Matrixport: ETH faces increased short-term risks due to Bitmine buying exits and a lack of new capital to sustain the rally.

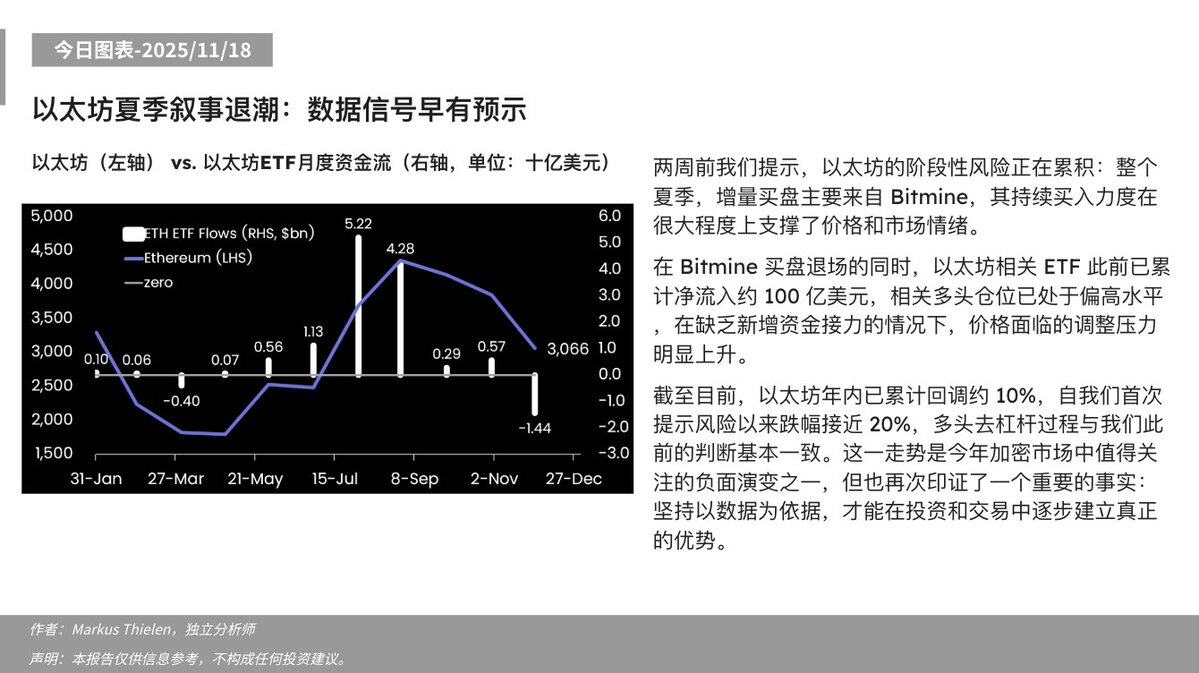

According to a chart released today by Matrixport, Odaily Planet Daily, two weeks ago we pointed out that Ethereum's short-term risks were accumulating: throughout the summer, incremental buying mainly came from Bitmine, whose continued buying power largely supported the price and market sentiment.

As Bitmine's buying activity recedes, Ethereum-related ETFs have already seen a net inflow of approximately $10 billion, and their long positions are already at a relatively high level. Without new funds to follow up, the downward pressure on prices is clearly increasing.

As of now, Ethereum has seen a cumulative pullback of approximately 10% this year, and a drop of nearly 20% since we first warned of the risks. This deleveraging process by long positions is largely consistent with our previous assessment. This trend is one of the noteworthy negative developments in the crypto market this year, but it also reaffirms an important fact: adhering to data-driven principles is essential to gradually building a genuine advantage in investment and trading.