作者 | Azuma

编辑 | 郝方舟

出品 | Odaily星球日报(ID:o-daily)

Solana 之上最大的借贷协议 Solend 这两天上演了一出闹剧。

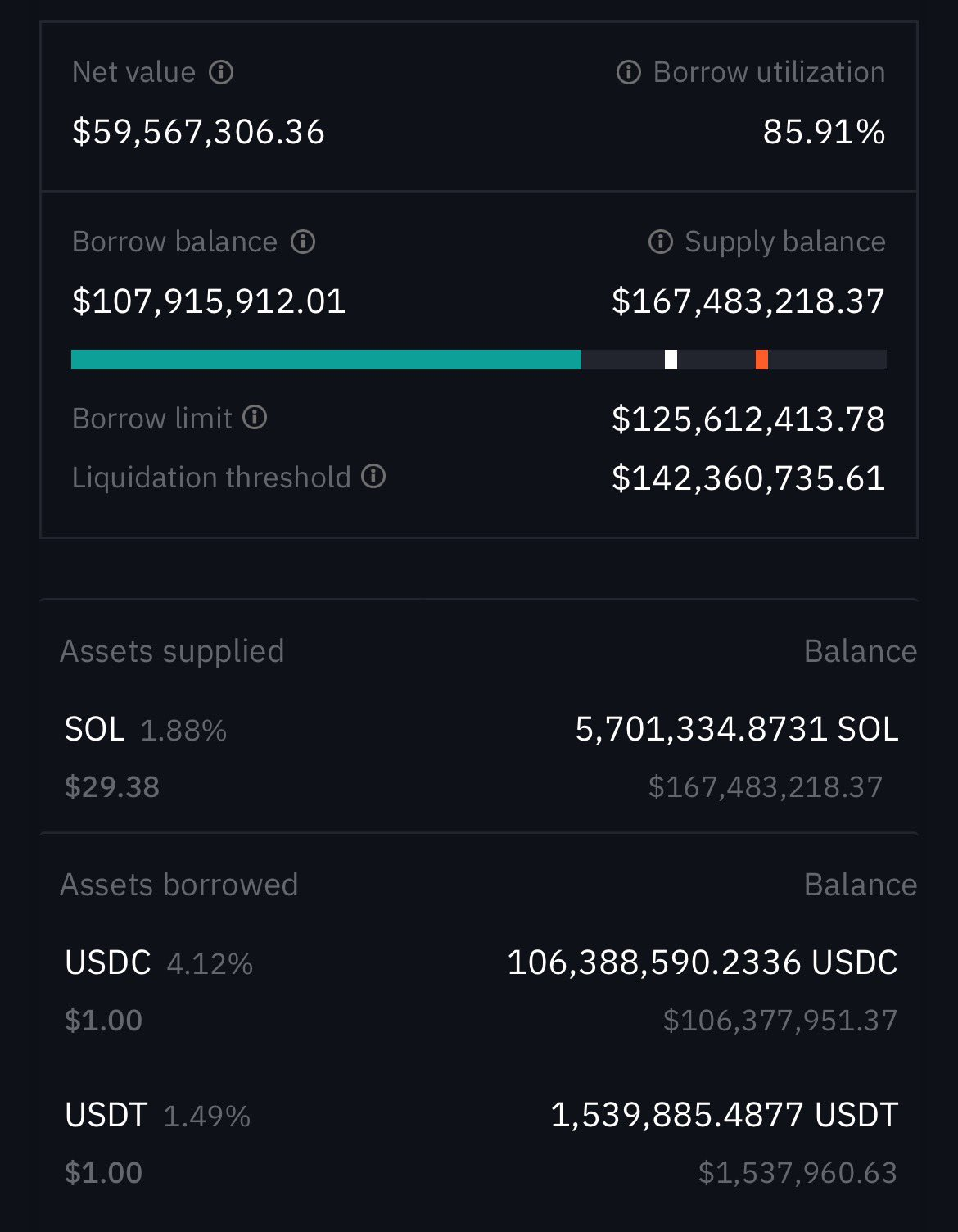

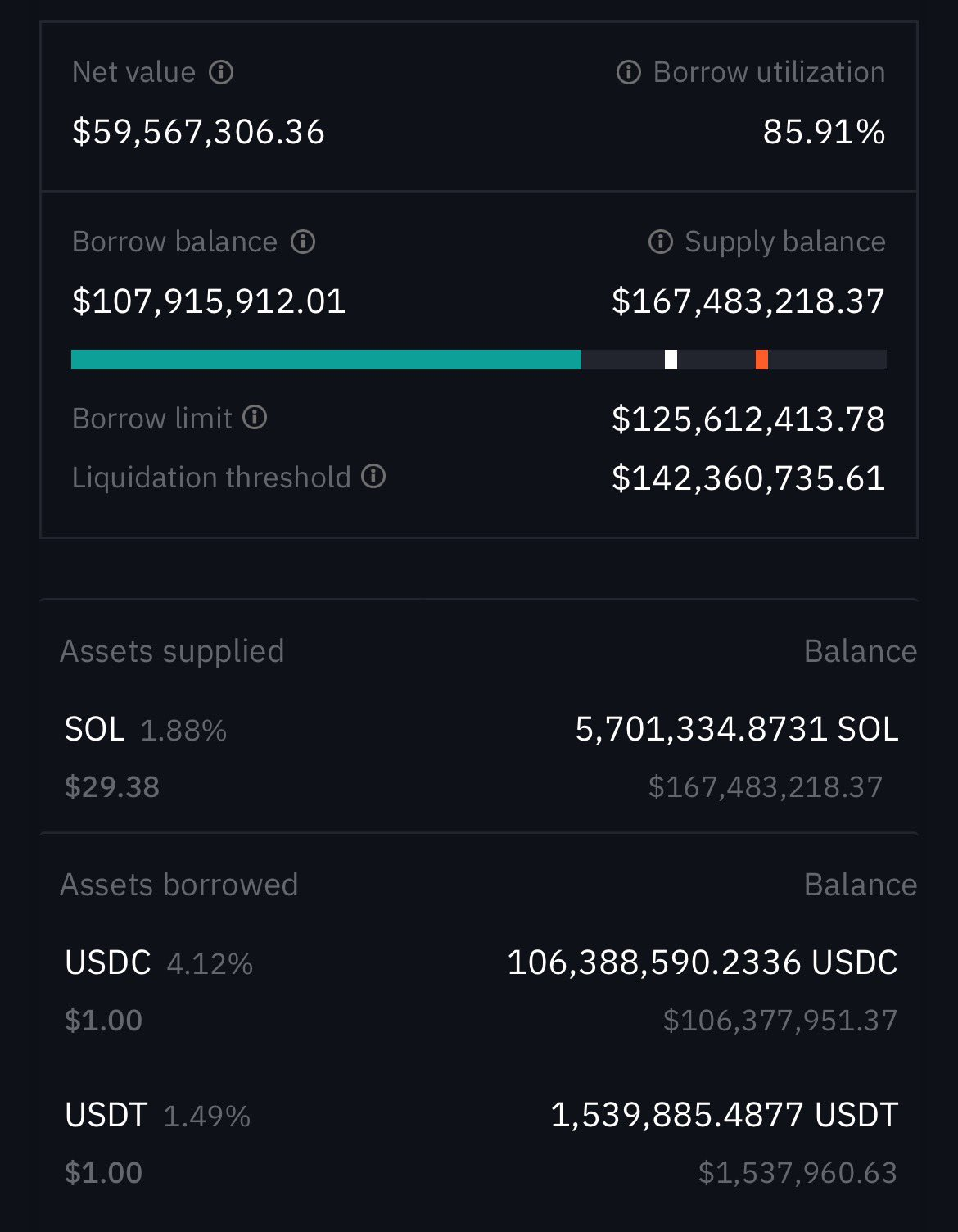

事件的开端是,Solend 创始人 Rooter 近期发推称,某个巨鲸(3oSE开头地址)在 Solend 上有着价值 1.7 亿美元的 SOL 存款(池子占比近 95%)和价值 1.08 亿美元的 USDC+USDT 债务头寸(USDC 池子占比近 86%),考虑到市场整体的下行趋势,SOL 当时的价格距离该地址的清算线(约为 22.27 美元)越来越近,Rooter 希望该地址能够尽快补充抵押资产或偿还部分债务,以避免潜在的清算麻烦。

关于该巨鲸为何迟迟没有就其借贷仓位进行任何去风险操作,其实存在多种可能,你可以说是巨鲸还没来得及操作,也可以说是巨鲸不觉得 SOL 会跌到其清算线,但最可怕却又最合理的一种可能性却是——考虑到该地址几乎在协议允许范围内借满了稳定币,巨鲸或许一开始就没想过保住其仓位,而是想通过借贷协议实现“变相的出货”。因为在市场情绪极度恐慌的今天,直接于二级市场抛售如此体量的代币很有可能会造成连环性的踩踏,最终的 market impact 损失或许要比借贷折扣及清算惩罚加起来更高,所以不如交出(抵押)流动性存疑的 SOL,换得(借出)实实在在的价格筹码(USDC+USDT)。

在接连数日尝试联系该巨鲸无果后,Solend 也越来越倾向最后的这一种可能性。结合该仓位规模占协议规模比例过大的现实情况,以及 Solana 在处理如此规模清算时曾过载宕机的历史教训,Solend 认为一旦该地址遭到被动清算,在无法保证链上清算顺利执行的情况下极有可能会产生大量坏账(Odaily 星球日报注:这里可参考 Terra 事件对 MIM 的影响),进而给协议带来系统性的风险(资不抵债,亏损需有其他用户承担),甚至还会影响整个 Solana 生态的平稳运行。

紧急之下,Solend 最终采取了一个超出所有人预料的避险措施——提议赋予 Solend Labs 紧急权力以临时接管巨鲸账户。具体来说:

