Web3 does have real use cases, but it's not perfect

Author | Packy McCormick (Not Boring Capital)

A few weeks ago, when I was on a podcast with Flatiron Health co-founder Zach Weinberg, we had an argument over whether crypto assets had real use cases. My conversation with Zach has always been on the back of my mind since then, and as it stands, there are real use cases for Web3 and cryptoassets, even if some seem silly, early or flawed.

secondary title

The market is collapsing and the crisis is looming

If you thought you were smart a few months ago, now that the crypto market crash is making you feel less smart again. If you were proud to tell people what you were investing in a few months ago, you are not so proud now. (And vice versa: If you’ve been thinking of crypto assets as a scam or a bubble, you should be feeling smart by now.)

Neither is wrong, as the market has undoubtedly changed. The price of BTC and ETH fell by 76% and 69% respectively, and the situation of altcoins was even worse than this.

While we can attribute the collapse of the crypto market to macro reasons (Fed rate tightening, wars, rampant inflation), no industry has actually been hit harder than cryptoassets and Web3. In addition to falling prices, the implosion of crypto assets has wiped out people's life savings. First up is LUNA and UST, as explained by my colleague Jon Wu:

I've seen tweets describing people putting their life savings into Terra to get 20% through the Anchor protocol, only to lose everything when UST crashed.

Recently, the centralized DeFi platform Celsius became insolvent...those who deposited money into Celsius wondered if they would be able to get their money back and if so, how much?

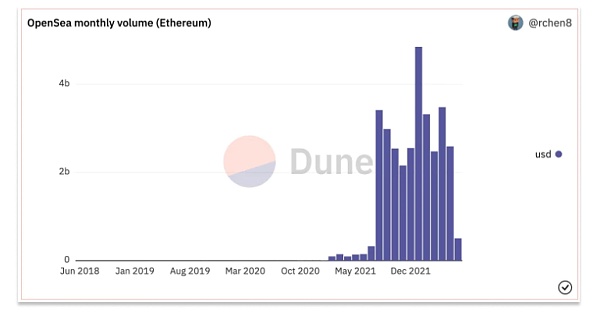

NFTs are also a lot less attractive in this early bear market. Trading volumes on OpenSea, the largest NFT marketplace, plummeted in June:

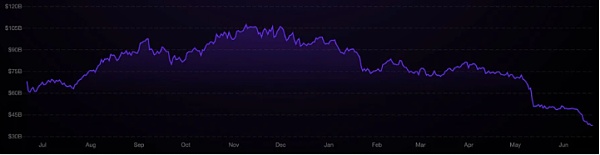

However, NFT is not alone. According to data from DeFiPulse, the total value locked (TVL) of DeFi as a whole has fallen by 65% from a peak of $107 billion in November to the current $37 billion.

More crises may be on the way...if ETH falls as much as the last crash, it could end up at $200 (not saying it will, but it's not impossible). More funds will go bankrupt, and more companies and projects will go bankrupt.

secondary title

Aggressive Hype Can Pull "Crypto Innovation Cycle"

Recently, Zach Weinberg summed up his position on Twitter:

Essentially, he argues that there is currently too much hype and risk in Web3 relative to the real use cases being created, making it especially problematic for ordinary people to invest in, and that VCs with tens of billions of dollars in funding are pouring in This field, but the money can actually be invested in better fields.

Regarding the second half of his point, I understand that money can be invested in other things more effectively - if VCs back entrepreneurs that address education, healthcare, energy, housing, infrastructure and other key industries, then That's great.

Leaving aside the second part for now, let's demonstrate what he said about the first part: hype and risk.

Hype is not unique to crypto assets.

Because of the ease with which people can invest in crypto projects, those who have already invested in projects have an incentive to try to convince others to invest in them, which is why Twitter is filled with rainbow graphs of xx tokens and comments on $100,000 BTC, $10,000 ETH, and $1 Confident predictions from DOGE.

At the same time, encrypted assets themselves are also a kind of technological innovation and financial innovation, so there is more hype than general new technologies, but this time, it brings financial risks.

