Bankless: Four investment strategies in the context of Ethereum mergers

This article comes fromBankless, original author: Ben Giove

Odaily Translator |

Odaily Translator |

The merger is perhaps one of the most important "catalysts" for the upgrade of the Ethereum network so far, and it will also affect the network in many ways, such as:

Significantly reduce Ethereum’s energy consumption, alleviating critics’ concerns about its environmental impact;

Clear the way for Ethereum network optimization at the protocol level, including separating the "proposer-builder" and separating block production from block validation;

So for a wider range of investors, are there any other investment opportunities that take advantage of Ethereum mergers? Here we bring you four investment strategies that take advantage of Ethereum mergers -

secondary title

1️、Liquid Pledge Token

Examples: LDO, RPL, SWISE

Liquidity staking services will be the most immediate beneficiaries of Ethereum’s consolidation, and non-custodial protocols are expected to experience a significant uptick in the months following Ethereum’s transition to proof-of-stake.

In fact, the concept of liquidity staking is very simple, it allows users to do all three of the following operations at the same time: continuously custody collateral, earn staking rewards, and deploy DeFi assets by issuing liquid staking derivatives (LSD).

Since Ethereum can eliminate previous technical and execution risks through mergers, the mortgage risk is greatly reduced, which will also promote the development of a wave of protocols.

In addition, Ethereum will also help reduce the discount associated with ETH in LSD transactions after the completion of the merger. At present, the price of stETH on the DeFi liquidity giant Lido is about 0.963 ETH, but when Cessius started to storm in June, the price of stETH once broke the anchor and reached a low of 0.933 ETH.

It is expected that the Beacon Chain will not be rolled back until the "Shanghai" network is upgraded, but will wait until 6-12 months after the merger. Still, the implications of the merger are significant, and since discounts will be further reduced, there will be less price risk for pledgers, making these staking agreements even more attractive.

Additionally, collateral in liquid staking protocols is likely to increase as staking yields are expected to increase. Now, beacon chain validators can only get block rewards, and after the merger, pledgers can use the MEV strategy (referring to miners or validators based on their ability to determine the order of transactions on the Ethereum blockchain) from transaction blocks Maximum value extracted in ) for transaction fees and other revenue. This shift is expected to see a significant increase in staking yields from around 4% currently to 6-12%.

With the arrival of higher yields and higher ETH prices, the income of liquid staking agreements will continue to increase, and the income of pledgers will also be further improved.

So far, there are three liquidity staking agreements that support publicly traded Tokens in the market, namely: Lido (LDO), Rocket Pool (RPL) and Stakewise (SWISE).

Among them, different Tokens play different roles in the investment portfolio:

1. If investors seek blue-chip exposure, they can choose LDO, because it is the largest pledge entity on the beacon chain, with a pledge share of 31.2%. Additionally, Lido holds the largest hold in the liquid staking industry with a 90.3% market share. Currently, the Token's market cap (MC) is $1.48 billion, and its fully diluted valuation (FDV) is $2.7 billion.

3. If investors want to maximize risk and optimize the beta coefficient, they can choose StakeWise (SWISE), with a market value of US$26.66 million and a fully diluted valuation of US$198.45 million. Although the protocol’s beacon chain and liquidity staking shares are only 0.4% and 1.3% respectively, due to its small size and low volatility, SWISE may be the token with the highest beta coefficient among the three.

secondary title

2️, DeFi investment

Of course, buying tokens is not the only way to make money with mergers. Savvy market participants can invest in DeFi in a variety of different ways, reflecting how different markets reacted before, during, and after the Ethereum merger.

