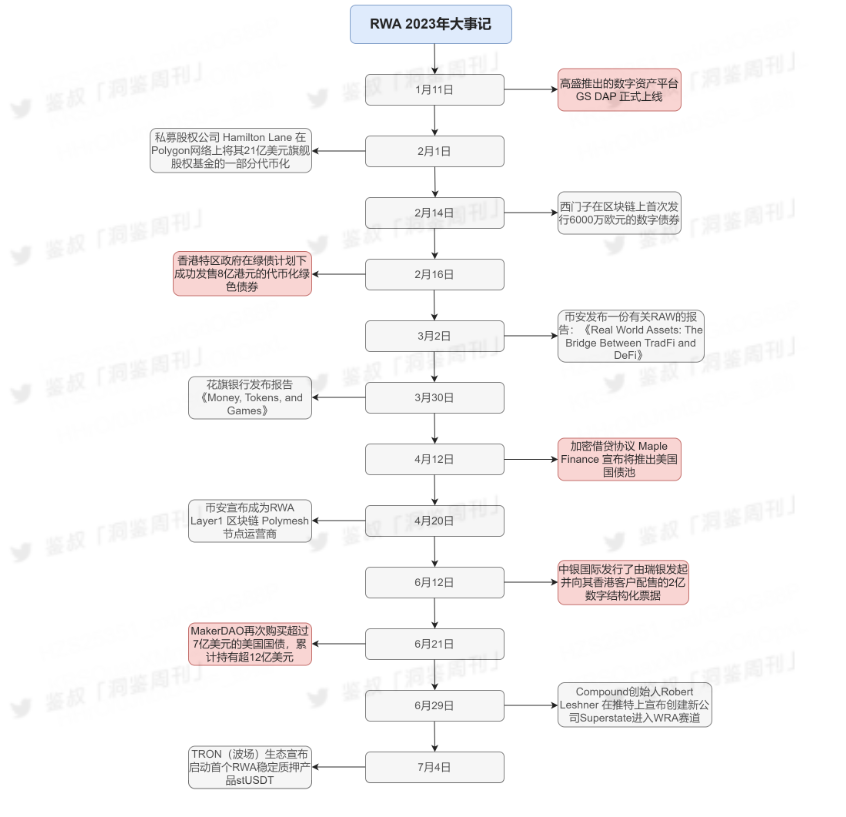

MakerDAO, thỏa thuận cho vay stablecoin hàng đầu, đã công bố các kế hoạch liên quan đến RWA vào năm 2020 và Aave cũng tuyên bố gia nhập thị trường RWA vào năm 2021. Tuy nhiên, trong giai đoạn gấu sâu vào năm 2022, RWA dần trở nên không được quan tâm. Để phân tích lý do tại sao RWA lại thu hút sự chú ý, trước tiên chúng ta phải xem những sự kiện lớn nào đã xảy ra trên đường đua RWA trong năm nay.

Các mốc quan trọng của RWA 2023

Sự gia nhập thể chế, sự thúc đẩy từ trên xuống

Không khó để nhận thấy từ những kỷ vật trên rằng năm nay RWA đã được các tổ chức như Goldman Sachs, Citigroup, Binance, MakerDAO và các giao thức hàng đầu trên chuỗi đẩy lên sân khấu. Citigroup đã chỉ ra trong báo cáo Tiền, Mã thông báo và Trò chơi của mình rằng RWA sẽ là công cụ sát thủ để thúc đẩy ngành công nghiệp blockchain đạt quy mô hàng chục nghìn tỷ đô la, bởi vì hầu hết mọi tài sản có thể được biểu thị bằng giá trị đều có thể được mã hóa, và người ta ước tính một cách lạc quan rằng đến năm 2030, quy mô RWA sẽ đạt 4 nghìn tỷ USD.

