Overview of the Derivatives DEX Race: Will it Drive the Next Bull Market?

Original author: MooMs, encrypted KOL

Original translation: Felix, PANews

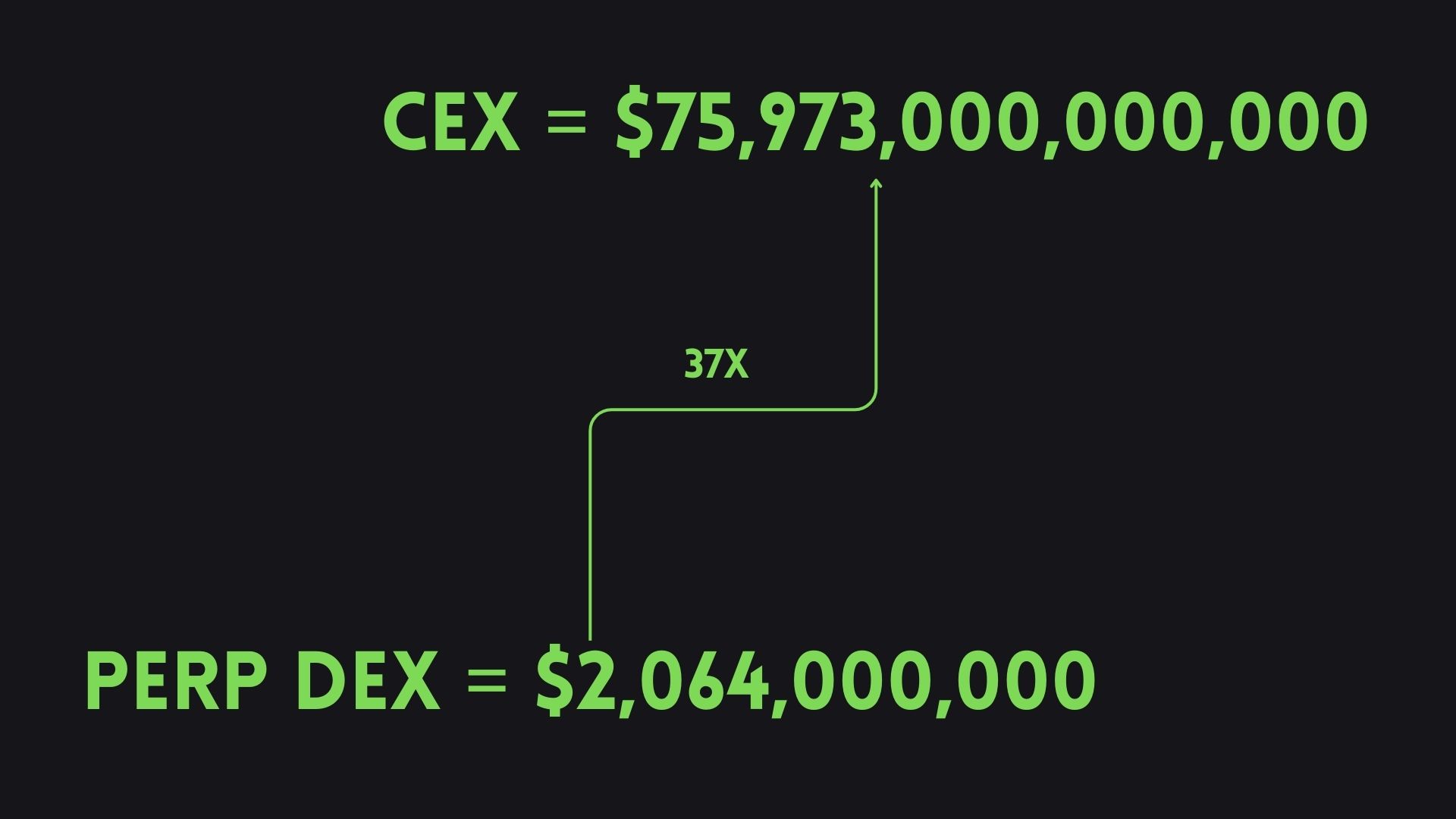

Currently, over 97% of derivative trading volume is executed on CEX. Derivative DEX only accounts for 2.72% of the total trading volume, indicating a huge growth potential for derivative DEX and it may dominate the next bull market. This article provides relevant information about the derivative DEX track.

