Comprehensive interpretation of the competitive landscape of NFT trading platforms: what is the core competitiveness?

text

1. Competitive landscape of nft exchanges

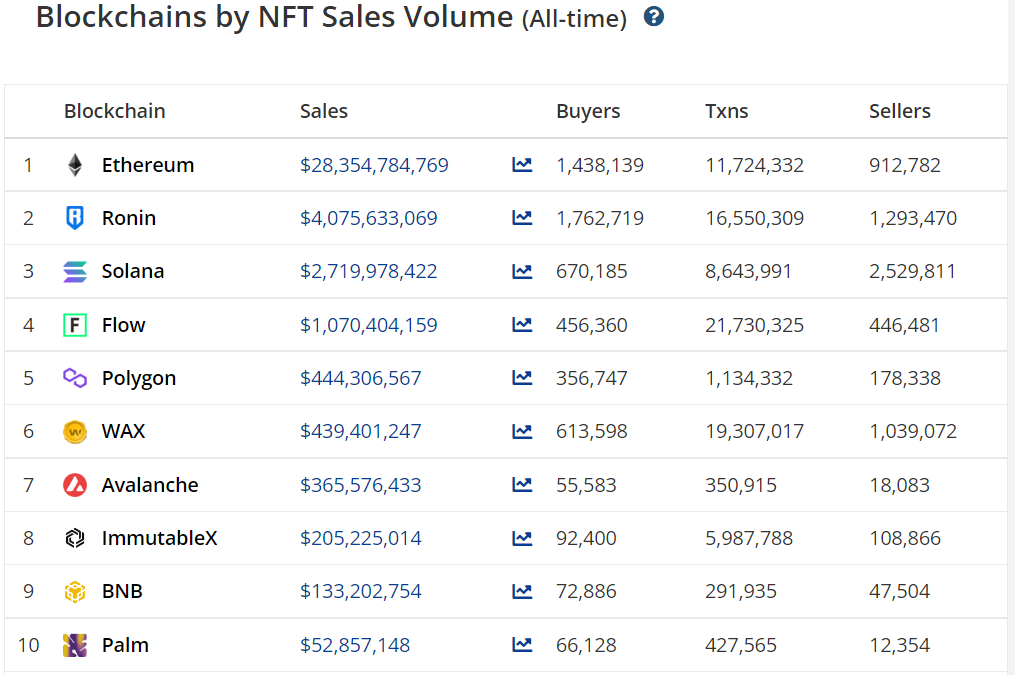

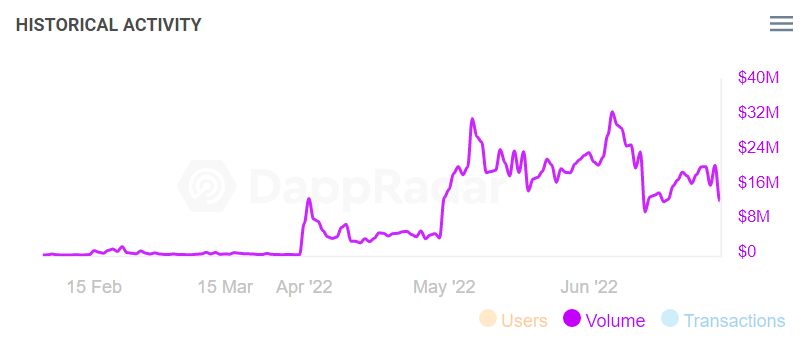

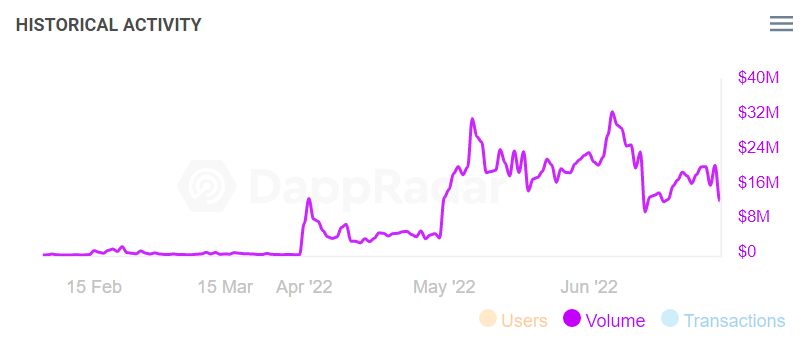

(1) Rapidly growing nft market

As of June 30, 2022, the cumulative transaction volume of the NFT industry has reached 67.818 billion US dollars, and more than 50,000 NFT traders participate in transactions on the chain every day. The figure of 67.818 billion US dollars may seem insignificant, but what if I told you that the figure was only 1.3 billion US dollars a year ago? In just one year, the cumulative transaction volume of NFT has increased nearly 50 times.

image description

(2) Three stages of nft exchange competition

(2) Three stages of NFT exchange competition

In such a rapidly growing ecology, the participants in the ecology are also highly competitive. The current competitive state of NFT exchanges is very similar to the competitive state of DEX in DeFi Summer back then.