On the one hand, this causes people to buy at the top and over-leverage. Emphasis: Never trade on margin if you don't know what you are doing, never invest more than you can lose, don't listen to other people's opinions, research stocks, encrypted assets or other by yourself.

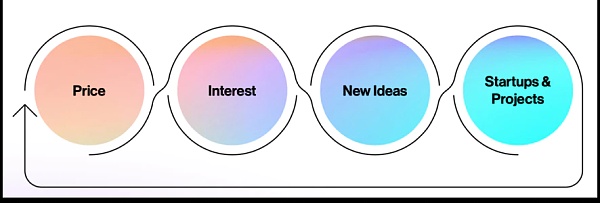

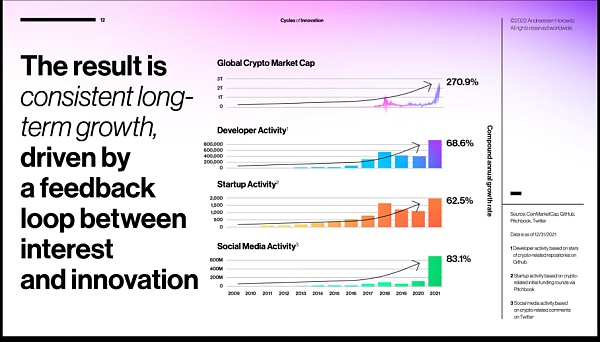

Active hype, on the other hand, can be productive, spurring faster iteration and innovation. In the State of Crypto Report, research by a16z Crypto shows that cyclical price increases lead to interest in the space, which attracts new entrepreneurs to create new startups and projects, driving the next cycle.

They call it the "crypto price-innovation cycle." In each cycle, even after the price drops, more developers and startups remain in the crypto ecosystem than return to the industry before the cycle started.

These entrepreneurs build better infrastructure and novel applications, and turn potential use cases into real use cases.

secondary title

Use Cases for Web3

Not surprisingly, today's Web3 startups look silly or overhyped.

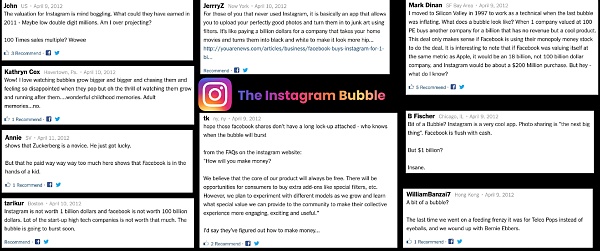

When Facebook bought Instagram for $1 billion in 2012, some people thought it was crazy, that there was a lot of bubbles in there.

But a decade later, when Acquired ranked the 10 best acquisitions of all time, Facebook's Instagram deal was No. 1 on the list. They calculate that Instagram currently contributes $153 billion to Facebook's market cap. That's more than VCs have invested in Web3 startups combined.

For Instagram, Facebook, Snap or other Web2 social media, their model is basically to get a large number of users first, and then find a way to make money (advertising), and even Google has applied this "script".

Web3 startups, on the other hand, take the opposite approach: first have a lot of money, and then, hopefully, a lot of users. Just as it is uncertain whether companies in the Web2 era can transition from "attracting users' attention" to "making money", it is also uncertain whether today's Web3 startups can transition from "making money" to "attracting users' attention".

This is the trade-off that Web3 projects make today: financialization versus user experience.

Many of today's Web3 projects rely too much on financialized leverage - partly because it's an easier way to make money; partly because it's important; partly because it's early days and good user experience takes time; partly The reason is that the infrastructure is still being developed - but that doesn't mean there aren't any use cases today.

We'll start with the most immediate use case: understanding at face value what's going on without further extrapolation.

