ETH Weekly | The Goerli testnet plans to activate the Shapella upgrade on March 15; the trading volume of CME Ethereum options hit a record high in February (3.6-3.12)

1. Overall overview

1. Overall overview

Data shows that bitcoin and ethereum futures and options volumes (in U.S. dollar terms) were higher again in February. Bitcoin’s futures and options volumes are up about 13%, while ethereum’s futures and options volumes are up 2% and 30%, respectively.

Bitcoin futures trading across all exchanges totaled $791 billion last month, up from $697 billion in January, marking the third straight month of growth. At the same time, options volume rose from $17.7 billion to about $20 billion. Driven by the FTX debacle, institutional investors are turning to regulated exchanges. CME’s ethereum options trading volume is at its highest level since it went live last August. Bitcoin options open interest also hit an all-time high, surpassing $1 billion for the first time.

Second, the secondary market

Second, the secondary market

1. Spot market

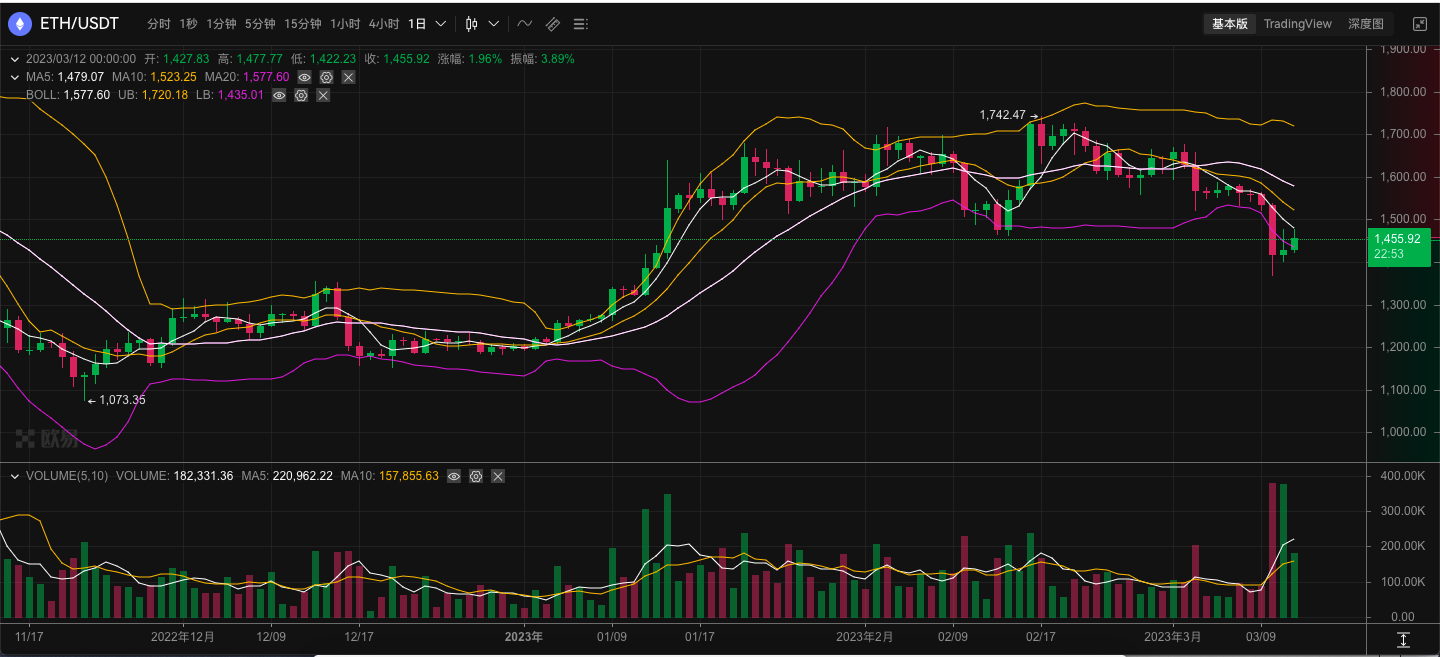

image description

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,450, and the support is at $1,400. If the support is valid, it is expected to continue to hit $1,500; the price may continue to test $1,400 in the short term.