In the first stage, each public chain will have its own NFT exchange, such as Opensea on ETH, Magic Eden on Solana, and Treasureland on BSC.

In the second stage, starting from Ethereum, each public chain will have an endless stream of imitation disks and challengers to compete with leading products. In DeFi, Sushiswap challenges Uniswap; in NFT exchanges, Looksrare and X2Y2 challenge Opensea.

(3) Competition landscape on ethereum

(3) Competition landscape on Ethereum

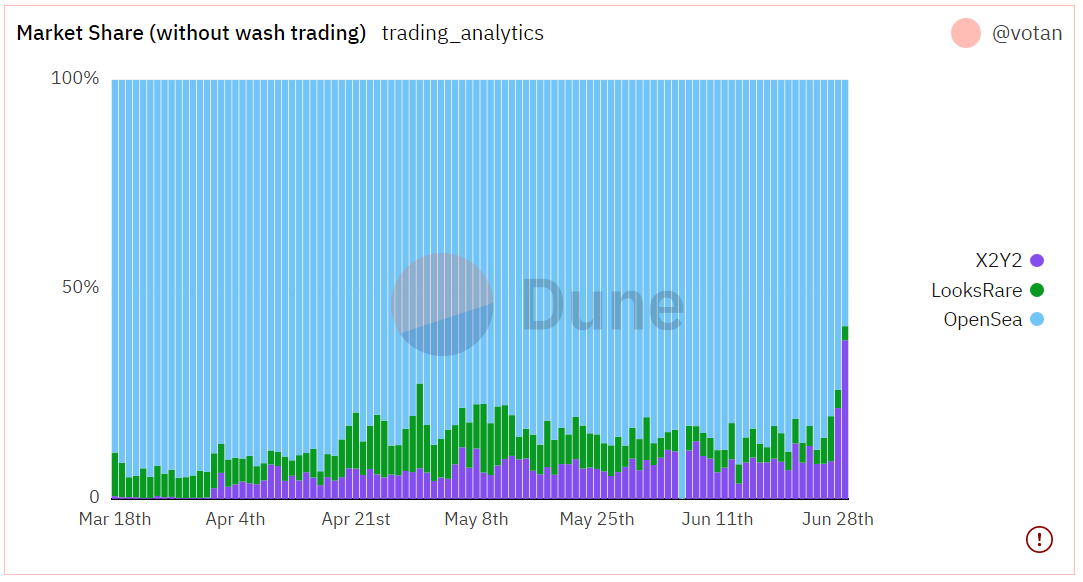

At present, there are mainly three NFT exchanges on the Ethereum chain: Opensea, Looksrare and X2Y2. The average transaction volume share in the past month is 85%, 6% and 9% respectively (the brush volume has been excluded). In fact, the share of each company will be a little lower than the above data, because only these three companies are counted in the total here, but the trading volume of other NFT exchanges on Ethereum is not at the same order of magnitude as the above-mentioned companies, so there is no need to discuss it . It is not difficult to see from the chart that the emergence of Looksrare and X2Y2 has indeed seized part of Opensea's market, but overall Opensea is still the dominant player, and Opensea's advantages are difficult to be shaken in the short term.

image description

2. Competitive development route of nft exchange

2. Competitive development route of NFT trading platform

(1) Transaction Mining Incentives

(1) Transaction Mining Incentives

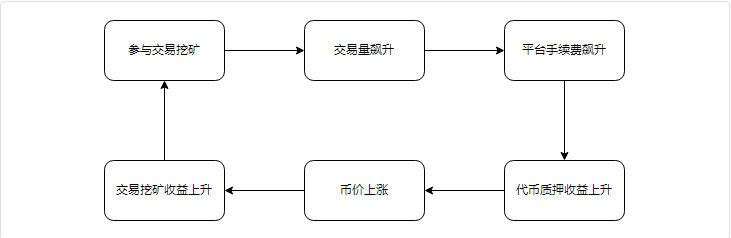

1. Transaction mining incentives are the most direct and effective way to increase the transaction volume of the platform

Transaction mining is to use platform tokens to reward transactions. In order to obtain platform token rewards, users will continue to trade on the platform. The cost of user transactions is mainly composed of two parts: transaction fees (platform fees + creator fees) and Gas Fee. As long as the cost is lower than the transaction incentive, there is room for arbitrage, and arbitrageurs will continue to trade until the space for arbitrage disappears.

