坎昆升级在即,在L2和L1间如何做出投资选择?

原文作者:Revelo Intel

原文编译:深潮 TechFlow

引入:了解 Rollup 的经济学原理

以太坊的可扩展性路线图越来越关注 Rollup 解决方案,并且随着不断采用和预期的 EIP-4844 ,以太坊第 2 层 (L2) 解决方案正在获得持久的重要性。

然而,评估 L2 解决方案远非那么简单。与以太坊等 L1 网络不同的是,L1 网络具有来自交易费用的明确收入来源和来自代币发行的明确费用,而 L2 解决方案带来了独特的估值挑战。

本报告探讨了评估以太坊 Layer 2 解决方案的复杂性,深入了解支撑其价值主张的经济因素。

概述

近年来,Rollup 解决方案在技术领域的显著进步不容忽视。自 2018 年 Rollup 技术问世以来,大量人才和研究投入带来了显著的技术进步,包括与以太坊虚拟机(EVM)等效的 Rollup 实现、基于欺诈和有效性证明的桥接技术、批量数据压缩的突破,以及 Rollup 软件开发工具包(SDK)的推出。值得注意的是,Optimism、Arbitrum、Base、zkSync 和 StarkNet 等多种 Rollup 解决方案已经进入市场,促进了一个繁荣的生态系统的形成,使得其他 Layer 1 解决方案在市场份额争夺战中处于脆弱和暴露的位置。

尽管当前的采用率符合预期并证明了吸引下一代用户的可行性,但第 2 层解决方案 (L2) 的增长轨迹将在未来几个月内加速。随着 EIP-4844 的即将到来以及新链如 Scroll、Linea 和 Base 的推出,L2现在成为了焦点。

EIP-4844: 削减成本树( Cost Tree)

即将到来的 Dencun(坎昆)升级带来了一个重要功能——EIP-4844 ,也称为 Proto-Danksharding,这标志着与 Rollup 相关的运营成本显著降低。虽然 Danksharding 的具体规范不断发展,但 EIP-4844 为以太坊协议架构的无缝过渡铺平了道路,以适应未来 Danksharding 的实现。

当前 Rollup 实现面临两大挑战。首先,由于L2每天处理数百万笔交易,将其聚合并向以太坊提交交易证明,存在数据存储瓶颈。其次,将交易数据从L2s传输到以太坊会产生交易成本。

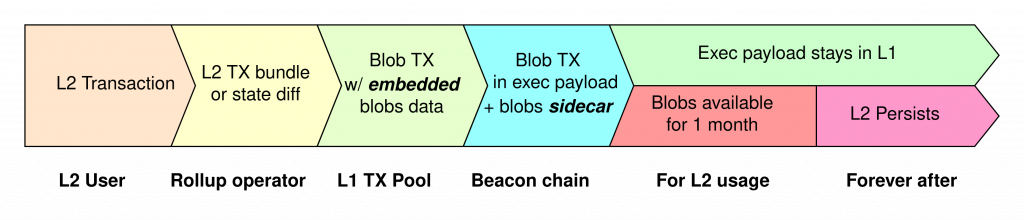

EIP-4844 的核心是“Blob”(二进制大对象)的概念。本质上,blob 是与交易相关的数据块,与常规交易不同。这些 blob 数据块专门存储在 Beacon Chain 上,并产生最低的 gas 费用。它们使得以太坊区块可以增加更多数据而不会增加其大小。简单来说,利用 blob 可以使存储的数据量与平均区块大小相比几乎增加 10 倍。

blob 的主要目的是显著降低数据可用性(DA)成本,特别是对于 Rollup 的L1发布。与传统方法不同,传统方法中所有 Rollup 数据都存储在以太坊的 calldata 空间中,blob 提供了一种高效和成本效益高的替代方案。由于共识层管理 blob 存储,blob 交易不会对验证者造成额外要求。此外,blob 数据会在建议的 30 至 60 天时间内自动删除,符合以太坊追求可扩展性而非无限期数据存储的目标。

在 EIP-4844 实施之前,L1发布成本占 Rollup 总费用的 90% 以上。展望未来,EIP-4844 引入了“数据 gas”的概念,这是 blob 交易的新费用类别。这将L2数据发布到以太坊的成本与标准 gas 价格分开。随着基于 blob 供需的动态定价,L2在将其数据提交给以太坊时可以实现显著降低成本,潜在的降低成本可能高达 16 倍,或者是目前 gas 费用的 90% 。

