Looking back on 2021: Layer-1 blockchain, Layer-2 scaling solutions and the future of Ethereum 2.0

Original Author: bacool

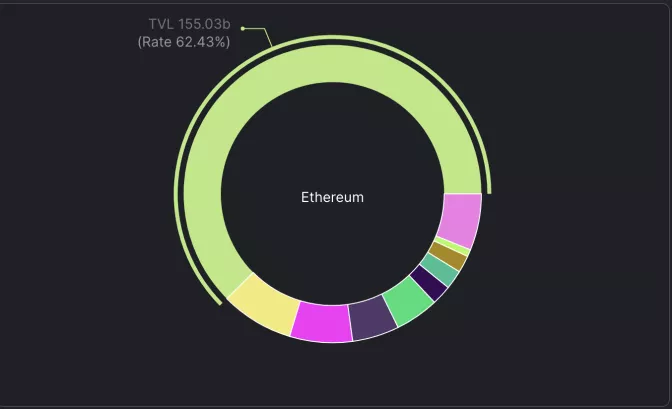

Ethereum’s share of DeFi’s total locked-up volume (TVL) has dropped from 96.91% in January 2021 to 62.43% in Q4 of 2021. (Source: https://defillama.com/chains)

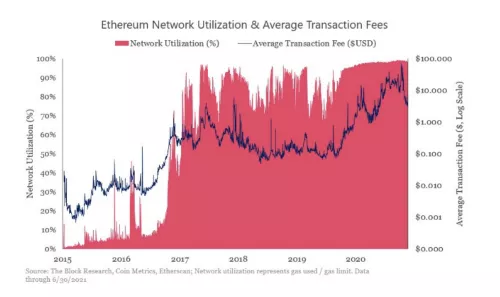

Ethereum has become a victim of its own success - Ethereum's decentralization and openness ignited the DeFi revolution, but it also prevented many users from joining due to high transaction fees caused by congestion.

In the short term, when the community is still waiting for the Ethereum 2.0 upgrade, some L2 expansion solutions (such as the rollup solution), the first phase of the Ethereum 2.0 data layer, and various L1 blockchains that will be widely adopted in 2021, such as Avalanche, Solana, are filling the market's need for low transaction fees and fast transactions.

The launch time of the second phase of Ethereum (shard chain) is not clear today, and it is not known whether it will completely rely on the L2 roll-up solution in the future, which has an impact on the L1 protocol, L2 expansion plan, and the market of Ethereum 2.0 .

Today, Ethereum is conducting daily transactions worth tens of billions of yuan as usual, and assets worth more than 150 billion yuan are stored in decentralized exchanges built on smart contracts for lending, insurance and payment purposes.

Expensive Gas fees (transaction fees) make many people abandon Ethereum 1.0 and turn to other decentralized and secure Layer-1 blockchains that provide similar applications but have lower transaction fees.

L1 solutions are native blockchains with different capabilities and functions, such as Avalanche, Solana and Terra. The L2 solution is a protocol built on top of L1 Ethereum, which has higher throughput and availability.

The competitive L1 protocol has an innovative consensus algorithm, blockchain architecture, and execution environment. How much has their adoption grown compared to Ethereum and L2 solutions?

Among the total locked positions of DeFi in January 2021, Ethereum accounted for 96.91%. And today in Q4 of 2021, the total lock-up volume of Ethereum accounts for 62.43%.

While we are still waiting for Ethereum 2.0 to take shape, some L2 expansion solutions are solving the problem of Ethereum gambling, allowing users to use the DeFi platform with cheaper transaction fees.

The question is, how many people are using existing L2 scaling solutions and bridges?

What is the impact of Ethereum 2.0 on other L1 blockchains? Will the fragmentation of solutions seen in 2021 continue?

How will the final launch of Ethereum 2.0 based on sharding technology affect the existing L2 expansion solutions that more and more people adopt?

Let's explore briefly.