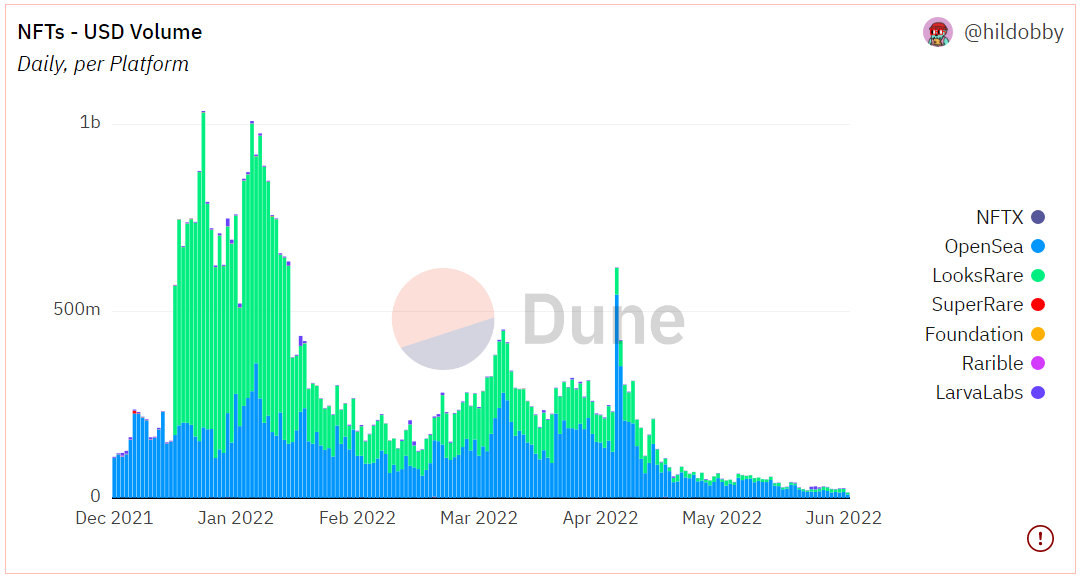

The effect of transaction mining is very good. After Looksrare launched transaction mining in January, the transaction volume soared, surpassing Opensea at one point.

(Data source: dune.com/hildobby/NFTs)

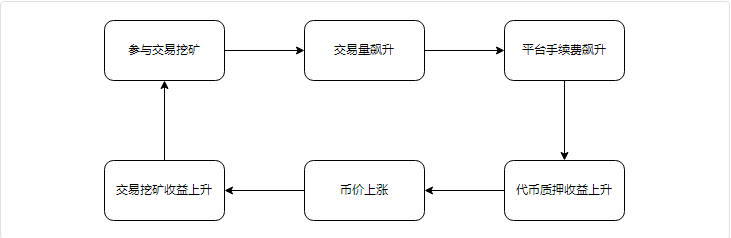

Transaction mining is easy to form a positive flywheel in the early stage of launch. After the transaction mining is started, the transaction volume of the platform will increase significantly, so that the platform fee will soar. , the rise in token prices increases the incentives for transaction mining, so arbitrageurs are willing to spend more to earn transaction mining incentives, thus forming a positive cycle. Of course, this cycle in turn is a death spiral. After April, Looksrare’s market share dropped sharply. Aside from macro factors, another core reason is that its transaction mining rewards were halved, so that both transaction volume and currency prices doubled. fall.

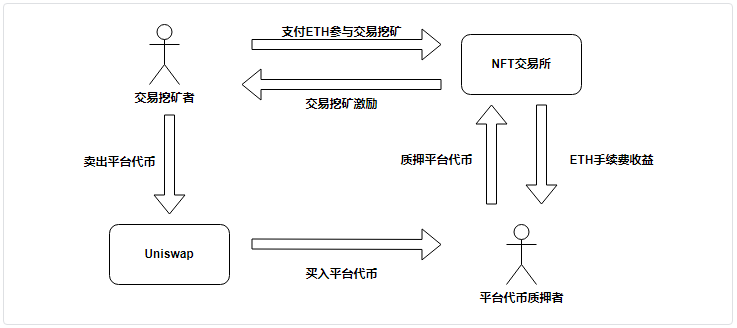

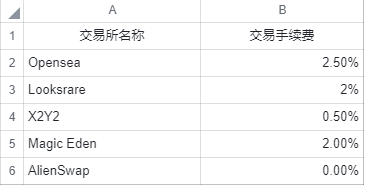

X2Y2 apparently also discovered that transaction mining is an important means to increase transaction volume in the short term. In April 2022, X2Y2 canceled its own innovative pending order rewards and switched to transaction mining rewards similar to Looksrare. It can be seen that the transaction volume of X2Y2 before April is almost negligible compared with that after transaction mining is adopted.

(X2Y2 historical trading volume data data source: Dappradar)

2. NFT transaction mining rewards are a means of acquiring customers, not a moat

Transaction mining incentives were first used in the DeFi field, and dYdX is one of the best. However, transaction mining in contract transactions can help improve liquidity and allow prices to be fully discovered. On the one hand, the participants in transaction mining carried out mining arbitrage, and on the other hand, they also contributed liquidity to the platform, becoming the counterparty of real traders. As for NFT transaction mining, the transaction method of the miners is mostly the transaction between the left hand and the right hand before the two wallets, which does not contribute to the liquidity of NFT.

