Coinbase Ventures: A Guide to Multichain Futures, Sidechains, and L2 Solutions

By Justin Mart & Connor Dempsey

By the end of 2021, Ethereum has grown to support thousands of applications from decentralized finance, NFT, games, and more. The entire network processes trillions of dollars in transactions annually, with over $170 billion locked on the platform.

But as the saying goes, the more money, the more problems. Ethereum's decentralized design ultimately limits the number of transactions it can process to 15 per second. With Ethereum's popularity well over 15 transactions per second, the result was long waits and fees of up to $200 per transaction. Ultimately, this costs a lot of users and limits the types of applications Ethereum is currently able to handle.

first level title

Is it competition or complementarity?

The goal is to increase the number of transactions that a publicly accessible smart contract platform can process while maintaining sufficient decentralization. Scaling a smart contract platform with a centralized solution managed by a single entity is trivial (Visa can process 45,000 transactions per second), but then we are back to square one: a world owned by a few powerful centralized actors.

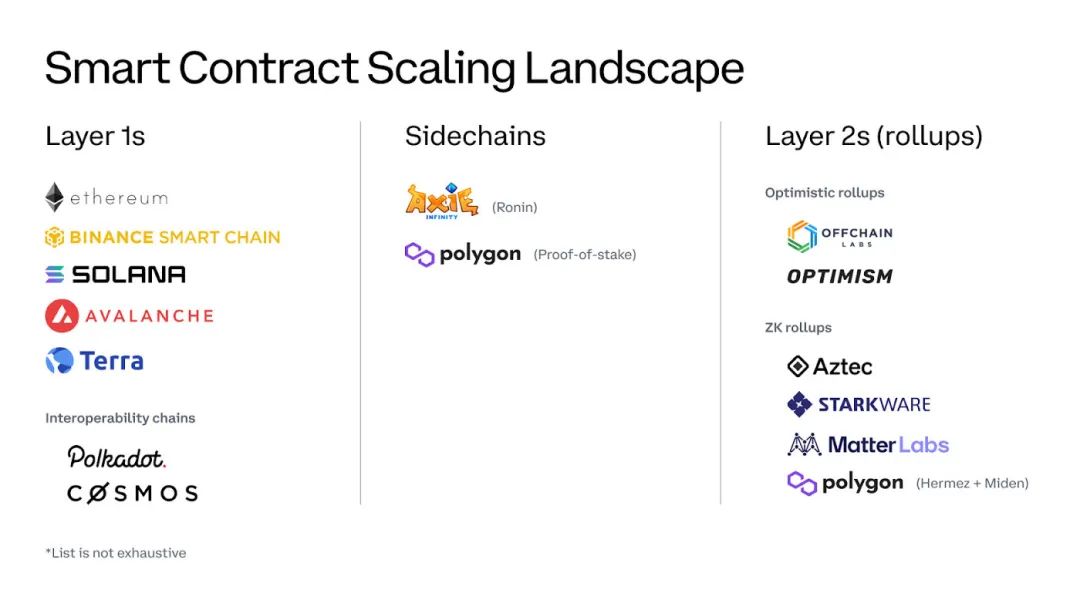

Broadly speaking, they can be divided into the following categories:

Broadly speaking, they can be divided into the following categories:

Layer 1 blockchains (competing with Ethereum)

Sidechains (complementary to Ethereum)

Layer 2 network (complement to Ethereum)

first level title

Tier 1

Ethereum is considered a layer 1 blockchain - an independent network that secures user funds and executes transactions in one place. Want to swap 100 USDC for DAI using a DeFi app like Uniswap? Ethereum is where this all happens.