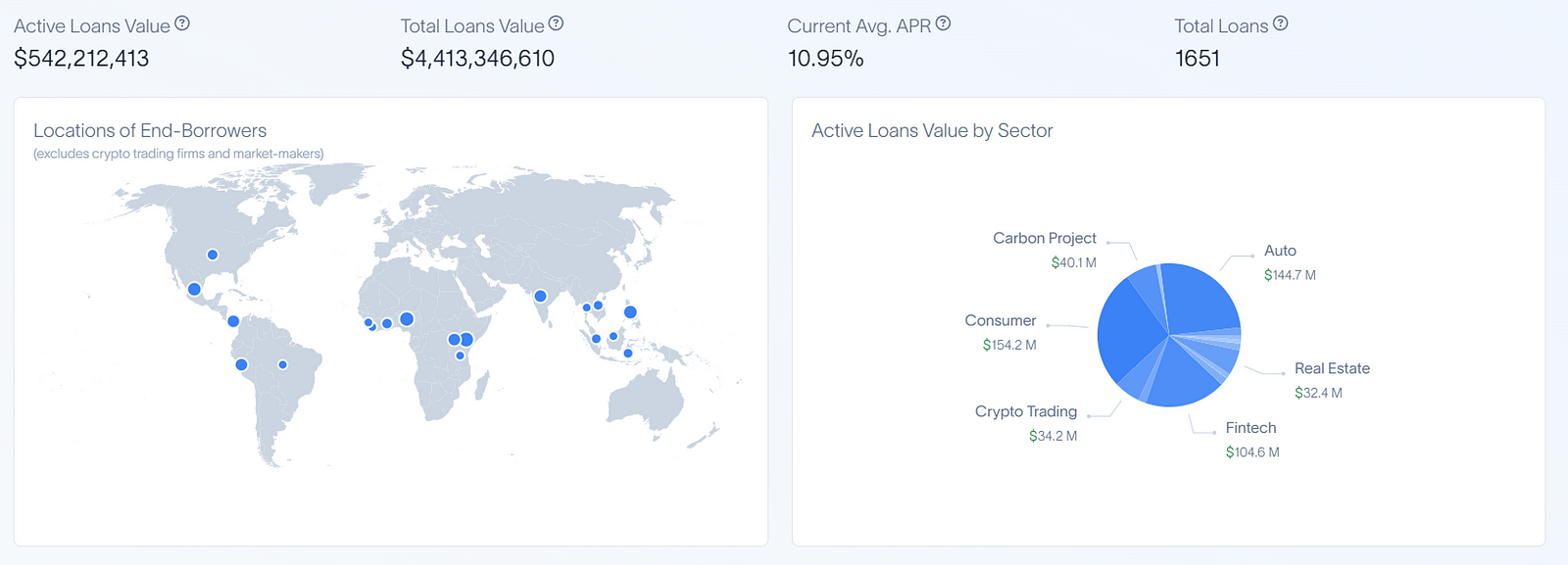

Các tổ chức tài chính truyền thống nắm giữ một số lượng lớn tài sản thực, chẳng hạn như cổ phiếu, trái phiếu, bất động sản, v.v. Nếu những tài sản này có thể được token hóa, nó có thể tăng thu nhập và khả năng cạnh tranh của tổ chức, đồng thời mang lại cho tổ chức nhiều cơ hội đầu tư hơn. Theo số liệu của rwa.xyz, tính đến ngày 17/7, tổng số khoản vay trong hợp đồng tín dụng RWA là 1651 khoản, tổng số tiền vay lên tới hơn 4 tỷ đồng. Số tiền cho vay cho thấy mặc dù RWA đã giúp các tài sản tài chính truyền thống có tính thanh khoản cao hơn và khả năng tiếp cận toàn cầu, nhưng các tổ chức và doanh nghiệp vẫn tham gia rộng rãi và các nhà đầu tư thông thường không tham gia nhiều vào đường đua này.

Lợi suất DeFi giảm, lãi suất trái phiếu có rủi ro thấp tăng

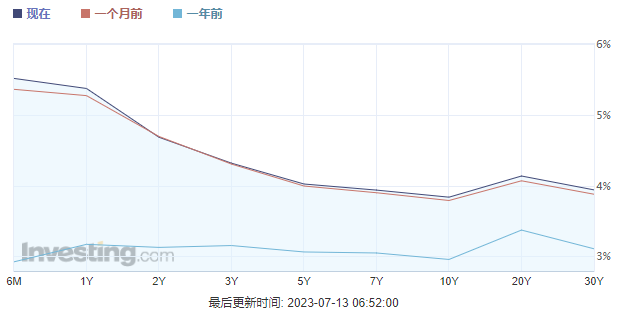

Ngoài việc các tổ chức truyền bá tin tốt từ trên xuống dưới, một lý do quan trọng khiến các thỏa thuận hàng đầu trên chuỗi và các nhà đầu tư chuyển sang RWA là sự sụt giảm lợi suất DeFi và sự gia tăng lãi suất của các tài sản có rủi ro thấp như trái phiếu Hoa Kỳ. Tính đến thời điểm hiện tại, lãi suất tiền gửi của hợp đồng cho vay hàng đầu Aave USDT là khoảng 3%, lãi suất tiền gửi của USDT tổng hợp là khoảng 2,25% và lãi suất của stablecoin DAI của MakerDAO là khoảng 3,49% (nguồn dữ liệu: LoanScan).

Đồng thời, do Cục Dự trữ Liên bang tiếp tục tăng lãi suất, lãi suất trái phiếu Kho bạc Hoa Kỳ đang tăng lên, hiện tại, lãi suất trái phiếu Hoa Kỳ có kỳ hạn dưới một năm là khoảng 5,3%, tức là đã cao hơn. hơn lãi suất tiền gửi của nhiều thỏa thuận trên chuỗi.