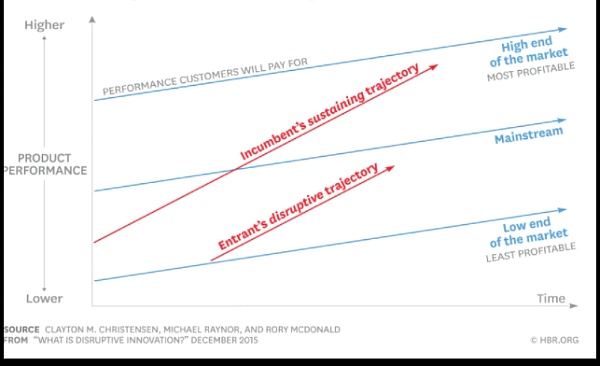

In many respects, new Web3 offerings are worse than Web2's existing counterparts for some users, but for overserved or neglected market segments, new entrants' offerings are "good enough" to prove disruptive Sexual companies will find a foothold among a small group of overserved and neglected users, and then expand their market share.

Disruptive products often look like a toy at first, and it’s easy to point out their shortcomings, but those shortcomings are often fixable, and the magic is that they can find something better for some users than existing options.

Today, most popular Web3 products are in their early stages. They're not perfect, but "good enough" for certain groups of users. More focused, more powerful, and more secure Web2 products that can do a lot of what Web3 products do, but don't meet the needs of this group very well. As a result, Web3 products have found a foothold in this group.

NFT

NFT is a good example, simply put, in addition to digital properties such as programmability and composability, NFT also has physical properties that make it unique, ownable and tradable. Over time, the use cases for NFTs will be broader, not just for collectibles, but for music, movies, and more, but even today, the use cases for NFTs for collectibles are real.

In the first part of this article, I showed a picture: On OpenSea alone, 1.8 million accounts purchased $31.9 billion worth of Ethereum-based NFTs, $31.3 billion of which occurred in the last year.

Of the 1.8 million accounts, does anyone have multiple accounts? certainly. Is there volume wash trading? certainly. Is a large part of it speculative? certainly.

But there are already some fascinating models emerging in the NFT space.

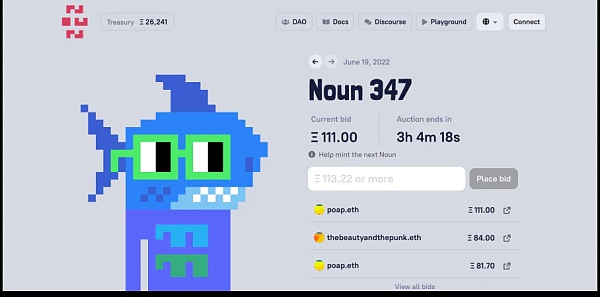

As an example, Nouns describes itself as "an experimental attempt to improve on-chain avatars" and "bootstrapping the identity of the community, governance, and community-accessible treasury." For the past 347 days, one Nouns NFT has been auctioned every day, and anyone in the world with enough ETH can participate in the bidding.

The ETH of each sale will enter the Nouns DAO treasury, and all Nouns NFT holders become members of the DAO, and each holder can vote on how to distribute the ever-growing treasury (currently 26,568 ETH, about $29.86 million) ——Each Nouns NFT can cast one vote. It is worth mentioning that Nouns DAO has voted to allocate assets to: send 3D printed Nouns Logo to the International Space Station, produce Nouns brand luxury sunglasses and promote them to the market, donate 100 ETH to UNICEF for humanitarian aid, etc. .

You may think that NFT is the stupidest thing in the world, but it's hard to say that the annual transaction volume of 31.3 billion US dollars does not mean that it does not satisfy some people's real uses.

