Bloomberg 2023 Crypto Outlook: Bitcoin Is Ready For A Rally

This article comes fromBloomberg IntelligenceOdaily Translator |

Odaily Translator |

secondary title

Bitcoin: To be or not to be? This is a problem.We are about to enter 2023, and the cryptocurrency market may be looking for an answer to this question. For Bloomberg Intelligence, the answer is more inclined to the former. As part of the global asset portfolio, the cryptocurrency market is ripe for recovery.

If cryptocurrencies are indeed headed for demise, the futures markets should be the first to be “alarmed” (at least market makers will be notified by CME Group). But in fact, the opposite is true. Data analysis shows that the encryption market may be brewing a rebound. CME Group’s bitcoin futures positions are rising, while crude oil futures positions are declining. You know, compared to the mature crude oil market , cryptocurrency should still be in its infancy.

image description

Growing Bitcoin Futures Open Interest

It should be noted that Bitcoin is now at a low point, and in the past November, the crypto market has never been colder. FTX and a string of cryptocurrency firm failures burned the profits of the bull market to ashes.

image description

Bitcoin price may reach the $10,000-12,000 support level, and the entire crypto market may be facing one of the worst drawdowns in history.

image description

How will cryptocurrency trends change in 2023? As of December 2, 2022, the value of the entire cryptocurrency market has fallen by about $13,000-roughly equivalent to the combined decline in the stock market value of Amazon and Google, and this decline also shows that cryptocurrency is still in its infancy. The Fed's most aggressive tightening policy in 40 years is undoubtedly one of the reasons why the market value of cryptocurrencies has shrunk, but the Fed is likely to consider a policy shift in the coming time-after all, if they don't switch to loose policy, the world may be in a deeper crisis. In a recession, all risk assets are affected. In this scenario, cryptocurrencies are likely to outperform most traditional assets.

How will Bitcoin perform when the Fed turns in 2023?

secondary title

The Three "Musketeers" of the Crypto Market in 2023: Bitcoin, Ethereum and USD Stablecoins

A macroeconomic bear market could push Bitcoin towards the support levels of $10,000 and Ethereum $1,000, which means further losses for the two cryptocurrencies are likely. But the two cryptocurrencies are poised for a restorative rally as the Fed shifts to accommodative policy.The certainty of Bitcoin’s supply “halving,” along with rising demand and adoption, should drive its price higher over time if economic rules work. In the long development trajectory of Bitcoin, 2022 does encounter some bumps, and may even fall to around $10,000, but Bitcoin is still on an upward trajectory and may return to the $40,000 resistance level .

image description

Bitcoin supply dwindles, adoption and price riseEthereum completed the upgrade in 2021, and successfully switched to the proof-of-stake (PoS) consensus mechanism in 2022. These milestones will have an impact on its price performance. Amid the global market downturn, we saw a sharp drop in the price of the second largest cryptocurrency by market capitalization. But even so, Ethereum is still expected to continue to outperform Bitcoin and stocks in 2023. Starting in December, the key support level for Ethereum will be in the $1,000 range. If this support level is breached, it could bring more stop-loss selling and ETH could be in for another painful period.

image description

The key range for Ethereum in 2023 could be $1,000-3,000

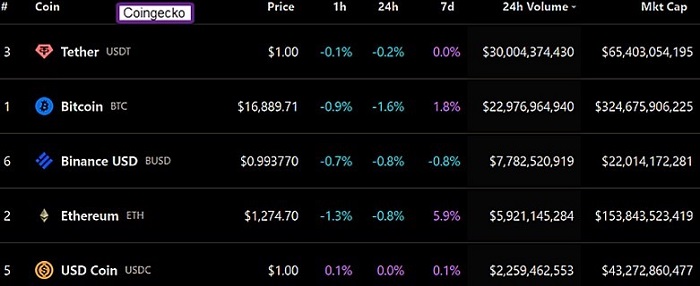

There may be many problems with new technologies, but the incremental supply of Ethereum has begun to decline continuously. According to the rules of economics, this trend is beneficial to the development of Ethereum prices.If you look at the ranking of crypto assets on CoinGecko, you will find that three of the top five cryptocurrencies by trading volume are USD stablecoins. Thanks to the underlying technology of Ethereum, it is possible to trade USD stablecoins with near-instant settlement and low-cost 24/7 trading. In the long run, there is little to prevent this advanced technology from being applied to financial services such as the futures and exchange-traded fund markets. In addition, NFT and decentralized exchanges are also promoting the continuous development of Ethereum.

image description

U.S. Dollar Stablecoin Has 'Dominated' in Crypto Volume Ranking

Although it is a matter of time, any new technology needs to adapt to the market. There may also be regulatory hurdles involved in the development of tokenization, and futures and ETFs have gone through similar stages of development.The market is enjoying the calm before the storm right now, but there are rough waves ahead.

