How did the DeFi protocols perform under this round of stress testing?

Recently, the prices of Bitcoin and Ethereum have continued to fall, hitting new lows in the past year. The entire encryption market has been affected, and DeFi is hardly immune to it. The data shows that the total amount of locked positions on the chain has halved from $163.5 billion in early May to the current $81.8 billion.

secondary title

DeFi lending, liquidation disabled

The market is going down, and DeFi lending is the first to face liquidation.Some DeFi protocols have also exposed several problems that cannot be ignored in the recent liquidation, which deserves special attention:

One is the failure of the oracle machine, which caused the liquidation to fail to proceed normally.Processes such as liquidation rely on on-chain oracles for accurate quotations. During the LUNA crash on May 12, the minimum accuracy of LUNA triggered the built-in circuit breaker mechanism of Chainlink, and the price feed was suspended, but the lending agreement Venus failed to respond to the liquidation in time, resulting in a loss of more than 14 million US dollars.

Coincidentally, half a month later, the same oracle quote bug reappeared. On May 30, the new Terra chain was launched, and the oracle machine on Anchor, the largest lending agreement on the Terra chain, misreported the price of LUNC (Luna Classic) as $5 (Note: The price of LUNC is $0.00001, and the price of LUNA is $5 U.S. dollars); users of the platform took advantage of quotation loopholes to successfully arbitrage. Fortunately, the team responded in a timely manner, and finally lost only 800,000 U.S. dollars.

In any case, the bloody lessons have also reminded DeFi protocols: choosing multiple oracles as quotation sources can more effectively avoid single points of failure.

Second, there were flaws in the design of the liquidation procedure itself, which failed to respond in a timely manner.Also during the crash period of Terra, the issuer of the algorithmic stablecoin MIM (Abracadabra) also incurred bad debts of US$12 million. Not enough speed.

The liquidation procedure is an important part of the early design of the DeFi lending agreement. For example, when liquidating, do you choose to process the collateral through an off-site auction, or are you throwing it directly into the market? If you choose the market, should you choose DEX or CEX, which platform or platforms should you choose?

For example, in the early days of MakerDAO, some liquidated assets were auctioned at a discounted price, but currently most DeFi lending agreements choose to be liquidated directly through DEX. Looking back at the summary, I found that Abracadabra did not make a preset plan at the beginning, because it did not expect the possibility of UST's substantial de-anchoring.

The third is that the collateral has poor liquidity and high volatility, which is more likely to aggravate bad debts.Of course, it should be noted that the speed of liquidation is not only related to the design of the product itself, but may be directly linked to the "quality" of the collateral. For example, some altcoins are highly volatile, falling by 20% at every turn, and their liquidity is not good. In a unilateral downward trend in the market, their liquidation is more difficult; Faced with a run on, resulting in a serious discount, the current conversion ratio of stETH to ETH on Curve is currently 1:0.9368.

In fact, the leading DeFi lending projects have established a set of strict collateral screening standards. Taking Compound as an example, it accepts a total of 20 types of collateral, 7 of which are stablecoins, and three of the top five (USDC, ETH, WBTC, DAI, USDT) in terms of collateral lock-up volume are stablecoins. Both liquidity and stability have been tested for a long time, and the risks are controllable.

Even if there are certain preparations and plans, it does not mean that the loan agreement can reduce or avoid liquidation. Liquidation is a routine operation of DeFi lending, and leading projects are no exception.

secondary title

"Credit Loan" is difficult to repay, and is about to face a crisis?

At present, the most important form of DeFi lending is over-collateralization, that is, borrowers who want to obtain $100 in DAI need to invest $150 (for example) in ETH or other cryptocurrencies as collateral, but there are also some products that are trying to under-collateralize Loans to improve capital efficiency, the so-called "credit loan" or "credit combined mortgage".

Different from AAVE’s “Flash Loan”, TrueFi, Maple and other platforms adopt a review system for unsecured credit loans, and only open loan applications for borrowers who have passed the review, and they are basically service institution users. For example, TrueFi launched the first single borrower pool for Alameda Research in March this year, providing it with up to $750 million in working capital; in April, it launched a single borrower pool for Blockchain.com, providing up to $100 million in liquidity.

However, in recent days, short-term payment of credit loans has been difficult.On June 21, Maple announced that there may be liquidity problems in the fund pool this week, and lenders (Lenders) may not be able to withdraw funds, and must wait for borrowers (Borrowers) to repay in the next few weeks before withdrawing cash.

All of a sudden, rumors spread, and the market believed that Maple might be implicated by Celsius and Three Arrows Capital, leading to a break in the capital chain. In response, the official response stated that Celsius and Three Arrows Capital had never borrowed through Maple. However, the platform admitted that Babel Finance had a loan position of 10 million USDC in the USDC pool of the Canadian hedge fund Orthogonal Trading on the platform; since Babel stopped withdrawing, Orthogonal has been in touch with Babel management and focused on protecting the lender's Benefit.

