Arthur Hayes: What will be the impact of the Fed's new Bank Term Funding Program (BTFP)?

Author: Arthur Hayes

Original compilation: GaryMa Wu said blockchain

Author: Arthur Hayes

Original compilation: GaryMa Wu said blockchain

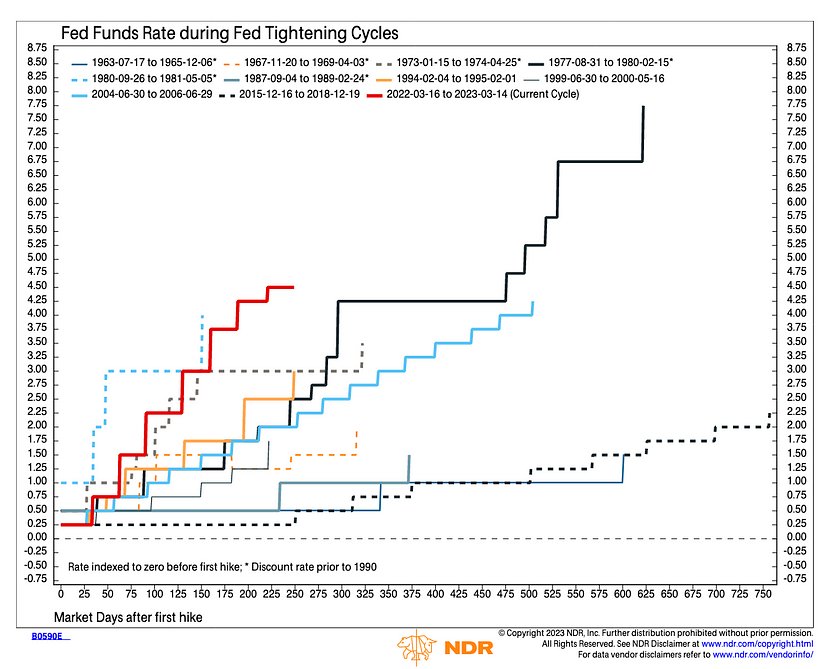

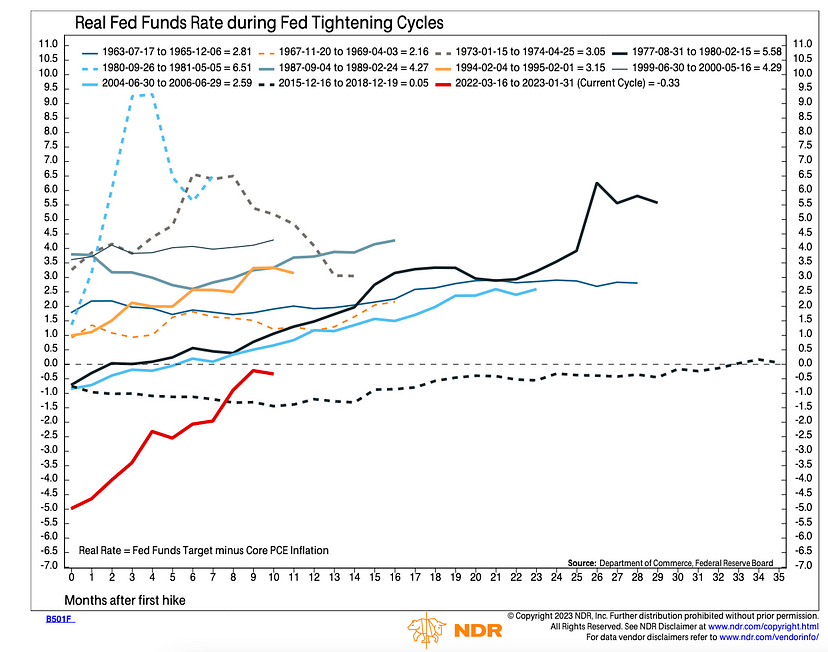

Since the Fed started raising interest rates in March 2022, I have always believed that the end result will always be major financial turmoil followed by a resumption of money printing. It's important to remember that it is in the best interest of the Fed and all the other major central banks to keep our current financial system (where they can wield power) afloat, so in effect cleaning out the system that has been built up since World War II Shocking debt and leverage is out of the question. So we can almost certainly predict that they will respond to any real banking or financial crisis by printing money and encouraging a new wave of behavior that put us at risk in the first place."I, like many other analysts, have predicted from our virtual rostrum that the Fed would keep raising rates until it wrecked something. Nobody knows exactly which things will crash first, but we all know for sure it will. Before jumping to conclusions though, some (including me) have been arguing that a rupture in some part of the U.S. financial system in 2023 will force the Fed to reverse the tightening cycle that has been going on for the past year, and now it appears we are on the way on this track."I discussed the implications of the Fed's new Bank Term Funding Program (BTFP) with my favorite hedge fund manager. BTFP also expressed

(Buy The Fucking Pivot)! I thought I understood the significance of what the Fed just did, but I didn't fully appreciate how big of an impact this policy really had. I'll elaborate on what I learned later, but suffice it to say that BTFP, Yield Curve Control (YCC) repackaged in a new, shiny, more palatable form, is a very clever way of enabling unlimited purchases of government bonds, without actually buying them.

