The chain reaction of the LUNA incident: 80,000 new addresses for speculation and arbitrage, and the total market value of major stablecoins has shrunk by US$8.4 billion

The thunderstorm between UST and LUNA continued to ferment. What kind of chain reaction did the dominoes fall? In fact, since the rise of DeFi, the discussion of its "combinability" has not stopped. In the past, everyone cheered that protocol combinations can bring more trading opportunities and magnify investment returns, but the higher the Lego bricks are piled up, the more and more connections between various products in the market, which makes the risk combination impossible to ignore. The series of chain reactions triggered by the recent UST de-anchoring happened to be an excellent window to observe this risk combination. When there is a problem with a large-scale product, how does this internal problem affect other markets and products? To this end, the data column PAData under PANews observed a number of data on DeFi and spot markets before and after the UST unanchoring event, and found that:

1) Large holders of UST are damaged: among the top 30 non-exchange addresses with UST balance on Wormhole, the average balance of each address is about 7.04 million UST, calculated according to the current price of $0.1767, then the average loss of these 30 addresses The amount is around US$5.79 million.

2) A total of 4.04 million addresses were "victimized" on the chain, and 80,000 addresses newly entered the market to buy bottoms or participate in arbitrage. On May 7, there were 4.04 million addresses on the Terra chain, which is equivalent to 4.04 million addresses that may be "victimized". As of May 14, the number of addresses on the chain increased to 4.12 million, which is equivalent to 80,000 addresses newly entering the market to buy bottoms or participating in the arbitrage transactions created by the "rescue market" afterwards.LUNAThere are three characteristics in the process of "returning to zero", which are continuous price decline, ultra-high intraday volatility and rising trading volume.

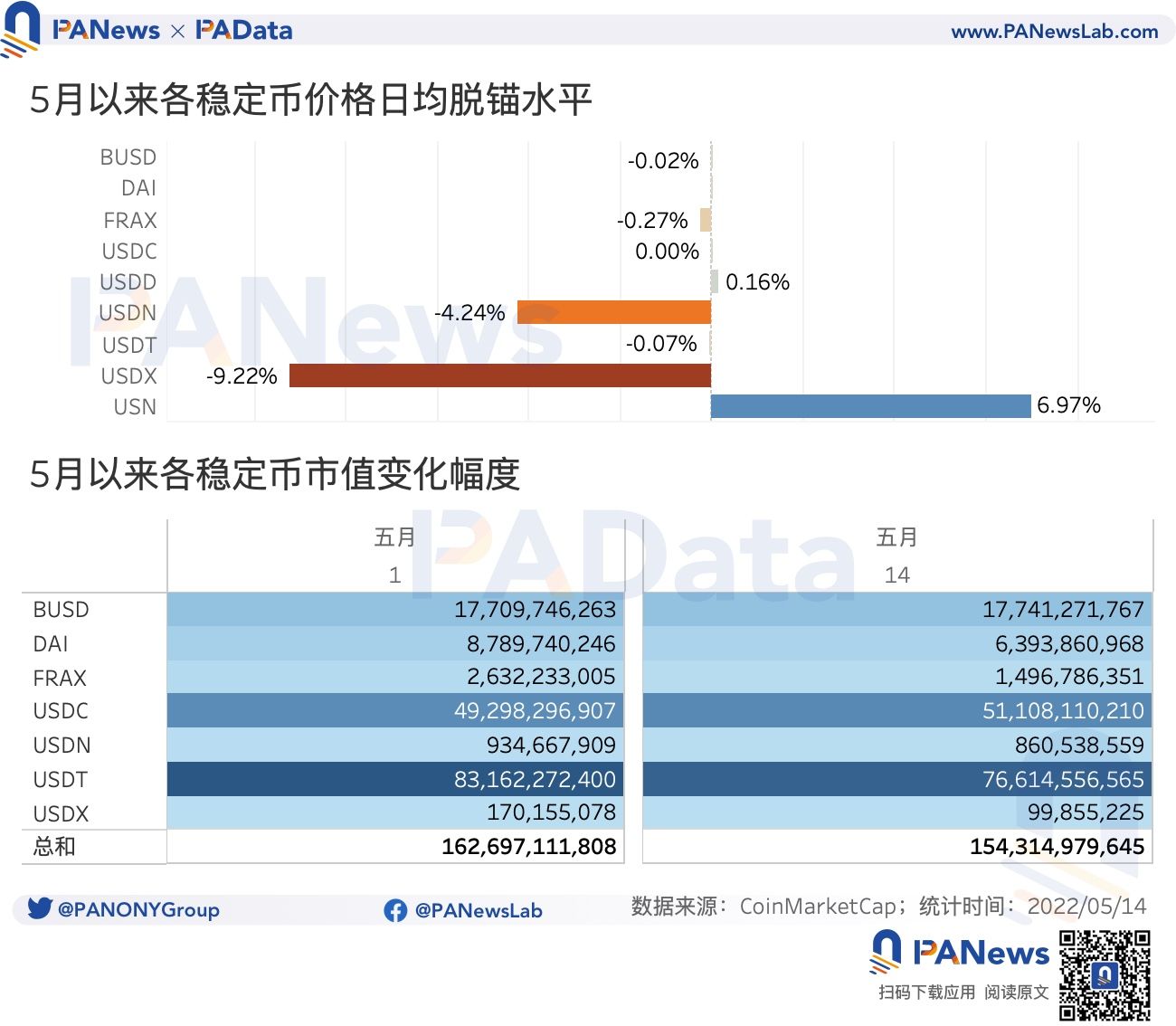

public chainpublic chainAlgorithmic stablecoins of tokens are affected to generate high volatility while reducing the overall market size of stablecoins. The average daily deviations of USDN and USDX from the anchor price this month have reached -4.24% and -9.22% respectively, while USN has reached 6.97%. The total market capitalization of the seven stablecoins within the scope of statistics has decreased by nearly 8.4 billion U.S. dollars since this month, a drop of about 5.15%.

