Chainalysis Web3 Report: Who Is Holding and Investing in NFTs?

This article comes fromChainalysis, Odaily translator | Moni

, Odaily translator | Moni

As one of the hottest verticals in the encryption industry, NFT will experience explosive growth in 2021, and as it enters 2022, the entire market will begin to stabilize. Data will not lie, let us take a look at what has changed in the NFT market since the beginning of 2021.

secondary title

Significant growth in transaction volume but cyclical fluctuations

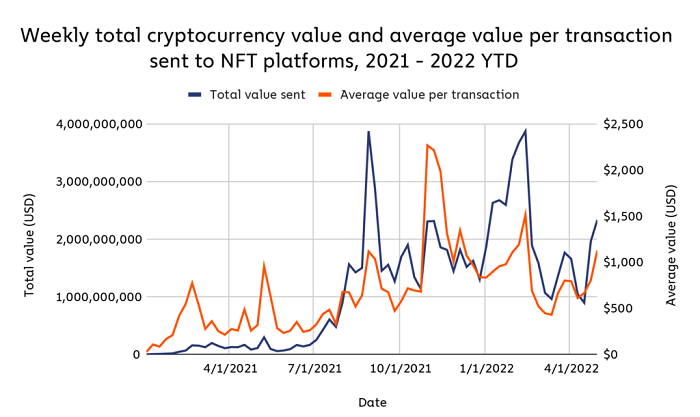

Since the beginning of 2021, NFT transaction volume has increased significantly, but this growth has been accompanied by cyclical fluctuations. NFT trading activity has ebbed and flowed – January 2022 continued the growth seen in 2021, but entered a downturn in February and then began to recover in mid-April.

As of May 1, more than US$37 billion has been injected into the NFT market. If there is no abnormality in the market in the remaining 7 months, then this year's NFT market is likely to exceed the inflow of US$40 billion in 2021. In addition, since late summer 2021, the growth of NFT transactions has been intermittent, during which two transaction peaks occurred:

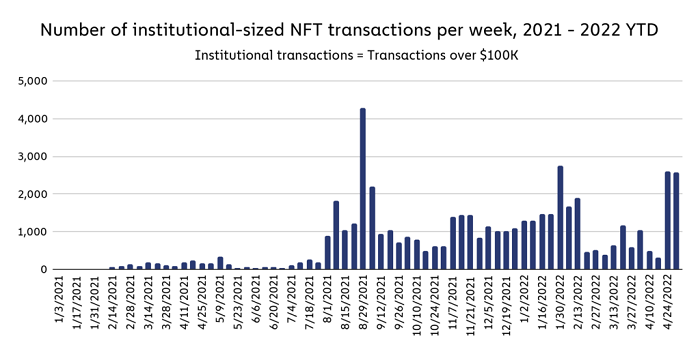

1. The first time will be in late August 2021. This transaction peak may be driven by the release of the Mutant Ape Yacht Club NFT series;

After these two trading peaks, NFT trading activity has declined significantly since mid-February, from $3.9 billion in the week of February 13 to $964 million in the week of March 13 — the highest since 2019. The lowest weekly level since the week of Aug. 1, 2021. However, when the time came to mid-April 2022, the trading volume of the NFT market began to recover again, because the "boring ape" BAYC launched the metaverse project Otherside.