Top projects

Fee structure comparison

Indicator comparison

Growth potential

Most promising derivative DEX

Top projects

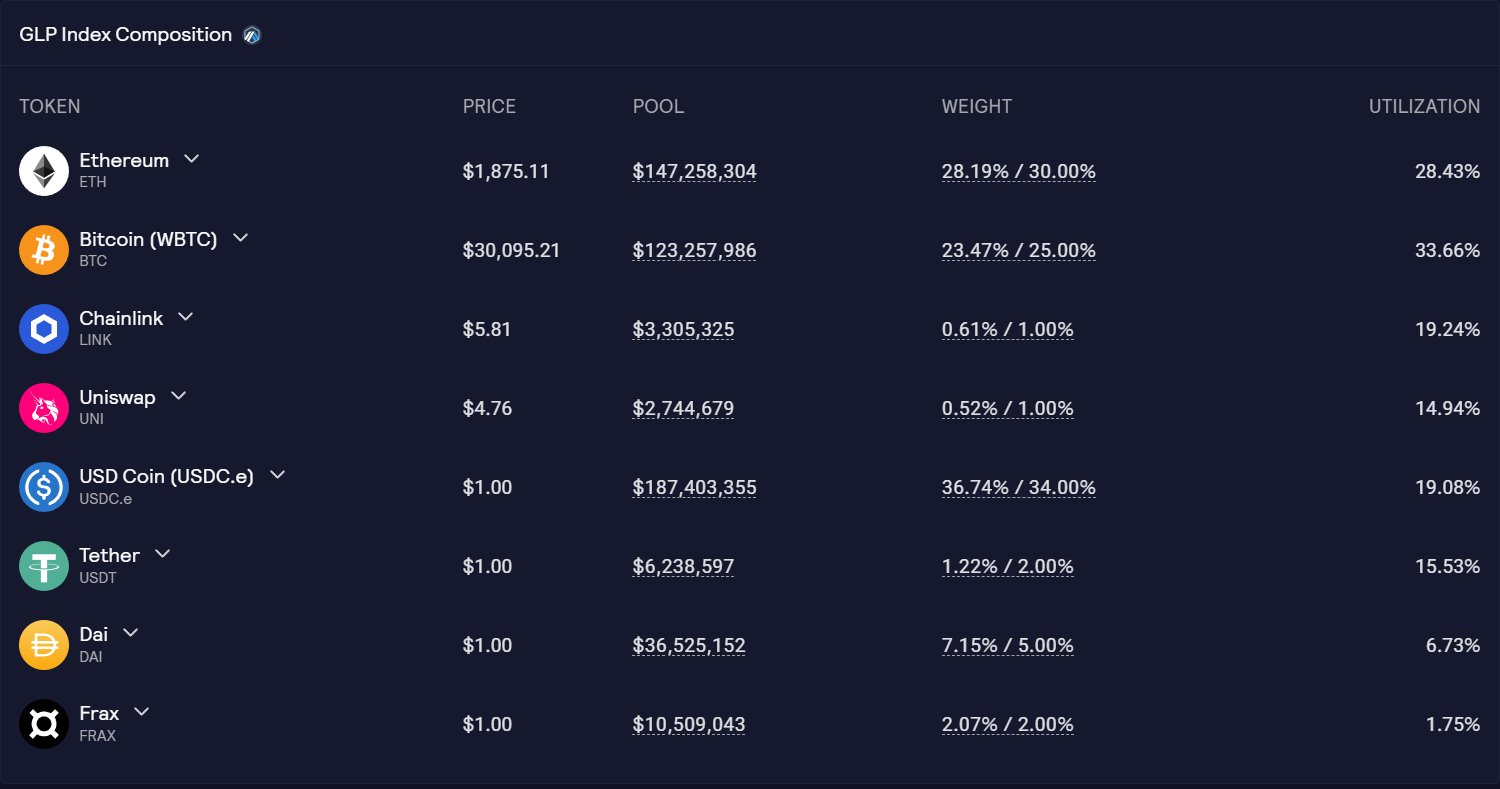

GMX

GMX allows users to trade on the GLP pool, providing zero-slippage spot and margin trading. GLP is the funding pool of GMX, including BTC, ETH, UNI, LINK, and 4 stablecoins. The great advantage of this model lies in its composability; some protocols are starting to create investment products that utilize GLP and its earnings to generate additional returns.

