Wake up in 2022, look forward to 2023

Author | Azuma, Shiwen, Qin Xiaofeng, Loopy Lu, Fat Tiger

Editor | Hao Fangzhou, Mandy

produced |Odaily

In 2022, V God, CZ, and SBF appeared on the cover of "Fortune" magazine one after another, and the corresponding titles were "The Prince of Crypto Has Concerns", "The $ 74 Billion Man", and "The Next Warren Buffett?".

The direction of the plot of the Crypto world this year is an ups and downs that even the best screenwriters can’t write. There are so many embarrassing dramatic black swan incidents. Looking back now, the grass snake gray line in the story has long been buried. Foreshadowing.

In the first four months, the total market value of encryption was still hovering around $2 trillion.

The Russia-Ukraine conflict that began in February brought crowdfunding DAOs and encrypted cross-border payments to the fore. In March, Biden signed an executive order on digital assets, putting the research and development of potential US CBDC (central bank digital currency) options in the most urgent position. Major economies are also steadily promoting the development and implementation of their CBDCs.

A number of traditional financial giants have been approved to issue cryptocurrency-related products, expanding the adoption of Crypto and breaking the circle; Web2 manufacturers are actively testing the waters of NFT, Metaverse and Web3, and celebrities and brands are also following suit, embracing new marketing rules. Leaders in the DeFi segment have launched new versions one after another; the total transaction volume of NFT and the floor price of blue chips hit new highs, Yuga Labs launched the Metaverse Otherside, and the new generation of application Light StepN continues to expand its boundaries based on M2E...

However, good dreams are fleeting. In May, the "UST unanchored and LUNA collapsed" event knocked over a basket of eggs, and had a three-dimensional and far-reaching impact on user funds, ecological projects, industry confidence, and regulatory attitudes.

In the following six months, we witnessed the bankruptcy and liquidation of Three Arrows Capital (3 AC), the bankruptcy and reorganization of Celsius, the suspension of cash withdrawals of Babel Finance, the bankruptcy protection of Voyager Digital, the collapse of FTX in just a few days, and the bankruptcy and reorganization of BlockFi , DCG fell into a liquidity crisis. Institutions that were once considered "too big to fail" have been questioned and laid off for the winter. Some CEXs that have accumulated large amounts of funds have run away or stopped paying. More decentralized projects are facing severe security environment tests...

Since mid-June, the total crypto market capitalization has fallen to around $1 trillion (about $844.7 billion as of press time).

The bubble burst, and we found that: "Institutional funds aggressively entering the market" is an illusion created for the cycle of increasing leverage; piercing the shell of algorithm stability and ultra-high returns, Ponzi's eyebrows that will eventually collapse are revealed; embracing regulatory compliance, The CeFi giants representing the industry in the U.S. Congress have messed up their accounts and misappropriated user funds; the shadow hackers who have succeeded repeatedly are still stealing and are at large, and accountability and compensation are so far away.

However, the encryption industry, which is rapidly entering the winter, has not been crushed, and it just curled up and fell down.

After several pulls, Musk finally acquired Twitter. After drastic reforms, DOGE, meme, SocialFi, and Web3 were brought up again; Ethereum completed Merge and entered a new era of PoS, writing an important footnote for the history of encryption; Move, which inherited Diem’s mantle The L2s, which are public chains and riding the wind, are nurturing new killer applications and brewing the next super ecology; the CeFi competition landscape has been unexpectedly reconstructed, and the "elders" who have learned lessons have become pivotal KOLs.

Whether it is rain or snow, it falls on the land of Web3, helping the spring buds break out of the frozen soil, and pushing every participant in the industry to the next cycle.

first level title

1. The secondary market is cold, and the market has entered into a deep bear

In 2022, the Federal Reserve will continue to raise interest rates, and global liquidity will tighten; the external financial environment is panicked, coupled with many internal incidents, and the chain of thunderstorms, the encryption market will eventually enter a deep bear.

On the whole, the total market value of encrypted assets has shrunk by nearly 1.5 trillion US dollars throughout the year. The data shows that the total market capitalization has dropped from USD 2,334 billion at the beginning of the year to USD 844.7 billion at present, a drop of more than 63%; the first time the market capitalization fell below the USD 1 trillion mark was on June 14 this year, and it has continued to consolidate since then.

Even in a bear market, the market value ratio of BTC and ETH has not changed much during the year: BTC's market value ratio has dropped from 37.83% at the beginning of the year to 37.4%; ETH's market value ratio has dropped from 18.95% at the beginning of the year to 18.11%.

While maintaining a high market value, compared with other altcoins, the price decline of BTC and ETH is relatively small.The price of BTC once fell from US$46,215 at the beginning of the year to US$15,461, the largest drop was 66%, and it closed down 62% during the year; the price of ETH once fell from US$3,676 at the beginning of the year to US$880, the largest drop was 76%, and it closed down 64.7% during the year. In contrast to other assets, as many as 72 tokens among the top 100 tokens by market value have fallen by more than 90% from their historical highs; in the DeFi sector and the GameFi sector, the total market value has generally fallen between 80% and 90%. The drop can reach as high as 99%.

The top ten currencies by market capitalization have also undergone earth-shaking changes this year. There are three main trends:One is the retreat of the old mainstream,The market value of ADA and DOT, which once ranked among the top five last year, has continued to decline this year. ADA currently ranks 9th in market value, and DOT ranks 12th in market value;The second is the withdrawal of DeFi and infrastructure assets.The market value of UNI, AVAX, and LINK dropped to 15th and 20th places, and the only relatively strong one is MATIC, indicating that L2 is still active in the front line;The third is that the black swan time has caused the value of related tokens to shrink severely.For example, Terra token LUNA, in the first four months of this year, the market value has always been stable in the top ten, but as the UST continued to de-anchor, the price of LUNA also suffered a waterfall drop, plummeting from a maximum of 120 US dollars (April 5) to a minimum of 0.000001 The U.S. dollar became a meme currency, and eventually Terra was forced to issue a new currency. The experience of SOL is also sympathetic. In the first ten months of this year, its market value has been ranked among the top ten. However, with the collapse of FTX, SOL was affected miserably. The price fell from $38 to $11 within a week, with the largest drop of more than 70% , currently ranked 16th in terms of market capitalization.

Two other tokens deserve special attention:

XRP: With a relatively low decline this year (accumulative decline of 51% during the year), it has successfully retained the top ten and currently ranks sixth in market value; for XRP in 2023, the news that is worth looking forward to is the two-year lawsuit with the SEC The final verdict may be ushered in in the first quarter, and once it wins, the sea and the sky will be bright.