Usage Comparison: Ethereum VS Layer-1 Blockchain VS Layer-2

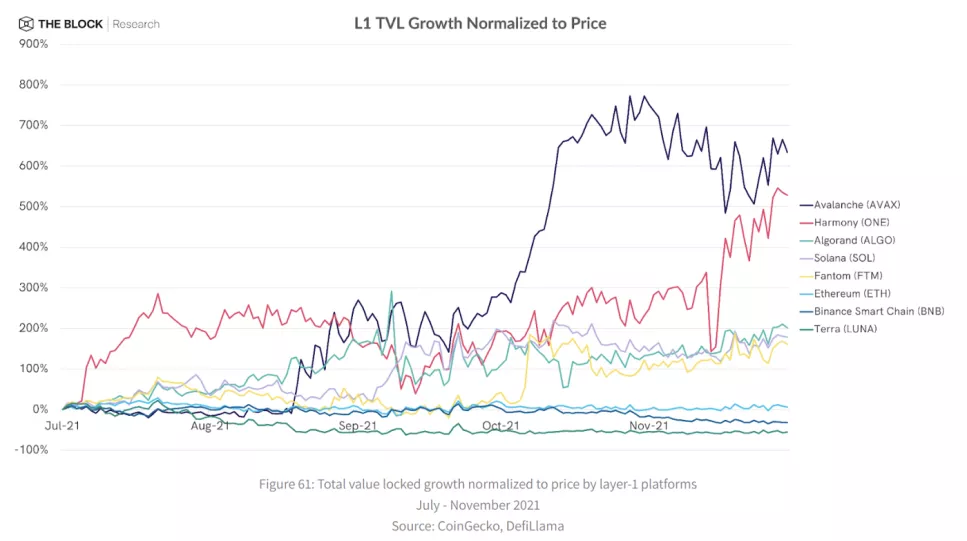

Compared to other L1 solutions, Ethereum's existing L2 scaling solutions have not yet been adopted on a large scale. Other cheaper L1 solutions like Avalanche and other blockchains are used more than Ethereum's L2.

Ethereum's current transaction delay (time-to-finality) is about 12-60 seconds, and it can process 15-30 transactions per second (tps), but such tps is far lower than traditional payment systems, such as Visa can process per second 1700 transactions.

The processing performance of Ethereum's Layer 2 expansion solution is increased to 2000-4000 transactions per second.

In contrast, the Layer-1 protocols that took DeFi market share from Ethereum in 2021 - Solana, Binance Smart Chain and Avalanche - have achieved higher transaction throughput. Before you consider sharding technology and Layer-2 optimization, Avalanche has achieved a transaction latency (time-to-finality) of less than 1 second and 4500 transactions per second.

Solana can process more than 2000 transactions per second (tps), the transaction delay (time-to-finality) is about 13 seconds, Binance Smart Chain is 150 tps, and the block time is 3 seconds.

The following is an overview of the total locked volume of Layer-1 protocols other than Ethereum - the leader is Terra with $20 billion, Binance Smart Chain with $16.9 billion, Avalanche with $12.68 billion, followed by Solana, over $12 billion.

The above chart provided by The Block compares the growth of total locked volume and price of Layer-1 blockchains; Avalanche has been the best performer since September 2021.

But what about Layer-2 solutions, how many people use them?