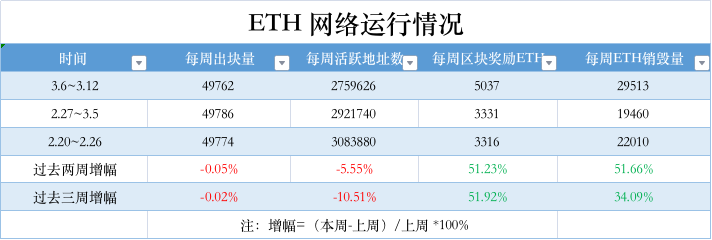

2. Network operation

etherchain.org3. Large transaction

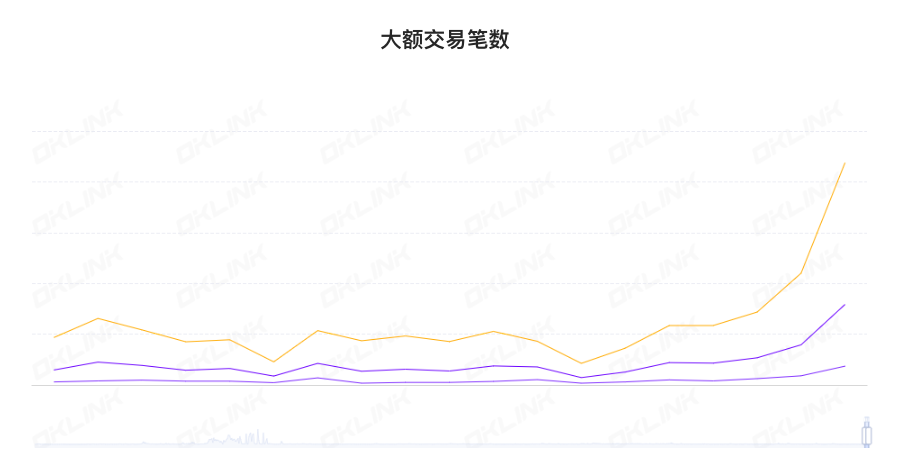

3. Large transaction

OKlink data4. Rich list address

4. Rich list address

OKlink data3. Ecology and technology

3. Ecology and technology

1. Technological progress

(1) EIP-6147 has been moved to the final version, which separates NFT and SBT holding and transfer rights

The Ethereum Improvement Proposal EIP-6147 proposed by 10 K Universe has been moved to Final. This standard is an extension of ERC-721, which separates the holding and transfer rights of NFT and soul-bound tokens (SBT), and defines a new role, namely guard (expiration time can be set). The flexibility of guard settings makes it possible to design NFT anti-theft, NFT lending, NFT leasing, SBT, etc.

According to the official blog, the Ethereum Foundation announced that the Shapella network upgrade will be activated on the Goerli network at epoch 162304, and the planned time is 06:25:36 on March 15, Beijing time. It is expected that this will be before the Shapella upgrade is arranged for the Ethereum mainnet. The last testnet upgrade. The Shapella community conference call is scheduled for March 13 at 23:00 Beijing time. Additionally, the zhejiang testnet can be used to test Shapella functionality before the Goerli upgrade.

2. Voice of the Community

Coinbase CEO Brian Armstrong said the company's newly launched Ethereum L2 network, Base, may include transaction monitoring and anti-money laundering measures. He admitted that Base will have some "centralized components" but will become more and more decentralized over time and will now need to be accountable for transaction monitoring, meaning that while Base will be open to all developers, But it will eventually become "the home of products on the Coinbase chain." Presumably, any existing products that Coinbase integrates with Base will maintain their original KYC/AML measures. (Cryptoslate)

3. Project trends

(1) Taiko, the second-tier network of Ethereum, announced its roadmap and plans to launch the main network early next year

(2) The Optimism mainnet Bedrock upgrade V2 proposal will be released during the 11th cycle review

Ethereum expansion project Scroll announced the completion of a new round of financing of 50 million US dollars, Polychain Capital, Sequoia China (Sequoia China), Bain Capital Crypto, Moore Capital Management, Variant Fund, Newman Capital, IOSG Ventures, Qiming Venture Partners, OKX Ventures Participate in voting. The round brings Scroll’s total funding to $83 million.

