2분기 주류 DeFi 프로토콜의 진행 상황에 대한 개요

주요 내용:

원문 편집: Kyle

주요 내용:

올해 남은 기간 동안 수익을 창출하는 DeFi 프로토콜에 가치가 유입될 것으로 기대합니다.

Fraxlend 및 fraxETH의 출시로 Frax는 더 많은 시장 점유율을 확보할 수 있는 잠재력을 갖게 되었습니다. 이 계약은 현재까지 3,630만 달러를 벌어들였습니다.

Synthetix와 GMX는 계속해서 Optimism과 Arbitrum에서 영구 거래 규모와 TVL을 지배하여 프로토콜당 일일 수익에서 ~$100,000-$300,000를 가져옵니다.

dYdX(DYDX) 및 Uniswap(UNI) 토큰 가치 상승

crvUSD 및 GHO의 발표는 프로토콜별 스테이블 코인에 대한 새로운 이야기의 잠재적인 시작을 의미합니다. 다른 기능 중에서도 네이티브 스테이블 코인은 프로토콜이 추가 수익을 창출하고 거버넌스 토큰의 유용성을 높일 수 있도록 합니다. Curve는 깊은 stablecoin 유동성을 제공하도록 최적화되어 있으므로 이 내러티브의 전장이 될 수 있습니다.

2분기 최종 보고서는 약세장에서 DeFi 자산의 진화에 초점을 맞추고 주요 프로토콜의 미래를 탐구합니다.

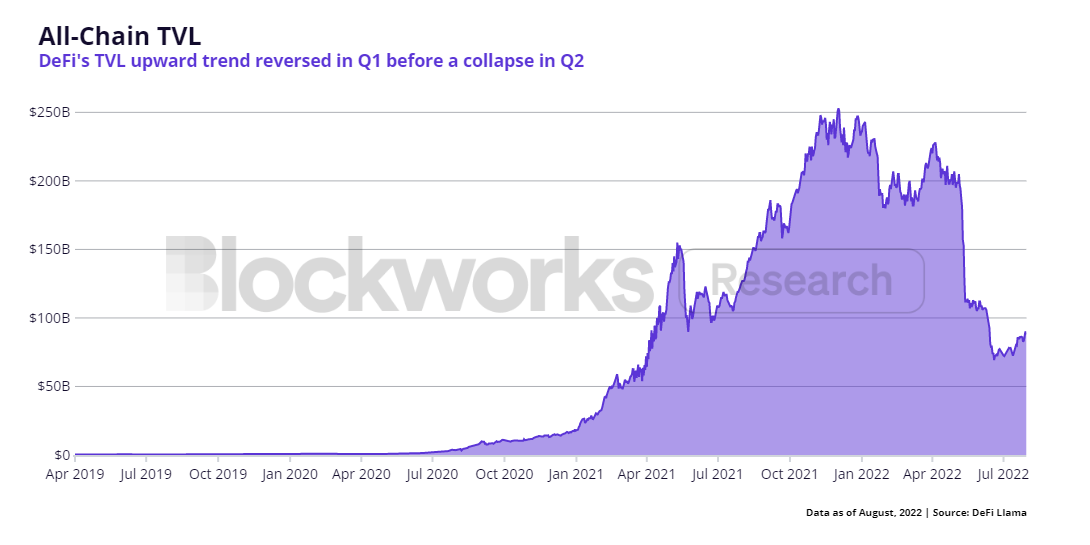

Maker의 통치부터 Synthetix와 Compound가 이끄는 DeFi 여름, "DeFi 2.0"과 "불안정한" 스테이블 코인의 잘못된 희망, 그리고 이제 OGs 프리미티브의 부활에 이르기까지 DeFi는 오랜 투쟁이었습니다. 그 동안 TVL은 최고의 성공 척도로 사용되었습니다.

