数据解读:Otherdeed二级市场承压后还值得入手吗?

YugaLabs在Web 3前沿的探索中又落下重要一子,与Animoca Brands一起推出了一个游戏化的、可互操作的元宇宙Otherside。这是一个角色扮演类游戏(metaRPG),成千上万的玩家可以一起实时建构原型、建设世界、游乐玩耍。首批10万份土地资源Otherdeed已于4月30日正式上线。

Otherdeed的发行不出所料地受到了用户热烈追捧,引发了抢购潮,但同时也引发了一些争议,比如公开发售演变成了一场Gas War使以太坊上短时交易费用骤然升高;抢购到Otherdeed的用户因二级市场价格快速下跌产生了巨额亏损;Otherdeed对BAYC持有者而言缺少吸引力等。那么,Otherdeed发行背后的真实图景是怎样的?目前亏损的可能性大吗?怎么才能在Gas War中成功铸币?持有地址有何变化?PAData通过分析一些列市场数据和链上交易数据后发现:

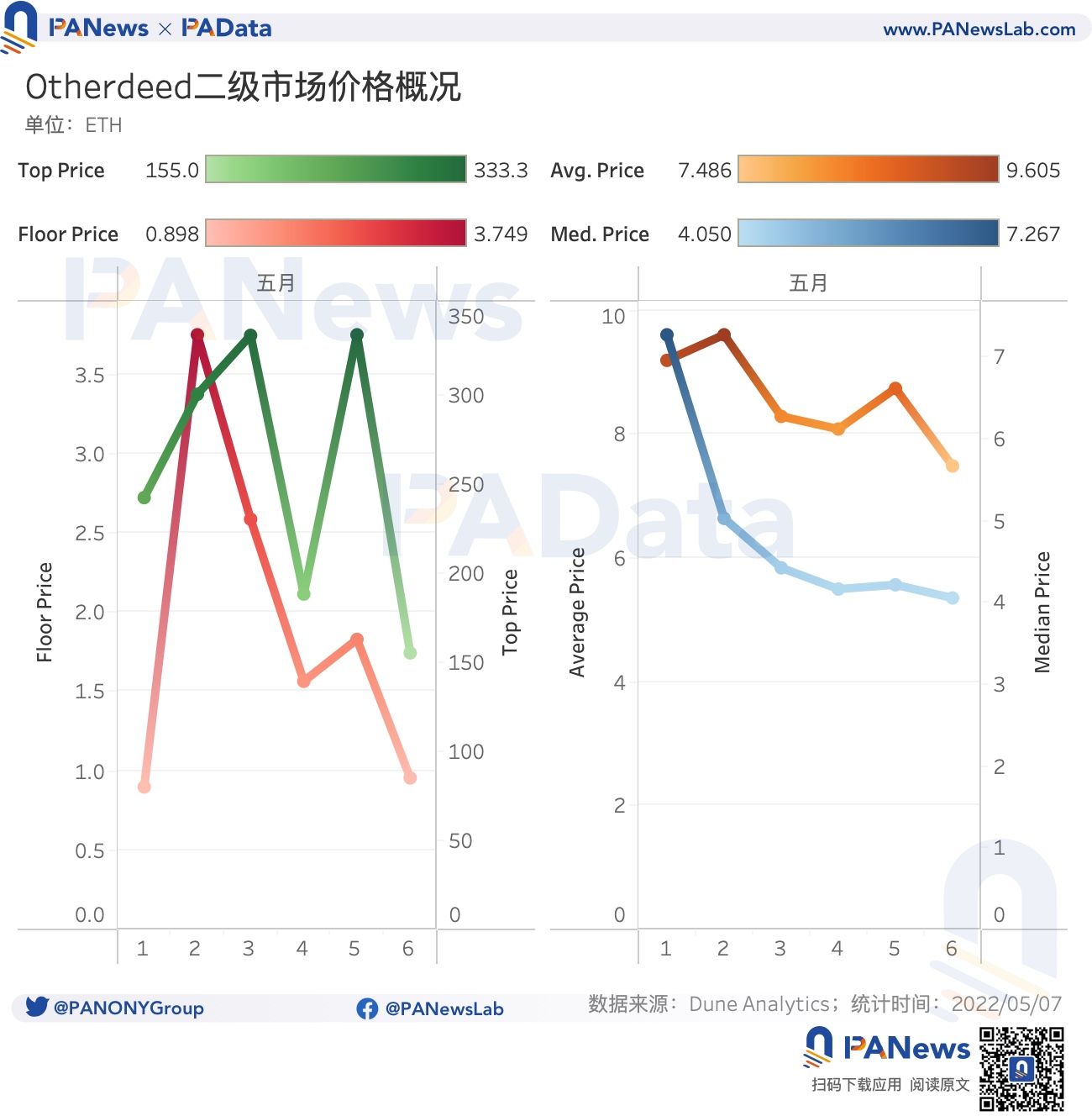

1)Otherdeed的二级市场成交价格自上线后明显承压。且成交价格趋向离散和分化,少部分Otherdeed的成交价格较高,但多数则较低,且逐渐更低。

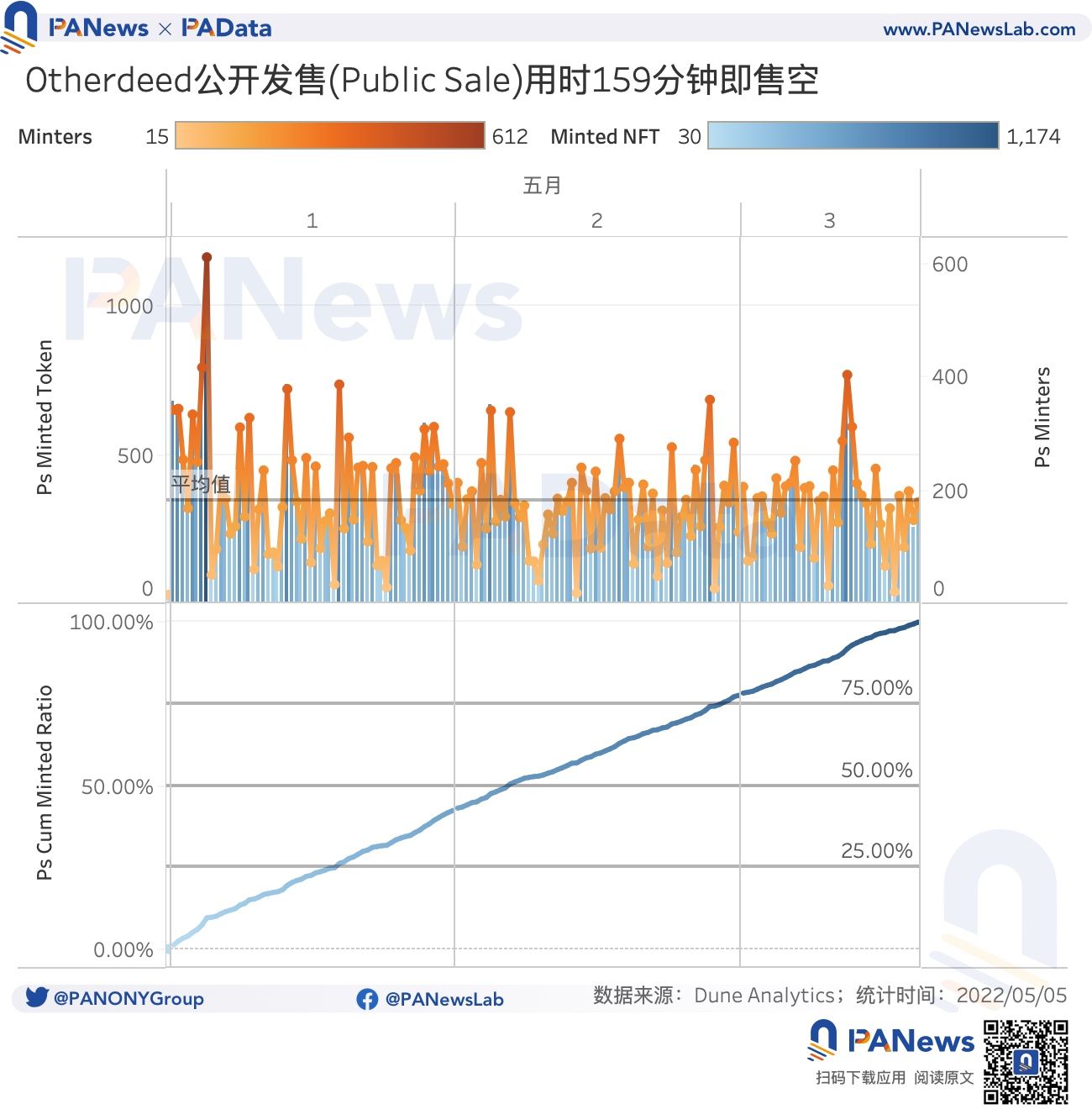

2)公开发售的5.5万个Otherdeed在159分钟内即被抢购一空。第60分钟已累计有12130个地址铸造了23282个Otherdeed,第74分钟累计铸币数量占总公开发售数量的比重就超过了50%。