To fully understand why this BTFP scheme was so groundbreaking and ultimately disruptive to savers, let's take a look back at how we got here. We must first understand why these banks failed, and why the BTFP was a very elegant response to this crisis.

secondary title

March of that year: the epidemic opened the floodgates

It all started in March 2020, when the Federal Reserve pledged to do whatever was necessary to ward off financial stress from the pandemic.

The U.S. federal government moved to create the largest fiscal deficit since World War II in order to deposit money directly into people's bank accounts (in the form of stimulus checks). The Fed effectively cashed the government's check. The government has had to issue vast amounts of new Treasuries to finance borrowing, which the Fed has dutifully purchased to keep interest rates close to zero. It was a hyper-inflationary practice, but it didn't matter then because we were facing a pandemic of the century.

As expected, an unprecedented financial boom began. Everyone has stimulus checks to spend, rich and poor. At the same time, the cost of capital for asset speculators has dropped to zero, encouraging wild venture capital investment. Everyone gets rich and everything becomes a pulling exercise!

secondary title

bull market

With so much new money available to the public, banks were flooded with deposits. Remember, when we buy goods, services or financial assets, money doesn't leave the banking system, it just moves from one bank to another. Therefore, most of the newly printed money ends up in some bank's deposit balance.

For important systemic banks such as JP Morgan, Citibank, and Bank of America, the proportion of deposits has increased, but it is not too exaggerated. But for small and mid-sized banks, it's a huge increase.

The underdogs in the U.S. banking industry, sometimes called regional banks, have never had such fat deposits. When banks take deposits, they use those deposits to make loans. These banks need to find somewhere to park all this new money in order to earn net interest margins (also known as net interest margins). Given that yields are either zero or slightly above zero, depositing money at the Federal Reserve Bank and earning interest on its excess reserves cannot cover its operating costs, so the bank must do so by taking some credit and/or duration risk to increase revenue.

The risk that the borrower will not repay is called credit risk. The highest credit-rated credit (i.e., the one with the lowest credit risk) that you can invest in is U.S. government debt, also known as treasury debt, because the government can legally print money to pay its debts. The highest credit risk you can invest in is the debt of a company like FTX. The more credit risk a lender is willing to take, the higher the interest rate the lender will demand from the borrower. Credit risk increases if the market perceives that the risk that businesses will not be able to pay their bills is increasing. This causes bond prices to fall.

Most banks are generally very credit risk-averse (i.e. they don't want to lend money to companies or individuals they think are likely to default). But in a market where the most obvious and safest alternative — investing in short-term U.S. government debt — yields close to 0%, they need to find some way to turn a profit. As a result, many banks began to enhance returns by taking duration risk.

Duration risk is the risk that a rise in interest rates will cause the price of a given bond to fall. I won't explain in detail how to calculate a bond's duration, but you can think of duration as the sensitivity of a bond's price to changes in interest rates. The longer a given bond has to maturity, the higher its interest rate or duration risk. Duration risk also varies with interest rate levels, which means that the relationship between duration risk and a particular interest rate level is not constant. This means that the bond is more sensitive to interest rates when rates rise from 0% to 1%, and less sensitive to interest rates when rates rise from 1% to 2%. This is called convexity or gamma.

In general, most banks limit credit risk by lending money to various departments of the US government (rather than risky companies), but by buying bonds with longer maturities (which carry more duration risk) to increase its interest income. That means they can quickly lose a lot of money as bond prices fall as interest rates rise. Of course, banks can hedge their interest rate exposure by trading interest rate swaps. Some banks do this, many don't. You can read something about the very stupid decisions made by SVB management in hedging the huge interest rate risk embedded in its government bond portfolio.

Let's walk it through. If a bank takes $100 in deposits, they will buy $100 worth of US government debt, such as US Treasuries (UST) or mortgage-backed securities (MBS). So far, there has been no problem with this asset-liability management strategy. In practice, the ratio of deposits to loans should be less than 1:1 in order to maintain a sufficient safety balance against loan losses.

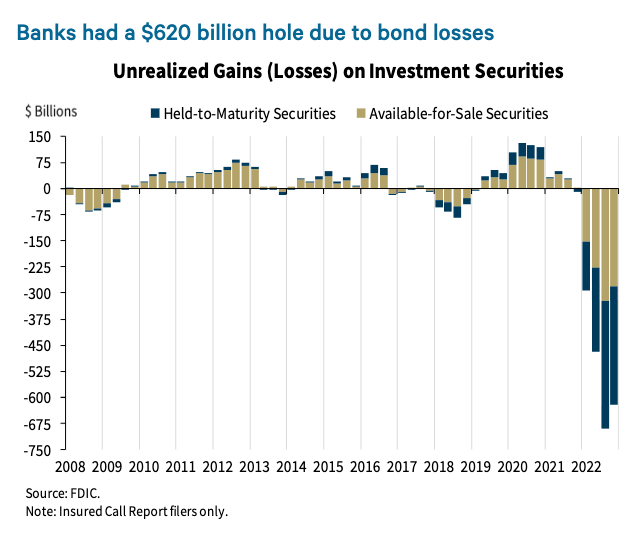

How do banks hide these large unrealized losses from the fallout to their depositors and shareholders? Banks hide losses by employing a number of legitimate accounting tricks. Banks that have already made loans do not want to see their earnings fluctuate in the market value of their portfolio of tradable bonds. Otherwise, the whole world will see the trick they are playing. That could depress their share prices, or force regulators to shut them down for violating capital adequacy requirements. Therefore, a bond is allowed to be marked as "held to maturity" if the bank intends not to sell it before maturity. This means they mark the bond at the purchase price until it matures. Thereafter, the bank can ignore unrealized losses regardless of the price at which the bond trades in the open market.

