Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMediumGet deeper research and insights.

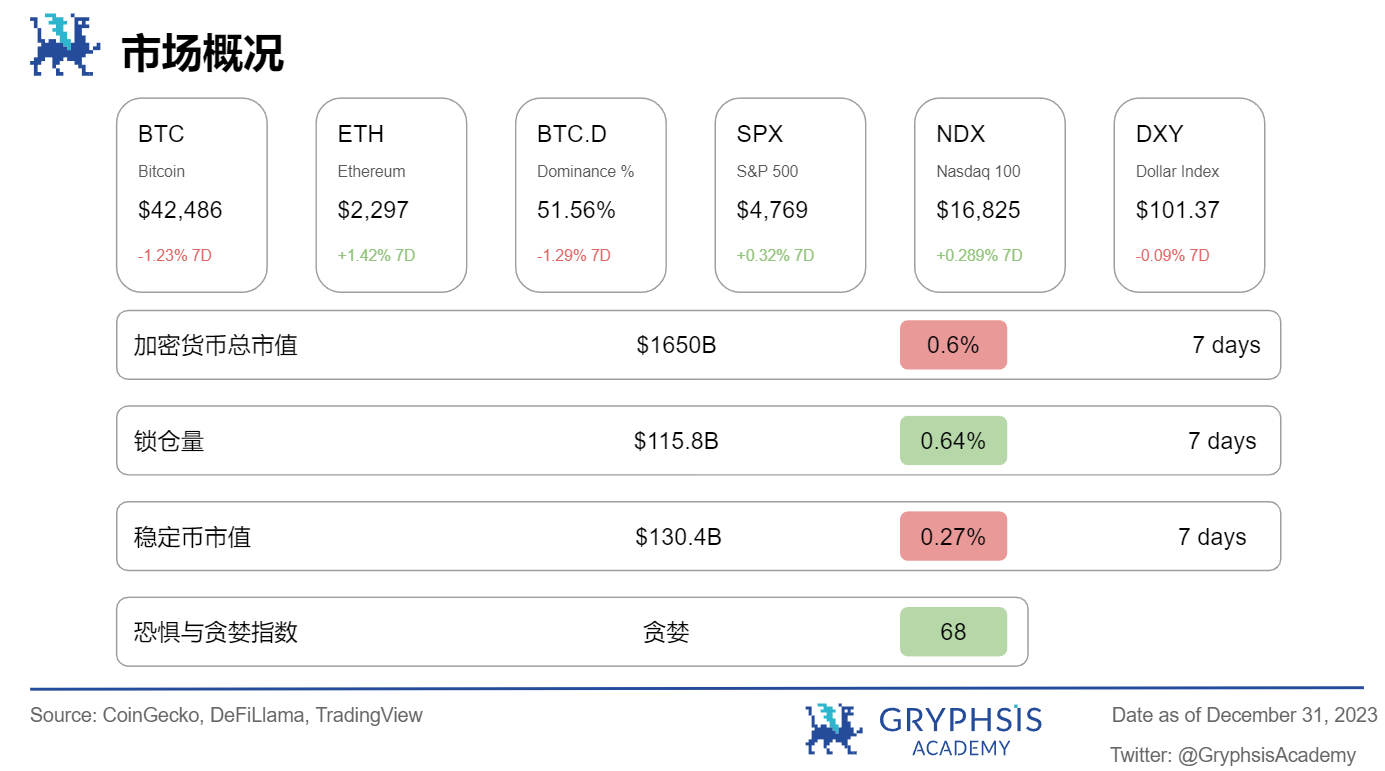

Market and Industry Snapshot:

