Web3 Lawyer's Interpretation: New Regulations from 8 Departments Take Effect, RWA Regulatory Path Officially Clarified

- Core Viewpoint: The "Document No. 42" jointly issued by eight Chinese departments is the most comprehensive and precise regulatory document on virtual currency, stablecoins, and real-world asset (RWA) tokenization to date. It marks an expansion of the regulatory scope from virtual currency trading to the entire chain of "virtual currency + RWA + stablecoins," and establishes a clear dual-track regulatory responsibility system and strict cross-border business rules.

- Key Elements:

- Significant Expansion of Regulatory Scope: For the first time, it explicitly brings RWA and stablecoins into the core regulatory framework, clearly defining RWA as activities that use cryptographic technology to convert asset rights into tokens for trading.

- Establishment of a Dual-Lead Regulatory Mechanism: Virtual currency regulation is led by the central bank, while RWA regulation is explicitly led by the China Securities Regulatory Commission (CSRC), addressing the previous difficulty in multi-departmental coordination and implementation.

- Clarification of the Prohibition on Domestic RWA Business: It stipulates that conducting RWA activities within China constitutes suspected illegal financial activities and should be prohibited, unless approved by the competent business authority and carried out relying on specific financial infrastructure.

- Strengthening of Cross-Border Business Supervision: It sets strict prohibitions or a "same business, same risk, same rules" principle of look-through supervision for behaviors such as domestic entities issuing tokens overseas or conducting RWA financing based on domestic assets.

- Reinforcement of Responsibilities for Financial Institutions and Intermediaries: It requires overseas branches of domestic financial institutions to prudently conduct RWA business and incorporate it into the head office's risk control system. It also formally brings intermediaries providing cross-border services into the scope of regulatory reporting.

- Extension of Civil Liability Clauses to Cover RWA: It explicitly defines investments in "real-world asset tokens and related financial products" that violate public order and good morals as invalid civil legal acts, with investor rights not protected by law.

- CSRC Simultaneously Issues Supporting Guidelines: For the overseas issuance of asset-backed security tokens based on domestic assets, it clarifies the filing process, negative list, and ongoing supervision requirements, preserving a limited window for compliant business.

The People's Bank of China and seven other ministries and commissions jointly issued regulatory provisions related to virtual currencies and real-world asset (RWA) tokenization: Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, National Financial Regulatory Administration, China Securities Regulatory Commission, and State Administration of Foreign Exchange on Further Preventing and Disposing of Risks Related to Virtual Currencies and Other Activities (Yin Fa [2026] No. 42) (hereinafter referred to as "Document No. 42").

Previously, rumors had circulated within the industry about the impending new regulations. After the official document was released, its content was found to be comprehensive. After reading it, ShaLv felt that the previous compliance explorations in the RWA field were almost entirely addressed in the documents issued by the eight departments and the CSRC.

Let's take a quick read:

1. The Nature of Document No. 42

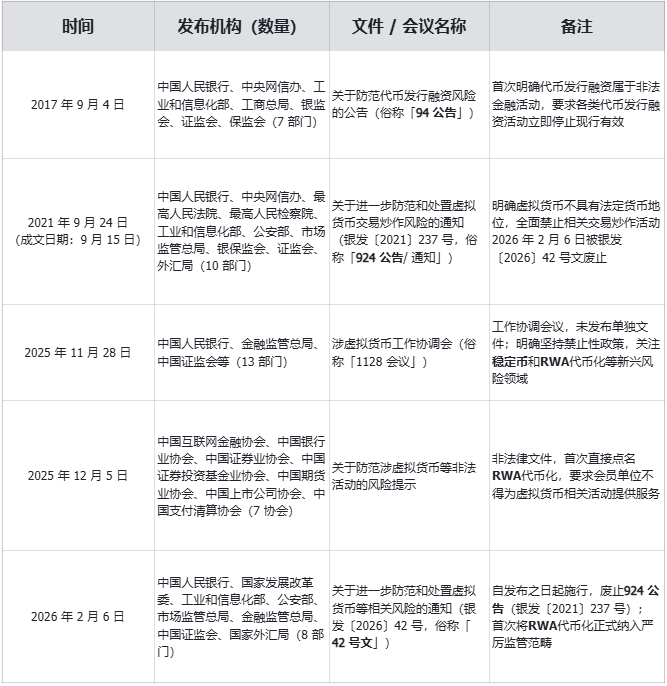

In 2017 and 2021, regulators successively issued the "94 Announcement" and the "924 Announcement." Since then, there has been a long period without the introduction of a complete legal document in this field. The inter-ministerial coordination meeting of thirteen departments at the end of 2025 and the risk warnings issued by seven associations do not constitute formal upgrades to legal documents. The following is a comparison of the nature of five core related documents:

Core Conclusion: Document No. 42 is currently the most precise and comprehensive legal normative document in the field of virtual currency-related business. The "924 Announcement" has been formally repealed upon its implementation.

2. Core Differences Between Document No. 42 and Previous Virtual Currency Regulatory Documents

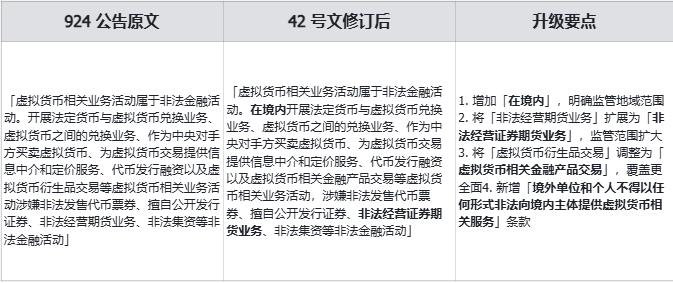

(1) Comprehensive Expansion of Regulatory Scope

- Addition of Core Regulatory Targets: For the first time, real-world asset tokenization (RWA) and stablecoins have been included as core regulatory targets. The regulatory dimension has expanded from mere virtual currency trading and speculation to a trinity of "virtual currency + RWA + stablecoins," enabling full-chain supervision.

- Refined Stablecoin Regulation: Clearly states that "stablecoins pegged to fiat currency partially perform the functions of fiat currency in circulation and use." Prohibits "any domestic or foreign entity or individual from issuing stablecoins pegged to the RMB overseas without the lawful and regulatory approval of relevant departments."

- Clear Definition of RWA: Defines it as "activities that use encryption technology and distributed ledger or similar technology to convert asset ownership, income rights, etc., into tokens or other equity or debt certificates with token characteristics, and conduct issuance and trading activities."

(2) Elevated Issuing Authority and Legal Effect

Document No. 42 was jointly issued by eight departments including the PBOC and the NDRC. It also reached consensus with three other departments: the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and was approved by the State Council. Its issuing level and legal effect are significantly higher than previous documents.

(3) Updated and Improved Legal Basis

Adds higher-level legal bases such as the "Futures and Derivatives Law of the People's Republic of China," the "Securities Investment Fund Law of the People's Republic of China," and the "Regulations of the People's Republic of China on the Administration of the Renminbi," providing more comprehensive legal support. Simultaneously, removes some documents referenced in the 924 Announcement, such as the "Regulations on the Administration of Futures Trading" and the "State Council Decision on Rectifying Various Trading Venues to Effectively Prevent Financial Risks," making legal application more precise.

(4) Precise Upgrade in the Characterization of Virtual Currencies

(5) New Definitions for RWA and Stablecoins

Document No. 42 adds specific clauses defining the nature of RWA: "Within China, conducting real-world asset tokenization activities, as well as providing related intermediary and information technology services, etc., are suspected of illegal financial activities such as illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, and illegal fundraising, and shall be prohibited; except for related business activities carried out relying on specific financial infrastructure with the lawful and regulatory approval of the competent business authorities."

