Weekly Editors' Picks Weekly Editors' Picks (0514-0520)

"Weekly Editor's Picks" is a "functional" column of Odaily.On the basis of covering a large amount of real-time information every week, a lot of high-quality in-depth analysis content will also be released, but they may be hidden in the information flow and hot news, and pass you by.

Now, come and read with us:

Now, come and read with us:

Investment and Entrepreneurship

Investment and Entrepreneurship

Foresight Ventures: Bear Market, Back to Paradigm-Changing Formula for Investment Opportunities

In the field of Crypto, technical features include: decentralization, interoperability, programmability, and composability; requirements include: ownership, asset protection and value-added, speculation, Showoff, privacy, etc.; use first principles to imagine the underlying paradigm of Crypto The revolution may include: lower customer acquisition costs, lower transaction costs, sustainable, unmanaged operating environment, open protocols and composable apps, Token-oriented programming, user-owned platforms, assets, data, identities, An immutable trust system, a new source of income, a new type of stable currency, and a new form of organization.

Bankless: Welcome to the market stage where fundamentals matter, how to seize opportunities?

ETH and BTC have experienced bear markets before and have built investor resilience over the years. However, Alt L1s has decided from the design pattern that its performance in the bear market is not ideal. Alt L1 oversupplied the market with cheap products to undercut competition and drive growth; but when the market saw user and capital outflows, this cheap product turned from an asset to a liability.

The author is bullish on L2, because L2 does not have to pay for security; L2 provides a basic answer to the expansion problem of Ethereum; L2 can be measured with the tried and tested DCF valuation model, and it is the basis for finding real fundamental factors as the basis for investment. Investors provide guarantees.

DeFi

The article respectively introduces the basic situation, financial strategies and risks of Maple Finance, Convex Finance, Balancer, and GMX, and briefly mentions Notional Finance, Tokemak, and Ribbon Finance.

Talk about algorithmic stable currency after UST falls into a death spiralThe front is mainly an introduction, and you can jump directly to the conclusion area. In the design of the core mechanism of the algorithmic stablecoin, at least the following three aspects need to be considered: the underlying asset selection of the algorithmic stablecoin; what kind of mortgage (destruction) parameters can take into account both security and capital efficiency; Who is behind and how to regulate.》

Similar to this topic, a more vivid and colloquial article is: "

Full combing of stable coins: Ponzi 2.0 era based on algorithm stability?

