The locked position broke another 1.5 billion US dollars, and the Iron.Finance project was revived like this?

Today, when the total locked funds (TVL) of major ecological DeFi have exceeded 100 billion U.S. dollars, it is no longer rare for projects with a TVL of more than 1.5 billion U.S. dollars, but if this number appears on a project that once returned to zero, it is more or less still It will be surprising.

The screenshot of this picture was taken at 12:00 Beijing time on July 14, and the project in the picture is named Iron.Finance. You may have heard that the Polygon-based partially collateralized algorithmic stablecoin project plummeted to zero last month due to a "run".secondary title

Take a sip of poisonous milk, milk yourself to death

Before explaining how Iron.Finance "resurrected", let's briefly review how the project "dead" before.

Iron.Finance was forked from FRAX. It first started in BSC, but it has been tepid. It was not until May when it was expanded to Polygon that Iron.Finance ushered in explosive growth: TVL in just a month or so It broke through 2.4 billion US dollars, and the price of the old governance token TITAN (Note: TITAN is the governance token of the Polygon-side product, and the governance token of the BSC-side product is named STEEL) has also doubled dozens of times within a few weeks , up to $64.19.

However, all good momentum came to an end on June 16. Earlier in the day, perhaps feeling that the daily rise in the price of its own currency was not exciting enough, the Iron.Finance official brainstormed and released an article titled "TITAN and STEEL have become bear market safe-haven assets"Toxic milk, emphasizing that TITAN and STEEL still maintained excellent growth despite the overall market downturn.

The power of this tainted milk is incredible.Only a few hours after the article was published, TITAN began to plummet all the way, returning to zero in a straight line. The rapid momentum is also rare in the history of the currency circle.Twitter users dubbed the phenomenon the "Cuban Missile Crisis" and posted pictures to commemorate it.

The power of this tainted milk is incredible.Only a few hours after the article was published, TITAN began to plummet all the way, returning to zero in a straight line. The rapid momentum is also rare in the history of the currency circle.Twitter users dubbed the phenomenon the "Cuban Missile Crisis" and posted pictures to commemorate it.

According to Iron.Finance released the next day "autopsy report"(I'm not making it up, this is the official term), the reason why TITAN suddenly returned to zero was because the project encountered the first large-scale bank run (bank run) in the history of DeFi. Let's recap what happened that day:

According to Iron.Finance released the next day "autopsy report"(I'm not making it up, this is the official term), the reason why TITAN suddenly returned to zero was because the project encountered the first large-scale bank run (bank run) in the history of DeFi. Let's recap what happened that day:

First of all, I need to explain that Iron.Finance adopts the dual currency mechanism of stable currency IRON + governance token TITAN. IRON can be minted through USDC + TITAN, and can also be redeemed reversely.

At around 10:00 UTC time, when the price of TITAN hit a historical high of $64, the profit whales began to withdraw liquidity from the IRON/USDC pool, and at the same time sold TITAN for IRON, and then sold IRON for USDC (direct pool exchange , did not take the redemption path), this behavior not only caused the price of TITAN to plummet, but also caused the price of IRON to break the anchor. However, when TITAN fell to around $30, the giant whales suspended their selling. The price of TITAN slowly recovered, and the price of IRON gradually recovered its anchor.

At this time, Iron.Finance officials believe that this incident is no different from the previous IRON unanchoring incident, and the system has completed self-correction, so no intervention measures have been taken.

Around 15:00 UTC time, giant whales acted again, and retail investors also reacted this time. As the price began to plummet and panic began to spread, more and more users began to reverse redeem IRON (obtain USDC and TITAN) and sell TITAN. As the price of TITAN continues to drop, more TITAN will be generated for each redemption operation. At the same time, due to the 10-minute quotation interval of the oracle machine, the spot price of TITAN will further decrease compared with the redemption price, which further amplifies the user’s selling motives and created a vicious circle. In this case, more and more TITANs began to be minted through the redemption mechanism. The most fatal thing is that due to a design error, the TITAN minted through the redemption mechanism can break the original supply limit of 1 billion tokens ( When the report was issued, the supply of TITAN was as high as 27805 billion), which eventually caused the price of TITAN to be smashed to zero.

secondary title

Another good guy after a month

exist"autopsy report"In the end, Iron.Finance frankly admitted that the old system has nothing to fix, and a better way is to learn from the lessons and launch a new replacement product in the future.

Nearly two weeks have passed, Iron.Finance officials have successively disclosed specific projectsreconstruction plan. On the one hand, Iron.Finance will issue a new governance token, ICE, with a total circulation of 1 billion, 70% of which will be used for liquidity mining rewards, 29% will be used as compensation for damaged users in the event of a run, and 1% will be reserved In the treasury; on the other hand, Iron.Finance will redesign IRON's stable currency mechanism and will continue some previous development plans.

