Có phải Bộ Tư pháp Hoa Kỳ kiện KuCoin chỉ là một cái tát vào các sàn giao dịch khác nhau? Hay đó là khúc dạo đầu để thanh trừng?

Bản gốc|Hàng ngày

Tác giả|jk

Vào thứ Ba, giờ địa phương ở Hoa Kỳ, Bộ Tư pháp Hoa Kỳ và Ủy ban Giao dịch Hàng hóa Tương lai Hàng hóa (CFTC) đã đệ đơn cáo buộc hình sự đối với sàn giao dịch tiền điện tử KuCoin và hai nhà sáng lập của nó. Sự kiện này đánh dấuCơ quan quản lý Hoa Kỳ tiếp tục điều chỉnh thị trường tiền điện tử, cũng theo trường hợp Binancemột phần của chương trình đang diễn ra nhằm chống rửa tiền。

Theo bản cáo trạng do Bộ Tư pháp Hoa Kỳ công bố hôm thứ Ba, đơn khiếu nại nhắm vào KuCoin, các đơn vị đứng đằng sau nó và hai người sáng lập Chun Gan và Ke Tang, cáo buộc họ điều hành một hoạt động kinh doanh chuyển tiền không có giấy phép và vi phạm Đạo luật Bảo mật Ngân hàng. .》. Đồng thời, Ủy ban giao dịch hàng hóa tương lai (CFTC) tuyên bố trong một bản cáo trạng khác nộp cùng ngày rằng KuCoin đã vận hành trái phép một sàn giao dịch phái sinh tài sản kỹ thuật số.

Hai cơ quan đưa ra cáo trạng cho biết sàn giao dịch đã không duy trì đầy đủ các thủ tục chống rửa tiền và không thực hiện."Thủ tục hợp lý"KuCoin không xác nhận danh tính khách hàng, gửi báo cáo hoạt động đáng ngờ và không đăng ký với CFTC và FinCEN. Những hành động này đã khiến KuCoin trở thành công cụ để rửa các quỹ tội phạm quy mô lớn, liên quan đến hơn 9 tỷ USD.

Chi tiết truy tố: KuCoin đã phạm tội gì?

KuCoin và những người sáng lập đã bị truy tố vì âm mưu điều hành một doanh nghiệp chuyển tiền không có giấy phép và âm mưu vi phạm Đạo luật Bảo mật Ngân hàng, liên quan đến việc cố tình không duy trì các thủ tục chống rửa tiền (“AML”) đầy đủ, theo thông cáo báo chí được công bố bởi KuCoin. Bộ Tư pháp Hoa Kỳ. Các quy trình này được thiết kế để ngăn chặn KuCoin được sử dụng để rửa tiền và tài trợ khủng bố, đồng thời KuCoin không duy trì các quy trình hợp lý để xác minh danh tính khách hàng và không gửi bất kỳ báo cáo hoạt động đáng ngờ nào. KuCoin cũng bị cáo buộc điều hành một doanh nghiệp chuyển tiền không có giấy phép và vi phạm nghiêm trọng Đạo luật Bảo mật Ngân hàng.

phải nhận thức được là,Việc truy tố này không có sự tham gia của SEC nên cáo buộc không bao gồm tội yêu thích của SEC - bán chứng khoán chưa đăng ký, vì các vấn đề liên quan đến chứng khoán không thuộc thẩm quyền của truy tố này.

Bản cáo trạng nêu rõ KuCoin đã thông qua"Tuyên bố sai rằng họ không có khách hàng Mỹ"Để cố tình lách các quy định chống rửa tiền (AML) và xác minh danh tính khách hàng (KYC) của Hoa Kỳ, KuCoin thực sự có một số lượng lớn khách hàng Hoa Kỳ và bên công tố tuyên bố rằng KuCoin đã cho phép sử dụng nền tảng của mình để rửa hơn 9 tỷ USD.

