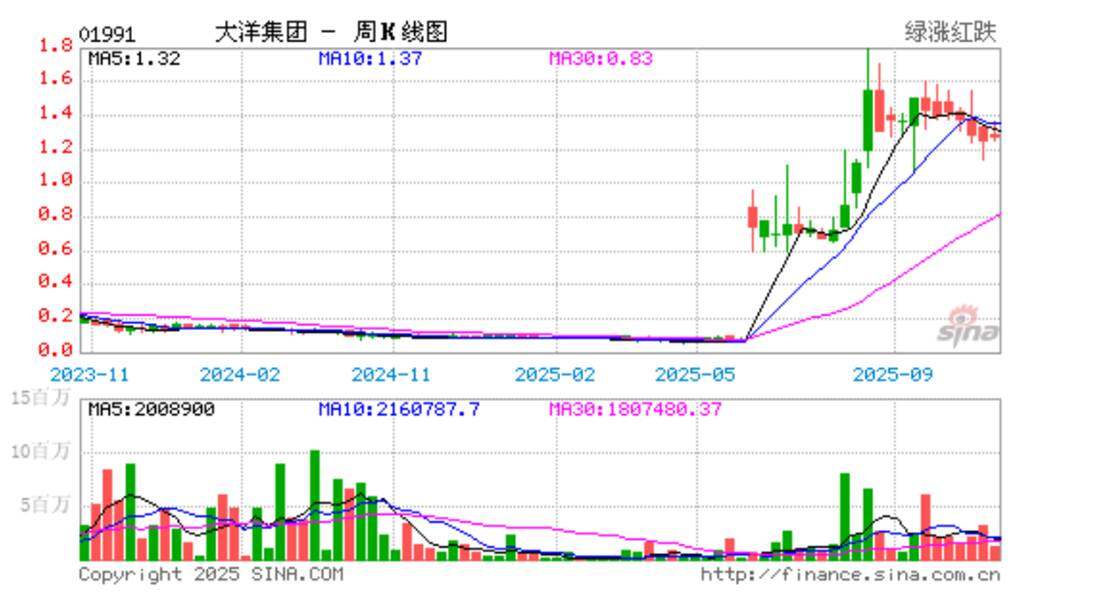

On November 3, 2025, Hong Kong-listed company Ocean Group (01991.HK) announced a strategic investment memorandum of understanding with RWA service platform CoinVEX. This marks the first time a listed company in the Hong Kong capital market has invested in an RWA+AI platform, signifying the entry of traditional financial capital into the intersection of RWA and AI. This collaboration comes at a crucial time for Hong Kong's accelerated development into an international digital asset center, sending a positive signal that traditional financial capital is accelerating its deployment in the Web3 physical asset and smart trading sectors.

Traditional Finance Embraces Digital Assets: Ocean Group's Strategic Transformation

This investment in CoinVEX by Dayang Group is not a sudden move, but a key step in its long-term strategic plan. As a long-established company founded in 1991 and listed on the Hong Kong Stock Exchange in 2007, Dayang Group has built a complete path for transformation from traditional manufacturing to the digital economy.

In August 2025, Dayang Group held a Web 4.0 strategy launch conference, clearly proposing a transformation blueprint driven by AI digital humans and using Real-World Asset Tokenization (RWA) as the value channel. Group Chairman Shi Qi emphasized on multiple occasions that "the Web 4.0 era is an era of deep integration of AI and RWA, where digital humans, empowered by AI, become dynamic entities with economic output capabilities." This strategic positioning provides clear logical support for this investment in CoinVEX.

Financial performance confirms the success of the transformation: According to the interim results announcement released by Ocean Group on August 29, 2025 , Ocean Group recorded a net profit of HK$2.41 million in the first half of 2025, successfully turning a loss into a profit. This is in stark contrast to the net loss of HK$31.66 million in the first half of 2024 and the net loss of HK$85 million for the whole year. The Group's gross profit margin increased significantly to 21.3%, especially with a significant improvement in the profitability of the digital marketing division, laying a financial foundation for further investment in the digital asset field.

CoinVEX's unique value: RWA + AI dual-engine model

CoinVEX, a platform that has received strategic investment from Ocean Group, has its core competitiveness in innovatively combining RWA services with AI quantitative investment to form a differentiated business model.

RWA Service Capabilities: CoinVEX provides professional real-world asset tokenization services, helping traditional assets achieve on-chain circulation. This solves the liquidity management problem commonly faced by traditional RWA projects. Industry analysts point out that "traditional RWA projects often neglect value management after tokenization. CoinVEX introduces AI quantitative trading into the RWA ecosystem, effectively solving the liquidity pain point after assets are on-chain."