Blob 就像是让以太坊运行更高效的数据块。它们被单独存储,不干扰验证者,并在不再需要时消失。这意味着更低的成本和更多的数据空间,使以太坊更快更便宜。

Rollup 的经济学

为了理解 EIP-4844 的重要性,关键是要把握 Rollup 的商业模式。该升级导致成本显著地降低,而收入预期可能保持稳定或随着链上活动的增加而增加。

为了全面理解 EIP-4844 对 Rollup 经济模型的影响,必须详细分析它们的收入来源。Rollup 从网络费用和 Miner Extractable Value (MEV)获得收入,目前 MEV 资本由对 MEV 拥有垄断权的中心化 Sequencer(排序器)控制。

在成本方面,Rollup 面临固定和可变费用。固定成本来自于诸如向 Rollup 智能合约发布状态根、ZK Rollup 的有效性证明,以及以太坊的基本交易费用等操作。可变成本包括L2 gas 费用和存储批量数据到以太坊所需的L1发布费。

EIP-4844 引入了一种动态的 blob 费用系统,这种费用是根据 blob 供需独立于区块空间需求确定的,与传统的费用模型不同。因此,EIP-4844 后以太坊的费用市场包括两个维度:

基于 EIP-1559 的常规交易费用市场:这一维度保留了常规交易的现有 EIP-1559 费用市场,其独特的动态包括基本费用和符合 EIP-1559 原则的优先费用。

blob 费用市场:第二维度引入了 blob 费用市场,其中费用完全由当前的 blob 供需决定。这创建了一个与常规交易费用市场不同的独立生态系统,确保 blob 费用不受区块空间需求波动的影响。

对 EIP-4844 费用市场的分析揭示了几个值得注意的结果:

随着应用链和广义L2数量的增加,预计 blob 需求将逐渐上升。在需求超过 blob 目标的情况下,EIP-4844 的价格发现机制可能导致数据 gas 价格上升。

随着需求激增,数据 gas 成本预计将呈指数级增长。如果 blob 需求超过目标水平,数据 gas 的成本将会迅速且指数级增长,可能在几小时内增加十倍以上。一旦 blob 需求达到目标价格,数据 gas 价格将每 12 秒指数级增长。

EIP-4844 改变了 Rollup 赚钱和花钱的方式。有了动态的 blob 费用,费用市场的一部分遵循常规规则,而另一部分则根据 blob 供需进行调整。随着 blob 需求的增长,gas 成本也随之上升。

Rollups as a Service

随着特定应用链数量的增加,Rollups as a Service (RaaS)商业模式变得越来越重要。举例来说,与像 Cosmos 这样的平台上的特定应用链相比,以太坊 Layer 2 有着明显的优势,主要得益于 RaaS 解决方案的出现。

这种优势的一个主要原因是基础设施开销的减少。在以太坊 Layer 2 的背景下,这一过程得益于 RaaS 解决方案而显著简化。这些服务简化了定制 Rollup 的部署、维护和管理,有效地解决了开发者在主网开发时经常遇到的技术复杂性。因此,RaaS 使开发者能够专注于应用层开发,提高了他们的整体生产力。

RaaS 还提供了显著的定制程度。开发者不仅可以选择他们偏好的执行环境、结算层和数据可用性层的协议,还可以在排序器结构、网络费用、代币经济学和整体网络设计等关键方面获得灵活性。这种适应性确保了 RaaS 能够根据广泛项目的具体需求和目标进行定制,增强了以太坊二层解决方案的多功能性。

我们可以区分两种主要服务类型:

SDK(软件开发工具包):这些作为 Rollup 部署的开发框架,包括 OP Stack、Arbitrum Orbit for L3s、Celestia Rollkit 和 Dymension RollApp Development Kit(RDK)等著名选项。

无代码 Rollup 部署服务:为了简化设计,这些服务使得无需深入编码知识就能部署 rollup。诸如 Eclipse、Cartesi、Constellation、Alt Layer、Saga 和 Conduit 等解决方案属于此类。它们降低了开发者和组织利用 Rollup 技术的门槛。

我们还可以包括一个第三类,用于同时服务多个 rollup 的共享排序器集,例如 Flashbots 的 Suave 或 Espresso。

尽管当前市场景观显示对定制 Rollup 创建的需求并不大,但普遍预期随着宏观经济条件的改善和产品市场契合度变得更加明确,RaaS 可能会激发数百至数千个 rollup 的出现。

RaaS 使开发者的工作更加简单、快速和灵活。这让他们有更多时间优先考虑和专注于应用程序的核心逻辑和商业模式。

质疑L2代币的实用性

像 Optimism、Arbitrum、Mantle、zkSync 等 Rollup 解决方案的成功是毋庸置疑的。然而,从投资角度来看 Rollup 治理代币,如$OP 或$ARB,情况就变得更加复杂。