Simultaneously clarifies the ban on RWA services from overseas: "Overseas entities and individuals shall not provide real-world asset tokenization-related services to domestic entities in any form illegally."

Core Conclusion: Based on the above clauses, it is clear that:

1. RWA project located in China, service provider in China — Illegal

2. RWA project located in China, service provider overseas — Illegal

3. NFT projects of a similar nature, suspected of illegal issuance of token vouchers — Illegal

4. RWA project located overseas, suspected of illegal fundraising within China — Illegal

(6) Refined Division of Regulatory Responsibilities, from Multi-department Coordination to Dual-track Supervision

The 924 Announcement only established a multi-department coordination mechanism: "The People's Bank of China, together with the Cyberspace Administration of China, the Supreme People's Court, the Supreme People's Procuratorate, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange, shall establish a work coordination mechanism."

Document No. 42 innovatively implements a dual-lead system, clearly dividing regulatory responsibilities into two lines:

1. Virtual Currency Regulation: "The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the National Financial Regulatory Administration, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, shall improve the work mechanism."

2. RWA Regulation: "The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the National Financial Regulatory Administration, the State Administration of Foreign Exchange, and other departments, shall improve the work mechanism."

Core Conclusion:

1. The previous problem of ineffective multi-department coordination is addressed, as the clear higher-level laws and accountability mechanisms leave no room for buck-passing or negligence.

2. Market entities intending to explore related businesses can clearly understand the government's power list and scope of responsibilities, reducing business misjudgments.

(7) Strengthened Local Departmental Accountability

Building upon the 924 Announcement, Document No. 42 adds: "Specifically led by local financial management departments, with participation from branches and dispatched offices of the State Council's financial management departments, as well as telecommunications authorities, public security, market regulation, and other departments, coordinating with cyberspace departments, people's courts, and people's procuratorates." This clarifies the lead department and collaboration mechanism at the local implementation level, further solidifying local regulatory responsibility.

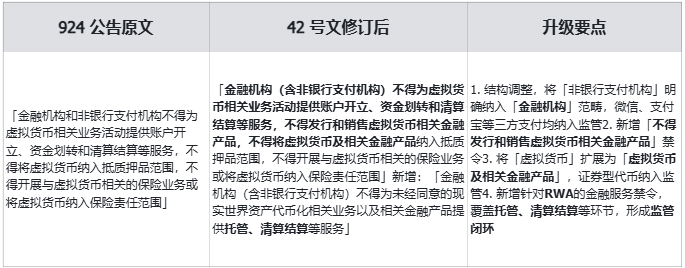

(8) Strengthened Management of Financial Institutions

(9) Expanded Regulation of Intermediary and Technology Service Providers

The regulatory scope of the 924 Announcement was limited to virtual currency-related services. Document No. 42 adds: "Relevant intermediary institutions and information technology service institutions shall not provide intermediary, technical, or other services for real-world asset tokenization-related businesses and related financial products that have not been approved," formally extending the regulatory scope to intermediary and technology service providers in the RWA field.

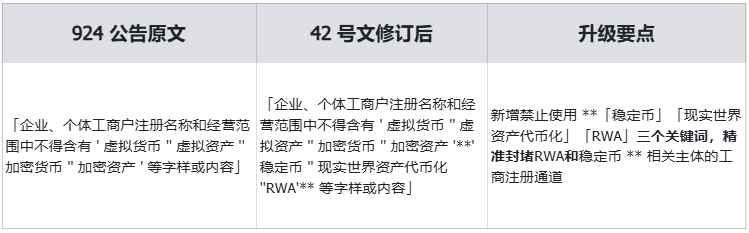

(10) Tightened Registration and Management of Market Entities

(11) Enhanced Crackdown on Mining

The 924 Announcement only mentioned "achieving full-chain tracking and full-time information backup for virtual currency 'mining,' trading, and exchange." Document No. 42 separately lists Article 9 with detailed provisions, clearly stating "strictly prohibit 'mining machine' manufacturers from providing services such as 'mining machine' sales within China," cutting off the mining industry chain at its source. Compared to the monitoring requirements of the 924 Announcement, the new regulations are stricter, more enforceable, and clarify the handling mechanisms for relevant departments after receiving leads.