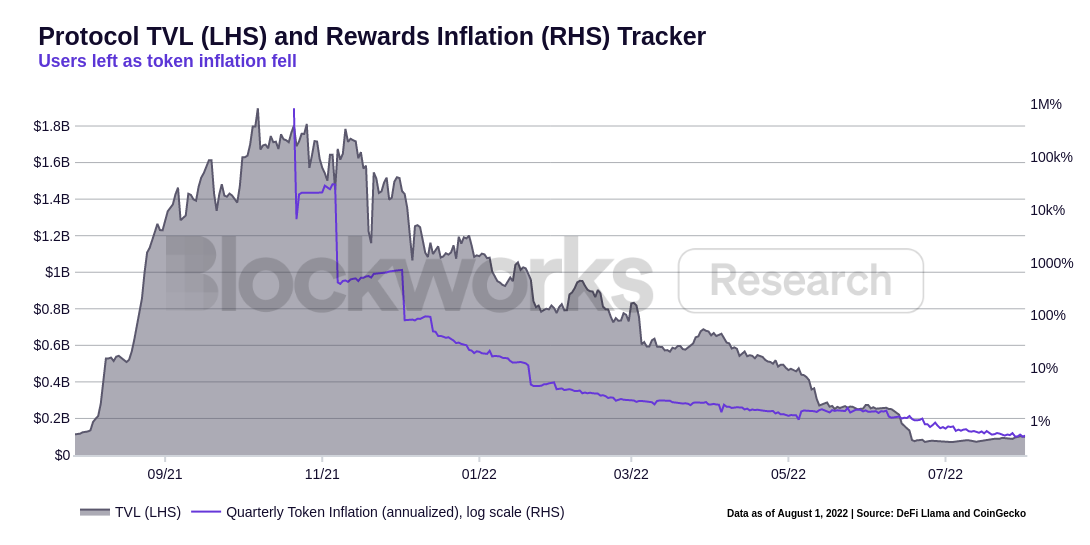

사용자가 지속 불가능한 인플레이션 네이티브 토큰 보상에 끌리면서 TVL은 제품 시장 적합성(PMF) 메트릭으로서의 유용성을 잃습니다. 사용자는 프로젝트에 참여하여 농장을 운영하고 수입을 버립니다. 보상이 느려지거나 중단되면 사용자는 떠납니다. 토큰 가격이 하락하면 약속한 APY를 얻을 수 없게 됩니다.

이미지 설명

출처: DeFi Llama, Coingecko. 2022년 7월 31일

PMF는 사용자가 서비스에 대해 지불하고자 하는 금액으로 더 잘 측정할 수 있습니다. 임시 보상은 고객 획득 비용을 줄이는 데 도움이 될 수 있지만 프로토콜은 보상이 끝난 후에도 사용자가 남아 있어야 합니다.

현재 프로토콜 금고나 토큰 보유자에게 실질적인 가치를 제공하는 프로토콜은 거의 없지만 사용자는 토큰을 빌리고 거래하고 유동성 풀에 뇌물을 주고 DeFi 외부에 투자하기 위해 비용을 지불합니다. 사용자는 또한 ETH 스테이킹 및 시뇨리지를 통해 실제 수수료를 얻습니다. Uniswap, dYdX, Convex, Frax, Aave, GMX, Synthetix, Curve 및 MakerDAO는 모두 DeFI 수수료 상위 20위 안에 들었습니다.

성장주는 거의 배당금을 지급하지 않습니다. 초기 암호화폐 프로토콜도 유사하게 수수료 수입을 축적하고 재투자하여 비즈니스를 성장시키는 것을 고려할 가능성이 있습니다. 총 수수료는 수익이 지급되든 재투자되든 상관없이 그들이 지원하는 성공적인 벤처로부터 궁극적으로 이익을 얻을 수 있는 토큰 소유자의 권리 측면에서 계속해서 핵심 지표가 될 것입니다.

돈을 빌리다

돈을 빌리다

Aave

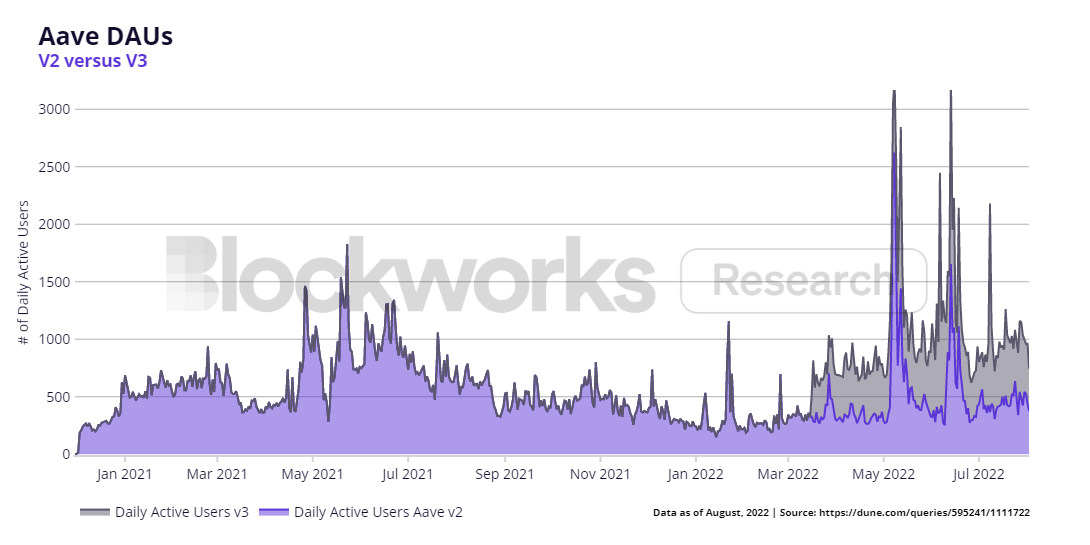

Aave는 2022년 1분기 말까지 6개의 서로 다른 체인에서 V3 제품을 출시하여 몇 가지 주요 새로운 기능을 시장에 출시했습니다.