Advantages of AI-Powered Quantitative Investment: The platform introduces AI-powered quantitative models to provide intelligent solutions for digital asset trading. These models enable automated monitoring and risk optimization, making asset management more efficient and scalable, significantly reducing operating costs and improving investment decision-making efficiency.

From an industry perspective, the current asset composition of the RWA market shows a clear trend. Excluding stablecoins, private lending dominates at $13.81 billion, followed by US Treasury bonds at $7.37 billion. CoinVEX leverages AI technology to optimize the pricing, risk control, and liquidity management of these assets, providing investors with more efficient asset allocation solutions.

Three signals: Traditional financial institutions are accelerating their deployment of digital assets.

Ocean Group's investment in CoinVEX sends three important industry signals that will have a profound impact on the entire digital asset market.

Signal 1: Listed capital enters the RWA sector

This marks the first strategic investment by a Hong Kong-listed company in a digital asset platform focused on RWA+AI. This groundbreaking collaboration demonstrates that traditional listed companies are viewing RWA as a core strategic direction rather than a peripheral business experiment, and the example set by Ocean Group may inspire more traditional financial institutions to follow suit.

It is worth noting that on August 27, 2025, the "Hong Kong Digital Asset Listed Companies Association" was established in Hong Kong, with Shi Qi, Chairman of Ocean Group, serving as the Vice President of the Association. The establishment of this organization provides a collaborative platform for listed companies to participate in digital asset business, indicating that more traditional enterprises will enter this field in a compliant manner.

Signal Two: AI Reshapes Asset Management Logic

The deep integration of AI and blockchain is driving RWA from "asset digitization" to "intelligent decision-making," enabling real-time monitoring of asset status and dynamic pricing. CoinVEX's application of AI quantitative technology to RWA asset management represents the forefront of industry development.

AI applications in the RWA ecosystem include automated asset valuation, real-time risk monitoring, smart contract optimization, enhanced cross-chain interoperability, and automated compliance auditing. Morgan Stanley predicts that AI-driven asset management will play a key role in the $16 trillion RWA market by 2030, with AI-driven asset valuation, risk management, and compliance auditing becoming industry standards.

Signal 3: Hong Kong's regulatory framework creates competitive barriers.

The Hong Kong Financial Services and the Treasury Council released the "Hong Kong Digital Asset Development Policy Declaration 2.0," highlighting stablecoins and RWA as key application scenarios. In 2024, the Hong Kong Monetary Authority launched the "Ensemble" sandbox scheme, allowing banks and other institutions to experiment with tokenized asset trading, providing a testing ground for innovative financial businesses.

The core advantage of Hong Kong's regulatory framework lies in its "same business, same risks, same rules" principle of transparent supervision. On May 21, 2025, the Hong Kong Legislative Council passed the Stablecoin Bill, requiring 1:1 full reserves, regular third-party audits, and robust redemption mechanisms, providing legal certainty for the key infrastructure of the RWA ecosystem.

Ocean Group's decision to establish its RWA (Resistant Water and Energy) business in Hong Kong fully leverages this regulatory advantage. Hong Kong not only provides a clear compliance path but also incentivizes RWA projects through tax breaks and other policies. According to industry reports, Hong Kong offers a 50% tax reduction for the first three years for green energy RWA projects.

Hong Kong Ecological Exploration: Pioneering Practices of Traditional Finance Embracing RWA

Pioneers in Hong Kong's traditional financial sector are already exploring breakthroughs in integrating with RWA. On September 20, 2025, the Hong Kong Stock Market Liquidity Global Digital Summit, co-hosted by Ju.com and xBrokers in Hong Kong, attracted over a hundred guests from regulatory agencies, listed companies, securities firms, and the Web3 ecosystem.

xBrokers' innovative model: Real stock trading on blockchain

xBrokers' breakthrough lies in its implementation of a "1:1 real-share custody + on-chain verification" mechanism. Unlike most tokenized projects on the market, xBrokers allows users to directly buy and sell real Hong Kong stocks through a familiar crypto trading interface. All stocks are held in 1:1 custody by licensed brokers, and transaction records are stored on-chain. More importantly, the Hong Kong stocks purchased by users can be directly withdrawn to any brokerage account that supports Hong Kong stocks after December 1st, and shareholder rights such as dividends are fully retained.

This model addresses a long-standing pain point in the RWA (Real-Time Asset Trading) field. Over the past year, most RWA projects have remained at the tokenization stage, with users essentially only purchasing certificates of beneficial ownership. xBrokers brings asset trading itself into the crypto world, rather than merely tokenizing assets; this represents a true deep integration of traditional finance and Web3.

