Weekly Editors' Picks (1224-1230)

As the New Year's Eve approaches, various organizations, media, KOLs, etc. have releasedMulti-angle annual inventory and forecast(see "With 32 pairs of eyes, see through Crypto's 2023"), Odaily also published "Waking up to 2022, looking forward to 2023", and sorted outInvestment and Entrepreneurship。

"Weekly Editor's Picks" is a "functional" column of Odaily. On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days. You bring new inspiration.

Now, come and read with us:

Investment and Entrepreneurship

DApp Annual Report: DeFi is no longer the dominant application type on Ethereum

This article analyzes the status quo of all 4464 DApps in the 8 public chains of Ethereum, EOS, Tron, Solana, Avalanche, BNB Chain, Polygon, and Optimism. Games (games), DeFi, Marketplace (trading market), Collectibles ( NFT collections), Social&Media (social media) among the top 10 DApps in terms of user activity among the five major DApp types are analyzed, trying to fully demonstrate the 2022 of DApps from the cross-perspective of "public chain x type x user". Conclusions include:

The DApps on BNB Chain and Ethereum are mainly composed of 3 types, and all types are fully covered, but the ecologies on the other 6 public chains are only composed of 1-2 types, and some types are missing. Collectibles on Ethereum have surpassed DeFi to become the dominant type, accounting for about 50% of the total.

According to the average number of daily active addresses of each active DApp in the last 30 days to estimate the number of active addresses in the whole year, the estimated total number of active addresses in the year of 4464 active DApps in 8 public chains is about 113 million. Among them, BNB Chain has the most active users, followed by Polygon, Ethereum, and Optimism.

This year, only the active addresses of the top applications of Social&Media showed an upward trend, and the accumulative increase of active addresses from January to December reached 1583.75%. The other 4 categories of DApps have seen declines between 50% and 80%.

This year, only the number of transactions of Social&Media top applications has increased, and the cumulative number of transactions from January to December has increased by 715.26%. While the other 4 categories all have different degrees of decline, among which Games has dropped by 17.47%, which is a small decline.

The average monthly total revenue of the top 20 DApps is approximately US$152 million, and shows a significant downward trend throughout the year. The total revenue in January was as high as 515 million US dollars, but the total revenue in December has dropped to 24 million US dollars, a 95.34% decline for the whole year. The average annual total revenue of the 20 DApps is about $83 million.

(also recommendedTen main points of DappRadar's "2022 Dapp Industry Report"。)

