4D Inventory Top 10 Themes of Solana DeFi in 2023

This article is from:substackOdaily Translator |

Odaily Translator |

secondary title

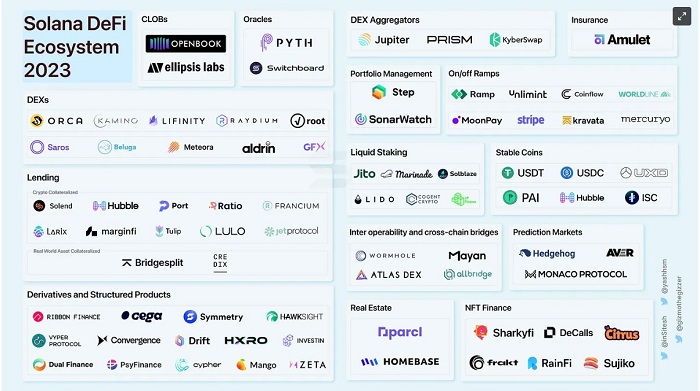

Overall overview of the DeFi ecosystem

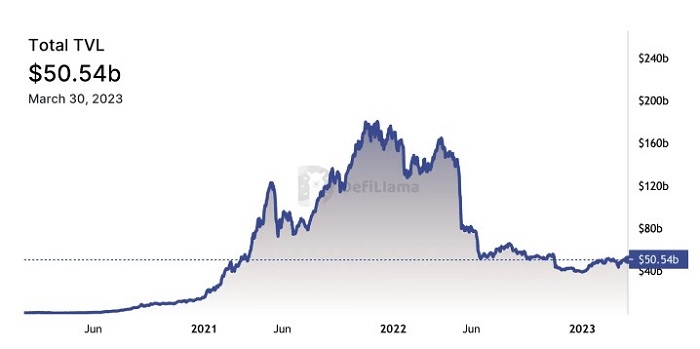

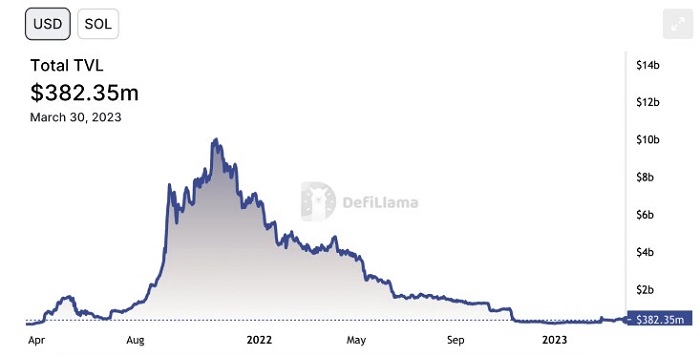

From DeFi Summer in 2020 to the end of 2021, the amount of locked positions in DeFi will continue to rise, but it will drop sharply in 2022. Due to the huge risks in customer deposits of a series of centralized entities such as BlockFi, 3AC, Celsius, and FTX, due to the huge risks of these enterprises Unsustainable lending practices and the use of illiquid assets as collateral ultimately led to the downfall and destabilized the DeFi ecosystem.

In fact, every time the encryption market encounters a major event, the total lock-up volume of DeFi will suffer huge losses, and this time is no exception. Following the Terra crash in May, total DeFi lock-ups plummeted by $60 billion, and the ongoing liquidation event in June lost another $25 billion. However, the worst blow occurred in November when the FTX collapsed, causing about $10 billion in the loss of DeFi lockups and affecting the entire ecosystem.

image description

Above: DeFi total locked positions (data as of March 30, source: DeFiLlama)

image description

secondary title

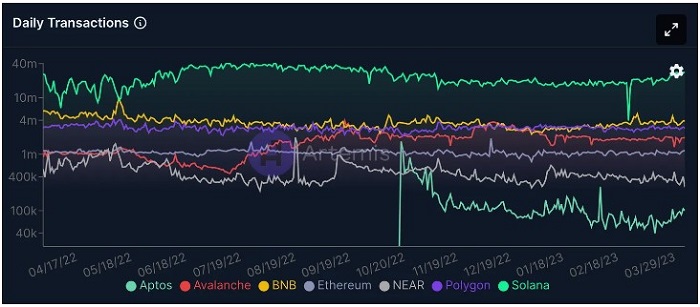

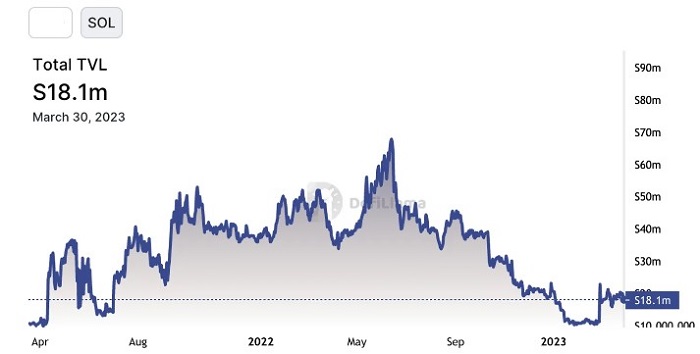

Solana DeFi Overview

Compared with the EVM DeFi ecosystem, Solana is younger and smaller, but its development speed is very rapid, because many products that cannot be built on the Ethereum blockchain can be supported on Solana. However, Solana DeFi is not a low-level version of EVM DeFi, but is injected with a new design, which can also bring more value to stakeholders. As an example, central limit order books bring TradeFi to DeFi thanks to efficient price discovery and liquidity.