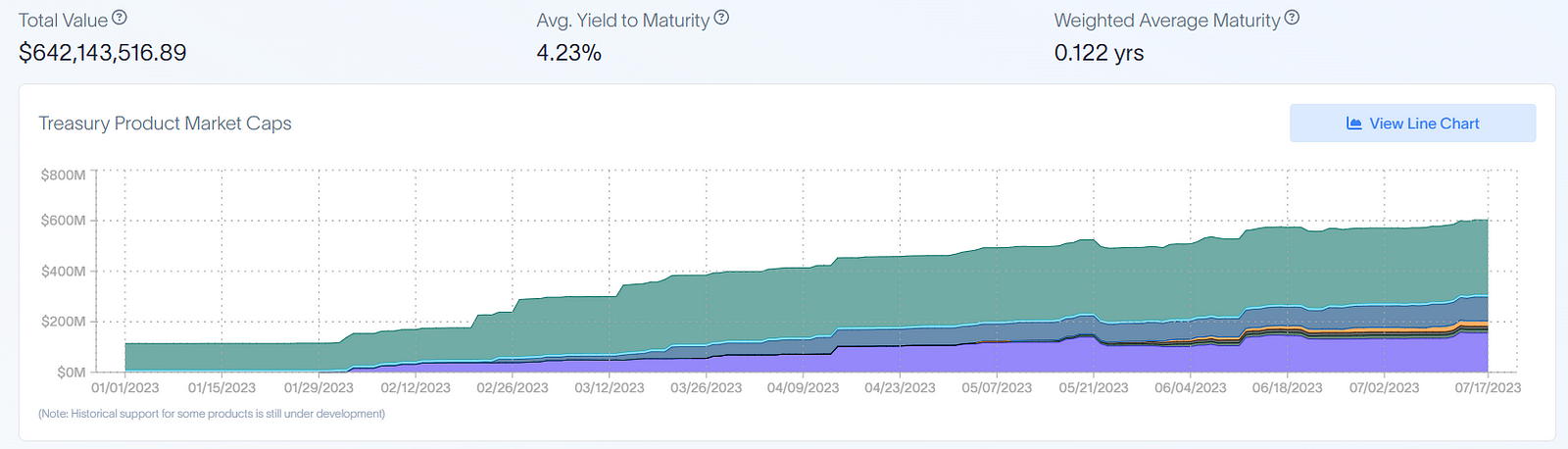

Các nhà đầu tư DeFi trên thị trường hiện tại đang theo đuổi lãi suất cao và lợi nhuận cao so với thời kỳ thị trường tăng trưởng. Với sự bất ổn ngày càng tăng của thị trường, họ đã thay đổi chiến lược đầu tư và chuyển sang theo đuổi lợi nhuận ổn định, ít bị ảnh hưởng bởi thị trường mã hóa. Nợ của Mỹ là khoảng 5,3% Lợi nhuận hàng năm phi rủi ro đủ để các nhà đầu tư theo dõi lợi nhuận của trái phiếu Mỹ trên chuỗi. Theo dữ liệu của rwa.xyz, tính đến ngày 17 tháng 7, tổng giá trị trái phiếu Mỹ trên chuỗi là khoảng 600 triệu, với lợi suất bình quân gia quyền là 4,23% và thời gian đáo hạn bình quân gia quyền dưới một năm.

Nỗi sợ hãi sâu sắc, ngành công nghiệp mã hóa rất cần một câu chuyện mới

Những người tham gia vào ngành công nghiệp mã hóa khá đoàn kết ở một mức độ nhất định. Đối mặt với thị trường gấu đen tối hiện tại trong ngành mã hóa, mọi người đang cùng nhau tìm ra một câu chuyện mới để thoát ra khỏi thị trường gấu. đã rất phổ biến trong nửa đầu năm nay Câu chuyện về hệ sinh thái, Bitcoin ETF và ZKP đều có thể thấy nỗ lực này để thoát ra khỏi vũng lầy. Câu chuyện về RWA vượt qua các rào cản giữa TraFi (tài chính truyền thống) và DeFi (tài chính mã hóa) không tệ hơn những câu chuyện trước đó, điều này đã mang lại rất nhiều chỗ cho trí tưởng tượng cho ngành công nghiệp mã hóa.

Thống kê các dự án hot trên đường RWA

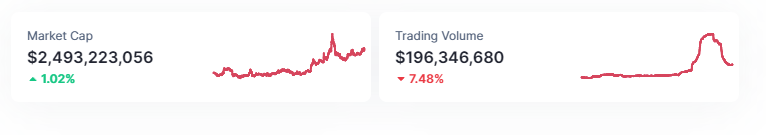

Theo dữ liệu của CoinMarketCap, tính đến ngày 17 tháng 7, tổng giá trị thị trường của token theo dõi RWA đã vượt quá 2,4 tỷ đô la Mỹ, gần bằng 1/20 trong số hơn 44 tỷ giá trị thị trường của token DeFi. Đường đua RWA vẫn còn rất lớn.