Things are going well for small banks. They do not charge interest on customer deposits, but instead lend these deposits to the US government at 1% to 2% (UST) and to US homebuyers at 3% to 4% (MBS). That might seem trivial, but on tens of billions of dollars in lending, it's meaningful revenue. Bank stocks soared on these "great" gains.

text

KRE US — SPDR S&P Regional Bank ETF

The ETF is up more than 150% from the 2020 pandemic lows to the end of 2021.

However, with that comes inflation.

He's not Arthur Burns, he's Paul Volker

A brief history lesson on former Fed chairs.

Arthur Burns served as chairman of the Federal Reserve from 1970 to 1978. Contemporary monetary historians are not impressed by Mr Burns. His accomplishment was refusing to address inflation in the early 1970s.

Paul Volker served as chairman of the Federal Reserve from 1979 to 1987. Contemporary monetary historians have praised Mr Volker for his commitment to eradicating the inflationary problems his predecessors had sluggishly faced. Mr Volker has been described as brave and bold, while Mr Burns has been described as weak and powerless.

Powell wants to be more like Volker than Burns. He cared deeply about his place in history. Powell isn't doing this job to get paid, he's probably a billionaire. He was all about cementing himself as a currency reformer. That's why, when inflation hit a 40-year high post-pandemic, he put on his best Volker attire and walked into the Mariner Eccles building ready to do something big.

In late 2021, the Fed said inflation was a problem. Specifically, the Fed said it would start raising interest rates above 0% and reduce the size of its balance sheet. From November 2021 to early January 2022, risky asset prices peaked. The pain train is ready to go.

Powell felt he was doing what had to be done. The financial portfolios of the rich take a backseat to keep prices down for most Americans (who don't own any financial assets). He's not worried about a hedge fund taking a big dip for the year or a banker's bonus being cut. So what... eat the rich, the US economy is strong and unemployment is low. That means he can keep raising interest rates and dispel the notion that the Federal Reserve is only concerned with boosting financial asset prices to help the wealthy. What a hero!

But trouble is brewing for the banking industry.

secondary title

insolvent

As a bank saver, you would think that when the Fed raises rates, you will get a higher interest rate on your savings. wrong.

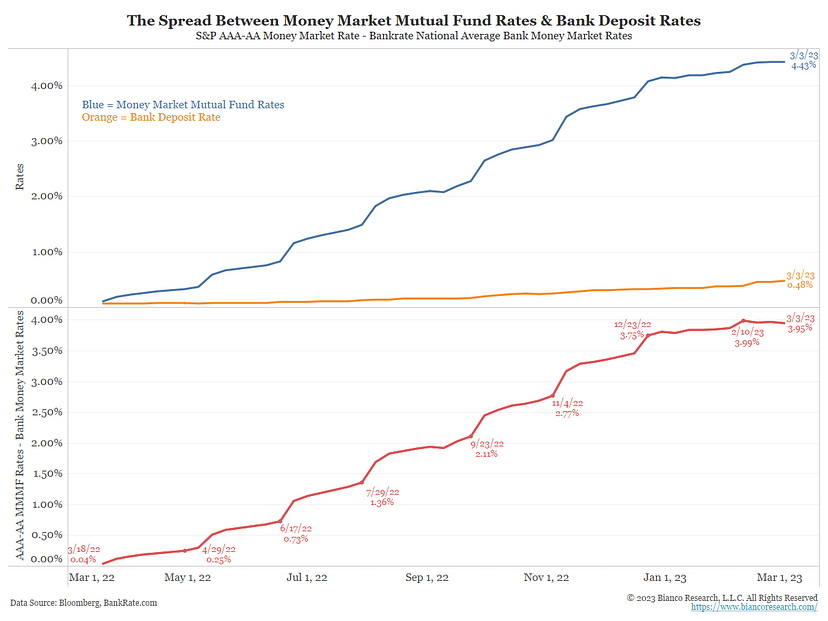

The above chart, from Bianco Research, shows that deposit rates lag significantly behind the higher money market funds rate, which moves in tandem with the Fed's policy rate.

The big "too big to fail" banks don't need to raise deposit rates because they don't actually need deposits. They have trillions of dollars in excess reserves at the hands of the Fed. In addition, their customers tend to be larger corporate clients, whose deposits are sticky. The CFO of a Fortune 500 company isn't going to trade JP Morgan for a regional bank headquartered in the backwoods of the US just to earn a few extra basis points. Large businesses also receive other services from these large banks, such as cheap loans, in return for loyal depositors.