image description

image description

image description

secondary title

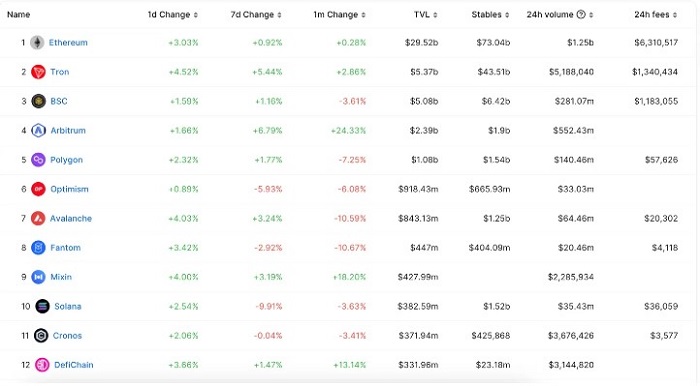

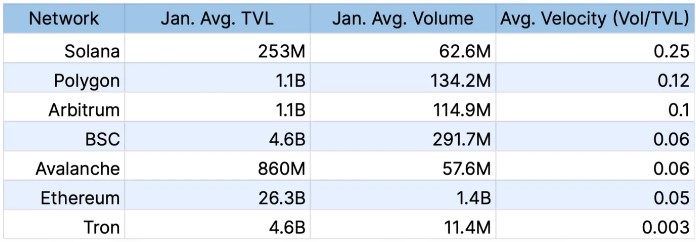

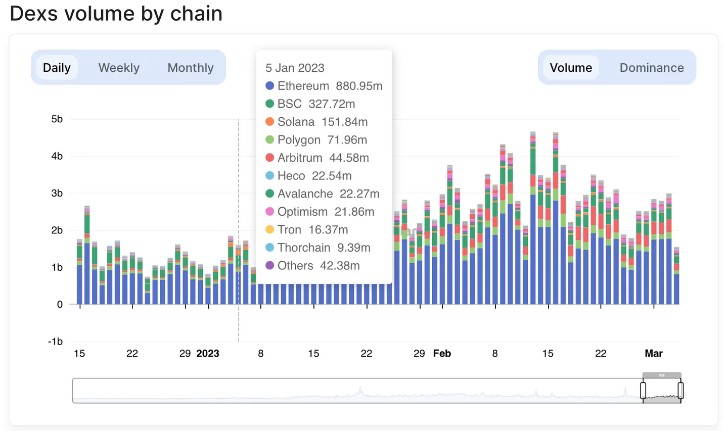

Solana is a "capital efficient" chain

While the lock-up indicator is very important, it can sometimes be misleading because the related statistics are double-counted, so the indicator number is slightly exaggerated. In contrast, the "DeFi Velocity" indicator may better reflect cross-chain activities. The value of this indicator = 24-hour DEX transaction volume / blockchain lock-up volume. The higher the value, the more active the DeFi ecosystem.

image description

Data source for the above picture: DeFi Llama

image description

Source of the image above: DeFiLlama

Although networks such as Binance Smart Chain (BNB), Avalanche, and Ethereum have relatively high locked positions, the trading ecology of these networks is weaker than Solana, which also shows that the "DeFi Velocity" indicator can describe the locked positions more accurately. on economic activity.

In addition, Tron's "DeFi Velocity" indicator is only 0.003, indicating that its on-chain capital activity is not high. If you want to read more about the “DeFi Velocity” metric, you can refer to this article by Kamino Finance.

secondary title

1. The way forward for DEX, CLOB and AMM

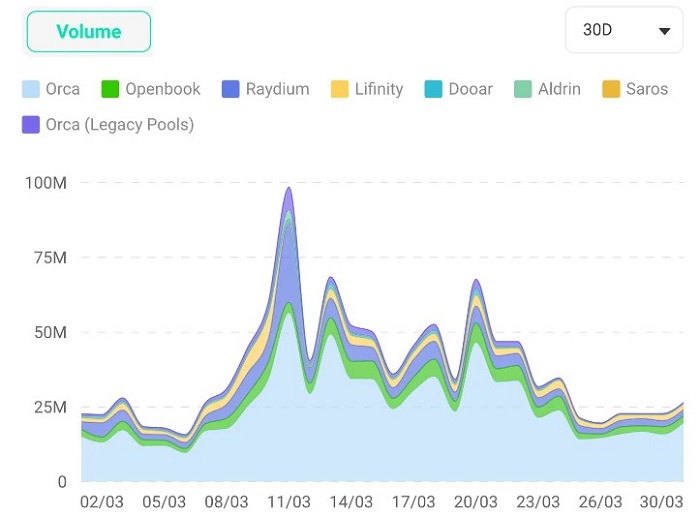

image description

Recent trading volume on DEXs (data as of March 30, source: Solscan)

Orca has become the most important DEX on the Solana chain, and its transaction volume has reached more than 74%, followed by OpenBook, Raydium, Lifinity and Aldrin. However, we can still see innovative projects on the Solana chain like Root Protocol, which builds a hybrid DEX that combines the high efficiency of AMMs with the flexibility of order books.