NFT transaction mining can be divided into two stages: the first stage, with a large number of participants, users actively participate in the transaction to obtain rewards; the second stage, the influx of giant whales, several giant whale accounts carry out several NFT transactions with inflated prices every day Trading squeezes retail trading mining space.

In the first stage, because the trading and mining incentives have just started, many new users can be attracted to experience the product, similar to the "10 billion subsidy" and "10% off coffee" activities in the Internet. If the product is really good for user experience, then There is an opportunity to keep new users and realize the cold start of the project. At this stage, not only the trading volume of the platform will increase, but also real trading users will be attracted.

In the second stage, when the giant whale finds that the incentive for transaction mining is short-term sustainable and safe, the giant whale will participate in transaction mining. The way the giant whale participates in mining is to choose an NFT without creator fees (Creator Fees) , and then set the price of the pending order to thousands of ETH, and then buy and sell several times with left hand and right hand to complete the transaction mining. This process did not provide liquidity for NFT, and also squeezed the enthusiasm of retail traders to participate. At this stage, the core function of transaction mining is to maintain the most basic platform NFT transaction volume data and provide a stable ETH cash flow for users who pledge to mine.

In the second stage of transaction mining, the essence is that the agreement party sells the tokens unlocked every day in exchange for ETH and then distributes them to the current token pledgers in proportion. At this stage, transaction mining can no longer attract too many new users for the platform, but through the first stage of customer acquisition, the platform has accumulated some users and gained a certain market popularity, and the second stage of transaction mining can bring The business data of the platform is maintained at a relatively "beautiful" level.

This stage is not only a stage of boiling frogs in warm water, but also a stage of low-key construction by exchange project parties. At this stage, even if the project party does nothing, it can maintain the platform data at the previous level, but this is actually a false prosperity. At this stage, both investors and the project party themselves should focus on pure transactions. The share turns to the growth of the real number of users, and the user's product experience feedback. From another perspective, at this stage, the project party does not have too much performance pressure, and the platform data can basically cope with investors, so it is also a good time to calm down and polish the product.

The duration of this phase mainly depends on the design of transaction mining incentives. The day when the incentive drops is the day when the second phase ends. Looksrare’s second phase obviously ended in mid-May this year. Transaction mining After the reward was halved, the trading volume of the platform dropped sharply, resulting in a drop in pledge income, which in turn led to a drop in currency prices, realizing the "Davis double-click".

When the frog was about to be boiled to death, Looksrare seemed to realize that it was the frog swimming in warm water, so users who followed Looksrare recently will find that they have finally started to iteratively optimize their products, and launched some new features that are quite sincere . But obviously they missed the most golden period of product optimization, and the best way to stop the death spiral is not to let it start spinning. For X2Y2, its transaction mining will last for 2 years, and the rewards are always constant, so the cycle of the second phase will be longer. Can you make good use of this time to polish the product, improve the user experience, and try to Capturing more traffic and users is the key to the future development of X2Y2.

(2) Pending order incentives

(2) Pending order incentives

Listing Reward means that NFT holders list popular NFTs at a reasonable price on the platform, even if the NFT is not sold, they can still get listing rewards.

1. Change path of exchange incentives

Regarding the issue of pending order rewards, the competitive path between Looksrare and X2Y2 is particularly interesting

Looksrare: transaction mining → transaction mining + pending order rewards

Looksrare started transaction mining at the beginning of its launch on January 11, and then changed its incentive strategy on April 20, distributing part of the original transaction mining revenue to pending order rewards.

X2Y2: Pending order reward → transaction mining

When X2Y2 was launched on February 15, it innovatively proposed pending order rewards. Due to some loopholes in the rule settings at the beginning of the launch, the promotion of NFT transactions was not obvious. After a series of corrections, X2Y2 launched on April 1. The rewards for pending orders are cancelled, and the income originally allocated to rewards for pending orders is allocated to transaction mining.

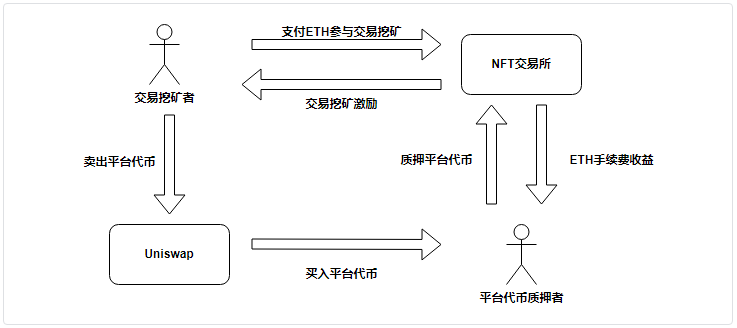

2. Are the rewards for pending orders effective?

First of all, make sure that the main purpose of the platform's various incentives is to increase the number of users and thus promote transaction volume. Therefore, it is most intuitive to see whether there is any effect on the trading volume. Going back to the graph of the X2Y2 historical trading volume, you will find that the trading volume on the platform is very low when the platform adopts the mechanism of pending order rewards.

image description

(X2Y2 historical trading volume data data source: Dappradar)

The reason is that we divide the users who participate in the pending order rewards into two categories.