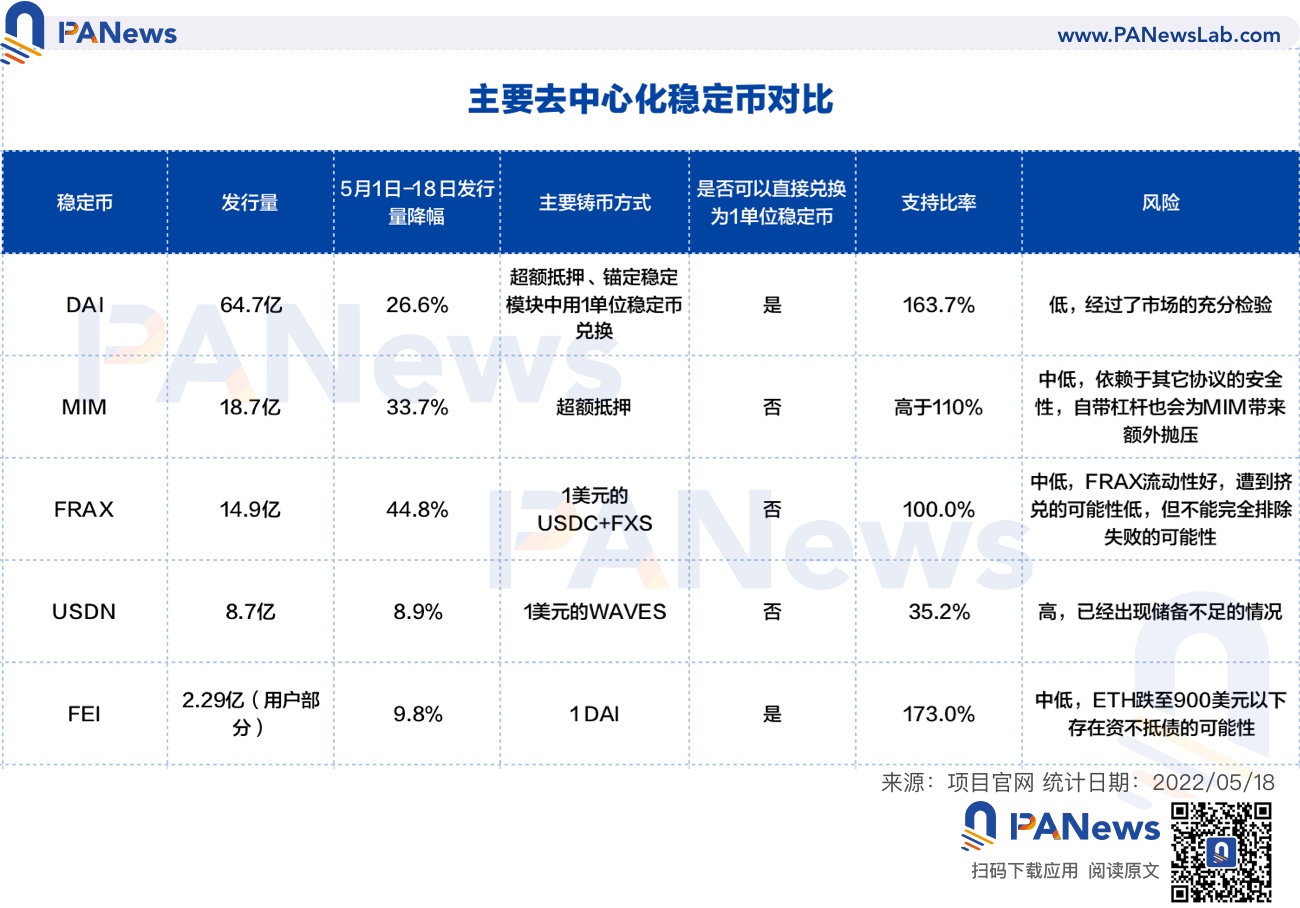

At present, the commonly used decentralized stablecoins have corresponding mortgage assets or reserves, most of which are commonly used assets such as ETH or stablecoins, and a small part include assets with large fluctuations such as FXS and WAVES.

NFT, GameFi and Metaverse

NFT, GameFi and Metaverse

Based on data analysis and historical review, the author is still optimistic about BAYC as a whole.

Data Interpretation: Is Otherdeed still worth buying after the secondary market is under pressure?

There are more than 6,200 holders of this series of NFTs. Since its minting, 257 holders have held it until now. The floor price is more flexible, and there are not so many "whale" holders who can sell their NFTs to lower the price. Early customers have begun to gradually reduce their holdings, and the smart money is still making purchases.

Data Interpretation: Is Otherdeed still worth buying after the secondary market is under pressure?

The transaction price of Otherdeed's secondary market has been under obvious pressure since its launch, and the recent market selling pressure may be heavy. The application enthusiasm of BAYC and MAYC holders is not high. The accumulative payment of minting coins is 61,800 ETH, and the highest Gwei exceeds 45,000.

Detailed explanation of GameFi's best model Fantasy Westward Journey: How does the open economic model last for 20 years?

The point card serves as an anchor point for the economic system of Fantasy Westward Journey, and provides a pricing guarantee for the user's output per unit time. Game planners will target games/roles with relatively low levels of krypton gold or popularity, and regularly carry out major iterative enhancements. The team has been constantly testing the balance of different heroes and cards for 4 years, and the economical design is also very restrained. The benefits of the level cut design are: equipment value preservation, payment ability stratification, liver degree division. Each attribute/effect needs to consume different materials and skills to create. The process is full of social division of labor in various links, and each link is full of randomness and probability. Every link of beating the baby is also full of randomness and probability. The team task is also a good entry point for Gamefi to gradually add social elements. Tournament players' demand for high configuration creates an economic consumption port for the entire game. The social attributes of Fantasy Westward Journey are reflected in each gameplay. Players have a high degree of recognition of their social identities. The economic transactions of Fantasy Westward Journey are completely free and open. Players can use Fantasy Coins to trade in-game assets. Relying on the free circulation of the in-game economic system, the value of fantasy game currency remains relatively stable.

Web 3.0

Vitalik's latest paper: Decentralized Society - Finding the Soul of Web3 (superior)(middle)(superior)

Down

Ethereum and scaling

Ethereum and scaling

On the eve of the merger of Ethereum, what did V God talk about at the ETH Shanghai Summit?

Relatively scattered, not long, it is recommended to read the full text.

IOSG report: Rollup empowers a new financial system

Multi-chain DeFi is a new narrative direction. Although the multi-chain statement and the saturated Ethereum have gradually increased activities on other chains, giant whales have a soft spot for security. Some users who cannot afford Ethereum fees are gradually migrating to these chains, but the contributions of these users are not enough. In the long run, most applications will be built on top of Rollup. Because it’s the only solution that can sustainably support billions of users over the long term without sacrificing fundamental principles like decentralization, censorship resistance, security, and trustlessness.