More and more crypto-native users are shifting from CEX to DEX and starting to conduct self-custodial transactions on DEX. However, a big obstacle to the widespread adoption of self-hosted exchanges is the user experience. While some EVM DEXs have high transaction volumes, most DEXs use additional token incentives to attract transaction volumes, without significantly reducing user experience. Due to the experience gap, it will be difficult for DEX to surpass CEX in terms of quantity and liquidity.

1. Development status of CLOB

First, a brief history of Web3 is worthwhile. In the early days of FTX, SBF talked to every major L1 developer in the market, looking for a blockchain that could support its vision of an on-chain central limit order book (CLOB). In 2020, after a 3am call with Anatoly, Project Serum was launched on Solana.

Serum was one of the first on-chain central limit order books (CLOBs) and fueled the growth of Solana DeFi. Traders can experience their familiar decentralized version of order book trading in TradFi. After the FTX crash, the DeFi community forked the Serum code and named it OpenBook.

There are now two real-time central limit order books on Solana: OpenBook, which is still widely adopted, and Phoenix, an alternative developed by Ellipsis Labs. For a detailed analysis of OpenBook, see thisSuperteamarticle. Note that both projects are open source.

OpenBook employs cranking, an operationally intensive and centralized process to ensure that orders are matched correctly, with transactions batched at regular intervals. The Phoenix solution enables transactions to be processed immediately and reduces the possibility of front-running and other forms of market manipulation. Although Phoenix's original design would require institutional market makers to disclose their identities or be whitelisted, their The v2 version will enable permissionless and anonymous liquidity provisioning.

For builders, here are some opportunities to consider:

Design choice: One way to design the order book is as a separate application chain, although there is a trade-off for atomic composability, typical examples are like dYdX v 4 or Sei, doing so enables customizability through the Solana Virtual Machine (SVM) , without compromising Solana's speed and low cost. However, exchanges like dYdX v3 or 0x would allow off-chain order books, they may have chosen a different approach to transaction design.

Scalability: Jump Crypto's second validator client, Firedancer, will launch on Solana, which will be interesting as it could further improve Solana's performance by a factor of 10 or more, Firedancer has 100 in test environments Ten thousand + TPS, opening up new possibilities for on-chain high-frequency trading and derivatives trading.

New Marketplaces: Marketplaces can be created with new applications and asset classes, from running licensed orders for imported and exported merchandise goods to trading collectibles like rare spirits, the opportunities are endless.

2. On-chain foreign exchange (FX) market

Forex is a huge market with over $6 trillion in daily trading volume, and many Web3 players are focusing on this space. "Exchanges" and "tokenized cash issuers" will facilitate the on-chain foreign exchange market, according to a research report published by Uniswap in conjunction with Circle, which argues that AMMs will reduce the likelihood of flash crashes during periods of high market volatility, but in fact CLOBs are A better market structure because there is less price impact and better trade execution.

The foreign exchange market will be a key part of the chain of global economic activities. As the most liquid market in the world, the microstructure of the foreign exchange market on the order book is unmatched by automatic market makers. If you look at any of the big market makers in this space, they would rather provide liquidity on LOBs (limit order books) than on AMMs.

secondary title

2. Borrowing: beyond speculation

Decentralized lending provides users with access to funds without intermediaries. We can classify lending activities by collateral type, mainly: cryptocurrency-backed lending and real-world asset (RWA)-backed lending.

1. Lending service mortgaged by encrypted assets

Solana has seen a number of decentralized lending protocols operate on a collateralized basis, most notably Solend, Port Finance, Francium, Tulip, Hubble Protocol (actually the only remaining player in the over-collateralized stablecoin market), Jet Protocol, marginfi, Ratio Finance, and Larix.

During the bull market, the Solana blockchain built a large amount of lending infrastructure, and the bear market happens to be able to stress test various models. A well-designed infrastructure should allow users to obtain loans quickly and easily with minimal friction, and Solana does a good job of this, including the speed and convenience of the lending process.

Despite this, leading protocols like Solend are still struggling due to lack of liquidity, but they have proposed a potential solution in their v2 release. Mortgage loans do not solve many real-world problems and are mainly used for speculative purposes such as leveraged trading. This is why the FTX fiasco has severely impacted this vertical, as the FTX price fetched by the oracle does not match the actual price.

If we look at the EVM blockchains, they have strong collateralized lending programs like AAVE with $4.8 billion locked up (figures as of February 2023), AAVE has been aggressively liquidating all of its loans, simultaneously on multiple fronts Innovations such as the yield-generating GHO stablecoin, cross-chain lending, Centrifuge's RWA program, and flash loans.

In terms of lending, there may be greater potential opportunities in the following areas:

On-chain business: Bring more business to the chain, and cooperate with multi-signature providers such as Squads to provide loans with a lower mortgage rate (~ 100-150%) or even under-collateralized (mortgage rate <100%). Centralized institutional underwriters can act as validators of the protocol, they act like multi-signature guardians, approving loans for on-chain entities, loan details can all be placed on-chain and encrypted if necessary.

Tokenize real-world assets and put debt on-chain. Projects such as Centrifuge, Figure and the recent Apollo deal are exploring this space by tokenizing assets such as real estate, invoices and royalties, which aim to create new investment opportunities and make capital more accessible to businesses. If successful, it could lead to a significant expansion of the mortgage lending market and bring more real-world use cases to DeFi.

Aave's GHO stablecoin provides an ideal case study for a lending protocol that could also be built on Solana.

There are other projects to watch on the Solana chain in the coming months, such as:

marginFi: marginfi has raised more than $1.5 million through self-funding, and its structure is also changing to a prime brokerage model. Assets on marginfi can be used to do long Zeta, Drift or Cypher.

