Weekly Editor's Picks (December 20-26)

- 核心观点:加密市场正经历从散户投机到机构配置的范式转移。

- 关键要素:

- 机构持仓24%,散户退场66%,换手完成。

- 稳定币交易量高度集中,前1000钱包占84%。

- 超八成新币TGE即巅峰,代币FDV中位数跌71%。

- 市场影响:市场规则改变,对项目质量与生存能力要求提高。

- 时效性标注:中期影响

"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis, but these may be hidden in the news feed and trending news, and you may miss them.

Therefore, every Saturday, our editorial team will select some high-quality articles worth reading and saving from the content published in the past 7 days, bringing new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, let's read it together:

Investment and Entrepreneurship

2025 Asset Review: Why is Bitcoin significantly underperforming gold and US stocks?

When the growth curve of silicon-based intelligence is steeper than the scarcity curve of "digital reserves," the excess global liquidity will preferentially flow to productivity assets with non-linear growth potential, rather than simply digital assets.

Gold hedges against systemic collapse, while Bitcoin is currently seen more as an overflow of systemic liquidity. US stocks are in an AI-driven parabolic acceleration phase. ETFs are reducing Bitcoin volatility.

Why is the US embracing encryption? The answer may lie in its massive $37 trillion debt.

Stablecoins handle distribution, Bitcoin handles receiving; the US is using crypto assets to dilute its debt burden.

2025: The darkest year for the crypto market, but also the dawn of the institutional era.

The crypto market is undergoing a paradigm shift from retail speculation to institutional allocation. Core data institutions hold 24% of the shares, while retail investors have exited 66%—the turnover is complete, and new rules are on the horizon.

Long-term practitioners and investors do not predict short-term prices, but rather identify structural trends.

Buy the dip or wait and see on MSTR? Three key questions you must know about Strategy

Strategy's "cash flow crisis" can be delayed until at least the second half of 2027.

MSCI is currently conducting a public consultation and will announce its final decision on January 15th next year (which will also be the final moment for taking over MSTR shares).

Only 15% of tokens have seen an increase in FDV compared to TGE. The median FDV of tokens has decreased by 71% since issuance (median market capitalization decreased by 67%).

High-value funding, active communities, and exchange listings—these are common criteria for evaluating project quality, but they have little impact on the price movement of project tokens.

To survive in 2026, projects should ideally: aim for $300,000 to $5 million in funding; set the offering price between $0.01 and $0.05; prioritize the product; be able to explain the token's existence in a single sentence; ignore vanity metrics; embrace industry realism; and if independent expansion is not possible, seek an acquirer.

Other recommendations:

Pantera Capital: 12 Predictions for the Crypto Market in 2026

A Cruel Coming-of-Age Ceremony in the Crypto World: A Review of the Crypto Index in 2024-2025

Redphone's 2026 prediction: The Silicon Era is Coming, Encryption Will Become the "Last Free Port"

Stablecoins

The top 1,000 wallets accounted for approximately 84% of the transaction volume, demonstrating a high degree of centralization.

Prediction Market

The more complex the prediction environment, the higher the success rate of the group consensus.

Airdrop Opportunities and Interaction Guide

Popular Interactive Roundup | PiP World Test Coin Trading; Earn Points on ETHGas (December 26)