Competing layer 1s can do everything Ethereum does. They differ in that new system designs enable higher throughput and thus lower transaction fees, often at the expense of increased centralization.

image description

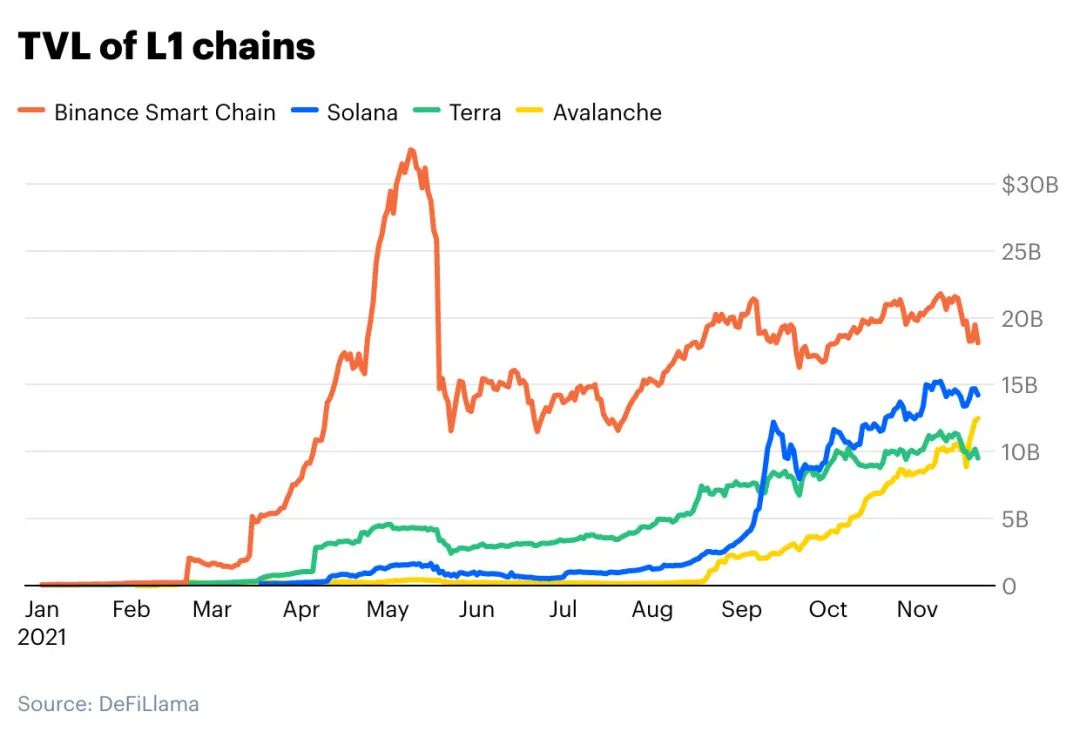

Non-Ethereum Layer 1 TVL

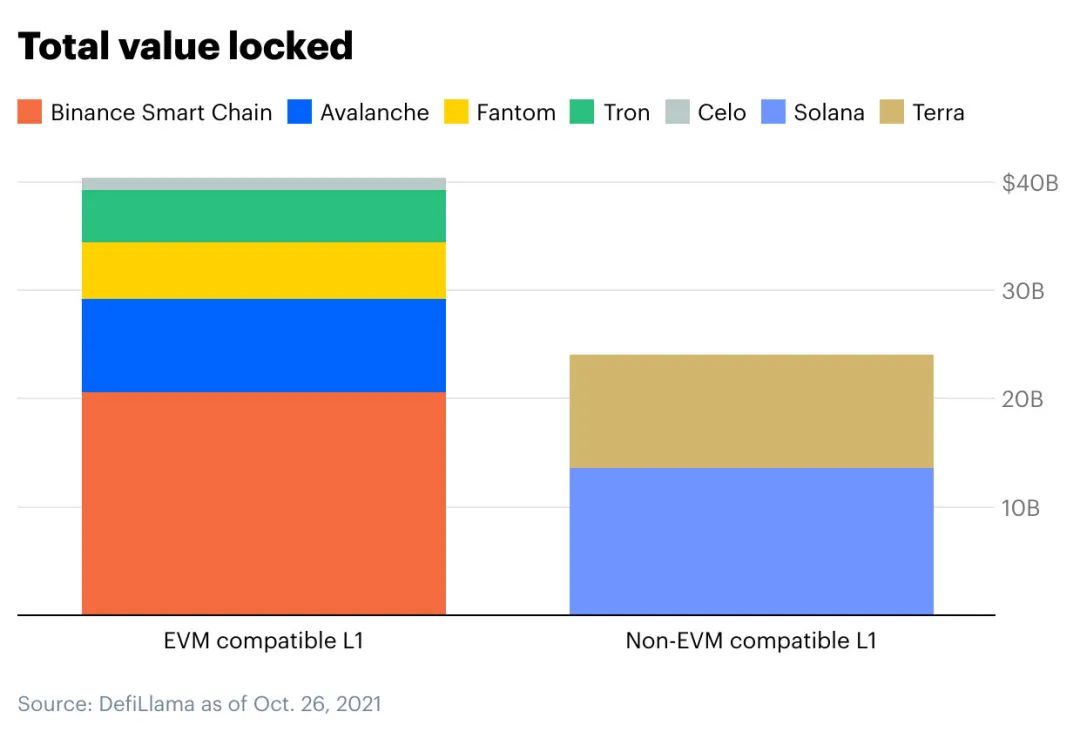

All Layer 1s are competing to attract developers and users. Achieving this is difficult without any of Ethereum's tools and infrastructure that make it easy to build and use applications. To bridge this gap, many layer 1s employ a strategy called EVM compatibility.

EVM stands for Ethereum Virtual Machine, which is essentially the brain that performs calculations to make transactions happen. By making their network compatible with the EVM, Ethereum developers can easily deploy existing Ethereum applications to the new Layer 1 by simply copying and pasting their code. Users can also easily access the EVM-compatible layer 1 through their existing wallets, simplifying migration.

Take Binance Smart Chain (BSC) as an example. By releasing an EVM-compatible network and tweaking the consensus design to enable higher throughput and cheaper transactions, BSC saw a surge in usage in DeFi applications similar to popular ethereums such as Uniswap and Curve last summer. Square app. Avalanche, Fantom, Tron, and Celo have taken the same approach.

image description

first level title

interoperable chain

In slightly different layer 1 storage areas are blockchain ecosystems such as Cosmos and Polkadot. Rather than building new standalone blockchains, these projects build standards that allow developers to create application-specific blockchains that can communicate with each other. For example, this could allow tokens from a gaming blockchain to be used in applications built on a separate blockchain of a social network.

There are currently over $100 billion on-chain built using the Cosmos standard, which will eventually be interoperable. Meanwhile, Polkadot also recently reached a milestone that will likewise unify its blockchain ecosystem.

side chain

side chain

The distinction between sidechains and the new Layer 1 is certainly a blurry one. Sidechains are very similar to EVM-compatible layer 1, except that they are designed specifically to handle Ethereum's excess capacity, rather than compete with Ethereum as a whole. These ecosystems are tightly integrated with the Ethereum community, hosting Ethereum applications in a complementary manner.