One type is users who really need to sell NFT. The core appeal of this type of user is to sell NFT at the price they want as soon as possible, so he will not just hang NFT on For these two exchanges, he will definitely place orders on Opensea at the same time. Then, because of Opensea’s traffic, there is a high probability that his pending orders will be traded on Opensea (this has been improved after the emergence of aggregators, which will be described in detail below), so X2Y2 and Looksrare gave rewards to pending orders in vain, but did not promote transaction volume. At the same time, because the core demand of users is to sell NFT as soon as possible, the time for placing orders will not be very long, so the corresponding rewards will not be very high. For some users who are not sensitive to prices, even if they know that a certain platform has rewards for placing orders, they may It will only choose to place orders in Opensea.

The other category is users who do not want to sell NFT, but want to earn income through pending orders. The core demands of this part of users are: (1) NFT will not be bought by others (2) The longer the order is, the better.

In order to limit these users’ profit, the platform will design a series of rules. For example, the price of the pending order must not exceed a certain percentage of the floor price. For example, only the series with a transaction volume exceeding a certain level can receive the reward for the pending order. Under the restrictions of such rules, the practice of speculators is to set a maximum price within the specified range to ensure that their NFT will not be bought. This has indeed increased the number of NFT pending orders on the platform, but the promotion of transactions is not obvious.

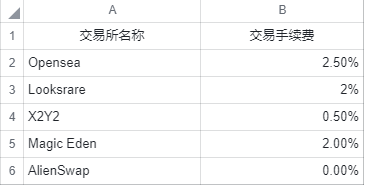

(3) Competition in transaction fees

(3) Competition in transaction fees

There are two main handling fees in NFT transactions, one is the transaction fee charged by the exchange, hereinafter referred to as "transaction fee", and the other is the creator fee (Creator Fee) charged by the NFT creator. It should be noted that there is no one-stop agreement for the setting of the creator’s fee collection ratio, which means that the creator cannot set it once and apply it to the entire platform. Often, for some new exchanges, creators need to go to The other party's website must be set, otherwise it cannot be charged.

There will be price wars in any fully competitive market, and the price wars among NFT exchanges revolve around the above two handling fees.

1. Price war on transaction fees

Let’s talk about the transaction fee first. As a leading exchange with a monopoly position, Opensea charges the highest transaction fee of 2.5% in the industry, and basically sets an upper limit for latecomers. Looksrare and Both X2Y2 have set lower transaction fees to compete for the market, and there are still many exchanges like Alienswap in the market joining this price war under the banner of 0% transaction fees.

There is a very interesting phenomenon here. Even though other platforms have obvious price advantages compared to Opensea, they have not grabbed much market share.

A simple concept called switching cost is introduced here, which roughly means the hidden cost for users to switch from using product A to using product B.

For users of NFT exchanges, the cost of migration is extremely low, and the cost of learning the new platform is also very low, because the front-end pages of different exchanges have very little difference. So in theory, when the handling fee of one exchange is one-fifth of the other, rational traders will choose to trade on exchanges with low fees. Especially with the emergence of aggregators such as Gem, after solving the traffic entrance problem of small exchanges, the rate advantage will become more obvious. But now there is a huge discrepancy between theory and reality, so where is the problem?

One of the reasons must be poor information. Many traders do not know that there is a low-fee exchange, and naturally they will not run to trade.

The deeper reason is that in the current NFT trading market, a large number of traders are not price-sensitive. Under the high fluctuation of the price of NFT itself, the 1%-2% handling fee is not so intuitive, because "doubling the cost" and "returning to zero overnight" are everywhere. In the face of such gains and losses, most Most people don't care about the difference in fees.

But NFT traders will not always maintain low price sensitivity. Now everyone is not sensitive to handling fees. On the one hand, they think that the NFT price itself fluctuates violently, and high price fluctuations make handling fees less important. On the other hand, because NFT is now mainly concentrated in PFP, which is more like a work of art, traditional art auction houses like Christie’s charge commissions ranging from 10% to 20%, compared to NFT exchanges. 2% or so is not so high.

With the development of the market and the gradual maturity of traders, traders will gradually realize that the 2% transaction fee is so unbearable. You must know that the transaction fee of traditional stock investment is about 3/10,000. At the same time, with the rise of GameFi, the trading category of NFT may shift from pure PFP to NFT in GameFi. At this time, NFT is not just an avatar artwork, but a means of production. As a result, investors' payback period will be longer, and the advantages of low-fee exchanges will gradually increase.