熊市:有限的上涨空间

在传统金融市场中,股东享有一系列权利,包括分红、投票权和资产索赔权,这为股票提供了内在价值,使其成为有吸引力的投资。相比之下,仅代表治理权力的代币缺乏这些保证,仅限于对治理提案的投票。由于交易费用产生的 Sequencer 收入不会流向代币持有者,因此网络的增长不一定会转化为代币价值的增加。这引发了有关 Rollup 代币价值主张的合理问题。

尽管治理权具有固有价值,特别是在二层解决方案中,代币持有者拥有显著影响力(如 Optimism 的 RPGF 和 Arbitrum 的 STIP 所示),但缺乏分红或其他收入来源使它们成为一种不同形式的投资。

在当今的高利率环境中,不提供实际收益的资产可能对保守投资者来说较不具吸引力。上升的利率增加了资本成本,使持有非产生收益资产的机会成本更加重要。在这种背景下,拥有稳定质押回报的 ETH 可能是风险厌恶投资者的更佳选择,尽管 Rollup 代币具有增长潜力。

牛市:增长叙事

在金融市场中,公司的价值不仅仅与利润或股息挂钩。例如,成长型股票的估值取决于其长期增长潜力和再投资策略。投资 Rollup 治理代币也可以与投资非股息增长股票类似。 历史上,像亚马逊这样的公司选择不分发分红,而是将利润再投资于扩张和创新。这类公司的投资者并不一定寻求通过分红获得即时回报;相反,他们期望长期增长和价值升值。 以 Optimism 和$OP 代币为例,有明确的承诺将盈利再投资于生态系统增长,促进其原生 dApp 的需求增加、排序器收入和 RPGF 的良性循环。此外,随着诸如 Superchain 这样的计划即将到来,OP Stack 的带宽持续扩展,最终创造了一个由于网络效应而难以忽视的强大护城河。

行业展望

L2正发展成为一个高度竞争的领域,而空投的隐含期望可以显著影响任何给定 L2 内的用户行为。然而,重要的是要认识到特定 L2 的估值与L1 的价值存在内在联系,而网络效应是差异化因素。

当我们检查当前 Rollup 的运作时,这种联系变得显而易见。他们以 ETH 的形式收取 gas 费,并且必须以 ETH 形式向以太坊支付数据可用性费用。本质上,这些 rollup 无法执行自己的货币政策;以太坊规定了他们必须向底层链支付多少钱。

因此,L2并没有独特的货币溢价。尽管如此,L2代币目前的交易方式并不总是与这一现实相符。然而,只要它们能够建立强大的生态系统并促进网络效应,这些L2就有潜力在未来成为主权实体,市场可能会寻求预期并抢先这一机会。

空投确实可以影响用户行为。但问题在于:L2的价值与以太坊(L1)密切相关。L2以$ETH 收费并支付,因此它们没有自己的货币规则。 在这个背景下,当前的L2运作模式显得很清晰:它们向最终用户收取费用,并保留这些费用的一部分,以支付以太坊的结算和数据可用性成本。拥有相关治理代币实际上等同于持有L2产生的利润差额的一部分。

当可以创建多个实例时,事情会变得更加有趣,就像 Optimism 的情况一样。在这些场景中,这些实例产生的利润差额可以流回代币持有者。例如,Base 就将其 10% 的费用分配给 Optimism。

这种模式为L2资产的可扩展性解锁了更大的潜力,为与其他链共享费用的一部分作为隐含的授权协议树立了先例。这种动态不仅为L2生态系统增添了深度,而且还强化了L2代币的价值主张,因为它们在竞争格局中不断演变和适应。

当前形势

目前以太坊的交易价格约为 3014 亿美金,预计随着其上构建的 rollup 的增长,其价值将会上升。此外,Rollup 作为服务(RaaS)的引入,预计将会带来一波通用和特定应用 rollup 进入市场的潮流。

但即使我们可以预期基础层的价值增加,L2通常与$ETH 相比具有更高的 beta 值。此外,投资者可能会将他们的代币视为对整个生态系统的赌注。我们建议对这种方法保持谨慎,因为个别项目在任何特定时刻转移到最新和最流行的L2是常有的事。

此外,L2被定位为吸引更多用户,从而增加回流到以太坊的价值。这种动态可能遵循幂律分布,尽管不如在流动性质押中观察到的那样明显。因此,有可能反过来看,ETH 是投资者可能更愿意持有的标的。随着更多L2进入市场,dApp 最终在多个L2上扩散,选择最终的赢家的链变得更加复杂。然而,无论最终的赢家是谁,ETH 持有者和以太坊验证者都将从增加的 Rollup 活动中受益。

总而言之:

以太坊的价值随着 Rollup 技术的增长而上升,Rollup 作为服务(RaaS)将会带来一波市场上的 Rollup 浪潮

L2 的波动性与 ETH 不同,项目可以在 L2 之间快速切换

L2将吸引更多用户,从而使$ETH 持有者和验证者受益,但在L2中选择赢家变得复杂

最终,持有 ETH 可能是最安全的赌注。

我们还需要其他的替代性L1解决方案吗?

