Michael Saylor卸任MicroStrategy CEO,由Phong Le「接棒」

本文来自 Decrypt,原文作者:Jason Nelson

Odaily 星球日报译者 | 念银思唐

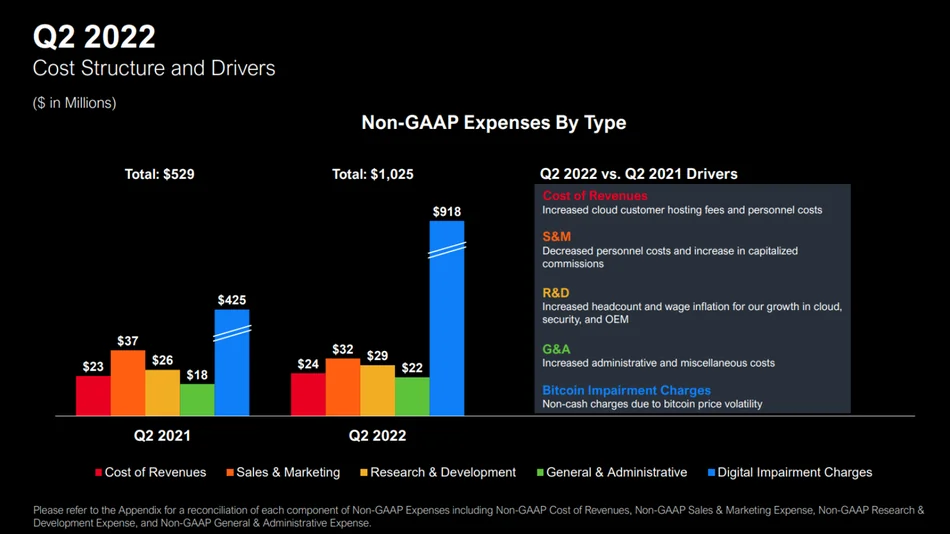

据 MicroStrategy 周二发布的 2022 年第二季度财报显示,该公司在该季度计入了 9.178 亿美元的非现金数字减值支出。

减值支出是指资产可收回价值的大幅减少或损失。就 MicroStrategy 持有的比特币而言,减值支出反映了比特币价格与 MicroStrategy 购买时价格相比的下跌情况。

减值可能会因为政策或经济环境的变化而发生,比如当前的加密熊市。

MicroStrategy 2022 年第二季度 Non-GAAP 费用。

MicroStrategy Q2 的 9.178 亿美元数字资产减值支出较 2022 年第一季度的 1.701 亿美元大幅增加。

自 2020 年 8 月以来,MicroStrategy 以每枚 30664 美元的平均价格购买了 129699 枚比特币。当比特币在 2021 年 11 月达到每枚 6.8 万美元的历史高点时,该公司持有的比特币总价值约为 80 亿美元。而以当前每枚比特币 2.3 万美元的价格计算,这些比特币的总价值约为 29 亿美元。

该公司此后还以 2 万美元的价格购买了 421 枚比特币。

首席财务官 Andrew Kang 表示,MicroStrategy 的母公司持有 1.4 万枚比特币,其余 115 枚由子公司 MacroStrategy 持有。其中,85000 枚比特币是没有作为抵押的。

“我们有足够的抵押品来应对任何价格波动。”他说。

Kang 补充道:“每个季度的数字资产减值支出总是大于 Non-GAAP 的经营亏损。”这意味着比特币的价格波动是该公司资产负债表上亏损的主要因素。

“我们预料到了比特币的波动,”Michael Saylor 补充道。

“波动性意味着比特币更有趣,所以微策略更有趣,”他解释称,“波动是活力。”

MicroStrategy 今日同时宣布任命公司总裁 Phong Le 接替 Michael Saylor 担任首席执行官,Saylor 将继续担任执行董事长。Saylor 自 1989 年创立公司以来一直担任 MicroStrategy 首席执行官兼董事会主席。Phong Le 自 2020 年 7 月起担任总裁,自 2015 年加入 MicroStrategy 以来还担任过其他各种高级管理职位,包括首席财务官和首席运营官。

Michael Saylor 表示,“我相信,分离董事会主席和首席执行官的角色将使我们能够更好地实施两项战略,即购买和持有比特币,以及发展我们的企业分析软件业务。作为执行董事长,我将能够更多地关注我们的比特币购买战略和相关的比特币倡导计划,而 Phong 将被授权作为首席执行官来管理整体公司运营。”

Saylor 进一步表示:“因为人们害怕波动和对会计准则的反感,我们作为比特币标准上最大的运营公司一直处于领先地位,这让我们有了竞争优势和差异化,从而为股东创造价值。”

在第二季度的电话会议上,Phong Le 表示,到目前为止,MicroStrategy 还没有出售任何比特币。

“MicroStrategy 属于独一类:我们是世界上最大的比特币持有者。”他称,“我们的策略是买入并长期持有,就是这样。”