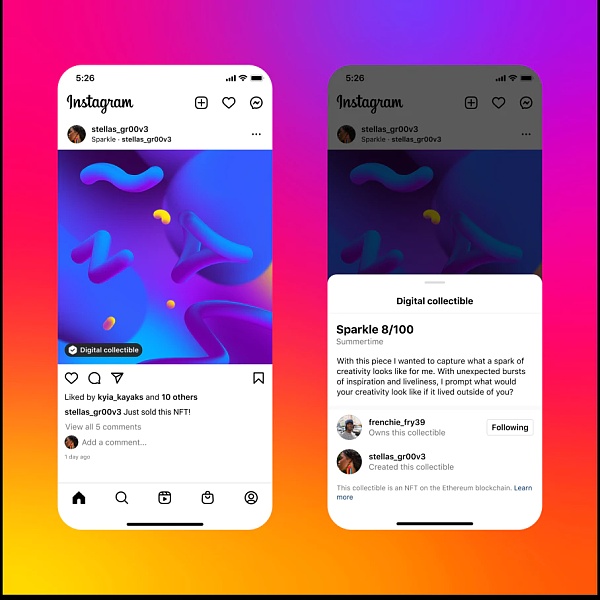

Instagram announced in May that it had started testing for creators and collectors to display their NFTs.

NFTs are still a very young technology, but they have already generated huge sales and inspired a lot of creativity, not only in terms of art, but also in technology itself.

DeFi

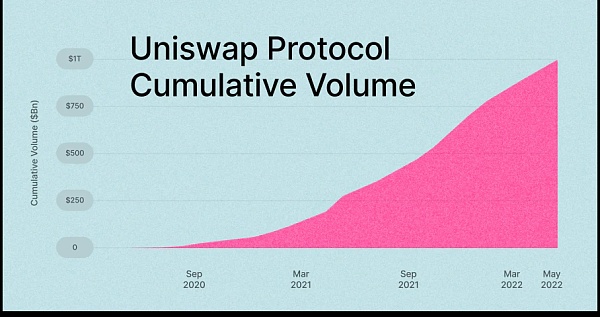

Decentralized exchanges (DEX) like Uniswap are also real use cases today, DEX can create liquidity for any number of token pairs, users trade without intermediaries, which was not possible before.

Uniswap is currently the largest DEX where anyone can trade any pair of tokens to each other permissionlessly without going through an intermediary or going through a central order book. There's only code and incentives behind it all, and it's running at scale right now.

On May 24th, Uniswap announced that it had surpassed $1 trillion in transaction volume in just three years (although they didn't need to announce, all of this data is available on-chain).

Surprisingly, it was done by a team of about 50 people from Uniswap Labs, the company that created the protocol (Robinhood employs about 3,800 people), and is co-managed by UNI token holders. It can be said that Uniswap itself is the infrastructure, which means that others can use fewer resources to build on it without permission.

Uniswap can be described as the Hyperstructure (superstructure) proposed by Jacob Horne, the co-founder of Zora:

- Take the form of a protocol running on the blockchain.

- Unstoppable: The protocol cannot be blocked by anyone. It will run as long as the underlying blockchain exists.

- Free: 0% protocol-wide fees and run entirely at Gas cost.

- Scalability: There are built-in incentives for participants in the protocol.

- Permissionless: Universally accessible and censorship resistant. Builders and users cannot be deplatformed.

- Positive sum: Creates a win-win environment for participants to utilize the same infrastructure.

- Trusted: the protocol has nothing to do with the user.

As it stands, DeFi protocols are real use cases.

Protocols like Compound, Aave, and Maker allow people to lend or borrow their crypto assets. While more centralized DeFi products like Celsius have collapsed, these protocols have held up well through the downturn. Loans are overcollateralized, and the protocol liquidates borrowers when collateral falls as prices fall. Of course, in reality, we can beg lenders for a month's grace, and we will indeed feel more comfortable, but for some users who cannot borrow, these agreements provide a real service. Compound, Aave, and Maker currently have around $15 billion locked in crypto assets combined, even after the massive market drop.

Astute observers might point out that DeFi is "financing without any economic value." It depends on your definition of economic value, but if you understand it as "real world assets", Goldfinch is "a decentralized credit protocol that provides encrypted loans to real businesses". To date, more than 200,000 borrowers have received credit in "India, Mexico, Southeast Asia, and more," helping to address a very real credit gap in developing countries.

Let's move on to crypto startups that look like traditional Internet businesses.

Braintrust is a real use case. Braintrust is a decentralized job marketplace network that connects highly skilled technicians with jobs at companies like Nike, NASA, and Porsche. The average salary value on the network is $77,630 for 217 days.