(12) Innovative Regulation of Overseas Issuance

Document No. 42, considering new developments in the overseas crypto field, adds dual prohibitions on overseas issuance for cross-border business:

1. Without lawful and regulatory approval from relevant departments, domestic entities and their controlled overseas entities shall not issue virtual currencies overseas.

2. Regarding RWA: "Domestic entities directly or indirectly going overseas to conduct real-world asset tokenization business in the form of external debt, or conducting asset-backed securitization-like or equity-like real-world asset tokenization business overseas based on domestic asset ownership, income rights, etc., shall be strictly supervised by relevant departments such as the National Development and Reform Commission, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange according to their respective duties and in accordance with laws and regulations, following the principle of 'same business, same risk, same rules.'"

Core Conclusion: Based on the above clauses, it is clear that:

1. Overseas token issuance of the non-RWA type without underlying assets — Illegal

2. Security tokenization behavior similar to external debt, equity, or ABS — Legal under strict supervision

3. Regulatory principle for legal RWA — Refer to securities business: "same business, same risk, same rules"

(13) Strengthened Supervision and Accountability for Overseas Business of Domestic Financial Institutions

Document No. 42 adds: "Overseas subsidiaries and branches of domestic financial institutions providing real-world asset tokenization-related services overseas shall act lawfully, prudently, and steadily, equipped with professional personnel and systems, effectively prevent business risks, strictly implement requirements such as customer due diligence, suitability management, and anti-money laundering, and incorporate them into the compliance and risk control management system of the domestic financial institution," achieving a look-through supervision of cross-border business.

Core Conclusion: Based on the above clauses, it is clear that:

1. Overseas branches of domestic financial institutions (subsidiaries, branches, etc.) can conduct tokenization-related business.

2. Overseas branches conducting tokenization business must comply with both local laws and Chinese regulatory requirements, fulfilling highly prudent, anti-money laundering, and other legal obligations.

3. Business information and data of overseas branches must be fully incorporated into the compliance and risk control system of the domestic financial institution.

(14) Regulatory Coverage of Cross-border Services by Intermediary Institutions

Document No. 42 adds: "Intermediary institutions and information technology service institutions that provide services for domestic entities directly or indirectly going overseas to conduct real-world asset tokenization business in the form of external debt, or conducting real-world asset tokenization-related business overseas based on domestic rights and interests, shall strictly comply with laws and regulations, and in accordance with relevant normative requirements, establish and improve relevant compliance and internal control systems, strengthen business and risk management and control, and report or file the relevant business development situation with relevant management departments for approval or filing," formally bringing cross-border service intermediary institutions into the regulatory scope.

Core Conclusion: Based on the above clauses, it is clear that:

1. Intermediary institutions such as law firms and technology companies can provide tokenization-related services within a controlled regulatory scope.

2. Intermediary institutions conducting tokenization business must have sound risk control and internal control systems, and their business development must be reported or filed with regulatory departments for approval or filing.