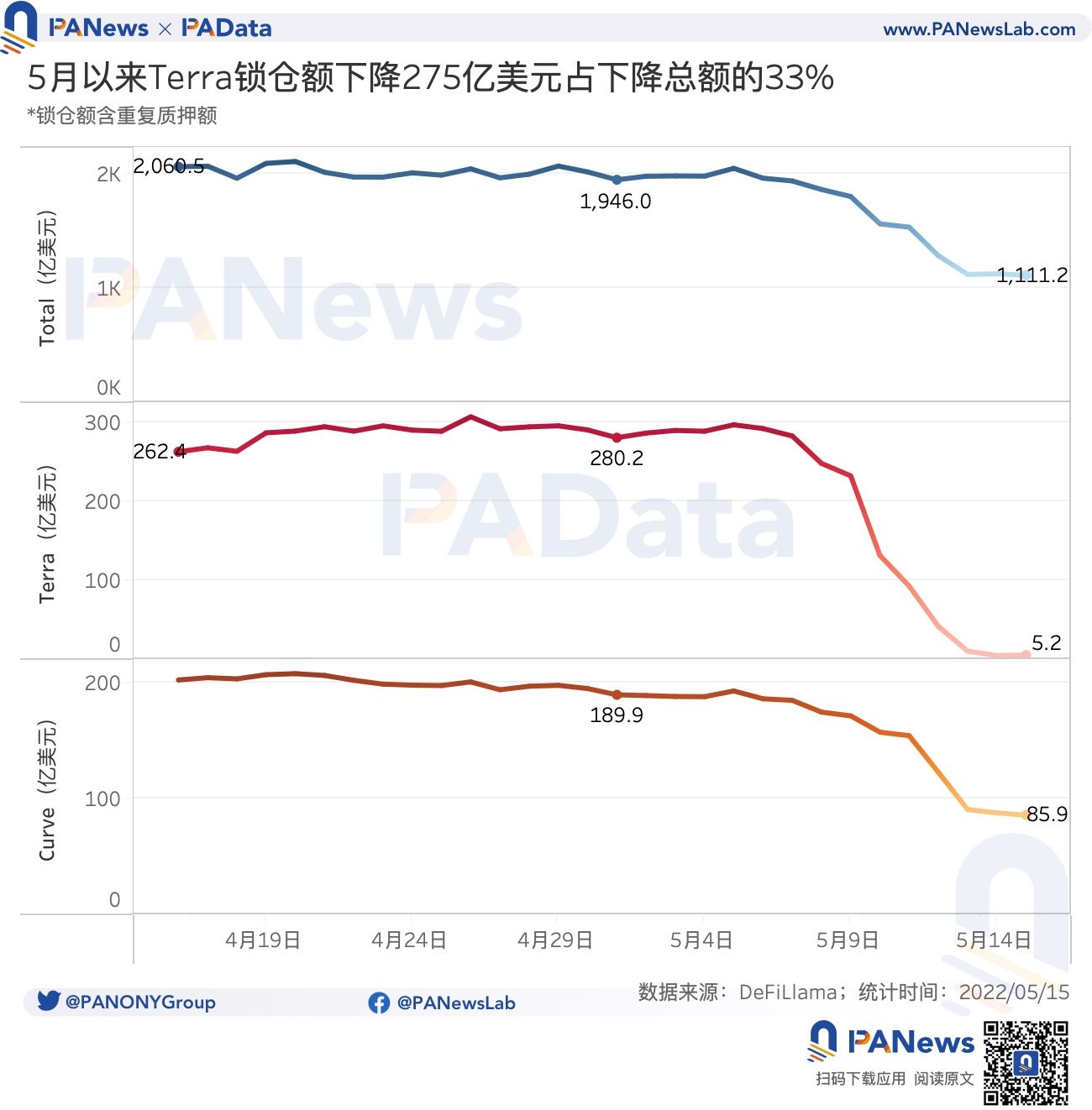

4) The four effects are to further exacerbate the decline in the scale of DeFi lock-ups. Since May, the total locked position of DeFi has decreased by US$83.485 billion. During the same period, Terra’s lockup decreased by $27.498 billion, accounting for 32.94% of the total decline in DeFi’s lockup. In addition, Curve also dropped about 12.46% of the locked-up amount of DeFi.

first level title

01

Before UST broke the anchor, the proportion of liquidity was out of balance, and the maximum loss of the single address on Wormhole exceeded 45 million US dollars

EthereumEthereumAnd sold, triggering a sell-off. Since then, Terraform Labs has removed 100 million UST liquidity from Curve, and after UST was decoupled, an unknown address began to sell ETH to buy UST.