Assets Online

Cryptocurrencies: Up to 50x leverage

Token Economics

Supply: 8,813,076

XVIX and Gambit Migration: 45.3% (Note: The anonymous team behind GMX has previously developed two other protocols, XVIX and Gambit)

Floor Price Fund: 15.1%

Reserves: 15.1%

Liquidity: 15.1%:

Presale Rounds: 7.6%

Marketing and Partnerships: 1.9%

Although the platform offers only four currency pairs, the introduction of GMX V2 brings in a synthetic market offering a variety of new currency pairs, including stocks and forex. Additionally, it introduces isolated pools and lower fees for a better trading user experience.

Gains Network

Gains offers a trading platform with a variety of asset classes and high leverage. The platform utilizes the gDAI treasury as a counterparty, where the amount of DAI is constantly changing.

When traders win, they receive bonuses from the treasury.

When traders incur losses, their losses are stored in the treasury.

Similar to GMX, Gains' model is highly composable, allowing other protocols to integrate with gDAI and build products on top of it.

Supported Assets

Cryptocurrencies: Leverage up to 150x

Commodities: Leverage up to 150x/250x

Forex: Leverage up to 1000x

Token Economics

Total supply: 100 million

Initial supply: 38.5 million

Developers: 5%

Governance: 5%

Circulating supply: 90%

No seed round, no venture capital, no token lock-up.

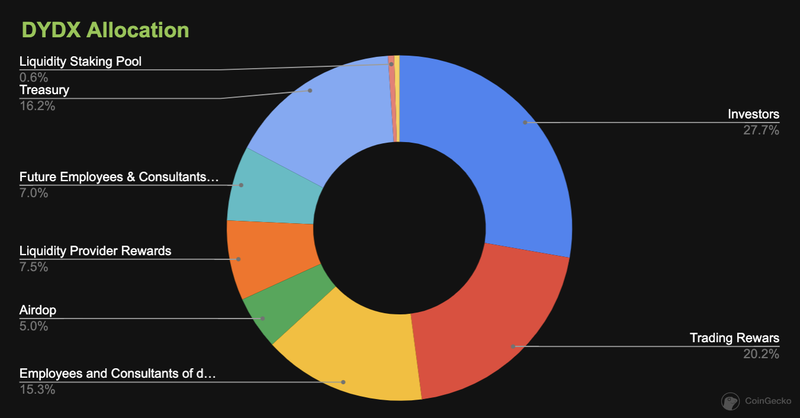

dYdX

dYdX is the first decentralized derivatives exchange, offering leveraged trading on 36 cryptocurrency pairs (up to 20x leverage). dYdX is the only platform that uses an off-chain order book, sacrificing decentralization to increase liquidity depth. However, the team is working hard to release v4 soon. dYdX v4 will be deployed on Cosmos, aiming to make the protocol fully decentralized. The new version will also introduce a highly anticipated feature: revenue sharing. Stakeholders of DYDX will earn a certain percentage of the platform's revenue.

Token Economics

Total Supply: 1 billion

Investors: 27.7%

Trading Rewards: 20.2%

Employees and Advisors: 15.3%

Airdrop: 5%

Liquidity Provider Rewards: 7.5%

Future Employees: 7.0%

Treasury: 16.2%

Liquidity Staking Pool: 0.6%

Security Staking Pool: 0.5%

Kwenta

Kwenta is a decentralized derivatives trading platform that offers perpetual futures and options trading on Optimism. Currently, the platform offers over 42 pairs of cryptocurrencies, forex, and commodities with leverage of up to 50x.

Kwenta has partnered with Synthetix, which provides the underlying protocol for managing liquidity and directly providing Perps. This partnership allows Kwenta to focus on user experience and interface design, while Synthetix focuses on liquidity mechanisms.

Similar to dYdX and GMX, Synthetix will release a new version of the platform in September. The new version, developed for over a year, will offer permissionless markets, full collateral mode, and multi-collateral staking, among other features.