Solend v2: Solend is one of the largest lending projects on Solana. Since its launch, it has undergone many "combat" tests and learned some lessons. Now it has launched a further optimized lending protocol Solend V2. Their latest white paper can Click here to view.

2. Real-world asset mortgage:

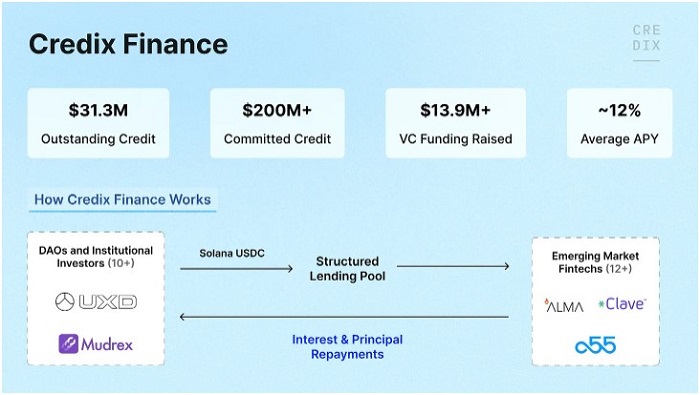

For lenders, features such as verified on-chain assets and real-time balance tracking not only help them make quick lending decisions, but also reduce risks. Finding an ideal business model and regulatory framework is extremely challenging. Previously, Celsius, Lenders like BlockFi and Hodlnaut have had problems because of the way these traditional lenders operate, there is no transparency about who is borrowing and what money is being lent. Next, let's look at an example of a real-world asset mortgage service: Credix Finance.

With over $200 million in committed credit and growing, Credix Finance is building a credit ecosystem designed to bridge the gap between institutional borrowers and lenders by providing liquidity and creating attractive risk-adjusted investment opportunities. gap between investors. Credix Finance uses consumer loans (such as auto loans and invoices) and invoices receivable as collateral in its loan pool, some of which are insured by established reinsurers such as MunichRE.

Real world asset projects can also attract funds from other ecosystems, as Credix Finance has done, they aggregate USDC from Solana and the Ethereum blockchain, but build the execution layer on top of Solana.

Credix Finance is actually built on two ideas:

First, there are many investment opportunities in emerging markets that investors can access because institutional borrowers in these markets often face geographic or capacity constraints in finding capital. Credix Finance effectively solves these problems by giving these borrowers access to capital and credit that they would not otherwise have access to. As a result, fintech companies and non-bank loan originators in emerging markets can raise debt funding with less friction and lower interest rates.

Second, the investment options offered by DeFi will be based on tangible assets rather than the volatility of cryptocurrencies. Credix Finance provides investors with a more stable and predictable investment environment by linking DeFi investments to tangible assets with low beta coefficients to crypto assets.

herehereRead the Solana Foundation's case study on Credix Finance.

Some other exciting opportunities in the real world asset space include:

The need for standards for real-world asset tokens: Standards enable different entities to follow a common set of rules, for example, standards for packaging and shipping physical goods in shipping containers have reduced shipping costs and fueled a surge in global trade. Likewise, establishing an asset standard for how real-world assets are generated, categorized, packaged, and distributed is critical to improving market efficiency and better price discovery.

secondary title

3. Enhance the competitiveness of the derivatives market

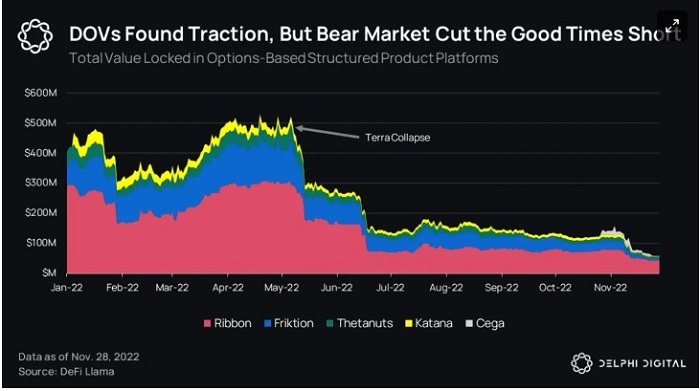

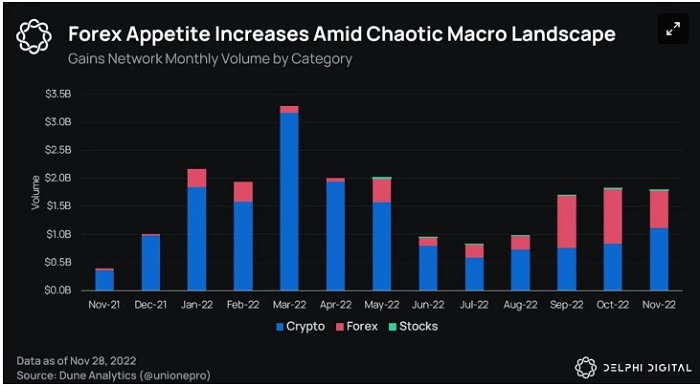

image description

Above image source: Delphi Digital

Before the FTX crash, the DeFi options market was relatively strong. As an on-chain primitive, Ribbon introduces a systematic option sales vault, the model is simple: market makers are incentivized to provide users with the necessary liquidity and profit handsomely from management fees or performance fees. In order to hedge their positions and earn the spread, market makers are encouraged to buy call options from Ribbon's users and then sell call options like a centralized derivatives exchange like Deribit.