At the time of the incident, 4pool was still in the preparation stage, and the main liquidity was 3pool on Wormwhole on the Curve mainnet.

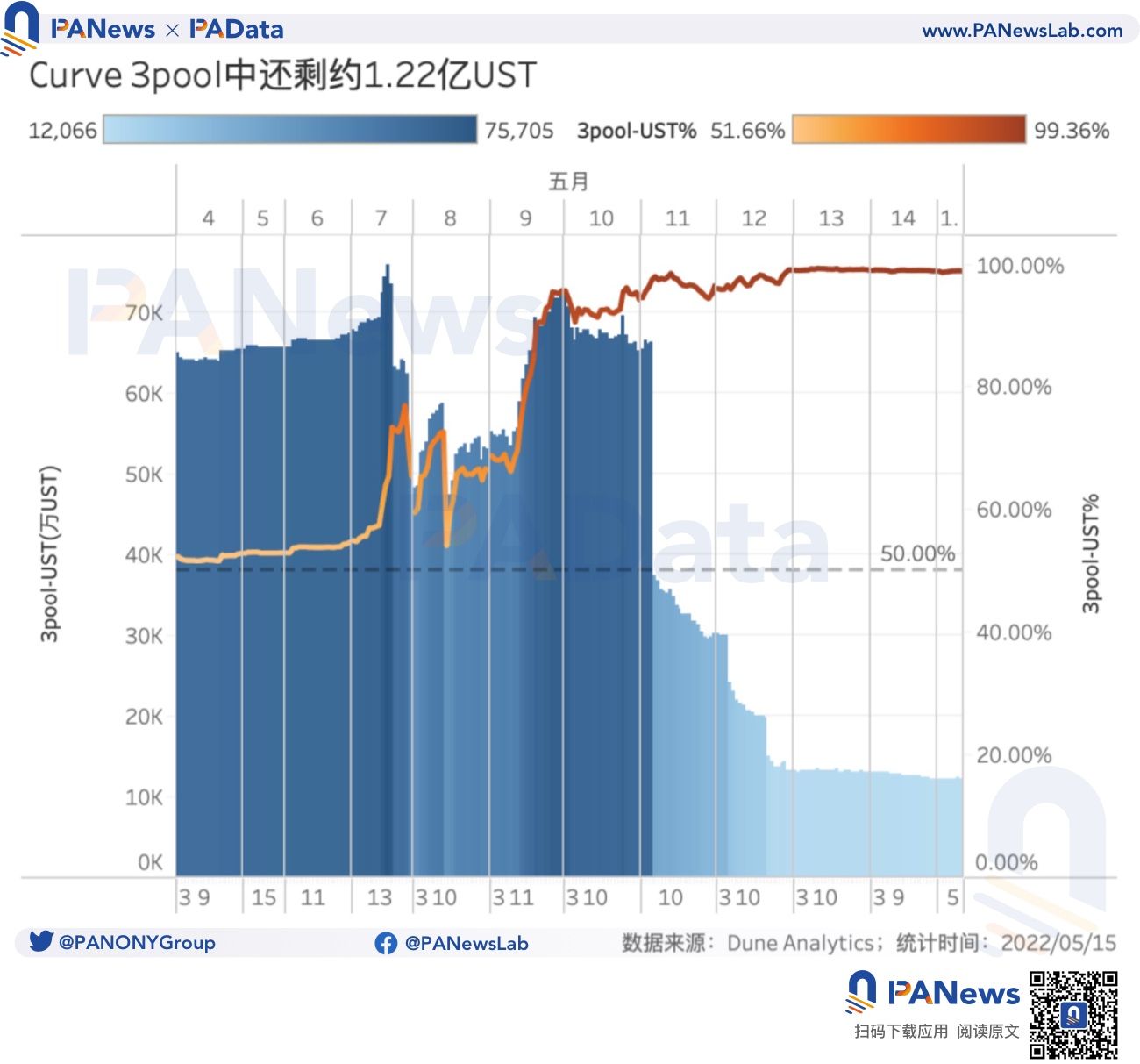

As of May 15, there were about 122 million UST left in 3pool, accounting for 98.94% of the total in the pool, and 1,314,700 other three stablecoins remained, accounting for only 1.06%. The disparity in asset allocation makes the pool basically unable to provide liquidity. It is worth noting that on May 7, the proportion of UST in the pool has remained above 55%, exceeding the theoretical level of 50%. The result of changing liquidity in an already unbalanced pool is obviously not that UST "ends the Curve War", but steps into the abyss.

first level title

02

The highest daily amplitude of LUNA exceeds 70,000%, and the number of affected addresses may exceed 4.04 million

Due to the design of UST’s dual-coin mechanism, after UST’s severe unanchoring, LUNA will be affected first, causing serious damage to LUNA holders, but at the same time it also opens up the trading space of LUNA for some speculators.

According to general speculation based on the number of addresses on the Terra chain, on May 7 before this liquidity event, there were a total of 4.04 million historical cumulative addresses on the Terra chain, which can basically be regarded as 4.04 million addresses holding LUNA. That is, about 4.04 million addresses could be "victimized". As of May 14, the number of addresses on Terra's chain increased to 4.12 million, which is equivalent to 80,000 addresses newly entering the market, or participating in arbitrage transactions created by the "rescue market", which does not include exchanges If the latter is counted, then this number is obviously much larger.