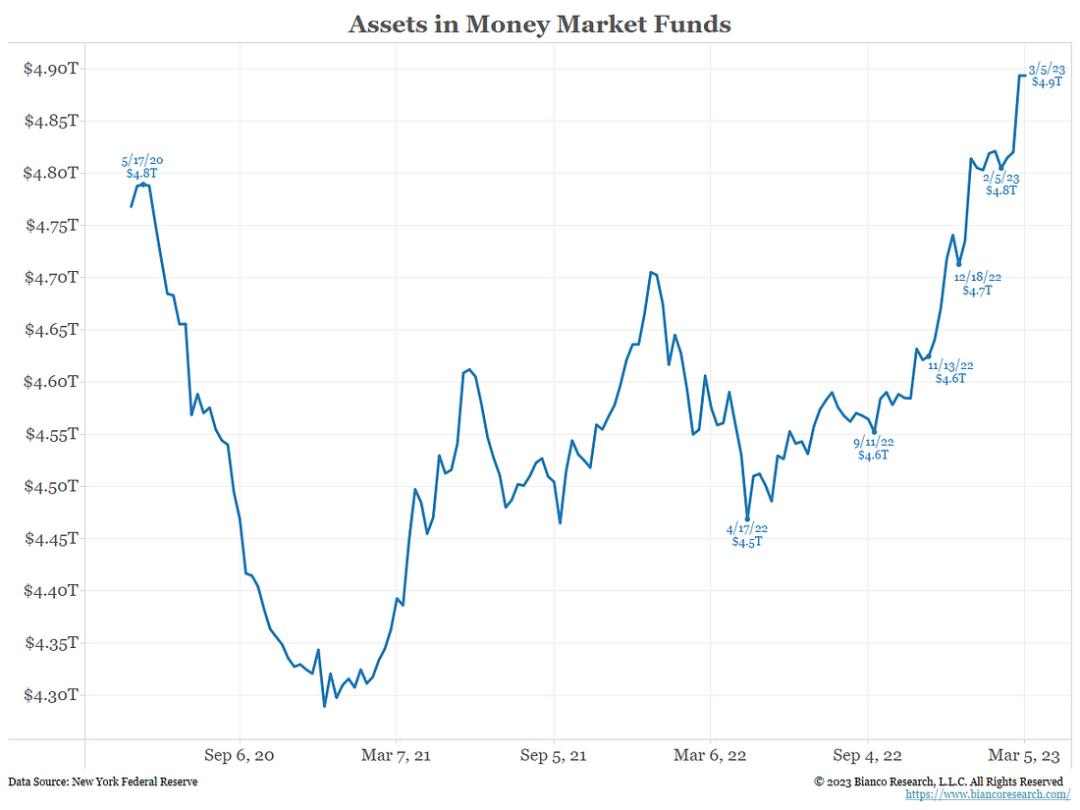

The result was depositors fleeing small banks and finding new homes in higher-yielding money market funds.

As deposits leave smaller banks, they have had to sell the most liquid thing on their balance sheets. U.S. Treasury bonds and mortgage-backed securities (MBS) are very liquid. However, since they were purchased in 2020 and 2021, when the market is marked up in late 2022 or early 2023, the value of these bonds will drop significantly.

ps:"secondary title"game over

canary in the coal mine

It is a figurative metaphor referring to the first warning signal or sign in a dangerous or unstable environment.

The "canary in the coal mine" of the banking industry was the bankruptcy of Silvergate. After becoming the friendliest crypto bank, Silvergate went from an obscure Californian bank to the go-to bank for all the largest exchanges, traders and crypto holders needing USD banking services. Their deposit base balloons and invests depositors' money in the U.S. government, often one of the safest investments you can make. It's not like they're dealing with a dodgy company or person like Three Arrows Capital; they're lending money to the richest and most powerful country in the world.

Silvergate's cryptocurrency depositors decided to flee, depositors didn't want to bother, and didn't want to know if Silvergate in any way facilitated (or even just knew about) suspicious and potentially illegal activity emanating from FTX. So they pulled away, and the bank had to sell its loans and bonds at a loss to pay compensation. That's why Silvergate reported a staggering $754 million loss for 2022.

What happened next was a failed equity offering by SVB. An equity offering is when a company sells shares to large institutional investors at a price below the current market price by cooperating with investment banks.

SVB's equity offering is notable because of the sequence in which it was executed. Goldman Sachs was both the bank bidding for SVB's underwater bond portfolio and coordinating the equity offering.

The question is, why did SVB sell the bond to Goldman Sachs first and then issue the equity? Once SVB sold the bonds, it had to realize a loss and a clear breach of regulatory capital requirements. It must also disclose all of this information to investors (i.e., who might buy the stock). Why would you buy stock in a bank if, just moments before, it had announced that it was incurring massive losses and a potential capital adequacy violation? Obviously not buying, and indeed no one is buying. The bank went bust just days after the equity offering fiasco, in which tech luminaries directed their portfolio companies to immediately withdraw their money in SVB.

The lesson of this sad story is that the poor execution of SVB's equity offering has further drawn market attention to unrealized losses on regional banks' balance sheets. The market is starting to ask more questions. Who else could be in trouble?

It turns out that banking across the US region has problems similar to Silvergate and SVB. To summarize why these banks are in trouble:

1. Their deposit base swelled and they lent out money at a time when interest rates were historically low.

2. These banks have seen large unrealized losses on their bond and loan portfolios as interest rates rise as the Fed raises policy rates.

3. Depositors want higher interest rates than regional banks, so they start to flow out and invest in high-yielding products, such as money market funds and short-term US Treasury bills. Banks can't afford these losses because they can't pay their depositors the federal funds rate, since the average interest they earn on their bond and loan portfolios is far below that rate.

Over the weekend, the world focused on the impact on deposits of cryptocurrencies and technology companies over the issues at Silvergate and SVB. Circle’s USDC stablecoin also de-anchored, dropping below $0.90 due to its possible significant ties to Silvergate, SVB, and possibly Signature Bank. Many believe that the issue is not about cryptocurrencies or technology, but that all banks not designated as systemically important banks face systemic problems.