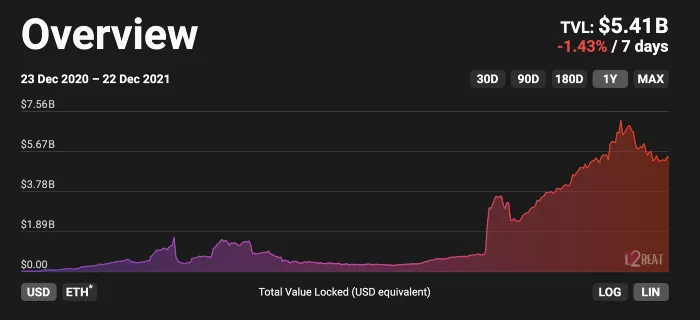

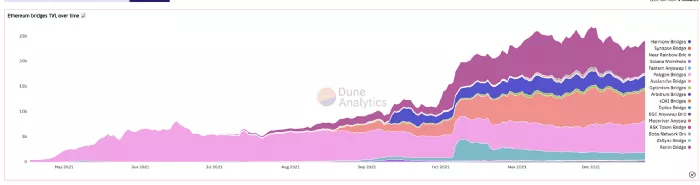

Between 2020-2021, the total locked-up volume (TVL) of L2 solutions will only reach a maximum of about 7 billion US dollars.

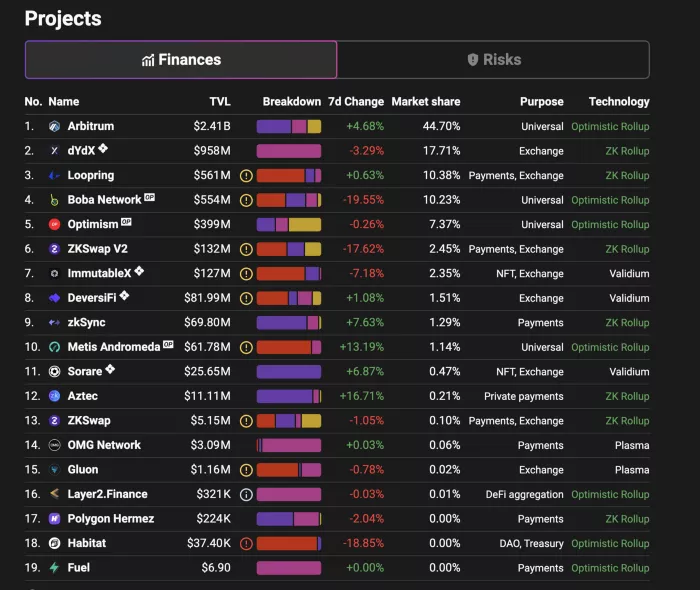

The chart below shows the total amount locked (TVL) for each L2 protocol. Most of them focus on Aribitrum, dYdX and Loopring, which are all roll-up L2 solutions, which will be explained later.

As the graph shows, cheaper L1 solutions like Avalanche and others are used more than Ethereum’s L2 solutions.

For example, more and more people are adopting the Avalanche C chain (contract chain compatible with EVM). As of December 2021, its daily average transaction volume has exceeded 700,000, and the cumulative number of smart contracts on the C chain has exceeded 70,000 .

What is the total locked volume (TVL) and market share of bridges that move assets from Ethereum to other protocols (such as Avalanche, etc.)?

(Note: The bridge is an agreement or blockchain attached to the main chain)

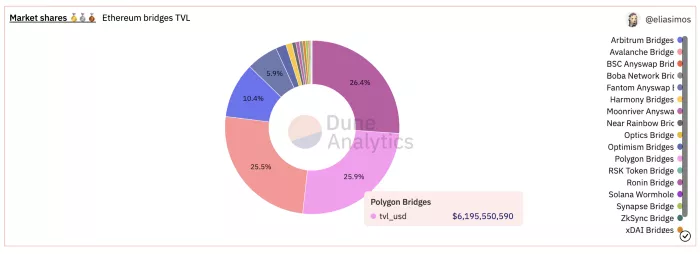

The picture below is from Dune.xyz

As shown in the figure, the top three bridge market shares are Ronin, an Ethereum sidechain made for the Axie Infinity chain game, Polygon, a plasma solution (sub-chain) attached to the Ethereum main chain, and Avalanche C Chain (EVM compatible contract chain) Avalanche bridge, as of December 24, 2021, Avalanche bridge has transferred 6.1 billion US dollars.

