ETH Weekly | 30 Ethereum projects cooperate to launch MEV Blocker RPC; Swiss InCore Bank provides ETH pledge service (4.3-4.9)

1. Overall overview

text

secondary title

InCore Bank, a financial bank based in Zurich, Switzerland, announced that it will provide Ethereum staking services to customers. The bank stated that customers using its Ethereum staking services must fully comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. Require. InCore Bank CEO Mark Dambacher said that the bank will provide customers with Ethereum staking services through segregated wallets and comply with regulatory and tax regulations.

Second, the secondary market

1. Spot market

1. Spot market

ETH daily chart via OKX

image description

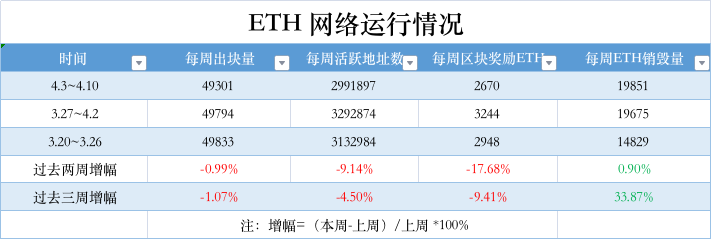

2. Network operation

etherchain.org2. Network operation

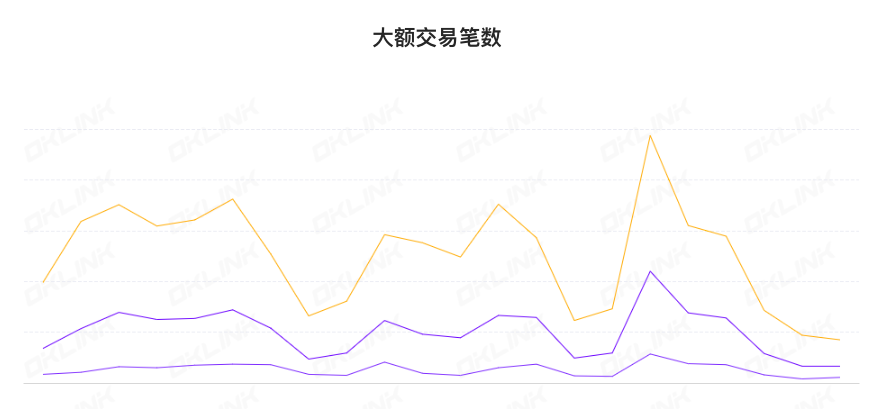

3. Large transaction

OKlink dataOKlink data

4. Rich list address

OKlink dataOKlink data

3. Ecology and technology

1. Technological progress

1. Technological progress

2. Voice of the Community

Safe, BitKeep, DODO, Oasis, Balancer, 1inch and more than 30 Ethereum projects have cooperated to launch MEV Blocker RPC, a tool designed to protect users from various types of MEV attacks. MEV Blocker protects users from front-running and sandwich attacks on Ethereum transactions. With MEV Blocker, users enjoy a fast, free and censorship-resistant RPC to process transactions. Get instant protection by adding this RPC endpoint to your wallet.

2. Voice of the Community

Marc Zeller, head of strategy at Aave, published an article discussing the four stages of decentralization, namely Autocracy, Oligarchy, Liquid Representative Democracies, and Stateless Stage.

3. Project trends

Marc Zeller believes that no project has yet reached the mature DAO stage, and MakerDAO and Aave are on the verge of transitioning from stage 2 to stage 3. The stateless phase is similar to a stateless society, and currently, LUSD, Ethereum, and Bitcoin are the only significant players in Phase 4 that Marc Zeller believes.

(1) StarkNet: At present, those who claim to provide token release or airdrop are all fake accounts

StarkNet, the Ethereum Layer 2 network, issued a security alert stating that there are currently a large number of false private messages on Discord, Twitter, and Telegram, claiming that StarkNet is providing token releases or airdrops. StarkNet says the accounts currently claiming these activities are all fake.

Lido, a liquidity staking protocol, published a document predicting the withdrawal speed of Ethereum after the upgrade in Shanghai. According to Lido, if there is enough ETH in the protocol buffer to provide services, withdrawal requests of less than 1000 ETH can be completed within 1 day (standard Ethereum withdrawal takes 2-6 days), and withdrawal requests in the range of 1000 to 5000 ETH Withdrawal requests may take 2 days to complete, withdrawal requests over 5,000 ETH are expected to take 4-10 days, and withdrawal requests over 100,000 ETH are expected to take two weeks to complete.

(3) OpenSea releases functional updates such as wallets to further simplify ETH encapsulation/uncapsulation

(4) Coinbase Ventures has joined Rocket Pool's joint governance DAO ODAO

(5) LSD protocol unshETH launches v2 version on Ethereum and BNB Chain

(6) ArchiveNode.io, the Ethereum mainnet archive node service, announced the end of the project

(7) Optimism: Token House has approved the mainnet Bedrock upgrade

Optimism, the second-layer solution of Ethereum, announced that its governance organization Token House has voted to approve the upgrade of the Optimism mainnet Bedrock. Not only was this the first on-chain vote conducted by the Collective using the new voting page, it was also the first protocol upgrade. The voting link is the V2 version of the Bedrock upgrade proposal. The upgrade standard process is to first perform a Regolith hard fork on Optimism Goerli. After the audit is repaired, a 2-week test will be carried out on the testnet. Only after the testnet stability standard is met , the Optimism Foundation will not announce the upgrade date until at least 3 weeks after the release date. Upgrades will be triggered at specific times, not block heights.