DOGE: Affected by Musk’s acquisition of Twitter this year, DOGE regained attention. It more than doubled within a week (October 24-October 30), and finally recorded an increase of 105.71% in October, returning to the top ten again ranks.

In terms of platform currency,According to the data of 48 companies collected by Coingecko, as of December 1, the total market value of platform coins was 57.4 billion US dollars, of which the top five were: BNB (43.4 billion US dollars), OKB (5.68 billion US dollars), LEO (3.51 billion US dollars), CRO ($1.55 billion) and HT ($820 million). FTT, once the third largest platform currency in terms of market value, had a circulating market value of US$3.4 billion before the crash on November 8. In just one week, FTT fell from US$22 to US$1.2, a drop of 95%. In addition, multiple platforms such as Hoo (HOO) and AAX (AAB) ran away one after another, and the price of their platform tokens also plummeted by 99%.

This year, the encryption exchange BitMex released the platform currency BMEX. Since February, BMEX began airdropping to users, and "accumulatively, millions of BMEX have been airdropped to more than 80,000 traders"; in June, the company postponed the listing of its tokens on the grounds of "market conditions"; , BMEX was officially launched on November 11. However, judging from the performance of the secondary market, BMEX's initial listing price was US$0.9, and the highest rose to US$1.3, and then began a month-long slump, with the lowest falling to US$0.37. It is currently reported at US$0.64, with a market value of US$64 million.

In terms of stable coins,As of December 1, the total market capitalization of stablecoins reached $141 billion, accounting for 15.6% of the total crypto market capitalization ($899.7 billion). In terms of market size, nearly 90% of the entire stablecoin market is dominated by three centralized fiat currency stablecoins: USDT ($65.5 billion), USDC ($43.2 billion) and BUSD ($22.4 billion). At present, the largest decentralized stablecoin is DAI ($5.2 billion), which ranks fourth in the market value of stablecoins. Compared with the top three, there is still a big gap; on February 16 this year, the market value of DAI reached a maximum of 9.9 billion U.S. dollars, Then began to decline.

Since May, the market value of USDT has dropped from a minimum of 83.2 billion US dollars to 65.3 billion US dollars, shrinking by 17.9 billion US dollars; on the other hand, USDC has risen from a minimum of 48.5 billion US dollars to a maximum of 56.1 billion US dollars, an increase of 7.6 billion US dollars. The Cash incident fermented, and USDC was also deeply affected, and its market value dropped by US$2 billion within a month; in addition, Binance launched a stablecoin exchange plan in September this year-the USDC, USDP, TUSD stablecoin balance and new recharge on the platform Automatic conversion to BUSD at a ratio of 1: 1 will have an impact on stablecoins such as USDC. Data shows that in the past three months, the total market value of USDC has shrunk from US$52.3 billion to US$42 billion, while the market value of BUSD has risen from US$19.3 billion to US$22.4 billion, an increase of nearly US$3 billion.

This year, several decentralized stablecoins also encountered setbacks and gradually withdrew from the stage of history.

The market value of decentralized stablecoin USTC (formerly UST) has continued to rise after this year, reaching a peak of 18.7 billion U.S. dollars in early May, surpassing BUSD to rank third in market value; but eventually collapsed due to design defects, and currently only 240 million U.S. dollars are left .

Another collapsed DeFi stablecoin is MIM (Magic Internet Money). Last year, the project greatly stimulated minting demand by binding Curve incentives. At the beginning of this year, the market value was as high as 4.56 billion US dollars, ranking sixth, second only to USTC and DAI; However, with the shrinking incentives and falling into a growth bottleneck, the market value has dropped significantly after the year, and it is currently only 87 million US dollars, falling out of the top ten stablecoin market value rankings.

The decentralized stablecoin FEI was hacked after the end of this year and lost more than 80 million US dollars. The market value has dropped from 780 million US dollars at the beginning of the year to the current 45 million US dollars. According to the latest news, Tribe DAO has passed a proposal to start integrating the protocol with assets, when all work is completed, Tribe DAO will be completely dissolved.

The price of HUSD broke the anchor in August this year and once fell below $0.9, but has now returned to normal; in this regard, Huobi officially stated that it will withdraw from HUSD in April 2022.

first level title

2. The total investment and financing amounted to about 35 billion US dollars, and the crash sounded the alarm for VC

According to incomplete statistics from Odaily, as of November 30, the encryption industry has publicly disclosed 1,658 primary market financings in 2022, an increase of 8.4% year-on-year, and the total disclosed amount is about 35 billion US dollars, an increase of 7.3% year-on-year.

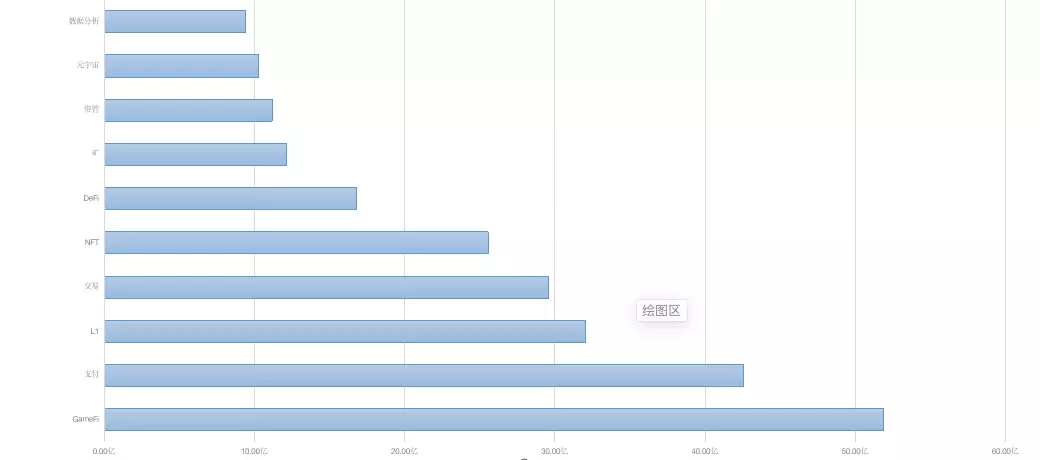

According to the business type, service object, business model and other dimensions of the invested project, we divide all the projects that disclose financing into five tracks: infrastructure, application, technology service provider, financial service provider and other service providers. Each track is divided into different sub-sections including GameFi, DeFi, NFT, payment, wallet, DAO, Layer 1, cross-chain, etc.

From the perspective of financing tracks, the popular financing tracks in 2022 are applications, financial service providers and other service providers.