User volume and activity on EVM-compatible chains and their bridges will increase significantly in the second half of 2021, partly due to the large number of incentives implemented by the L1 development team and its treasury.

One such example is Avalanche Rush, a $180 million rewards program for Avalanche’s DeFi, attracting users to Avalanche’s blue-chip DeFi projects such as the Aave and Curve lending platforms. This plan is mainly to reward ecological users who participate in liquidity mining.

Although the goals, scope, and token distribution models of each Layer-1 reward program are different, most programs focus on promoting the development of DeFi in their own ecosystems.

Overview of current Layer-2 expansion solutions

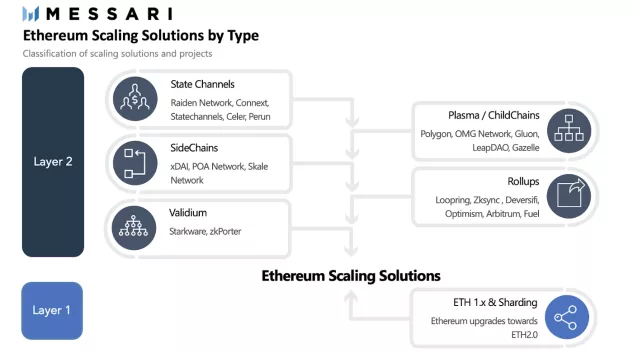

The Layer-2 solution performs off-chain scaling, and does not conduct transactions and calculations on the main chain to ensure that the main chain is no longer congested. The Layer-1 solution is (note: a new protocol) for on-chain scaling, and transactions and calculations are performed on the main chain.

Existing Ethereum L2 expansion solutions include rollups, (such as Loopring, Zksync, Optimism and Arbitrum); Validium, (such as Starkware and zkPorter); Sidechains (Sidechains), (such as xDai and Skale Network); State Channels, (such as Celer); and Plasma, (such as Polygon and OMG Network).

Each of these expansion schemes has unique improvements and trade-offs, and expansion strategies can also be combined. Some are limited to specific applications, such as payment channels, but others can be used to execute any contract.

Among the L2 expansion solutions, Rollups provides the most complete solution. Plasma chains or State channels do not support application development; side chains are less secure because they use a different consensus mechanism from the main chain.

Rollups executes transactions off-chain, and writes encrypted proofs on the chain after the transaction is completed, confirming that the transaction is valid, reducing the resource occupation of the main chain, reducing congestion and gas fees (transaction fees).

Ethereum 2.0 will highlight the scalability advantages of Rollups; because Rollups only need to expand the data layer, they can be used in the first phase of Ethereum 2.0.

The Rollups solution provides Ethereum with a path to scalability, and the time it takes to enter the market is similar to other new Layer-1 solutions. It can be said that Layer-1 participants are competing with rollup solutions to some extent.

Disadvantages of L2 solutions

The L2 solution does improve performance, but its main disadvantage is that it increases the fragmentation of the blockchain, and the L2 solution is developed and expanded from the poor performance of the L1. On the other hand, a more scalable native L1 solution (such as Avalanche) guarantees higher security, is less fragmented and more decentralized, and the main chain comes with higher performance.

Among the existing L2 solutions, no single solution can fully support those smart contracts in any combination. At present, most users are accustomed to using and interacting with the L1 system, but the L2 expansion plan will require users to change their usage habits, wallets, oracles and decentralized applications (dApps), and sacrifice various security.

The asset transfer experience between cross-L2 solutions is not friendly, and a bridge is also required to enter the side chain, and it is generally difficult to communicate between L2 projects.

A special disadvantage of the Plasma scheme is that the waiting time for withdrawing funds from L2 is very long.

State channels are limited to specific applications, do not support general smart contracts, and must be locked in advance before using funds.

Although Zero-Knowledge Proof Rollups are faster and more efficient than Optimistic Rollups, there is currently no easy way for Zero-Knowledge Proof Rollups to migrate existing (L1) smart contracts to Layer 2.

