ETH "Big Short" Openly Provokes War: Tom Lee's Bullish Logic Is Wrong, Like a Mentally Idiot

- 核心观点:Andrew Kang驳斥Tom Lee的ETH看涨逻辑。

- 关键要素:

- 手续费收入未随代币化增长而提升。

- 机构未大规模买入或质押ETH。

- 技术分析显示ETH呈看跌震荡趋势。

- 市场影响:引发对ETH估值逻辑的争议与反思。

- 时效性标注:中期影响。

Originally Posted by Andrew Kang, Partner at Mechanism Capital

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

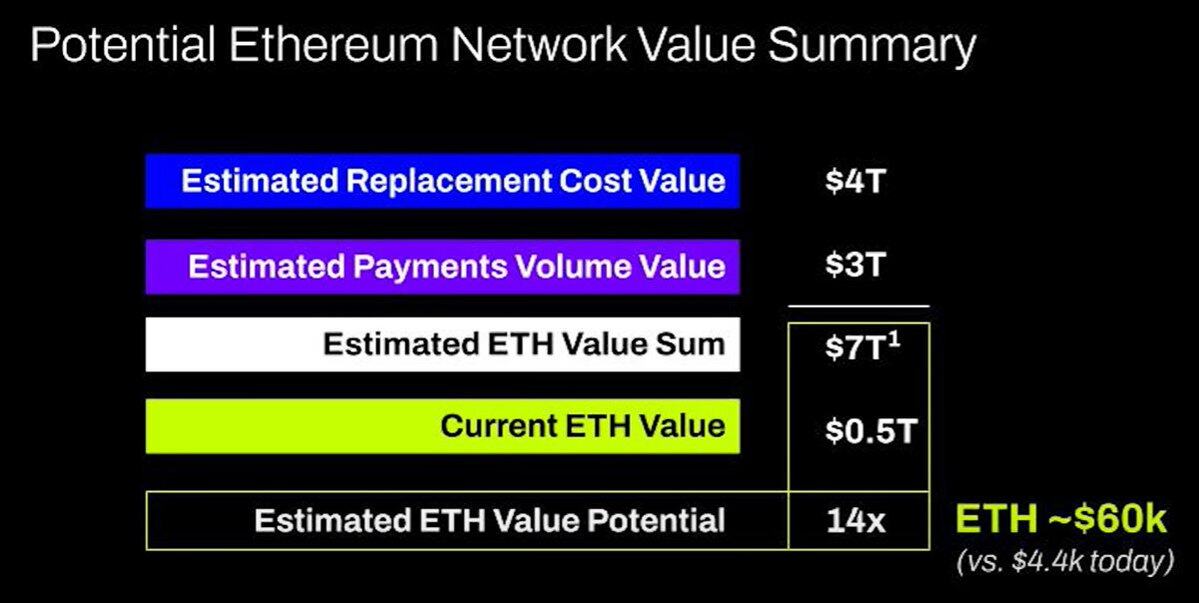

Editor's Note: Since becoming Chairman of BitMine and driving the DAT's continued purchase of ETH, Tom Lee has become the industry's leading ETH bull. In recent public appearances, Tom Lee has repeatedly emphasized ETH's growth prospects, even stating that ETH's fair value should be $60,000.

However, not everyone agrees with Tom Lee's logic. Mechanism Capital partner Andrew Kang published a long article last night, publicly refuting Tom Lee's views and bluntly mocking the latter as "a retard."

One more thing to add is that Andrew Kang predicted that ETH would fall below $1,000 when the market overall corrected in April this year. He also expressed a bearish view during the subsequent rise of ETH... Positions determine the mind, so his position may be at two extremes from Tom Lee. It is recommended that everyone look at it dialectically.

The following is the original text by Andrew Kang, translated by Odaily Planet Daily.

Among the financial analyst articles I have read recently, Tom Lee's ETH theory is one of the dumbest. Let's analyze his points one by one. Tom Lee's theory is mainly based on the following points.