Judging from the amount of financing in sub-sections of each track,The GameFi section in the application field has received the attention and layout of many large institutions, and it is also the track most favored by capital in 2022.A total of 272 financings have been obtained, accounting for 16% of the total financing, ranking first in this track, and also at the top of all major tracks. Investments in the track include the X 2 E project, game guilds, GameFi development infrastructure, and more.

Secondly, the DeFi and NFT sectors in the application field are more concerned by capital.Received 191 financings and 188 financings respectively. At the beginning of this year, the Metaverse sector, which was highly discussed, was relatively weak, probably because its various infrastructures were not yet perfect, and at the same time, the metaverse direction that was easier to implement was also concentrated in the GameFi sector.

The top sub-sections of other tracks include financial service provider transactions, with a total of 78 transactions; other technology service providers (including development, BaaS, algorithms, etc.), a total of 92 transactions; the infrastructure L1 section, a total of 30 transactions; other sectors of other service providers (including marketing, education, media, incubation, compliance, etc.), a total of 162 transactions.

From the perspective of sector rotation and investment amount,GameFi throughout 2022,The total financing amount is 5.189 billion US dollars, and relaying NFT and DeFi will become the driving force behind the outbreak of the next round of bull market.

The second is the payment section,Although it is not dominant in the amount of financing, the total financing amount ranks second, with 4.258 billion US dollars. The project that has attracted more attention in this sector is Checkout.com, a global payment solution, with a financing amount of US$1 billion, ranking second in the single financing amount for the whole year of 2022. This is followed by Cross River Bank, which provides legal currency entry and exit for encrypted transactions, NFT markets, and encrypted wallets, with a financing amount of US$620 million. The last thing worth noting is Circle, the USDC issuer, which raised $400 million.

Also winning with the total amount of financing is the L1 sector.At the beginning of the year, Luna led the financing list of the public chain sector with a financing amount of US$1 billion. Although the Luna thunderstorm in May brought huge losses to the market, the public chain is still the focus of investment institutions. Previously, the relatively mature Near Protocol and Polygon received US$500 million and US$450 million in financing respectively; later, new public chains Aptos, Sui, and Aleo completed US$350 million, US$300 million and US$200 million in financing respectively.

Although the turn from bull to bear in 2022, the performance of the secondary market in the second half of the year was not satisfactory, and it was transmitted to the primary market, causing many institutions to decisively press the investment pause button. However, in the difficult period of industry development, there are still some unicorns that have won high financing with high valuations.

According to the division of specific tracks, the projects with the largest single investment amount in each hotspot and field are as follows:

In the field of GameFi, game developer Epic Games has completed a financing of US$2 billion at a valuation of US$31.5 billion to build the metaverse, which is currently the largest single financing in the encryption market. (Odaily Note: Strictly speaking, Epic Games is still a traditional game technology service track, and it is not yet certain whether blockchain and cryptocurrency will play a role in its plan.)

In the L1 field, the highest single financing amount is Luna (completed a financing of 1 billion US dollars at that time, which is also the second largest single financing project this year).

In the L2 field, Matter Labs, a zkSync development company that is considered to be able to solve the scaling problem of Ethereum, completed a $200 million Series C round of financing, bringing its total financing to $458 million.

In the NFT field, Yuga Labs, which occupies the entire NFT market hotspot in 2022, completed a financing of US$450 million at a valuation of US$4 billion, which is also the largest financing in the NFT industry so far.

In the DeFi field, DEX leader Uniswap Labs completed a $165 million Series B round of financing at a valuation of $1.66 billion.

In the metaverse space, Improbable raised $150 million to build an interoperable metaverse network, M² (MSquared).

In the field of wallets, Solana’s ecological wallet Phantom raised US$109 million in Series B financing and is currently valued at US$1.2 billion. Due to the impact of the FTX bankruptcy incident on the Slana ecosystem, Phantom has also expanded its service scope from a single-chain wallet (only supporting Solana) to a multi-chain wallet.

In the field of digital identity, Unstoppable Domains, the project that has received large amounts of financing, completed a round A financing of US$65 million at a valuation of US$1 billion.

In the field of DAO, there is no financing of hundreds of millions of dollars in this field, but there are two large-scale financing projects: CoWDAO, the management organization of CoW Protocol, and Utopia, the DAO salary payment system, each completed a financing of 23 million US dollars.

In the field of technology service providers, NodeReal, a Web3 one-stop infrastructure provider, completed a US$16 million seed round of financing led by Sky 9 Capital in May.

In addition to the above hot fields, data analysis, privacy and other fields have also seen financing projects worth hundreds of millions of dollars.