So everyone knows that when the U.S. stock market opens on Monday, many banks will be punished. Specifically, many fear a possible nationwide bank run.

secondary title

The Fed and the US Treasury did not let a good crisis go to waste. They devised a really elegant solution to some systemic problems. Most importantly, they can blame mismanaged cryptocurrencies and tech-focused banks for having to step in and do something they would have done anyway.

Now, I'll detail the truly game-changing document describing BTFP. (References in the documentation are in bold and italics, with a detailed description of the actual impact below each reference.)

secondary title

Bank Term Funding Scheme

The plan: To provide liquidity to U.S. depository institutions, each Federal Reserve bank will extend loans to eligible borrowers against certain securities as collateral.

Borrower Eligibility: Any federally insured depository institution (including a bank, savings association, or credit union) or U.S. branch of a foreign bank that qualifies for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the program.

It's pretty straightforward, you need to be a Bank of America to participate in the program.

Eligible Collateral: Eligible collateral includes any collateral that qualifies as collateral purchased by the Federal Reserve Bank in open market operations (see 12 CFR 201.108(b)) provided that, as of March 12, 2023, the collateral is owned by the borrower.

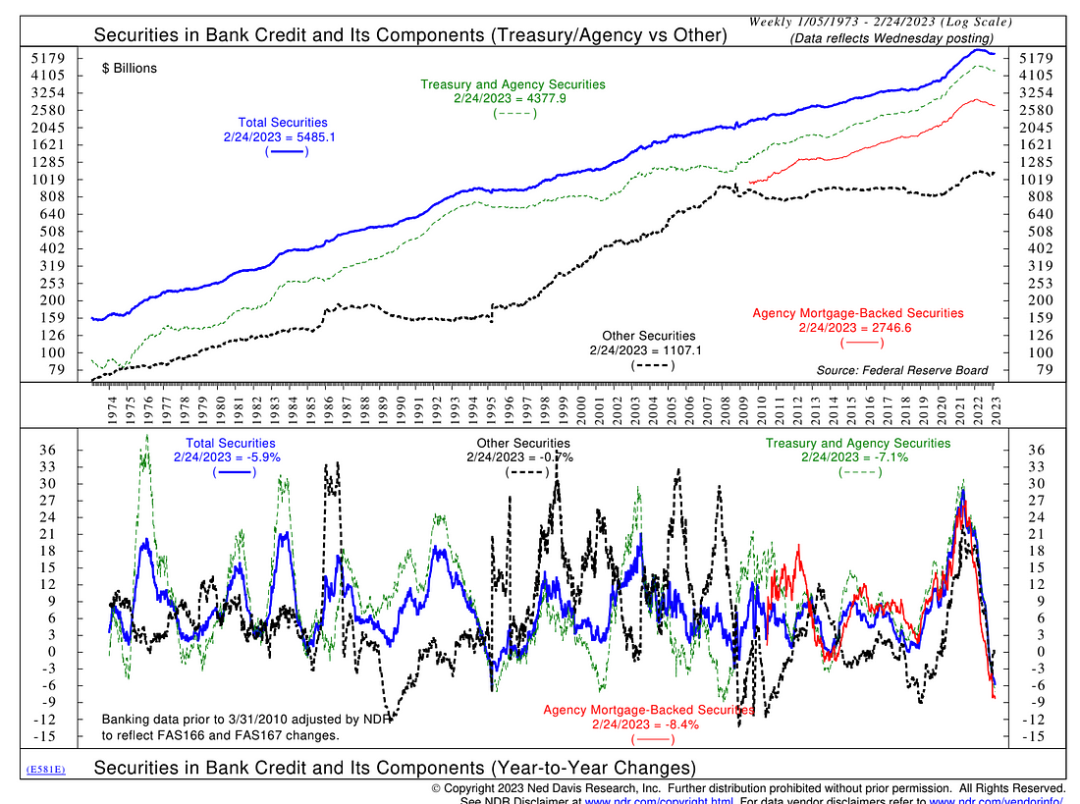

That means the financial instruments that can be used as collateral under the program are largely limited to U.S. Treasuries and mortgage-backed securities. By setting a deadline, the Fed limited the scope of the program to the total size of U.S. Treasuries and mortgage-backed securities held by U.S. banks (approximately $4.4 trillion).

Funding Amounts: Funding Amounts will be limited by the value of assets secured by eligible borrowers.

No quota limit is provided. If your bank holds $100 billion in US Treasuries and mortgage-backed securities, you can submit that total to leverage the BTFP for financing. That means the Fed could theoretically lend against all of the U.S. Treasuries and mortgage-backed securities held on U.S. banks' balance sheets.

The first two BTFP paragraphs are very important and need to be understood. The Fed just did another $4.4 trillion of QE. let me explain.

Quantitative easing is the process by which the Federal Reserve provides reserves to banks in exchange for selling their holdings of U.S. Treasuries and mortgage-backed securities. Under the BTFP, instead of buying bonds directly from banks, the Fed prints money and makes loans against US Treasuries and mortgage-backed securities mortgaged by banks. If depositors want $4.4 trillion in cash, banks simply pledge their entire portfolio of Treasurys and mortgage-backed securities to the Fed in exchange for cash, which they then pass on to depositors. Whether it's quantitative easing or BTFP, the amount of money the Fed creates and puts into circulation is growing.