- Stablecoins and RWA (real-world asset) adoption;

- the “digital oil” analogy;

- Institutions will purchase and stake ETH, both to provide security for the network where their assets are tokenized and as operating capital;

- ETH will be equal to the total value of all financial infrastructure companies;

- Technical analysis;

1. Stablecoins and RWA Adoption

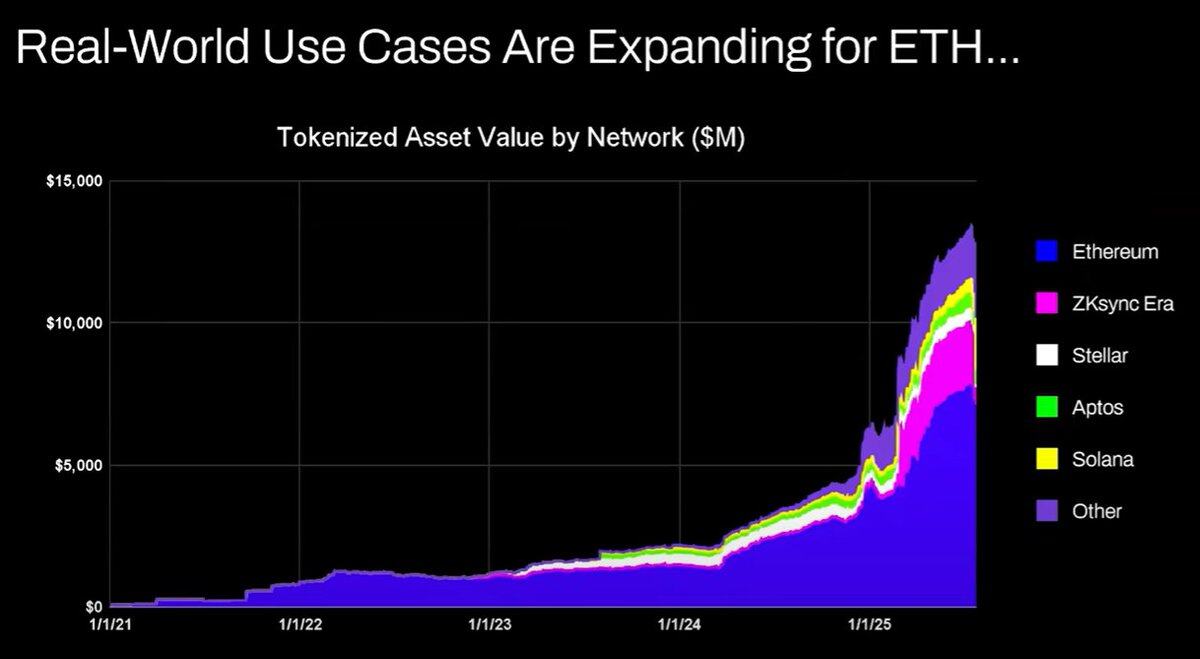

Tom Lee’s argument that increased stablecoin and asset tokenization activity will drive up transaction volume, thereby increasing ETH’s fee income, seems reasonable on the surface, but a few minutes of data review reveals otherwise.

Since 2020, the value of tokenized assets and stablecoin trading volume have increased 100-1000x . However, Tom Lee's argument fundamentally misunderstands Ethereum's value accumulation mechanism - he misleads people into thinking that network fees will increase year-on-year, when in fact Ethereum's fee revenue remains at 2020 levels.

The reasons for this result are as follows:

- The Ethereum network will improve transaction efficiency through upgrades;

- Stablecoin and asset tokenization activities will flow to other public chains;

- The fees for tokenizing illiquid assets are negligible — the tokenized value is not directly proportional to ETH revenue. For example, one could tokenize a $100 million bond, but if it were traded every two years, how much would that generate in ETH fees? Perhaps only $0.10. Even a single USDT transaction generates far more in fees than that.