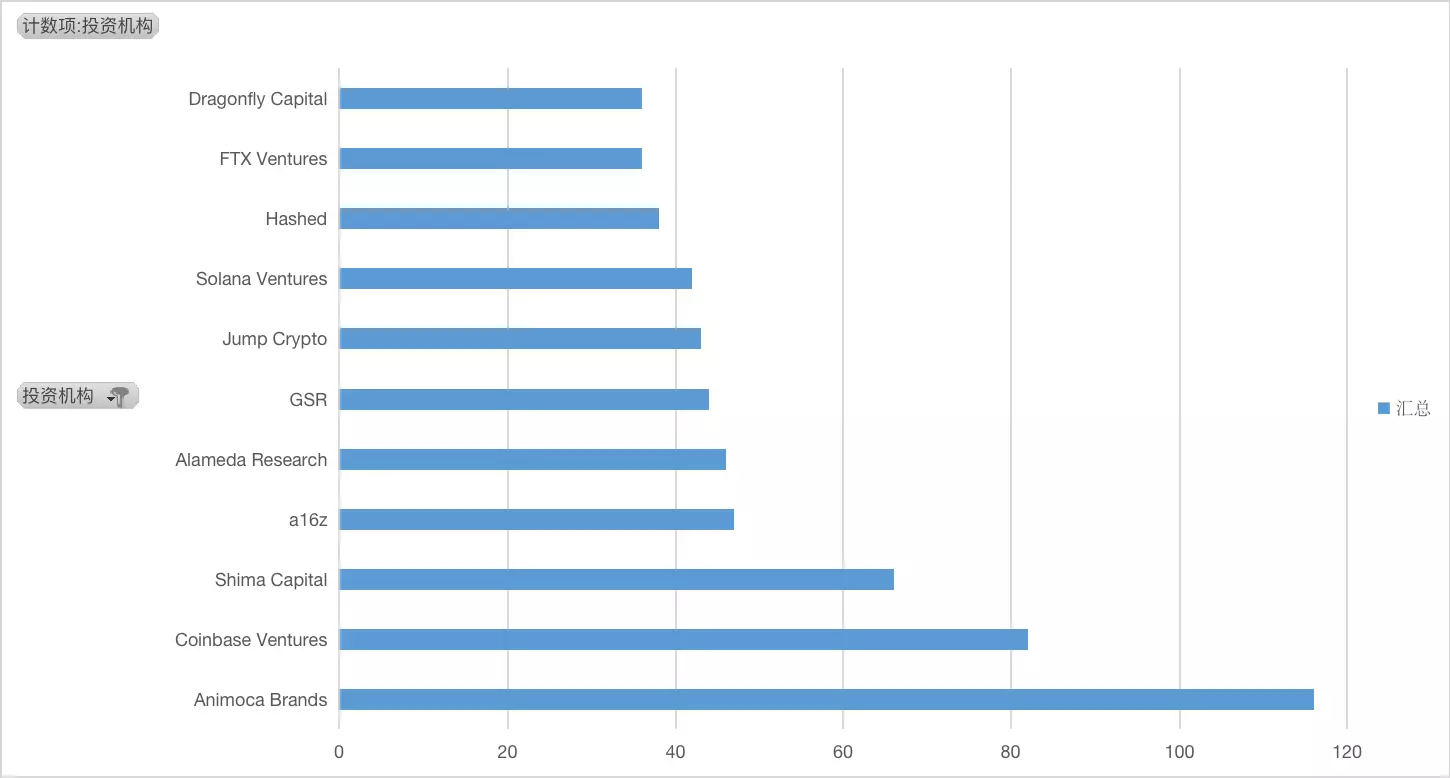

From the perspective of the number of shots made by investment institutions,As a blockchain game unicorn company, Animoca Brands has become the institution with the most shots this year by investing about 116 GameFi and metaverse-related projects.Meanwhile, Animoca Brands itself has raised three funding rounds this year, totaling roughly $490 million. Moreover, under the generally unsatisfactory market conditions, Animoca Brands plans to launch a metaverse fund with a scale of up to US$2 billion to support the development of the metaverse business. It can be seen that Animoca Brands' financial situation is still strong, and it is always optimistic about GameFi and metaverse related fields.

The second largest investment institution is Coinbase Ventures,Invested in about 82 projects this year;The third investment institution is Shima Capital,A total of 66 investments were made this year. The investment institution was established in 2021, and the tracks it is keen to invest in are GameFi, Metaverse and NFT.

Other investment institutions that squeezed into the top 10 include a16z with about 47 deals; Alameda Research with about 46 deals; the established market maker GSR, established in 2013, is also very active in the investment field this year, with about 44 investments. Investment institutions, and provide $5 million in financial support to the industry recovery fund led by Binance. GSR is keen to invest in DeFi, GameFi, etc.; Jump Crypto about 43 deals; Solana Ventures about 42 deals; Hashed about 38 deals; FTX Venture (denied merging investment business with Alameda Research) about 36 deals; Dragonfly Capital about 36 deals.

In the turbulent year of 2022, the collapse of Luna, the unanchoring of the UST algorithm stablecoin, the implosion of Three Arrows Capital, and the bankruptcy of FTX caused heavy losses to more than 1 million creditors. All these events have allowed us to witness the risks of the encryption market. We also realized that VC was not very successful. The reputation of once well-known investment institutions was discredited, and they withdrew from the market, resulting in a decline in the valuation of their investment portfolios.

Among the top ten investment institutions in the number of shots, Jump Crypto may be frustrated by over-investment in Solana ecology and risk exposure to FTX; Hashed lost an estimated $2.9 billion on its LUNA assets; and was at the center of the FTX bankruptcy incident Alameda Research of Alameda could lose more than $15 billion, and FTX Venture, which both invests in companies and receives investments, spreads its funds among Clifton Bay Investments LLC, FTX Ventures Ltd, Island Bay Ventures Inc and some potential affiliates, resulting from the lack of financial It was chaotic and disorderly, and the two parties invested in more than 250 projects in the encryption field. The bankruptcy incident also shocked the encryption industry. Although Solana Venture, which mainly invests in the Solana ecology, has no public information indicating its financial damage, the Solana ecology is also in jeopardy due to the bankruptcy of FTX, and it is difficult to predict that its investment and return will be proportional.

In addition, Singaporean fund Temasek and Silicon Valley venture capital institution Sequoia Capital successively announced that the investment of US$275 million and the investment of US$213.5 million in FTX and FTX.US were written down to zero. These incidents may also reflect that investment institutions did not do a good job of pre-investment due diligence, ignored the potential risk factors of the project, and were attracted by high returns and contagious visions, resulting in underestimated risks.

first level title

3. Chronicle of Events in 2022

secondary title

1. Ethereum and Layer 2: Evolution and Growth

Although the cold air hangs over the entire 2022, the pace of upgrading the Ethereum ecosystem has never stopped.

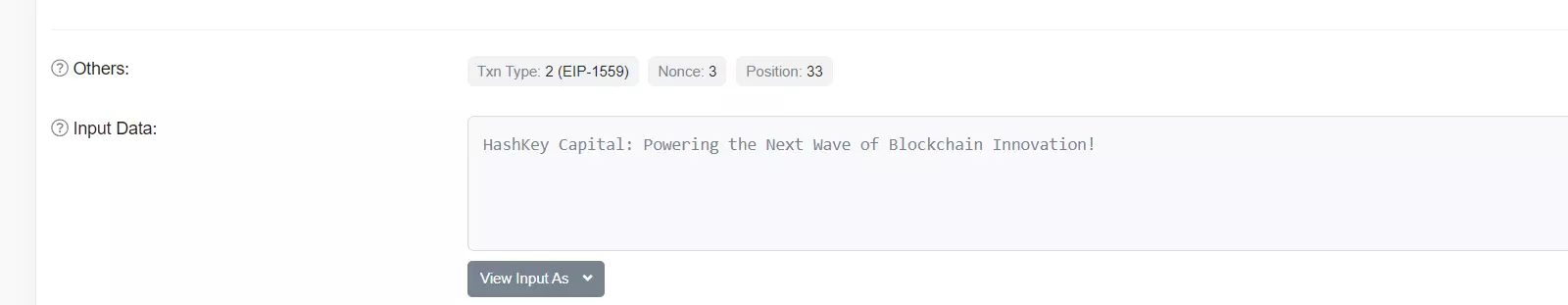

In September, under the eyes of everyone, the total difficulty (TDD) of Ethereum’s mainnet merger finally reached the predetermined value of 58750000000000000000000, the Paris upgrade was activated, and The Merge officially started.With the completion of the merger, the consensus mechanism of Ethereum has also switched from PoW to PoS.The era of miners has passed away, and in the first PoS block after the merger, HashKey Capital, as the transaction packer, wrote such a message - supporting the next generation of blockchain innovation.