Do định nghĩa về RWA rất rộng nên lộ trình RWA liên quan đến Lớp 1, tiền tệ ổn định, cho vay, bất động sản, trái phiếu công, giao dịch tín dụng carbon, v.v., đặc biệt liên quan đến hơn 60 dự án. Sau đây sẽ tổng hợp sáu dự án hot nhất về giá trị thị trường của đường đua RWA để giúp độc giả hiểu sâu hơn về đường đua RWA. (Nguồn dữ liệu: CoinMarketCap, tính đến ngày 17 tháng 7)

MakerDAO(MKR)

Vốn hóa thị trường vượt quá 900 triệu USD

MakerDAO là một nền tảng cho vay thế chấp phi tập trung trên Ethereum được thành lập vào năm 2014. Nó hiện thực hóa các khoản vay được thế chấp quá mức bằng cách khóa các tài sản được mã hóa như ETH trong các hợp đồng thông minh và đúc tiền ổn định DAI được liên kết với đồng đô la. MakerDAO là một trong những dự án đầu tiên tuyên bố tham gia vào đường đua RWA. Vào năm 2020, nó đã bỏ phiếu cho vay thế chấp dựa trên mã thông báo RWA, mở rộng stablecoin DAI. Hiện tại, MakerDAO cũng đang mở rộng cách bố trí đường đua RWA, chủ yếu theo hướng trái phiếu đại chúng.

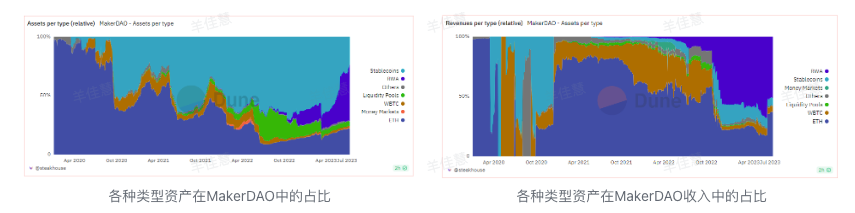

Theo dữ liệu của Dune, cho đến nay 48% tổng tài sản của MakerDAO là RWA và hơn 50% doanh thu đến từ RWA. MakerDAO đang chuyển từ giao thức DeFi truyền thống sang hướng mới tập trung vào RWA.

Synthetix(SNX)

Vốn hóa thị trường vượt quá 700 triệu USD

Được thành lập vào năm 2017, Synthetix hiện là dự án hàng đầu trong lĩnh vực tài sản tổng hợp trên đường đua RWA, nhằm mục đích cung cấp khả năng tiếp xúc trực tuyến với các loại tiền tệ, hàng hóa, cổ phiếu và chỉ số trong thế giới thực. Người dùng có thể đúc tài sản tổng hợp (Synth) bằng cách đặt cọc SNX và Synth theo dõi giá của nhiều tài sản khác nhau trong thế giới thực.

Synthetix đã trải qua ba vòng tài trợ, với các nhà đầu tư bao gồm các tổ chức nổi tiếng như Coinbase và DWF Labs. Synthetix, với tư cách là một dự án tiêu biểu về tài sản tổng hợp, đã không thể đưa RWA thoát khỏi vòng vây vào năm 2021 và TVL đã giảm từ 2,9 tỷ USD vào tháng 2 năm 2021 xuống còn 380 triệu USD hiện tại. Vào tháng 3 năm nay, Synthetix đã nhận được khoản tài trợ mới trị giá 20 triệu đô la Mỹ từ DWF Labs và thông báo rằng DWF Labs sẽ cung cấp thanh khoản và tạo lập thị trường cho SNX, hy vọng rằng sẽ có sự thay đổi.

Centrifuge(CFG)

Vốn hóa thị trường ~ 130 triệu USD

Được thành lập vào năm 2018, Centrifuge là một giao thức tín dụng trên chuỗi được thiết kế để cung cấp cho chủ sở hữu SME cách thế chấp tài sản của họ trên chuỗi và có được khả năng tiếp cận thanh khoản. Người đi vay có thể tài trợ cho tài sản trong thế giới thực của họ mà không cần ngân hàng hoặc trung gian khác và cung cấp cho các nhà đầu tư DeFi nguồn thu nhập ổn định độc lập với thị trường tiền điện tử.