포털은 교차 체인 트랜잭션을 용이하게 하는 "허가된 목록" 브리지로, 서로 다른 체인에 배포된 Aave V3 마켓플레이스 간에 자산이 원활하게 흐를 수 있도록 합니다. 유동성 파편화 문제를 해결하는 데 도움이 됩니다.

효율적인 모드(e-mode)를 통해 사용자는 동일한 자산 클래스에서 더 높은 차용 능력을 얻을 수 있으므로 차용자는 담보로부터 최대 수익을 얻을 수 있습니다.

분리 모드를 사용하면 Aave 거버넌스가 새로 상장된 특정 토큰을 분리하고 최대 대출 가치 비율을 결정하여 프로토콜이 고위험 자산에 노출되는 것을 제한할 수 있습니다.

가스 최적화 기능은 모든 거래에 대한 수수료를 20-25% 절감합니다.

L2 관련 기능은 Ethereum 확장 솔루션의 사용자 경험을 향상시킵니다.

Aave V3는 이제 Aave V2보다 더 많은 DAU를 확인합니다.

앞을 내다보면 모든 시선은 Aave가 최근에 제안한 스테이블 코인인 GHO에 쏠려 있습니다. GHO 스테이블코인 발행 투표는 7월 31일 압도적 지지로 통과됐다. 스테이블 코인을 사용하면 Aave 사용자가 제공하는 담보로 GHO를 발행하여 계속해서 이자를 얻을 수 있습니다. 차용 수익의 100%가 Aave 재무부로 가는 Aave DAO에게는 엄청난 수익 기회가 될 수 있습니다. Aave 포럼에서 가장 일반적인 우려 사항에는 잠재적 촉진자(예: GHO 주조/소각 권한이 있는 사람)를 적절하게 조사해야 할 필요성, MakerDAO와 같은 고정 안정성 모듈(PSM)의 중요성, 금리를 제어하는 DAO를 둘러싼 논쟁, Aave 프로토콜의 위험과 Chainlink 오라클을 사용하여 GHO 가격을 추적하는 것과 관련된 위험을 피하기 위한 공급 한도의 중요성. GHO 스마트 계약은 현재 감사를 받고 있으며 GHO의 강력한 시작 상태를 설명하는 별도의 제안이 뒤따릅니다.

앞을 내다보면 모든 시선은 Aave가 최근에 제안한 스테이블 코인인 GHO에 쏠려 있습니다. GHO 스테이블코인 발행 투표는 7월 31일 압도적 지지로 통과됐다. 스테이블 코인을 사용하면 Aave 사용자가 제공하는 담보로 GHO를 발행하여 계속해서 이자를 얻을 수 있습니다. 차용 수익의 100%가 Aave 재무부로 가는 Aave DAO에게는 엄청난 수익 기회가 될 수 있습니다. Aave 포럼에서 가장 일반적인 우려 사항에는 잠재적 촉진자(예: GHO 주조/소각 권한이 있는 사람)를 적절하게 조사해야 할 필요성, MakerDAO와 같은 고정 안정성 모듈(PSM)의 중요성, 금리를 제어하는 DAO를 둘러싼 논쟁, Aave 프로토콜의 위험과 Chainlink 오라클을 사용하여 GHO 가격을 추적하는 것과 관련된 위험을 피하기 위한 공급 한도의 중요성. GHO 스마트 계약은 현재 감사를 받고 있으며 GHO의 강력한 시작 상태를 설명하는 별도의 제안이 뒤따릅니다.

MakerDAO

Maker는 PSM에서 단기 국채 및 회사채에 5억 달러를 할당하기로 결정하고 두 개의 주요 기관과 제휴하여 실제 자산 전략에서 진전을 이루었습니다.

소시에테 제네랄(Societe Generale), 토큰화된 커버드본드로 DAI 3천만 달러 재융자

헌팅던 밸리 은행, P2P 대출 파트너십을 위해 최대 10억 달러의 DAI 확보, 연간 프로토콜 수익 3천만 달러 창출 예상

이것은 거버넌스 문제를 해결하기 위해 계속해서 두 진영을 형성합니다. 어떤 대가를 치르더라도 탈중앙화를 원하는 진영과 효율성과 성장을 위해 이사회 스타일의 거버넌스 구조를 지원하는 진영입니다. Lending Oversight Core Unit 거버넌스 투표는 약 3억 달러 상당의 293,911개 이상의 MKR 토큰이 투표에 참여하여 역사상 가장 높은 참여율을 보였습니다. 투표 결과 60%/38%는 구현을 거부했으며 이는 보다 분산된 거버넌스 구조에 대한 지지를 암시합니다.

Maker는 DeFi 전체에서 선도적인 프로토콜 중 하나로 남아 있으며 DeFi 프로토콜 중 가장 많은 TVL을 약 85억 달러로 유지하고 있습니다. 대출 플랫폼으로서 Maker는 암호 화폐 시장이 레버리지에 대한 수요가 높을 때 최선을 다합니다. 이것은 일반적으로 DAI 공급의 확장 및 축소에 해당합니다. DAI의 공급은 상반기에 27% 감소했지만 이후 확대되고 있다. 7월 초 상승세의 상당 부분은 PSM 성장으로 인한 것이지만 레버리지에 대한 수요가 서서히 증가함에 따라 7월 27일 이후 비 스테이블코인 담보에서 1억 5천만 달러의 DAI가 발행되었습니다.