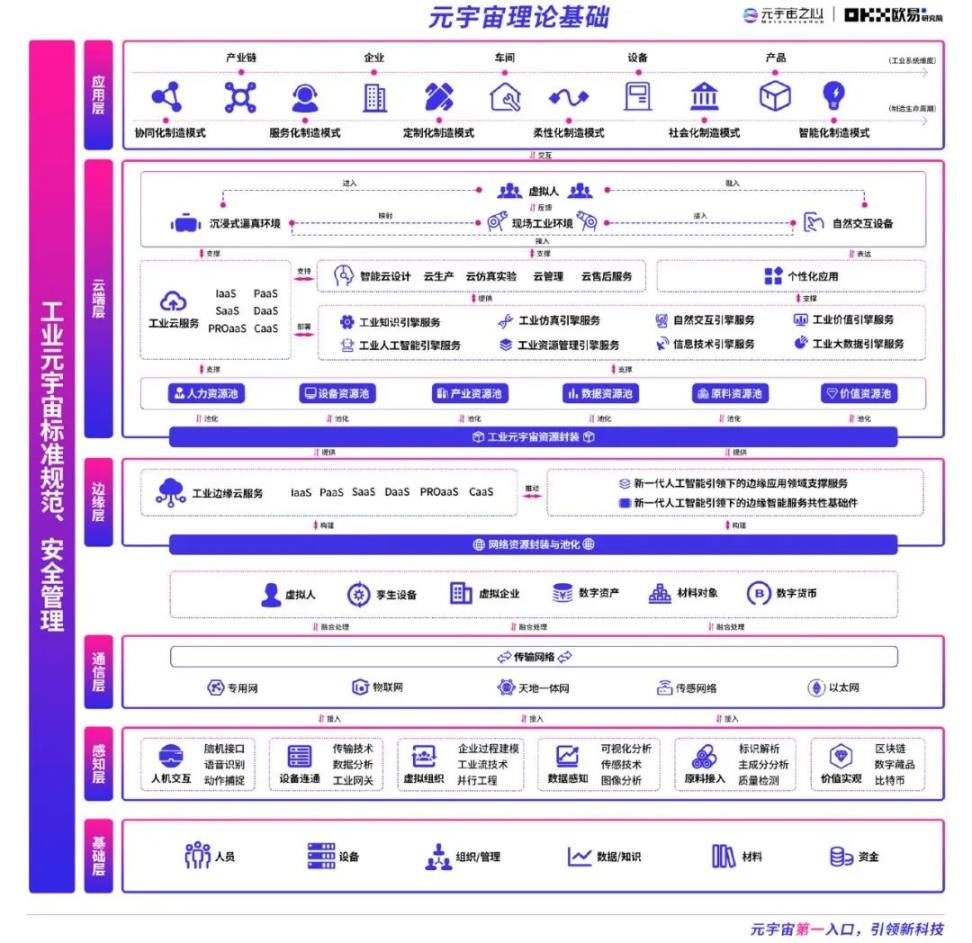

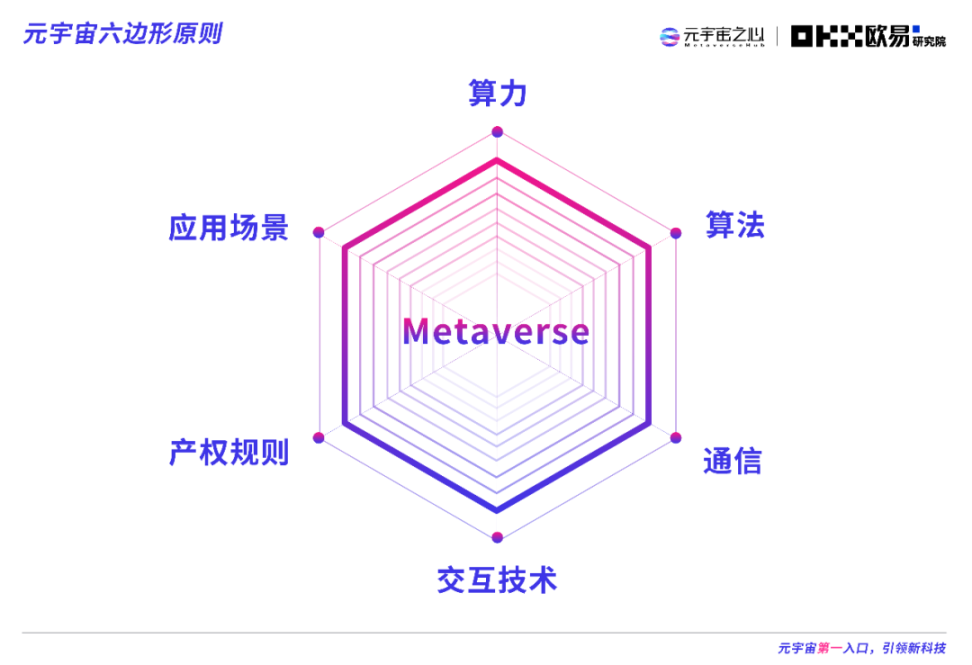

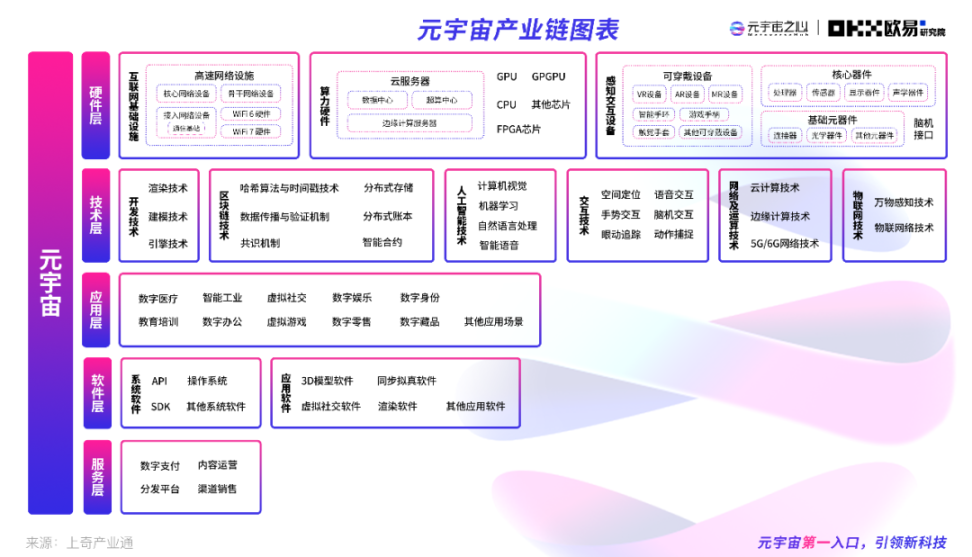

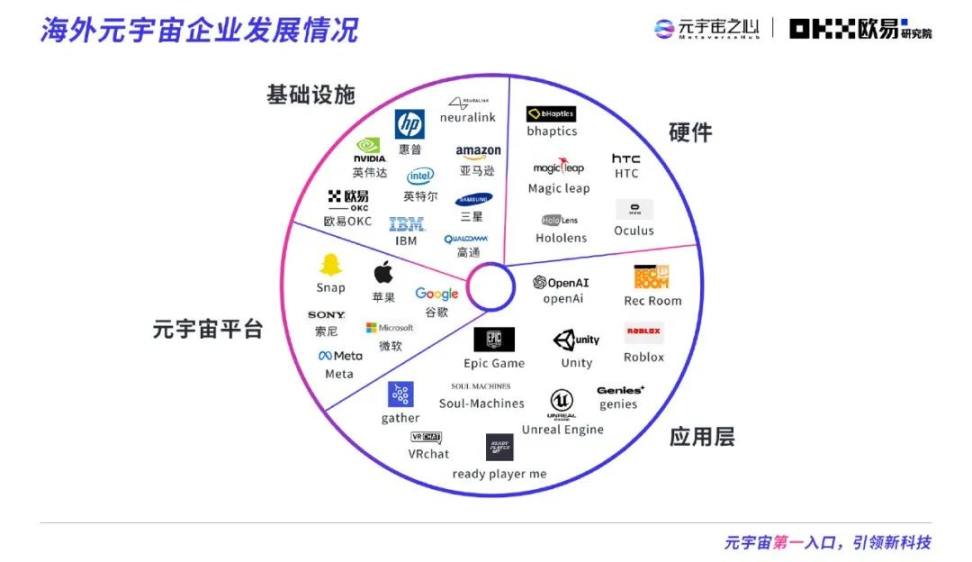

Metaverse Annual Report: Where is the next 100 billion market capitalization company?

image description

image description

image description

image description

image description

2023 Outlook and Predictions

OP Research: The 2023 Crypto Nomad Launch Guide

The article introduces countries or regions as potential destinations for digital nomads from the perspectives of policy industry environment, visa, lifestyle, cost and security. The essence of digital nomads is transnational arbitrage.

