Weekly Editors' Picks Weekly Editors' Picks (0730-0805)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

invest

invest

DeFi analyst: How to build a cryptocurrency analysis research framework?

DeFi

Understanding technology can go from shallow to deep, first learn directly from the source, and then find third-party videos or articles for interpretation. Profitable skills include decision making, cognitive biases, trading psychology, portfolio construction, profitable strategies, risk management strategies. Cryptocurrency skills include understanding the metaverse and new narratives, discovering new protocols, tracking whale wallets, on-chain analysis, and more. In terms of learning methods, you can create a to-be-read list, focus on good content, study in depth and focus, take notes, and output more.

IOSG Ventures: Building an Institutional-Grade Credit Market for Polkadot Parachain Auctions with Fixed Rates

The basic narrative of DeFi has undergone a phased change: inclusive finance (financial products that can be used by everyone in the world without permission) → professional financial infrastructure (more to solve the needs and pain points of institutional customers and professional players) tilt). Institutional customers/giant whales are the most important customers of DeFi, and this trend will intensify, and even become the biggest narrative of DeFi in the next 5 years.

Among the L2 DeFi building blocks, fixed-rate lending and derivatives have always appeared. The most well-known players in the loan agreement track are Maple Finance and Notional Finance, while more complex fixed-rate derivatives (such as credit default swaps, interest rate markets) also have players such as Swivel Finance and Element Finance.

An overview of the progress of mainstream DeFi protocols in the second quarter

Web 3.0

Ambush the next ENS? An inventory of public chain domain name protocols

In-depth analysis of ENS domain names: What opportunities do latecomers have?

A look at the must-have tools for ENS domain names: How to spot trends and monitor expired domain names?

Ethereum

The article introduces the domain name market and tool ENS.Vision, expired ENS domain name discovery tool ENS.Tools, dashboard Dune, ENS official DApp, simple domain name registration real-time update website ENS Ideas, OpenSea, Gem, LooksRare and other markets.Ethereum》《Recently, the number of articles on Ethereum has exploded, mainly focusing on the technical details of the merger, its impact on the mining industry, and its impact on the token economy and price. The core point of view is similar to the analysis articles in the past few weeks. Interested readers are welcome to read "》《The merger is approaching, and the feasibility of Ethereum fork is analyzed》《This article sorts out the technical details and reasons behind ETH Merge and ETC migration》《Comprehensive interpretation of the status of Ethereum mergers: What impact does the merger have on MEV and miners?》《a16z talks to Ethereum Foundation Danny Ryan: where is the way after the merger?》。

An in-depth look at the future of MEV: the final state in different cryptoeconomic systems

Bankless: Everything You Need to Know About the Ethereum Merger

Vitalik: The future of different types of ZK-EVM

Vitalik explores different types of ZK-EVM and ZK-EVM-like projects, and the trade-offs between them, describes the different "types" that multiple EVMs are equivalent to, and the benefits and costs of trying to implement each type.

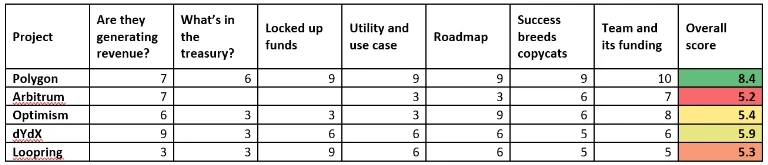

From the analysis of seven aspects, who is the winner of Layer2?

DAO

secondary title

secondary title

hot spots of the week

In the past week,Babel FinanceIn the past week,MuskProprietary trading losses of more than $280 million, seeking to raise hundreds of millions of dollars in funding,MuskCountersued Twitter over $44 billion acquisition deal,Celsius NetworkGoldman Sachs, JP MorganHashedMusk asked to be subpoenaed to appear in court due to the Twitter acquisition incident,Escrow client entrusts lawyers to claim USD 180 million,,Confirmed that it lost more than $3 billion in the LUNA crash, the Nomad cross-chain bridge was attacked,Losses could reach $165 million41 addresses profitAbout $152 million at NomadcallAfterwards, white hat hackers have sent Nomadto return,Approximately $8.56 million in stolen funds, another approximately $11 million in stolen fundsSolana experiences massive security incidentTopic;

, see related progressTopicIn addition, policy and macro market, Fairfax County, Virginia, USA, Forbes said;

perspectives and voices,US SEC is investigating all US crypto exchangesperspectives and voices,Robinhood CEO Denies FTX Acquisition Rumors, saying the company has $6 billion in cash available for acquisitions,a16zMatt Huang, founding partner of Paradigmbelieves that the next 12-24 months will be a good time to build and invest in cryptocurrencies,Ethereum Core Developer

Institutions, large companies and top projects,Michael SaylorSaid that if the merger of the testnet goes smoothly, the total difficulty of the merger of the Ethereum mainnet will be agreed on August 11;Institutions, large companies and top projects,Stepping down as MicroStrategy CEO, MicroStrategyShares soar 15% after Q2 earnings announcement and announcement of CEO replacement,, a record high in the past three months,Public chain Sui opens incentive testnet registrationAave's Proposal to Issue Overcollateralized Stablecoin GHOPassed by voting, Aave V3 goes liveOptimism Liquidity Mining Program1.4 billion MATIC unlocked

NFT and GameFi fields,Tiffany, the token was unlocked 1 year ago;NFT and GameFi fields,With "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~