Scroll declined to comment on the valuation and structure of the round, but a source said the round values Scroll at $1.8 billion. Scroll had previously raised $33 million over two funding rounds at an undisclosed valuation at the time.

Scroll declined to comment on the valuation and structure of the round, but a source said the round values Scroll at $1.8 billion. Scroll had previously raised $33 million over two funding rounds at an undisclosed valuation at the time.

Scroll plans to use the new funding to continue building out its product, launching the mainnet, and expanding the ecosystem. Additionally, Scroll plans to grow its current team size from about 60 people to nearly 100.

(4) MolochDAO launched a zero-knowledge proof-based "privacy pool" encryption mixing service

(5) Maverick Protocol, a derivatives protocol, will be launched on the Ethereum mainnet on March 8

(6) Consensys released the "ETH Pledge Withdrawal Guide", and commemorative NFT will be launched at that time

Consensys publishes "ETH Staking Withdrawal Guide". The main outcome of the Shanghai/Capella upgrade is to allow stakers to withdraw their staked ETH, but more specifically, it will provide three key features related to withdrawals:

Ability to update withdrawal credentials for Ethereum validators from the old 0x 00 type (derived from BLS keys) to the newer 0x 01 type (derived from Ethereum addresses).

Partial withdrawals, or consensus layer rewards for periodic automatic "exits" from active validator balances (over 32 ETH).

Withdraw in full, or get back the entire balance of the "exited" validator.

(7) The Blur platform accounted for 84% of the total NFT transaction volume on the Ethereum chain in the first week of March

The data shows that 84% of all Ethereum-based NFT transactions in the first week of March occurred on the Blur platform, surpassing the high of 68% in February and accounting for 43% in January. That is, in just over two months, Blur's market share has almost doubled.

(8) Lido's proposal to upgrade the V2 version on Ethereum has been voted through

(9) EigenLayer developer Layr Labs is raising $64 million

(10) The ARFC proposal of the Aave community on the "BUSD delisting plan" has been voted through

The Ethereum pledge agreement ether.fi will be launched in three phases: Phase 1: In April, the mainnet will be launched after the upgrade in Shanghai and ETH delegated pledge will be launched. The second stage: In Q2 or Q3 of 2023, the eETH liquidity pool will go online. The third stage: In Q4 of 2023 or Q1 of 2024, the permissionless node market will be launched.

4. Borrowing

DeFiLlamaThe data shows that the value of locked collateral on the chain fell from $28.55 billion to $25.96 billion last week, a 9% drop in the week. Specifically, the number of ETH mortgages dropped from 18.26 million to 17.6 million last week, a drop of 3.6%. From the perspective of individual projects, the top three lock-up values are: Lido 8.53 billion US dollars; MakerDAO 7.69 billion US dollars; Aave 3.89 billion US dollars.

4. News

(1) Driven by regulatory uncertainty, CME Ethereum options trading volumes hit record highs

Data shows that bitcoin and ethereum futures and options volumes (in U.S. dollar terms) were higher again in February. Bitcoin’s futures and options volumes are up about 13%, while ethereum’s futures and options volumes are up 2% and 30%, respectively.

Bitcoin futures trading across all exchanges totaled $791 billion last month, up from $697 billion in January, marking the third straight month of growth. At the same time, options volume rose from $17.7 billion to about $20 billion. Driven by the FTX debacle, institutional investors are turning to regulated exchanges. CME’s ethereum options trading volume is at its highest level since it went live last August. Bitcoin options open interest also hit an all-time high, surpassing $1 billion for the first time. (The Block)

(2) The chairman of the US CFTC believes that Ethereum and stablecoins are commodities rather than securities, which differs from Gary Gensler

During a Senate Agriculture Committee hearing, U.S. Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam disagreed with U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s previous statement that “all cryptocurrencies except Bitcoin should be classified as securities.” statement.