Token Economics

Total Supply: 1 million

Synthetix Stakers: 30%

Synthetix + Early Kwenta Traders: 5%

Investment: 5%

Community Development Fund: 25%

Core Contributors: 15%

Kwenta Treasury: 20%

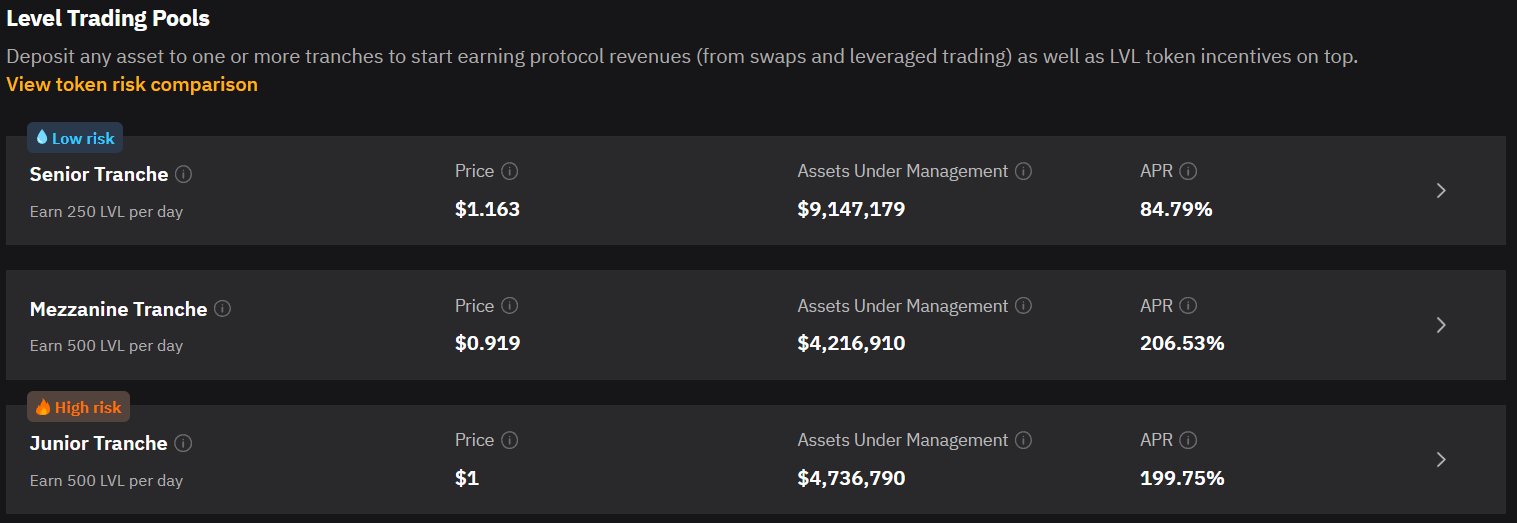

Level Finance

Level was launched in December 2022 and offers spot and leveraged trading (up to 50x) for BTC, ETH, and BNB. Level gained significant attention due to its "loyalty program" that rewards traders with 16,000 LVL tokens daily. A substantial portion of trading volume and fees comes from this program, and users can earn annual interest rates ranging from 85% to 206% through a three-tier model. Miners can choose whether to deposit assets into lower-risk pools and earn lower annual interest rates, and vice versa.

Token Economics

Total Supply: 50 million

Liquidity Provider: 36%

Community Incentives: 34%

Team: 20%

DAO: 10%

MUX Protocol

MUX Protocol is a perpetual DEX deployed on five chains, providing traders with deep liquidity and up to 100x leverage.

The two main features are:

• Leverage Trading: Users trade with MUXLP, following the same model as GMX and GLP pools.

• Aggregator: Selects the most optimal liquidity path to minimize trading prices and liquidity depth across different Perp DEXs.

Token Economics

The protocol involves four tokens:

MCB: The main token of the protocol

MUX: Non-transferable token obtained by staking veMUX or MUXLP

veMUX: Governance token

MUXLP: Liquidity provider token

Now that we have discussed six major protocols and their key features, let's examine the current landscape of the derivatives industry.