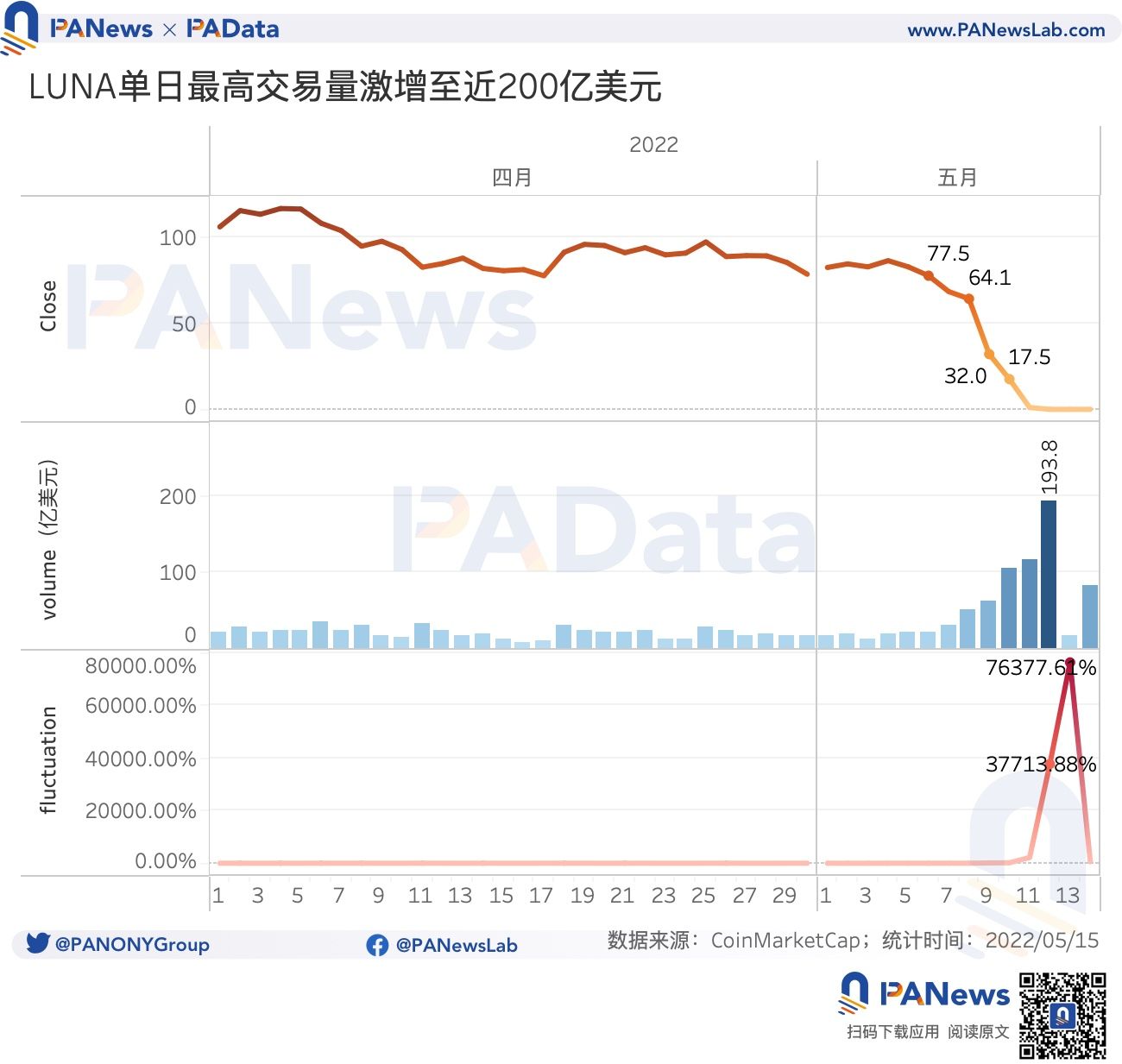

There are three characteristics in the process of LUNA's "return to zero", namely, the continuous price decline, ultra-high intraday volatility and rising trading volume. From the price point of view, on May 6, the price of LUNA could still reach 77.5 US dollars, and it could still close at 64.1 US dollars on the 8th, but after that, the price of LUNA could not be stabilized. Confidence crumbled. On the 9th, LUNA only closed at $32.0, a day-to-day drop of 50%. On the 10th, LUNA closed at $17.5, a day-to-day drop of another 45%. After the 11th, the price of LUNA kept moving to the right at a rate of one decimal point every day, and by the 14th it was only $0.0004588.

At the same time, LUNA's intraday maximum amplitude and single-day trading volume have repeatedly hit new highs. Since May 9th, LUNA’s intraday maximum amplitude has exceeded 100%, reaching 2186% on the 11th, and as high as 37713.88% and 76377.61% on the 12th and 13th, and 574.12% even on the 14th. You know, in April, the maximum daily amplitude was only 8%. On the other hand, since May 8, LUNA's daily transaction volume has continued to rise from US$5.11 billion to US$19.38 billion on the 12th, a day-to-day increase of more than 67%. , the average daily trading volume is only 2.18 billion US dollars. This shows that the unanchoring of UST has greatly opened up the trading space and profit space of LUNA, attracting a lot of funds to participate. Of course, some excess returns and some losses.