You can tokenize trillions of dollars worth of assets, but if those assets aren’t traded frequently, it might only add $100,000 in value to ETH.

Will blockchain transaction volume and fees increase? Yes.

However, the majority of these fees will be captured by other blockchains with stronger business development teams. Other projects have already seen the opportunity to migrate traditional financial transactions to blockchain and are actively pursuing this market. Solana, Arbitrum, and Tempo have all achieved some early successes, and even Tether is supporting two new stablecoin chains (Plasma and Stable) in the hope of shifting USDT's trading volume to their own chains.

2. The “Digital Oil” Analogy

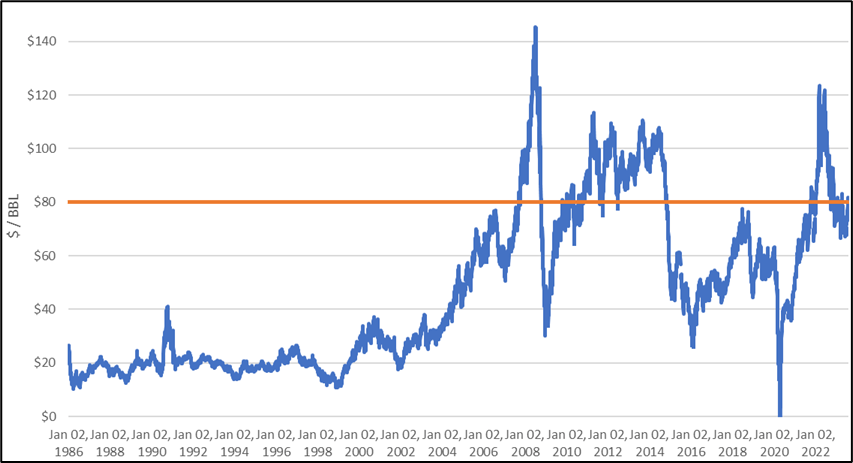

Oil is essentially a commodity. The real price of oil, adjusted for inflation, has remained in the same range for a century, with occasional fluctuations and reversions.

I partially agree with Tom Lee’s point that ETH can be considered a commodity, but this does not mean it is bullish. I am not sure what Tom Lee is trying to say here.

3. Institutions will purchase and stake ETH, both to provide security for the network and as operating capital.

Have major banks and other financial institutions already added ETH to their balance sheets? No.

Have they announced plans to buy ETH? No.

Do banks have to stockpile gasoline barrels because they have to keep paying energy bills? No, the costs are not significant enough and they only pay when they need to.

Do banks buy shares in the custodians they use for their assets? No.

4. ETH will be equal to the total value of all financial infrastructure companies

I'm speechless. This is another fundamental misunderstanding of value accumulation. It's pure fantasy, and I don't even want to criticize it.