With the smooth implementation of the merger, Vitalik also let go of his rhetoric:"Increasing scalability and making good use of Layer 2, the ability of the Ethereum ecosystem to accommodate and process transactions is expected to increase by 100-1000 times."

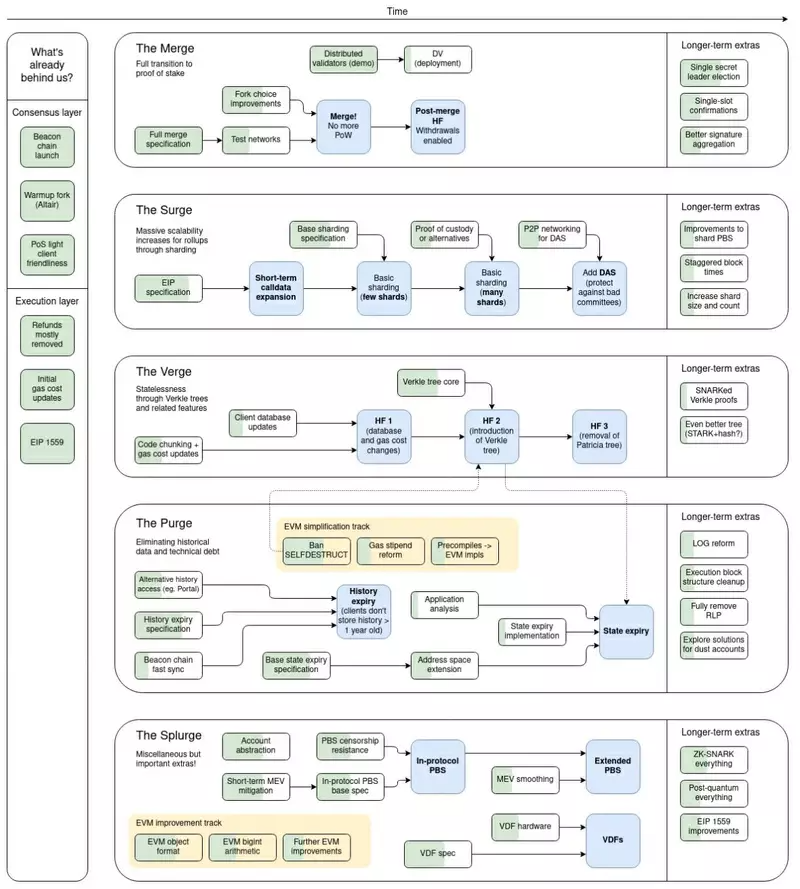

In early November, Vitalik shared on Twitter the new version of Ethereum's roadmap following the completion of The Merge. The roadmap shows that in addition to continuing to improve The Merge’s follow-up work (such as pledge unlocking, distributed verification, etc.), it will gradually advance:

The Scourge, the goal is to ensure the reliability and trustworthiness of transaction packaging, and avoid the centralization risk of MEV and other protocol risks.

The Verge, the goal is to increase the threshold of block verification by introducing light clients that are easy to run and have low storage and bandwidth requirements.

The Purge, with the goal of simplifying the protocol, eliminating technical debt, and controlling the cost of participating in the network by purging historical data.

The Splurge, all other upgrades that are not of high priority fall into this category, including account abstraction, which is more heatedly discussed in the second half of the year.

Entering December, the core developers of Ethereum finalized the time plan for the "Shanghai" upgrade at the weekly meeting, answering a question that has been most concerned by the market for a long time-when will the pledged ETH be unlocked.

According to the plan, the upgrade of Ethereum "Shanghai" is scheduled to be carried out in March 2023. At that time, the withdrawal of pledged ETH on the beacon chain will be opened. As of December 15, the number of pledged ETH has reached 15.6 million. However, there is no need to worry too much about the so-called "smashing the market" risk, because for security reasons, the withdrawal amount and the withdrawal rate of the verifier will be limited at that time.

The upgrade of the main network keeps going, and Layer 2, which carries another part of the expectation of Ethereum expansion, has also made remarkable progress in 2022, and issues related to the tokens of various projects have more or less been raised.

In terms of Optimismtic-Rollup, the two representative projects, Optimism and Arbitrum, rely on their first-mover advantages, and their respective ecosystems have accumulated considerable TVL scale.

Optimism officially issued the native token OP in June, becoming the first project to issue tokens in Layer 2 of the Rollup series. Although there were small episodes such as robot rushing, interface downtime, and market-making partners losing coins during the TGE stage, considering the trend throughout the year, the release of OP has successfully helped Optimism attract a large number of users and funds. Its ecological expansion has played an effective role in promoting. In October, Optimism officially announced the blueprint of the OP Stack architecture, focusing its future efforts on modularization, opening up a new imagination space for project development and valuation.

Compared with Optimism, although the progress in terms of tokens is slightly slower, and the "Odyssey" activity, which is generally regarded as the prelude to the issuance of coins, has also been unexpectedly suspended, Arbitrum still has accumulated TVL figures far exceeding competitors. In terms of ecological data Lead the entire Layer 2 track. In August, Arbitrum launched another chain, Arbitrum Nova, in addition to Arbitrum One. By placing data off-chain, the new chain exchanged part of the security for extremely low transaction costs, thus satisfying social, game and other types of chains. Applications have higher requirements for throughput and cost.

In terms of ZK Rollup, the legendary zkEVM is no longer just a phantom in expectations.Under the competition and cooperation of multiple teams, technical problems are being gradually overcome, and we are getting closer and closer to the first publicly available and fully functional ZK Rollup mainnet.

zkSync launched the first phase of the EVM-compatible zkSync 2.0 mainnet Baby Alpha at the end of October, but this phase is only used for stress testing and security work, and is temporarily not open to external applications and participants. According to the latest announcement, the subsequent phase is Fair Onboarding Alpha and Full Launch Alpha still have to wait until the first and second quarters of next year to go online. In November, zkSync’s development company, Matter Labs, completed a $200 million Series C round of financing. It is expected that the finalization of this round of financing will greatly accelerate the subsequent development of zkSync.