After the FTX crash, many market makers took a risk-averse approach and withdrew liquidity from the ecosystem. Rebuilding liquidity and confidence in the Solana ecosystem and the options market is the first priority before complex structured options products are offered on a large scale. At this stage, the market for structured products is still much smaller than expected, so products with better risk-reward structures are needed to cater to retail investors.

While options-based derivatives markets are struggling with the shutdown of protocols like Friktion, the next wave of derivatives infrastructure is being built on the Solana blockchain, such as Fusion, and unlike traditional protocol token airdrops, options airdrops allow the community to contribute There is more flexibility in how and how to protect tokens from instant dumping.

1. Some derivatives agreements that are being actively constructed and worthy of attention

Drift Protocol: Drift Protocol is a decentralized exchange designed to minimize slippage, fees, and price impacts for all transactions. It solves inefficiencies by introducing a centralized liquidity engine into the chain. Drift Protocol has three Liquidity source:

-Constant Liquidity, which is Drift Protocol's virtual AMM, is designated as a source of support for liquidity and can adjust its bid-ask spread according to the inventory held.

-JIT-Liquidity, which is a short-term Dutch auction with market makers competing at or above the auction price.

- Decentralized Limit Order Book (DLOB) paired with Keeper Bots' off-chain order monitors, providing traders with low slippage and deep liquidity.

Cypher: Cypher is a Solana blockchain-based trading platform and margin engine that enables users to trade spot, futures, perpetual contracts and options markets from segregated accounts or cross-margin trading accounts. The platform also provides convenience and time efficiency Optimized mobile trading experience.

- Through the native lending pool, Cypher supports margin trading, allowing users to launch any derivatives with a specified return function.

-Cypher supports two liquidation models, public liquidation and private liquidation, both of which share the same liquidity and order book. Public Clearing allows anyone to transact on it and is a permissionless margin layer. In contrast, private liquidations are reserved for institutional partners and can reduce margin requirements for greater capital efficiency.

Hxro: Hxro allows users to trade futures, options, and perpetual contracts on Solana, and its protocol creates a decentralized exchange service for these financial contracts.

- As of April 3rd, the Hxro network had a cumulative trading volume of $232.83 million and a 30-day average daily trading volume of $3 million (including derivatives and pari-mutuel trading volume)

- With the advancement of several community initiatives such as OpenHxro and partnerships such as Convergence RFQ and Degen Ape, Hxro may build a more integrated ecosystem.

The Vyper Protocol, currently in public beta and unaudited, allows users to create, trade and settle on-chain derivatives in a permissionless and decentralized manner.

- Allows trading any asset or data source backed by oracles like Pyth and Switchboard.

- Users can build custom derivatives based on their specific needs, or can choose from a variety of pre-existing options.

Additionally, Ribbon Finance, PsyFinance, Mango Markets, Cega, Zeta Markets, and Dual Finance are some of the other protocols operating in the derivatives and structured products space. Recently, Mango Markets also launched V4, and another project Devol Network (currently in beta and will launch the mainnet in June) also supports on-chain options trading.

2. The case of stable and sustainable transactions on Solana

Solana needs a reliable perpetual exchange that can provide a CEX-like experience to attract active traders to join the ecosystem. A potential solution is to build a derivatives trading platform on the Solana blockchain to provide perpetual contracts, For products such as options and synthetic assets, the platform should provide a first-class user experience, high leverage and competitive fees to attract traders. At the same time, a hybrid liquidity model combining AMM and order book and cross margin can be explored, as well as applicable Features such as a mobile-friendly interface and advanced API for traders and liquidity providers.

secondary title

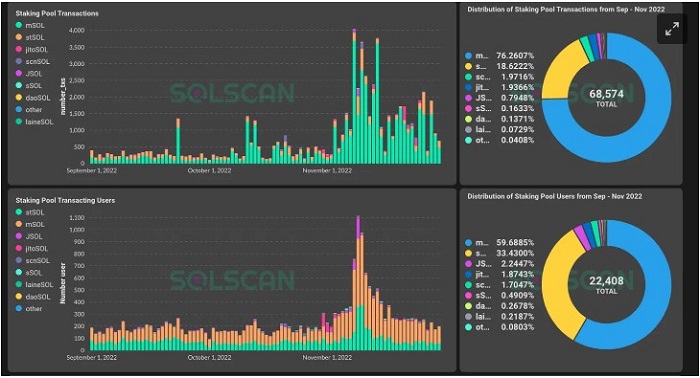

4. Liquidity staking is getting hotter

Liquid Staking (Liquid Staking) is actually a capital-efficient option that uses pledged assets as collateral to provide greater participation and cross-market capital flows than the traditional financial system.

In December 2020, Lido made it easy for anyone to earn Ethereum staking income without maintaining a validator node. For Ethereum users using Lido, there is no need to consider the choice between DeFi yield and staking yield. By staking on Lido, and then using the stETH they obtained in DeFi, they can get two streams of income. Lido currently supports many blockchains including Solana, and is ahead of other liquidity staking protocols in terms of locked positions.