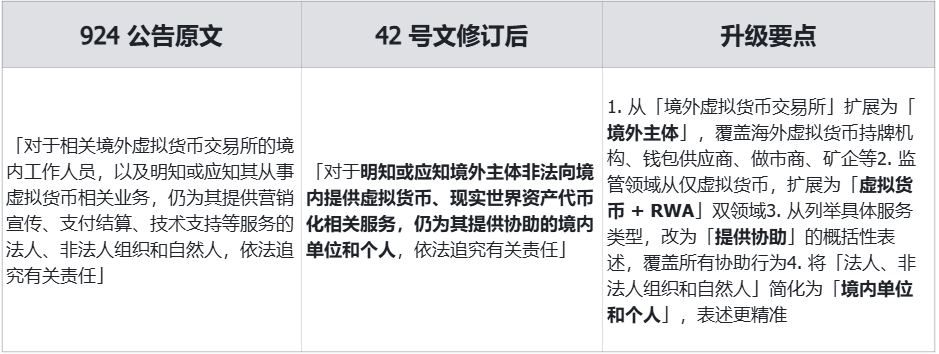

(15) Expanded Scope of Legal Liability Subjects

(16) Optimized Civil Liability Clauses

The 924 Announcement stipulated: "Any legal person, unincorporated organization, or natural person investing in virtual currencies and related derivatives, if it violates public order and good customs, the related civil legal act is invalid." Document No. 42 revises this to: "Any entity or individual investing in virtual currencies, real-world asset tokens, and related financial products, if it violates public order and good customs, the related civil legal act is invalid," expanding the investment targets from "virtual currencies and related derivatives" to "virtual currencies, real-world asset tokens, and related financial products," achieving more comprehensive regulatory coverage.

Core Conclusion: Various pyramid schemes soliciting funds from domestic investors in the name of RWA will not have their investment rights and interests protected by law.

3. Current Status and Future Direction of RWA Business

The concept and projects of RWA first emerged overseas, similar to the early STO concept but with broader imagination, dubbed "everything can be RWA" within the industry. Domestic discussions about RWA gradually heated up starting in 2024, reaching a peak in volume from June to August 2025. This trend is closely related to the entry of major domestic institutions like Ant Group, JD.com, and Guotai Junan, as well as the upgrading of crypto regulation, the introduction of stablecoin regulations, and the continuous issuance of licenses in regions like the United States and Hong Kong.

Current Mainstream RWA Projects and Underlying Assets

1. Emerging operating cash flow assets such as new energy and computing power

2. Traditional operating assets such as commercial leases

3. Consumer goods projects for cultural IP value-added

4. Physical assets such as real estate, antiques, artworks, and minerals

5. Other types of assets

Mainstream RWA Financing Solutions for Practitioners

1. In countries and regions with clear regulatory provisions, conduct security token offerings (STOs) for the above-mentioned types 1 and 2 assets — completely legal, but with the highest regulatory requirements and operational costs.

2. Issue on domestic platforms such as cultural asset exchanges, digital asset exchanges, and property rights exchanges for the above-mentioned type 3 assets and NFTs — lower regulatory requirements, not explicitly defined as illegal.

3. Issue token projects lacking cash flow support for the above-mentioned types 4 and 5 assets on overseas centralized and decentralized exchanges — seemingly have underlying assets, but are actually high-risk behaviors involving recruitment, speculation, fundraising, and market manipulation, not yet precisely defined in legal texts.

Due to significant differences in underlying asset characteristics, fundraising targets, operational standardization, and project team values, there are numerous gray-area operations in the RWA field. Practitioners also engage in behaviors that deliberately blur regulatory boundaries. Without strict supervision, it is easy for bad money to drive out good, leading to frequent high-risk projects and mass fraud incidents. Currently, participants in this field are mixed, including domestic and foreign securities institutions, issuance service providers, overseas exchanges, digital compradors, data service providers, and domestic property rights exchanges.

However, with the introduction of Document No. 42, everything has changed. Through meticulous analysis, the regulators' thinking and philosophy can be discerned:

1. Legislators comprehensively considered laws and regulations from regions such as the United States, Europe, and Hong Kong, referencing them in regulatory links and expressions, achieving moderate alignment with international regulation.

2. The new regulations comprehensively cover emerging fields such as stablecoins and RWA, while filling previous regulatory gray areas like mining machine sales and mining law enforcement.

3. In areas where technological maturity is insufficient and rule-making power