Weekly Editor's Picks (December 6-12)

- 核心观点:加密行业周报揭示多元趋势与潜在风险。

- 关键要素:

- 巨鲸在市场下跌时囤积XRP、ADA等资产。

- Tether需增资45亿美元以满足更高监管标准。

- Farcaster放弃社交优先,转向钱包驱动增长。

- 市场影响:引导关注合规、资产配置与模式转型。

- 时效性标注:短期影响。

"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis, but these may be hidden in the news feed and trending news, and you may miss them.

Therefore, every Saturday, our editorial team will select some high-quality articles worth reading and saving from the content published in the past 7 days, bringing new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read it together:

Investment and Entrepreneurship

Four key words to herald the four seasons of Cryoto in 2025.

BlackRock's 2026 Investment Outlook: Can the AI Bubble-Driven Global Bull Market Sustain?

Overweight US stocks, bullish on Japanese stocks, wary of long-term bonds, gold is only used as a tactical operation and not regarded as a long-term hedging tool.

A Brief History of the Crypto Future: Seven Trends to Reshape the Industry Narrative by 2026

Appchain, a prediction market, and Agentic Curators extend to the next layer of DeFi; short videos become a new traffic entry point; blockchain drives new AI Scaling Laws; RWA, an agent-driven product.

What have whales stockpiled during the market's "discount season"?

Payment/Cross-border Settlement Sector: XRP becomes the favorite of whales; Established Layer 1: ADA is being accumulated against the trend; DeFi Blue Chips: UNI and AAVE are being snapped up simultaneously; Meme Coin: Overall correction, with some being "buy low" by whales; AI + Data Sector: ENA and TIA are the most favored; Storage Sector: FIL and ICP.

Pickle Cat is currently the most profitable trader on Binance Futures Trading Ranking, with total profits exceeding $45 million.

The article details why retail investors should not engage in high-frequency intraday trading when trading cryptocurrencies, arguing that retail intraday trading has too many flaws and shortcomings compared to institutional intraday trading. "In reality, the trading strategies you believe in and execute may not necessarily make you consistently profitable, nor may they be suitable for you. Often, persisting with high-frequency intraday trading results in losing all your capital; this approach may not be as effective as seizing a big opportunity and making a decisive move."

Ken Chan's attitude in the article is extremely negative. He believes that the industry has lost its idealism and has become the largest and most participated super casino in human history. He also expresses the deep-seated problems of faith confusion and value collapse that exist in the industry today.

Singapore surpassed the United States, Lithuania, Switzerland, and the United Arab Emirates to rank first in the global cryptocurrency application index, while Vietnam and Hong Kong also ranked among the top ten globally.

The three major trends in cryptocurrency applications in 2025 include RWA, native stablecoins, and on-chain payroll.

Policy and stablecoins

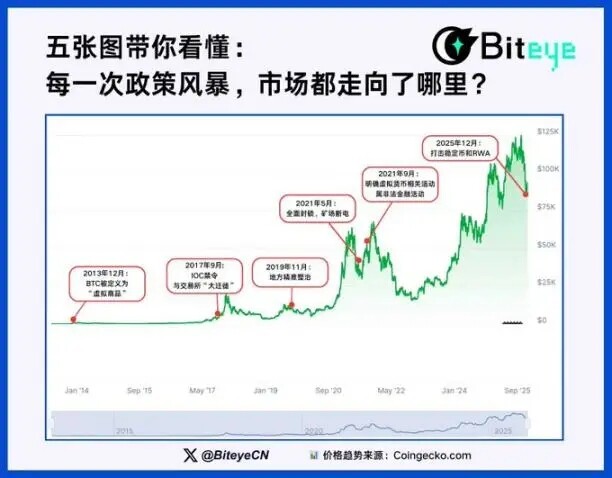

Five charts to help you understand: Where does the market go after every policy storm?

Regulatory interventions are characterized by a clear "timing." Policies are often introduced when market activity reaches its peak or a local climax, aiming to cool down the risks of overheating. However, the long-term effects of these policies are diminishing.

The binary structure of "strict defense in the East" and "pricing dominated by the West" may become the new normal in the crypto world.

Tether Financial Analysis: Requires an additional $4.5 billion in reserves to maintain stability.

Assuming Tether's excess reserves are approximately $6.8 billion, its total capital adequacy ratio (TCR) will fluctuate between 10.89% and 3.87%, providing sufficient capital buffers to withstand 30%-50% price fluctuations in BTC. In this case, the USDT collateral level should be able to meet the minimum regulatory requirements.

If judged by the higher standards of large banks, Tether might need an additional $4.5 billion in capital to maintain its current USDT issuance size.

The cheaper the price, the more carefully we should study it, rather than dismissing it too easily.