Maker는 또한 RWA를 H2 및 프로토콜의 장기 비전으로 가는 우선 순위로 계속 만들 것입니다. 그들은 실제 담보를 DeFi에 온보딩하기 위한 "Maker Standard"를 만들면 Maker가 RWA 시장 점유율 측면에서 유리한 출발을 할 수 있고 다른 DeFi 프로토콜이 스스로 합류할 수 있는 플레이북을 만들 수 있다고 믿습니다. Real World Finance Core Unit의 구성원인 Teej는 단기 채권 ETF 버퍼를 토큰화하려는 SME 대출 플랫폼 Monetalis Clydesdale과 스위스 은행 Backed Finance로부터 자금을 확보한 후 RWA가 총 담보의 10%와 10배의 흑자를 나타낼 수 있다고 믿습니다. , 현재 총 담보의 2%와 2배의 잉여 완충액에 비해. 떠오르는 RWA는 Maker의 대표 암호화폐 대출 상품과 함께 매우 견고한 수입 흐름을 제공합니다.

파생상품 거래 플랫폼

dYdX

dYdX는 영구 선물 거래를 위한 분산형 거래소입니다. 2분기 동안 dYdX는 사용자 경험과 기능 세트를 개선했습니다. 새로운 자산에는 TRX, XTZ, ICP, CELO, RUNE, LUNA, NEAR 및 ETC가 포함되며 거버넌스 제안이 통과되어 15개를 더 추가합니다. 토큰의 빠른 목록은 dYdX를 영구 선물 교환에 필적하는 지원되는 자산 세트로 밀어 넣었습니다. 새로운 주문 유형과 더 높은 최대 포지션 크기를 구현하여 더 큰 자금과 거래자에게 dYdX로 마이그레이션하는 데 필요한 도구를 제공합니다. 월 거래량이 $100,000 미만인 사용자의 경우 거래 수수료가 전반적으로 인하되었으며 8월 1일에 완전히 제거되었습니다. 또한 원활한 모바일 거래 경험을 제공하기 위해 자체 iOS 앱을 출시했습니다.

dYdX에는 완전한 로드맵이 있습니다. 2022년 말까지 dYdX는 레이어 2 ZK-Rollup에서 Cosmos SDK를 사용하여 구축된 자체 주권 PoS 체인으로 마이그레이션할 계획입니다. 오더북 저장, 매칭 및 유효성 검사기 세트가 분산되어 프로토콜의 검열 저항이 증가합니다. DYDX 토큰은 거래 수수료가 스테이커에게 분배되는 PoS 토큰으로서 새로운 감사 메커니즘을 갖게 됩니다. 몇 가지 분명한 과제가 남아 있지만 온체인 파생 상품 이야기의 선두주자로 자리 잡은 dYdX가 추진력을 얻고 있는 것으로 보입니다.

GMX

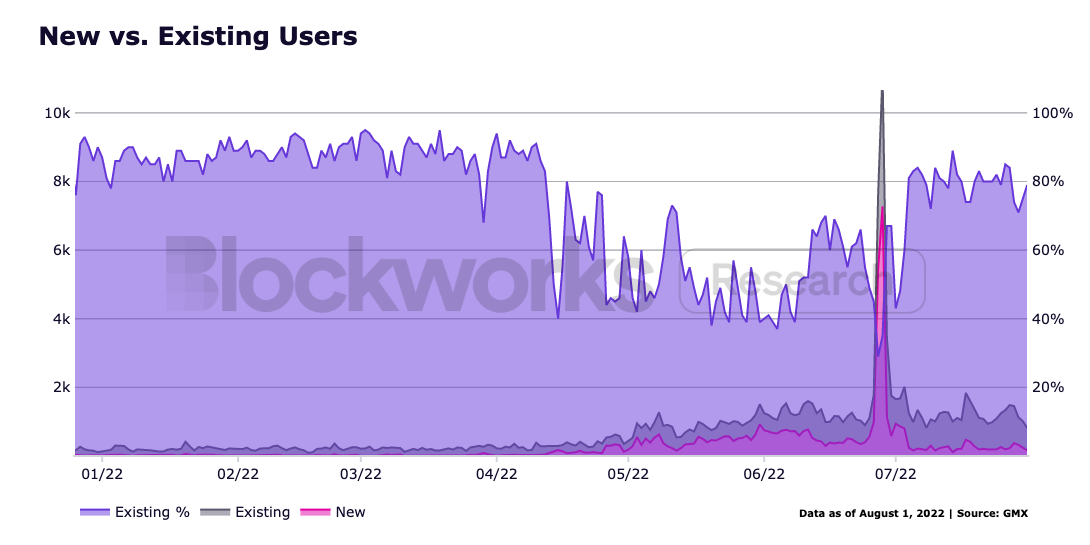

Arbitrum과 Avalanche의 낮은 스왑 수수료와 제로 가격 임팩트 거래를 지원하는 현물 및 영구 거래소인 GMX는 전반적인 시장 침체에도 불구하고 2분기 내내 계속 채택되었습니다. 거래는 스왑, 시장 조성 및 레버리지 거래를 통해 LP 수수료를 받는 다중 자산 풀(GLP)에 의해 지원됩니다. 약 $300M TVL로 Arbitrum에서 가장 큰 dApp이 되었으며 TVL $100M 미만으로 Avalanche에서 계속 견인력을 얻고 있습니다. 지난 분기의 하이라이트는 다음과 같습니다.