The setup of zero-knowledge proof Rollups also needs to rely on centralized organizations, such as developers, which undermines decentralization and risks social engineering hacking.

Compared with L2 solutions (such as Rollups), the benefit of ETH 2.0 sharding technology is to ensure that the entire system operates with exactly the same verifiability and data access rights, (note: compared to L2 fragmentation).

Shards are part of the main chain and do not require deposits or pledges like Rollups or Plasma schemes.

Comparison of Ethereum 2.0, Layer-1 Protocols, and Specific Purpose Protocols

Certain L1 protocols are purpose-built and have vastly different designs, architectures, and consensus.

In the future, there is a high probability that multiple main chains will coexist, such as Ethereum and Solana, and interact through a series of side chains.

Certain purpose-built blockchains have emerged, such as making supply chains more efficient; moving and storing different types of information; pursuing high throughput to achieve higher transaction volumes, etc.

Large-scale and complex applications require customized blockchains to solve specific problems and do not need to be constrained by general blockchain architectures such as Bitcoin or Ethereum. (Note: EVM design needs to be used in all kinds of contracts, but customized blockchain does not need to be like this)

Although these purpose-built blockchains can be deployed in specific situations, such as enterprise use, the existing L2 expansion solutions, the interaction between ETH 2.0 and various L1 blockchains, can be implemented at low cost and high Throughput realizes the vision of DeFi, that is, a financial system that is open to the public and has a low-cost threshold.

What is Ethereum 2.0?

Ethereum 2.0 includes multiple stages of upgrades. In order to improve the scalability of the network and improve its own infrastructure, it will switch from the proof-of-work consensus mechanism (PoW) to the proof-of-stake consensus mechanism (PoS).

Ethereum 2.0 will process more transactions with higher throughput, slow down the scalability bottleneck that currently prevents the network from being used by general users, and change from a single blockchain to a multi-chain network.

ETH 2.0 will be launched in phases, the first one is called Beacon Chain (Phase 0), which will go live in December 2020. In order to move to the proof-of-stake consensus mechanism (PoS), Beacon Chain introduced a native pledge mechanism for Ethereum.

The second phase of ETH 2.0 is called The Merge. It is expected that Beacon Chain will be merged with the Ethereum mainnet in Q2 2022, officially switching from PoW to PoS.

At this stage, the existing Ethereum (1.0) network will be migrated to Ethereum 2.0 in the form of a shard.

The final stage is the Phase 2.0 phase or shard chain, which is expected to put the execution of transactions into the shard chain in 2023. Sharding expansion technology sends all operation results to 64 new chains (rather than a single blockchain), which significantly increases the transaction throughput of the base layer.

The current Ethereum infrastructure is a linearly connected blockchain, which is very slow and inefficient. A shard chain splits that blockchain and processes transactions on the split parachains.

What are the advantages of Ethereum 2.0?

Ethereum 1.0 supports up to about 30 transactions per second, but ETH 2.0 plans to support up to 100,000 transactions per second.

Compared to most PoS networks with fewer validators, Ethereum 2.0 requires at least 16384 validators to make it more decentralized and secure. But as of Q3 of 2021, more than 200,000 verifiers have pledged more than 6.6 million ETH, totaling about $14 billion.

For comparison, Avalanche currently has 1205 validators and Solana has 1331 validators.

The Future of Ethereum 2.0 and Layer-2 Solutions

Since ETH 2.0 is expected to solve the scalability issues that L2 scaling solutions are dealing with, it is natural to ask, will the increased throughput and speed of Ethereum 2.0 make L2 scaling solutions obsolete?

Blue-chip DeFi apps on Ethereum should eventually show up on L2 Rollups.

The emotional response and incentives of the community will play a role.

The Block's article said that if the future is centered on roll-up, then Ethereum 2.0 will not be used for executing transactions, but for security and data.