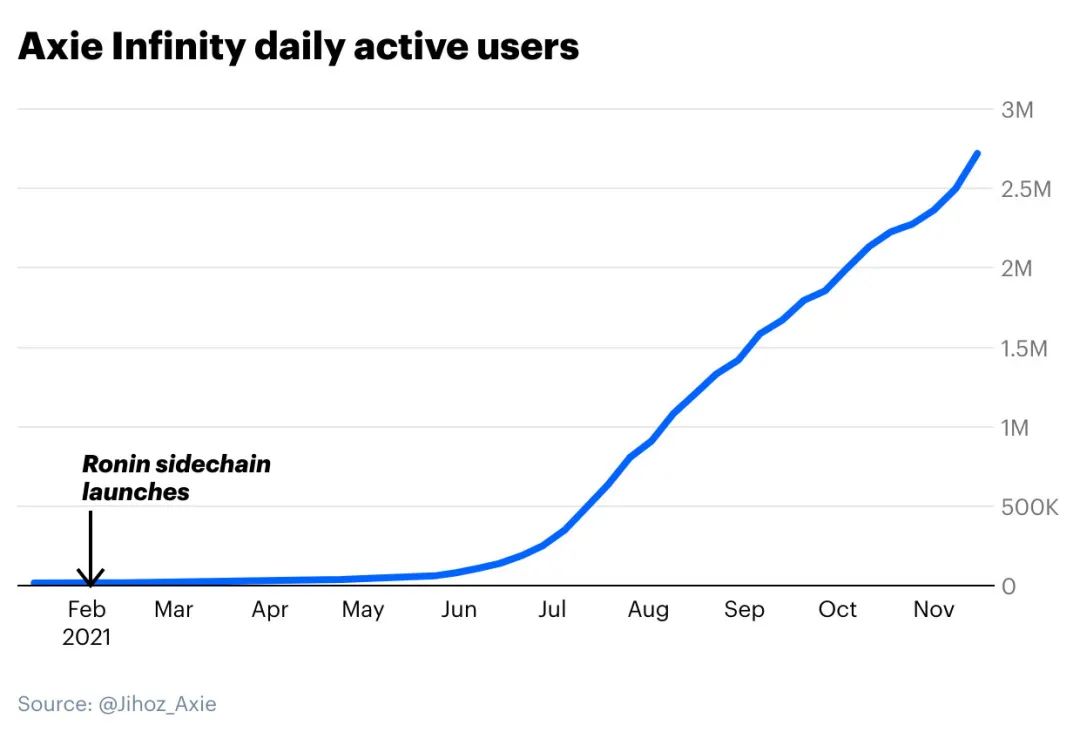

Axie Infinity’s Ronin sidechain is a prime example. Axie Infinity is an Ethereum-based NFT game. Because Ethereum fees make playing games very expensive, establishing a Ronin sidechain allows users to transfer their NFTs and tokens from Ethereum to a low-fee environment. This made the game affordable to more users and made the game a hit.