L1作为轮换交易的时代似乎已经成为过去。随着L2解决方案有效地解决了以太坊的可扩展性挑战,质疑其他L1区块链如 Near、Avalanche、Solana、Fantom 等的价值主张变得十分重要。

一个关键的区别在于启动总锁定价值(TVL)的容易程度。L2在这方面享有优势,因为用户和开发者已经熟悉以太坊上的工具。他们只需要将资产桥接到L2链上,就可以利用交易成本降低的优势。本质上,最初在以太坊上的 TVL 只是在寻找一个更具成本效益的交易环境。

然而,重要的是要认识到,其他L1解决方案仍然服务于特定目的,并提供可能吸引某些用例的独特特性。

多样化的生态系统:其他L1培育了自己的生态系统,常常有着不同的社区、项目和创新。这些生态系统可能满足特定市场或特定行业的需求。

专业化特性:一些 L1 会优先考虑高吞吐量、低延迟或特定共识机制等功能。这些属性可能使它们更适合某些应用,例如高频交易或游戏。

多元化:从投资角度来看,跨不同L1进行多元化投资可以降低风险。尽管以太坊仍占主导地位,其他L1可能提供多元化的机会。例如,投资 Solana 可以作为对抗 EVM(以太坊虚拟机)主导地位的一种方式(想象一下 EVM 中发现零日漏洞的情景)。

那些能够为生态系统带来独特价值的L1(如 Solana、Monad 等)将会存活下来。仅提供一个与 EVM 兼容且拥有更低 Gas 费用的链已不再足够。这现在看来显而易见,但在过去,有许多实例表明,拥有更低 Gas 成本的 EVM 兼容链达到了过高的估值。以 Moonriver 为例,它是 Kusama(波卡的金丝雀链)上的一个 EVM 兼容链,在 2021 年第四季度达到了 494 美元的历史最高点,现在交易价格为 4 美元。

总而言之:

L2减少了对L1轮换交易的需求。尽管其他L1区块链仍然服务于独特的目的,但L2在总锁定价值(TVL)方面具有优势,因为它们提供了熟悉的工具和更低的交易成本。

然而,多样化的生态系统、专业化的特性和多元化使得其他L1对于特定用例和风险缓解仍具有吸引力。

幸存下来的L1 将带来超越 EVM 兼容性和较低 Gas 费用的独特价值

关键要点

传统的估值方法更适用于L1,交易费用作为收入,代币发行作为费用。 L2 给估值带来了独特的挑战。

尽管加密货币和股票在结构上有所不同,但基本的投资逻辑仍然适用——投资具有长期增长潜力的资产可以是一种吸引人的策略。

L2 通过捕获价差来运作,当与其他链形成隐性收入共享协议时,这种模式会得到加强,例如 Base 将 10% 的费用分配给 Optimism 财库。

ETH 可以被视为“指数”资产,而 L2 的功能就像个人“选股”。不管哪些L2最活跃,ETH 持有者和以太坊验证者都将从增加的 Rollup 活动中受益。

结论

看待这一问题的一种方法是,EIP 4844 将显着降低 L2 的成本,而其收入将随着时间的推移而增长。两者之间的差额就是这些 L2 的利润率。随着这个差距的扩大,他们决定开始与代币持有者分享这些利润的可能性增加。如果你愿意等待这些拼图落到合适的位置,提前考虑这种逻辑是一个合理的方法。

当我们为像$OP 或$ARB 这样的 Rollup 治理代币的未来规划道路时,很明显,这个领域正准备进行转型。EIP 4844、ERC 4337 的崛起,以及 RaaS(包括 SDK 和无代码部署服务)的出现,预示着一波 Rollup 采用的浪潮即将到来。

这波采用可能会看到成千上万,甚至可能是数以万计的 Rollup 的兴起。然而,投资者对这些治理代币价值的看法出现了分歧。一方面,像缺乏传统价值捕获机制和高利率环境的影响等挑战可能限制了 Rollup 代币的潜在上涨空间。另一方面,一些投资者可能会将这些代币比作像谷歌、亚马逊和特斯拉这样的非股息增长股,认识到它们由于长期增长前景而具有更高估值的潜力。

当我们进入一个更具竞争性的领域时,保持适应性至关重要,考虑到 Rollup 治理代币不断变化的动态和独特特质。