DeFi Beginner's Guide (Part 4): Plasma Mainnet Launch Subsidy Opportunities, Tutorials, and Precautions

- 核心观点:Plasma主网提供短期高收益稳定币理财机会。

- 关键要素:

- 官方稳定币金库APR达33.78%。

- AAVE USDT池补贴收益20.42%。

- Fluid/Euler协议收益超23%。

- 市场影响:吸引资金流入,推高链上TVL。

- 时效性标注:短期影响

20%-40% stablecoin APR! No time for explanation! Seize the opportunity to subsidize stablecoins after the Plasma mainnet launch! This article will summarize the opportunities for stablecoin yields on the Plasma mainnet, along with a tutorial and precautions for participating, from a DeFi novice's perspective.

A quick background on the Plasma project

Just yesterday, September 25th, I'm sure many of you saw the wealth-generating effect of XPL (XPL) through various consulting and social media platforms, giving its issuer, Plasma, a strong start to its TGE. If you missed out on the early rounds of XPL, don't worry. Since its mainnet launch, Plasma has provided short-term, high-subsidized returns for various stablecoin interest-earning scenarios. I believe these scenarios offer low risk, simple operations, and very substantial returns, making them suitable for DeFi novices. Therefore, I'd like to quickly summarize some information and precautions that readers may need to consider before participating.

First, let's quickly introduce the Plasma project. In short, it's a Layer-1 blockchain with strong investor backing, specifically designed for stablecoin payment systems. It aims to provide high-performance, low-cost, and near-instant transfers for US dollar stablecoins like USDT. Its core selling point is "zero-fee USDT transfers" (meaning users don't need to pay extra gas fees for standard USDT transfers). Furthermore, it's EVM-compatible, enabling rapid integration with established EVM DeFi products.

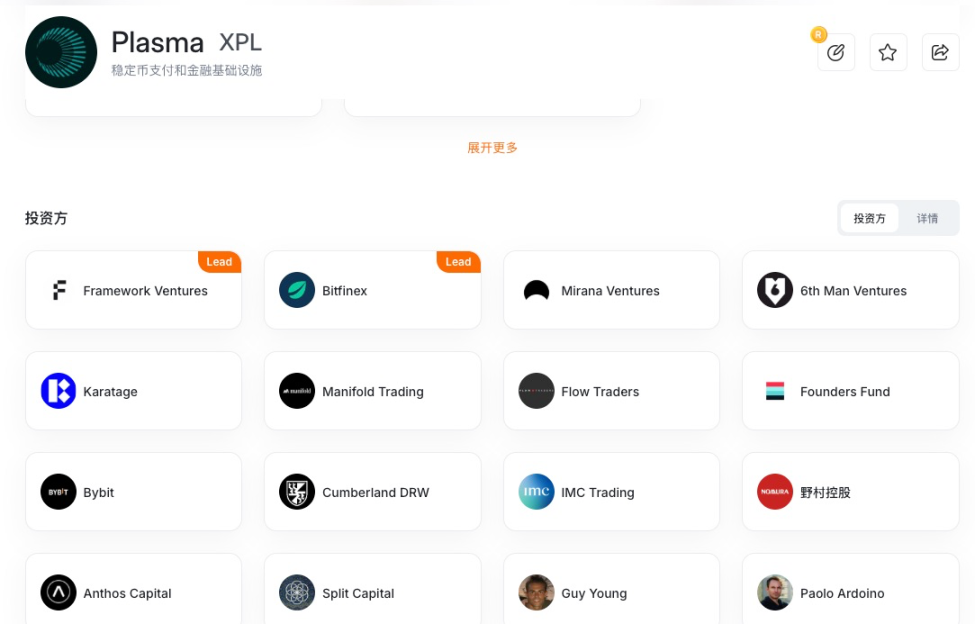

Plasma (XPL) boasts a strong backing, including Founders Fund, Framework Ventures, Bitfinex, and Tether executives, providing both financial and strategic support. Since 2024, the project has completed a seed round of approximately $3.5 million and a Series A of approximately $20 million. Furthermore, it raised over $370 million in a pre-mainnet public offering, which will fund its stablecoin liquidity pool, ecosystem incentives, technology R&D, and security audits. These funds have laid a solid foundation for Plasma to build a zero-fee stablecoin transfer network and a broad DeFi ecosystem.

The significance of introducing these is that we can understand that this is a relatively hot project with a high probability of not encountering problems in the short term, so there is still good protection for asset security.

Plasma Mainnet Cold Start Phase: Watering Subsidy Opportunities, Tutorials, and Precautions

From a GoToMarket perspective, the Plasma project has adopted a high-profile strategy. After a strong start with its token TGE, Plasma officially offered short-term, high-return XPL token subsidies to stablecoin use cases within the ecosystem's DeFi projects, aiming to maintain project momentum and rapidly attract capital. On average, the APR for most stablecoin interest-earning scenarios remains between 20% and 40%. According to DeFillama, TVL has rapidly reached $2.5 billion since its mainnet launch yesterday. Major DeFi projects have already begun to integrate Plasma, and Plasma's official subsidies are primarily focused on these major DeFi protocols. Therefore, for the time being, it's recommended to avoid participating in new, native, and early-stage projects to avoid unnecessary risk.