We don’t yet know how much scalability Ethereum 2.0 will provide. Considering that the adoption and development of Ethereum (1.0) will continue to increase, even with Ethereum 2.0 in the future, L2 solutions may still have value.

While developing ETH 2.0, if rollups can be successfully expanded, there is a high probability that Ethereum (1.0) will maintain a monopoly on DeFi applications.

Moreover, the L2 solution is not exclusive to Ethereum, but also for future cross-chain service scenarios.

The majority of the community regards Ethereum 2.0 as a long-term solution for sustainable development to ensure the stability of Ethereum, but it is expected that L2 solutions that expand the existing Ethereum (1.0) ecosystem can also have good development.

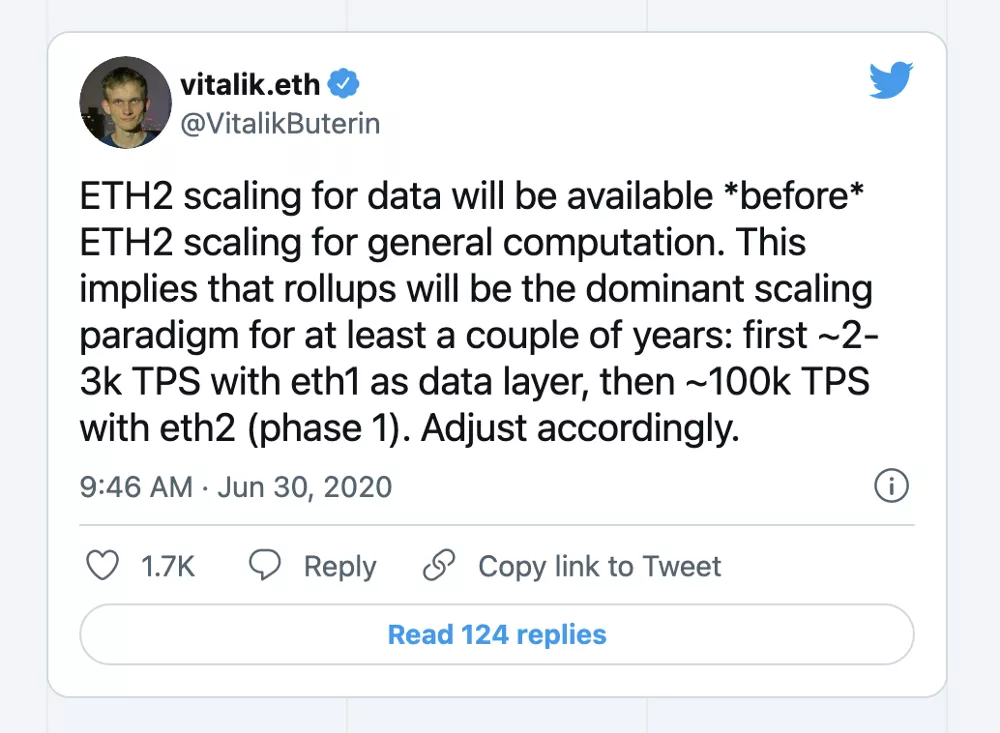

Vitalik Buterin, who created Ethereum, publicly stated in 2020 that zero-knowledge proof rollups may dominate the expansion scheme within a few years before the shard chain is implemented.

As Vitalik said, the data capacity upgrade of Ethereum 2.0 takes precedence over the computing power upgrade, which means that before Ethereum processes more transactions, it will be able to store more data.

It is estimated that in 2023, the final stage of Ethereum 2.0 migration will open the smart contract execution capability of sharding technology.

When Ethereum 2.0 and rollup cooperate with each other, theoretically there will be a computing throughput of 100,000 transactions per second, which can be adopted by billions of people.

The development process of Ethereum is dynamic and needs to solve the problems of expensive gas fees, scalability, and competition with other chains, so the migration of Ethereum 2.0 may be prioritized.