Arbitrum Odyssey 이벤트(연기됨)로 인해 6월 28일 7,273명의 신규 사용자가 기록적으로 유입되었습니다.

63,000명의 고유 사용자 돌파

현재 LP를 위한 거래 수수료로 5천만 달러 이상을 창출했습니다.

과거 트레이더 P&L 또는 일부 LP 수익은 현재 3,600만 달러입니다.

이미지 설명

출처: https://stats.gmx.io

투자자들은 GMX가 2022년 하반기에 UI 광택 및 플랫폼 안정성 외에도 몇 가지 중요한 새로운 기능을 추가할 것으로 기대합니다. Synthetics는 앞으로 몇 달 안에 출시될 예정이며, 이 제품을 사용하는 거래자들에게 더 많은 옵션을 제공할 것입니다. 이 출시 후 GMX 팀은 다른 체인과 X4에 배포하기 시작할 것입니다. 풀 생성자와 프로젝트에 풀 작동 방식에 더 많은 유연성을 제공하도록 설계된 AMM입니다. 표준 AMM에서 풀 생성자는 사용자 지정 옵션이 거의 없습니다. GMX 팀은 이와 관련하여 기존 AMM을 능가하고 상당한 시장 점유율을 확보할 수 있다고 믿습니다. 몇 가지 흥미로운 기능에는 풀에 대한 동적 수수료가 포함되어 있어 트레이더가 다양한 토큰에 대한 맞춤형 가격 곡선, 수익률 토큰이 있는 풀 또는 Uniswap V3와 같은 다른 AMM을 통해 집계된 거래에 액세스할 수 있습니다. GMX의 계획은 야심차며 다른 프로젝트가 활용하고 구축하는 플랫폼이 될 AMM을 구축하고자 합니다.

Synthetix

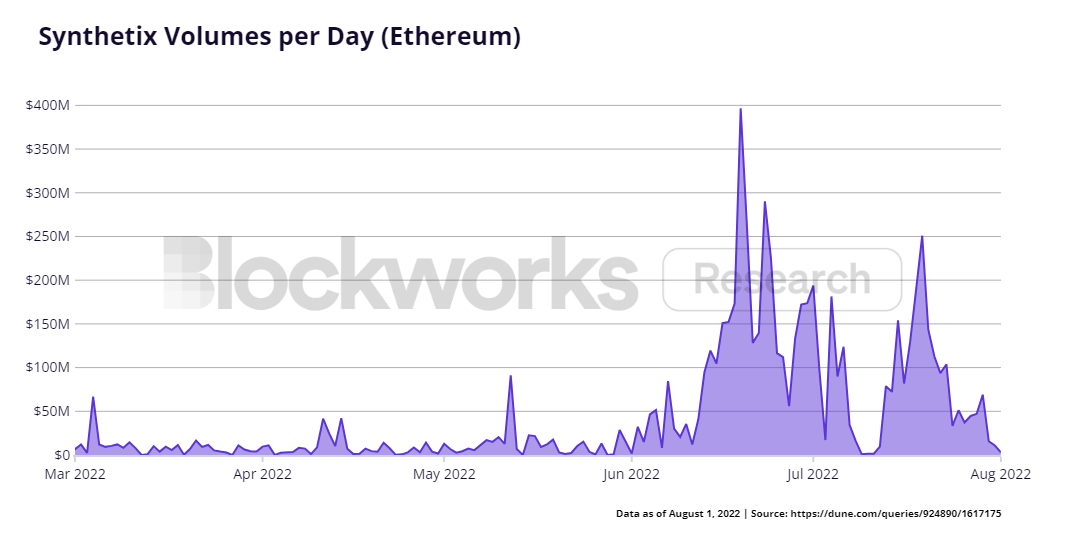

2분기에는 Synthetix에서 아토믹 스왑이 증가하여 신디사이저와 관련된 트랜잭션에 대한 즉각적인 실행과 미끄러짐이 발생하지 않았습니다. 다이렉트 페어 트레이딩보다 유리한 아토믹 스왑은 일일 거래량이 최대 3억5000만 달러에 이른다. 3분기가 시작되면서 Atomic Swap은 Synthetix의 주요 수익원으로 남아 있습니다.

