The merger of Ethereum is imminent, and forked parties gather, what should ordinary users do?

As the ethereum “merge” date approaches (expected September 15th, exact date depends on hashrate), talk of a hard fork intensifies.

At present, several teams in the community have publicly announced that they will hard fork Ethereum to retain the PoW mining mechanism, and a number of fork projects including EthereumPoW and Ethereum Fair have been born; miners, mining pools, Trading platforms, DeFi project parties, stablecoins (USDT, USDC), capital and other forces have also expressed their views on the hard fork one after another.

All indications are that the largest hard fork in the history of Ethereum is inevitable.

Why fork Ethereum? What are the interests of all parties behind the fork? During this critical node period, how should project developers and users make choices? This article Odaily will answer these questions one by one.

(1) Interest considerations behind the fork

On August 1, the old player in the currency circle "Bao Erye" (Guo Hongcai) established an Ethereum fork discussion group on WeChat, and then released the "Ethereum Fork Declaration", which opened the prelude to this dispute.

In the declaration, he said that the Ethereum miners have invested a lot of capital, money, and time in the Ethereum ecology. In order to prevent the miners from losing their jobs, they decided to fork the Ethereum. Dig, make changes, keep the original chain.

Due to the large number of "previous records" that were the platform of the previous zero-returned project, the new project of "Bao Erye" has been ridiculed by the crowd, and many people questioned that it once again "cut leeks" under the banner of a fork (Note: I did the Bitcoin God fork (Bitcoin God), and it has now returned to zero).

However, the discussion about the retention of the POW mining mechanism in the hard fork of Ethereum has aroused strong concern in the entire community.

In the past two weeks, various forces have expressed their views on this topic one after another:

From the current perspectives of all parties, most of the supporters of the fork are Ethereum miners, mining pools (f2pool), and even the shadow of the activities of mining machine manufacturers; while exchanges are basically neutral, OKX, Binance, Bitwell and other platforms are all Said that if a new fork coin is generated, it will be listed after the evaluation if it meets the conditions; capital (DCG), top DeFi projects (AAVE, Chainlink), wallet applications (Argent, DeBank) and stable coins (USDC, USDT) etc. clearly stated that it only supports the Ethereum POS chain, and does not support forked projects such as Ethereum PoW.

Under the banner of liberalism and decentralized community autonomy, many people advocate forking two Ethereum networks (PoW, PoS) to compete together and let the market vote with their feet. Some people think that the PoW mechanism is fairer and more efficient. Safety.

But in the author's opinion, the core purpose of the fork has nothing to do with beliefs, and everything is based on the self-interest of all parties. If you really have a soft spot for Ethereum and POW, ETC seems to be a better choice, and there is no need to fork Ethereum.

Miners are profit-seeking and hope to maintain high mining income. Once Ethereum ends POW mining, miners can only turn to other POW networks. The more computing power cut in, the greater the competition, the lower the income will be; or turn to Web3 protocols such as Render Network, Livepeer and Akash to provide high-performance computing, Rendering and other services. However, from the actual situation, the current computing power of the entire Ethereum network is 935 TH/s, and it is difficult for these other protocols to undertake all the computing power and consume excess computing power capacity.

Mining machine manufacturers do not want the Ethereum POW mining mechanism to disappear. Since last year, a number of mining machine manufacturers including Bitmain (Antminer E9), Innosilicon (A10, A11), and Howmicro Technology (Pineapple V1) have successively launched Ethereum with higher mining efficiency. For ASIC mining machines, the cancellation of the Ethereum POW mining mechanism will lead to no market for new machines. In this context, mining machine manufacturers are likely to return to their old business, and once again lead the Ethereum fork just like they led the Bitcoin fork out of BCH in 2017.

For the mining pool, the current POW business income far exceeds the POS income, prompting it to stand on the side of supporters.

For the trading platform, the users who obtain the forked new coins have transaction needs, which can bring new traffic and handling fees to them. There is also no reason to "reject" the fork event, but considering that the new coins on the platform may be new currency endorsement, so it needs to be treated with caution. Of course, there are already trading platforms that have started to launch bifurcated currency futures. V God criticized that these people just want to make quick money.

(2) Fork new projects, do you want to get on board?

To be clear, forking Ethereum is not an easy task.

This fork is completely different from the ETC/ETH fork in 2016. From a code point of view, this fork needs to remove all POS conversion logic from the Ethereum testnet code, remove the difficulty bomb, and update the chain ID to provide protection; the mining software may also need to be forked/updated, which will require Cooperate with wallet providers to agree to support ETH POW; need to cooperate with exchanges to agree to support ETH POW.