In general, I think the price war of NFT exchanges will intensify. Even giants like Opensea, which are close to monopoly, will lower their handling fees. You must know that Opensea’s single handling fee income is about 600 million US dollars a year. The extremely profitable industry will inevitably flood a large number of competitors. If Opensea continues to maintain a transaction fee of 2.5%, the price advantage of low-fee exchanges will gradually expand.

2. Creator fee

If the price war of transaction fees is a clear competition, then the creator fee belongs to the dark area. Creator fees are usually set from 0%-10%. As mentioned earlier, this fee needs to be manually set by the creator on the platform, so there is a loophole that is not considered a loophole. Most creators will only set creator fees on Opensea. For some new and smaller NFT exchanges, for various reasons, creators have not set fees. This also leads to many NFTs, if NFT sellers sell NFTs on X2Y2 or Looksrare, they will receive about 10% more money than Opensea. So many times you will find that the same NFT may have a higher order price on Opensea, because only Opensea charges creator fees.

The main reason for saying it is a dark area is that no exchange dares to publicly publicize in official channels that its own NFT transactions do not charge creator fees (because this obviously damages the rights and interests of creators), but privately not charging creator fees has become a problem. important means of publicity. Of course, NFT exchanges do not dare to make public outrage. Generally, creators who take the initiative to set fees on the platform will get the cooperation of the exchange.