KuCoin đã thu hút hoạt động kinh doanh từ khách hàng Hoa Kỳ thông qua nền tảng giao dịch giao ngay và sau đó, nền tảng giao dịch tương lai ra mắt vào tháng 7 năm 2019. Kể từ khi thành lập vào năm 2017, KuCoin đã trở thành một trong những nền tảng giao dịch tiền điện tử lớn nhất thế giới, với hơn 30 triệu khách hàng và khối lượng giao dịch tiền điện tử hàng tỷ đô la hàng ngày. Trang web của KuCoin tự hào về vị trí của mình trong top 5 trong bảng xếp hạng công khai về các sàn giao dịch tiền điện tử toàn cầu. Một trong những bảng xếp hạng công khai xếp KuCoin là sàn giao dịch phái sinh tiền điện tử lớn thứ tư và sàn giao dịch giao ngay tiền điện tử lớn thứ năm.

Trong một tuyên bố do Bộ Tư pháp đưa ra, những người sáng lập và các đơn vị KuCoin đã biết về nghĩa vụ chống rửa tiền (AML) của họ tại Hoa Kỳ nhưng đã cố tình bỏ qua những yêu cầu đó: KuCoin đã không thực hiện đầy đủ quy trình xác định khách hàng (KYC) quá trình. Trên thực tế, cho đến ít nhất là tháng 7 năm 2023, KuCoin đã không yêu cầu khách hàng cung cấp bất kỳ thông tin nhận dạng nào.Chỉ đến tháng 7 năm 2023, sau khi KuCoin được thông báo về cuộc điều tra hình sự liên bang đối với các hoạt động của mình, KuCoin mới áp dụng thủ tục KYC cho khách hàng mới. Tuy nhiên, quy trình KYC này chỉ áp dụng cho khách hàng mới và không áp dụng cho hàng triệu khách hàng hiện tại của KuCoin, bao gồm một số lượng lớn những khách hàng có trụ sở tại Hoa Kỳ.KuCoin cũng chưa bao giờ nộp bất kỳ báo cáo hoạt động đáng ngờ bắt buộc nào, chưa bao giờ đăng ký với CFTC với tư cách là nhà kinh doanh hoa hồng tương lai và ít nhất cho đến cuối năm 2023, chưa bao giờ đăng ký FinCEN với tư cách là một doanh nghiệp chuyển tiền.

Ví dụ: Bộ Tư pháp cho biết từ tháng 8 năm 2022 đến tháng 11 năm 2023, khoảng 197 địa chỉ gửi tiền KuCoin đã nhận được số tiền điện tử trị giá 3,2 triệu đô la, gián tiếp hoặc trực tiếp, từ máy trộn tiền ảo Tornado Cash, vốn nằm trong danh sách trừng phạt.

Thông cáo báo chí có nội dung: Trên thực tế, KuCoin tích cực cố gắng che giấu sự hiện diện của khách hàng Hoa Kỳ để làm cho có vẻ như KuCoin được miễn các yêu cầu AML và KYC của Hoa Kỳ. Mặc dù KuCoin thu thập và theo dõi thông tin vị trí của khách hàng, KuCoin vẫn tích cực chặn khách hàng Hoa Kỳ của họ nhận dạng chính họ khi mở tài khoản KuCoin.Hơn nữa, KuCoin đã nói dối ít nhất một nhà đầu tư vào năm 2022 về vị trí của khách hàng, tuyên bố sai rằng họ không có khách hàng Hoa Kỳ,Trên thực tế, KuCoin có lượng lớn khách hàng Mỹ. Trên thực tế, trong nhiều bài đăng trên mạng xã hội, KuCoin tích cực tiếp thị bản thân như một sàn giao dịch dành cho khách hàng ở Hoa Kỳ, nơi họ có thể giao dịch mà không cần KYC. Ví dụ: KuCoin đã nói trong một tin nhắn trên Twitter vào tháng 4 năm 2022:KYC không được hỗ trợ cho người dùng Hoa Kỳ, tuy nhiên, KYC không bắt buộc trên KuCoin. Thông thường các giao dịch có thể được hoàn thành bằng tài khoản chưa được xác minh.