1인치가 아토믹 스왑의 주요 수요처였지만 여전히 트랜잭션 라우팅 경로를 놓쳤습니다. 사용자는 USDC -> sUSD -> sETH 또는 그 반대로 스왑할 수 있지만 sETH -> ETH의 마지막 단계는 해야 합니다. 수동으로. 1인치는 곧 라우터에 마지막 단계를 추가할 예정입니다. 즉, 신디사이저를 통해 더 많은 라우팅을 기대할 수 있으므로 SNX 스테이커에게 더 많은 수익을 올릴 수 있습니다. 또한 이미 신디사이저를 사용하여 ETH -> USDT에서 라우팅하는 OpenOcean을 포함하여 다른 애그리게이터가 원자 스왑을 구현하기 시작했습니다. Curve가 OP 보조금 제안을 발표하면서 Optimism에도 아토믹 스왑이 사용될 것으로 예상할 수 있습니다. 우리는 아토믹 스왑이 3분기에도 주문 실행 라우팅에 널리 사용될 것으로 예상합니다.

Synthetix 생태계는 또한 Kwenta의 영구 선물 일일 거래량이 8천만 달러 이상에 힘입어 Optimism에서 엄청난 성장을 보였습니다. Kwenta의 영구 거래는 올해 하반기에 훨씬 낮은 수수료와 더 많은 시장을 갖춘 V2로 업그레이드됩니다. V2에는 모바일 UI 지원, 교차 마진 거래, 지정가 주문, 손절매, KWENTA 토큰 출시(및 거래자를 위한 가능한 에어드롭)도 포함됩니다. SIP-254는 또한 플랫폼에서 영구 거래자에게 보상하기 위해 SNX 인플레이션의 20%를 할당하여 거래자가 Kwenta를 선택한 플랫폼으로 사용하도록 장려할 것을 제안합니다.

안정적인 통화

안정적인 통화

Frax

Frax는 몇 가지 새로운 메커니즘을 통해 Curve 에코시스템에 더욱 통합되고 가까운 미래에 출시될 일부 제품을 소개합니다.

Frax 기본 풀: Curve와 쌍을 이루어 더 많은 FRAX 수요를 촉진하고 파트너의 자본 효율성을 장려할 수 있는 새로운 스테이블 코인 풀입니다.

Frax가 CRV 잠금을 위해 화이트리스트에 추가됨: Curve는 Frax가 veCRV에 대해 CRV 토큰을 잠그도록 투표할 수 있도록 제안을 통과시켜 Frax에게 Curve에 대한 더 큰 거버넌스 권한을 부여했습니다.

Fraxswap: Frax는 사용자가 가격 영향을 줄이기 위해 일정 기간 동안 시간 가중된 다양한 자산을 구매할 수 있는 새로운 DEX를 출시했습니다. 이 프리미티브는 자금을 관리하려는 프로토콜에 유용할 수 있습니다.

2,000만 달러 FXS 환매: Frax는 현재 누적 수익을 사용하여 공개 시장에서 FXS 토큰을 환매하고 있습니다. FXS는 파기되거나 veFXS 보유자에게 배포됩니다. FXS에서 200만 달러를 구매했습니다.

Fraxlend: Frax는 무허가 대출 페어링 및 맞춤형 부채 구조를 지원하는 새로운 대출 dApp을 출시하여 실제 자산 대출, 채권 및 담보 대출을 위한 길을 닦을 계획입니다.

FraxETH: Frax는 비콘 체인에서 두 개의 유효성 검사기를 실행하고 있다고 밝혔습니다. Frax는 자금을 지원하고 새로운 ETH 제품을 만들기 위해 ETH 담보 파생 상품(fraxETH)을 만들 계획입니다. 우리는 fraxETH의 모든 이득이 veFXS 보유자에게 어떤 식으로든 이익이 될 것이라고 가정할 수 있습니다.