单从提案内容来说,不得不承认 Solend 的措施极具针对性,一是可以有效降低该仓位规模占协议规模的比例,二是可以通过调整清算门槛来摊平 22.27 美元价位的集中清算压力,三是引入场外交易来进一步减少大规模清算对 Solana 性能的影响。整个提案的思路非常清晰,核心逻辑就是想尽办法保证清算的顺利执行,避免出现坏账以及系统性风险,保住协议以及除该巨鲸之外其他用户的最大利益。

最终,只经过了六个小时的社区治理投票,该提案在几家大户的推动下迅速通过。(Odaily 星球日报注:现已被提案二提议否决,后边会提到。)

Odaily 星球日报注:从上图该提案的投票权重图表中可以看出 6HFx 开头的大户几乎以一己之力推动了提案的通过。这里需要补充说一点的是,有人认为该提案的最大失败之处在于大户裹挟了社区的意识,但我个人并不完全认同,因为在这件事上大户与其他社区成员在经济利益上是存在一致性的,如果该巨鲸遭遇清算,潜在的坏账需要所有用户一起承担。

然而,这个看起来多少有些“结果正确”色彩的提案却在整个 DeFi 圈子内造成了轩然大波,甚至引出了“DeFi 已死”的悲鸣,究其原因,是因为该提案最核心的举措在道义上立不住脚,也就是说 Solend 在达成期望结果的路径上存在着“程序错误”。

这其中最凸显的问题是:如果某个人的“死亡”对大家都有利,社区是否有权决定他的生死?以社区群体意志来支配某一个体的资产,这怎么想都与以“掌握自己金融主权”为核心理念之一的所谓 DeFi 相矛盾。

这不禁我想起了一个很荒诞的故事,在一条漏水的船上,其他人为了争取更大的存活几率,就一起把一个胖子给推了下去,在 Solend 这条船上,巨鲸就是那个胖子。

可能有人会说,上边的描述并不完全贴切,在 Solend 的故事里巨鲸可能本就“有意赴死”(蓄意清算),社区只是更改了个中细节,让他的“死”对大家更有利而已。这同样也说不通,该巨鲸所执行的“金融主权”是以 22.27 美元为清算价格抵押部分资产并借出部分资产,社区后期所做的任何针对性更改都在破坏其“金融主权”的执行。

集体投票干预个体资产,这在加密货币历史上其实并非首例。此前,Juno Network 也曾通过治理提案剥夺了某巨鲸地址的持仓代币,不同之初在于,Juno Network 在“处刑”时多少还可指责该巨鲸恶意利用了规则漏洞,而这次 Solend 巨鲸在行为上却很难挑出毛病。所谓的蓄意清算暂时仅是猜测(即便是事实也没啥毛病),从既成的事实上看他只是存了些币,又借了些币而已,也正是出于这个原因,大家才会同情巨鲸之无辜,继而纷纷对 Solend 口诛笔伐。

可站在 Solend 的角度,作为那艘已然漏了水的船,他们也不得不去做一些自救操作。彼时的 Solend 所处的是一个似乎无解的两难境地,出手干预则会导致协议陷入极大的舆论危机,放任不管的后果则可能是系统性的崩盘。

幸而,由于市场短线复苏,事态暂时开始向好的方向发展。随着 SOL 的价格距离该巨鲸的清算线越来越远,悬在 Solend 脖子上的剑也渐渐放下,这就给了协议以喘息之机。今日上午,Solend 再次发起治理提案(现已通过),拟撤销此前通过的“接管控制权”提案,希望找到一个不涉及接管账户控制权的全新解决方案。

可如果事态没有好转呢?如果这一轮小反弹没有出现,SOL 的价格继续逼近 22.27 亿美元,等到了不得不立即决策的当口,已经得到了社区意识结果的 Solend 在“结果正确”和“程序错误”究竟会如何决策?我不知道答案。

对于其他更多的 DeFi 项目来说,与其去思索自己在面临如此情况时该如何抉择,不如去想一想如何才能有效规避此类事件的发生。

纵览这次的 Solend 事件,今天这个局面可以说既是偶然,也是必然。如果 Solana 的性能完全不惧如此规模的链上清算,如果 Solend 能够提前对类似场景作出预设性的风险应对措施,如果治理模块能够更加清晰(比如明确限制不可涉及用户资产主权)……这个故事或许会像不同的方向发展,但在底层性能有限,风险预设准备不足,治理模型尚不完善的普遍大环境下,没有人能够确定未来不会出现下一艘漏水的船。

这不是关于 Solend 的局部问题,而是整个 DeFi 行业继续发展所面临的共同考验,需要所有从业者群策群力,各司其职,协作攻关。

过去两年,DeFi 在叙事、加杠杆、组合、模式复制的支撑下实现了数字层面上的狂飙突进,回过头看,基础设施、安全机制、治理模型等多个方位的工作却没能完全跟上。

这种发展错配使得 DeFi 枝繁叶茂却根茎中空。Solend 事件一定程度上损害了去中心化治理的信任度,也同时可以成为其他 DeFi DAO 的一面镜。或许,趁着本次全行业“降杠杆运动”深化之机,DeFi 从业者要放缓脚步,沉下心来,直面一些更深层、更麻烦的考验了。