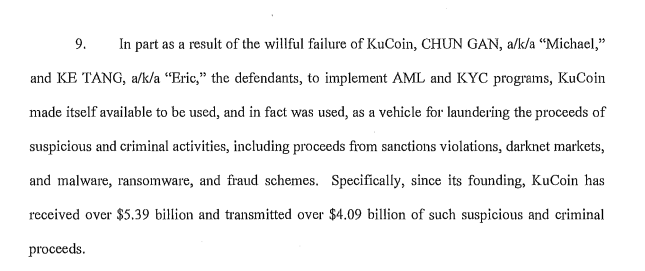

Do KuCoin cố tình không duy trì các thủ tục AML và KYC bắt buộc, KuCoin đã được sử dụng như một phương tiện để rửa một lượng lớn tiền thu được từ tội phạm, bao gồm tiền thu được từ thị trường darknet, phần mềm độc hại, ransomware và các âm mưu lừa đảo. Kể từ khi thành lập vào năm 2017, KuCoin đã nhận được hơn 5 tỷ USD và gửi hơn 4 tỷ USD tiền thu được đáng ngờ và hình sự. Nhiều khách hàng của KuCoin sử dụng nền tảng giao dịch của nó đặc biệt vì tính ẩn danh của dịch vụ mà nó cung cấp. Nói cách khác, chính sách không KYC của KuCoin là một phần quan trọng cho sự phát triển và thành công của nó.

Số tiền tài chính được đề cập trong bản cáo trạng, nguồn: Bản cáo trạng của Bộ Tư pháp Hoa Kỳ

Mỗi tội danh chống lại những người sáng lập có hình phạt tối đa là 5 năm tù.

Luật sư Hoa Kỳ Damian Williams cho biết: Như bị cáo buộc trong bản cáo trạng ngày hôm nay, KuCoin và những người sáng lập đã cố tình che giấu sự thật rằng một số lượng lớn người dùng Hoa Kỳ đang giao dịch trên nền tảng KuCoin. Trên thực tế, KuCoin bị cáo buộc đã tận dụng cơ sở khách hàng lớn ở Hoa Kỳ của mình để trở thành một trong những các công cụ phái sinh tiền điện tử lớn nhất và sàn giao dịch giao ngay trên thế giới, với khối lượng giao dịch hàng ngày hàng tỷ đô la và khối lượng giao dịch hàng năm hàng nghìn tỷ đô la. Tuy nhiên, các tổ chức tài chính như KuCoin tận dụng những cơ hội duy nhất có sẵn ở Hoa Kỳ, cũng phải tuân thủ Luật pháp Hoa Kỳ giúp xác định và loại bỏ tận gốc các âm mưu tài chính tội phạm và tham nhũng. bên trong và được sử dụng như một nơi trú ẩn an toàn cho hoạt động rửa tiền bất hợp pháp, KuCoin đã nhận được hơn 5 tỷ đô la và gửi hơn 4 tỷ đô la trong các quỹ hình sự và có vấn đề. Các sàn giao dịch tiền điện tử như KuCoin không thể có cả hai cách. tin nhắn rõ ràng:Nếu bạn định phục vụ khách hàng Mỹ thì phải tuân theo luật pháp Hoa Kỳ, điều đó thật đơn giản.