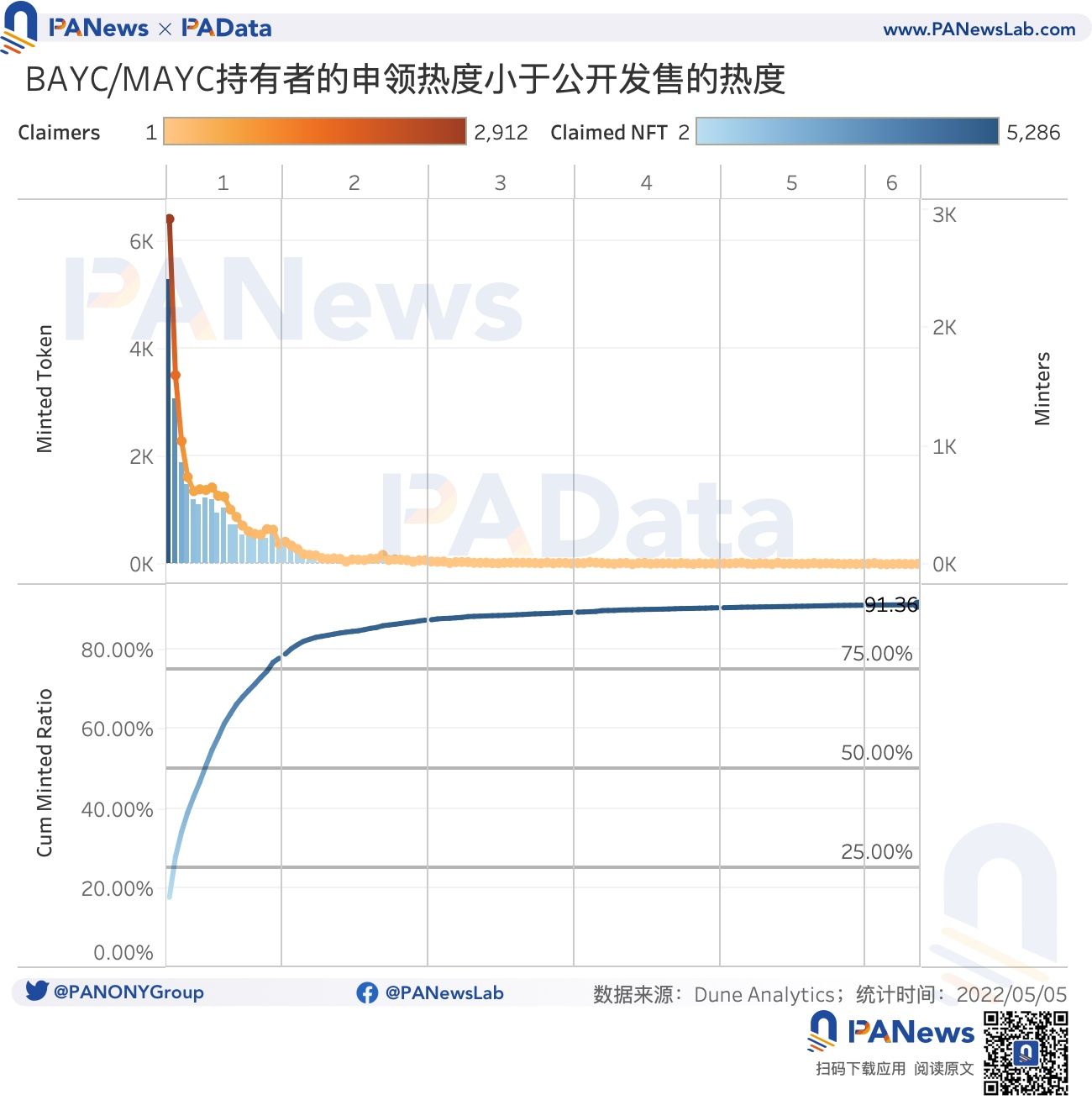

3)BAYC和MAYC持有者的申领的热度并不高。截至5月8日午间12:00(UTC),共有15241个BAYC和MAYC持有地址累计申领了27610个Otherdeed,占可申领总额的92.03%,尚有2390个Otherdeed未被申领。

4)截至5月5日,Otherdeed的持有地址数量约有33997个。单地址的持有量却有比较明显的层级分化。值得关注的趋势包括,不断有新地址持有Otherdeed、拥有2-5个Otherdeed的地址继续增持、少量巨鲸地址存在抛售Otherdeed的可能。

5)共有28746笔交易成功铸币,支付的Gas价格基本集中在4000-6000 Gwei之间,合计占比超过90%。支付的最高手续费达到了45556 Gwei,超过10000 Gwei的交易还有93笔。

6)28746笔铸币成功的交易被打包进了696个区块,累计支付的手续费达到了60233.98ETH">ETH,相当于每笔成功的交易平均需支付约2.12 ETH。13174笔铸币失败的交易被打包进了703个区块,累计支付的手续费达到了0.55 ETH。

7)因Otherdeed交易而销毁的手续费已经达到了55916.61 ETH,仅次于OpenSea">OpenSea、Uniswap V2、Tether和Uniswap V3这四大协议。

01

