This article takes stock of DeFi projects worthy of attention in the Near ecosystem

Near Protocol is one of the high-performance blockchains featuring the concept of "sharding". Compared with other public chains, the deployment of DeFi is relatively slow. The first decentralized exchange, Ref Finance, was officially launched in April 2021. The chain oracle machine Flux was launched on the main network in December. With the continuous improvement of the underlying facilities, DeFi projects have recently begun to exert force, and the ecological construction has accelerated, which has also brought funds to the Near public chain.

In order to support the development of the Near ecology, especially DeFi, Proximity Labs, the research and development company of the NEAR ecology, established a Grants DAO worth 300 million US dollars to support projects, institutions and individuals who develop DeFi applications based on the NEAR blockchain. Ecological incentive plans for other public chains.

In the past year, Near has been interested in attracting developers to build. In the 2021 Web3 Developer Report released by Electric Capital, Near is the third fastest growing smart contract platform for developers, after Terra and Solana, and continues to pass hackers Pine and other forms to attract developers. With the rapid development of the ecology, the price of NEAR has also hit a new high recently. In addition to projects directly deployed on the Near mainnet, Near has also expanded its ecosystem with the help of EVM-compatible Aurora, and the application chain Octopus network is also being actively deployed.

first level title

Ref Finance Decentralized Exchange

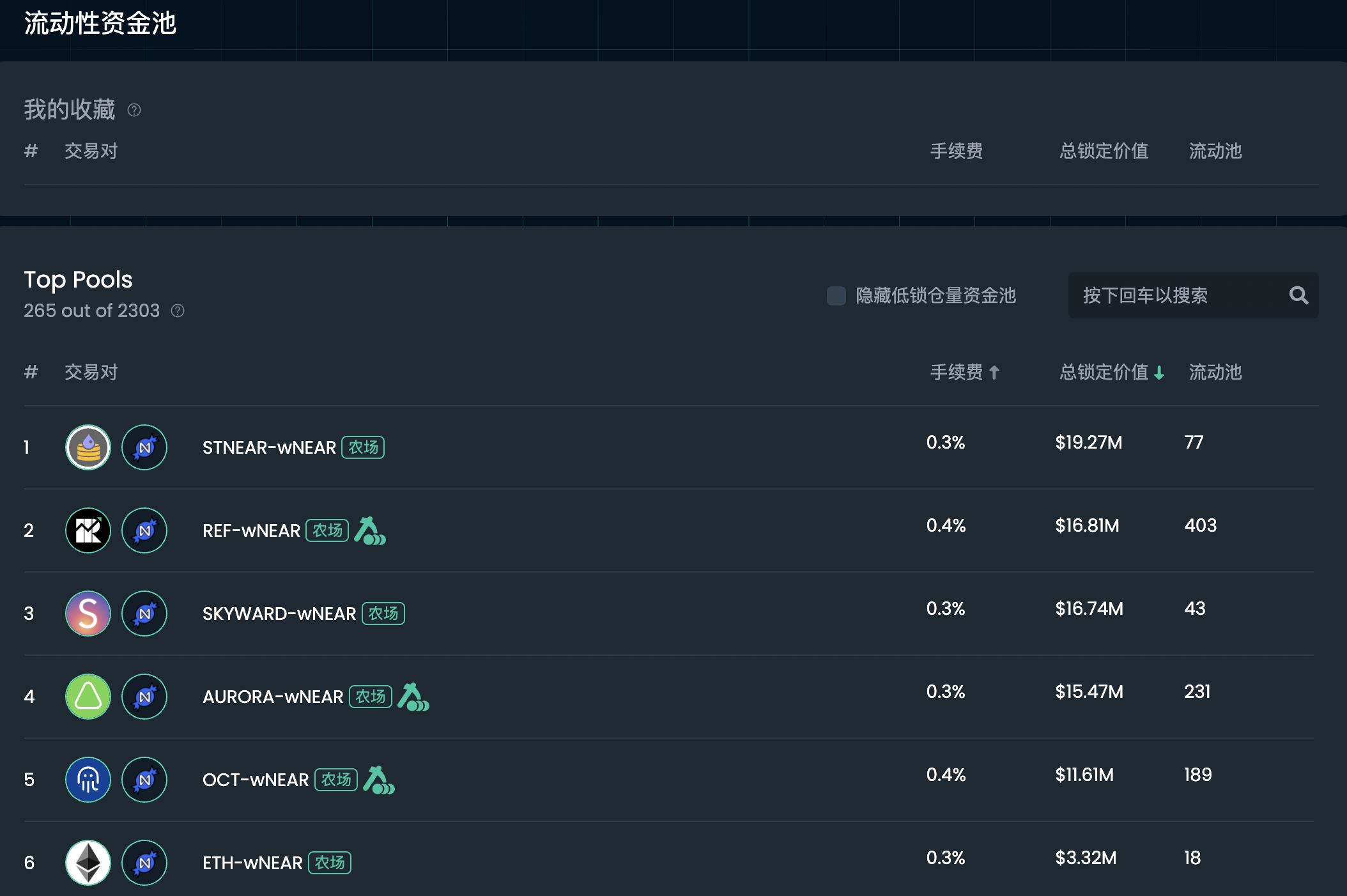

Ref Finance is the first decentralized exchange on Near. In addition to the simple AMM function, Ref Finance added functions such as stable currency pool and intelligent routing transaction in the fourth quarter of 2021, which also has the basic functions of Uniswap V2 and Curve. Its transaction fee is close to that of other DEXs. The exchange fee for stablecoin trading pairs is 0.05%, and that for other trading pairs is mainly 0.3%.