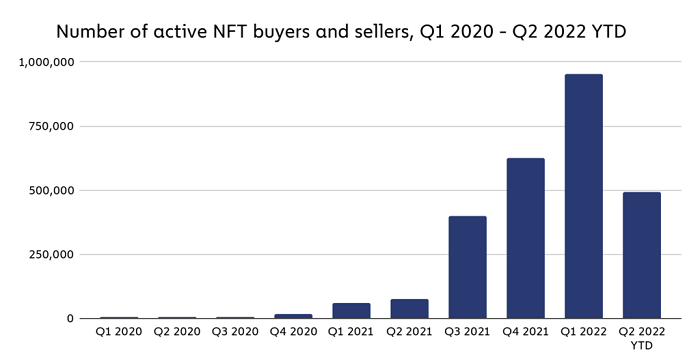

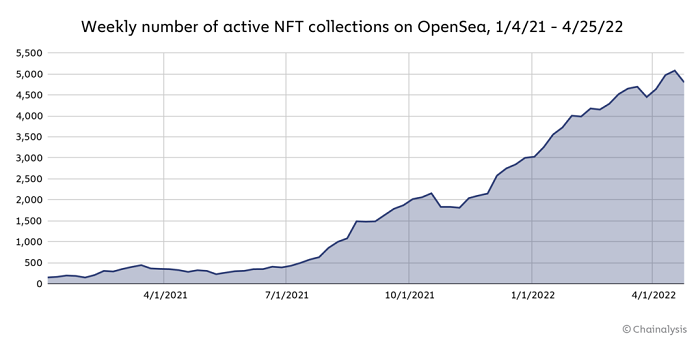

It is worth mentioning that despite the ups and downs of NFT transaction volume, the number of active buyers and sellers has continued to grow. In the first quarter of 2022, 950,000 unique addresses bought and sold NFT T, up from 627,000 in the fourth quarter of 2021. In fact, the number of active NFT buyers and sellers has increased every quarter since the second quarter of 2020. rise. As of May 1, the number of addresses with NFT transactions in the second quarter of 2022 reached 491,000. In addition, since March 2021, the number of active NFT collections on OpenSea has also continued to grow, and it has basically remained above 4,000 at present, and exceeded 5,000 at the peak.

secondary title

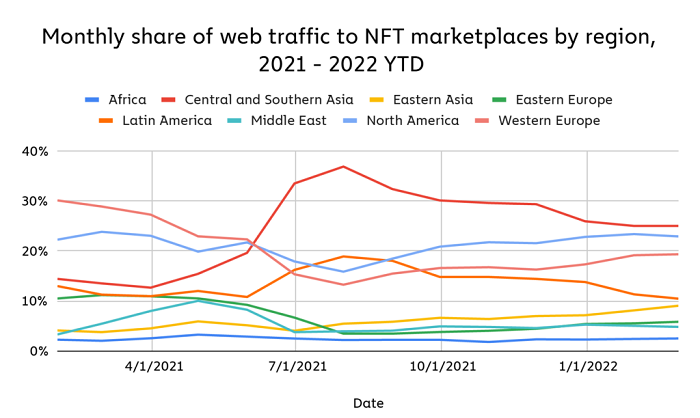

Analysis of the network traffic of mainstream NFT platforms in the market shows that NFT has attracted users from all over the world, with Central Asia and South Asia leading in the number of NFT investors, followed by North America and Western Europe. It should be noted that since the beginning of 2021, there has been no region where NFT platform access traffic has exceeded 40% of all network traffic, which means that NFT popularity is very even on a global scale.

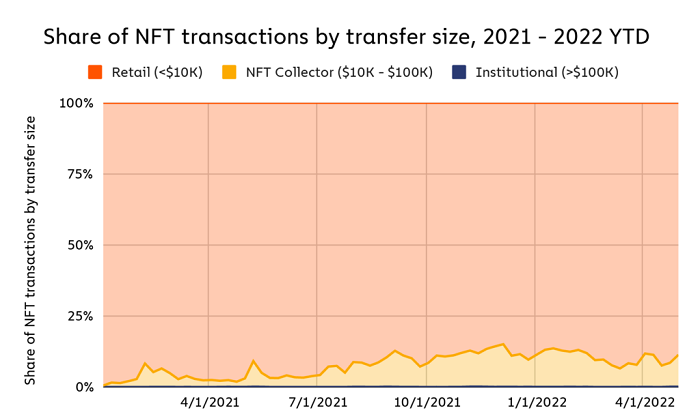

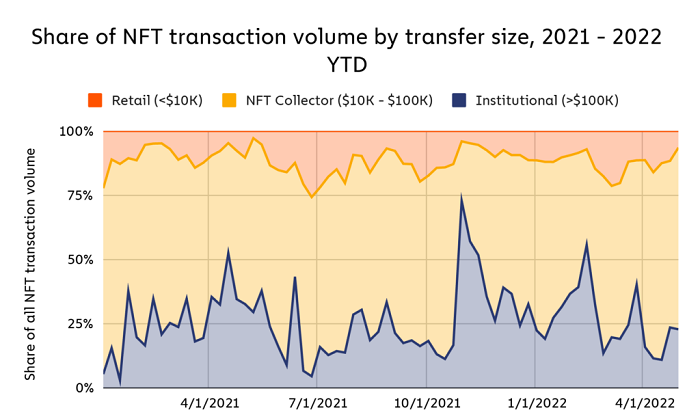

So, who is investing in NFTs? The data shows that the vast majority of NFT transactions are driven by retail investors, as NFT transactions worth less than $10,000 account for the majority. During the period from January to September 2021, the proportion of NFT transactions with a size of 10,000 to 100,000 US dollars increased significantly, and gradually remained stable after October 2021.

secondary title

When the market is hot, institutional NFT investment has begun to decrease significantly

However, if we analyze the NFT market from the perspective of transaction value rather than transfer volume, we will find that institutional NFT investors have changed. During the period from January to September 2021, institutional investors are still relatively active in participating in the NFT market, and even occupy most of the trading activities in a certain few weeks (with relatively generous sales). For example, in the week of October 31, 2021, institutional NFT transactions accounted for 73% of all NFT market transactions, especially several NFTs in the Mutant Ape Yacht Club series were bought at high prices.