Ủy ban giao dịch hàng hóa tương lai cũng đã đệ đơn kiện dân sự song song chống lại KuCoin vào thứ Ba. CFTC tìm cách giải quyết các hành vi làm giàu bất chính, các hình phạt dân sự về tiền tệ, cấm giao dịch và đăng ký vĩnh viễn cũng như các lệnh cấm vĩnh viễn đối với các hành vi vi phạm trong tương lai.

hiện tại,KuCoin đã trả lời:"KuCoin đang hoạt động tốt và tài sản của người dùng được đảm bảo an toàn tuyệt đối, chúng tôi đã biết về các báo cáo và đang điều tra chi tiết thông qua luật sư của mình. KuCoin tôn trọng luật pháp và quy định của nhiều quốc gia khác nhau và tuân thủ nghiêm ngặt các tiêu chuẩn tuân thủ."

Giám đốc điều hành KuCoin Johnny Lyu đã nói trong một bài đăng trên X:"Trong khi chúng tôi giải quyết vấn đề này, nền tảng không bị ảnh hưởng và hoạt động bình thường như bình thường. Tài sản của bạn được an toàn với chúng tôi. Nhóm của chúng tôi và tôi sẽ cập nhật cho bạn về tiến độ."

Đây là lần thứ hai KuCoin vi phạm pháp luật. Tổng chưởng lý bang New York Letitia James đã kiện sàn giao dịch này vào tháng 3 năm 2023 vì vi phạm luật pháp bang về giao dịch chứng khoán và hàng hóa.

Chuyện gì xảy ra tiếp theo?

Một phân tích đơn giản thực sự có thể kết luận rằng Bộ Tư pháp Hoa Kỳ thực sự đã đạt được rất nhiều điều trong vụ Binance, theo sát làCác sàn giao dịch thực sự có khách hàng Mỹ sẽ là mục tiêu của các vụ kiện tiếp theo (vào thời điểm đó, Binance cũng từng bị cáo buộc hướng dẫn khách hàng Mỹ bỏ qua KYC của Mỹ và sử dụng sàn giao dịch Binance có tính thanh khoản cao hơn thay vì Binance.US), bởi vì một số sàn giao dịch thì không đã đăng ký với các cơ quan chính thức của Hoa Kỳ, giống như những gì được viết trong vụ KuCoin ngày hôm nay.

Một hình thức có thể là vụ kiện sẽ nhắm mục tiêu, sau khi vụ kiện chống lại một sàn giao dịch kết thúc, một vụ kiện khác sẽ theo sau, nếu hầu hết các sàn giao dịch tương tự như KuCoin bị kiện cùng một lúc trong một khoảng thời gian ngắn thì rất có thể sẽ xảy ra sự cố. sẽ xảy ra tình huống bạn không thể tự nhận mình là một sàn giao dịch lớn mà không nhận được bản cáo trạng, tức là các sàn giao dịch lớn có thể giải quyết vấn đề đó một cách tập thể hoặc có những khả năng khác. Và việc xử lý từng vấn đề một cũng như thực hiện các biện pháp trừng phạt có thể đảm bảo tỷ lệ thành công cao nhất.

Tổng hợp lại, cáo buộc hình sự này gửi một tín hiệu rõ ràng tới các sàn giao dịch tiền điện tử toàn cầu rằng các công ty hoạt động tại Hoa Kỳ hoặc phục vụ khách hàng Mỹ phải tuân thủ nghiêm ngặt luật pháp Hoa Kỳ. Khi ngành công nghiệp tiền điện tử phát triển nhanh chóng, các cơ quan quản lý đang tăng cường nỗ lực để đảm bảo sức khỏe và tính bền vững của ngành cũng như bảo vệ các nhà đầu tư khỏi các hoạt động bất hợp pháp. Tất cả những nỗ lực này đều hướng tới một mục tiêu chung: xây dựng một thị trường tiền kỹ thuật số an toàn và minh bạch hơn.

Trong bối cảnh đó, sự phát triển của vụ việc KuCoin đáng được sự quan tâm chặt chẽ của tất cả các bên trong và ngoài ngành và Odaily sẽ cung cấp các báo cáo tiếp theo cho độc giả.