Ju.com's Ecosystem Strategy: A Forward-Looking Perspective from an Exchange-Based System

Ju.com, as an exchange-affiliated ecosystem platform, is committed to embedding complex technologies within simple interactions, abstracting matching, risk control, compliance, operations, and community capabilities into composable interfaces, thus becoming a key bridge between traditional finance and Web3. This positioning coincides with the strategic thinking behind Ocean Group's investment in CoinVEX, both seeking to provide a compliant and efficient channel for traditional assets to enter the digital world through technological innovation and ecosystem integration.

Industry observers believe that the explorations of Ju.com and xBrokers provide a valuable practical model for the Hong Kong RWA ecosystem. Fang Hongjin, co-chairman of the Hong Kong Blockchain Association, pointed out at the summit that "the combination of decentralized and multi-centralized mechanisms is becoming a key tool for improving the cross-border liquidity of Hong Kong stocks." This view echoes the emphasis by Shi Qi, chairman of Ocean Group, that "the Web 4.0 era is a deep integration of AI and RWA," demonstrating the consensus among Hong Kong market participants regarding the construction of digital asset infrastructure.

From policy signals to corporate practices, from infrastructure to ecosystem collaboration, Hong Kong is forming a complete chain for traditional finance to embrace Web3. Whether it's the forward-looking strategies of Ju.com and xBrokers, or the investment in CoinVEX by Ocean Group, all are important links in this wave.

RWA Market Size: Investment Opportunities in a Trillion-Dollar Sector

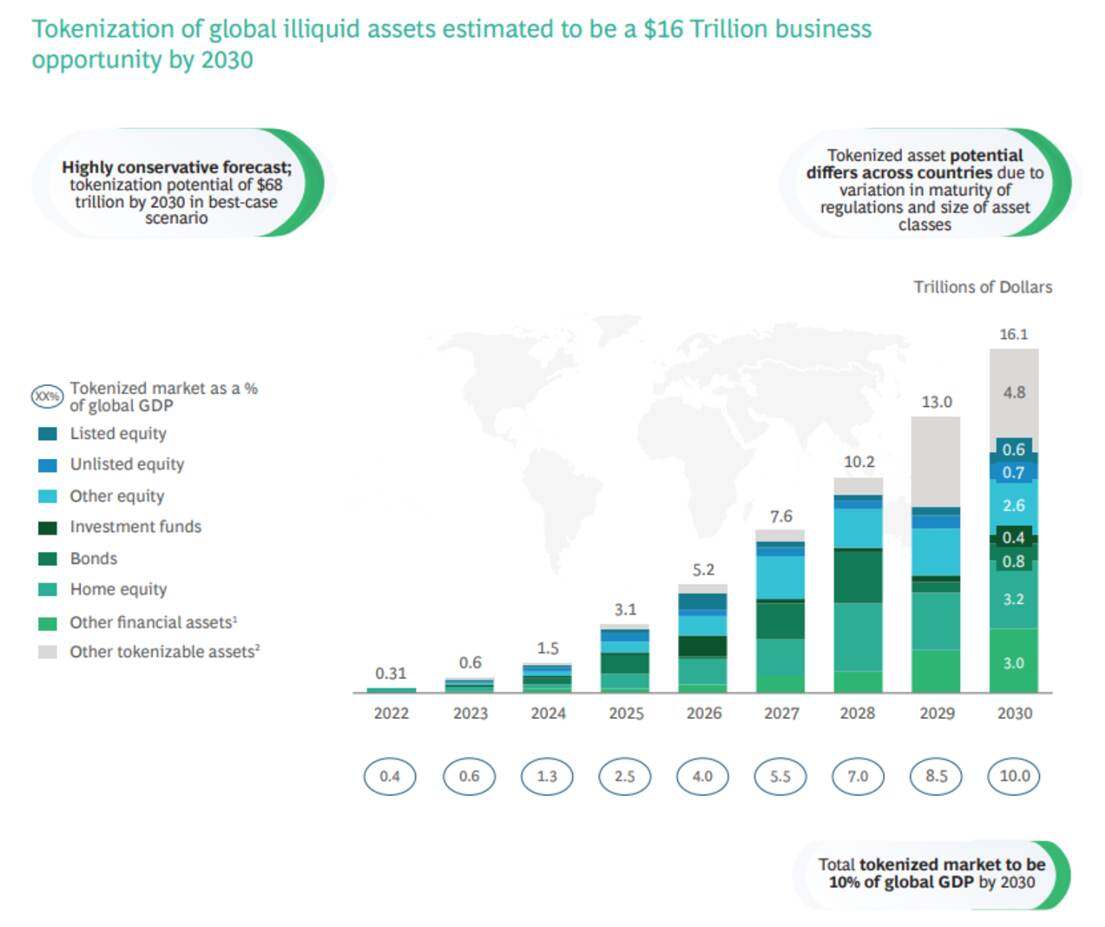

The RWA market is currently at a critical juncture, transitioning from proof-of-concept to large-scale applications. Multiple data points confirm the enormous potential of this sector.