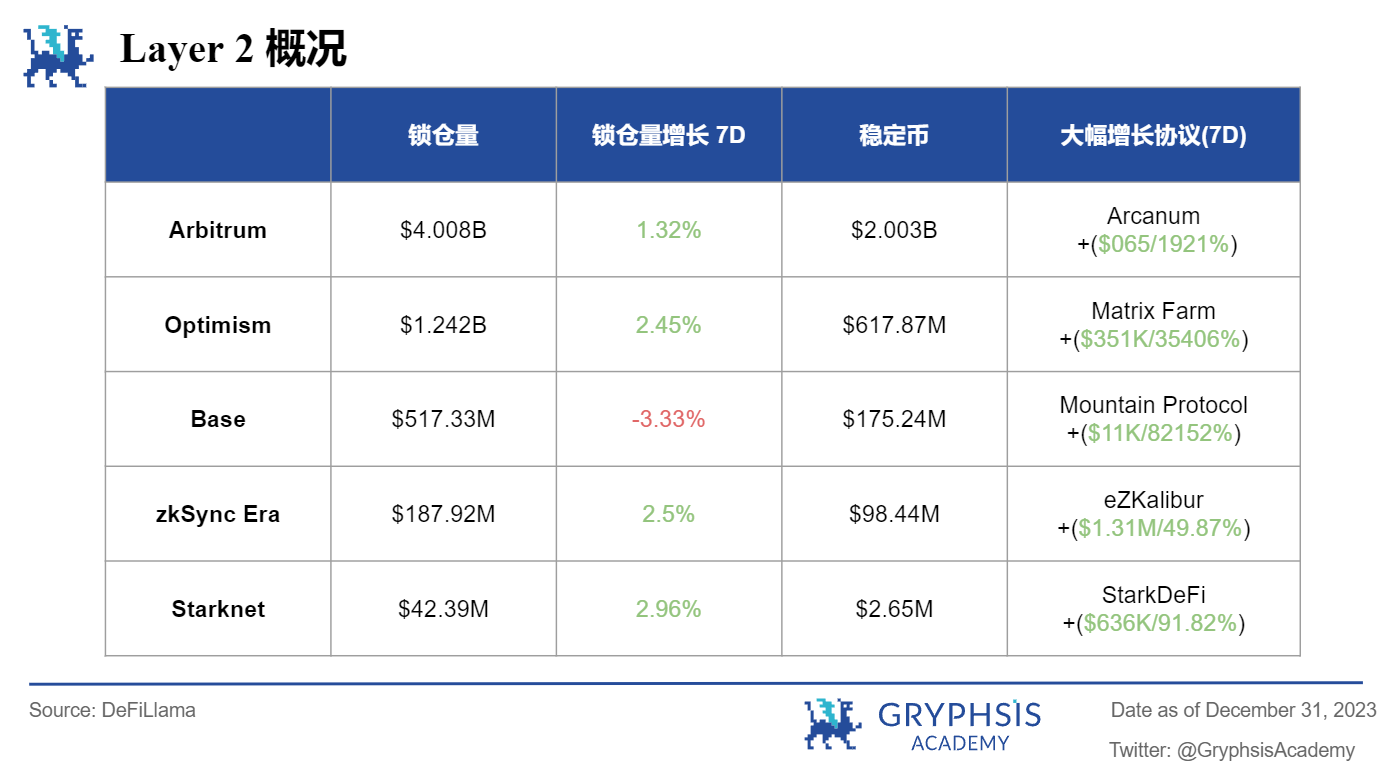

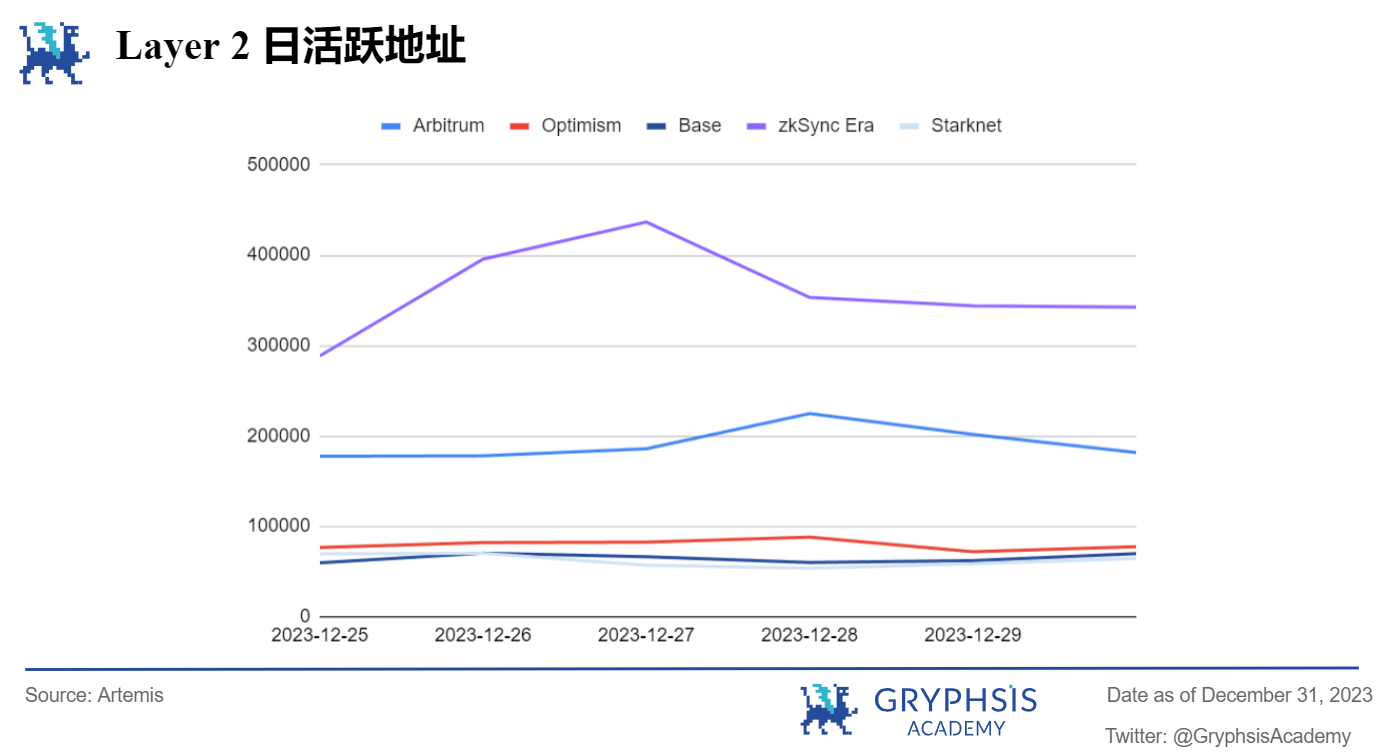

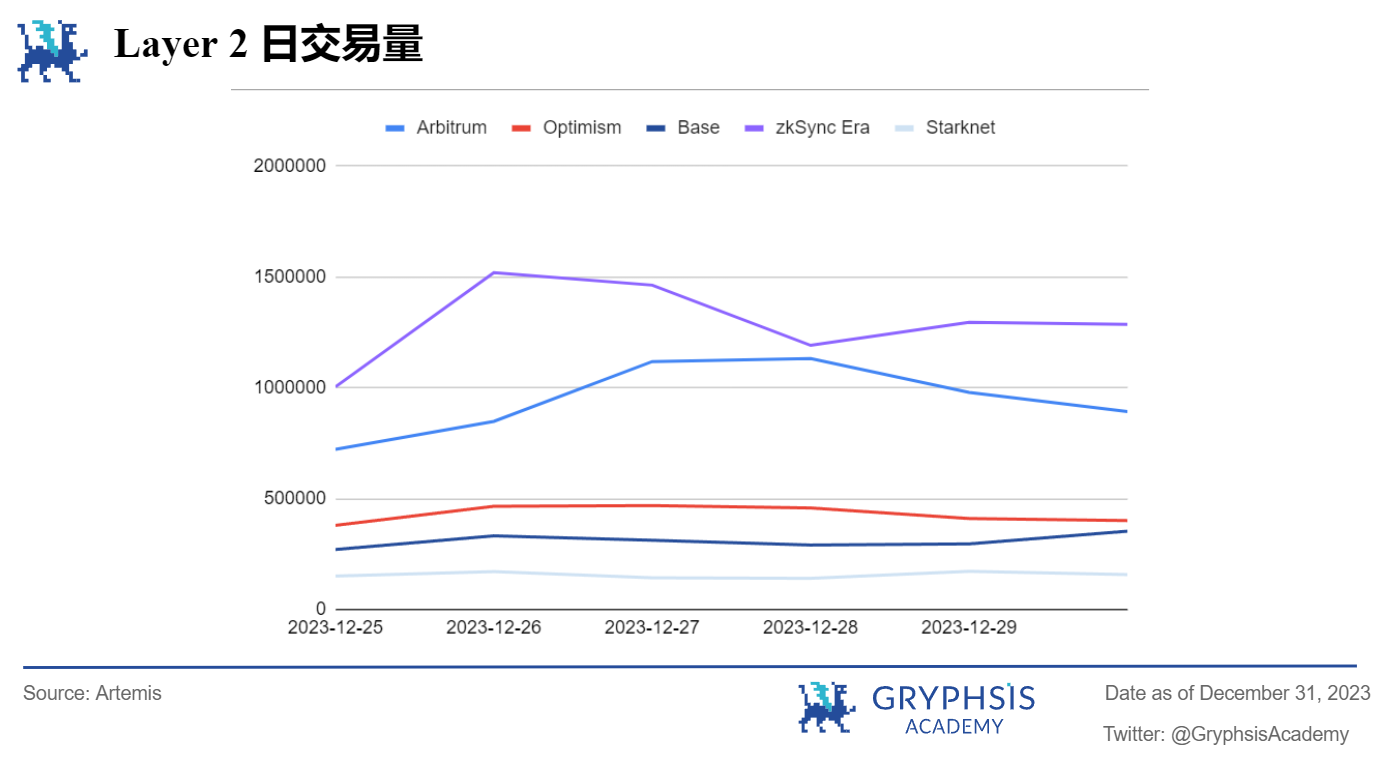

Layer 2 Overview:

Last week, all Layer 2s showed an upward trend except Base, which fell by 3.33%, and Starknet, which had the most obvious growth, was 2.96%. Protocols like Arcanum, Matrix Farm, Mountain Protocol, eZKalibur, and StarkDeFi have demonstrated noteworthy TVL growth rates.