Maximum Extractive Value (MEV) refers to on-chain activities that generate economic gain by exploiting market inefficiencies, and the boom in liquidity staking on Solana may resume as Jito Labs redistributes MEV through its validator client Initially, by providing additional rewards for individuals operating jitoSOL clients, jitoSOL staking pools enable distributed value capture across many validators, although over time it may lead to centralization risks. As of March 30, JitoSOL is offering an annualized return on staking of around 6.80%, on par with other leading staking pools such as Marinade (6.84%) and Lido (6.7%) on Solana.

image description

secondary title

5. Untapped Synthetic Assets and Prediction Markets

image description

The image above is from Delphi Digital

Prediction markets offer users the opportunity to place bets on the outcome of future events, and Solana is a high-throughput blockchain, so it can take advantage of its fast and scalable infrastructure to handle large volumes of transactions and power prediction markets. To give a few examples:

1. Aver Exchange is a peer-to-peer betting and prediction platform on Solana, which eliminates the traditional concept of "bookmakers" in sports betting.

2. Hedgehog is another prediction market on Solana that generates passive income for liquidity providers.

3. Monaco Protocol provides open source infrastructure for prediction markets on the Solana network.

4. The Vyper Protocol can trade event/prediction markets structured as digital options.

Despite Solana's strengths in the prediction market space, some weaknesses may limit its growth, such as lack of user adoption - Solana is a relatively new blockchain platform, and its prediction market may not have as much user adoption as Ethereum and sufficient liquidity, Solana currently has a limited number of prediction markets available compared to other networks. Not only that, but the process of understanding and participating in these markets can be complex and intimidating for users unfamiliar with the concept of prediction markets, thus discouraging potential users from participating in the market, thereby limiting its overall adoption and potential impact. However, prediction markets attract non-crypto-native users who can learn about tokens through games before participating in the DeFi ecosystem.

secondary title

6. Use UX aggregators to improve the DeFi experience

The user interface is often the key to attracting users, and the role of liquidity aggregators is self-evident, as they can take over the layer for DeFi users. Although users can use addresses on the chain to trade directly and the cost is very low, the cash outflow in the DeFi field is still relatively complicated, and UX aggregators can bring better trading strategies.

For novice crypto users, UX aggregators offer considerable advantages, not only offering a level of freedom, but also an efficient user experience by limiting access to secure protocols and alerting high-risk tokens.

At this stage, there are hundreds of liquid DEXs available for trading in the market, such as Jupiter on Solana, 1inch and Paraswap, etc. These liquidity aggregators can obtain quotes from various DEXs to find the best execution price for users , users do not need to visit various DEXs to find the best exchange rate, nor do they need to be "stuck" on a certain DEX. With the continuous development of the DeFi ecosystem, liquidity aggregation may surpass DEX, and will also accommodate different protocols that support these operations. It is inevitable that more DeFi aggregator products will appear in the future.

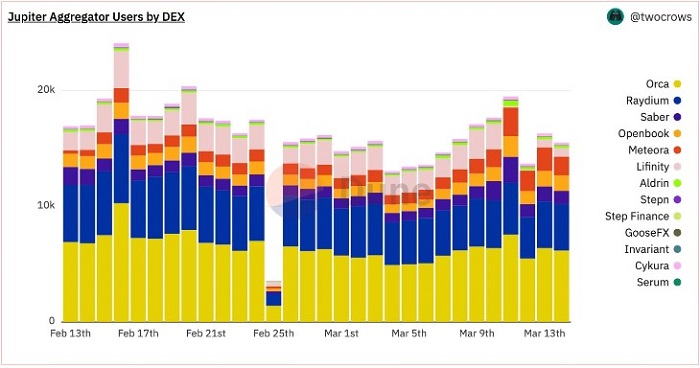

image description

Above: Jupiter aggregator users (Source: Dune Analytics)

Jupiter transaction volume has been high recently, making it the most widely used UX aggregator project on the Solana chain. In fact, Jupiter contributes as much as 41% of the average daily non-voting transaction volume on the Solana chain. In addition, Jupiter participated in the pre-BONK token boom, which also drove a lot of trading activity on the platform.

The success of Jupiter demonstrates two points, one is the growing popularity of DeFi applications; the other is that liquidity aggregators can play an important role in facilitating transactions across multiple DEXs. Liquidity aggregators like Jupiter are likely to continue to play an important role in the DeFi ecosystem as more users enter the DeFi space and seek the best price and execution.

For builders in the aggregator space, key opportunities include:

1. Build a complete DeFi UX aggregator: where users can access multiple opportunities, such as Swap, income opportunities, lending rates, execution of perpetual futures, earning the cheapest/most expensive option fees, etc.

secondary title

7. Strengthen investment portfolio management and analysis

Symmetry, Step Finance, and Sonar Watch are all portfolio management and analysis tools for the Solana ecosystem. These platforms help users track the real-time performance and value of their positions on Solana, including mining, staking, and other yield strategies. A distinctive feature of the Symmetry platform is that it allows anyone to create or purchase indices, and Sonar Watch provides users with advanced tools such as DEX managers and IL calculators.

However, Solana-based portfolio management applications still suffer from limited functionality when compared to more comprehensive multi-chain platforms such as Zapper, which are not suitable for users who want a more comprehensive portfolio management and analysis solution. Apps may become less attractive. It has to be admitted that the market competition is also very fierce nowadays, because many mature multi-chain platforms have acquired a large number of users, such as DeFiYield, CoinStats, and Starlight, etc., which may lead to limited adoption of platforms on the Solana chain. After all, these applications The switching cost is not high.

