Strong return: dialysis of the encryption market in January by 5 major data indicators

This article comes fromDapprader, Originally by Sara Gherghelas

Odaily Translator |

The cryptocurrency market started 2023 with a strong trend, and the on-chain indicators in January have shown greater growth and activity, especially in vertical fields such as the NFT market, DeFi, and games. This article will deeply interpret the five major encryption industry indicators and analyze relevant data. Perhaps we will usher in a prosperous and hopeful year.

secondary title

1. The total lock-up volume of DeFi increased by 26.8%, showing signs of recovery

The DeFi market is showing signs of recovery in January 2023, with the total value locked (TVL) increasing by 26.82% month-on-month to $74.6 billion. The DeFi market has benefited greatly from the recent surge in cryptocurrency prices, seemingly signaling a bullish trend to come.

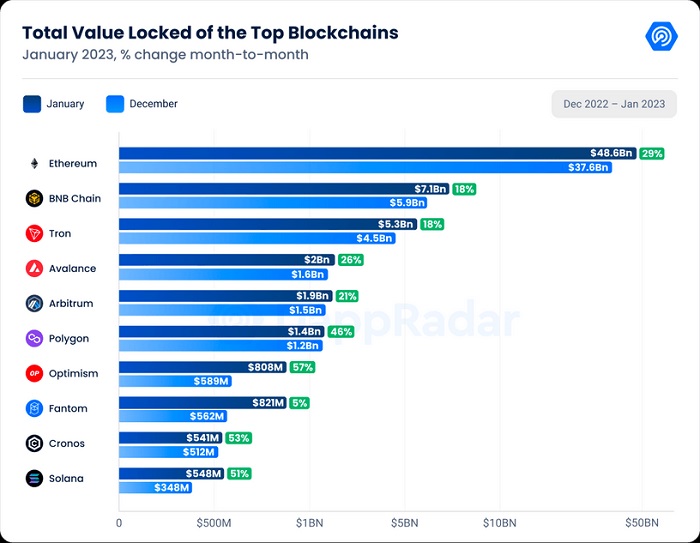

Among the top ten blockchains by lockup volume, we saw an increase in lockup volume for almost all blockchains in January. The best performer was Optimism, whose lock-up volume increased by 57.44% to $808 million (although Optimism’s volume plummeted after the end of the “learn-to-earn” incentive program on January 17th). As of Jan. 17, Optimism averaged 174,810 transactions per day, but has since dropped to 41,026, a 76.53% drop, the data shows.

Solana is another chain that does better in terms of DeFi, and its lock-up volume rose by about 57.33% to $548 million. The increase in Solana lock-up volume was mainly driven by Marinade Finance, which saw a 84.32% increase in lock-up volume in the past 30 days to $152 million. Orca and Raydium's lockup volume also increased, by 37% and 33%, respectively, to $46 million and $38 million. Followed by Avalanche, the DeFi lock-up volume on the Avalanche chain rebounded to $2 billion in January this year, an increase of 26.84%, which may benefit from Avalanche's announcement of a partnership with Amazon Web Services (AWS) to encourage on-chain development.

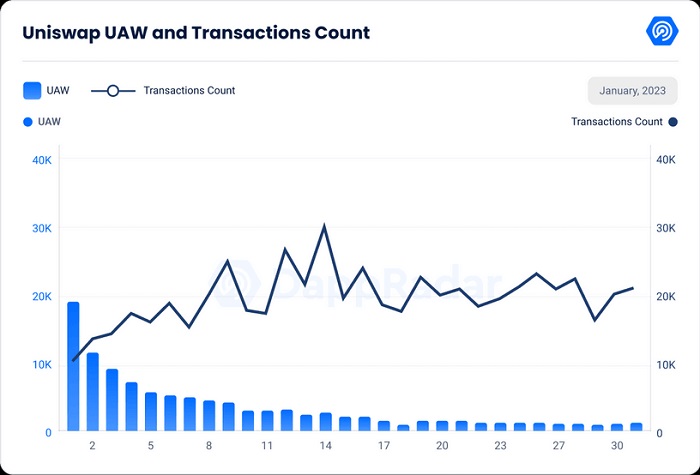

In terms of BNB Chain, Uniswap's proposal to deploy on this blockchain was passed with over 80% approval in January. Like other DEXs, Uniswap operates through smart contracts to match transactions between traders and provide liquidity. As of the end of January, the total lock-up volume of the platform was approximately US$2.7 billion, an increase of 12.48% from the beginning of the month. Due to its growing user base, high transaction speed, and low fee requirements, it is not surprising that Uniswap is moving to BNB Chain. Deploying Uniswap V3 on BNB Chain can also take advantage of DeFi advantages in the Binance ecosystem, such as staking and cross-chain transactions. chain support etc.