二级市场均价下跌超18%,近期市场抛压或较重

多项价格数据表明Otherdeed的二级市场成交价格自上线后明显承压,下跌趋势明显。从地板价来看,Otherdeed在发行首日的地板价约为0.898 ETH,次日达到峰值3.749 ETH,随后便连续快速下跌,至5月6日,地板价已经跌至0.956 ETH,较峰值下跌超74%,跌幅显著。与地板价在6天内走出“A”字型不同,最高成交价在此期间则走出了“M”型。发行首日的最高成交价达到了242.1 ETH,折合约68.58万美元。5月3日,最高成交价达到了第一个峰值,约为333.0 ETH,折合约92.78万美元,次日即下跌至188.0 ETH。5月5日,最高成交价再次达到峰值,约为333.3 ETH,折合约91.79万美元,次日又下跌至155 ETH。最高成交价在6天内的总体跌幅约为36%,且波动较大。

从成交价格的平均值和中位数来看,下行趋势更加明显,这意味着,从总体上看,大部分Otherdeed的价格在过去6天内变得便宜了。成交价格的平均值从5月1日的9.192 ETH下跌至5月6日的7.486 ETH,跌幅约为18.56%。成交价格的中位数从5月1日的7.267 ETH下跌至5月6日的4.050 ETH,跌幅约为44.27%。值得注意的是,同期中位数的跌幅较平均值的更大,这表明,市场成交价格趋向离散和分化,少部分Otherdeed的成交价格较高,但多数则较低,且逐渐更低。