Ref Finance can serve projects in the Near ecosystem, help their tokens provide liquidity, and provide "double mining" rewards. As of January 12, 2022, a total of 16 trading pairs in Ref Finance can be used for liquidity mining, and the corresponding tokens of well-known projects in the Near ecosystem, such as Aurora, Octopus Network, and Skyward Finance, are all within the scope of incentives. According to Defi Llama, the total lock-up in Ref Finance is about $93 million.

Meta Pool Liquidity Staking Scheme

After the success of Lido on Ethereum, the direction of liquidity staking has attracted people's attention. So far, almost all PoS chains have at least one project that helps users to carry out liquidity staking, and such projects are also easy Get high TVL like Lido TVL 10.5 billion USD, Marinade Finance TVL 1.09 billion USD on Solana. While obtaining pledge income, users can also hold corresponding derivatives for liquidity mining, etc., which improves the utilization rate of funds.

first level title

Skyward Finance Launchpad platform

Skyward Finance is a Launchpad platform on Near that helps projects on Near Protocol achieve fair distribution and price discovery. In terms of auction mechanism, Skyward is quite different from other projects, it adopts the Streaming auction mode. Users can participate in the auction at any point in time. The auction price will change with the block. In each block, tokens will be received according to the proportion of funds. If the price is too high, they can withdraw at any time.

The auction on Skyward does not need to pledge the platform currency SKYWARD, which ensures the fairness and openness of the auction. 1% of the auction tokens and auction proceeds will be charged 1% by the Skyward treasury. As the number of auctions increases, the assets of the Skyward treasury will increase. Because users can choose to destroy SKYWARD to redeem the assets in the treasury, the value of SKYWARD will also increase with the number of auctions (90% of SKYWARD is distributed through auctions, and the auction funds also enter the treasury).

Many well-known projects in the Near ecosystem have been auctioned through Skyward, such as Ref Finance, Octopus Network, Paras, Aurora, Meta Pool, etc.