Tinlake là ứng dụng đầu tư của Centrifuge hoạt động như một thị trường mở cho các nhóm tài sản trong thế giới thực. Các nhà đầu tư có thể xem các nhóm được cung cấp bởi các nhà quảng bá tài sản và đầu tư vào các nhóm phù hợp với họ, hiện có 17 nhóm. Thỏa thuận Centrifuge đã huy động được tổng tài sản tài chính là 421 triệu đô la Mỹ. Điều đáng chú ý là Centrifuge cũng là nhà cung cấp công nghệ đằng sau các thỏa thuận cho vay thế chấp hàng đầu như MakerDAO và Aave.

Máy ly tâm đã trải qua ba vòng tài trợ, với các nhà đầu tư bao gồm Coinbase, IOSG, v.v.

Reserve Rights(RSR)

Vốn hóa thị trường ~ 110 triệu USD

Được thành lập vào năm 2018, Reserve Protocol là một giao thức stablecoin phi tập trung cho phép người dùng đúc các stablecoin được chốt bằng USD được hỗ trợ bởi bất kỳ tài sản tiền điện tử nào, được gọi là RTokens. Hiện tại, giao thức này đã ra mắt ba RTokens, eUSD (đô la điện tử), ETHPLUS (chỉ số cam kết ETH đa dạng), hyUSD (đồng đô la tiết kiệm năng suất cao). Bởi vì stablecoin của nó được chốt bằng đồng đô la Mỹ nên nó thuộc về hướng stablecoin của đường đua RWA.

tiêu đề phụ

Ribbon Finance(RBN)

Vốn hóa thị trường ~ 100 triệu USD

Ribbon Finance được thành lập vào năm 2021 bởi cựu nhân viên Coinbase Julian Koh. Ribbon Finance cũng thuộc dự án trái phiếu đại chúng thuộc đường đua RWA, kết hợp các quyền chọn, hợp đồng tương lai và thu nhập cố định, đồng thời cố gắng mang lại lợi suất ổn định cho các nhà đầu tư DeFi.

Ribbon Finance đã trải qua hai vòng tài trợ, các bên tham gia bao gồm các tổ chức như Coinbase và Dragonfly và các nhà đầu tư cá nhân như người sáng lập Synthetix Kain Warwick.

Polymesh(POLYX)