Interest rate: The interest rate for the term of the loan will be the one-year overnight index swap rate plus 10 basis points; the interest rate will remain unchanged from the date the loan is disbursed.

Collateral Valuation: Collateral valuation will be at face value. The security deposit will be 100% of face value.

Fed funds are priced based on the 1-year rate. Since short-term interest rates are higher than long-term rates, this means banks will be charged negative interest rates for most of the life of the loan. While losses are bad, banks can swap undervalued bonds instead of admitting losses and going bankrupt. Everyone can keep their jobs, except for the unfortunate companies like Silvergate, SVB, and Signature.

Program Duration: Eligible borrowers can apply for loans under the program until March 11, 2024.

The program is regulated to last only one year, when has the government ever given back the powers that the people have entrusted to them in a time of crisis? The program will almost certainly be extended precautionary; otherwise, the market will have enough commotion over the need to print money to prolong the program anyway.

secondary title

The impact of BTFP

Bigger than the release of water from the epidemic

The Fed printed $4.189 trillion in response to the coronavirus crisis. After the implementation of BTFP, the Federal Reserve implicitly printed 4.4 trillion US dollars. During the money printing period of the epidemic, the price of Bitcoin rose from $3,000 to $69,000. How will it perform this time?

banks are bad investments

Unlike the 2008 financial crisis, this time the Fed will not bail out the banks and let them participate in the rally. The bank has to pay the 1-year interest rate. The 1-year rate is much higher than the 10-year rate (also known as an inverted yield curve). Banks borrow short-term from depositors and lend long-term to the government. When the yield curve is inverted, the trade must lose money. Likewise, any bank using BTFP will need to pay the Fed more than the deposit rate.

U.S. Treasury 10-Year Yield minus U.S. Treasury 1-Year Yield

Banks will be negative in yield until either the yield curve becomes positive again, or short-term rates fall below the combined rate of their loan and bond portfolios. The BTFP does not address the problem of banks being unable to afford the high short-term interest rates that depositors can earn on money market funds or Treasuries. Deposits would still flow to these facilities, but banks could borrow from the Fed to fill the gap. From an accounting perspective, the bank and its shareholders lose money, but the bank does not go bankrupt. I expect bank stocks to significantly underperform the general market until their balance sheets are repaired.

House prices soared

30-year mortgage rate minus one-year Treasury yield

Mortgage rates will move in tandem with the 1-year rate. The Fed has enormous control over short-term yields. It can basically set mortgage rates wherever it likes, and never have to "buy" a single mortgage-backed security again.

As mortgage rates fall, home sales will resume. In the United States, like in most other countries, real estate is an important industry. Increased sales will help increase economic activity as financing becomes more affordable. If you think real estate is going to become more affordable, then you need to think again. The Fed is back and pushing up house prices again.

secondary title

Stronger U.S. Dollar

As this process progresses, the central banks of all other major developed countries must follow the Fed and implement similar guarantees to stem the outflow of bank deposits and weaken their currencies. Central banks such as the European Central Bank, Bank of England, Bank of Japan, Federal Reserve Bank of Australia, Bank of Canada, Swiss National Bank, and others are likely to be delighted. The Fed just implemented an unlimited form of money printing, so now they can do the same. The U.S. banking system faces the same problems that other banking systems face. Everyone has the same deal, and now - under Sir Powell - every central bank can respond with the same measures without being accused of triggering fiat currency hyperinflation.

Credit Suisse had effectively failed a few nights ago. The Swiss National Bank had to provide 50 billion Swiss francs in covered loans to stem the drain on credit. A large bank in every major developed western country is expected to come close to failure, and I think in each case the response will be a full deposit guarantee (similar to what the Fed does) to avoid contagion.

secondary title

road to infinity

As stated in the BTFP document, the scheme will only accept collateral that appears on the bank's balance sheet by March 12, 2023, and ends a year later. But as I mentioned above, I don't believe this program will end, and I also think the amount of eligible collateral will be relaxed to any government bonds that exist on the balance sheet of any authorized US bank. How do we go from limited support to unlimited support?

Once people realize that there is nothing shameful in exploiting BTFP, the fear of a bank run will disappear. At that point, depositors will stop stuffing their money into a too-big-to-fail bank like JPM and start pulling their money out and buying money market funds (MMFs) and 2-year or shorter US Treasuries. Banks will not be able to lend to businesses because their deposit base is flowing into the Federal Reserve's repurchase facility and short-term government bonds. This would be extremely recessionary for the US and all other countries with similar plans.

Government bond yields will fall from all sides. First, the fear that the entire U.S. banking system would have to sell their entire stockpile of U.S. government debt to repay depositors disappeared. That removed a huge selling pressure in the bond market. Second, markets will begin to price in deflation, as the banking system cannot return to profitability (and thus create more loans) unless short-term interest rates fall enough to lure depositors back with rates that compete with repo facilities and T-bills.

I expect the Fed will either recognize this outcome early on at its upcoming March meeting and start cutting rates, or a deep recession will force it to pivot a few months later. The 2-year Treasury yield has fallen by more than 100 basis points since the crisis began. The markets are clamoring for deflation backed by the banking system, and the Fed will finally listen.

Banks will be in the same position as they were in 2021 as they become profitable again and are able to re-compete with the government to lure depositors back. That is, deposits will grow and banks will suddenly need to start lending. They will start underwriting loans for businesses and governments at low nominal yields. Again, they will think that inflation is not there yet, so they won't worry about future rate hikes. Does this sound familiar?