03

The market value of stablecoins "shrunk" by US$8.4 billion, and DeFi locked positions fell by 43%

Algorithmic StablecoinsAlgorithmic Stablecoinsvolatility, while reducing the overall market size of stablecoins. According to statistics, since May, BUSD, DAI, FRAX, USDC, USDD and USDT have remained relatively stable, but the prices of USDN, USDX and USN have deviated from the anchor price to a large extent. Among them, the USDN issued by Waves The USDX issued by Kava and Kava have deviated from the anchor price on a daily basis by -4.24% and -9.22% respectively, while the USN issued by Near has deviated from the anchor price by 6.97%. A large degree of de-anchoring has brought tests to both these stablecoins and issuers, and also increased market volatility.

In addition, the UST de-pegging has also caused general doubts in the market about the stablecoin stabilization mechanism. For example, it once again questioned the adequacy of the reserve assets of centralized stablecoins such as USDT and USDC, and questioned the collateral of algorithmic stablecoins such as USDX. Whether it is affected etc. Coupled with the impact of the downturn in the external market environment, since May, except for USDC and BUSD, the market value of the 7 major stablecoins has increased, and the market value of the other 5 stablecoins has declined to varying degrees. Among them, FRAX, USDX, and DAI had a larger "shrinkage" in market value, which dropped by 43.14%, 41.32%, and 27.26% respectively. Overall, the total market value of the seven stablecoins has decreased by nearly $8.4 billion this month, a drop of about 5.15%.

The UST unanchor event and the market downturn further exacerbated the decline in the scale of DeFi lock-ups. According to statistics, since May, the total lock-up amount of DeFi has dropped from US$194.60 billion to US$111.12 billion, a decrease of US$83.485 billion, or about 42.90%. Among them, during the same period, due to the shrinking of token value, Terra’s lock-up amount dropped from 28 billion US dollars to 520 million US dollars, a decrease of 27.498 billion US dollars, a drop of about 98.14%. Importantly, the total decline in Terra's lock-up accounted for 32.94% of the total decline in DeFi's lock-up, which is equivalent to Terra's drop of nearly 1/3 of the entire DeFi market's lock-up. It is also worth paying attention to the changes in Curve's lock-up amount, which is closely related to UST and stablecoins. During the same period, Curve’s locked positions dropped from $18.99 billion to $8.59 billion, a decrease of $10.400 billion, accounting for 12.46% of the total decline in DeFi locked positions.