Currently, short sellers are seeing short-term structural risks: excessively high distribution costs, path dependence on interest rates, supply pressure from the lifting of restrictions, and the potential impact of marginal changes in the tax system and regulations.

The bulls are betting on structural benefits over a longer time horizon: the migration of global settlement needs, the institutionalization of compliant stablecoins, and the "quasi-infrastructure attributes" of network-based products once they are established.

Also recommended: " Securities or Commodities? The decade-long tug-of-war ends, and the Cryptocurrency Market Structure Act heads to the Senate ."

Airdrop Opportunities and Interaction Guide

Looking back at 2025, the arbitrage market went from a "get-rich-quick myth" to a "winter of intense competition." With limited returns from altcoins, arbitrage methods became more diversified.

Going forward, the focus should be on IPOs and stablecoin investments. Instead of randomly opening high-leverage contracts on exchanges and blindly hoarding a bunch of altcoins, it's better to concentrate on building a "premium account" and steadily accumulating wealth.

Also recommended: " Is Zama's public sale too complicated? A comprehensive guide to sealed Dutch auctions ", " A roundup of 7 recent hot IPO projects ", " Hot interactive collection | StandX launches mainnet points event; 'Trump Game' candidate list application (December 12) ".

Bitcoin

Unveiling the secrets of Bitcoin Core and the financial backers of Bitcoin developers.

Several major problems exist in the Bitcoin developer ecosystem: a small number of active developers, low funding amounts, a concentration of funding organizations in different jurisdictions, a lack of presence in Asia, high concentration of maintainers (in 2024, three maintainers belonged to the same company, but this issue has improved), scarce employment opportunities (most funding is still in the form of grants), concentrated funding sources, and fragile sustainability.

CeFi & DeFi

The fact that the financial company did not buy at the bottom during this downturn is not simply because it ran out of "ammunition" at the high point or fell into panic. Rather, it is because the financing mechanism, which relies heavily on premiums, suffered a systemic paralysis during the downturn, leaving it "with money but unable to use it".

When stock prices fall too much, the "ammunition depot" (convertible notes and ATM issuance mechanisms) is locked up. Besides issuing bonds and selling stocks, there is another, more direct "ammunition depot": cash reserves. In terms of total volume, companies' "nominal ammunition" (cash + ATM credit) on their books amounts to tens of billions of dollars, far exceeding the previous bull market. However, in terms of "effective firepower," the actual number of bullets that can be fired has decreased.

DAT is shifting from "leveraged expansion" to "earning income and seeking survival".

What exactly did the shrewd money that aggressively bought AAVE at low prices see?

Aave's revenue model is gradually entering a mature phase, GHO has opened up a second growth curve for vertical integration, and the repurchase mechanism has begun to exert real and quantifiable deflationary constraints on the supply side.

a16z predicts that decentralized payments will become mainstream, but my judgment is as follows:

The stablecoin "gateway" is undergoing a revolutionary change; the integration of RWA assets and stablecoins is giving rise to on-chain lending businesses; the internet as a bank model is arriving, and AI Agents, the x402 protocol, and stablecoins will offer more possibilities; we are moving into an era of universal finance, with investment thresholds being further lowered; the fierce competition among stablecoin groups will continue, and user dividends will always exist.

Prediction Market

How to build a Polymarket passive income robot from scratch

Web3 & AI

The x402 approach involves having Facilitator act as an "execution agent" for on-chain transactions. Facilitator is responsible for verifying signatures, covering gas, submitting transactions, and handling on-chain details. The payer only needs to submit a signature to Facilitator and doesn't need to directly complete on-chain operations. For both buyers and sellers, this greatly simplifies the payment process because Facilitator handles the trust and settlement issues for them.

The x402 is naturally suited for this type of high-frequency, fragmented collaboration scenario between machines.

However, the x402 protocol is heavily reliant on facilitators like Coinbase. While it simplifies development, it also introduces a single point of failure, and currently, the x402 protocol does not have a built-in refund mechanism.

Currently, the biggest beneficiaries of AI agents are the developers themselves, and they also bring a breakthrough in capabilities from 0 to 1 to non-technical personnel to a certain extent.

SocialFi

Farcaster turns its back, and "Binance Square" and similar entities take over crypto social media.

Farcaster co-founder Dan Romero announced that the platform is abandoning its "social-first" strategy, which it has adhered to for four and a half years, and instead focusing on a wallet-centric growth model. This shift by the "flag bearer" of SocialFi may indicate that Farcaster lacks a true product-market fit.

Meanwhile, the strategy of "not being fixated on decentralization and Fi, but focusing more on Social" and "building social scenarios first, and then developing social applications" is being carried forward and popularized by CEXs.