Burrow loan

Burrow is a lending protocol on Near, but it has only launched the testnet so far. The current testnet only supports loans of five assets: NEAR, ETH, USDT, USDC, and DAI. It is functionally similar to other lending protocols.

first level title

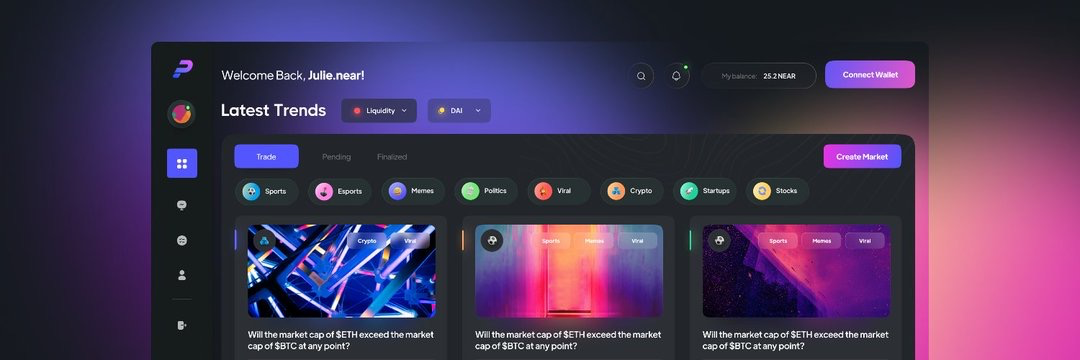

Pulse Markets prediction market

Pulse is a prediction market built on Near and Flux (decentralized oracle machine). Because of its open and decentralized features, the prediction market allows users to trade any asset without permission. Pulse lets the market price positions through the AMM, and when the settlement date is reached, correct predictions can be rewarded.

As of January 12, there are a total of 6 tradable contracts on Pulse, 5 of which are sports and 1 is cryptocurrency, but there are very few users involved. The most involved fund is "Whether the market value of ETH will exceed BTC at any time" in the cryptocurrency. The settlement date is April 15, 2023, with a total of 225 DAI liquidity, of which 72.99% think it will exceed.