5. Technical Analysis

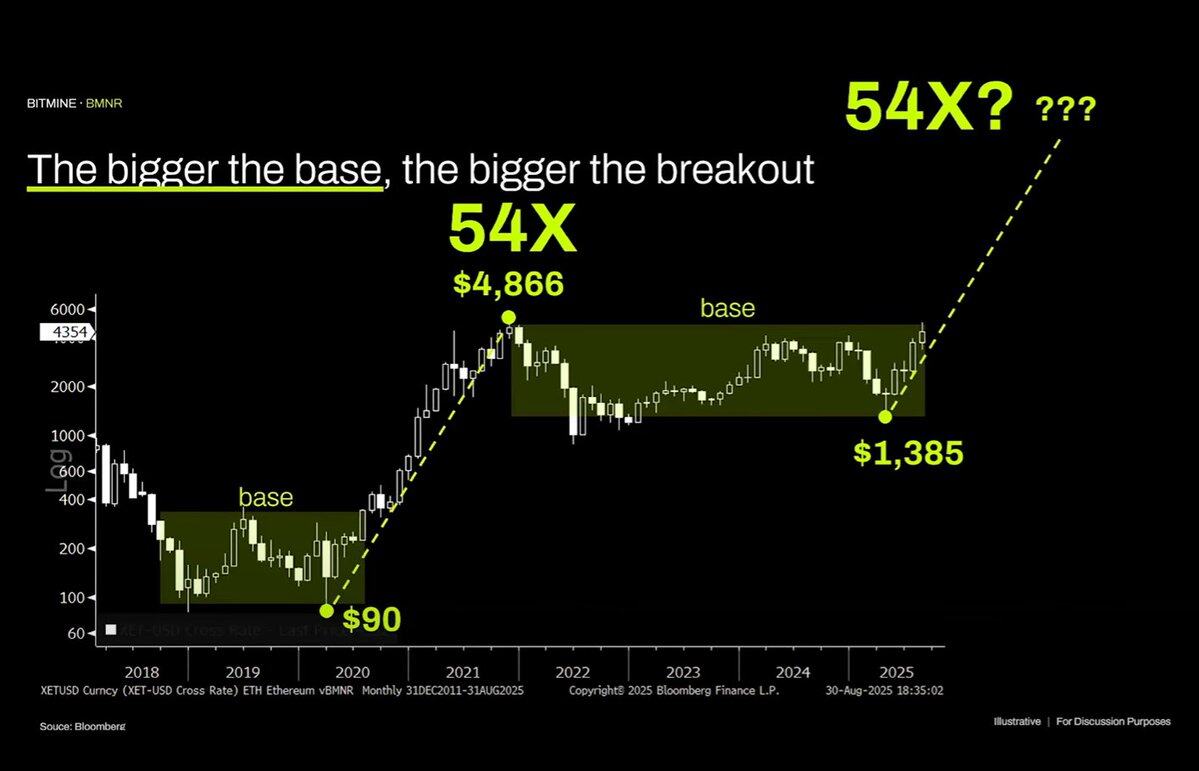

I personally am a huge fan of technical analysis and believe that it can provide valuable information when viewed objectively. Unfortunately, Tom Lee seems to be using it as a pretext to support his biases.