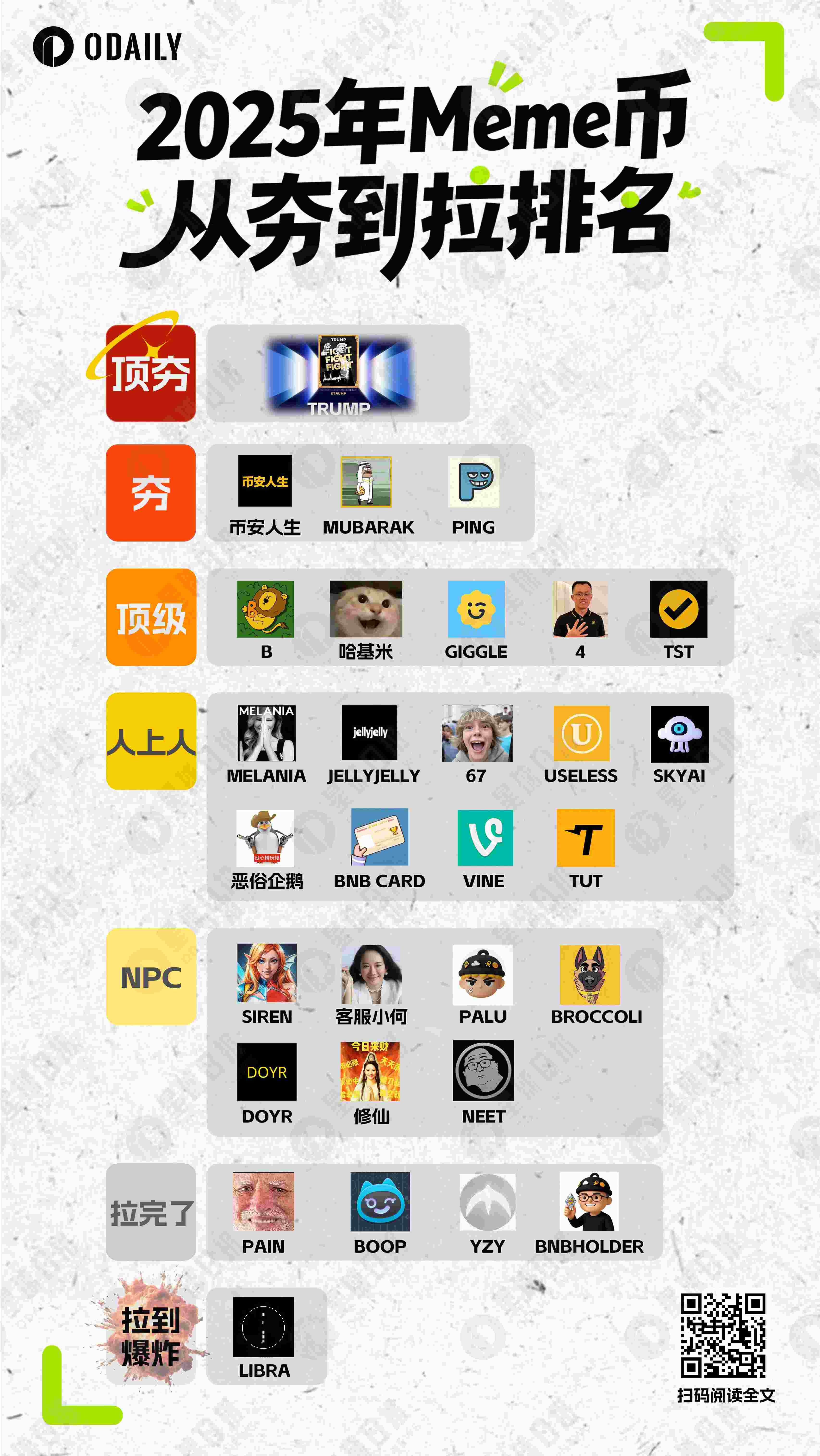

Meme

2025 Meme Coin "From Popularity to Demand" Ranking

Bitcoin

A comprehensive review of the Bitcoin protocol layer in 2025

In 2025, the technological evolution of Bitcoin will exhibit three core characteristics: proactive defense (against quantum threats), functional layering, and decentralized infrastructure.

Ethereum and Scaling

The Birth of ETHGas and Block Space Pricing

ETHGas redefines Ethereum block space as a priced resource, moving beyond transaction fees that fluctuate with demand. Through block space futures and pre-confirmation mechanisms, it allows large-scale users to lock in costs and time certainty in advance.

By introducing block space futures and validator-backed preconfirmation, ETHGas brings a structure similar to traditional financial markets to Ethereum, enabling applications and institutions to plan, hedge, and operate in a more deterministic environment.

ETHGas has released an important signal about the direction of Ethereum's evolution: Ethereum is moving from a pure technical protocol to a settlement layer with economic management at its core, and time and block space are beginning to have clear value.

Also recommended is " Ethereum's 'Second-Level' Evolution: From Fast Confirmation to Settlement Compression, How Does Interop Eliminate Waiting Time? ".

Multi-ecosystem

The economic implications of Polymarket's exodus from Polygon

Polymarket plans to migrate from Polygon and launch an Ethereum Layer 2 network called POLY. Polymarket's decision to leave Polygon isn't surprising; one is a rising star in the application layer, while the other is a declining older underlying layer, creating a mismatch in market attention and expected value. Building its own Layer 2 network will allow Polymarket to reverse-engineer underlying features based on its platform needs, enabling more flexible adaptation to future platform upgrades and iterations.

Besides contributing about a quarter of Polygon's economy, Polymarket also revitalizes stablecoins and adds behavioral value to retained users.

With Polymarket TGE approaching, now is the best time to relocate.

CeFi & DeFi

The Crypto Mega-App Revolution: When Coinbase and Others Break Financial Boundaries

Last week, Coinbase launched a new product touted as the "future of finance." A single app offers five main functions: 24/7 stock trading, centralized exchange and on-chain cryptocurrency trading, futures and perpetual contract trading, prediction markets, and AI-powered financial analysts. All functions can be accessed via mobile phone, and users can instantly switch between different asset classes using their single account balance.

This is far more than a simple aggregation of functions; it breaks down the artificially defined boundaries of financial asset classes imposed by regulatory and technological constraints. The core driving force behind this transformation is that funds scattered across different applications are essentially idle funds. Platforms that integrate liquidity are more efficient. As for the challenge of asset discovery, it leverages social trading (with its built-in dynamic information flow).

Coinbase and Robinhood are gradually becoming the new type of banks.

Why do DeFi users reject fixed interest rates?