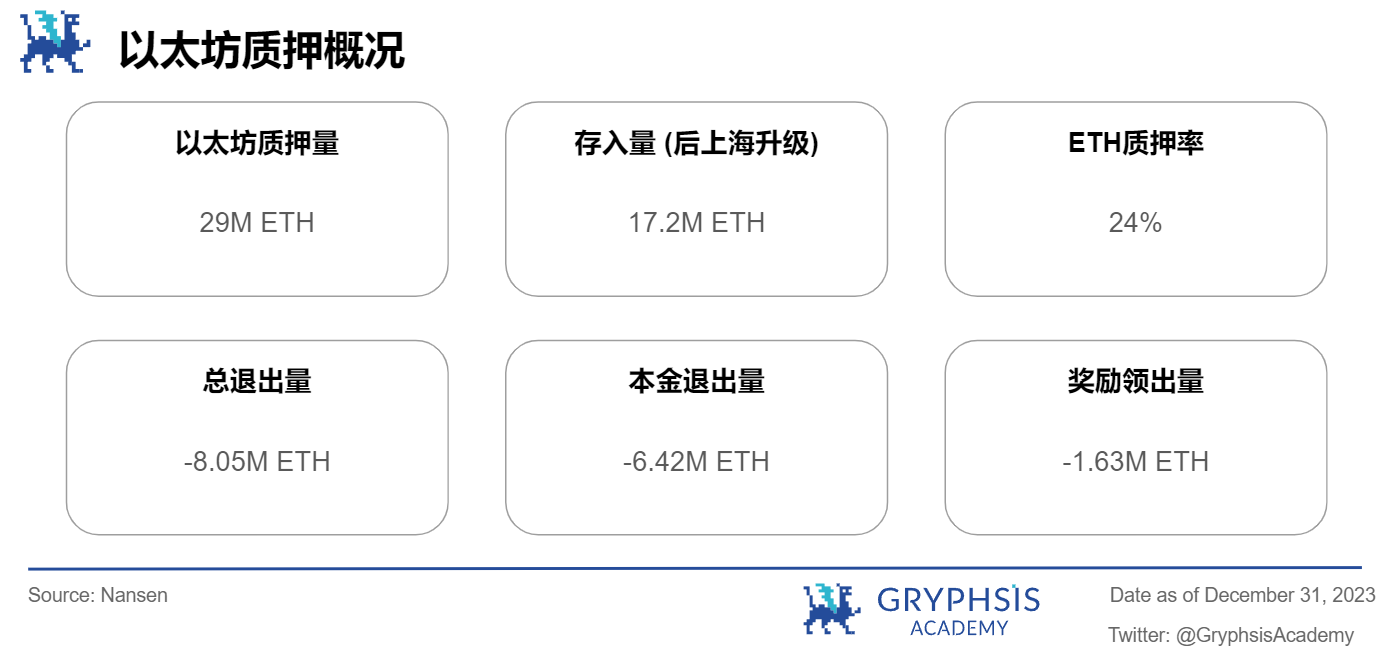

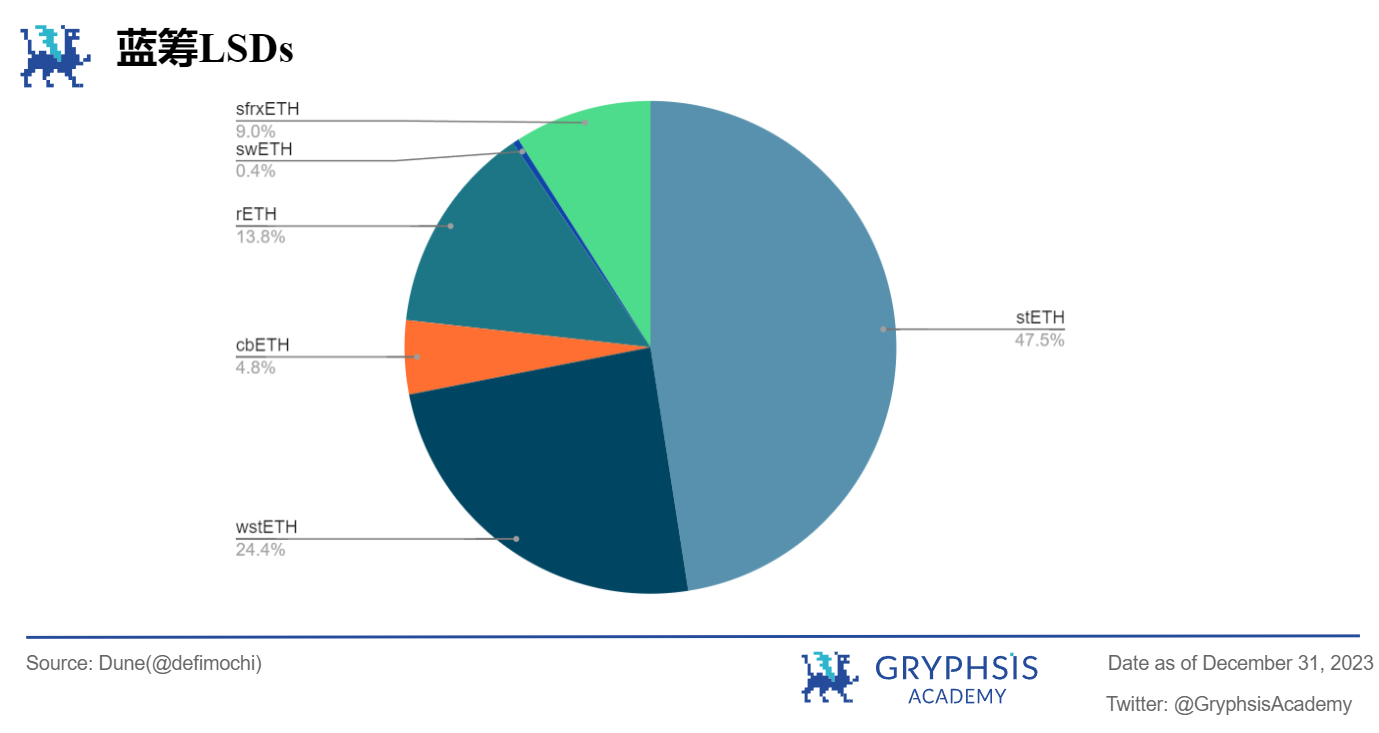

LSD Sector Overview:

In the LSD space, Ethereum deposits fell by 7.53% and total withdrawals rose. In terms of market share, with the exception of rETH, which rose by 29.28%, the rest of the blue-chip LSDs have declined, with swETH having the most obvious decline of 25.22% this week.

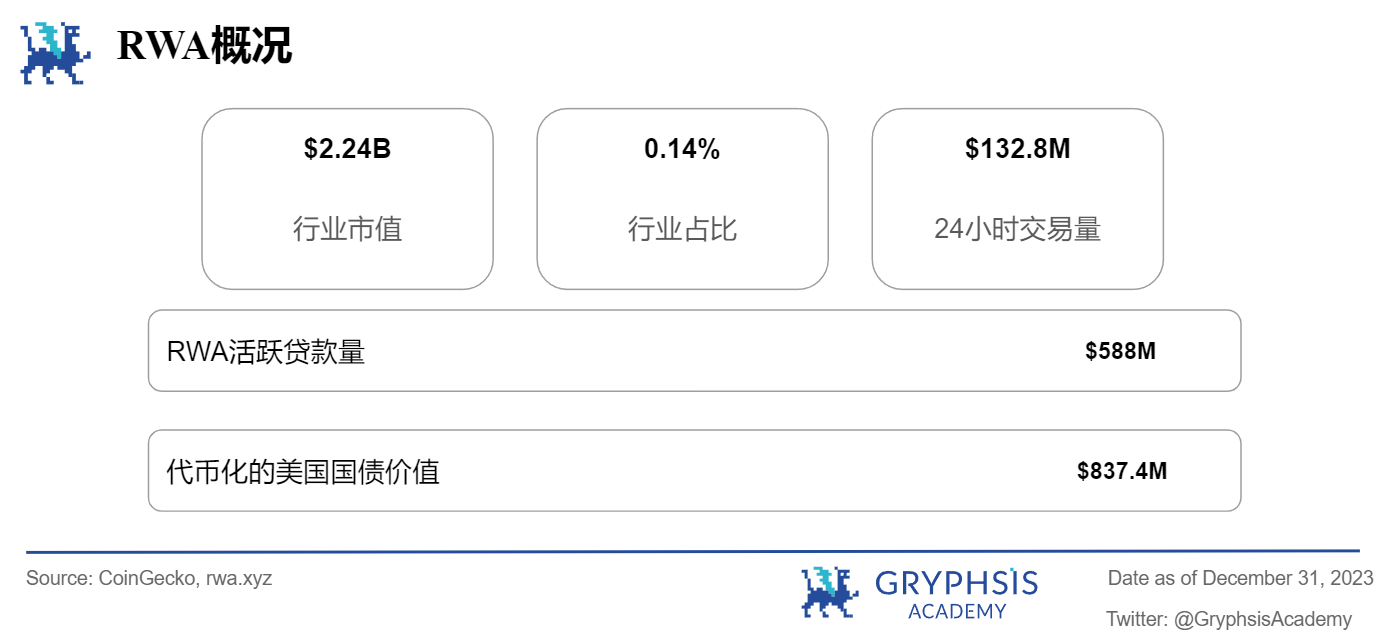

RWA Sector Overview:

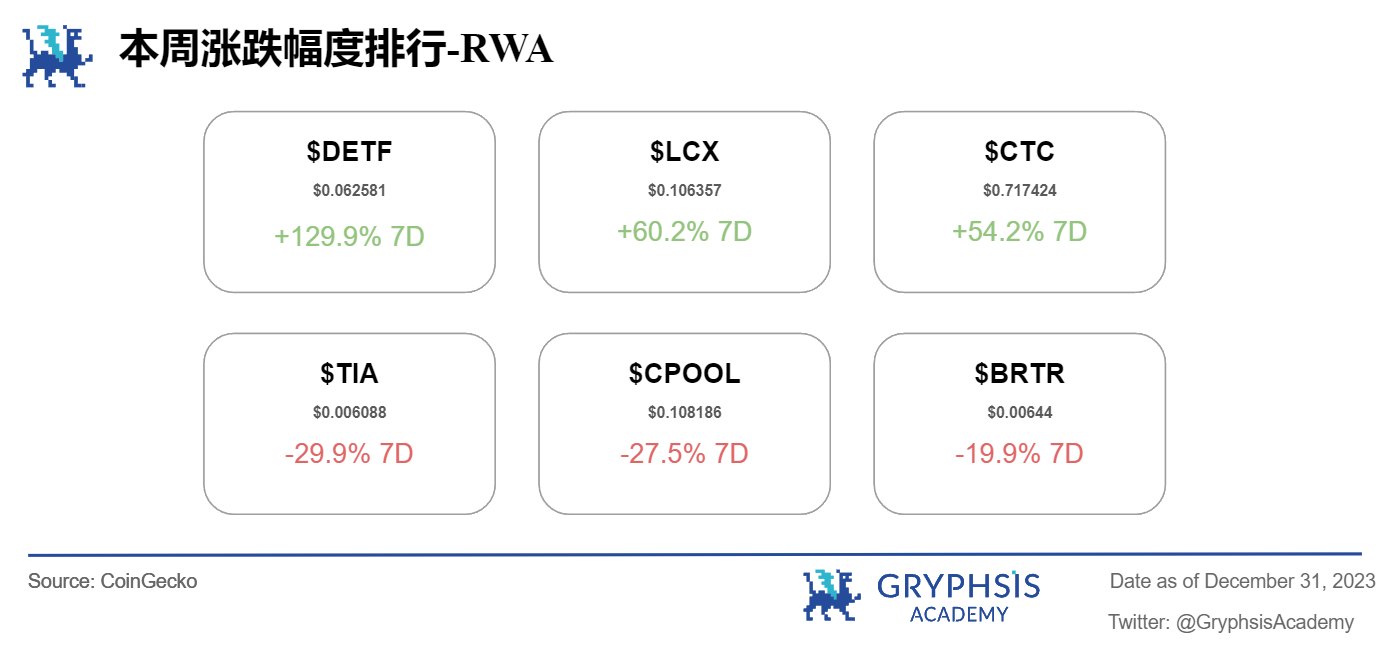

Last week, the worlds real asset market value increased by 7.69%, the overall industry share was 0.14%, and the 24-hour trading volume decreased by 6.48%. RWA tokenized treasuries declined slightly but the value of tokenized U.S. Treasuries increased by 3.25%. Notable growth coins include $DETF, $LCX, and $CTC. Tokens like $TIA, $CPOOL, and $BRTR experienced larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

The expectations of the Bitcoin spot and futures markets in 2024

Weekly Agreement Recommendations:

Clearpool

Weekly VC Investment Focus

Eclipse Fi($ 1.9 M)

Tonka Finance($ 2.5 M)

BRC 20.com($ 1.5 M)

Twitter Alpha:

@TheDeFISaint on MUX Protocol

@0x elonmoney on Metis

@milesdeutscher on Cosmos

@0x AndrewMoh on RWA

@KingWilliamDefi on Solana Meme-coin

Macro overview

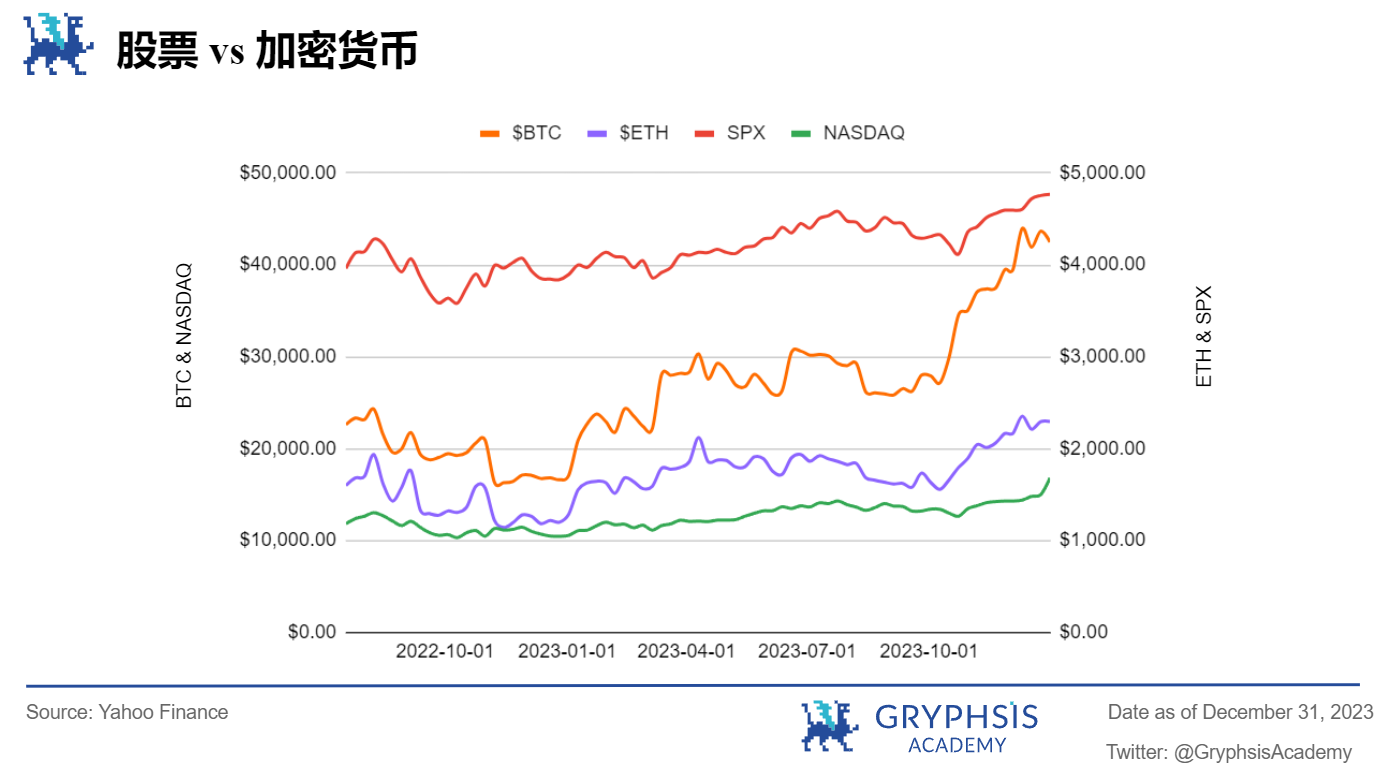

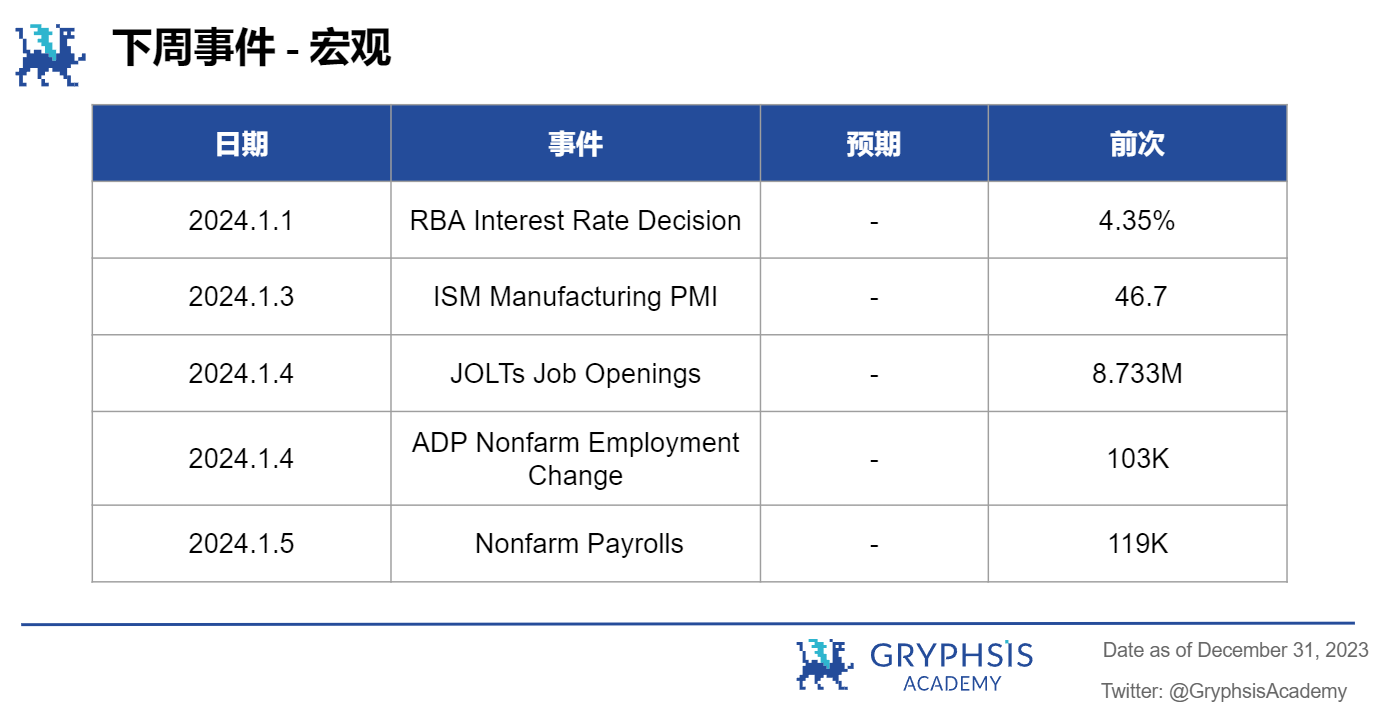

This week, the changes in the stock market were weaker than those in the crypto industry, with SPX and NASDAQ increasing by 0.32% and 0.29% respectively. In the coming week, pay attention to major events such as the ISM Manufacturing Purchasing Managers Index, JOLTs job vacancies, changes in ADP non-farm payrolls, and non-farm payrolls.

Big news this week

Bitcoin spot and futures market status and expectations in 2024

U.S. regulators are expected to approve a spot Bitcoin ETF in 2024, and approval would trigger a nearly 49% rise in Bitcoin prices since October.

Spot Bitcoin trading is currently concentrated on a few exchanges: Coinbase, Binance, Bybit, and OKX. They account for approximately 65% of spot Bitcoin transactions. Binance accounts for 35.5%, while Bybit, OKX and Coinbase account for 11.3%, 9.2% and 8.9% respectively.

The average Bitcoin order size has been gradually decreasing since the beginning of 2021 and is currently around $1,652. While smaller order amounts are associated with retail investors (retailers), there are also institutions that divide orders into many smaller orders to minimize slippage.

It would be unwise to assume that retail investors are the main force in recent spot Bitcoin trading based solely on order size.