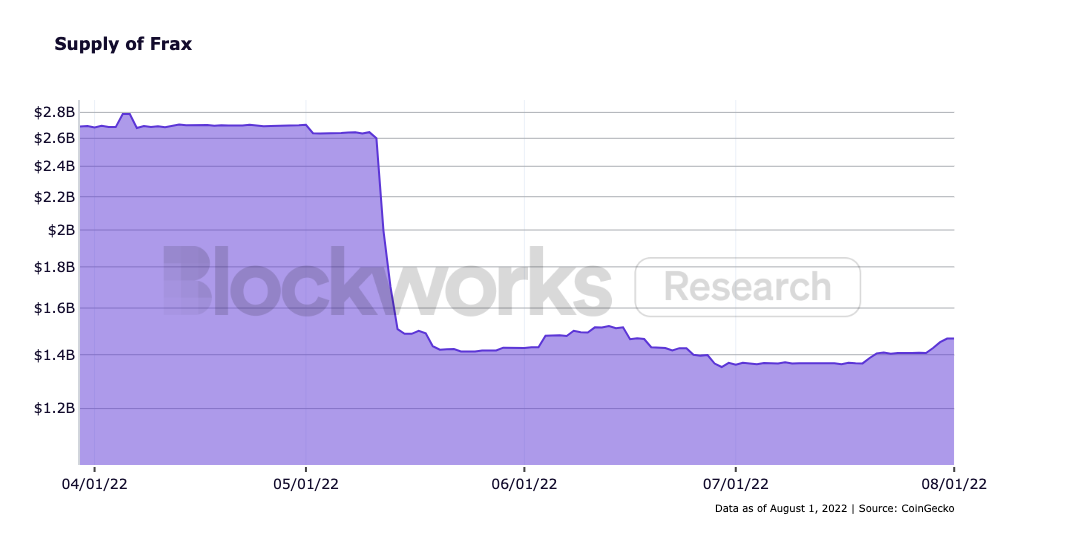

하반기에 Frax의 FXS 토큰은 신제품 출시가 급증할 수 있습니다. 올해 초 거의 반토막이 난 후 FRAX 공급이 천천히 반등하고 있으며 궁극적으로 FXS에 더 많은 가치를 제공합니다. Frax 기본 풀 출시 이후 FRAX 공급이 약 1억 달러 증가했습니다. 현재 Frax의 금고에는 발생한 이익이 3,630만 달러 있습니다. Fraxlend와 Fraxswap은 프로토콜에서 더 많은 수입을 얻을 수 있는 가능성을 열어 FXS 보유자에게 장기적으로 이익이 될 것입니다.

Fraxlend는 AMM, 대출 플랫폼 및 스테이블 코인을 포함하여 분산형 은행 서비스를 위한 완전한 소프트웨어 제품군 역할을 하는 프로토콜의 이정표를 세울 것입니다. 프로토콜은 첫날 fraxETH 담보를 출시할 계획이며, 이를 통해 사용자는 FRAX를 빌려 스테이킹한 ETH 담보를 걸 수 있습니다. Fraxswap은 FRAX/SYN 및 FRAX/OHM이라는 두 가지 새로운 유동성 쌍을 추가하여 AMM에 더 많은 거래량을 제공할 수 있습니다. Frax와 Curve 및 Convex의 시너지 효과는 제품군에 대한 노출을 원하는 플레이어에게 매력적인 이점을 제공합니다.

탈중앙화 거래소

곡선과 볼록

Curve와 Convex 모두 2분기 약세장의 고통을 느꼈습니다. 지난 분기에 우리는 다음을 확인했습니다.

13억 달러 이상의 UST가 Curve에 예치되어 Curve와 Convex의 TVL이 76% 감소했습니다.

Frax Base Pools의 도입과 FIP-95 승인은 Frax, Curve 및 Convex 간의 연결을 강화합니다. 현재 cvxCRV 가격을 기준으로 Frax는 CRV 보상의 최대 95%를 Curve 풀을 통해 cvxCRV로 스왑하거나 CRV를 Convex에 직접 입금하여 cvxCRV 페그를 안정화합니다.

Convex는 6월 30일에 기록적인 2,750만 vlCVX를 잠금 해제했습니다. 거래자들이 이벤트 기간 동안 CVX를 크게 매도하는 동안 대부분의 CVX는 즉시 다시 잠겼고 일시적인 매도 압착을 생성했습니다. 특히 Terra Wallet은 CVX를 다시 잠그고 새로운 Terra 생태계 스테이블 코인의 문을 열었습니다.

Curve는 창립자 Michael Egorov가 과도하게 담보화되고 혁신적인 청산 메커니즘을 갖게 될 네이티브 스테이블 코인(crvUSD)을 출시합니다. 백서는 아직 공개되지 않았기 때문에 그 설계와 의미에 대해서만 추측할 수 있습니다.

프로토콜과 밀접하게 관련된 개발자에 따르면 LP 토큰과 CRV는 crvUSD의 초기 담보 역할을 할 수 있습니다. 스테이블 코인을 지원하는 특정 자산은 성공에 매우 중요하므로 Curve는 새로운 메트릭을 도입한 것과 유사한 프로세스를 통해 수락된 담보를 화이트리스트에 올릴 가능성이 높습니다. Convex는 현재 Curve의 의결권의 53.9%를 보유하고 있으므로 승인된 LP 토큰은 Curve LP 토큰이 아닌 Convex LP 토큰일 가능성이 높으며 양 당사자 간의 합의는 상호 이익이 됩니다. Convex는 또한 cvxCRV를 화이트리스트에 추가할 수 있으며 추가 유틸리티는 cvxCRV/CRV 후크를 강화하고 Convex에 영구적으로 잠긴 CRV의 수를 늘리는 데 도움이 됩니다. CRV가 담보 자격을 갖추기 위해 먼저 veCRV에 고정 투표되어야 하는 경우 Convex는 여전히 금고에서 3억 6천만 달러 이상의 veCRV라는 강력한 위치를 보유하고 있습니다. Convex는 veCRV를 사용하여 crvUSD를 주조하고 자체 CRV 농사를 시작할 수 있습니다. 새로운 수익원에 의해 생성된 CRV는 cvxCRV에 영구적으로 고정되고 Convex LP 및 vlCVX 락커에 지급될 수 있으므로 Convex의 가치 제안을 높이는 동시에 공급을 줄임으로써 Curve 생태계에 도움이 됩니다.