Basic strategies and interactive objectives of Ambush Arbitrum Airdrop

The article first introduces the skills of using Arbitrium: add the Arbitrum network to the wallet through Chainlist, use Arbitrum One Bridge to send ETH or ERC20 token from Ethereum, search Arbitrum One Portal, find a Dapp (such as Balancer liquidity pool) to invest funds; Finally, recommend the Dapps mentioned in Arbitrium to try the Odyssey initiative (specific tasks listed every week), try to get related free minted NFTs and the final prize; finally list 12 Arbitrum Dapps that deserve attention and have not been issued.One article to understand the basic strategy of ambush StarkNet ecological airdropInstall the Argent wallet on Google Chrome, then go to the faucet to get some test tokens; complete a transaction on Starkswap, then go to JediSwap, Myswap and Alpharoad to complete several transactions respectively; join Matchbox Dao’s Discord and mint one on PlayOasisXYZ NFT; then transfer GOERLI ETH to L1 through SuezBridge, then you can fill in the Zkxprotocol

up.

New ecology and cross-chain

New ecology and cross-chain

Unlike the power structure of the Internet where "the hardware owner controls the software", the blockchain is constructed in such a way that the software is "responsible" for the hardware by using a consensus mechanism. When designing a blockspace (making a public chain), the most important feature to focus on is security attributes, followed by performance and community. Common blockchain expansion methods include L2 (such as Ethereum), underlying system design (such as Solana) and cross-chain, and the three methods can be mixed.

DAO

secondary title

DAOrayaki: Evaluating the "Fairness" of DAO Governance Based on Data Perspective

Through the analysis of 20 Ethereum charity/donation addresses and their about 100,000 transaction records, this article explores the current state of charity/donation based on the blockchain network, and glimpses the power of cryptocurrency in charity (donation/fundraising) , efficiency and speed. During the research process, the author discovered the significant impact of giant whales, and concluded four on-chain charitable collaboration models: viral, incentive-based, automatic, and spontaneous.

Safety

Safety

For ordinary users, it is recommended that after joining Discord, prohibit users in the server from private chatting in the privacy function, learn to identify common attack methods, and improve security awareness; for project parties, they must always pay attention to community feedback and delete in time Malicious accounts, and take the initiative to undertake security education obligations.

hot spots of the week

secondary title

hot spots of the weekIn the past week, hotspots focused on:The Terra crash continues to ferment. Officials, investors, ecosystem builders, other L1s, exchanges, regulators, other stablecoin issuers, speculators, and other roles are all discussing intensively, publishing opinions, rescue proposals, action strategies, or launching investigation. Odaily has classified relevant important news and articles into "From peak to collapse, UST's roller coaster ride》《In the special topic, it is convenient for readers to grasp the whole picture of the event and the latest developments according to the timeline. We also track supplements from different angles, see "》《Terra's self-help is full of doubts: 80,000 BTC are spent on the back of the knife》《Terra falls apart, what about ecological projects?》;

Where will the NFT projects of Terra ecology go?

Interview with Terra community representative: Do Kwon is selfish, LFG is also shadyThe overall market trend and sentiment continued to be depressed. Many entrepreneurs sent internal letters to boost team morale, and investment institutions also offered their experience of crossing bulls and bears to stabilize the mentality of practitioners;The back and forth of "Musk's acquisition of Twitter": Musk said "Deals cannot proceed unless Twitter proves that fake/spam accounts account for less than 5%",TwitterPromise to complete the transaction with Musk at an agreed price;

, the transaction isas expected,In addition, the chairman of the US SEC stated thatSEC and CFTC plan to jointly regulate some tokensGrayscale will be in Europelaunched its digital asset-related ETF,Nomura SecuritiesPlans to set up a subsidiary to help institutional clients diversify into cryptocurrencies, DeFi and NFT,FTX.US launches FTX Stocks, providing US listed stocks and ETF trading,Robinhood to Launch Standalone Crypto WalletSolidity released v0.8.14 versionOptimism Launches Bedrock, a Decentralized Rollup Infrastructure;, to fix two important bugs,Optimism Launches Bedrock, a Decentralized Rollup InfrastructureSolana NFT MarketplaceDaily trading volume hit a two-month high,Solana NFT ProjectWith "Editor's Picks of the Week" series

With "Editor's Picks of the Week" seriesPortal。

See you next time~