DeFi

Understand the difference between market manipulation and oracle manipulation in one article

Market manipulation that needs to be guarded against includes spoofing, ramping, bear raid, cross-market manipulation, wash trading, and frontrunning. Sources of oracle manipulation may be misreporting and insufficient market coverage.

Once oracle manipulation occurs in DeFi protocols such as currency markets, options markets, synthetic assets, algorithmic stablecoins, and automated asset management, it will cause a series of negative consequences, such as stablecoin de-anchoring, malicious arbitrage transactions, forced liquidation, and protocol liquidity drying up.

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

NFT trading guide: how to avoid becoming a picker?

DYOR。

Divide your NFT into 4 categories: short-term, medium-term long-term, long-term, diamond hand, make a plan according to the category to achieve the investment goal, and execute the plan.

secondary title

Web 3.0

From Degen to Regen: How to push Web3 to start a positive sum game?

"regenerative economics", the idea that money can be used to incentivize communities to solve systemic problems. Even if an open source project fails, that work can benefit other projects if everyone moves along the same axis toward social betterment. Innovate, iterate, evolve, repeat.

In addition to financial capital, there are our social, material, life, intellectual, experiential, spiritual and cultural needs. With a programmable currency, we can program our values into our currency. Web3 can also build more positive-sum protocols, expanding resource capacity over time. Many of today's most mainstream cryptocurrency projects have positive positive externalities.

Ethereum and scaling

Ethereum and scaling

Top 5 Predictions for the Ethereum Ecosystem in 2023

The bear market is not over yet;

EigenLayer will be the most important innovation of Ethereum;

Blob transactions will not fix scalability issues;

ZK-Rollups will not see significant traction in 2023;

Layer 3 will be the real competitor of Cosmos.

IOSG Ventures: What’s changed and what’s not in MEV after the merger

MEV is a rare pure chain-native business model in the current encrypted world, which is stable enough.

The current PBS is a non-protocol layer, and the Validator can still choose to build the block itself instead of outsourcing it to a professional Builder. After the introduction of Danksharding in Ethereum in the future, PBS will become a mandatory implementation of the protocol design, and we will see that the market for block building becomes even larger.

After the merger, the supply and demand relationship between block proposals and block construction has changed; the need to resist censorship and decentralization has begun to emerge; the trend of block construction becoming a specialized market is also slowly emerging. These changes will lead us to the endgame of Ethereum.

There is a time window of two to three years between the non-protocol layer PBS (MEV-Boost) and the protocol layer PBS (Dankshading). Furthermore, if you jump out of the perspective of Layer 1 of Ethereum, there are also broad cross-domain MEV opportunities in the multi-chain ecology and multi-Rollup ecology.

Thoughts on zkRollup Hardware Acceleration and zkPOW

Independent ZK DAPP is the most direct application scenario for zero-knowledge proof. This type of application needs to prove simple matters, few types, and small quantities, so it is easier to develop, such as: pure privacy payment protocol, ZK bridge, identity solution wait. Medium-sized application scenarios include proving correctness in data storage networks, ZK-based games, etc. Layer 2 and zkEVM of zkRollup are the ultimate application of zero-knowledge proof in Web3, which are used to deal with state changes brought about by various possibilities in a VM or EVM.