First, let's explain how to discover these financial opportunities. The first key link is Plasma's dedicated section on the Merkl platform. Merkl is a multi-chain Web 3 incentive distribution platform that has allocated over $200 million in liquidity and reward points to over 200 protocols. It supports various programs such as liquidity mining, lending incentives, and airdrops, helping projects effectively attract and retain users, so security is a given. Plasma chooses to distribute rewards through the Merkl platform. You can find all subsidized scenarios here:

It is worth noting that Merkl's incentive model in some scenarios adopts the Merkle Root distribution form. This means that although rewards are accumulated in real time, they are not available for collection in real time. Users may need to actively claim rewards at regular intervals. If you are looking for compound interest opportunities, please do not ignore this detail.

Next, let's explain how to transfer funds to the Plasma mainnet. The cross-chain protocol specified on the official website is stragate.finance. Users can access this protocol by clicking on the top navigation bar.

There are four points to note during the cross-chain process:

- Plasma uses a private key system that is compatible with the EVM ecosystem, so your EVM address can be reused in the Plasma ecosystem.

- The current Plasma mainnet requires XPL to pay for transaction gas, so you need to deposit some XPL for the operation address in advance. It is recommended to purchase some from CEX, 5 to 10 are enough, and withdraw them to the address.

- Currently, the primary subsidized stablecoin in the Plasma ecosystem is USDT 0. USDT 0 is a cross-chain stablecoin based on the Omnichain Fungible Token (OFT) standard launched by Tether for LayerZero. It is pegged 1:1 to USDT. Therefore, you only need to prepare USDT.

- Stargate supports cross-chain transactions, so your cross-chain request isn't necessarily routed through LayerZero. You might be recommended other transaction paths. The default protocol seems to be Aori, which can lead to significant slippage and fees. Note that if you don't actively choose to use the OFT protocol for cross-chain transactions (which is free), you'll incur significant fees. Be mindful of this!

Finally, let me introduce some stablecoin-based risk-free financial management scenarios that I think are very suitable for DeFi newbies to participate in:

1. Official Plasma Stablecoin Lending Vault: This is an official stablecoin vault where users can stake USDT 0 to earn government subsidies. Funds provided by the vault are automatically staked to AAVE's USDT 0 pool. The pool currently has a total TVL of $1,604.64 million and a current instantaneous yield of 33.78%.

There are two points to note:

- The current yield of this pool can only last for 3 days, but Compaign #0 xffdb will end in 3 days, and the subsequent yield depends on how much funds the project party continues to allocate in this pool.

- There is a 48-hour cooling-off period for redemptions in this pool, and the principal can be retrieved only after the cooling-off period.

The key links are as follows:

- Reward details: https://app.merkl.xyz/opportunities/plasma/ERC 20_CROSS_CHAIN/0 xd 1074 E 0 AE 85610 dDBA 0147 e 29 eBe 0 D 8 E 5873 a 000

- Participation link: https://app.plasma.to/

2. Provide funds to the USDT 0 pool in AAVE: The second good opportunity is to provide funds directly to AAVE's USDT 0 pool, which will earn 20.42% of the income, of which 3.08% comes from interest payments from borrowers, and the remaining 17.35% comes from the official XPL token subsidy.

Points to note:

- The subsidy currently has a remaining duration of 6 days, and the yield after maturity depends on the official allocation.

- Since all the funds of the official Lending Vault are also injected into this pool, and the official Lending Vault has a cooling-off period, in the subsequent reward settings, if the official wants to retain the Lending Vault, the allocated yield must be higher than directly depositing funds into AAVE to subsidize the time cost of user funds.

- The subsidy part only calculates the net value of the funds provided by the user, that is, if you have a loan, this part of the funds will be deducted from the principal calculation, so revolving loans are meaningless in this scenario.

Key Links:

- Reward details: https://app.merkl.xyz/opportunities/plasma/MULTILOG_DUTCH/0 xc 5 a 8 eda 89 cc 8 ef 1 de 7 c 861 be 9 bcf 3 ffdbd 250627

- Participation link: https://app.aave.com/markets/

3. A designated vault in Fluid or Euler provides USDT 0: From a TVL perspective, Fluid and Euler are considered second-tier lending protocols. Compared to AAVE, they offer more complex features, making them slightly less secure, but both are time-tested. Plasma also distributes rewards in these two scenarios, with current yields reaching 23.76% and 27.20%.

Key Links:

- Fluid Reward Details: https://app.merkl.xyz/opportunities/plasma/ERC 20 LOGPROCESSOR/0 x 1 DD 4 b 13 fcAE 900 C 60 a 350589 BE 8052959 D 2 Ed 27 B

- Euler reward details: https://app.merkl.xyz/opportunities/plasma/ERC 20 LOGPROCESSOR/0 xe 818 ad 0 D 20 D 504 C 55601 b 9 d 5 e 0 E 137314414 dec 4

- Fluid participation link: https://fluid.io/lending/9745/USDT 0

- Euler participation link: https://app.euler.finance/earn/0 xe 818 ad 0 D 20 D 504 C 55601 b 9 d 5 e 0 E 137314414 dec 4?network=plasma

After the early subsidy phase, I will continue to track financial management scenarios on the Plasma chain that are suitable for DeFi novices to participate in. Stay tuned!