As the only project among the Layer 2 "Four Heavenly Kings" that did not choose the Solidity language, in order to achieve EVM compatibility similar to competitors, Starkware has open-sourced its programming language Cairo 1.0 in November, and plans to launch Solidity in the first quarter of next year - The first version of the compiler for Cairo 1.0. At the same time, StarkNet's ERC-20 token STRK contract has also been deployed to the Ethereum mainnet, but the specific token economic model and distribution plan have not yet been released.

Relying on the merger and acquisition strategy, Polygon, a "latecomer" to the Rollup expansion path, has become one of the leaders in the zkEVM track. In October of this year, Polygon announced the launch of the Polygon zkEVM public test network. Recent market news shows that the network has begun to accept comprehensive audits by security companies such as Spearbit and Hexens, and is expected to officially launch the main network in 2023.

In 2022, the most surprising dark horse on the Layer 2 track is Scroll.When Scroll completed its $30 million Series A round of financing in April, perhaps not many people really knew about the project, but when they launched the pre-alpha version at EthCC, the largest Ethereum community event of the year, in July, the market has already It is impossible to ignore it any longer. The "EVM equivalent" that Scroll strives to achieve is also regarded as another level above "EVM compatibility", and has begun to become a new standard for the market to judge the performance of Layer 2 projects.

secondary title

2. Layer 1: The old man sings, the new man comes on stage

"Cold and windy" plus "sudden wind and cloud" may be the best description for the Layer 1 track in 2022.

On the whole, as the market continues to decline,Layer 1 projects have basically given up the data growth in 2021. TVL, market value, and activity on the chain have all declined, and even the news is mainly negative.BNB Chain was deeply questioned about centralization, Avalanche was exposed to a vicious competition scandal, the NEAR stablecoin project died, Harmony almost lost half of its life due to a hacking incident, and Fantom disappeared from the news until the end of the year before AC desperately called for orders... Among the leaders of Layer 1, Terra and Solana were hit hard by the sudden black swan incident.

First, in May, as the incentives became unsustainable, Terra, which was spiraling up on the Ponzi ladder, went to spiral death with the bursting of the bubble. After trying various self-rescue solutions to no avail, both LUNA and UST returned to zero, and eventually became meme toys in the community, and Do Kwon, the once brilliant founder, also embarked on a journey of escape.

Then in November, another genius SBF who once had his own halo fell with his FTX business empire. As a new generation of Layer 1 promoted by SBF, Solana also personally felt that the free ride he took seems to reverse faster. Considering that there are still many ecosystems that have not completely overcome the impact, the impact of the FTX thunderstorm on Solana’s ecology may not be fully manifested, but judging from the TVL, which is nowhere near the peak, Solana’s future road is obviously not going to be easy. .

In 2022, a new darling appeared on the Layer 1 track-the Move development language.

In 2022, a new darling appeared on the Layer 1 track-the Move development language.

With the shattering of Meta (formerly Facebook)'s crypto dream, the Diem project, which was once highly expected, disintegrated, butA group of developers have inherited Move, the biggest development achievement of the project over the years, and changed to a decentralized model to sow seeds.Since then, Diem Gang represented by Aptos, Sui, and Linera has become the most eye-catching new force on the Layer 1 track.

Aptos, which launched its mainnet in October, is the one with the fastest pace in Move Layer 1. In the past year, Aptos has received at least US$350 million in financial support from major VCs through multiple rounds of financing, but objectively speaking, Aptos’ performance after its launch was not so satisfactory, and the chaotic token release It has caused the market to question the operational strength of its team, and as the fanatical pursuit of airdrop expectations fades, Aptos also needs to face the real market winter like other earlier Layer 1s.

In September, Sui’s development team, Mysten Labs, completed a $300 million Series B round of financing at a valuation of over $2 billion. In terms of the amount of financing alone, Sui does not lose to Aptos. But like Aptos, which is one step ahead, Sui will eventually face a decline in market attention and popularity in the future. Only then will the Move series Layer 1 usher in real competition. All in all, there is still a long, long road ahead of these "upstarts".

In addition to these relatively clear trends, there are many other "small" innovations on the Layer 1 track in 2022.The reason why the word "small" is put in quotation marks is because the discussion on these points may not be as good as the trend of the track like Move for the time being, but in the long run, it also has great potential to change the competitive landscape.

for exampleapplication chain,The discussion on this concept reached its peak after dYdX announced the migration. In the eyes of many analysts, this is also regarded as the ultimate destination of applications with hard requirements for concurrency and flexibility. Comparing the current mainstream application chain soil horizontally, Cosmos is temporarily in the leading position with its complete development support and open access threshold.

Another examplemodular blockchain,At present, the leading projects in this field include Celestia, Fuel, etc., and most of these projects have won tens of millions of dollars or even nearly 100 million dollars in financing within this year. This type of project hopes to solve the performance bottleneck of a single blockchain by modularizing the technology stack of the blockchain network, and then decoupling and dividing different levels such as the data availability layer, consensus layer, settlement layer, and execution layer. question.

secondary title

3. DeFi: bear market overwinter in various states

This year is clearly not the best year for DeFi.

With the decline of the broader market, the basic data of DeFi has almost declined all the way throughout the year. According to DeFi Llama data, as of December 23, the total value of assets locked in all DeFi protocols in the entire ecosystem was "only" US$39.81 billion, which has shrunk by more than three-quarters from the peak of US$178.54 billion at the end of last year.

Taking a closer look at the performance of individual projects at the micro level, depending on the financial situation, different projects have different "winter" postures in the bear market.

Those with a slightly better situation still have room to continue to "make troubles". Some will continue to optimize their core business vertically, while others choose to "roll" toward other tracks horizontally. Uniswap officially entered the NFT field through the acquisition of Genie, and became a cross-field decentralized trading hub in one fell swoop; Aave and Curve both aimed at the imaginative stablecoin market, trying to take a share from DAI ; Compound made a v3 with more thorough asset isolation and higher security; dYdX gave up Layer 2 and even Ethereum, and decided to launch its v4 version as an independent application chain based on Cosmos...

Those in a worse situation have to face up to the challenge of survival. Sudden black swans, elusive hackers, dwindling treasury...any element may become the last straw that crushes the project. A typical case here is Sushi. A governance proposal in December made us suddenly realize that this former track leader has reached the edge of a cliff. According to the current expenditure items, it can only continue for about one and a half years. Seeking self-help, the development team finally turned their ideas on SUSHI token holders, trying to replenish blood for the treasury by changing the fee distribution plan. It is difficult not to make this choice embarrassing.