Currently, most recruitment on the network is done in local currency, but participants in the Braintrust ecosystem, including talent, customers, can earn BTRST tokens by doing things that are beneficial to the network, such as screening applicants or recommending candidates . Talents may stake BTRST on a job vacancy to prove their seriousness and increase their chances of being hired, while customers may stake BTRST to increase the visibility of their job listings to attract more talents, which gives BTRST a real value.

All of this gives Braintrust a small but meaningful advantage over the larger talent acquisition players, but most importantly, in the long run, user ownership means that Braintrust doesn't end up building network effects and then charging more , because to do this, users would have to vote to charge themselves higher fees.

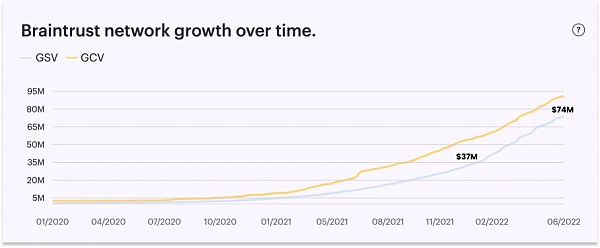

Braintrust is currently under further development. In January of this year, Braintrust facilitated $37 million in Gross Service Value (GSV). Five months later, its GSV had doubled to $74.4 million.

Similarly, other startups are building user-owned networks for physical world products, such as Helium, a distributed wireless network for Internet of Things devices, with 5G coming soon. It was launched in 2013 as a long-range point-to-point wireless network, but failed to gain adoption. By introducing $HNT tokens, hotspot owners earn that token every time their hotspot is used on the network, providing a strong enough incentive for people to install devices. Today, there are 867,190 hotspots in the network and HNT has a market cap of $1.25 billion.

Likewise, DIMO is building a "driver network" where drivers can collect and share vehicle data to help DIMO learn more about their vehicles, save money and build better mobile applications. For example, instead of buying auto insurance and plugging in the insurer's car-tracking device, a driver could plug in a DIMO device, share their data, and let insurers bid on their coverage. Ultimately, DIMO aims to be a public good that makes it easier for developers to build applications for any vehicle.

Or take stablecoins, the simplest use case. In the case of cross-border remittances, while many people would feel more comfortable doing cross-border remittances through a bank that can reverse the error, some people can obviously use stablecoins for convenience and send a small amount before sending the entire fund. Test transaction. Fintech is a very large, very real industry, and stablecoins are also a way to reduce the cost of sending money.

There are currently $155 billion in stablecoins in circulation.

There are many more use cases. A few days ago, Vibe Bio launched DAO-funded treatments for rare diseases. By creating a DAO, it funds research and drug development for rare diseases that clearly have smaller markets than blockbuster drugs that are more profitable. According to Vibe, "the biggest obstacle to treating patients with neglected diseases is not finding potential treatments—it's getting them funded." Gu's treatment is funded to test the drug by bringing together trial participants, which, if successful, can open up the market.

Cheap loans (Compound, Aave, Maker), decentralized storage (Filecoin's current storage cost is 0.0011% of S3), Braintrust, a user-owned decentralized talent recruitment market, and Lab DAO, Radicle, Helium, Toucan, etc. , from finding lab space to trading carbon credits to creating a “decentralized canonical knowledge graph,” these products have real users today.

To be fair though, the number of people involved in Web3 is still relatively small - only about 30 million Metamask wallets. Many of the Web3 use cases aimed at "attracting the next billion users", from GameFi, P2E to Web3 social media, do feel crudely crafted. From Axie Infinity to Stepn to Bitclout, the first attempts to build Web3 versions of games and social products to attract millions of "normal" users gained early traction, largely due to the financial aspects of the products. In terms of user experience, they still have a long way to go.

Now we are ending a cycle and entering a bear market. Better infrastructure is being developed. Many Web2 entrepreneurs and AAA game developers have recently entered the field of Web3 and encrypted assets.

I think that when we start to see the fruits of these new forces, the next cycle will begin: when Web3 projects start to make user experience a top priority, while retaining the unique strengths of their early successes.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.