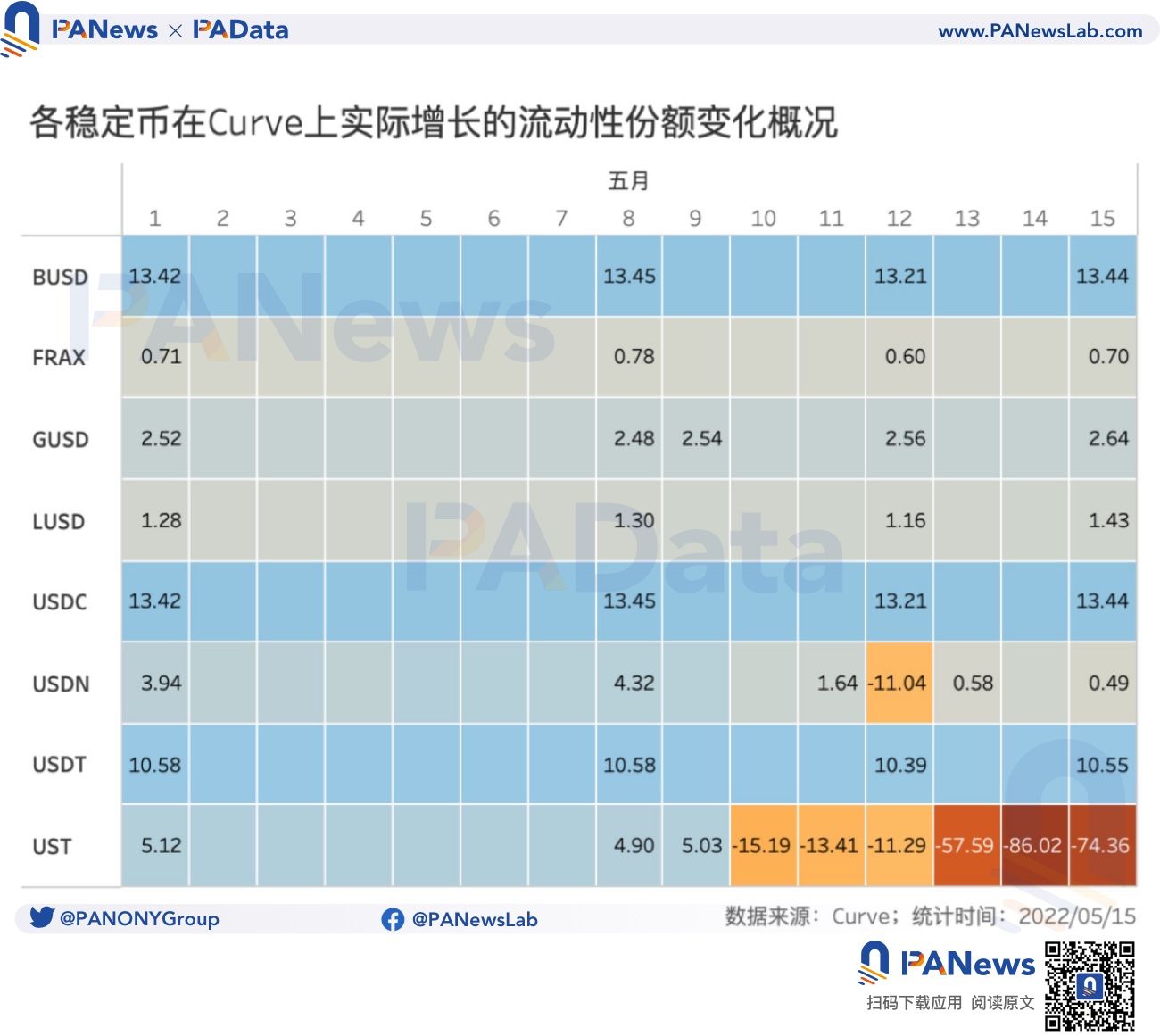

Moreover, according to the changes in the liquidity share of various stablecoins in Curve, UST has the greatest impact, with its liquidity share falling from 4.9% on May 8 to -74.36% on May 15, while other stablecoins were affected The impact was not significant, only the liquidity share of USDN fell to -11.04% on the 12th, but then returned to above 0%. Other stablecoins basically saw a small drop in their liquidity share on the 12th, but they all basically recovered afterwards.

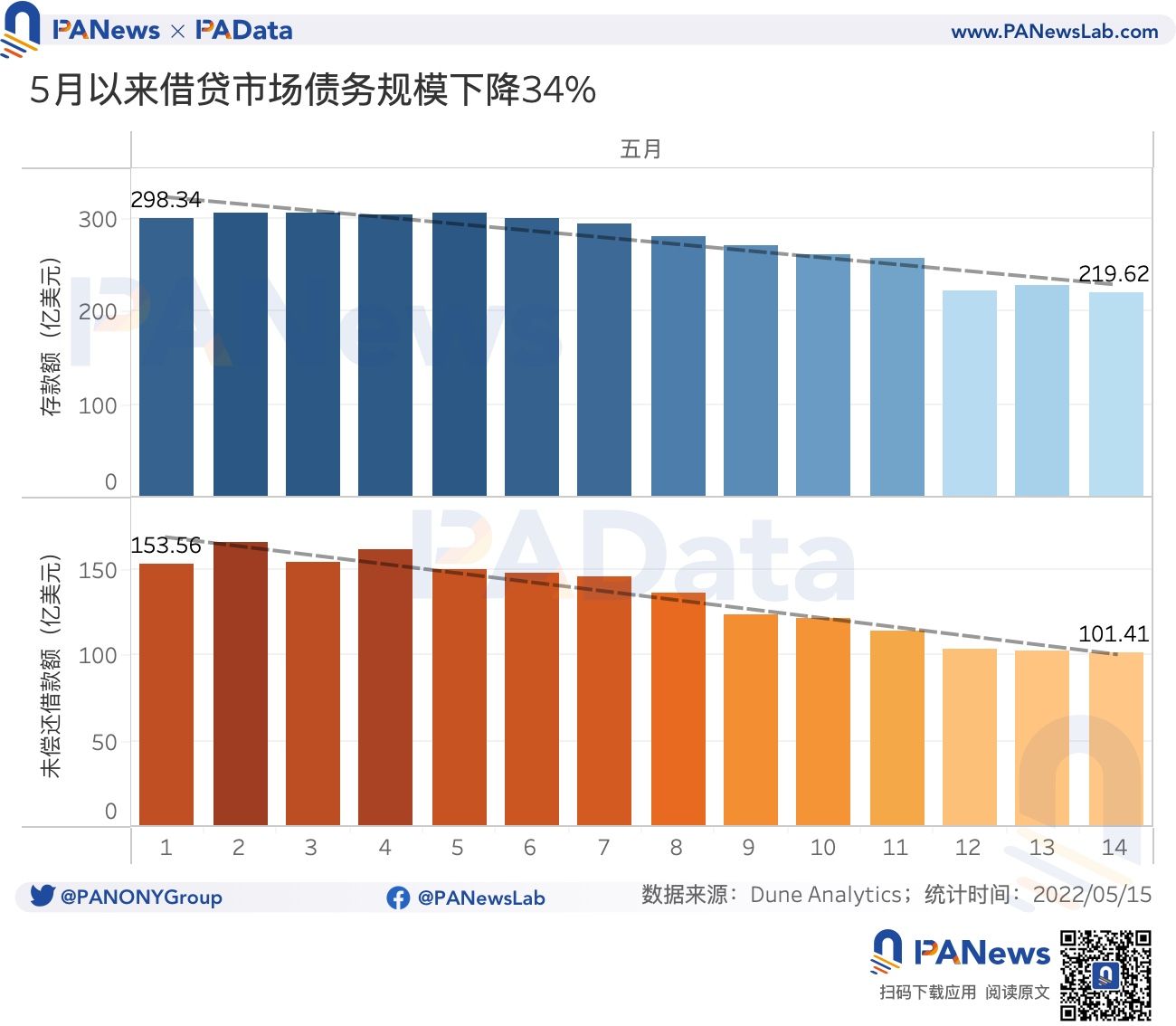

In addition, the size of the lending market in DeFi has also been affected. Since this month,CompoundThe deposits of the three major lending markets, Maker and AAVE, dropped from US$29.834 billion to US$21.962 billion, a decrease of US$7.872 billion, or about 26.39%. The amount of outstanding borrowings also dropped from US$15.356 billion to US$10.141 billion, a decrease of US$5.215 billion, or about 33.96%.