Beyond that, there are a number of factors that can hinder mass consumer adoption of DeFi, including but not limited to:

Lack of localization: Every DeFi product is telling the same narrative, such as offering high annual returns, low fees, and rewards. However, it is difficult for these products to be used by non-English speakers or those who cannot use local banks. This issue needs to be paid attention to, because these users are the users who can benefit most from DeFi.

Difficulty attracting new users: easy on-ramps for fiat currency transactions have not been widely addressed, and user self-regulation requires more education.

1. Build a mobile-friendly dashboard app

The Solana ecosystem still lacks sticky consumer apps, especially mobile apps, so it needs such a good product that more people will learn to self-regulate. At this stage, most of the projects receiving attention in the Solana ecosystem are speculative-based products that have not yet focused on practical use cases such as loans, insurance, and other financial services, nor catered to transactions that seek to profit by trading and investing in different DeFi tokens makers and investors.

While most crypto apps are exploring mobile functionality, having a mobile app is especially important for portfolio management projects, where many users turn on their computers simply because they have too many portfolios or want to avoid some of the erroneous things that can happen on their phones. friction is necessary.

As the DeFi market continues to grow, the Solana on-chain portfolio management and analytics platform can help users make more informed investment decisions by providing rich data insights and analytics to help users navigate and get the most out of the ecosystem. Having a mobile application that allows users to display all the information of their investment portfolio at the touch of a finger will undoubtedly be a game changer, and platforms like Saga have already appeared on the Solana chain.

2. Insurance

As more and more users enter the field, users need to manage their own risks and protect their investments, which provides a broad market for insurance providers who can provide insurance to help users protect against potential losses. As an example, Amulet has created an open risk protection model that brings exciting opportunities to the entire risk protection space. The traditional insurance industry is built on a centralized model, which often results in high costs, slow processing times, and poor coverage. limited issues.

Decentralized insurance protocols can provide more affordable and efficient solutions that can eliminate intermediaries and management costs, and can provide users with more comprehensive and affordable insurance coverage options.

3. NFT Finance

secondary title

8. Expansion bridges and oracles: infrastructure for connecting DeFi

Wormhole and Pyth are leading the bridging and oracle space in Solana DeFi, an area that, to be clear, has seen a lot of progress.

1. Interoperability protocols and cross-chain bridges

Cross-chain interoperability is a key element of the DeFi ecosystem, with as much as $25 billion in funds cross-chain interoperable during the market peak in March 2022. As a messaging and interoperability protocol, Wormhole connects multiple blockchain networks to provide cross-chain compatibility, and has a growing ecosystem of protocols that are leveraging its capabilities to serve users.

2. Circle cross-chain transmission protocol

Another highly anticipated cross-chain protocol is Circle's cross-chain transfer protocol, which bridges USDC by burning and minting tokens on the source and target chains. Portal Token Bridge (Wormhole itself), Atlas, Allbridge, and Mayan Finance (public beta, unaudited) are currently the main protocols that provide cross-chain transfers and exchanges, although these cross-chain bridging services provide users with many benefits, such as free Permissioned transactions and smart contract composability, but also bring other challenges such as security issues.

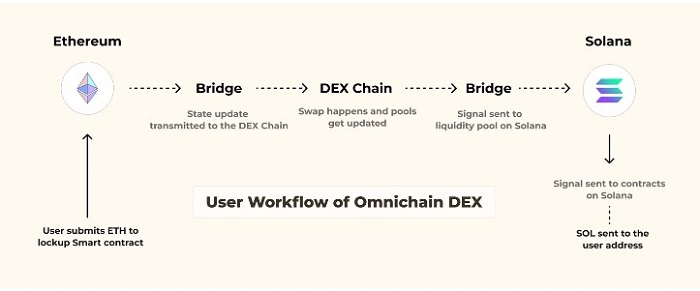

3. Full chain DEX

An alternative solution to "token bridge" is a "full-chain DEX" that combines CEX and token bridge, which you can think of as a kind of "Uniswap for bridging transactions". Like Uniswap, anyone can add liquidity to various encrypted assets, but instead of encapsulating tokens, the sender converts tokens into local bridge tokens, and then the receiver obtains bridge tokens through the local chain of DEX and Convert it back to the desired token. However, this method will also cause problems, such as: the intermediate chain will have its own loopholes, and Swap transactions will also bring additional fees and slippage.

The main problem of the current Solana ecology is that it relies too much on Wormhole as the only cross-chain liquidity. All bridging transactions are built on Wormhole and use it as the core message layer. In contrast, most cross-chain bridges focus on EVM and Cosmos-based blockchains. For non-Solana ecological cross-chain bridges, due to the different operating environments, adding Solana blockchain requires additional development work, but even so, there should be more cross-chain bridges in the next few months that will increase support for Solana.

Some exciting opportunities in the field of cross-chain interoperability include:

Native Asset Swap: It is a very headache to "unseal" encapsulated assets on the target chain, sometimes it takes 10-20 minutes, and sometimes it takes several days. "Native Asset Swap" may be the answer to this kind of problem. In this process, USDC on the target chain (such as Ethereum) creates new encapsulated assets when the source chain (such as Solana) is destroyed. Since assets like USDC Interoperable between blockchains, Circle's cross-chain transfer protocol can provide a wide range of seamless applications in payments and lending.