Vốn hóa thị trường ~ 97,6 triệu USD

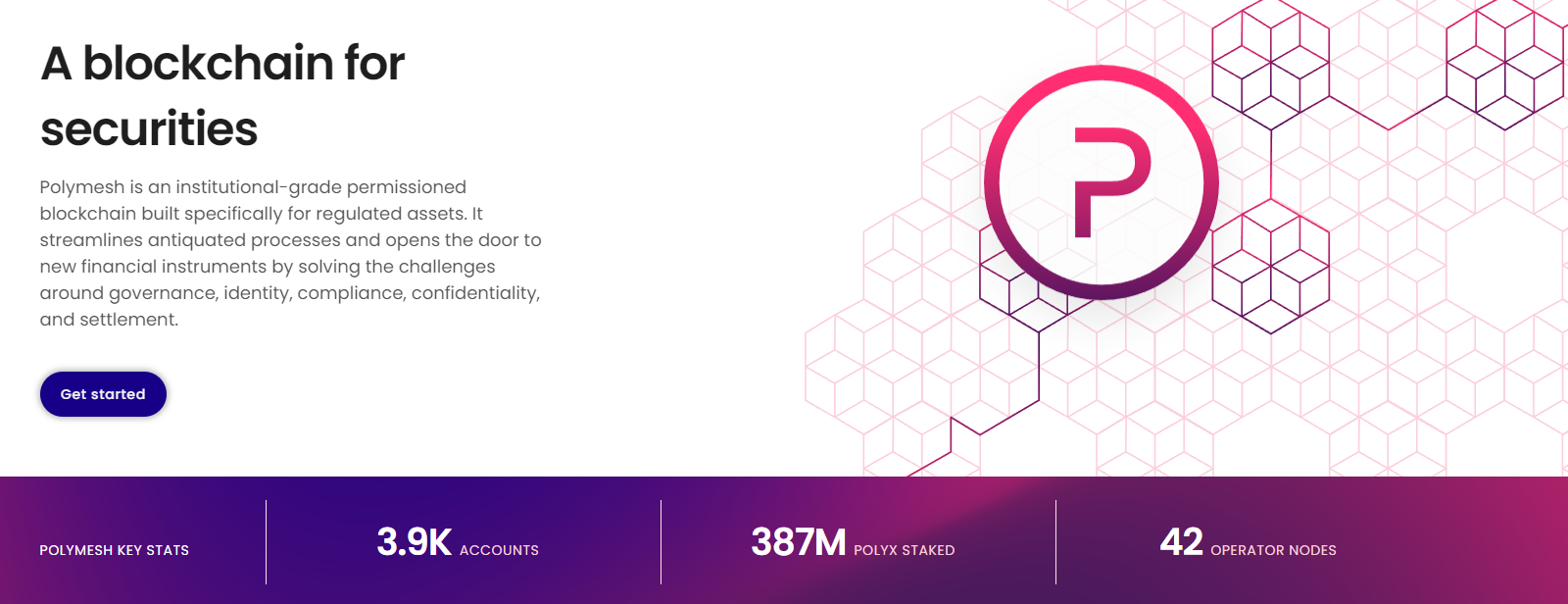

Do những hạn chế về giám sát, quản lý tài sản ngoài chuỗi phức tạp và các yếu tố khác, mã hóa gốc khó có thể đáp ứng nhu cầu giao dịch của RWA nếu không cần đến các chuỗi công khai như Ethereum. Đường đua RWA ra đời. Được thành lập vào năm 2020, Polymesh là một blockchain được cấp phép cấp tổ chức được xây dựng đặc biệt cho RWA và đây cũng là dự án có mức độ phổ biến và giá trị thị trường cao nhất theo hướng Lớp 1 của đường đua RWA.

Polymesh áp dụng khung phát triển tương tự như polkadot. Tất cả những người tham gia phải hoàn thành xác minh KYC, bao gồm tổ chức phát hành, nhà đầu tư, nhà điều hành nút, v.v. và giao thức quản lý tài sản do Polymesh thiết kế có thể thực hiện việc phát hành và chuyển giao tài sản bí mật. Hiện tại, Polymesh có 3,9 nghìn người dùng đã đăng ký thực sự (vì đã được KYC xác minh), 387 triệu POLYX được thế chấp và 42 nhà khai thác nút (bao gồm cả Binance).

Không khó để nhận thấy sáu dự án trên có giá trị thị trường RWA hiện tại trên 100 triệu hoặc gần 100 triệu, mặc dù RWA hiện có phạm vi rộng nhưng các nhà đầu tư lại quan tâm hơn đến các dự án tài chính như cho vay thế chấp tài sản vô hình. Bốn trong số sáu dự án thuộc loại này, nhưng các dự án liên quan đến tài sản hữu hình như bất động sản, kim loại quý và tác phẩm nghệ thuật đã không thể vượt qua vòng vây và thu hút được sự chú ý của thị trường.

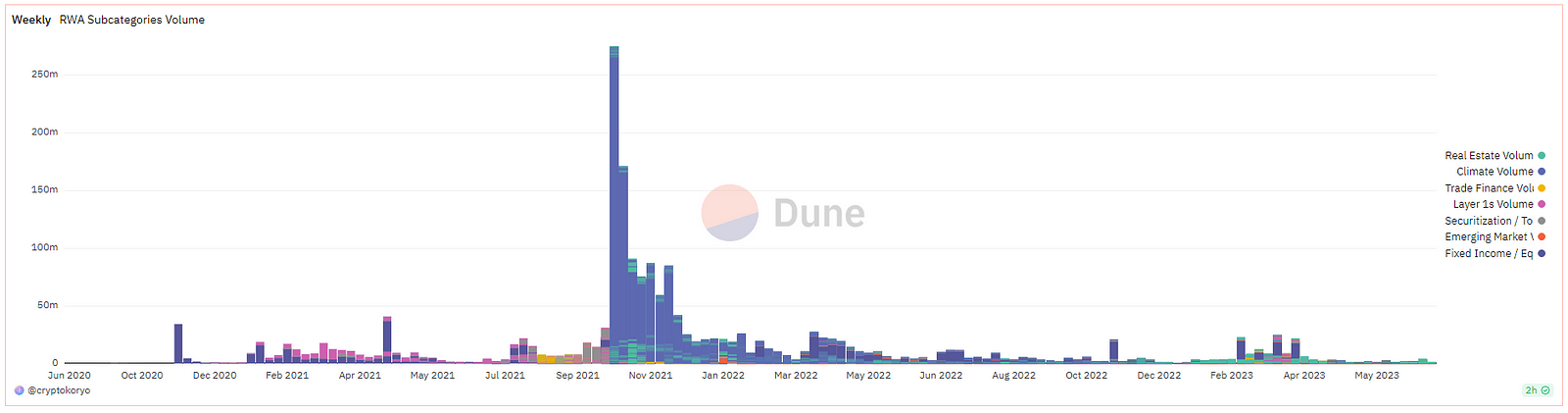

RWA sẽ lại đóng vai sói?

