風暴前夜:鮑威爾不降息,川普宣布新聯準會主席?

- 核心觀點:市場普遍預期聯準會將維持利率不變,但本次會議的關鍵在於鮑威爾的談話對未來降息路徑的暗示,以及川普可能宣布聯準會主席繼任人選,這兩大不確定性因素或將打破加密貨幣市場的橫盤狀態。

- 關鍵要素:

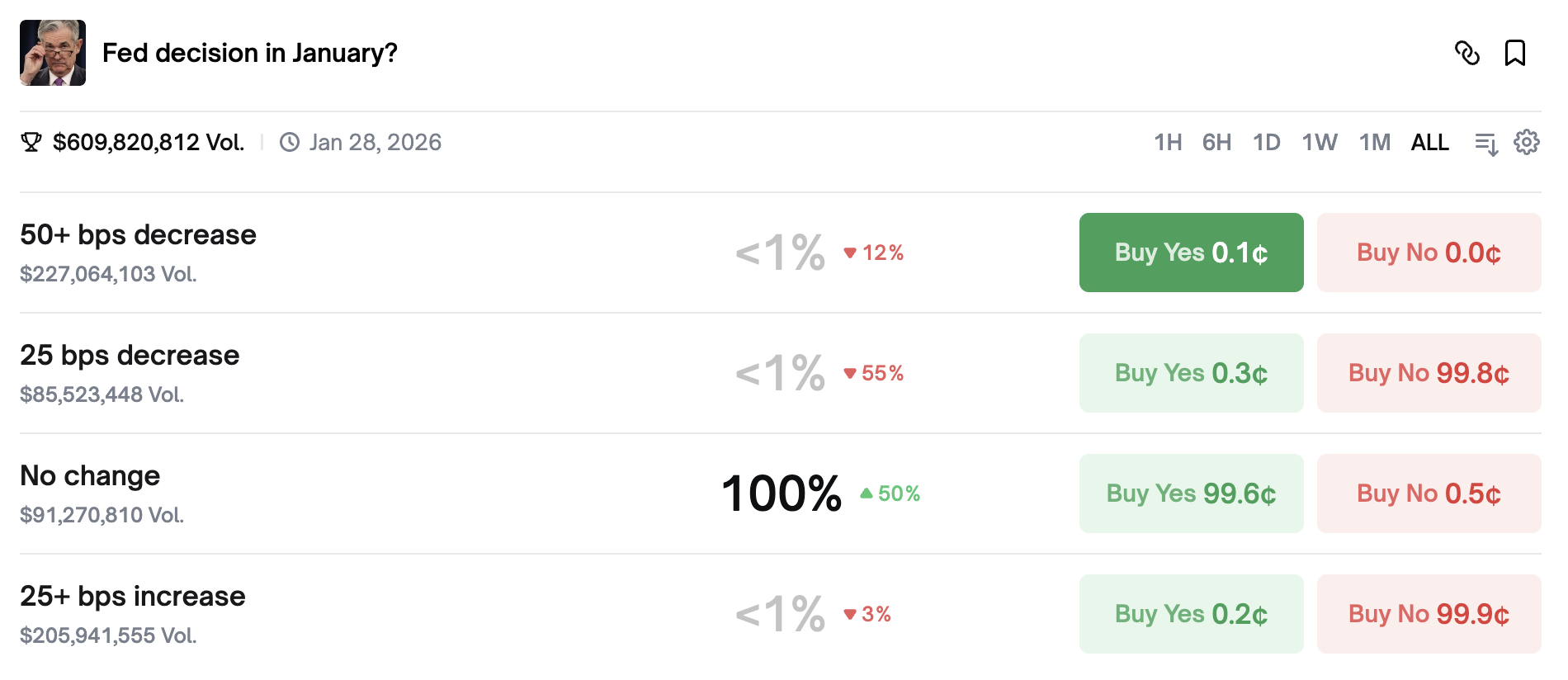

- 市場預期高度一致,Polymarket數據顯示聯準會維持利率不變的機率接近100%,市場已提前消化此資訊,BTC過去7天僅微跌0.39%。

- 市場核心分歧在於2026年降息路徑,鮑威爾的談話(是否偏鷹派)將成為關鍵指引,可能引發市場波動。

- 聯準會內部決策力量可能生變,2026年輪換進入利率決策委員會的成員以「鷹派」為主,可能影響後續政策平衡。

- 川普可能藉本次FOMC會議宣布聯準會主席提名人選,以轉移市場對鮑威爾潛在鷹派言論的注意力,釋放「鴿派」利好。

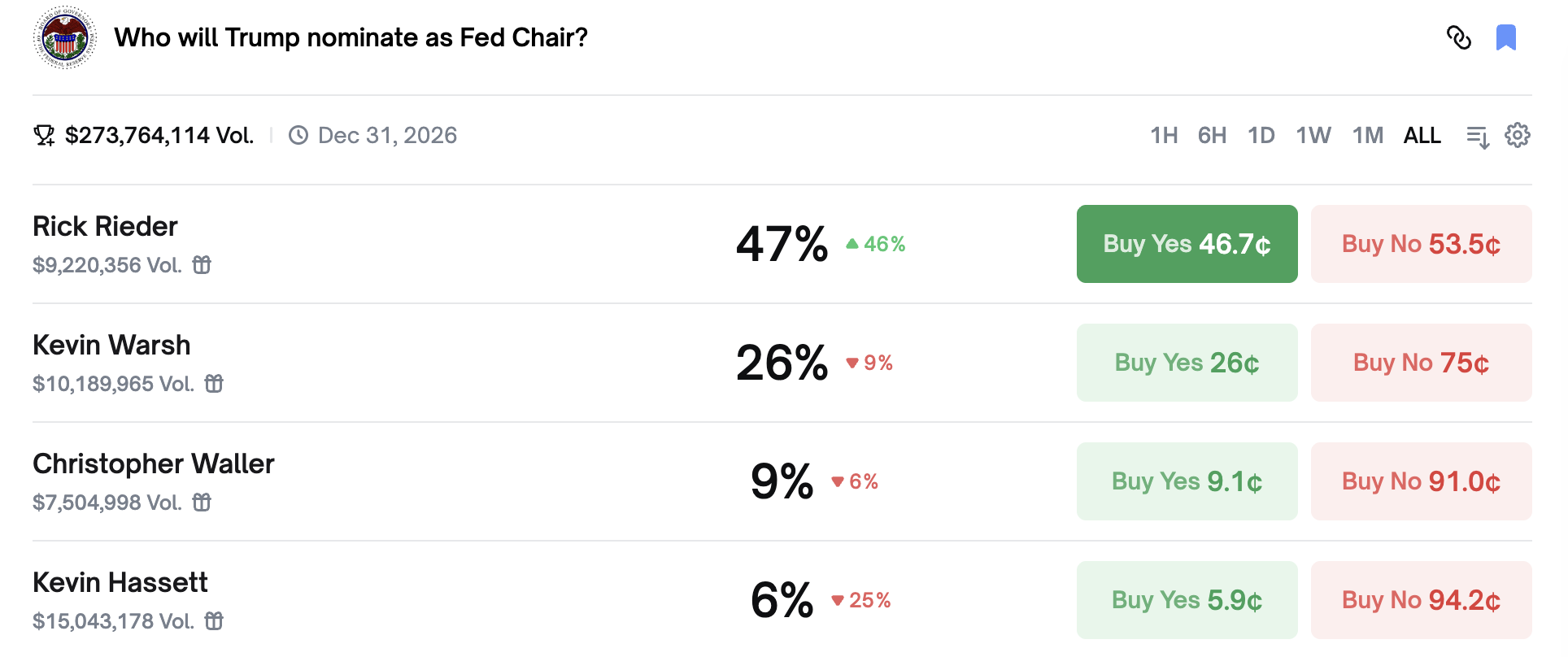

- 熱門候選人瑞克·里德爾(Rick Rieder)被提名機率最高(47%),其主張低利率的觀點可能吸引川普,但其政策獨立性仍是未知數。

Original | Odaily(@OdailyChina)

Author|Golem(@web3_golem)

At 3:00 AM Beijing time on January 29th (this Thursday), the Federal Reserve is set to announce its first interest rate decision for 2026; half an hour later, current Fed Chair Jerome Powell will hold a monetary policy press conference. However, there is little suspense surrounding this Fed rate decision, as the market widely expects the Fed to keep rates unchanged. Data from Polymarket shows the probability of maintaining the current rate is close to 100%.

Such a high probability has also allowed the market to digest in advance the negative impact of the Fed announcing "no rate cut" this time. OKX data shows that BTC has fallen only 0.39% over the past 7 days, essentially in a sideways consolidation, but this period of market "silence" may be broken tonight.

On one hand, although the market almost unanimously believes the Fed will keep rates unchanged this week, there is significant divergence regarding the monetary policy path for the remainder of 2026, making this still an important "wait-and-see" meeting. The Fed's future key policy inclinations for 2026, such as whether it will continue cutting rates and the frequency of cuts, will affect the market. If Powell makes hawkish remarks like "further observation is needed," the market might "drop in response."

On the other hand, the announcement of the successor to the Fed Chair will also have long-term effects on the market. The candidate pool has now been narrowed down to four individuals. Trump previously stated he has a preferred candidate but is waiting for the right time to announce, and that suitable time could very well be tonight.

2026 Rate Cut Direction Remains Uncertain

Since last September, the Fed initiated a new rate-cutting cycle, implementing three consecutive cuts. If rates are held steady this week, it would be the first pause since the cycle began. At this point, the market is not concerned about the reason for holding rates steady, but rather whether this is a brief pause to observe before resuming cuts, or the beginning of a prolonged pause, or even the start of a rate-hiking cycle?

Previously, the prevailing market view was that 2026 would be a year of further quantitative easing by the Fed.

Reason one: From a data perspective, the US labor market indeed shows signs of weakness. Non-farm payrolls in December 2025 increased by only 50,000, with an unemployment rate of 4.4%. While there is no "massive layoff," it remains in a state of "low hiring and cooling demand." Reason two: The Fed may still believe Trump's tariff policies will not have a long-term impact on inflation (Odaily: Powell cited this factor for a rate cut in September 2025). Reason three: Trump previously publicly stated he would select a "dovish" figure as the next Fed Chair.