first level title

Polygon POS

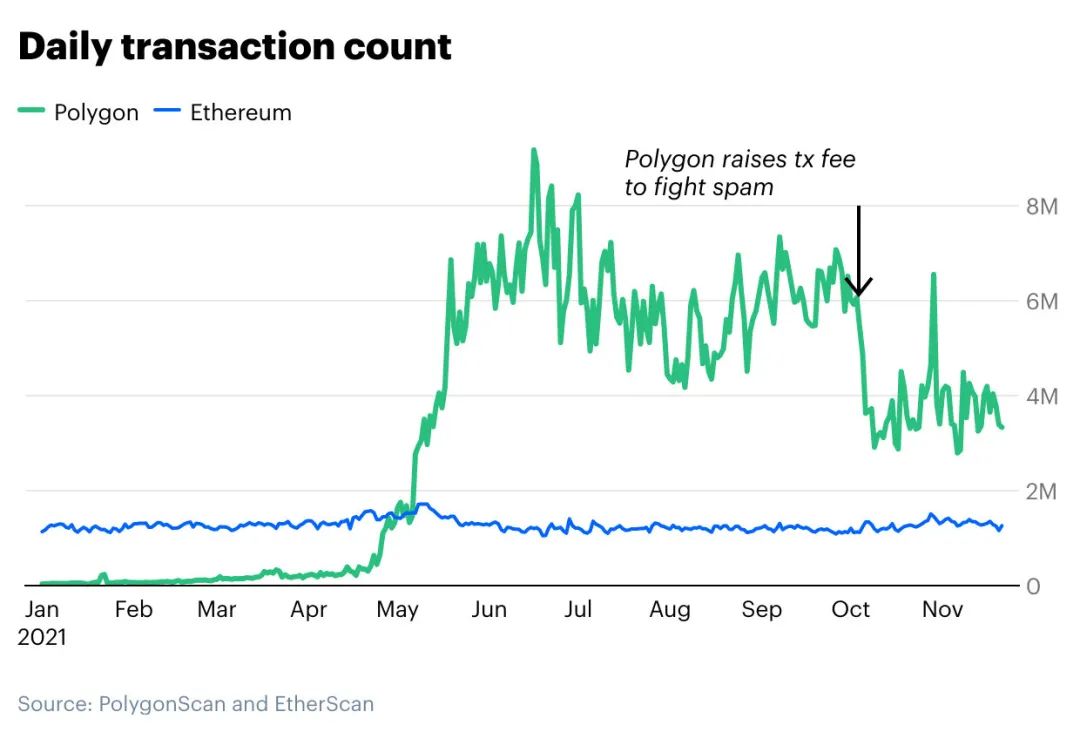

Sidechains like Ronin are application-specific, while others are for more general applications. Currently, the Polygon POS sidechain is the industry leader, with a value of nearly US$5 billion, deployed in more than 100 DeFi and game applications, including the familiar Aave and Sushiswap, and Quickswap, a clone of Uniswap.

Likewise, Polygon POS looks no different than EVM-compatible layer 1. However, it was built as part of the framework to extend Ethereum, not compete with it. The Polygon team believes that in the future, Ethereum will remain the dominant blockchain for high-value transactions and value storage, while daily transactions will be transferred to Polygon's low-cost blockchain. (Polygon POS also maintains a special relationship with Ethereum through a process called checkpointing).

first level title

Layer 2 (Rollup)

Both Layer 1 and sidechains have an obvious challenge: securing their blockchains. To do this, they must pay a new batch of miners or proof-of-stake validators to verify and secure transactions, usually in the form of inflation of the underlying token (e.g. Polygon’s $MATIC, Avalanche’s $AVAX).

However, this also comes with significant disadvantages:

Having an underlying token would naturally make the ecosystem more competitive rather than complementary to Ethereum.

Verifying and securing transactions is a complex and challenging task that your network will be responsible for indefinitely.

Wouldn’t it be great if we could borrow from Ethereum’s security to create a scalable ecosystem? Enter layer 2 networks, specifically “Rollup”. In short, Layer 2 is an independent ecosystem that sits on top of Ethereum and relies on Ethereum for its security.

first level title

How rollups work

Layer 2s are often referred to as Rollups because they "Rollup" or bundle transactions together and execute them in a new environment before sending updated transaction data back to Ethereum. Rather than having the Ethereum network process 1000 Uniswap transactions alone (expensive!), it would be better to offload the computation on the layer 2 rollup before submitting the results back to Ethereum (cheap!).

first level title

Optimistic Rollup

"Optimistic" in Optimistic Rollup assumes it is valid when submitting results to Ethereum. In other words, they let Rollup operators publish whatever data they want (including potentially incorrect/deceptive data) and assume it's correct - an Optimistic prospect, no doubt! But fighting fraud There is still a way. As a check and balance, there is a window of time after any withdrawal where anyone can check for fraud (remember, the blockchain is transparent and anyone can check what's going on). If one of the observers can mathematically prove that fraud occurred (by submitting a fraud proof), then Rollup will revert any fraudulent transactions, punish bad actors and reward the observers (a clever incentive system!).

The downside is that when users move funds between Rollup and Ethereum, there is a short delay waiting to see if any observers spot any fraud. In some cases, this could be as long as a week, but we expect these delays to decrease over time.

