Encrypted lending company BlockFi reached a settlement with the US SEC, what does it mean for the encryption field?

This article comes fromDecrypt, original author: Jeff Benson

Odaily Translator |

![]()

This article comes from, original author: Jeff BensonOdaily Translator |

According to the U.S. Securities and Exchange Commission (SEC)

press release issued on monday

, crypto lending firm BlockFi must pay $100 million to federal and state securities regulators to settle charges it failed to register its high-yield BlockFi Interest-bearing Account (BIA).

One way BlockFi makes money is as follows: paying up to 10% interest on deposits in crypto such as bitcoin and stablecoins, and then lending the assets out at a higher rate. According to the SEC, BIA is a security, but it is not registered as such. The agency also said that BlockFi "exaggerated the extent to which it protected institutional borrowers (borrowers) from default risk through collateral." In short, it claims that most of its loans are overcollateralized when in fact they are not.The company must pay a $50 million fine to the US SEC, a $50 million fine to 32 states, stop new account registrations and bring its business into compliance with the Investment Company Act within 60 days. It neither admitted nor denied the agency's allegations.BlockFi is actively promoting the matterBlockFi is actively promoting the matter

, saying it willRegister with the SECAnd launch new products, which will help clarify regulatory issues for similar products. “We intend to make BlockFi Yield a new, SEC-registered, cryptographic interest-bearing security that will allow customers to earn interest on their crypto assets.” After the SEC completes the BlockFi Yield registration process, unless otherwise directed by customers, Some US customers BIA will be converted to BlockFi Yield.BlockFi and competitor Celsius。

Receive cease and desist and notice of cause from the states. Last September,SEC also successfully blocked Coinbase exchange from launching a similar productSEC also successfully blocked Coinbase exchange from launching a similar product

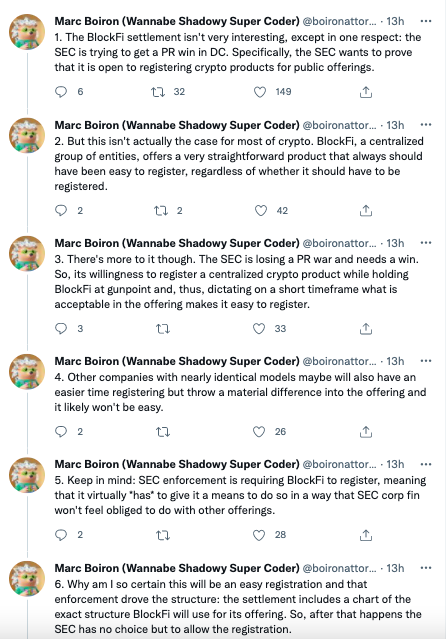

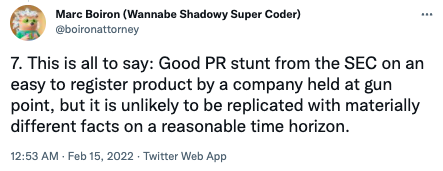

Chief Legal Officer of Ethereum-based decentralized exchange dYdX

Marc Boiron says

, the settlement sounds like a "US SEC PR stunt." According to him, the agency will be able to take a tough stance on crypto while also showing that “it is open to registering crypto offerings for public offerings.”He said, "BlockFi is a centralized entity group. It offers a very simple product, whether it needs to be registered or not, it should be easy to register." But he believes that for the more decentralized, more complex crypto space For some, this may not be the case.

But U.S. SEC Commissioner and "Crypto Mom" Hester Peirce believes that BlockFi will usher in a difficult few months.

She wrote in a statement on the SEC website

, “BlockFi will not be allowed to accept any additional crypto loans from retail investors until the company registers a new crypto lending product through the Form S-1 application. It’s an iterative, months-long process.” She added, “When it comes to cryptocurrencies, it can take longer than for more traditional application categories.”

Plus, she doesn’t think BlockFi can easily overcome another hurdle: Under the rules, it can’t actually register as an investment firm — a category that applies to firms that offer mutual funds, certain trusts, closed-end funds, and even some hedge funds — An exemption from registration therefore needs to be sought. Considering the US SEC's "lack of experience" with such cases and its skepticism towards crypto companies, Hester Peirce believes that the 60-day timeline is extremely difficult for BlockFi, even if it is extended by another 30 days.According to Brookwood PC managing partner Collins Belton, the rules around investment firms have brought attention to other products, not just Celsius and crypto lenders.

He said that the imminent enforcement action should not come as a surprise, but unfortunately for many people, especially those who are not truly decentralized "DAO" players, related actions will be implausible. Many online groups have been formed as DAOs to pool funds and invest using DAO-specific tokens, which are similar to voting rights and shares within companies. Even if some of these projects are not themselves centralized, they will be heavily influenced by a small number of token holders.Belton pointed out, “Centrally managed asset pools are one of the few things the SEC/CFTC can crack down on in crypto.”