Is Tom Lee's team still trustworthy, given their outwardly hawkish stance on Ethereum but internal reports predicting a bearish outlook?

- 核心观点:Tom Lee公开喊多与内部看空存在矛盾。

- 关键要素:

- 公开预测ETH年底1.5万美元。

- 内部报告看空至1800-2000美元。

- 身份涉关联公司利益未充分披露。

- 市场影响:损害研究机构公信力,引发信任危机。

- 时效性标注:中期影响。

Original author| Aki Wu, Blockchain

If one were to choose the most representative figure for the 2025 Ethereum bullish narrative, Tom Lee, Chairman of BitMine, Ethereum treasury firm, and co-founder and Chief Investment Officer of Fundstrat, would often be placed at the forefront. He has repeatedly emphasized the undervaluation of ETH in numerous public statements, and at Binance Blockchain Week on December 4th, he also stated that Ethereum at $3,000 was "severely undervalued," and had previously given a high target price of $15,000 for ETH by the end of 2025. As a strategist with a Wall Street background, known as the "Wall Street strategist," and a long-time presence in media and institutional roadshows, Tom Lee's views are often seen as a market sentiment indicator.

However, when the market shifted its focus from the spotlight to internal documents, the narrative reversed: Fundstrat, founded by Tom Lee, presented a contrasting 2026 outlook strategy for its internal subscribers, forecasting a significant pullback in crypto assets in the first half of 2026, with ETH targeting a range of $1800–$2000. This discrepancy between publicly bullish and internally bearish statements has thrust Tom Lee and his affiliated institutions into the spotlight of public opinion.

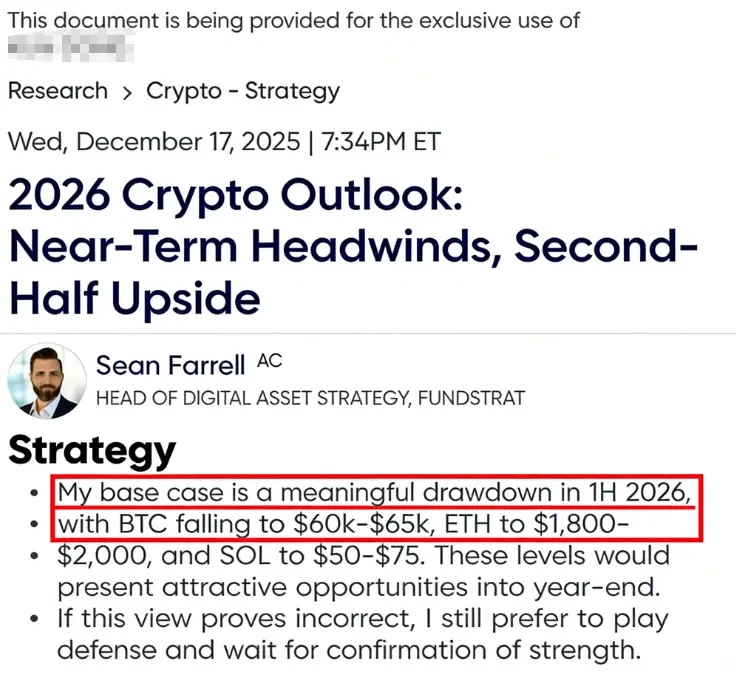

Fundstrat's Core Predictions and Views on "2026 Crypto Outlook"

This report was produced by Sean Farrell, an analyst at Fundstrat responsible for crypto asset research and currently serving as Head of Digital Asset Strategy. His work primarily covers strategy research and insights related to the crypto market and blockchain. The report is mainly available to Fundstrat's internal subscription clients, with a monthly subscription fee of $249.

The report outlined a short-term market outlook for internal clients that differed significantly from public opinion, predicting a significant market correction in the first half of 2026: Bitcoin could fall to $60,000–$65,000, Ethereum to $1,800–$2,000, and Solana to $50–$75. The report stated that these correction areas would present good opportunities to establish long positions. If the market did not experience a significant correction as expected, the team preferred to maintain a defensive strategy and wait for clear trend reinforcement signals before entering the market.

The report explains that the aforementioned pessimistic scenario is not a shift to a long-term bear market, but rather a risk management measure of "strategic reset." Fundstrat points out that several short-term headwinds may suppress the crypto market in early 2026, including a possible US government shutdown, uncertainty about international trade policies, waning confidence in AI investment returns, and policy uncertainties arising from the change of Federal Reserve Chairman.

These macroeconomic factors, coupled with high volatility, may trigger a valuation pullback in crypto assets in a tight liquidity environment. Fundstrat emphasizes that this adjustment is a "correction rather than a collapse," believing that sharp drops are often the prelude to a new round of gains. After digesting risks in the first half of the year, crypto assets are expected to strengthen again in the second half.