那么在这样的行情下,首发抢购Otherdeed的用户究竟还能获利吗?按照Uniswap上218.6APE">APE=1 ETH的汇率折算,305 APE的售卖价格相当于1.3953 ETH,再加上成功铸造Otherdeed的平均每笔交易的手续费2.12 ETH,相当于每个Otherdeed的平均成本价约为3.52 ETH,仍然低于每日二级市场上的成交均价,但已经显著高于多日地板价了。将平均铸币成本与平均交易价格进行对比的话,可以预测每个Otherdeed的盈利空间在15%至43%之间(未去除OpenSea交易手续费)。但如果以更高的手续费铸币,且以成交均价卖出的话,则存在亏损的可能。如果以更低的价格购入APE,且以成交均价卖出的话,则获利空间还可能大幅提高。用户最终的获利情况需要取决于买入APE的价格、交易手续费和最终的成交价格,这是一个多方博弈的动态系统,这里仅提供一个平均视角作为参考。

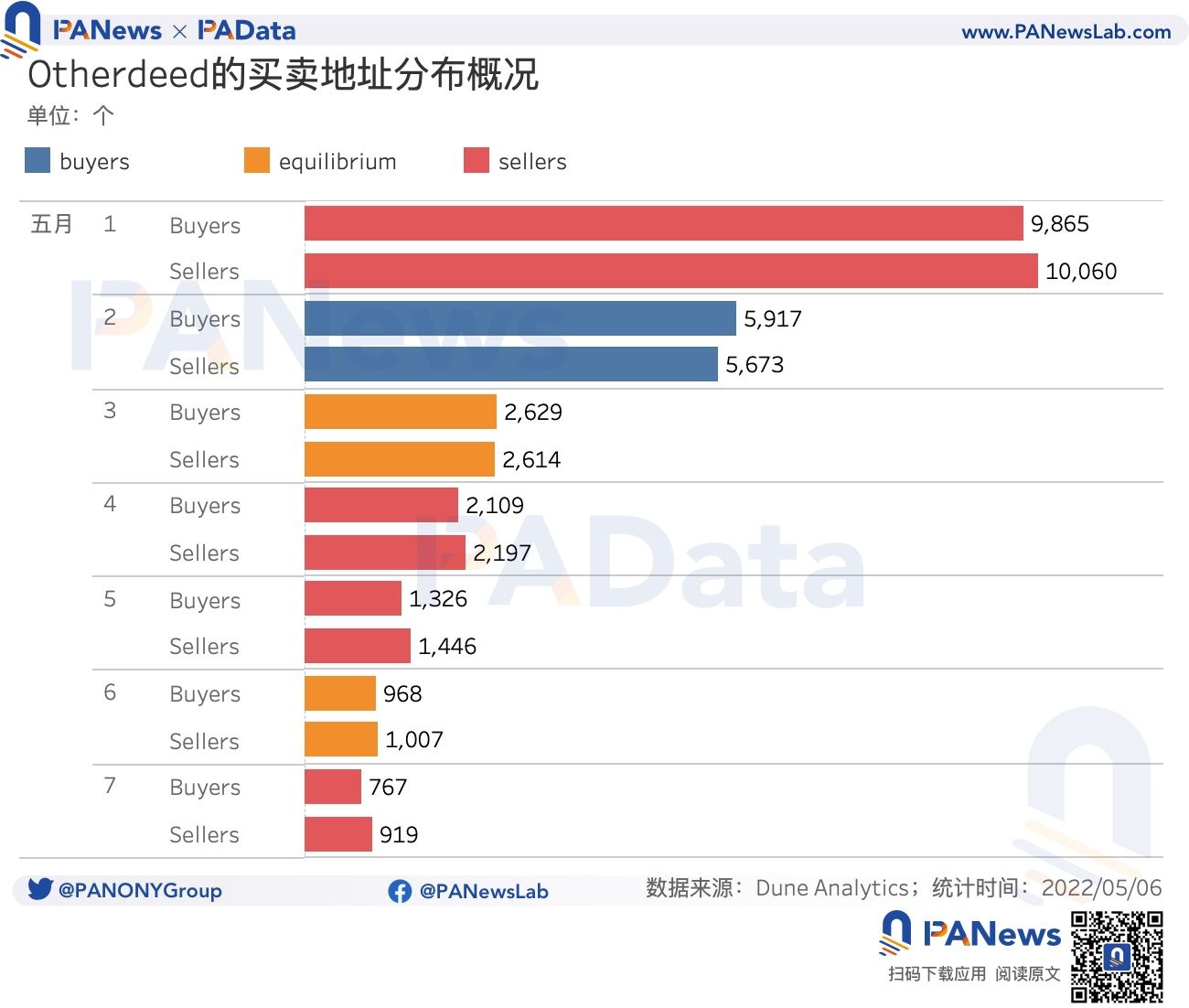

同时,近期二级市场上每日买卖地址的相对数量也在一定程度上从侧面印证了价格承压的现状。根据统计,在5月1日至5月7日这7天中,有4天都是卖方地址数量明显多于买方地址数量,这意味着更可能发生供过于求,买方具有议价优势,有利于价格下跌。只有5月2日这1天是买方地址数量明显多于卖方地址,也即更可能发生供小于求,卖家具有优势,有利于价格上涨。另外还有2天买卖双方地址数量接近,市场较为平衡。其次,从总体趋势来看,无论是买家地址数量还是卖家地址数量都明显下降,降幅都在90%以上,参与交易的地址少了,交易热度也随之下降。这与价格的变化可被视为相辅相成的连锁反应。

受到二级市场交易价格下行的影响,交易总额也逐日下降。Otherdeed在发行首日的交易总额约为3.856亿美元,次日即下跌至2.053亿美元,日环比降幅达到46.76%。3日以后,交易总额始终在1亿美元关口以下,至5日已不到5000万美元美元。5月1日至6日的交易总额整体降幅达到了近95%,降幅十分显著。