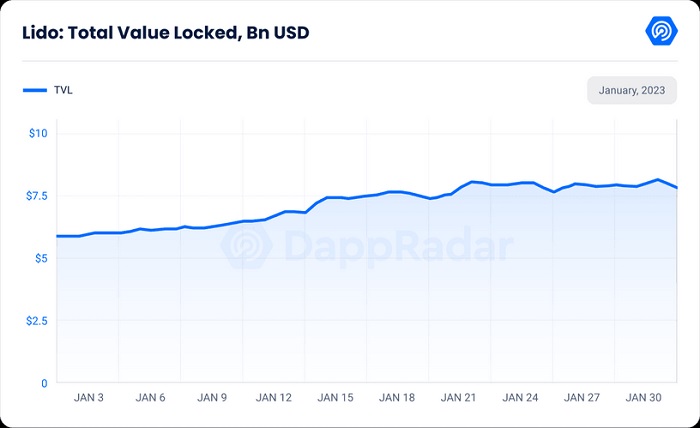

In addition, the upcoming Ethereum "Shanghai" upgrade in March 2023 is attracting market attention, when users will be allowed to withdraw funds from the Ethereum staking contract to reduce ETH staking risk. The “Shanghai” upgrade will also provide growth opportunities for liquid staking protocols, some of which have seen their governance tokens rise significantly since the beginning of the year, and since the Ethereum staking space is still in its early stages, this upgrade has the potential to push these tokens to High, market opportunities will also be further developed. Next, let’s focus on Lido, the most popular liquidity staking on Ethereum.

The difference from other DeFi protocols is that Lido's pledge solution is extremely innovative, which allows users to flexibly pledge ETH without committing to Ethereum's minimum pledge requirement of 32 ETH. This has proven to be a major draw for users looking to get the most out of their ETH staking. Due to its strong performance, Lido's total lock-up volume has increased by 36.77% since the beginning of January, and its recent pledge size has reached nearly 8.5 billion US dollars. participants.

secondary title

2. The transaction volume of the NFT market soared to 946 million US dollars, and the transaction volume reached 9.5 million

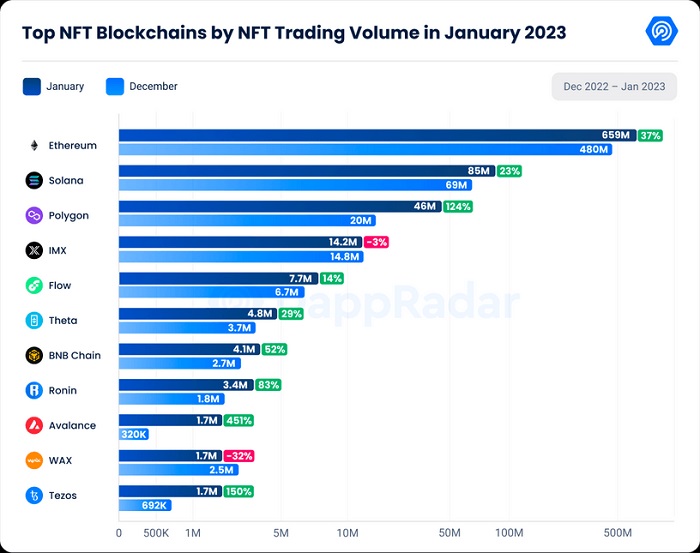

In January 2023, the NFT market began to recover, and both transaction volume and sales volume increased significantly. NFT transaction volume increased by 38% month-on-month to 946 million US dollars, setting a record since June 2022. NFT sales rose 42% month-on-month to 9.2 million.

Ethereum occupies a dominant position of 78.5% in the NFT market. In January, the NFT transaction volume on the Ethereum chain increased by 37.29% to 659 million US dollars, and the sales volume on the chain also increased by 7.37% from the previous month. 2 million transactions. Yuga Labs' NFT collections have once again made a significant contribution to the growth of the Ethereum NFT ecosystem, with the transaction volume of its collections reaching $324.8 million this month, accounting for 34.3% of all NFT transactions on the Ethereum chain. It is worth mentioning that Yuga Labs released an access token NFT called Sewer Pass, the holder can participate in the online game Dookey Dash.