ETC Cooperative believes that with only a few weeks until the merger, it is too late to do anything. "This is a huge and arduous coordination task, and the merger is only a few weeks away. Today's prosperity will most likely not be reproduced on the new Pow chain."

Therefore, the security of the forked project is questionable. In the case of a hasty fork under tight time constraints, there may be loopholes in the underlying code changes. Due to the lack of detailed auditing, the possibility of being hacked increases, which may eventually lead to a sharp drop in asset prices.

Even after passing the safety barrier, the ecological value of the new fork project is not high. Vitalik recently stated that the Ethereum PoW fork is unlikely to gain long-term widespread adoption. The core reason is that the fork project only captured miners and computing power, but did not attract enough developers to enter it.

The Ethereum ecology has always been characterized by: projects follow the core developers of Ethereum, and users follow the projects. Without the participation of developers, it will be difficult to generate applications; without applications, there will be no users, the value of forked projects will gradually decrease, and the income of miners will decline again, eventually entering a death spiral.

At present, only a few projects have announced support for the fork project: the fork project Ethereum Fair announced a cooperation with the cross-chain project SWFT Blockchain; APENFT Marketplace announced support for the potential fork of Ethereum and the circulation of new chain NFT. But these projects themselves are not top-notch, and it is difficult to attract enough users to support the development of the ecology.

The top projects that have already announced their positions, such as AAVE, Chainlink, Argent, DeBank, etc., have followed the asset side (USDC, USDT) and become fans of the Ethereum POS chain, which is bound to lead users into the new ETH2.0 ecology.

“Tether will closely monitor the progress and preparations for the merger and will support PoS Ethereum in line with the official timeline. We believe a smooth transition is critical to the long-term health of the DeFi ecosystem and its platforms, including those using USDT .This has nothing to do with our preference for PoW or PoS, stablecoins should act responsibly and avoid disruption to users.”

In addition, if we compare the Bitcoin fork in 2017, the death trend of the forked project will be more obvious. At that time, there were nearly a hundred forks of Bitcoin Cash (BCH), Super Bitcoin (Super Bitcoin), Bitcoin Pizza (Bitcoin Pizza), Bitcoin Boy (Bitcoin Boy), Bitcoin Hot (Bitcoin Hot), etc. Except for BCH, which has been hot for two years (backed by the support of Bitmain), the popularity of other forked projects can only be maintained for a period of time. The price has continued to decline since its launch, and there is no support for computing power. gradually die out.

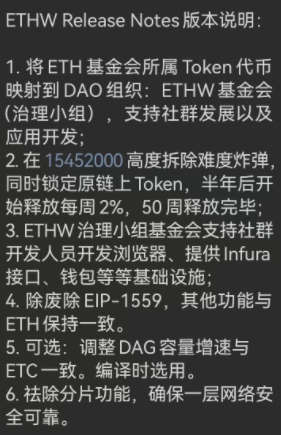

image description

(Network transmission of EthereumPoW scheme)

Therefore, Odaily recommends to be cautious about getting on the Ethereum fork project. After all, it is difficult for you to predict whether you are getting on a chariot or a hearse.

(3) What about Ethereum mainnet users?

Forks are inevitable, how do users of the Ethereum mainnet deal with them today?

The first is the price change that has attracted much attention. Compared with the Bitcoin fork in 2017, there is a high probability that the price of Ethereum will continue to rise before the fork. Two weeks before and after the Bitcoin fork in August 2017, the price rose from $2,200 to $4,200, an increase of up to 90%. The time for this fork is mid-September. At that time, under the double stimulation of fork and "merger", the price of Ethereum may have a good increase.

Of course, the price of Ethereum may experience severe fluctuations during this period, especially the recent continuous surge of open interest in Ethereum, which is close to the highest level in history, and the possibility of a sharp correction cannot be ruled out, so use futures leveraged products with caution.

In addition, before the merger and fork, in order to prevent transaction rollback and re-entry attacks caused by the fork, the trading platform may close the deposit and withdrawal channels of Ethereum and ERC20 tokens in advance.

In terms of DeFi, projects that clearly stated that they do not support the POW chain may close the smart contract to avoid confusion and losses for users. Therefore, it is recommended that users take out the positions of each protocol in advance and replace them with Ethereum (the potential benefit is to obtain forked coins). If you are holding or trading NFT, you need to focus on observing whether the Ethereum fork chain follows the EIP-155 protocol to prevent reentry attacks from causing your own NFT to be lost (recommended reading"If Ethereum forks, will NFT also "fork"? ")。

From the ETC in 2016 to the POW consensus fork in 2022, every occurrence of a hard fork is a big test for Ethereum. But Ethereum has proved time and time again that this huge and vibrant ecology is not afraid of any challenges, and has gradually become the Holy Grail of the industry just like Bitcoin.