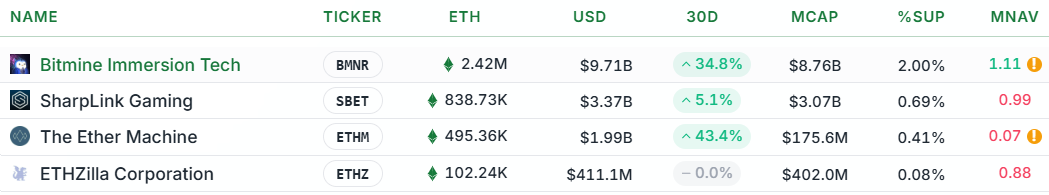

Odaily Planet Daily reported that Strategic ETH Reserve data showed that as the price of ETH fell, the mNAV indicators of the three Ethereum treasury companies, SharpLink, The Ether Machine and ETHZilla, had fallen below 1, currently reaching 0.99, 0.07 and 0.88 respectively. The three companies' ETH holdings were 838,730, 495,360 and 102,240 respectively.

The ratio of market capitalization to net asset value (mNAV) is a key indicator for measuring the valuation of a treasury company. If mNAV is greater than 1, the company can issue additional shares within the premium range and use the proceeds to purchase ETH, thereby increasing the ETH holdings per share and bringing about book growth; if it converges to 1 or below 1, the price of ETH itself will decline and the secondary market will be weak, and the flywheel mechanism will shift from "thickening" to "dilution", forming a negative feedback.