After a brief bullish signal from Bloomberg Intelligence's medium-term indicators in early November, trend indicators remain firmly bearish for now, suggesting more downside is likely in the near term. However, the analysis does not take into account the impact of the macro environment, which has improved over the past few weeks, so despite the capitulating levels of market sentiment, there are some signs of recovery in the price of cryptocurrencies such as Bitcoin. .

Bitcoin Remains in Downtrend as Realized Loss Metric Reaches All-Time Status

secondary title

Can ETFs Steal the Crypto Market Slump?

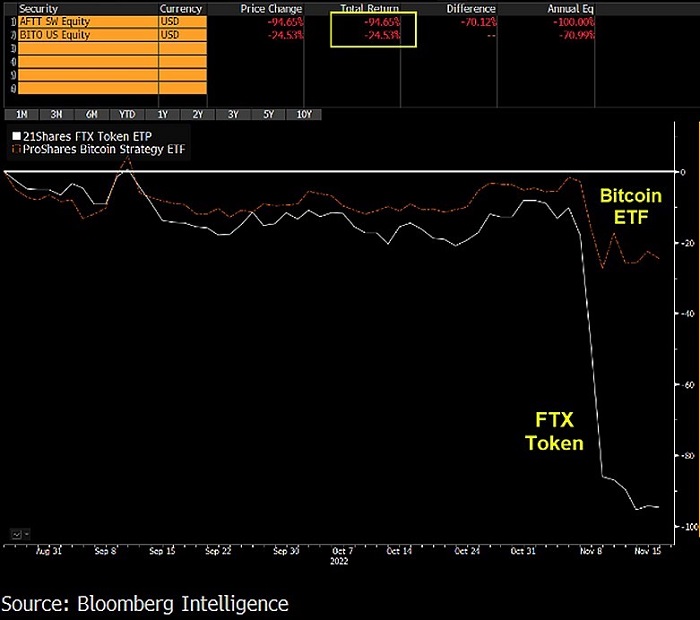

U.S. Securities and Exchange Commission Chairman Gary Gensler rejects spot bitcoin ETF listing in the U.S. could cost investors billions. Without a safe exchange-traded fund, many people can only gain exposure to cryptocurrencies through riskier options, such as unregulated offshore exchanges like FTX or the already heavily discounted Grayscale Bitcoin Trust GBTC .FTX’s bankruptcy highlights the urgent need for the U.S. to have approved spot bitcoin ETFs that would be regulated under the Securities Act of 1933 and deposit bitcoin in compliant custodians such as Fidelity. While an ETF won't protect against bitcoin's price drop, it certainly won't stop investors from withdrawing their money. Even if a major cryptocurrency exchange fails, the price of the ETF may not be affected given the capabilities of U.S. market makers, so it will continue to closely track the price of Bitcoin.