Aurora

first level title

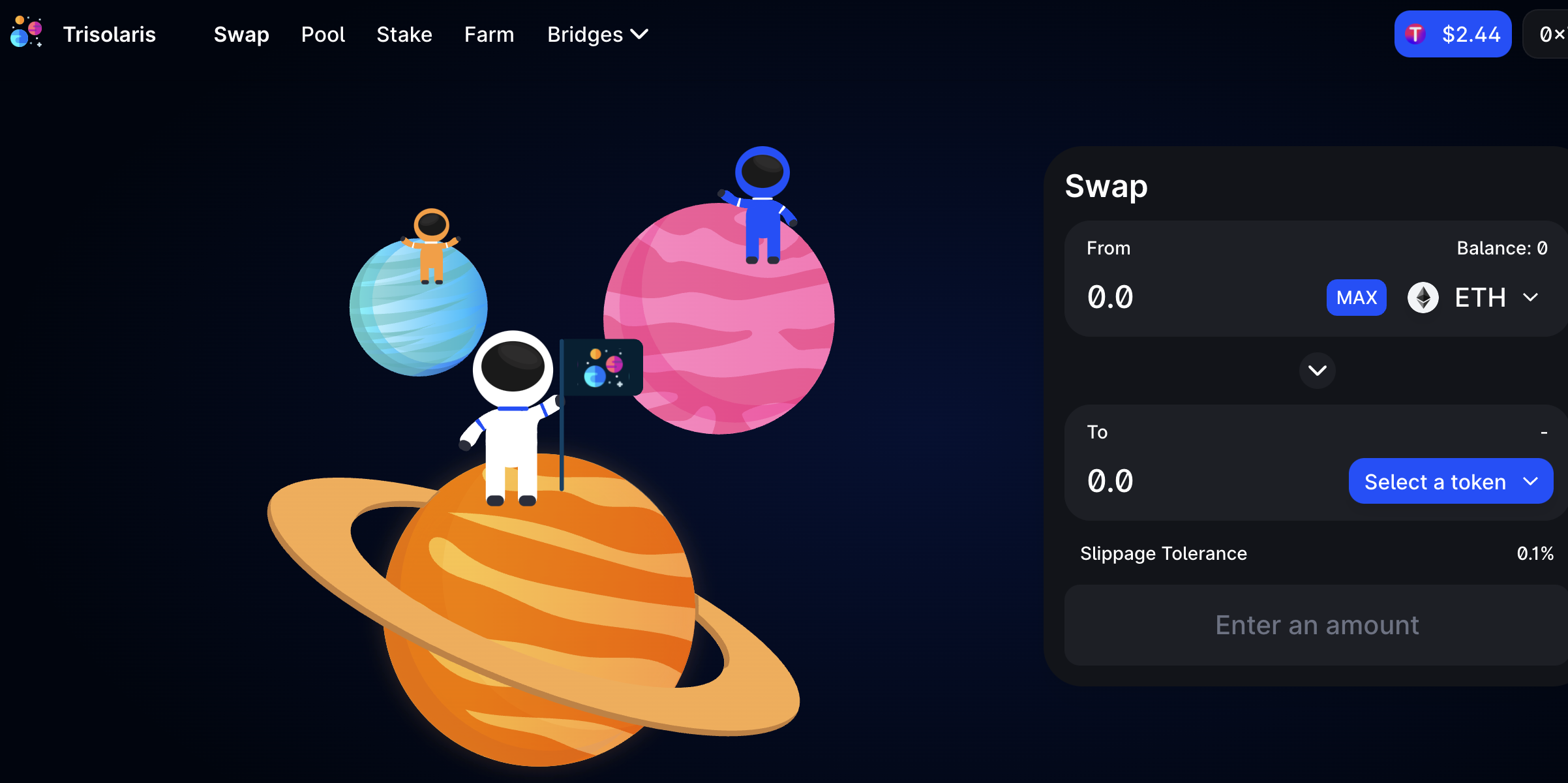

Trisolaris

Trisolaris is the largest DEX on Aurora, supporting liquidity mining of 14 trading pairs, with a TVL of $480 million, accounting for the majority of Aurora’s TVL. Among them, the stablecoin trading pair USDC/USDT with the best liquidity has a liquidity of 160 million US dollars and an APR of 24%, which is higher than most stablecoin wealth management returns. It is worth noting that Aurora provides additional AURORA mining rewards for the two trading pairs of TRI/AURORA and AURORA/ETH on Trisolaris, and liquidity providers can obtain AURORA and TRI token rewards at the same time, which shows that Trisolaris has received more rewards from Aurora. Much support.

In addition to the Rainbow Bridge on Near, Multichain, Allbridge, and Synapse Bridge can also be used on Trisolaris to cross-chain assets from public chains such as BSC, Terra, and Avalanche to Aurora. LUNA, UST, AVAX, BNB, and MATIC are all available Form a trading pair with WNEAR to participate in the liquidity mining of Trisolaris. On January 11, Proposition 165 on the UST liquidity incentive plan in Terra was passed, which will incentivize the use of UST on Aurora (Trisolaris, Rose), Oasis, and Solana.

Wannaswap

first level title

NearPad

LaunchPad and DeFi hub in the Near ecosystem, it wants to be a one-stop shop for navigating innovation, monitoring and managing digital assets. NearPad consists of three parts, distribution platform, DEX and revenue aggregator. Among them, Launchpad has launched 3 projects on Aurora. The auction pool is divided into whitelist and pledge participation. DEX is the following Rose.

Rose

Compared with other DEXs on Aurora, Rose is mainly oriented to stablecoin trading pairs and cross-chain asset transactions. Among them, the stablecoin pool DAI/USDT/USDC has a liquidity of about 8.3 million US dollars, and the transaction fee rate is 0.04%. When trading stablecoins, the experience is better than other DEXs on Aurora. Rose's TVL is about $15 million.