In addition to Maple, there is indeed Sanjian Capital among the customers of another platform, TrueFi. According to the data, on May 21 this year, Three Arrows borrowed USD 2 million from TrueFi, and the loan is expected to be repaid in August. However, considering the current difficulties faced by Sanjian, this loan may eventually become a bad debt.

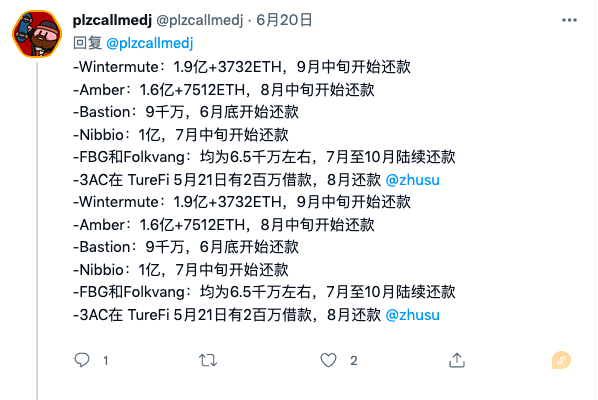

In addition, according to the statistics of Twitter user @plzcallmedj, Alameda, Wintermute, Amber, Nibbio, FBG, Folkvang and other institutions will concentrate on July and August. "Personally, I think the risk is very high. These companies that advertise hundreds of millions/billions are all borrowing tens of millions or hundreds of millions of short-term loans with an annualized rate of close to 10%, while mortgage loans only need 2%-3 % interest rate, indicating that most of these institutions are very tight. And TrueFi has 3AC bad debts, it is destined to be a thunderstorm, it is only a matter of time."

As the Three Arrows incident fermented, more organizations stood up and spoke out, trying to disentangle the relationship. Clearpool, a decentralized lending platform, removed the borrower pool of TPS Capital under Three Arrows, and claimed that there was no loss of funds; Nexo, an encrypted lending platform, tweeted that it rejected Three Arrows Capital’s unsecured credit request two years ago exposure is zero.

secondary title

DEX: Price unanchored, removal of impermanence loss protection

In the past period of time, the liquidity problem of decentralized exchanges has also attracted much attention.

The first is Uniswap. As the largest DEX at present, its cumulative trading volume has already exceeded 1 trillion US dollars (May 24), but it still faces the problem of short-term insufficient liquidity. On June 13, as MakerDAO liquidated ETH, a large amount of ETH flowed to Uniswap, causing the price to crash below $1,000. At that time, the fair price was $1,350, and the slippage was as high as 25%.

Fortunately, the ETH price on Uniswap quickly recovered and returned to a fair price. But if we observe other ecological agreements, we will find a hidden problem: the TVL of the largest DEX in the ecology is far lower than the TVL of the largest lending agreement. Especially in the Solana ecosystem, the TVL of Solend in its largest lending agreement was once more than twice that of Serum. When the market goes down, when Solend liquidates SOL collateral in Serum and other DEXs, it may directly drain the liquidity on the chain, causing the price of SOL to be greatly suppressed, which in turn triggers the liquidation of other accounts. This is also the core reason why Solend recently proposed a takeover proposal.

In addition, as the market goes down, the impermanent loss in DEX will also expand, and the handling fee earned by LP may not be able to make up for the loss at all, further reducing the enthusiasm for liquidity provision.

Regarding impermanence loss, Bancor has previously launched special features in V3"Impermanence Loss Protection"Liquidity providers who meet the above conditions can obtain Bancor's 100% impermanence loss insurance at the same time when withdrawing liquidity, but Bancor has recently suspended this mechanism. The fundamental reason is that the market is going down. If LP withdraws from Bancor at this time, it will need to pay sky-high insurance premiums, and it will also lead to a decrease in Bancor's liquidity, which it does not want to see.

Summarize

Summarize

Every extreme market is a big test for the DeFi protocol.

In general, the mature leading projects can submit satisfactory answers under this round of stress tests, while new projects have more or less exposed some problems, which will be the only way for them to mature. Back then, MakerDAO also generated $4 million in bad debts during the "312" crash, but it eventually got out of the shadow of failure and grew into today's "DeFi central bank."

Under the test of extreme market conditions, decentralized governance has also become a hot topic. We have seen discussions on "procedural justice" and "result justice" (click to read"DeFi Moral Paradox" Behind the Solend Farce). In this regard, the leaders of the DeFi protocol have already given the answer: since they advocate "Code is Law", they should act according to the rules, and the liquidation should be liquidated; all governance should be carried out according to the process, and even if the situation is urgent, enough time should be left for voting vote.