(8) Ethereum re-pledging protocol EigenLayer releases the first phase of the test network for pledgers

The Ethereum restaking protocol EigenLayer released the first phase of its protocol test network on the Ethereum Goerli network. Currently, it only supports liquid restaking (liquid restaking) and native restaking (native restaking). Among them, liquidity re-pledging supports the re-pledging of various liquidity tokens on the EigenLayer contract. It is reported that the release of EigenLayer will be carried out in three stages, namely pledgers, node operators and services. EigenLayer stated that the testnet is an early non-incentivized testnet and the code is under active development.

According to previous reports, the Ethereum re-pledging protocol EigenLayer completed a $50 million A round of financing, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Bixin Ventures, Hack VC, Electric Capital, and IOSG Ventures. Previously, EigenLayer had completed a $14.5 million seed round led by Polychain Capital and Ethereal Ventures.

(9) zkSync: The project whose funds are stuck in the contract is Gemholic, and a solution to the unfreezing contract and Gas-related problems has been found

zkSync explained that any smart contract using transfer() or send() is heavily dependent on Gas cost (hardcoded 2300 Gas), but this is not guaranteed to work on Ethereum, the fallback() function can consume more than 2300 Gas, opcode Gas Pricing may change in future versions of Ethereum and contracts will break. zkSync Era is not equivalent to EVM, Era has a divergent, dynamic gas metering scheme, allowing some transaction types to have Gas only equivalent to 1/10 to 1/1000 of any other EVM Rollup. According to the current gas level of Era main network, ETH transfer will cost more than 2300 gas. This is why any .transfer() call without an explicit Gas stipend will currently fail. zkSync has always been aware that this problem could arise, so added a warning about .transfer() directly to the compiler.

(10) Redacted releases white paper on over-collateralized stablecoin Dinero

Web3 infrastructure provider Redacted has released the white paper for Dinero, an over-collateralized stablecoin backed by Ethereum blockspace. It is reported that Dinero is a currency experiment that introduces a public and permissionless RPC for users; a decentralized over-collateralized stablecoin Dinero; and liquid collateralized derivatives that benefit from the pledged yield and Dinero protocol.

(11) The mainnet of the options trading platform Aevo is officially launched, and will first support users to trade ETH options

Aevo Exchange is built on top of Aevo Chain, allowing users to transfer funds to Aevo Chain directly from the Exchange user interface. Currently, Aevo only supports USDC cross-chain. Due to its early stages, Aevo will issue invitations to a limited number of users via PASS (an NFT that grants users the ability to transact on the platform), and has already issued invitations to existing Ribbon users, participating in Aevo's beta program, partners or Ribbon VIP Each wallet airdrops about 4,000 PASS.

(12) Memeland: 69 validator nodes will be set up for the Ethereum network

4. Borrowing

DeFiLlamaMemeland says there are three main reasons for setting up these validator nodes: to secure the ethereum network, to generate revenue by earning rewards, and to conduct “internal testing” of their developing Stakeland project. It is reported that Memeland also revealed that most of the project’s funds are in cryptocurrencies, and mainly ETH. According to its disclosed wallet address, the current holdings are about 10,000.32 ETH.

4. News

The data shows that the value of locked collateral on the chain rose from $29.03 billion to $29.89 billion last week, a month-on-month increase of 2.9%. Specifically, the number of ETH mortgages dropped from 16.15 million to 16.07 million last week, a drop of 1%. From the perspective of individual projects, the top three lock-up values are: Lido $11.13 billion; MakerDAO $7.72 billion; Aave $4.89 billion.

(1) In March, the NFT market transaction volume on Ethereum dropped to 1.37 billion US dollars, and the Blur platform once again surpassed OpenSea

According to The Block Pro data, in March this year, a total of 92,057 ETH (approximately $151.9 million) were destroyed. Throughout March, ETH was in a deflationary state. Since the implementation of EIP-1559 in early August 2021, a total of 3.04 million ETH (approximately $9.17 billion) have been destroyed. The monthly transaction value of the NFT market on Ethereum fell 26.3% to $1.37 billion. The monthly transaction volume of the Blur platform surpassed that of OpenSea again, mainly due to the launch of its BLUR token.

(2) Survey: 83% of the interviewed crypto users expect more ETH to be pledged before and after the Shapella upgrade

OKX published the results of a survey on the market impact of the Shapella upgrade, scheduled for April 12, that will allow withdrawal of staked ETH. Key findings include:

- 83% of respondents expect more ETH to be staked in the next three months;

- 63% of respondents predict that by the end of 2023, ETH will reach an all-time high of more than $5,000;

- 79% of respondents expect the price of ETH to react differently to Shapella than to Merge. Among them, 59% believe that the currency price will continue to rise before and after the upgrade; 20% believe that it will be sideways;

- 34% of respondents predict that ETH will be below $2000, while 33% think it will reach at least $3100 by June 2023;

(3) Swiss bank InCore Bank announced that it will provide Ethereum staking services to customers