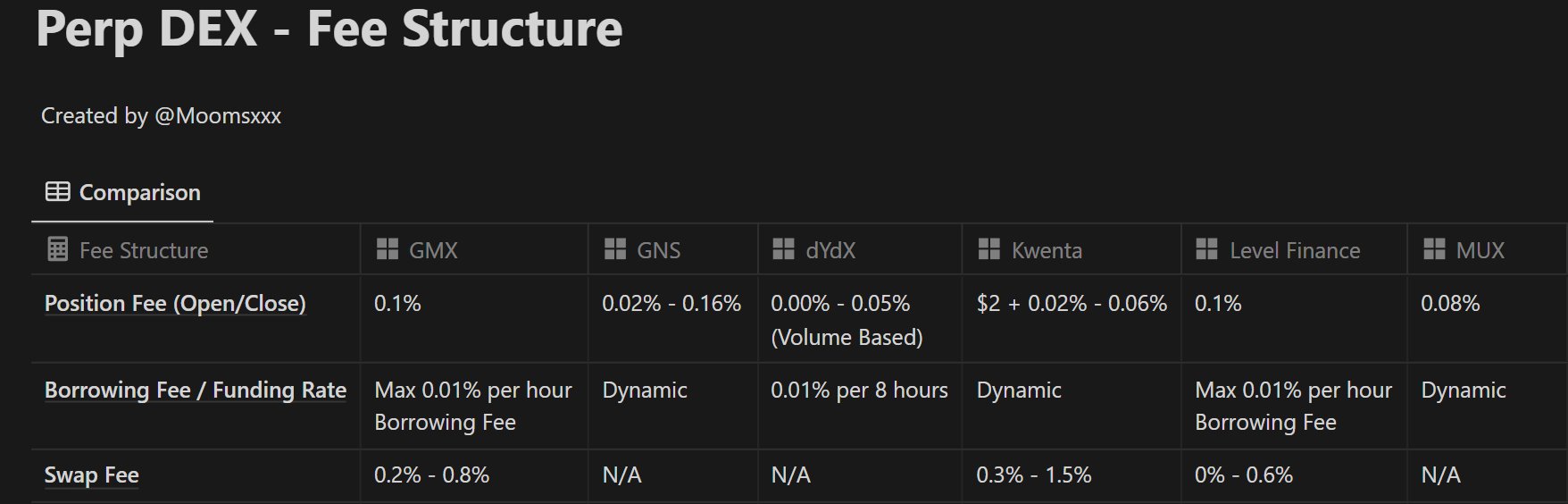

Fee Structure Comparison

Transaction fees (opening/closing): dYdX has the lowest transaction fees, ranging from 0 to 0.05% (based on trading volume); MUX follows with 0.08%; GMX and Level both have 0.1%.

Funding rate: dYdX is 0.01% every 8 hours; GMX and Level have a maximum of 0.01% per hour; GNS, Kwenta, and MUX have dynamic rates.

Comparison of Metrics

Currently, dYdX offers the best trading platform with the highest liquidity and lowest transaction fees, capturing 64.4% of the market share among the top 6 DEXs. However, dYdX's model does not allow them to list synthetic products like other protocols, which competitors can take advantage of to gain market share.

As mentioned earlier, dYdX is working on launching a fully decentralized platform with a revenue-sharing mechanism, so it is expected to gain more user support in the coming months.

On the other hand, GMX currently has the highest fees, but they are working to address this issue. Interestingly, GMX's trading volume is about one-fifth of dYdX's, but it generates fees approximately twice as much as dYdX.

A similar situation occurs with Level and GNS. Level and GNS have the same trading volume, but Level's generated fees are roughly twice as much as GNS.

Growth Potential

According to the indicators, Level Finance is the most undervalued platform. Additionally, Level Finance has the best token economics, with strong LVL + LGO incentives.

GMX can also be considered undervalued, as it ranks third among all DeFi protocols (excluding public chains) in terms of generated fees (year-to-date) and only ranks 79th in terms of market cap.

MUX has the best TVL/Volume ratio, indicating high capital efficiency.

GNS and Kwenta are excellent choices for the next bull market, as they generate high income and have medium to low market caps.

Lastly, dYdX is the safest choice, as it is the leader in its field, has top-tier capital support, and its upcoming new version should incentivize users to hold DYDX tokens.

Most Promising Derivatives DEX

The following are top DEXs entering the market in the next few months that may capture a significant market share.