Market size expands rapidly

The Boston Consulting Group (BCG) predicts that the RWA (Real Money Exploitation) market will reach $16 trillion by 2030, far exceeding the current total market capitalization of the entire crypto market. If the median forecast of $10 trillion is achieved, the RWA industry's value will increase more than 54 times from its current level.

Even more imaginative is the fact that the global real estate market is worth approximately $300 trillion; if just 1% of that were tokenized, it could create a $3 trillion RWA market. The global bond market is worth over $120 trillion; if 1% were to enter the blockchain space, it would form a $1.2 trillion emerging market. These figures reveal the true trillion-dollar blue ocean potential of the RWA sector.

Diversification of asset types

The application of RWA is rapidly expanding from traditional real estate and infrastructure to emerging fields. As of June 2025, private lending accounted for approximately 58% of the RWA market, while tokenized US Treasury bonds accounted for approximately 34%. Furthermore, new assets such as green energy, carbon credits, intellectual property, and supply chain finance are also accelerating their tokenization.

Traditional financial institutions enter the market

BlackRock's digital dollar bond (BUIDL) tops the list of US Treasury tokenized funds with a market capitalization of $2.6 billion, representing a 37% market share. The active exploration by traditional financial giants such as JPMorgan Chase and Goldman Sachs is injecting more liquidity and institutional trust into the entire RWA industry.

It's worth noting that the global debt market is currently worth over $300 trillion, while the total market capitalization of the crypto market is only $2-3 trillion. If the tokenization of bonds promoted by traditional financial institutions can be introduced into the DeFi ecosystem, it will drastically change the market landscape. The advantages offered by on-chain bonds, such as 24/7 trading, borderless access, and instant settlement, make them a key driver of trillion-dollar market growth.

How investors can seize the RWA+AI opportunity

Given the rapid development of the RWA market, investors need to rationally assess the opportunities and risks.

Focus on regulatory compliance: Choose RWA platforms operating in regions with clear regulatory frameworks, such as Hong Kong, to ensure the project complies with local laws. The Hong Kong Securities and Futures Commission requires institutions to conduct technical risk assessments of tokenized products and mandates disclosure of risks such as blockchain security threats.

Assessing the quality of underlying assets: Not all assets are suitable for tokenization. Assets that successfully achieve large-scale deployment must meet three key criteria: value stability, clear legal ownership, and verifiable off-chain data. High-quality RWA projects should possess stable cash flow, clear property rights, and high market acceptance.

Prioritize technological platform capabilities: The application of AI technology in the RWA ecosystem determines the efficiency and security of asset management. Investors should choose platforms with mature AI quantitative models and automated risk control systems to ensure asset digitization, improved liquidity, and intelligent investment decisions.

Seize the policy window of opportunity: Hong Kong will officially implement a stablecoin licensing regime in August 2025, and tokenized ETFs and digital asset funds, if legislation is passed, will enjoy the same stamp duty and profits tax exemptions as traditional ETFs. These policy benefits provide significant advantages for early investors.

Key takeaways

Ocean Group's strategic investment in CoinVEX represents a significant milestone in the integration of traditional finance and digital assets. With the RWA market projected to reach $16 trillion in the next five years, the entry of listed company capital injects more trust and liquidity into the industry. CoinVEX's unique RWA+AI dual-engine model, combined with Hong Kong's favorable regulatory environment, provides a viable path for the digital transformation of traditional enterprises.

The three key signals released by this collaboration will profoundly impact the entire digital asset industry landscape. For investors, while paying attention to policy dividends and technological innovation, it is crucial to rationally assess the compliance of projects, the quality of underlying assets, and the capabilities of the technology platform in order to seize genuine investment opportunities in this trillion-dollar sector.

- 核心观点:传统金融资本首次入股RWA+AI平台。

- 关键要素:

- 大洋集团战略投资CoinVEX平台。

- CoinVEX融合RWA服务与AI量化。

- 香港监管提供明确合规路径。

- 市场影响:加速传统资本布局Web3资产赛道。

- 时效性标注:中期影响