02

公开发售仅用时159分钟即售罄,BAYC/MAYC持有者尚未完全申领

根据规则,首轮发行的10万份Otherdeed中有55000个被公开发售(Public Sale),每个售价305 APE,10000个被空投给BAYC持有者,20000个被空投给MAYC持有者,剩下15000个被空投给开发者。

其中,公开发售的5.5万个Otherdeed在159分钟内即被抢购一空。第1个小时内,累计共有12130个地址铸造了23282个Otherdeed,第2个小时内,累计共有10030个地址铸造了19367个Otherdeed,在第3个小时内,累计共有6559个地址铸造了12321个Otherdeed。从更小的时间周期来看,在第7分钟的时候出现了一个铸币高峰,共有612个地址购买了1174个Otherdeed,此后每分钟铸币的热度回落。根据统计,发售期间,平均每分钟约有180个地址铸造346个Otherdeed。且到74分钟的时候,累计铸币数量占总公开发售数量的比重就超过了50%。早期抢购热度可见一斑。

相较于公开售卖引发的热情抢购,BAYC和MAYC持有者的申领的热度并不高。截至5月8日午间12:00(UTC),共有15241个BAYC和MAYC持有地址累计申领了27610个Otherdeed,占可申领总额的92.03%,尚有2390个Otherdeed未被申领。从具体申领情况来看,5月1日BAYC和MAYC持有地址申领数量较多,共有12691个地址申领了23360个Otherdeed。其中,当天11:00(UTC),申领进度已超过50%,到了22:00(UTC),申领进度就超过了75%。相当于大多数持有地址都在可申领的当天就基本完成了申领。而此后,申领热度则大幅下跌,5月2日便仅有1464个地址申领了2876个Otherdeed,到了6日仅有35个地址申领了43个Otherdeed了。