In the NFT market, the dominance of the Solana blockchain is second only to Ethereum. In January, the transaction volume on the chain increased by 23.7% to 86 million US dollars, but the sales volume fell by 5.79% to 788,992 transactions, of which DeGods and Monkey Kingdom is the head NFT series on the Solana chain.

Polygon’s on-chain NFT transaction volume has grown astonishingly, reaching approximately $46 million in January, an increase of 124%; on-chain NFT sales volume increased by 157.39% month-on-month to 4.5 million. The reason why the Polygon blockchain has improved so much has a lot to do with the popularity of the Trump NFT project Collect Donald Trump Cards.

However, Immutable X’s NFT transactions fell by 3.67% to just $14.2 million, but sales increased by 2.39% to more than 564,000 coins. Gods Unchained and Illuvium Land are the two leading NFT series on the Immutable X chain, with $9.89 million and $1.46 million in transactions over the past 30 days, respectively.

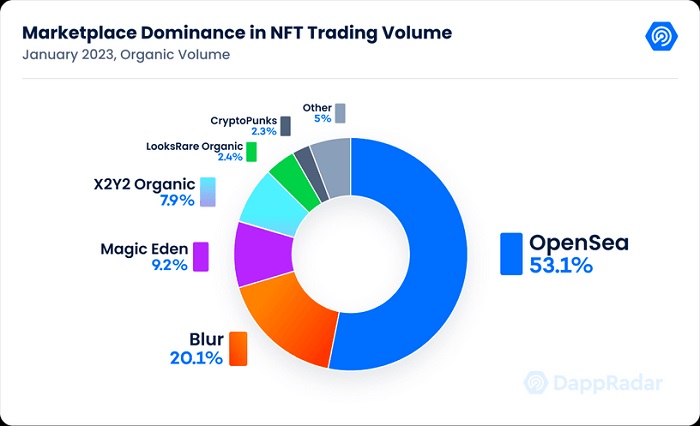

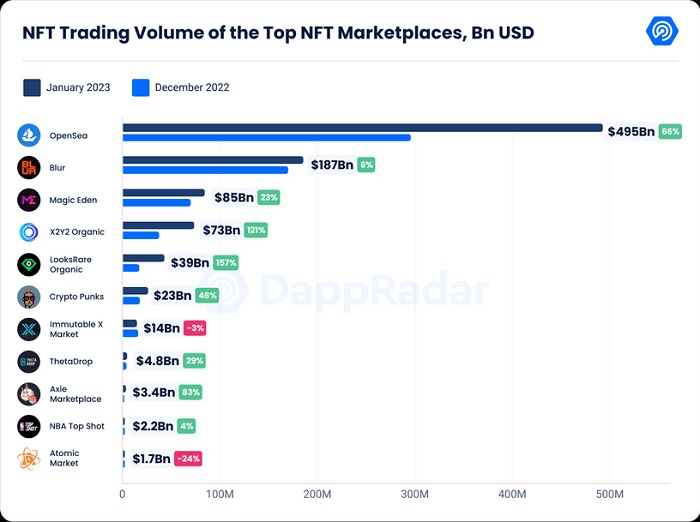

In terms of the NFT market, Blur has emerged as a leading NFT market participant with a transaction volume of US$187 million, but OpenSea still occupies the top spot, with a monthly transaction volume of US$495 million accounting for 58% of the market share, 1 The monthly increase reached 66.58%. Based on the transaction volume recorded on the platform and the 2.5% fee charged per transaction, the OpenSea platform earned approximately $12.3 million in transaction revenue in January this year.

Blur currently has a market share of around 20% and is one of the fastest growing NFT markets. It should be noted, however, that Blur is blacklisted along with LooksRare to trade the Sewer Pass NFT series, as Yuga Labs wants to block NFT marketplaces that do not support royalties.