The report even gave optimistic targets for the end of 2026: $115,000 for Bitcoin and $4,500 for Ethereum. It specifically mentioned that Ethereum may show relative strength in this round of adjustment. The report pointed out that Ethereum has some structural advantages: after switching to PoS consensus, there is no selling pressure from miners, unlike Bitcoin, which faces the pressure of continuous selling by miners; there is also no potential selling pressure from large holders like MicroStrategy; in addition, compared to Bitcoin, Ethereum is less threatened by quantum computing.

These factors suggest that Ethereum may be better able to withstand selling pressure in the medium term. It can be seen that Fundstrat's internal research report is cautious in tone. Although it is still bullish in the long term, it recommends that its internal clients increase their cash and stablecoin holdings and patiently wait for a better entry point in the short term.

Tom Lee's publicly optimistic prediction for Ethereum in 2025

In stark contrast to Fundstrat's internal reports, its co-founder Tom Lee consistently portrayed himself as a "super bull" in public throughout 2025, repeatedly issuing price predictions for Bitcoin and Ethereum that far exceeded actual market expectations.

At the beginning of the year, Tom Lee was bullish on Bitcoin, with CoinDesk reporting that he set a target of up to $250,000 for Bitcoin by the end of 2025. In July-August 2025, as Ethereum's price surged near its all-time high, Tom Lee publicly stated that Ethereum was poised to reach $12,000-$15,000 by the end of 2025, calling it one of the biggest macro investment opportunities of the next 10-15 years.

In an August appearance on CNBC, he further raised his price target, stating that Ethereum is entering a key inflection point similar to Bitcoin's in 2017. In 2017, Bitcoin started at less than $1,000 and surged to $120,000, a 120-fold increase, driven by the "digital gold" narrative. With the Genius Act giving the green light to stablecoins, the crypto industry ushered in the "ChatGPT moment," and since the core advantages of smart contracts do not apply to Bitcoin, he predicted this would be Ethereum's "2017 moment," with a price increase from $3,700 to $30,000 or even higher not being impossible.

Supercycle Theory: Even as the autumn market entered its upward trend, Tom Lee maintained an extremely optimistic stance. In an interview in November 2025, he stated, "We believe that ETH is embarking on a supercycle similar to Bitcoin's from 2017 to 2021," implying that Ethereum has the potential to replicate Bitcoin's trajectory of a hundredfold increase in the coming years.

Speaking at the Dubai Summit: At Binance Blockchain Week in early December 2025, Tom Lee once again made a startling pronouncement, proclaiming a bull market and predicting that Bitcoin could surge to $250,000 "within a few months," while stating bluntly that Ethereum's price of around $3,000 at the time was "severely undervalued."

He pointed out through historical data comparison that if ETH/BTC returns to the eight-year average level (about 0.07), the price of ETH could reach $12,000; if it returns to the relative high point of 2021 (about 0.16), then ETH could rise to $22,000; and in the extreme case, if the ETH/BTC ratio rises to 0.25, then theoretically the valuation of Ethereum could break through $60,000.

Short-term high expectations: Even amidst year-end market volatility, Tom Lee has not refrained from his bullish pronouncements. In mid-December 2025, during an interview with CNBC, he stated that he "doesn't believe this rally is over," and bet that Bitcoin and Ethereum would reach new all-time highs by the end of January next year . At that time, Bitcoin would have already surpassed its 2021 high, while Ethereum would be around $3,000, still about 40% away from its all-time high of $4,954.

The aforementioned list of predictions covers almost all of 2025. On unbias fyi's Fundstrat analysis page, Tom Lee is labeled "Perma Bull," and each of his pronouncements gives the market higher target prices and more optimistic time horizons. However, these aggressive predictions have deviated significantly from actual market movements. This series of facts has led the market to question the credibility of "Wall Street's shrewd strategist," Tom Lee.

Who is Tom Lee?

Thomas Jong Lee, often referred to as Tom Lee, is a renowned American stock market strategist, research director, and financial commentator. He began his career on Wall Street in the 1990s, working for Kidder Peabody and Salomon Smith Barney. He joined JPMorgan Chase in 1999 and became its chief equity strategist in 2007.

In 2014, he co-founded the independent research firm Fundstrat Global Advisors and became its head of research, transitioning from an investment banking strategist to the head of an independent research firm. He is considered one of the earliest Wall Street strategists to include Bitcoin in mainstream valuation discussions. In 2017, he published a report titled "A framework for valuing bitcoin as a substitute for gold," which first proposed that Bitcoin has the potential to partially replace gold as a store of value.