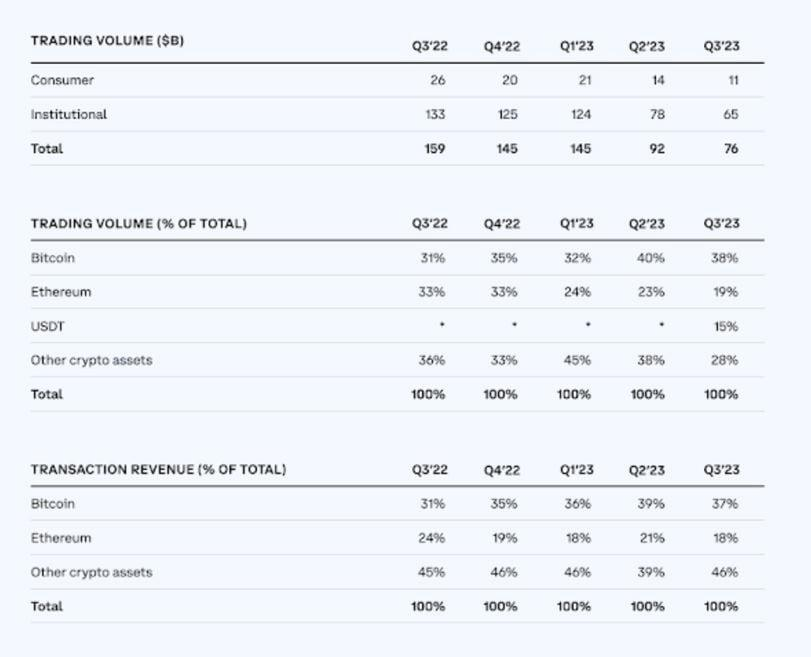

According to Coinbase’s third quarter 2023 trading summary, trading volume has declined in three of the past four quarters. Trading volumes for retail and institutional traders have declined at similar rates over the past year.

Path Crypto’s David Liang said history suggests we may see a price slowdown ahead of the halving in April 2024.

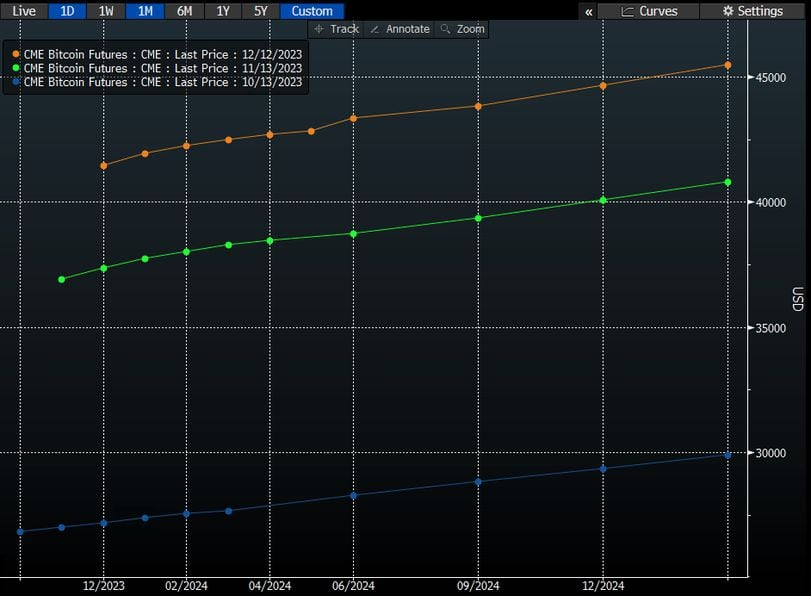

As far as the Bitcoin futures market is concerned, CME Group’s Bitcoin futures positions reached $4.55 billion, accounting for approximately 25% of total positions and reaching levels not seen since the second quarter of 2022.

Most CME Bitcoin futures positions are held by asset managers, which exhibit a long bias, and leveraged funds, which exhibit a short bias, as asset managers tend to trade on longer time frames relative to other buy-side clients. invest. In contrast, hedge funds and commodity trading advisors (CTAs) tend to trade on shorter time frames and engage in basis trading and hedging.

CME Group noted: “Institutional investors are increasingly active in the crypto space, with large Bitcoin holders holding at least 25 contracts hitting an all-time high during the week of November 7, 2023.”

The funding rate aligns the perpetual futures price with the spot price. When the funding rate is positive, long contract holders pay short contract holders a funding fee and vice versa. Funding rates are rising along with Bitcoin spot prices, indicating bullish sentiment and bias.

https://www.coindesk.com/markets/2023/12/27/what-to-expect-from-bitcoin-in-2024/

Weekly Agreement Recommendations

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we choose Clearpool, a permissionless decentralized lending protocol that allows institutions to raise funds directly without collateral.

Launched in March 2022, Clearpool has originated over $440 million in loans and has a growing user base spanning crypto and traditional financial institutions such as Wintermute, Jane Street, Fasanara Digital, CoinShares, and more. The protocol launched on the Ethereum mainnet in March 2022, followed by expansion to Polygon PoS in July 2022, Polygon zkEVM in July 2023, and Optimism in October 2023.

Clearpool is mainly divided into the following businesses: Permissioness, Prime, Stake

1. Permissionless

Borrower must pass Global KYC AML to ensure that digital asset lending activities comply with local financial regulations and compliance standards. The initiated Pool will be multi-signed through Clearpool, and currently only supports USDC/USDT funding.

2. Prime

Prime, Clearpools crossover into RWA private credit, has been put into use on the Optimism mainnet. On Prime, all counterparties, including Borrowers and Supplyers, are required to undergo strict KYC and anti-money laundering AML due diligence. Borrowers can launch capital pools with customized terms, while Supplyers can gain access to revenue opportunities with high-quality institutional counterparties in a safe and compliant environment.

Borrowing with Prime does not require the posting of collateral, and Borrower creates pools of funds with specific conditions within the core smart contract. Once a pool is created, the borrower can invite any other whitelisted institution to fund the pool. Lending assets are automatically transferred directly to Borrower’s wallet address, and the Clearpool protocol itself does not perform asset custody.

3. CPOOL Oracles and Staking

Clearpool has its own oracle network, the Clearpool Oracle Network, where various institutions vote to determine the interest rate of the pool. By pledging $CPOOL tokens to Oracle pool, you can not only get $CPOOL token incentives, but also jointly maintain the interest rate price mechanism.