New ecology and cross-chain

New ecology and cross-chain

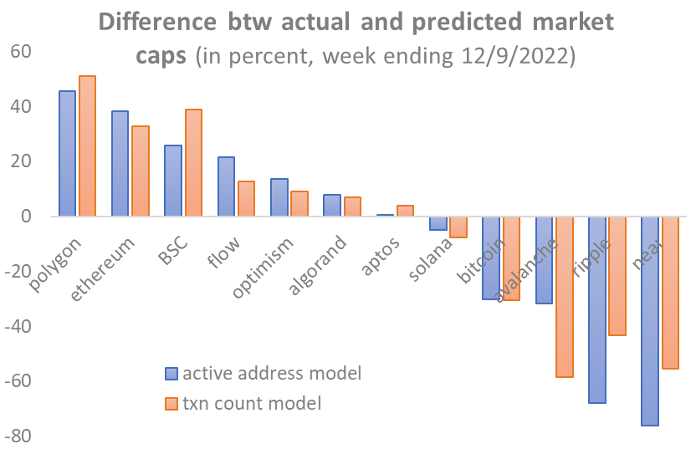

The article believes that adoption and use, platform moat, and encryption market conditions are three factors that jointly affect the valuation/market value of public chain Token. The author further quantifies these factors for 12 mainstream public chains and draws a comparison chart of actual market value and predicted market value, and finally draws the conclusion in the figure below (from left to right, the most overvalued to the most undervalued). The author also pointed out the limitations of this valuation method at the end of the article.

Why does Web3 need a DeFi native chain?

Sei and Berachain, as the new Layer 1 blockchains that will gain attention in 2022, let us see the purpose and vision of the birth of the DeFi protochain. In addition to the technical innovations of Sei and Berachain in different directions, they both chose the Cosmos SDK, which has the common advantages of being customizable and modular.

The DeFi protochain unlocks a new design space between the general chain and the application chain - neither general nor application-specific, but specific to a certain industry. For example, Sei's goal is to create a An environment customized for DEX applications, Berachain expects to solve the problems of lack of liquidity and insufficient sustainability that plague the DeFi industry through the liquidity proof mechanism.

hot spots of the week

hot spots of the week

Over the past week, Elon Musk:Got Twitter spending under control, not near bankruptcy,DOJ launches criminal investigation into FTX hack,FTX Clients File Class Action Lawsuit, requiring a statement that the digital assets held by the platform belong to the customer,SBF used Alameda assets to buy $546 million Robinhood stake, multiple parties claim ownership of this share,Hundreds of Clients of FTX, Celsius, and Voyager Are Selling Their Debt at a Loss,Defrost Finance Hacked, over $13 million in losses, CertiK:The Defrost Finance project is an exit scam, and its team did not perform KYC, says Defrost FinanceHackers have refunded the stolen funds and will return them to users as soon as possible,backAnnounced the specific process of returning stolen funds to users, V1 stolen funds have all been returned, the BitKeep APK package download used by some users was hijacked by hackers,BitKeep CEO issued a messageSaid that the root cause of the accident has been identified, some of the stolen funds have been frozen, andDamaged users will be fully compensated, and the alarm and case filing procedures have been initiated,BTC.com hacked, about $3 million stolen,Wintermute made over $250 million in arbitrage trades during Terra crash, earning tens of millions of dollars, CZ:3 Commas has a wide-ranging API key leak, please disable it now;

In addition, in terms of policies and macro markets, the US SEC intends to requireFTX Recoups Two $100M Venture Investments in Mysten Labs and Dave;

perspectives and voices,Three Arrows Capital Lianchuang Predicts Encryption Industry Events in 2023: SBF will plead guilty; Genesis and Grayscale may face class action lawsuits, etc.;

In terms of institutions, large companies and leading projects, MicroStrategyAnnounced an increase of 2,500 BTC and currently holds 132,500 BTC,First sale of 704 BTC for tax benefits,Bitcoin Lightning Network Apps and Solutions to Launch in 2023,Nexo denies abandoning takeover, and publish the final proposal to Vauld creditors,Binance now supports Apple Pay and Google Pay for cryptocurrency purchases,Ethereum Staking Withdrawal Devnet Launched, the public testnet will be launched soon,1inch launches Fusion upgrade, to improve the security and profitability of swap,Waves Founder Releases Waves 2.0 Plan, including new stablecoins, SafeFi models, etc.;

In the field of NFT and GameFi, Trump:Portal...well, another week of ups and downs.

With "Editor's Picks of the Week" seriesPortal。

See you in 2023~