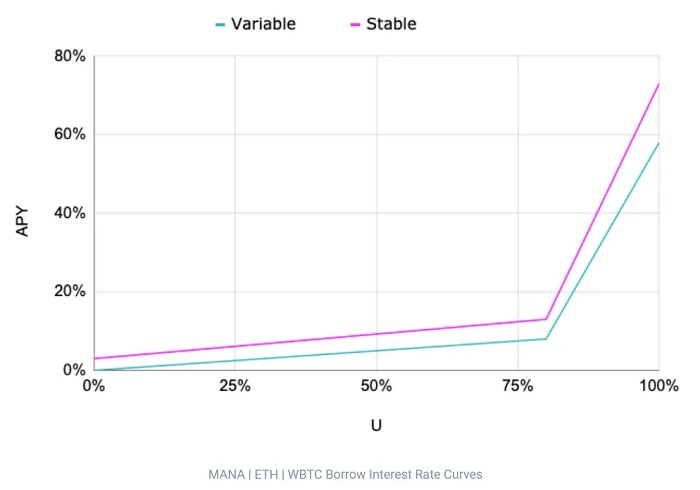

Since the rates on these protocols are based on utilization efficiency (like how much assets are being borrowed), a large spike in borrowing demand would result in very high deposit rates for lenders. We saw the interest rate curve for ETH on Aave V2 start to spike rapidly. The market is currently at 61.56% utilization, but has seen a significant spike since August 8th, with a continuing trend.

image description

Source: Aave docs

Another way is to useVoltz protocol, an AMM for interest rate swaps designed to bet on LSD mortgage yields. Since the return of Staking may increase after the merger, market participants can use Voltz to use ETH as a margin and purchase variable interest rate stETH or rETH Token. Users can use leverage to amplify their returns, but it should be noted that This comes with a greater risk of liquidation, use any form of leverage very carefully!

secondary title

3. PoW airdrop revenue farming

There are billions of dollars of "staking opportunities" in liquidity mining, and it is almost certain that there will still be some PoW instances in Ethereum after the merger. For example, many well-known industry figures such as Sun Yuchen and the exchange Poloniex have pledged to support this Hard fork, and plan to list ETHPOW Token.

Although it is not clear whether the forked chain has any long-term viability, nor how much value ETHPOW will have in the future, users do not have to give up this "fork opportunity", at least they can earn in many different ways Some airdrops (Tip: The easiest way to qualify for an airdrop is to keep ETH in a non-custodial wallet, such as Metamask, Coinbase, etc.)

If you're looking for a riskier investment opportunity, here's one way: Borrow ETH on the money market, which can be profitable if the value of the airdrop is greater than the cost of borrowing ETH. However, this strategy comes with considerable risks. Not only could the borrowing rate exceed the airdrop yield, but the borrower would be liquidated should the price of ETH spike or the value of the collateral drop. Investors need to make this choice very carefully given the high likelihood of large volatility on the day of the merger.

If you are afraid of high risk, you can also create an ETH position in perpetual futures. In this case, users can buy spot ETH while shorting the same amount of ETH using perpetual contracts on CEX or DEX. In this way, users can obtain both ETH investment exposure and airdrops without taking the price risk of holding assets. This strategy will be profitable if the value of the airdrop exceeds the capital (the cost of keeping the position open).

So, proceed with caution.

secondary title

4️、Other benefit opportunities

In fact, the combined Ethereum promises to have a transformative impact on other areas of the ecological economy.

The first to benefit should be Layer 2. After the transition of PoS, it can basically pave the way for the scalability upgrade of the Ethereum network (such as EIP-4844). More users will be attracted to conduct transactions on the network, which will also drive more Dapp innovations - lower fees will help "stimulate" the popularization of Layer 2 applications.

Another area that will change after the merger will be MEV. MEV's competitive dynamics will change dramatically as the "proposer-builder" is gradually separated, which will separate Ethereum block production (determining which transactions go into a block) and block validation. There are also some noteworthy projects in the MEV field, which are expected to make breakthroughs during the merger process, such as Manifold Finance (FOLD), Rook Protocol (ROOK) and Cow Protocol (COW). These Tokens have performed quite well in recent weeks. It is also expected to be a long-term beneficiary of PoS Ethereum.

secondary title

Conclusion: Focus on risk, do your research, and choose to take risks

The merger is coming. There is no doubt that this will be an important milestone in the development of Ethereum, and it will also bring major changes to the Ethereum economy.

If you are worried about risk, a safer way is to invest in ETH directly, but now is very different from the 2018 bear market, we live in the DeFi world, so there are many other ways for investors to participate in consolidation, whether it is through investment/ Trade liquidity staking protocols, explore Layer and MEV, or use DeFi to earn income.