3. Exchange front-end battle aggregator

3. Battle for front-end of trading platform - aggregator

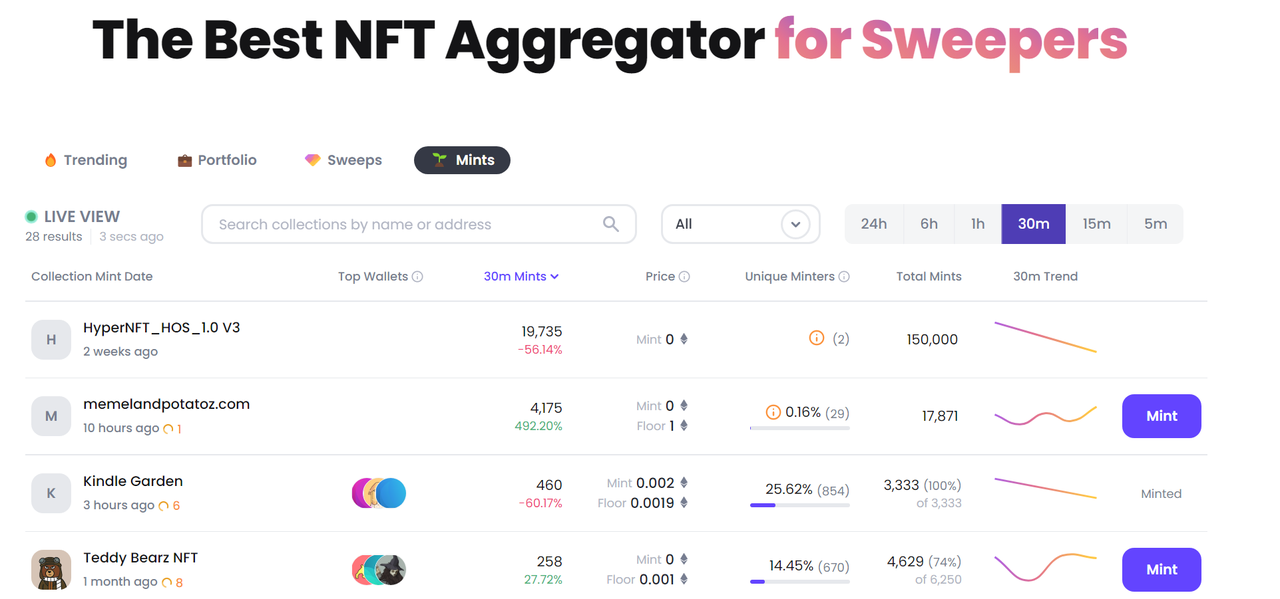

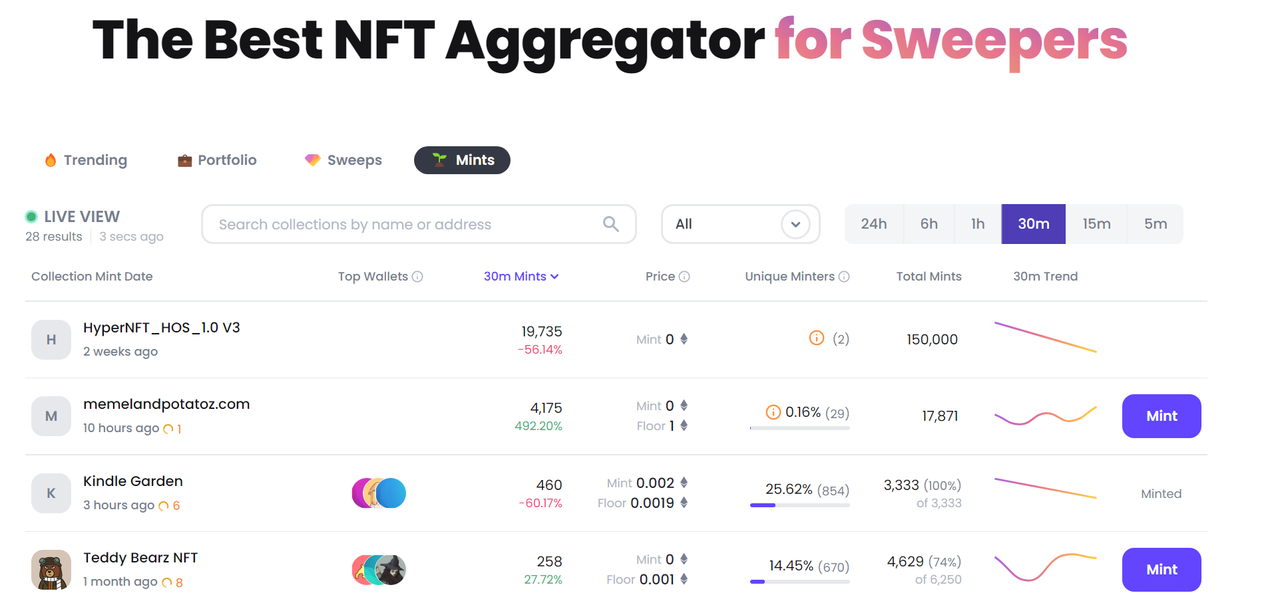

Along with Opensea's competitors came a new product, the NFT transaction aggregator. NFT transaction aggregators led by Gem and Genie quickly seized the entrance of NFT transactions with their nearly crushing front-end product experience.

Take Gem as an example to briefly introduce the transaction aggregator. Gem.xyz is an NFT exchange aggregator. Gem itself does not provide NFT pending orders and trading services. Gem integrates the pending orders of many NFT exchanges such as Opensea, Looksrare, and X2Y2. , Find a series of NFTs on Gem, it will show you all the series of NFT pending orders on different exchanges, and also has a shopping cart function, you can buy NFTs in batches to save Gas fees.

The reason why Gem became popular is very simple, because it is easy to use and very Crypto Native. You can feel that the product manager of Gem must be a senior player of NFT, because every iteration of their functions can hit the pain points of users.

This phenomenon is actually a manifestation of the gradual maturity of the industry. In the past two or three years, the core logic of the blockchain industry is whether users or investors can make money. Users do not care much about user experience. A product The quality of the currency is mostly linked to its currency price. The rise of products such as Gem means that Web3 users are paying more and more attention to user experience.

If we take a longer-term view, when products like Gem have accumulated a huge number of users, NFT exchanges such as Opensea, Looks, and X2Y2 may become a pure back-end product of Gem. One day in the future, You purchased an NFT or made a Token transaction on a popular front-end APP, and the underlying logic behind it may go through some NFT exchanges or DeFi protocols, but users don’t need to know it at all.

Long story short, back to NFT exchanges, it can be said that Looksrare and X2Y2 are now able to grab a piece of cake from Opensea. Gem has contributed a lot to these small exchanges. Gem provides a lot of traffic. As long as there is a pending order on a small exchange, and the price of the pending order has an advantage, it can be discovered and executed by traders. The traffic problem that plagued small exchanges seems to have been solved.

4. What is the core competitiveness of nft exchange

(1) Pending order volume (liquidity)

(1) Pending order volume (liquidity)

There is nothing new under the sun. In this era where everyone has Internet thinking, no one can ignore the importance of traffic. Here we decompose the flow of NFT exchanges into two parts: buyer flow and seller flow

1. Buyer traffic

Many people say that there is a new solution for Web3 traffic, such as the solution for NFT transactions, which is an aggregator. The emergence of aggregation platforms such as Gem has solved the problem of buyer traffic for small exchanges. It seems that the NFT trading platform does not need to consider whether anyone will buy NFT, because as long as the platform has NFT pending orders, the aggregators will put the pending orders on the shelves.

Aggregators seem to be the savior of small NFT exchanges. But do NFT exchanges really no longer need to have their own buyer traffic?

The premise of all this is that Gem can always remain neutral and not abuse its bargaining power after controlling the traffic. This is like the next step after Meituan and Ele.me have finished the price war and almost completely eaten the market share. Use your own bargaining power to collect returns from platform merchants. Capital is all about profit. If there is any exchange that thinks it can make money with the support of the aggregator’s traffic, then it must be the first exchange to be eliminated.