Additionally, X2Y2 and LooksRare saw significant organic sales growth in January, up 121% and 157%, respectively.

secondary title

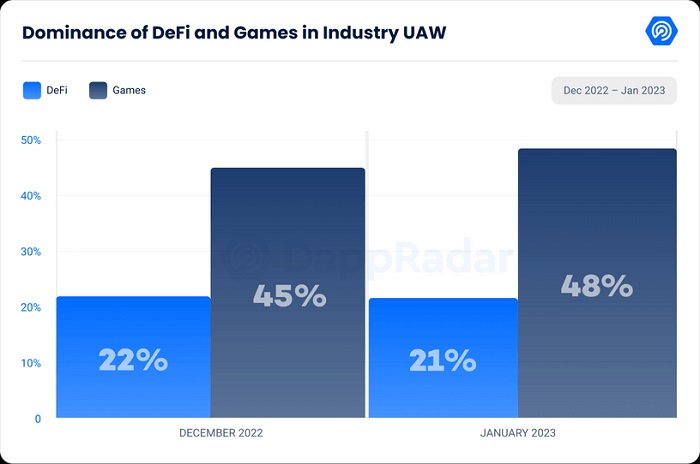

Blockchain gaming is one of the fastest growing segments of the Web3 industry, where game alphas and updates are constantly emerging. In January 2023, the number of daily active wallets in blockchain games reached 839,436, accounting for 48% of the total, up from 45.2% in December, marking a significant increase in the dominance of blockchain games in the Web3 market , is also an important indicator of its bullish long-term potential. As the blockchain gaming vertical continues to mature, we can expect to see more exciting developments in the years to come.

secondary title

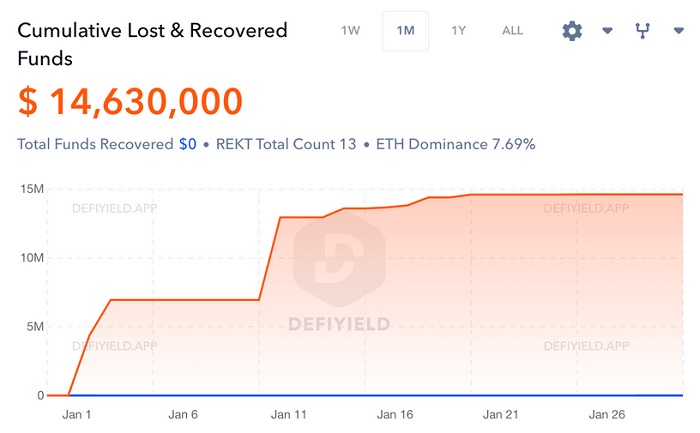

4. Vulnerability exploitation and other hacker attack losses have been greatly reduced

The largest exploit attack in January occurred on the LendHub lending protocol on the Heco network, causing approximately $6 million in damages. The vulnerability exists in lBSV contract replication, allowing an attacker to deposit funds into the old version and borrow from the new market. Transfer stolen assets to other blockchains such as Ethereum and Optimism by utilizing the minting and redemption process. The second largest exploit was the GMX protocol on the Arbitrum network, causing $2.8 million in damages.

secondary title

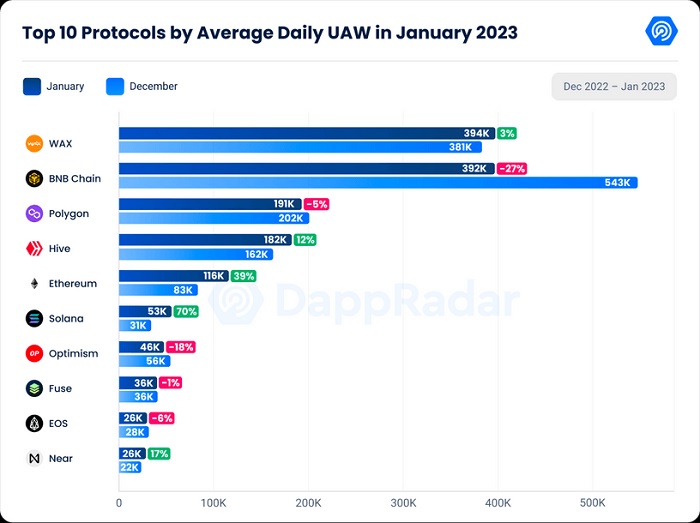

5. The number of daily unique active wallets (dUAW) decreased

The average daily number of unique active wallets in January was approximately 1.7 million, a decrease of 9.55% compared to December 2022, and may be the only on-chain indicator that declined last month. Among them, the average daily independent active wallet of DeFi was 377,039, a decrease of 9.23%, and the average daily independent active wallet of the blockchain game dUAW was 839,436, a decrease of 0.89%, but the average daily independent active wallet of the NFT market increased by 24.56% month-on-month , reaching 146,516.

secondary title

Summarize

Summarize

The cryptocurrency market is off to an impressive start to 2023, with bullish on-chain metrics for the DeFi and NFT markets and a significant reduction in capital losses due to exploits.