However, there are also views in the market suggesting uncertainty remains about the Fed continuing rate cuts in 2026. Some analysts believe that unless the job market deteriorates significantly, it will be difficult to see rate cuts before mid-year, as the pace of inflation decline is insufficient to convince hawkish committee members.

Simply put, the Fed's mandate is to curb inflation and promote employment. However, 2025 saw the coexistence of a weak labor market and high inflation in the US. The Fed ultimately prioritized addressing employment, hence initiating the rate-cutting cycle. Yet, the reality is that the US inflation rate remains stuck at 2.8%, far above the Fed's 2% target, forcing the Fed to reconsider the impact of tariffs on inflation. Holding rates steady this week would also indicate the Fed is beginning to "observe."

On the other hand, although Trump's chosen next Fed Chair is destined to be "dovish," the new rotating chairs on the Fed's rate-setting committee are predominantly "hawkish." At the beginning of each year, four of the 12 regional Fed presidents rotate onto the rate-setting committee, gaining voting rights for the next eight policy meetings. This year's rotating list includes Dallas Fed President Lorie Logan, Cleveland Fed President Loretta Mester, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari.

Among them, Logan and Mester are seen as "hawkish" figures, both having publicly stated the Fed should focus on inflation. Harker is seen as "dovish," having publicly expressed "cautious optimism" about inflation. Kashkari's stance is more neutral. The addition of new "hawkish" members might disrupt the previous balance of policy inclinations within the Fed. Even if Trump selects a "dovish" Chair, they may not be able to sway the entire rate-setting committee.

Moreover, the Fed Chair might not fully lead rate cuts according to Trump's wishes. Trump personally appointed Powell as Fed Chair years ago, but looking at last year, even though Trump promoted Powell, Powell did not "repay" Trump with sustained, significant rate cuts. Under US law, the Fed is independent and can make interest rate decisions based on economic conditions, not government wishes. Therefore, even if a new Fed Chair verbally promises Trump to cut rates, they might "go their own way" after taking office.

This kind of meaningless "political promise" is also a concern for Trump. Last week, speaking at the World Economic Forum in Davos, Switzerland, Trump said, "It's amazing how people change once they get the job," implying candidates say "what sounds good" during interviews but emphasize their independence once confirmed.

Considering these factors, Powell's remarks after tonight's FOMC meeting will also be closely watched by investors for hints on how long the Fed might pause rate cuts.

This Week's FOMC Meeting Could Be One of the Best Times for Trump to Announce the Fed Chair Successor

Besides this week's FOMC meeting, the successor to the Fed Chair is another macro event that can influence the market. The candidate pool has now been narrowed down to four: Kevin Hassett, Kevin Warsh, Rick Rieder, and Christopher Waller. According to Polymarket data, Rick Rieder currently has the highest probability of being nominated by Trump at 47%; Kevin Hassett has the lowest probability at 6%.

Rick Rieder is BlackRock's Chief Investment Officer of Global Fixed Income. Although he lacks extensive government experience, he has consistently advocated for supporting low interest rates based on market understanding rather than politics. This background might attract Trump, who is worried about a new Fed Chair becoming "uncooperative" upon taking office. Economists at Evercore ISI, including Krishna Guha, even believe that "if Rick Rieder becomes the new Fed Chair, he might advocate for three rate cuts this year." (Odaily Note: For more information on Rick Rieder, read 《What is the Crypto Stance of Rick Rieder, the Final Candidate on the Fed Chair Shortlist?》)

Hassett was once considered the most likely candidate to become the new Fed Chair, with probabilities exceeding 80%. However, Hassett is Trump's economic advisor. Previously, there were external concerns that nominating Hassett would damage the Fed's independence. Additionally, Trump publicly stated he did not want to lose Hassett from his administration. Consequently, Hassett's probability of being selected has declined, though some still believe his nomination probability is higher than 6%.

Trump has repeatedly publicly stated he would announce his nominee in January. In late December 2025, Trump told reporters in Florida he would announce the next Fed Chair candidate sometime in January. On January 14, 2026, Trump told Reuters in an interview he would announce the candidate within the next few weeks. Two weeks later, on January 27, Trump said in Iowa he would announce the new Fed Chair candidate soon, but has yet to do so.

Although Trump's answers have been vague each time, it's almost certain the probability of announcing the nomination in January is extremely high, and the best timing for the announcement could very well be during this week's FOMC meeting.

As mentioned earlier, Powell's speech tonight will be a key focus for investors. If Powell does not make dovish-leaning remarks, financial markets could suffer a blow, a scenario Trump clearly does not want to see. Therefore, if Trump wishes to shift market attention away from the uncertain Powell, he might announce his nominee for the next Fed Chair during tonight's FOMC meeting. This would release a "dovish Chair" positive signal to the market, reducing attention on Powell's speech or mitigating potential negative market impacts.

Tonight, let's wait and see!