borrow moneyborrow moneyfirst level title

04

Market selling pressure suddenly increased, leverage first diverged and then fell synchronously

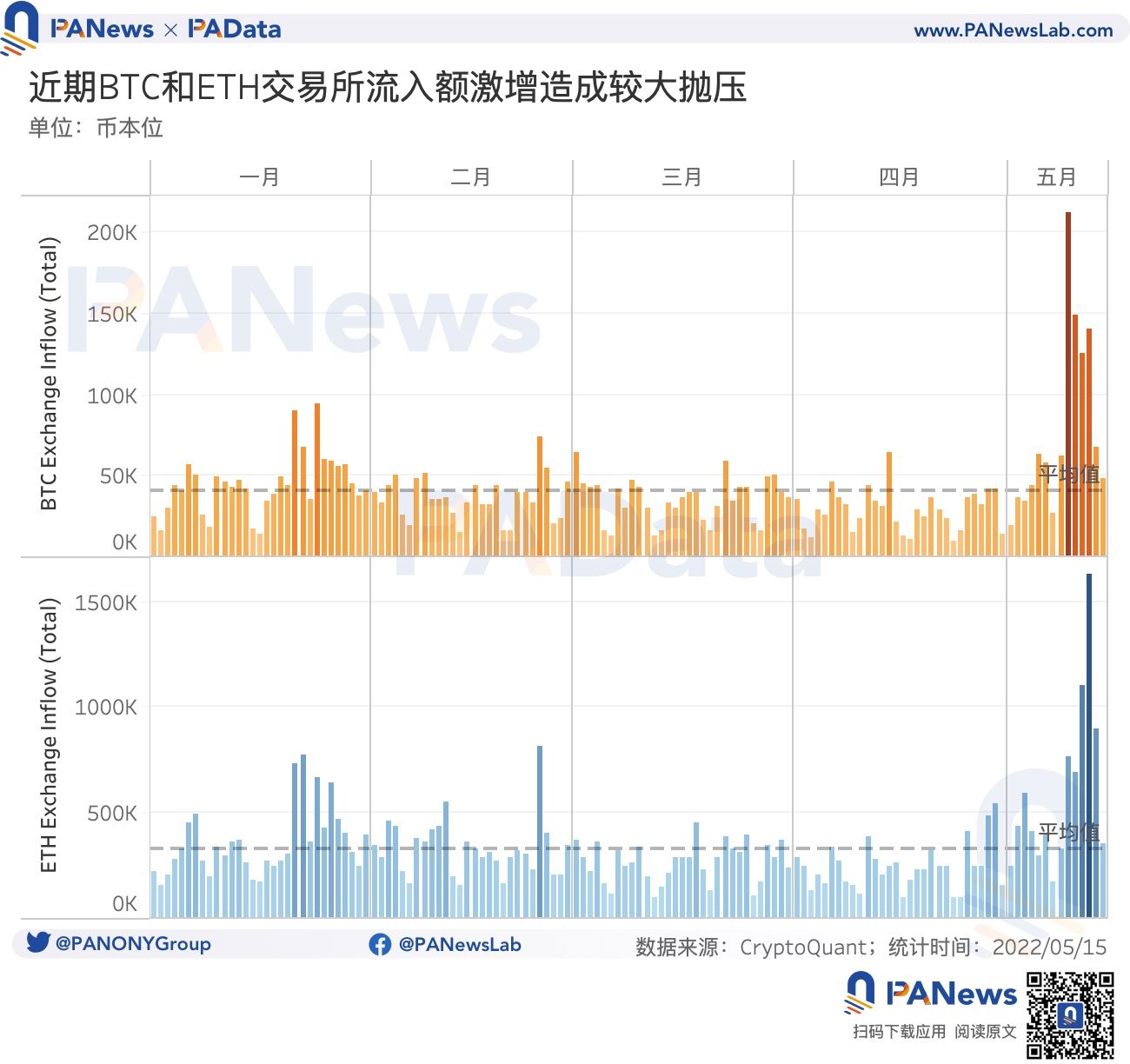

fundfundThe meeting launched a series of "rescue" measures, which brought the fifth impact to the market, that is, the selling of mainstream assets caused a large selling pressure in the market, which intensified the downward trend of the entire market. According to statistics, from May 8th to 14th, a total of about 805,000 BTCs were transferred to exchanges in the entire market, of which about 212,300 BTCs were transferred to exchanges on May 9th, which is a very high transfer level in the near future. Secondly, 10 From the 12th to the 12th, more than 120,000 BTC were transferred to the exchange every day. In addition, 5.772 million ETH was transferred to the exchange during the same period, of which more than 1 million ETH was transferred to the exchange every day on the 11th and 12th.