Due to the high media exposure of his research and opinions, Tom Lee frequently appears in mainstream financial programs and events as "Head of Research at Fundstrat" (including references to his title on CNBC's program/event pages and video content). Since 2025, his influence has further extended to the "Ethereum Treasury" narrative: according to Reuters, after BitMine advanced its Ethereum Treasury strategy funding, it added Fundstrat's Thomas Lee to its board of directors to support its Ethereum-oriented Treasury strategy. Meanwhile, Fundstrat also continuously releases market outlooks and opinion segments centered around Tom Lee through its own YouTube channel.

Arrogance before, obsequiousness after: The contrast between publicly and loudly promoting trades and internally being cautiously bearish.

Tom Lee and his team's contradictory statements on various occasions have sparked heated discussions within the industry regarding their motives and integrity. In response to the recent controversy, Sean Farrell, Head of Digital Asset Strategy at Fundstrat, stated that there are misunderstandings about Fundstrat's research processes.

Fundstrat has several analysts, each employing independent research frameworks and timescales to serve different client objectives. Tom Lee's research is geared towards traditional asset management firms and investors with "low-allocation" portfolios (typically allocating only 1%–5% of their assets to BTC/ETH), emphasizing long-term discipline and structural trends. He himself primarily serves portfolios with a higher proportion of crypto assets (approximately 20%+). However, when publicly advocating for ETH, Tom Lee did not specify that he was targeting the "1%–5% asset allocation to BTC/ETH" group.

Farrell further stated that his cautious baseline scenario for the first half of 2026 was risk management, not a shift to a bearish outlook on the long-term prospects of crypto. He believes that current market pricing is biased towards "near perfection," but risks such as government shutdowns, trade volatility, uncertainty surrounding AI capital expenditures, and a change in the Federal Reserve chairman remain. He also cited his historical performance, stating that his token portfolio has grown approximately threefold since mid-January 2023, and his crypto-equity portfolio has risen approximately 230% since its inception, outperforming BTC by about 40%. Over their respective lifetimes, both are highly likely to have outperformed most liquid funds. However, this wording seems more like a cover-up for Bitmine's $3 billion book loss and the founder's contradictory statements.

In conclusion: The contrast itself is not the problem; the problem lies in disclosure and boundaries.

The real controversy surrounding this matter lies not in the existence of different frameworks within Fundstrat, but in the lack of sufficiently clear scope of application and disclosure of interests between the co-founders on the public communication and service sides.

Sean Farrell's explanation of conflicting opinions by serving different types of clients is logically sound, but three issues still remain unresolved in terms of communication:

1. When Tom Lee frequently expresses strong optimism about ETH in public videos and media interviews, viewers do not assume this is "a long-term allocation discussion only applicable to low-leverage positions," nor do they automatically understand the implicit risk assumptions, time scales, and probability weights. He himself has not publicly clarified or defined the scope of application of this view.

2. FS Insight/Fundstrat's subscription model is essentially "research monetization." The official website directly presents subscription prompts such as "Start Free Trial" and features Tom Lee in its promotional materials. Tom Lee is a key figure at Fundstrat, and the FS Insight page directly identifies him as "Tom Lee, CFA / Head of Research." When traffic and subscription growth largely stem from Tom Lee's public interviews across various media outlets, how does the company convince the public that "this is merely expressing a personal opinion"?

3. Publicly available information shows that Tom Lee also serves as the Chairman of the Board of BitMine Immersion Technologies (BMNR), an Ethereum treasury strategy company, which considers ETH as one of its core treasury focuses. Given this role, his consistent public pronouncements of a "bullish" stance on ETH will naturally be interpreted by the market as a high degree of alignment with the interests of related parties. For CFA charterholders, professional ethics also emphasize "full and clear disclosure" of matters that may affect independence and objectivity.

These types of disputes typically involve compliance issues: anti-fraud and conflict of interest disclosure . In the context of U.S. securities law, Rule 10b-5 is a typical anti-fraud provision, the core of which is to prohibit materially false or misleading statements related to securities transactions.

Furthermore, Fundstrat's organizational structure complicates the controversy: Fundstrat Global Advisors emphasizes in its terms and disclosures that it is a research firm, "not a registered investment advisor or broker-dealer," and that subscription research is "for client use only." However, Fundstrat Capital LLC explicitly provides advisory services as an "SEC Registered Investment Advisor (RIA)."

Given that public interviews and Fundstrat's YouTube channel operations effectively function as "customer acquisition/marketing," another question arises: which content constitutes personal research dissemination, and which constitutes corporate marketing ? If an organization's public video channels continuously release "bullish" clips, while its subscription service releases "bearish" predictions for the first half of the year, without simultaneously presenting key limiting conditions and risk frameworks on the public communication platform, then it at least constitutes a selective presentation under information asymmetry .

This may not violate the law, but it will continue to erode public trust in the independence and credibility of research, and blur the boundaries between "research, marketing, and narrative mobilization." For research institutions where reputation is one of the core elements of their business, this kind of trust cost will ultimately backfire on the brand itself.