Then, March 2024 arrived. The BTFP program is about to expire. But now, the situation is even worse than in 2023. The combined size of the bank's low-interest bond underwriting portfolio to companies and governments is larger than it was a year ago. If the Fed doesn't extend the life of the program and expand the notional amount of eligible bonds, the same bank run we're seeing now could happen again.

Given that the Fed has no appetite for a free market where banks fail due to poor management decisions, the Fed can never remove their deposit guarantees. Long live BTFP.

While I'm sure it's an abomination to all followers of Ayn Rand (like Ken Griffin and Bill Ackerman), BTFP's continuation addresses one of the US government's concerns very serious problem. The U.S. Treasury has a lot of bonds to sell, and fewer people want to own them. I believe the BTFP will be expanded so that any eligible securities held on the balance sheets of Bank of America (mainly Treasuries and mortgages) can be exchanged for freshly printed dollars at the one-year rate. This gives banks confidence that they can always buy government debt risk-free as their deposit base grows. Banks no longer have to worry about what happens if interest rates rise, their bonds lose value, and their depositors want their money back.

With the introduction of the newly expanded BTFP program, the US government can easily finance larger deficits because banks will buy whatever bonds they can sell. Banks don't care about prices because they know the Fed is backing them. And those investors who focus on real returns and pay attention to prices will scoff and will not continue to buy trillions of dollars of US government bonds. The Congressional Budget Office estimates the fiscal deficit will reach $1.4 trillion in 2023. America is also waging wars on multiple fronts: a war on climate change, a war on Russia, and a war on inflation. Wars are inflationary, so deficits are expected to rise further. But that's not a problem because the banks will buy all the bonds that foreigners refuse to buy.

This allows the U.S. government to run the same growth strategy employed by Japan, Taiwan, and South Korea. The government implements policies to ensure that the interest rate on savings for savers is lower than the growth rate of nominal GDP. The government can then re-industrialise, and profit from, by providing cheap credit to any sector of the economy it wants to boost. This "profit" could help the US government reduce its debt/GDP ratio from 130% to a more manageable level. While everyone may be cheering growth, in reality the entire public is paying an implicit inflation tax in the ratio of [Nominal GDP - government bond yield].

In the end, this solves an image problem. If the investing public thinks the Fed is spending the government, they may revolt and dump long-dated bonds (>10yr maturity). The Fed would be forced to step in and fix long-term bond prices, an action that would mark the end of the Western financial system in its current form. The Bank of Japan faced this problem before and ran a similar program in which the central bank lends to banks to buy government bonds. In this case, the bonds never appear on the central bank's balance sheet, only the loans, which in theory have to be repaid by the bank, but in practice, are permanently rolled over to the next installment . Markets can be thankful that central banks are not moving toward 100% ownership of the government bond market. Long live the free market!

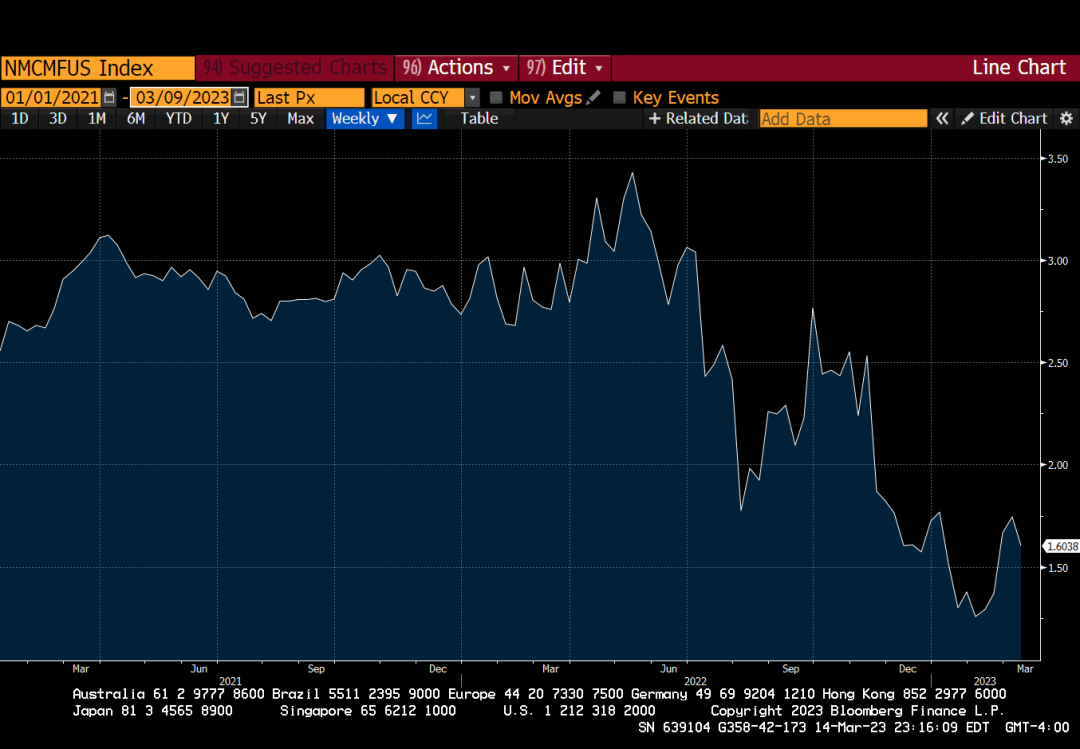

The broad decline in oil and commodity prices suggests that the market believes that deflation is on the way. The cause of deflation is that little credit is extended to businesses. Without credit, economic activity would drop, and therefore the amount of energy needed would decrease.