TradFi has a credit market, while DeFi relies on a money market.

Lenders need a premium to lock in funds, but borrowers are unwilling to pay this fee. This is why fixed-rate markets keep evolving into one-sided markets. Floating-rate markets prevail because they align with the actual behavior of participants. They are money markets for liquid funds, not credit markets for long-term assets.

DeFi protocols employ money market assumptions when designing credit products and then deploy them into a liquidity-driven ecosystem; the mismatch between user assumptions and actual capital behavior keeps fixed-rate lending a niche market.

From Aave to Ether.fi: Who has captured the most value in the on-chain credit system?

On Aave and SparkLend, the interest fees paid by the vaults to lending protocols actually exceed the revenue generated by the vaults themselves. This fact directly challenges the mainstream narrative that "distribution is king." Aave not only earns more than the various vaults built on top of it, but also surpasses the asset issuers used for lending, such as Lido and Ether.fi.

On its own, lending may seem like a low-profit business; but within the complete credit stack, it is the layer with the strongest value capture capability relative to all other participants—the treasury, the issuer, and the distribution channels.

The controversy surrounding the allocation of funds has sparked heated debate: who does the Aave brand truly belong to? If you believe that Aave Labs will remain highly aligned with Aave DAO in terms of long-term interests, and that the current friction is merely a communication and procedural error, then the emotionally driven price pullback might present a good entry point. However, if you believe that this controversy exposes not an isolated issue, but rather a structural contradiction stemming from long-standing ambiguity regarding the rights and interests of the team and agreements, coupled with a lack of institutional constraints, then this turmoil may only be the beginning.

As DeFi matures, protocol revenues become real and substantial, and brands and front-ends begin to possess commercial value, some structural contradictions between protocols and products, and between teams and communities, will surface.

Also recommended: " From Options Derivatives to Prediction Markets: A Quick Look at Coinbase's New Crypto Acquisition Landscape in 2025 ".

Weekly Hot Topics Intensive Review

In the past week, the US Treasury Secretary pushed for the "merger of Main Street and Wall Street," integrating cryptocurrencies into the mainstream financial system ;

In addition, regarding policy and the macro market, Shenyang police cracked an illegal currency exchange case, in which the suspects sold BTC and USDT to Mexican drug traffickers ; Victory Securities: prohibits virtual asset accounts with IP addresses in mainland China from executing buy operations ; Caixin: there are special legal risks associated with the issuance and use of U-cards in China ; the White House and the U.S. Department of Energy jointly launched the " Genesis Project ," with CoreWeave, Nvidia, OpenAI, xAI, and others selected as the first batch of companies; the U.S. ended the previous administration's investigation into Chinese chip trade and will not impose additional tariffs on Chinese chips for the next 18 months ; the outlook of the top 15 Wall Street investment banks was summarized as "precarious" by AI, with JPMorgan warning of the risk of an AI bubble ;

Regarding opinions and statements: Etherealize co-founder: The crypto industry must make substantial progress before Trump leaves office ; Pantera partner's outlook for 2026 : Tokenized gold, stablecoin payments, etc., may reshape the crypto industry structure; Michael Saylor: Supports free use of the Bitcoin network but opposes modifying the underlying protocol ; Polymarket believes Trump's claimed sales of Trump Gold Cards are "faked" ; VanEck: Recent Bitcoin miner capitulation may indicate the bottom is near ; CryptoQuant CEO comments on Tom Lee's differing views from his fund : Perhaps because Tom Lee is in the sell-side research field, he has to be bullish; Arthur Hayes: The altcoin season is always there , and investors misjudge because they don't hold rising assets; Hurun report: High-net-worth individuals' willingness to increase digital currency investment is rising, with a 25% increase in allocation expected in the next year ; Vitalik predicts: Bug-free code may appear within the next 15 years;

Regarding institutions, large companies, and leading projects, JPMorgan Chase's core US stock picks for 2026 include: the entire crypto sector is absent from the list, with only Google remaining among the seven AI giants ; Strategy is increasing its cash reserves and suspending Bitcoin purchases ; Ethereum plans two hard forks in 2026 , potentially increasing the L1 gas limit to 200 million; Kalshi has launched Kalshi Research and is providing internal data to researchers.

On the data front, spot gold and silver hit new highs; Bitcoin miners' revenue has fallen by 11% since mid-October and they are facing the risk of capitulation ; Ethereum has become the settlement layer for global dollar liquidity , processing approximately $90 billion to $10 billion in stablecoin transfers daily; the market capitalization of Ethena stablecoin USDe has shrunk by nearly half since the "1011 crash";

In terms of security, the Trust Wallet extension was hacked ; a 23-year-old man impersonated a Coinbase employee and defrauded users of $16 million in cryptocurrency ; quantum computing in 2026 will not cause cryptocurrency to collapse, but the risk of "collect first, then decrypt" should be guarded against ... Well, it's been another tumultuous week.

Link to the "Weekly Editor's Picks" series is attached .

Goodbye 2026~