Bởi vì RWA không phải là một khái niệm mới nên phần tường thuật về RWA này chắc chắn sẽ gây nghi ngờ. Theo dữ liệu của Dune, khối lượng giao dịch kết hợp hiện tại của nhiều loại RWA khác nhau thấp hơn nhiều so với khối lượng giao dịch cao điểm vào vòng cuối cùng của năm 2021. Vào khoảng tháng 10 năm 2021, khối lượng giao dịch hàng tuần tổng hợp của tất cả các loại RWA đã vượt quá 250 triệu đô la Mỹ và kể từ đó đã giảm xuống. Cho đến nay, ngay cả khi mức độ phổ biến tăng trở lại, khối lượng giao dịch hàng tuần vẫn chưa đến 50 triệu đô la Mỹ. Người ta không khỏi đặt câu hỏi, liệu đợt RWA này có lại diễn ra câu chuyện về sói nữa không?

RWA đang hướng tới một thị trường gia tăng cấp nghìn tỷ, dù miếng bánh rất lớn nhưng thị trường có thể không ăn được. Ngoài góc độ dữ liệu giao dịch, công nghệ theo dõi RWA còn gặp nhiều thách thức.

quy định không thể tránh khỏi

Quy định luôn là một từ nhạy cảm đối với ngành mã hóa và RWA không thể tránh khỏi chủ đề này vì mối quan hệ chặt chẽ với tài chính truyền thống. Đồng thời, bởi vì các quốc gia và khu vực khác nhau có chính sách quản lý RWA khác nhau và thậm chí có các phương pháp quản lý khác nhau đối với các tài sản thực khác nhau, nếu bạn muốn thúc đẩy sự lưu thông toàn cầu của RWA, bạn phải nhận được sự hỗ trợ của quy định khu vực. Do đó, RWA vẫn còn nhiều việc phải làm về mặt tuân thủ quy định, hiện tại, một số khu vực thân thiện với ngành mã hóa có thể đi đầu trong việc thử nghiệm.

Hạ tầng kỹ thuật cần được cải thiện

Cơ sở hạ tầng kỹ thuật hiện tại của RWA vẫn còn nhiều điều đáng mong đợi. Ví dụ: cách bảo vệ quyền riêng tư và dữ liệu giao dịch riêng tư của người dùng đã được xác minh KYC; cách kết nối dữ liệu trên chuỗi và ngoài chuỗi để phản ánh sự biến động giá trị của tài sản thực trên chuỗi khối; và đồng bộ hóa trên chuỗi và ngoài chuỗi khi giải quyết và giao tài sản câu hỏi, v.v.

Các vấn đề về định giá tài sản thực tế và tính xác thực

Đối với những tài sản trên thực tế, ngoại trừ những tài sản đã được định giá trên thị trường như tiền mặt, trái phiếu, giá thị trường của các tài sản hữu hình khác rất khó ước tính, giá của nhiều tài sản thường chỉ được biết trong quá trình giao dịch thực tế, và định giá tài sản vật chất cũng là một vấn đề. Đồng thời, dữ liệu trên chuỗi sẽ không lừa dối mọi người, nhưng tính xác thực của dữ liệu ngoài chuỗi không thể được đảm bảo, xét cho cùng, cũng có một số lượng lớn gian lận dữ liệu trên thị trường tài chính truyền thống. Làm thế nào để xác định và loại bỏ tình trạng làm giả, gian lận tài sản ngoài chuỗi cũng là vấn đề mà RWA cần cân nhắc đúng mức.

Sự phát triển không đồng đều của các dự án đường ray RWA

Trong số nhiều dự án trên đường đua RWA, giá trị thị trường và thu nhập của các hợp đồng trái phiếu và stablecoin hàng đầu vượt xa so với các dự án khác. Điều này không có lợi cho toàn bộ đường đua. Lý do khiến các nhà đầu tư chú ý đến đường đua này là do dự án nợ của Mỹ trên chuỗi rất phổ biến vì thu nhập của DeFi đã trở nên thấp hơn. Nhưng một khi nền kinh tế vĩ mô khởi sắc, lợi nhuận DeFi sẽ tăng lên và ngành mã hóa sẽ bước vào thị trường tăng giá, liệu lợi nhuận của các dự án RWA này nhìn chung có cao hơn các giao thức DeFi khác không? Khi đó, nếu không có sự hỗ trợ của các dự án ở các hướng khác, RWA khó có thể thoát khỏi số phận ngắn ngủi.