LP 토큰 담보는 자산 예금에 대한 수요를 창출하고 Curve TVL을 증가시키는 반면, CRV 및 veCRV 담보는 CRV를 순환에서 제거하며 이는 Curve의 지속 가능한 발전에 필요합니다. 연간 CRV의 총 락업량은 41%로 꾸준히 증가했으며 현재 평균 락업 기간은 3.6년입니다. 또한 CRV 릴리스는 연간 15.9% 감소했으며 다음 감소는 8월 14일에 발생했습니다. 잠긴 CRV에 대한 수요 증가와 CRV 공급 감소는 2022년 남은 기간 동안 강세 CRV 환경을 조성합니다.

crvUSD와 Aave의 GHO 스테이블코인 발표는 프로토콜별 스테이블코인에 대한 새로운 이야기의 잠재적인 시작을 의미합니다. 다른 기능 중에서도 네이티브 스테이블 코인은 프로토콜이 추가 수익을 창출하고 거버넌스 토큰의 유용성을 높일 수 있도록 합니다. 예를 들어 Frax는 FRAX를 채굴하여 주조세 수익을 창출하고 Aave는 stAAVE 보유자가 빌린 GHO에 대해 더 낮은 이자율을 지불할 수 있도록 합니다. 이런 추세가 지속된다면 유동성을 다투는 스테이블코인이 많아질 것이고 커브는 깊은 스테이블코인 유동성을 제공하는 데 최적화돼 있어 전장이 될 가능성이 높다. Curve 및 Convex를 중심으로 구축된 뇌물 시장은 다른 프로토콜이 CRV 릴리스를 활용하여 풀에 대한 유동성을 효과적으로 임대할 수 있도록 합니다. 새로운 풀은 증가된 TVL 및 스왑을 유도하여 Curve 생태계에 도움이 됩니다. 또한 다른 프로토콜은 기본 스테이블 코인을 Curve의 Frax 기본 풀(USDC 및 FRAX) 메타풀과 페어링하여 LP에 대한 FXS 및 CRV 보상을 생성할 수 있습니다. FraxBP는 스테이블 코인 유동성을 위한 사실상의 기반 풀이 되어 플라이휠을 더욱 견고하게 만들 수 있습니다.

Uniswap

Uniswap의 NFT 진출은 이제 막 시작되었으며 하반기에는 더 많은 소식이 있을 것입니다. 6월에 Uniswap Labs는 NFT 집계 플랫폼 Genie를 인수했습니다. 통합을 통해 Uniswap은 ERC20뿐만 아니라 모든 디지털 자산의 거래를 용이하게 할 것입니다. Uniswap은 sudoswap과 통합하여 거래자가 NFT에 즉각적인 유동성을 제공할 수 있도록 할 계획입니다.

2분기에 두 개의 새로운 배치가 추가되면서 이 AMM은 이제 Gnosis, Moonbeam, Optimism, Polygon 및 Arbitrum을 포함한 7개의 체인에 배치됩니다. 유니스왑은 2분기 월 평균 거래량이 470억 달러 이상을 기록하며 DEX 시장 선두 자리를 지켰다. Uniswap V3는 출시 이후 1조 달러 이상의 거래량을 완료했습니다. 짧은 기간 동안 Uniswap은 Ethereum 및 Bitcoin을 능가하는 모든 플랫폼의 총 수수료가 가장 높습니다.

UNI Governance는 수수료 전환 기능을 테스트할 준비를 하고 있습니다. 7월 21일, 수수료 전환 시행에 대한 UNI 보유자의 정서를 측정하기 위한 거버넌스 제안이 통과되었습니다. 정확한 세부 사항은 아직 확인되지 않았지만 V3 LP의 스왑 수수료의 일정 비율을 UNI DAO가 관리하는 금고로 다시 전송하는 재판이 곧 진행될 수 있습니다. 이것은 UNI의 부가가치에 대한 큰 뉴스입니다. 이번 주에 평가판에 대한 자세한 내용을 게시할 예정입니다.

스시 (Sushiswap)

Sushi는 새로운 제품을 제공하느라 바빴습니다. 그들은 브리징을 위해 Stargate를 사용하여 교차 체인 AMM을 배포하고 SushiGuard를 사용하여 MEV 보호 트랜잭션을 발행하고 MISO 2.0을 출시했습니다. Miso는 누구나 쉽게 새로운 토큰을 위한 자금을 조달할 수 있는 IDO(Initial Dex Offering) 플랫폼입니다. 이제 거래소는 9개의 체인에서 운영되며 사용자는 클릭 한 번으로 거래할 수 있습니다. Sushi는 제한 주문 기능을 시작하고 마이크로 거버넌스에 맞서기 위해 DAO 조직을 재구성하기 위한 제안을 통과시켰습니다.

마지막 생각들

마지막 생각들

원본 링크