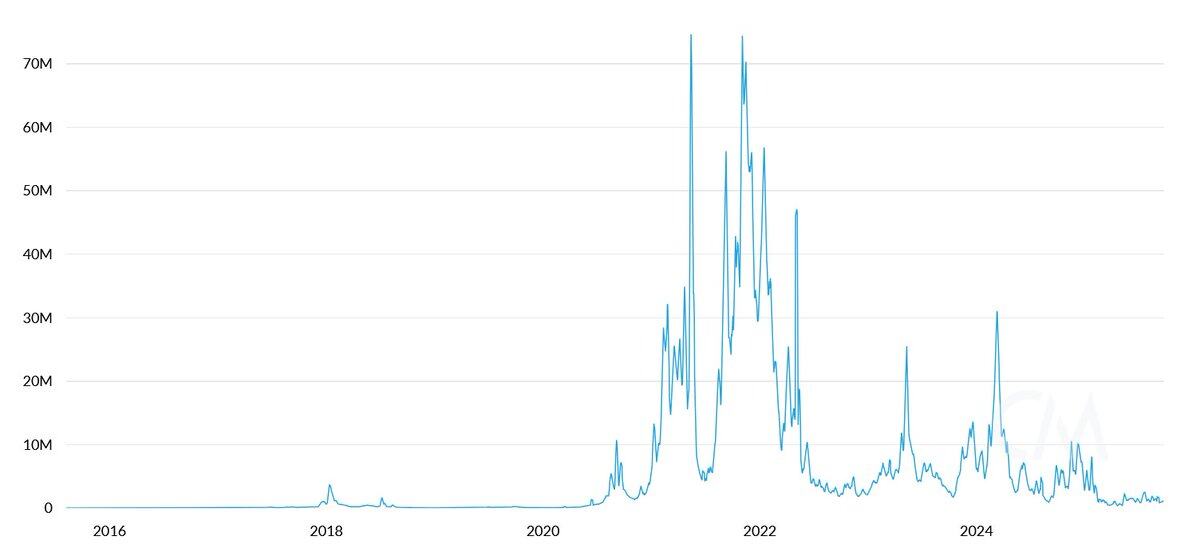

An objective examination of this chart reveals that ETH is currently stuck in a multi-year range-bound trading pattern—much like the wide range-bound trading pattern experienced by crude oil prices over the past three decades. This range-bound trading pattern has only recently reached the top of the range but has failed to break through resistance. Technically, this suggests a bearish trend for ETH, and the possibility of a prolonged range-bound trading between $1,000 and $4,800 cannot be ruled out.

Just because an asset has experienced a parabolic rally in the past does not mean that the trend will continue indefinitely.

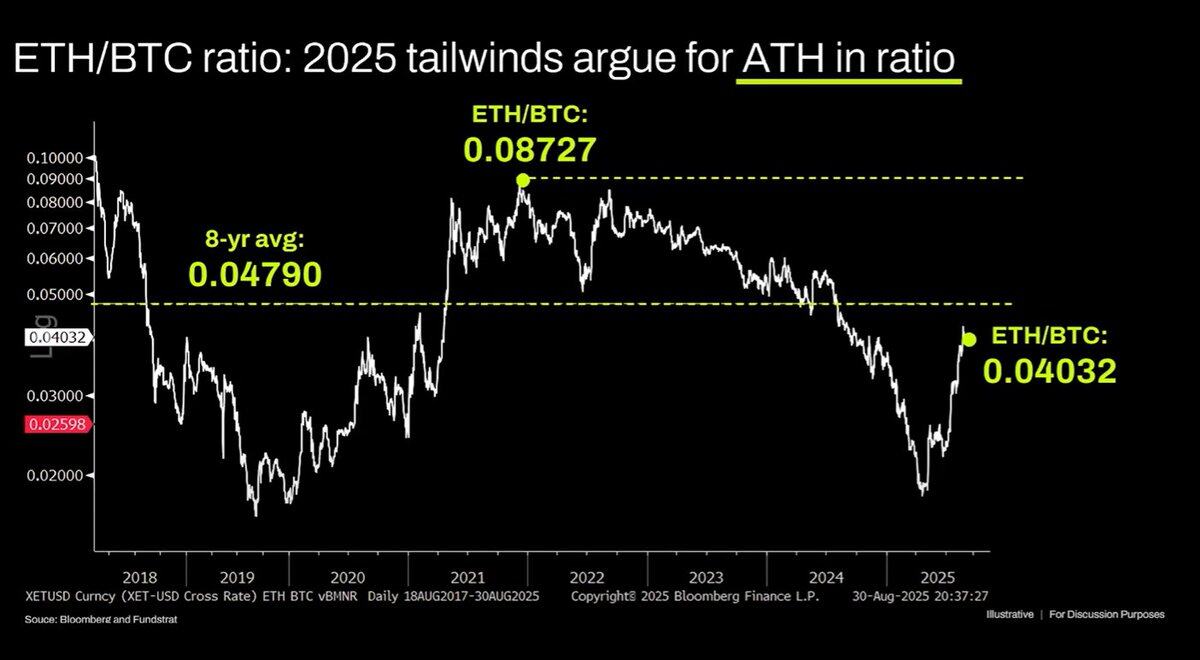

The long-term ETH/BTC chart has also been misinterpreted. While it has indeed been in a multi-year range, it has been constrained by a downward trend over the past three years, with recent rebounds merely touching long-term support levels . This downward trend stems from the saturation of Ethereum's narrative and the inability of fundamentals to support valuation growth. These fundamentals have not materially changed to date.

Ethereum's valuation is fundamentally a product of a lack of financial understanding. While this cognitive bias can certainly support a significant market capitalization (see XRP), its support is not unlimited. Macro liquidity has temporarily maintained ETH's market capitalization, but unless significant structural change occurs, it is likely to continue to underperform.