However, it seems lucky to be able to continue to "live". In this year, there are still many projects that have completely collapsed. The ones that everyone can name are UST and Anchor, which were once brilliant, but there are more small ecological projects. The project, however, went to substantive demise in silence.

Looking back at the last round of the rise of DeFi, the boost of liquidity mining can be said to have played a major role, but as the clock sweeps through 2022, this scheme with clear pros and cons seems to have quietly withdrawn .In March, the Compound community mentioned that the token incentives of the protocol would be gradually reduced to zero; in May, Aave ended its liquidity mining that had lasted for more than a year; in December, Sushi, whose tokens were about to be fully circulated, also mentioned the proposed The new token economic model will consider other schemes to subsidize liquidity…

Looking forward to the future, we still cannot know what will ignite the fuse that will ignite the DeFi explosion again, and we cannot predict which projects will set off the next wave, but what we want to believe is that the hard work will not be in vain, and the years will eventually We will reward those projects who have the courage to go through the cold winter.

secondary title

4. NFT: PFP innovation dries up, infrastructure flourishes

2021 is the year when NFT will shine, but as the market turns bearish, NFT will not continue its glory in 2022. Generally speaking, the market still reached a new high in the first half of the year, but gradually withered in the second half of the year, with occasional local hot spots.

Take the leading project BAYC as an example. In April, BAYC hit a historical high of 153.7 ETH denominated in ETH. Since then, the floor price has been falling all the way. As of November 30, the floor price of BAYC reached 66.9 ETH, more than half of the high point.

In this year's NFT market, after the baptism of the market, it is difficult for PFP projects purely relying on painting styles and communities to win.With the lowering of the creative threshold and the improvement of the creative threshold, the PFP market is facing unprecedented competitive pressure. mfers is perhaps the last pure PFP project to become a phenomenon this year. The style of the mfers series is minimalist, relying on a strong community consensus, its floor price hit a historical high of 5.3 ETH in February. This is naturally related to the successful operation of the project, and another factor that cannot be ignored is the market environment that has not cooled down at that time.

Entering the second quarter, leading projects gradually weakened, and the entire NFT market continued to weaken. In terms of trading volume, April was the peak of the NFT market. If denominated in ETH, the NFT market turnover is about 1.45 million ETH, but in the past November, the turnover fell to 340,000 ETH. In U.S. dollar terms, the gap is even more pronounced: the NFT market turnover in April was about $4.3 billion, and it was only $450 million in November, which has fallen to about one-tenth of its peak.

Another data that can be corroborated from the side is: Christie’s NFT auction turnover this year was only US$5.9 million, a decrease of 96% compared to last year.

In an overall weakening market, entrepreneurs are seeking innovation and breakthroughs.

In August, a new "invisible release" project called DigiDaigaku (meaning digital university in Japanese) became the top NFT for a while. The project does not disclose project information on the official website, has no team information, and does not preheat the sale, but it has attracted much attention once it is released, and the price has skyrocketed rapidly. At the end of August, its floor price once jumped to more than 18 ETH.

DigiDaigaku parent company Limit Break also won 200 million yuan in financing with this project. According to the information disclosed later, this project adopts a new concept called "free to own". Although the project party's explanation of this concept is vague and has attracted a lot of controversy, but"Free to own" has undoubtedly brought new hotspots to the market.

Since then, the new NFT series may have model innovation or strong endorsement, and it has been difficult for pure "small pictures" to gain investors' recognition.

NFTScan data shows that from the beginning of 2022 to November 30, a total of more than 77 million NFTs were minted. The NFT market has long been oversaturated, and a large number of new projects cannot gain attention and transactions. but,More competition around NFT infrastructure has intensified this year.

In August, "royalties" became the most popular topic among entrepreneurs, participants, and investors in the NFT market. For quite a long time, most trading platforms have adopted similar royalty rules to OpenSea. The situation that many project parties "sit down and do nothing" after sitting on the royalty income has also attracted dissatisfaction from NFT Holder. For NFT Trader, royalties have naturally become a transaction friction cost that affects earnings, and a battle around royalties has begun.

Sudoswap, as the initiator of this royalty war, also opened a new round of competition in the NFT market. Sudoswap's unique market-making system and zero-royalty strategy are both unique.

In contrast, marketplaces like Magic Eden, LooksRare, X2Y2, Blur allow user-defined royalties, and OpenSea and ImmutableX enforce royalties.

Around royalties, various roles in the NFT field have participated in this heated discussion, and some tools or platforms have even integrated the function of "blocking" the zero-royalty market. Project parties generally believe that royalties are "creator value" and should be earned. Investors believe that transaction taxes several orders of magnitude higher than ERC-20 are unreasonable, which also contributes to the "soft rug" situation of the project party and damages the interests of buyers.

At present, this royalty war has not come to an end. And as the bear market deepens,The composability of NFTFi in the market has also become increasingly prominent.For example, when the floor price of BAYC fell rapidly, BendDAO's liquidation mechanism became the object of attention: although he finally completed the task, it was not as perfect as people expected.

Innovations around NFT's financial attributes are being rolled out - liquidity enhancement methods such as lending, fragmentation, etc.

first level title

4. The total loss of safety accidents decreased, but "major cases" and "odd cases" occasionally occurred

According to Beosin statistics, in 2021, there will be more than 332 typical security incidents in the entire blockchain ecosystem, and the economic losses will exceed 15.3 billion US dollars.