first level title

Arbitrum and Optimistic Ethereum

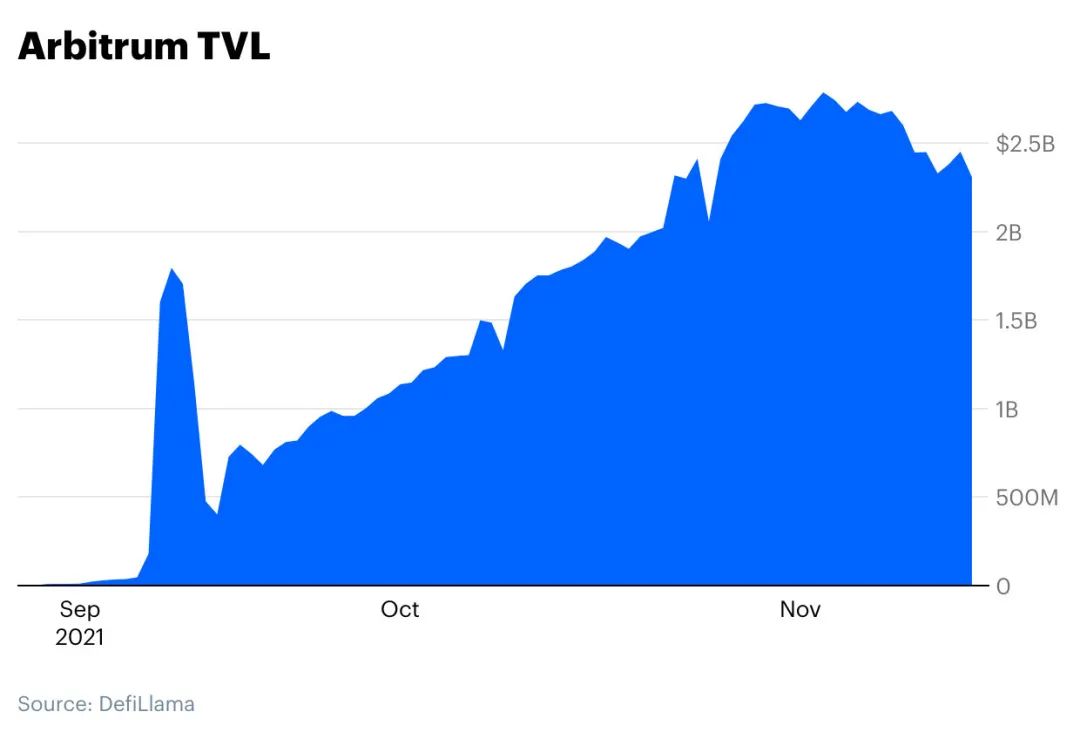

Arbitrum and Optimistic Ethereum are the two main projects currently implementing Optimistic Rollup. It’s worth noting that both companies are still in their early stages, and both maintain a level of centralized control, but both plan to decentralize over time.

It is estimated that once mature, Optimistic Rollup can improve scalability by 10-100 times. Even in its early days, DeFi applications on Arbitrum and Optimism have amassed billions in network value.

Optimistic has deployed over $300 million in TVL across 7 DeFi applications, most notably Uniswap, Synthetix, and 1inch.

Arbitrum has gone a step further, investing around $2.5 billion in TVL across more than 60 applications, including familiar DeFi protocols like Curve, Sushiswap, and Balancer.

first level title

ZK-Rollup

Optimistic Rollup assumes that the transaction is valid and provides room for others to prove fraud, while ZK-Rollup actually proves to the Ethereum network that the transaction is valid.

With the results of the bundled transaction, they submit a so-called proof of validity to the Ethereum smart contract. As the name suggests, proof-of-validity lets the Ethereum network verify that a transaction is valid, making it impossible for relayers to cheat the system. This removes the need for fraud proofs, so transferring funds between Ethereum and ZK-Rollup is effectively an instant operation.