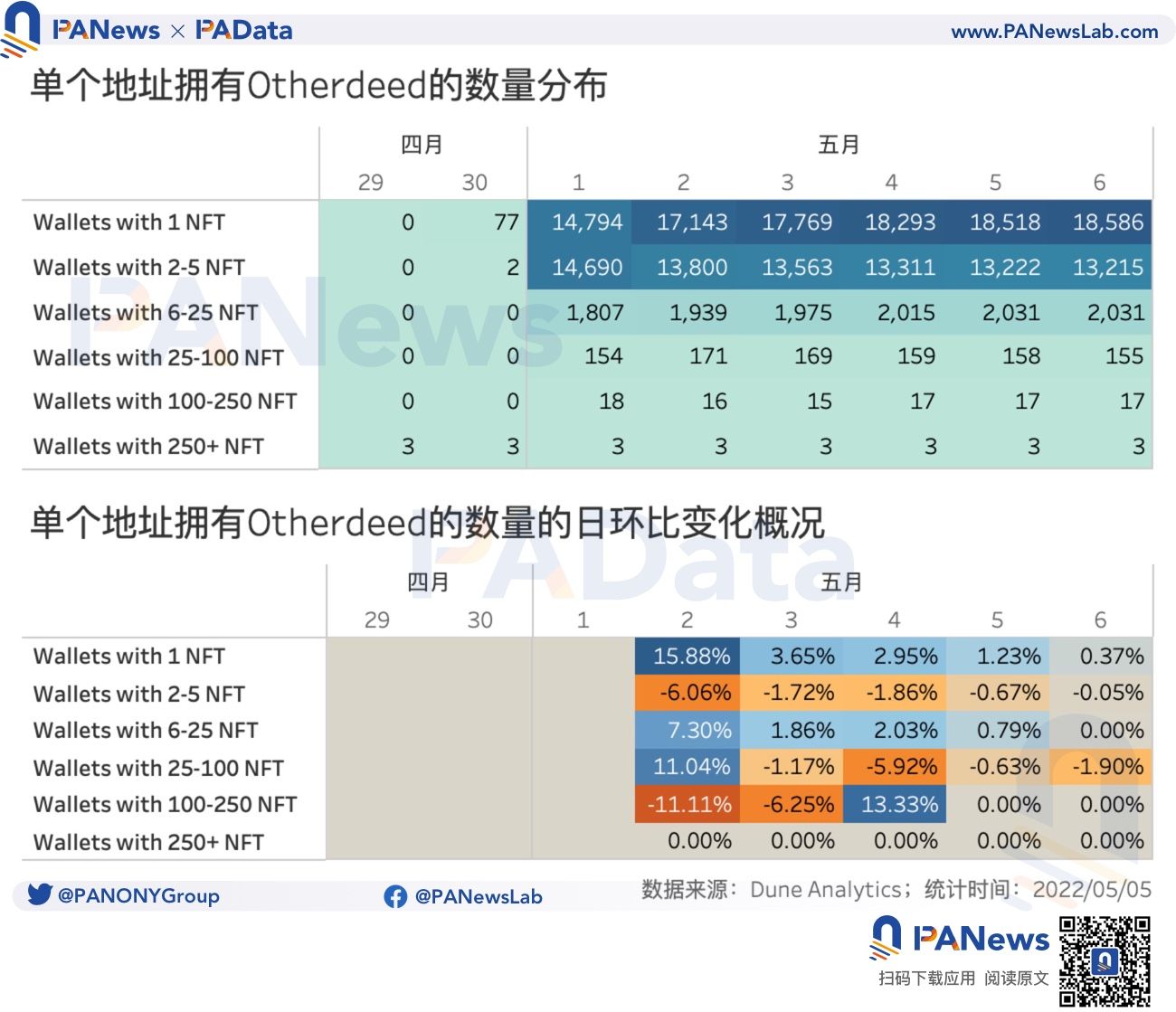

截至5月5日,Otherdeed的持有地址数量约有33997个,实际上,自5月2日以后,总持有地址的每小时环比增速大多在0.1%以下,总地址数量自上线首日后即保持基本稳定。不过,单地址的持有量却有比较明显的层级分化。单地址拥有1个和2-5个Otherdeed的地址最多,截至5月6日,这两个组别的地址数量分别达到了1.86万个和1.32万个左右,分别占总地址数的54.67%和38.87%,合计占比超过90%。其次,还有2031个地址持有6-25个Otherdeed,155个地址持有25-100个,17个地址持有100-250个,若将这些地址视为巨鲸,则巨鲸地址占比不到7%。另外,还有3个地址拥有250个以上的Otherdeed,可能是项目财政库地址,这里不进一步分析。

从近日各类地址的数量变化来看,其中可能存在这样3个趋势。第一个是不断有新地址持有Otherdeed。因为拥有1个Otherdeed的地址数量每日都在增长,其中5月2日环比涨幅超过了15%,此后其他日的环比涨幅则快速下降,至6日仅有不到1%了。第二个是拥有2-5个Otherdeed的地址继续增持。因为拥有2-5个的地址数量日环比变化幅度与拥有6-25个的地址的基本接近。第三个是少量巨鲸地址存在抛售Otherdeed的可能,拥有25个以上Otherdeed的地址数量总体减少。

03

铸币累计支付6.18万ETH,最高Gwei超4.5万

Otherdeed的公开发售引发了一场Gas War,那些成功铸币的交易都支付了多高的手续费?根据统计,共有28746笔交易成功铸币,支付的Gas价格基本集中在4000-6000 Gwei之间。其中,支付的Gas价格在4000-5000 Gwei的交易有12977笔,占比约为45.14%,在5000-6000 Gwei的交易有8908笔,占比约为30.99%,在6000-7000 Gwei的交易有4152笔,占比约为14.44%,三者合计占比超过90%。另外,支付的Gas价格在不足4000 Gwei的交易仅占比3.40%,而超过7000 Gwei的交易占比也只有6.03%。