According to glassnode on LunaFoundationMonitoring of Guard balance, its balance has changed from a peak of 80594.75 BTC on May 8 to 0 BTC on May 10. Leaving aside whether these funds are sold and used for “rescue the market”, even if they are all sold, they only account for about 1/10 of the recent BTC inflows to exchanges. This may indicate that in the context of recent changes in the external environment of the market and the tightening of monetary policy leading to a tightening of global liquidity, after the UST unanchored, other funds participated in the sell-off.

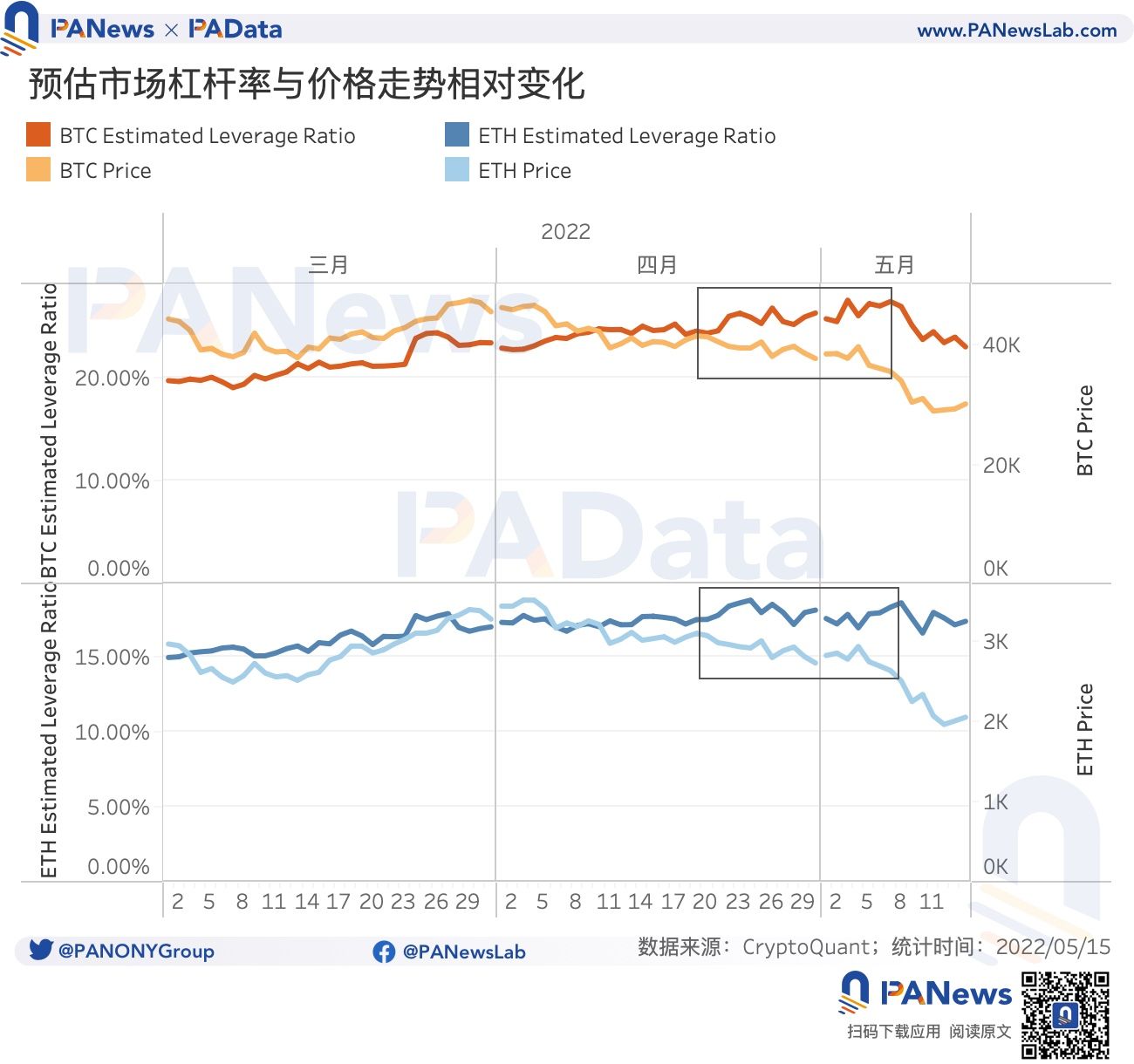

Moreover, after UST unanchored, the sudden increase in market selling pressure madeBTCThe accelerated decline of ETH and ETH has changed the correlation between the market's estimated leverage ratio and the price trend. It is worth noting that before this event (from mid-to-late April to early May in the black box), the estimated market leverage ratio deviated from the price trend, that is, when the currency price went down, the market leverage ratio rose instead, which is different from the previous two The trends of those who are basically the same are different. This means that, at that time, the market either expected a price decline, or had confidence in a price trend reversal, and there was a weak balance in the market. However, the unexpected breakout of UST's unanchoring broke this balance, and the price trend exceeded expectations. The sharp drop caused the market leverage ratio to also drop, and investors were more likely to suffer unexpected losses.