first level title

Adoption of ZK-Rollup

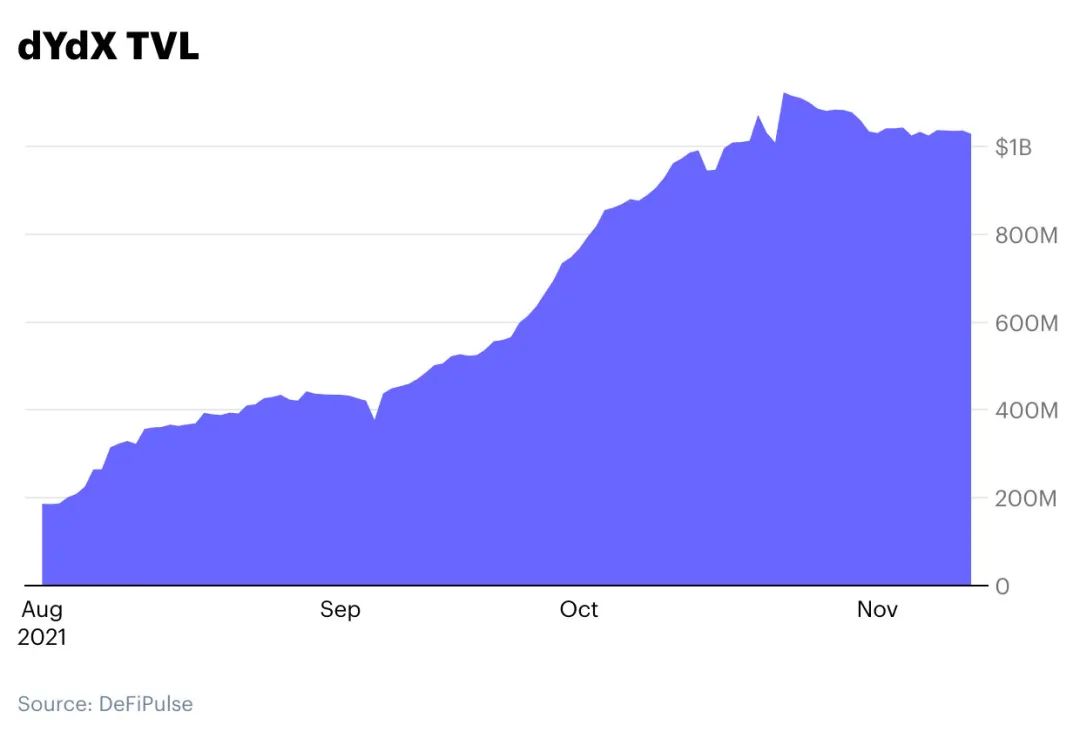

The ZK-Rollup situation is deep, with multiple teams working on the implementation and in production. Some notable companies include Starkware, Matter Labs, Hermez, and Aztec. Today, ZK-Rollup mainly supports relatively simple applications such as payments or exchanges. For example, derivatives exchange dYdX uses Starkware’s (StarkEx) ZKRollup solution, supporting nearly 5 million trades per week and a TVL of over $1 billion.

What really deserves credit, however, is the ZK-Rollup solution, which is fully EVM-compatible and thus able to support popular general-purpose applications (such as the full suite of DeFi applications) without the withdrawal delays of Optimistic Rollup. Major players in this space are MatterLab’s zkSync 2.0, Starkware’s Starknet, Polygon Hermez’s zkEVM, and Polygon Miden, all of which are currently working on mainnet launches. (Aztec, meanwhile, is focused on applying zk proofs to privacy).

first level title

text

In the long run, these scalable solutions are necessary if smart contract platforms are to scale to billions of users. In the short term, however, these solutions could pose significant challenges for users and crypto operators. Navigating to these networks from Ethereum requires the use of cross-chain bridges, which is complex for users and carries potential risks. For example, some cross-chain bridges have been targeted.

More importantly, the multi-chain world breaks composability and liquidity. Consider that Sushiswap is currently implemented on Ethereum, Binance Smart Chain, Avalanche, Polygon, and Arbitrum. Sushiswap’s liquidity was once centralized on one network (Ethereum), and now it is spread across five different networks.

first level title

an uncertain future

Will new layer 1s like Avalanche or Solana continue to grow, competing with Ethereum? Will blockchain ecosystems like Cosmos or Polkadot proliferate? Will sidechains continue to operate in harmony with Ethereum, taking on its excess capacity ? Or will Rollup combined with Ethereum 2.0 win? No one can say for sure.

While the future is uncertain, we should take comfort in the fact that so many bright teams are working on solving the most challenging problems facing the open, permissionless web. Just as broadband ultimately helped the Internet power many revolutionary applications, we believe we will eventually view these successful solutions at scale in the same light.

Source:https://blog.coinbase.com/scaling-ethereum-crypto-for-a-billion-users-715ce15afc0b