尽管支付相对较低或较高Gas价格的交易数量并不多,但这些交易对理解Gas War的激烈程度也十分有意义。在单区块包含的成功铸币的交易中,支付的最高手续费达到了45556 Gwei,而超过10000 Gwei的交易还有93笔,大多都在10000-13000 Gwei之间。即使是最低手续费,每块的平均最低Gas价格也达到了5905 Gwei。要知道,一般情况下,近期以太坊的每笔交易的Gas价格通常在100-200 Gwei之间。Otherdeed公开发售对瞬时交易费用的影响是巨大的。

从每个区块内包含的铸币交易数量和手续费来看,铸币成功的交易的数量和手续费表现出良好的线性拟合效果,也即当块内包含的铸币交易数量增加时,该块的交易手续费也相应大幅增加。根据统计,28746笔铸币成功的交易被打包进了696个区块,累计支付的手续费达到了60233.98 ETH,相当于每笔成功的交易平均需支付约2.12 ETH。

相反,哪些铸币不成功的交易的数量和手续费则不能拟合为线性相关,也即交易数量的多少和手续费的高低之间不存在明显的相关关心,当块内包含的铸币交易数量增加时,该块的交易手续费没有出现增加(如图中绿色圆圈群组),或者该块的交易手续费没有出现相应大幅增加(如图中红色圆圈群组)。根据统计,13174笔铸币失败的交易被打包进了703个区块,累计支付的手续费达到了0.55 ETH。

无论铸币成功与否,Otherdeed的公开发售共产生了61832.93 ETH的手续费,远远近期高于以太坊单日全网手续费基本不超过20000 ETH的通常水平。另外,根据ultrasound.money的统计,因Otherdeed交易而销毁的手续费已经达到了55916.61 ETH,仅次于OpenSea、Uniswap V2、Tether和Uniswap V3这四大协议。剩下的5916.32 ETH则为支付的Tip费。由此可见Otherdeed对以太坊网络的交易影响力。