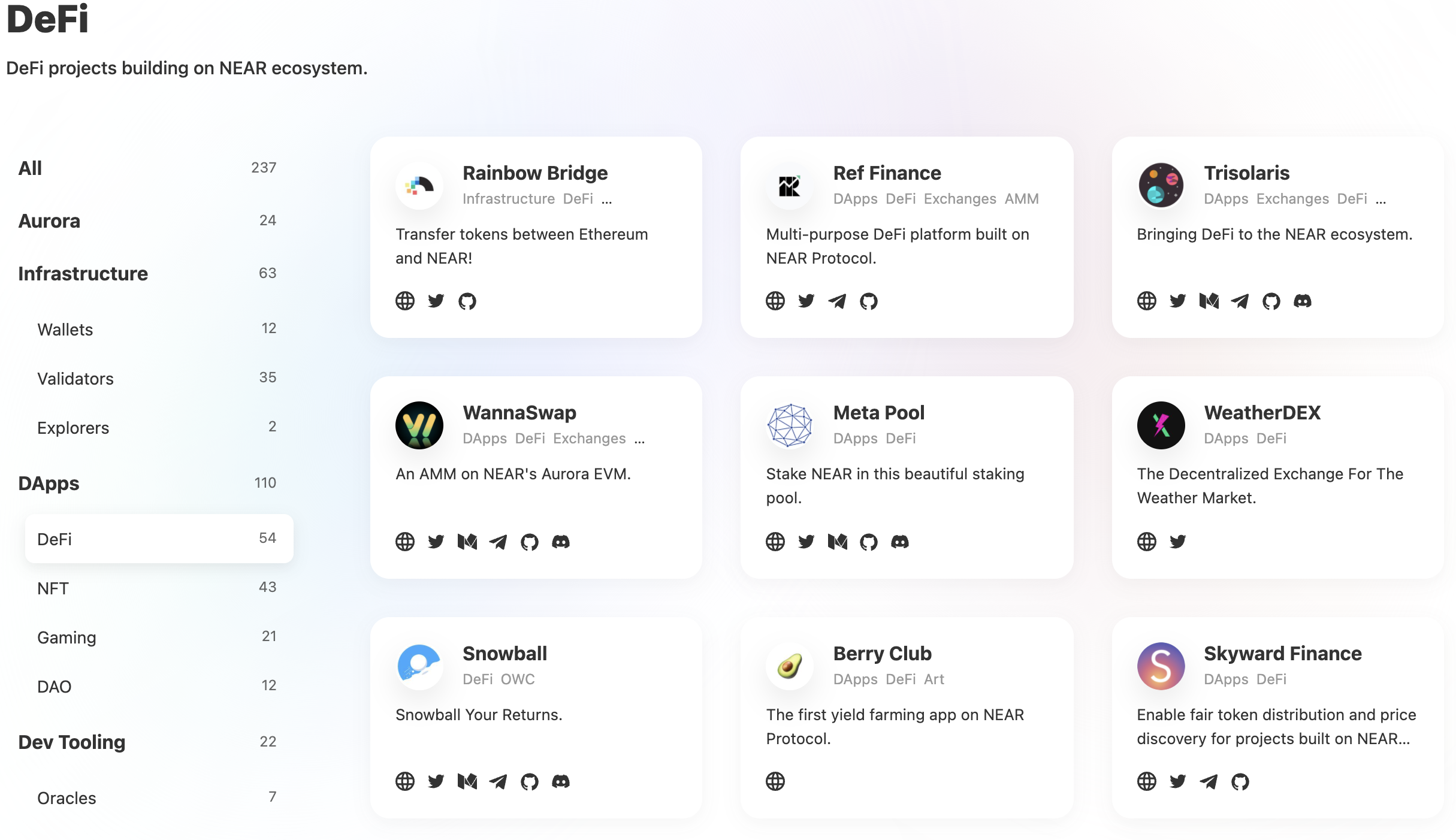

There are a total of 237 Near ecological projects included on Awesomenear.com, and there are corresponding projects in infrastructure, DApps, development tools, and ecosystem directions. Due to the limited space of the article, this article only introduces a few representative ones, and more projects can be found on this website.

summary

There are more than 200 DeFi projects in the Near ecosystem, and there are also representative projects in the key directions of DeFi. In addition to native projects, projects like DODO have also been deployed on Aurora. In addition to DeFi, there are also projects in other directions, such as Paras in NFT.

However, there is also an imbalance in the development of the Near ecology. The funds in the DeFi projects on the Near mainnet are mainly concentrated in Ref Finance and Meta Pool, and there are not enough projects that have been launched. This may be because the development costs of projects are higher, and users You also need to learn to use Near's wallet. Aurora, which has only started to develop its ecology in the past two months, has surpassed the projects on the Near mainnet on TVL because it is compatible with EVM.