It can be said that the premise of the emergence of NFT trading aggregators is that there are multiple exchanges in the market, and the flow provided by aggregators is indispensable for small exchanges to gain a firm foothold in the market. The two are complementary. But once the initial honeymoon period is over, I believe that the next step must be the joint hunting of disobedient exchanges by aggregators. Not to mention, now the largest aggregator gem in the market has been acquired by Opensea. When your biggest traffic entrance is the younger brother of your biggest competitor, you'd better not expect that you can always rely on this product to maintain traffic.

2. Seller traffic

If buyers’ traffic can still rely on aggregators, then sellers’ traffic is the core competition point of NFT exchanges. After all, Gem and Genie don’t dare to do evil on a large scale. In theory, as long as there are enough reasonable prices to place orders, NFT’s The trading volume will not be bad.

Apparently, Looksrare recognized this day in time in April, and began to implement order placement incentives to attract NFT sellers to place orders on the platform. Although X2Y2 canceled the incentive for pending orders, it launched a 0% transaction fee incentive in April and maintained a 0.5% transaction fee in the following months. Here is a popular science, the transaction fee is usually charged to the seller. That is to say, usually the buyer does not care how much the transaction fee is, because the price he pays is the price he sees. Sellers are more sensitive to transaction fees. Therefore, whether it is incentives for placing orders or reducing transaction fees, it is a way of giving profits to sellers. The platform uses profit sharing to attract more users to place orders.

In addition to selling profits to sellers, actively promoting and cooperating with NFT project parties and keeping up with real-time hotspots are also important channels to accumulate seller traffic. From "Ganbai" some time ago to "Free Mint" now, hot spots in the NFT market are constantly emerging, and NFT speculators are constantly chasing hot spots in the market. If the exchange can actively cooperate with the project party, let the project party cooperate with the guidance, and let the NFT holders go to a specific exchange to place the order, if it encounters a hot money, it can play a big role in attracting traffic.

3. Buying and selling from the same source

(2) User experience (product iteration capability)

(2) User experience (product iteration capability)

Product experience is a very important moat in Web2, but in Web3 or in a narrower sense, the blockchain industry is not so valued. When I first used Curve, I thought I was back to the era when the village just connected to the Internet.

The last boom in the currency circle was DeFi. In that round of narrative, the quality of a project or product mainly depends on whether it can bring users money. If it can make money, it is a good project. Even if your front-end is as bad as Curve, you can’t No matter how good the front-end experience of a profitable project is, it is useless.

The emergence of products such as Gem indicates that the next round of Web3 narrative logic will return to the level of product experience, because no matter how good the protocol and the best underlying infrastructure construction, it must be implemented at the user level. Simply put, Someone needs to use it.

The competition situation in the next stage of the blockchain industry may be that some projects have worked hard to write contracts to make products, and then they will be replaced by an aggregation product with excellent user experience, beautiful front-end design, and strong product iteration capabilities. Cut off the largest piece from the cake. In fact, this has already begun to appear in the CVX nesting dolls some time ago.

From Crypto Kittiy to today, NFT has entered a stage of rapid development. Every day there are new hot spots, new narrative logic, and new demands are born. Since the development resources of the project party are limited, it is necessary for the project party to have a keen sense of smell to discover which are the long-term real needs, and consider the ROI behind each new function iteration, so that the product iteration capability can be transformed into a good one. Product user experience, this is the real moat of a project.

Still taking Gem as an example, under the upsurge of Free Mint, Gem has developed a ranking database of Mint data, and directly provides the function of one-click mint on Gem official website, which solves the pain point that users dare not mint NFT and collect data at will. This is only a small part of its recent updates, but you can see how a good product uses its own development capabilities to iterate the product. Opensea, which acquired Gem, also recently launched its own Seaport protocol, and updated the front-end page that has remained unchanged for thousands of years to launch several small functions that should have been there long ago. The first-mover advantage is of course crucial, but active product iterations in the right direction are the magic weapon for maintaining dominance.

(3) Social attributes

(3) Social attributes

Whoever can build the NFT community into the NFT exchange will have the biggest moat.

In fact, the social value of NFT has not been captured by NFT exchanges. The NFT community is mainly concentrated on Discord, and the announcement of the project party is mainly distributed through Twitter and Discord. The experience of NFT users is fragmented.

epilogue

epilogue

epilogue

One of the reasons for writing this article is that I think the future prospects of the NFT market are far more than that. At this point in time, we will feel that Opensea’s position is almost unshakable, but if the time is extended to three to five years, maybe Five years later, another batch of NFT exchanges competed in this market. Imagine the changes in the competitive landscape of exchanges in the currency circle in the past ten years. The one I mentioned above may not be just a horror story, so I tried to find some key points of the success of the exchange to verify my investment logic, but I always I feel almost meaningless.

Finally, all content in this article does not constitute investment advice, DYOR.