image description

Bitcoin ETF May Avoid Another FTX Crisis

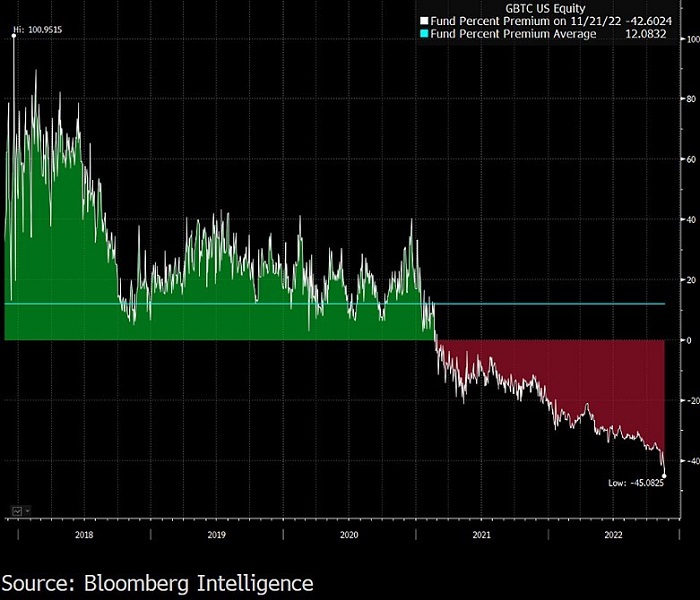

The data shows that both premiums and discounts on spot bitcoin ETFs outside of the U.S. market have remained fairly low amid heightened market volatility.Approval of a spot bitcoin ETF would also insulate investors from wild swings in Grayscale Bitcoin Trust (GBTC), a private trust that trades over-the-counter. Unlike ETFs, shares of GBTC cannot be created or destroyed, and therefore cannot be arbitraged through Bitcoin prices, which results in its price being independent of Bitcoin's price movements, and consequently large premiums and discounts. The data shows that GBTC has shifted from a 100% premium to a 50% discount, which could seriously hurt investor returns. For example, GBTC shares bought five years ago are down 21% today, while the price of Bitcoin has doubled.

GBTC Has Moved From 100% Premium To 50% Discount, SEC Approves Bitcoin Futures ETF, But Still Not Spot ETF

secondary title

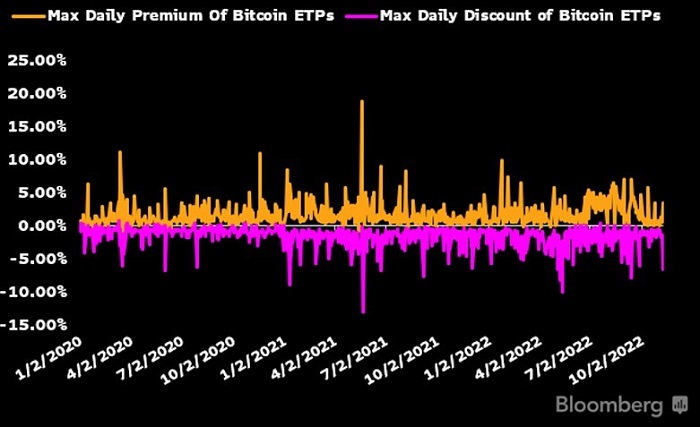

Spot Bitcoin ETFs in other countries are flat. The worst Bitcoin ETP discount after news of FTX’s bankruptcy was only 6% of net worth. As volatility increased, the spread between the top premium and discount increased slightly and was largely unaffected, compared to Grayscale Bitcoin Trust (GBTC), which has seen a discount of as much as 40% to net worth.

image description

Bloomberg Intelligence believes that U.S.-listed bitcoin spot ETFs will have a smaller gap in net value during market volatility than their European or Canadian counterparts because the U.S. market is much more liquid.

secondary title

Market concerns about Genesis and delayed approval of the spot Bitcoin ETF lead to a sharp discount on Grayscale GBTC

As Grayscale's application for a Bitcoin spot ETF has not been approved, the GBTC discount has continued to expand. According to the statement of Gary Gensler, chairman of the US Securities and Exchange Commission, it is unlikely that GBTC will be converted into a spot Bitcoin ETF in the short term. Not only that, but due to the collapse of FTX, the possibility of quickly approving other spot ETFs is further reduced. Futures-based Bitcoin ETFs, as well as other alternatives around the world, are constantly eating away at the market demand for GBTC. Not only that, but the widening discount of GBTC also indicates that the market is less likely to switch to spot Bitcoin ETFs. However, FTX's failure could also see the U.S. Securities and Exchange Commission (SEC) revisit its oversight and adjust the rules governing the conditions for approving ETFs.

image description

Launched in September 2013, GBTC has a structure similar to gold ETFs such as GLD. While the Grayscale Bitcoin Trust holds about $10.5 billion worth of bitcoin, its current market capitalization is only $5.5 billion due to the discount, compared with about $43.5 billion worth of crypto assets at its peak.

image description

Potential rewards for buying discounted GBTC

Finally, there is a question that many people want to know the answer to: is it possible to buy discounted GBTC now? Discounted GBTC provides investors with exposure to Bitcoin below market prices. When GBTC is traded at a premium, investors pay up to twice the market price to access the cryptocurrency through the fund. On Nov. 21, GBTC fell to 50% intraday — the equivalent of buying bitcoin at $7,900, which was trading around $15,800 that day.