nguy cơ vỡ nợ tiềm ẩn

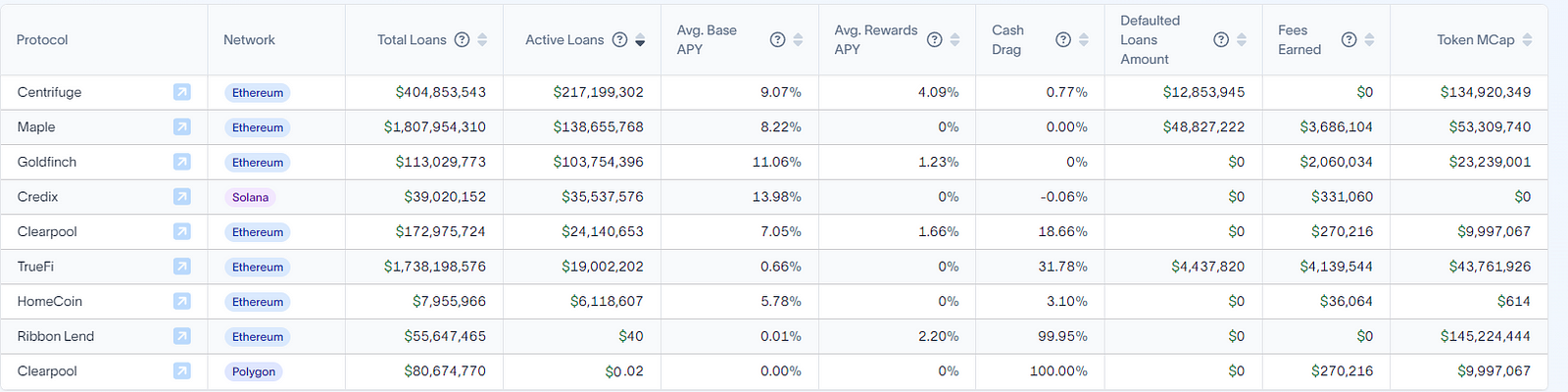

Vì tài sản thế chấp hoặc tài sản giao dịch của kênh RWA là ngoại tuyến và chúng không phải là mã thông báo ERC-20 trong giao thức DeFi truyền thống nên khi xảy ra sự kiện thanh lý tài sản, nó phức tạp hơn nhiều so với việc thanh lý tài sản được mã hóa gốc. Theo dữ liệu của rwa.xyz, trong số các thỏa thuận RWA lớn hiện nay, Centrifuge, Maple và TrueFi đều có nợ xấu, với tổng số tiền không trả được là hơn 66 triệu đô la Mỹ và tỷ lệ vỡ nợ khoảng 1,6%.

tập trung quá mức

Tóm tắt

Tóm tắt

Ngành công nghiệp tiền điện tử luôn bị chỉ trích vì không mang lại sự trợ giúp và giá trị cho thế giới thực. DeFi chỉ đóng vòng cấp vốn trên chuỗi và NFT không giúp các thương hiệu trong thế giới thực hình thành nhiều giá trị tăng trưởng hơn. RWA được các tổ chức thúc đẩy mạnh mẽ vì họ thấy nó giúp ích cho tính thanh khoản của tài sản thực. Quy mô thị trường trái phiếu hiện tại là khoảng 127 nghìn tỷ đô la Mỹ, và tổng giá trị bất động sản toàn cầu là khoảng 362 nghìn tỷ đô la Mỹ. Nếu những tài sản và chuỗi này có thể hình thành Tương tác thì giá trị mà nó tạo ra sẽ rất lớn.

Có lẽ trong môi trường hiện tại, thị trường giá lên tiếp theo sẽ chú trọng hơn vào việc tuân thủ và tính thực tiễn trong thế giới thực. Tuy nhiên, điều đáng chú ý là theo kinh nghiệm trong quá khứ, hầu hết các đợt bùng phát trong ngành mã hóa đều do nguyên nhân từ dưới lên, trong khi người tham gia và khán giả của RWA vẫn chủ yếu là các tổ chức và doanh nghiệp, còn các nhà đầu tư thông thường vẫn chưa có điểm vào thích hợp. . Còn một chặng đường dài phía trước và RWA vẫn cần nhiều nỗ lực thăm dò hơn.

Tuyên bố miễn trừ trách nhiệm: Tất cả nội dung trên trang này có thể liên quan đến rủi ro của dự án và chỉ nhằm mục đích phổ biến và tham khảo khoa học và không cấu thành bất kỳ lời khuyên đầu tư nào. Hãy xử lý nó một cách hợp lý, thiết lập triết lý đầu tư đúng đắn và nâng cao nhận thức về phòng ngừa rủi ro. Nên xem xét toàn diện các yếu tố liên quan khác nhau trước khi tương tác và nắm giữ, bao gồm nhưng không giới hạn ở mục đích mua hàng cá nhân và khả năng chấp nhận rủi ro.

Thông báo bản quyền: Bản quyền của thông tin được trích dẫn thuộc về phương tiện truyền thông gốc và tác giả. Nếu không có sự đồng ý của Câu lạc bộ Jianshu J, các phương tiện truyền thông, trang web hoặc cá nhân khác không được phép in lại các bài viết trên trang này và Câu lạc bộ Jianshu J có quyền truy cứu trách nhiệm pháp lý đối với các hành vi trên.