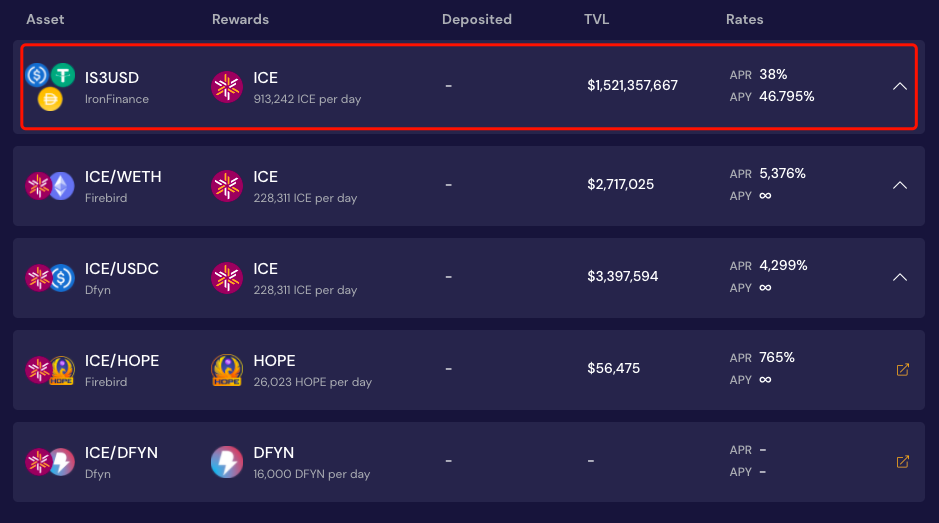

According to the development plan of the V2 version, before completing the redesign of IRON, Iron.Finance plans to launch IronSwap on July 5, and launch the IronLend beta version on July 19 to prepare for the subsequent system operation. As far as the actual development progress is concerned, Iron.Finance has not broken its promise. IronSwap is now officially launched and mining, which is the basis for the project to "resurrection".

As for why Iron.Finance can attract so much liquidity,The answer is actually very simple - the mining income they give is too high.According to ICE's token economic model, ICE tokens accounting for 10% of the total supply will be distributed to liquidity providers of the IronSwap stablecoin pool as mining incentives.

also,

also,Although Iron.Finance has suffered a complete failure, in reality, the current risk profile of participating in IronSwap may not be that high relatively.On the one hand, Iron.Finance’s return to zero was not caused by the team’s subjective evil. Although the team’s reputation has declined sharply, it will not be completely reduced to zero; on the other hand, although the failure of Iron. Currently immature algorithmic stablecoin products, now the V2 version has only launched the DEX product IronSwap with simpler logic, and the risk is relatively controllable; finally, the stablecoin pool is purely "free prostitution" and does not need to bear the risk of currency price fluctuations, Polygon procedures Fees are low enough that even retail investors don't have to worry about operating costs.

secondary title

Alive, but not quite alive

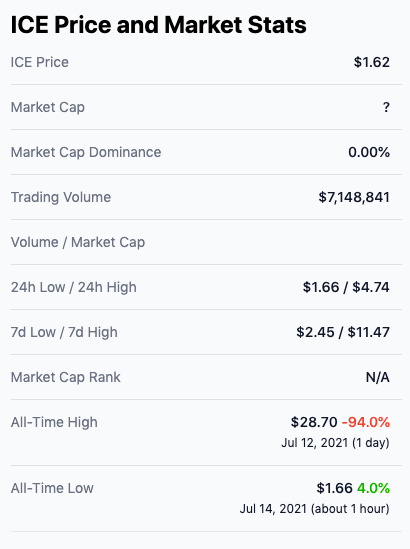

However, it is almost certain that Iron.Finance's current high yield status is difficult to sustain. A more obvious sign is that the price of ICE currency continues to fall. Excessive incentives will inevitably bring about greater selling pressure. This is the law of liquidity mining; Most of them come from the stablecoin "free prostitution" pool. The data of the pool that needs to hold and pledge ICE is bleak, and the liquidity will not have loyalty, and there is a high probability that it will go where it comes from.

Iron.Finance currently gives people the feeling that "alive, but not fully alive".It is easy to understand that it has lived, and the real money of 1.5 billion US dollars is placed here. It is said that it is not fully alive because the retention rate of these funds is doubtful, and the redesign plan of the core product of the project, the stable currency IRON, has not been disclosed, so the way forward is still undecided.

At the end of the article, I still want to remind users who want to rush into "White Prostitution" that the new version of Iron.Finance (only IronSwap is online for the time being) has not yet released any audit information from third-party security agencies, even if the logic of DEX is sufficient Simple, there are certain risk factors, please be cautious before entering the market.