Cross-chain identity: As the on-chain identity market develops, there will be huge opportunities for interoperability between blockchains, and will allow developers to more easily request user information from other networks. Currently ENS (Ethereum Name Service) is one of the largest identity ecosystems, if developers can build a "login with ENS" system on Solana or Sui by accessing users' cross-chain data (xData), the prospect will be What kind? Essentially, an end user's avatar, name, wallet address, and other details can be read by applications on other blockchains, eliminating the need for users to repeatedly upload this information across different blockchains. From this perspective, "how to build a cross-chain reputation" may be another place worthy of attention.

Good user experience and trustworthy cross-chain dApp: dApp needs to provide a user experience comparable to Web2 applications, so that users will not be aware of what is being processed in the background, so it is necessary to ensure that nothing is lost during data transfer , and bring together independent states on different blockchains through bridges, all of which must be fully protected. Because at the end of the day, if there is a problem with user funds, it will be the worst user experience.

4. Oracle

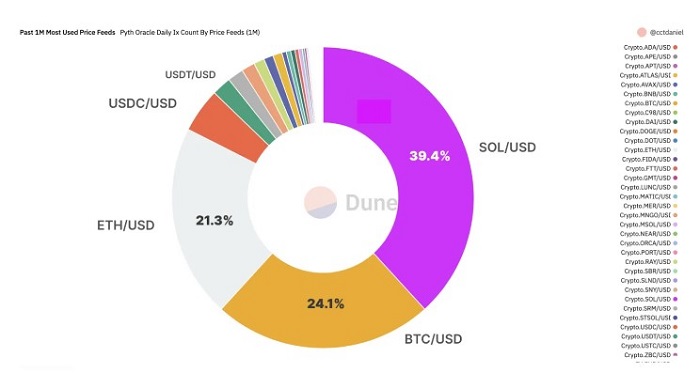

image description

Above: Most used Pyth price feeds over the past 1 month (data as of February 14th, source: Dune Analytics)

While Pyth dominates Solana (>90% market share), other players have emerged on the Solana blockchain, such as Switchboard. In the Ethereum ecosystem, established players like ChainLink have posed a serious threat to oracles on Solana. In contrast, ChainLink has more than 1,000 data consumers, supports more than 12 blockchains, and secured a total value of $75 billion at its peak in December 2021, with a cumulative transaction value of more than $6 trillion. Currently, the data source is dominated by stablecoin trading pairs; however, as more and more applications and financial assets are on-chain, the demand for reliable external data will grow exponentially.

Potential use cases for oracles include:

On-chain real-world assets: As more and more real-world assets (such as trade finance, revenue-based financing, carbon credits, and real estate) are on-chain, users will have a strong need for reliable data on these external assets. For example, if someone wanted real estate in New York to be traded on-chain, they would need a real estate price oracle through which they could obtain a reliable and robust price feed. At this stage, the project worthy of attention in this field is Parcl, which can help users access synthetic assets through AMM, so as to track the global transaction price changes of real estate assets. In addition, Homebase on the Solana blockchain has also built a platform that allows users to invest in tokenized residential real estate for as little as $100 and obtain fractional ownership through NFT.

secondary title

9. The formation of DeFi organizations

Consensus within the Solana DeFi space is now more important than ever, so there is a need to build better DeFi organizations, including:

1. Risk management organization: This organization can be called Risk DAO or an advisory committee, which specializes in researching DeFi protocols and making risk analysis. At the same time, these organizations can also publish a public "risk analysis dashboard" with key indicators of the Solana ecosystem, and provide paid research, risk assessment framework, and risk rating services for DeFi projects.

2. Build R&D laboratories like Proximity Labs, which can provide DeFi-related R&D services for DeFi projects and Web2 companies. The Proximity Labs project, long a major driver of DeFi in the NEAR ecosystem, recently established a $10 million developer fund to fund and invest in new development teams, giving a major boost to virtual Order book transactions.

secondary title

10. Safer and more stable DeFi on the Solana chain

When it comes to the importance of DeFi security, I believe it cannot be overemphasized. There have been many DeFi protocols before, such as Wormhole, Nirvana Finance, Crema Finance, and Mango Markets, which have been hacked, resulting in significant financial losses. These bloody lessons remind us all the time to strengthen security measures, and stop due to various Vulnerabilities cost users and organizations real money. In past real-world cases, hackers have managed to exploit code flaws and platform vulnerabilities (such as oracles) to carry out attacks that could have been avoided by auditing the codebase by a trusted third party, or by focusing on every possible Product decisions that cause problems to avoid.

As the means of hacker attacks become more and more sophisticated, if there are no loopholes, then the formulation of the protocol must have foresight and a deep understanding of its products. It is very important that there are standard security measures for anyone building a DeFi protocol to ensure that the entire ecosystem is protected. These measures will typically include security audits, frequent reviews of open source code repositories and code to fix potential vulnerabilities.

secondary title

Summary: Solana DeFi 2.0

While Solana DeFi still has its fair share of issues right now, we believe many of them will be resolved in 2023. In general, Solana DeFi will accelerate its development in the following two aspects:

1. Going mobile: Solana will launch the flagship mobile phone SAGA, which will adopt a series of mobile-friendly standards such as Solana mobile stack, Solana payment and xNFT, to accelerate the mobileization of Solana DeFi, thereby driving super applications and user experience The rise of the aggregators.

2. Asset tokenization: The credit market has begun to be tokenized on Solana. In the future, more credits, such as personal loans, trade financing, income-based financing, and carbon credits, will be tokenized. However, given Solana's high performance, the tokenization of high-frequency trading assets such as foreign exchange and stocks will be more worthy of attention.