Falling commodity prices help the Fed cut interest rates because inflation will fall. The Fed now has a reason to cut rates.

secondary title

outflow system

The most worrying outcome for the Fed is people moving capital out of the system. After guaranteeing the deposit, the Fed doesn't care if you move your money out of the SVB into a higher yielding money market fund. At least your capital is still buying government debt. But what if, instead, you bought an asset that was not controlled by the banking system?

Assets like gold, real estate, and (obviously) Bitcoin are not liabilities on someone else's balance sheet. These assets still have value if the banking system fails. However, these assets must be purchased in physical form.

By buying an exchange-traded fund (ETF) that tracks the price of gold, real estate, or bitcoin, you're not getting rid of the malign effects of inflation. All you are doing is investing in the liabilities of some member of the financial system. You own a claim, but if you try to cash out your stake, you get fiat currency notes and all you do is pay another trustee.

Imposing broad capital controls is very difficult for Western economies that are supposed to practice free market capitalism. It is especially difficult for the US because the world uses dollars because it has an open capital account. Any way to explicitly prohibit all kinds of withdrawals from the system will be seen as imposing capital controls, which will make sovereign countries even more reluctant to hold and use US dollars.

This is a controversial point of view. Instead of outright banning certain financial assets, governments may encourage investment vehicles such as ETFs. If everyone panics about the inflationary impact of BTFP and puts their money into GBTC (Grayscale Bitcoin Trust), it will have no effect on the banking system. You must use U.S. dollars to enter and exit this product. You have no escape."Beware what you wish for. A real US-listed Bitcoin ETF would be a Trojan horse. If such a fund is approved and absorbs a significant amount of the bitcoin supply, it will actually help maintain the status quo rather than bring people financial freedom."Buy"bitcoin"Bitcoin, but not your

bitcoin

The beauty of Bitcoin is that it is invisible. It has no external form of existence. You can memorize your Bitcoin private key and anytime you want to spend money, just use the internet to make the transaction. Owning lots of gold and real estate is heavy and obvious. The ostentatious way of saving and the associated display of wealth can easily invite looting from other citizens, or even worse, from your own government.

To Da Moon

Obviously, fiat currencies also have their uses. Take advantage of it, spend legal currency and store cryptocurrency.

secondary title

When I spoke to this hedge funder, I noticed how bullish I was on Bitcoin. This is the ultimate game. Yield curve control is already in place. BTFP brings unlimited money printing around the world...

The media may also push a narrative that this banking crisis is because banks are accepting fiat deposits from crypto people. This is so ridiculous it made me laugh out loud. Argues that the crypto industry is somehow responsible - banks' job is to deal with fiat dollars - accepted fiat dollars from crypto-related entities, followed all the banking rules, and lent those fiat dollars to the most powerful in human history The state, subsequently failing to repay depositors, is ludicrous. This happened as the Central Reichsbank raised rates and blew up the bank's bond portfolio.

Instead, cryptocurrencies have proven once again to be the smoke alarms of the stinky, wasteful, fiat-driven Western financial system. On the upside, cryptocurrencies show that the West is printing too much money in the name of the pandemic. On the downside, the crypto free market quickly uncovered a plethora of over-leveraged scammers. Even FTX's diverse family doesn't have enough love to overcome the swift sanction of the crypto free market. The stench of these unsavory individuals (and the people they do business with) drives depositors to move their hard-earned money to safer (and perceived more reputable) institutions. In the process, it showed everyone the damage that Fed policy has done to the US banking system.

For my portfolio, I've largely stopped trading stocks. What's the point? I generally buy and hold and do not adjust my positions frequently. If I believe what I write, then I am setting myself up for failure. If there is a short-term trading opportunity where I think I can make some quick money and then buy more Bitcoin at a profit, then I will do so. Otherwise, I would liquidate most of my stock portfolio and move it into crypto.

If I own any ETFs related to precious metals or commodities, I will sell them and buy and store commodities directly if possible. I know this isn't practical for most people, but I just wanted to show how deep my beliefs are.

The only exception to my disdain for stocks are companies related to nuclear energy. The West may scoff, but rising nations are looking for cheap, abundant energy to provide a good life for their citizens. Sooner or later, nuclear energy will create the next higher level in global growth, but I can't personally store uranium, so I'm doing nothing with my Cameco position.

I have to ensure that my real estate portfolio is diverse across various jurisdictions. You have to live somewhere, and if you can own your home outright or with as little debt as possible, that's the goal. Likewise, it's even better if you don't have to be attached to the fiat financial system.

Cryptocurrencies are volatile, and most goods and services require payment in fiat currency. it does not matter. I will hold as much cash as I need to earn the highest short-term return possible. Now, that means investing in dollar money market funds and holding short-term U.S. Treasuries.

This is the most important financial event since the outbreak. In a subsequent article, I will assess whether the impact of BTFP is consistent with my predictions. I realize that my extreme belief in Bitcoin's upward trajectory may be wrong, but I must judge events based on reality and adjust my portfolio if I find that I am wrong.