Weekly Hot Topics Intensive Review

In the past week, the US CFTC launched a digital asset collateral pilot program , allowing Bitcoin, Ethereum, and USDC to be used as margin in the derivatives market ( interpretation ); Binance received full regulatory authorization for the Abu Dhabi Global Markets and will fully migrate to the ADGM regulatory framework;

In addition, regarding policy and macroeconomic markets, the US Bureau of Labor Statistics announced that it will not release October PPI data for the time being , but will instead release it together with the November data in January next year; Trump plans to replace personal income tax with tariff revenue ; Do Kwon was sentenced to 15 years in prison by a US judge; the SEC ended its two-year investigation into Ondo Finance , paving the way for its expansion in the US tokenized asset sector; SEC Chairman Atkins stated that most types of ICOs are not securities and will not be under the SEC's regulatory purview; Trump announced that Nvidia will be allowed to sell H200 chips to China , with a 25% commission on exports; China Construction Bank responded to the locking of cards with "Dogecoin" in the transfer remarks : triggering risk monitoring will restrict account transactions; Hong Kong launched the CARF cryptocurrency tax consultation to combat tax evasion; South Korea plans to require cryptocurrency exchanges to assume "no-fault compensation obligations," with the Upbit hacking incident serving as the trigger;

In terms of opinions and statements, Bitwise CEO: The four-year cycle of crypto has ended, and a large-scale surge will occur in 2026 ; OKX Star: 50% of global economic activity will run on the blockchain in the future ; a16z Crypto Annual Report: Decentralized payment systems may be widely used in 2026; 10X Research: The prediction market has " extreme information asymmetry and obvious arbitrage windows ," with profits driven by a few elites, and most participants more like "emotional bettors" ; Industry leaders debated the blockchain moat ; Jupiter Lend and Kamino debated the definition of "risk isolation" ; Solana Foundation President called on ecosystem lending protocols to stop infighting and focus on expanding the market; Strategy CEO: The company will hold Bitcoin until at least 2065 , maintaining a long-term accumulation strategy; Polymarket CEO: Currently operating at a loss , expanding market share is the top priority; Vitalik: An on-chain gas futures market should be established to predict and hedge future transaction fee risks; Framework co-founder: Paradigm, a16z, and other VCs have all liquidated their SKY holdings. Only we are still heavily invested; a16z: "Inefficient governance" and "dormant tokens" are two major problems that lead to a more severe quantum threat to BTC ; Jensen Huang: Bitcoin is transforming "excess energy" into a portable form of currency ; Ondo Finance: The platform's stock token liquidity comes from Nasdaq and NYSE , not AMM pools, and large-scale transactions have close to zero slippage;

Regarding institutions, large companies, and leading projects: YouTube will allow US creators to receive earnings via PayPal stablecoins ; Western Union will launch payment cards supporting stablecoin pre-deposits , primarily targeting markets in high-inflation economies; Hashkey disclosed IPO details : aiming to raise up to HK$1.67 billion, with trading scheduled for December 17th; Coinbase may launch prediction markets and tokenized stocks on December 17th; Coinbase restarted user registration in India and will launch fiat currency deposit channels next year; Robinhood acquired a licensed brokerage and crypto trader in Indonesia , officially entering the Southeast Asian market; Robinhood expanded its crypto product line , launching futures, staking, and tokenized stocks, and announced its Layer-2 scaling network; Stripe and Paradigm opened their Tempo blockchains to the public , adding Kalshi and UBS as partners; MetaMask launched mobile perpetual contract trading , supporting multiple assets including US stocks and powered by Hyperliquid; Sei... Clarifying details of the collaboration with Xiaomi phones , with app-exclusive features to be launched later; Kalshi, Crypto.com, Robinhood, Coinbase, and Underdog, five major platforms, jointly established a prediction market alliance , committed to the compliant development of prediction markets; STABLE tokens are now open for application ; Farcaster announced a strategic transformation , shifting its focus from social scenarios to wallet-driven growth;

In terms of data, a Sygnum survey shows that 60% of high-net-worth investors in the Asia-Pacific region plan to increase their allocation to crypto assets , with an average holding ratio of 17%; Caixin reports that 3,032 people were prosecuted for money laundering related to cryptocurrencies last year, and the current focus should be on raising public awareness of the risks associated with virtual currencies; HashKey Holdings' public offering was nearly 148 times oversubscribed ; Uniswap CCA's first auction has ended , with bids reaching $59 million.

In terms of security, He Yi's WeChat account was hacked , and her posts on WeChat Moments promoting the sale of Meme coin Mubarakah caused a short-term surge in price; He Yi also announced that she would airdrop BNB to users who lost money due to her hacked WeChat account... Well, it's been another tumultuous week.

Link to the "Weekly Editor's Picks" series is attached .

See you next time~