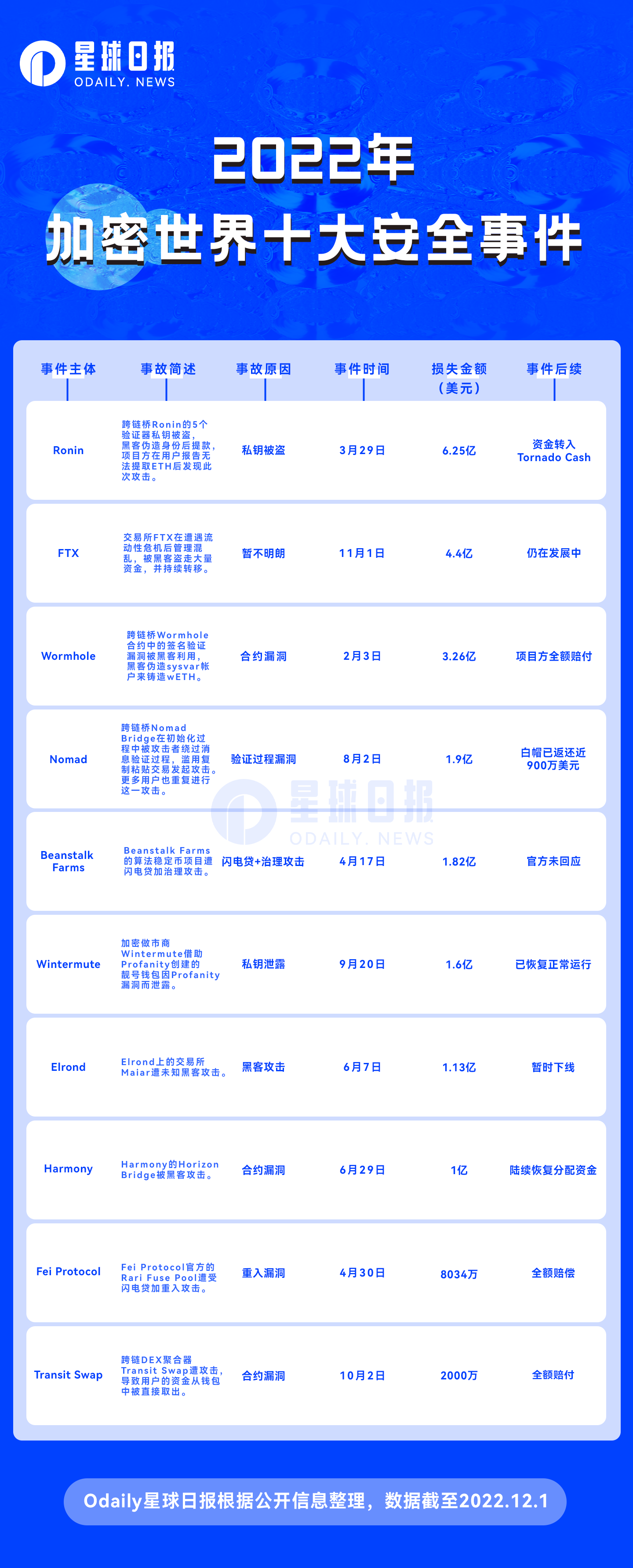

As of the end of November 2022, there have been more than 164 typical security incidents in the blockchain ecosystem, with an economic loss of approximately US$3.823 billion.Among them, the top ten event subjects in terms of loss amount are Ronin, FTX, Wormhole, Nomad, Beanstalk Farms, Wintermute, Elrond Harmony, Fei Protocol, and Transit Swap. See the figure below for details.

These 10 security incidents caused a total loss of more than 2 billion US dollars. From the perspective of the project categories attacked, the number of cross-chain bridges was the largest (4 cases), followed by algorithmic stablecoins (2 cases). Among them, in March, the Ronin attack caused $625 million in funds to be stolen, breaking the DeFi hacking record in August 2021 when the Poly Network was attacked ($610 million).

In terms of the number of security incidents and the total amount of losses, although there are occasional "big cases", this year as a whole is much "calmer" than last year.

From the perspective of the “place where” the incident occurred, DeFi and cross-chain bridge projects were hacked most frequently.The reason is that the audit rate of DeFi projects is still low, while the demand for cross-chain bridges is clear and the capital aggregation effect is strong. At the same time, cross-chain technology involves the cooperation of multiple chains and contracts, which is more complicated in structure and has more risk points.

From the perspective of attack methods, smart contract vulnerabilities are frequently exploited, and wallet private key leaks also occur from time to time. In addition, when the project party's own response is not timely and the attack method is easy to replicate, it is easy to form a group attack phenomenon.

In terms of profit-making methods, in addition to the "monotonous" method of withdrawing coins after mixing coins, financial techniques such as hedging, arbitrage, and pool building also appear from time to time.

Now that the security situation is still severe, what can practitioners and users do?

From the perspective of the project party, first, keep in mind the sense of responsibility, do a good job in auditing, and keep in sync with the updates of other technical parties involved in interaction and combination; Emergency stop mechanism, etc.

From the user's point of view, first of all, have correct profit and risk expectations for the encryption industry whose supervision is not yet sound, and do not lose the principal because of high profits or small profits; secondly, users are advised to understand and be familiar with the products and financial tools used as much as possible and keep an eye on important news in the industry and the latest trends of the platforms used; finally, given that code loopholes in smart contracts are a high-incidence area for accidents, protocols that are no longer (infrequently) used can be deauthorized in a timely manner.

first level title

5. In 2023, where does light shine into reality?

The butterfly effect of several industry vicious events in 2022 continues. The knock-on effects of thunderstorms, the follow-up of strong regulation, the loss of confidence of users and investors, etc., all make practitioners inevitably pessimistic about the upcoming 2023.

Fortunately, there are cracks in everything, and that's how the light gets in.

From a macro perspective, expectations of a slowdown in interest rate hikes by the Federal Reserve have increased. Hong Kong is gearing up to become an Asian Web3 hub. Metaverse and digital identity products are being adopted more widely. Privacy protection and data sovereignty awareness are constantly strengthening. Web2 era giants continue to embrace decentralized technologies. High-quality talents from all over the world are constantly pouring into the Web3 world, and the infrastructure construction is becoming more and more mature...

The bull market is always ignited by new narratives that attract much attention. Odaily will look forward to the performance of the following sectors/hotspots next year:

zkEVM - related technologies are advancing steadily, and zk-related projects may benefit from the currency issuance effect;

L2——Goes hand in hand with Ethereum, which has entered a new era, and the ecology is further developed and improved;

Decentralized cross-layer protocol - the ecological structure is still not stable, and safe and convenient interoperable services are essential;

A solution to release pledged liquidity - a must in the post-PoS era;

New L1——Aptos and Sui's ecology are further developed, and various application chains are blooming;

DID—the focus of domain names, POAP, and SBT, and also the cornerstone of richer on-chain services;

Storage - AIGC is expected to expand the high-quality content of Web3 and drive the demand for decentralized storage;

Wallet - account abstraction without private key and mnemonic may make the entry threshold of Web 3 lower;

GameFi——In the early stage of the primary market, the layout of the game bottom layer, platform, and high-quality applications began to sprout;

Web3 marketing - the rise of native channels, the establishment of a new user acquisition and maintenance model;

Developer tools - serving start-ups, the technology water delivery business will become more mature;

Safety and data analysis—prevention and prevention in advance, retrospective summary after the event, and assistance in supervision are more important. At the same time, the development of the industry also puts forward new requirements for the accuracy of data and analysis.

In 2023, Odaily will also continue to deepen the field of Crypto/Web3, covering the fastest and latest information and the most complete and deepest interpretation, accompanying the industry and readers to welcome the next wave together.

In addition, Odaily2022 annual content inventory, welcome to scan the code to read.