The weight of the oracle is determined by the amount of $CPOOL mortgaged/held by each oracle. Its voting rights are 15% of the amount of $CPOOL it owns. Holders can entrust the oracle to vote and vote according to their pledge. Proportionately receive $CPOOL rewards, and the oracle can also charge a certain percentage of commission.

Economic Token Model: The initial supply limit of the native token $CPOOL is 1000 M, and the main value capture is two:

1) Entrusted pledge: Holder can entrust and pledge the tokens it holds to the oracle machine. 15% of the total pledged amount of the oracle machine will be used as its Voting Power, and the pledge income will be obtained based on the percentage of the personal pledge amount.

2) LP rewards: Provide liquidity through Supply’s own funds to obtain CPOOL mining incentives.

The business model of the agreement is as follows:

1. Origination Fee

When a borrower makes a repayment transaction (including principal), the origination fee is sent directly to the Clearpool treasury and is collected from the borrower. The origination fee is calculated annually and the amount borrowed is calculated based on a standard 360-day year and a standard 30-day month.

2. Protocol Fee

The protocol fee is a percentage of the governance-approved pool interest that will be transferred to the protocol treasury upon maturity/repayment. This fee is only applied when the borrower initiates a repay transaction. Penalty interest will begin to accrue immediately upon late repayment.

The revenue generated by the protocol will be used to repurchase $CPOOL, either deposited into the reward pool and later redistributed as LP/staking rewards, or destroyed.

our insights

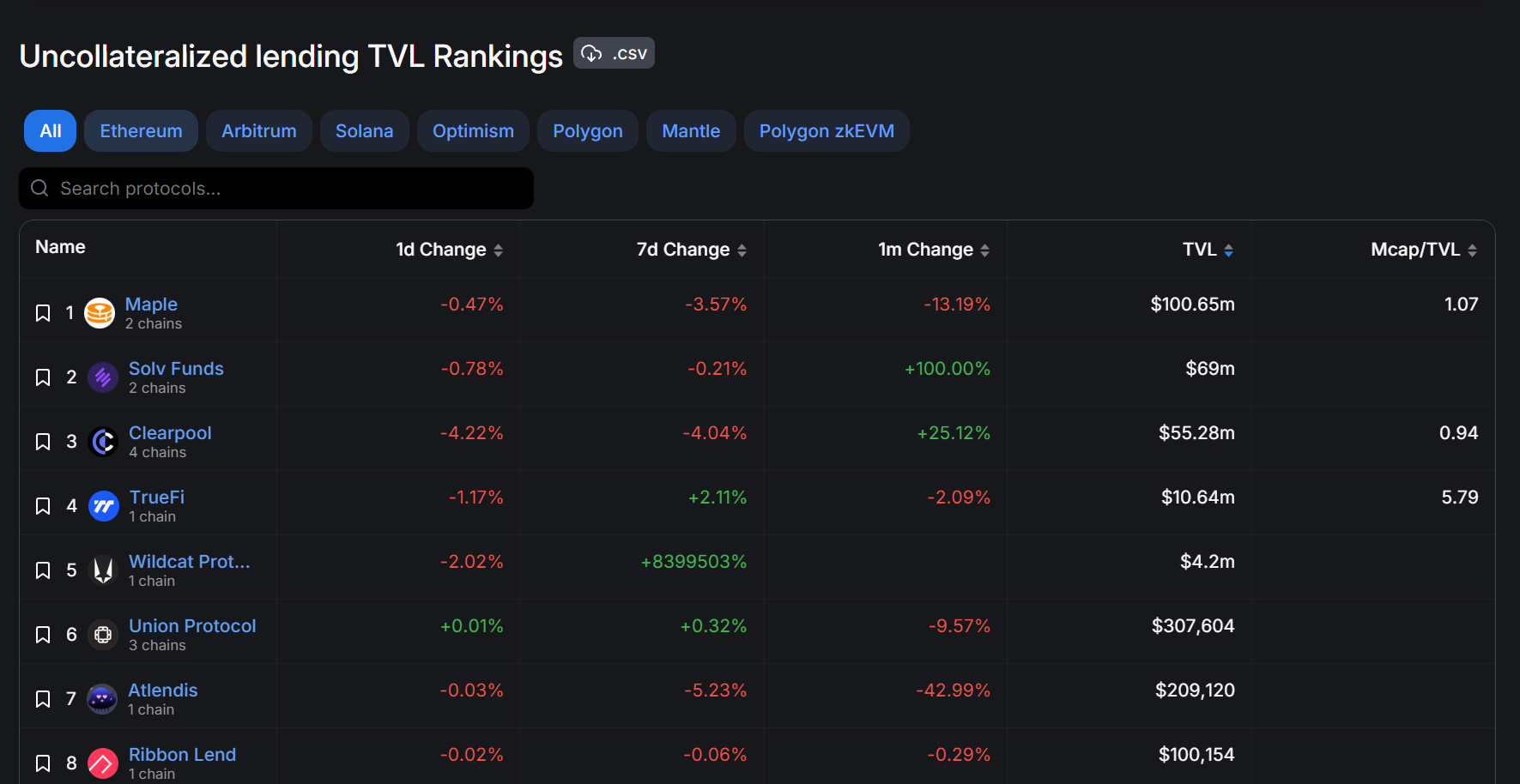

Currently, Clearpool ranks third among mortgage-free lending protocols, with an average monthly increase of 25.12%, and ranks first on Optimism. At the same time, its token $CPOOL has seen a monthly price increase of 111.29% since it announced the launch of Prime business on Optimism on December 12.

If it were purely a loan agreement, Clearpools TVL (55.28 M) would have no competitive advantage in this track. However, in addition to basic lending services, it has introduced RWA’s private credit Prime business, and its first Clearpool Prime loan is currently initiated by Portofino Technologies, which is a company that uses advanced technology to reduce the number of digital assets in exchanges and over-the-counter markets. Crypto-native HFT market-making institution for buying and selling friction. The lender on this first Clearpool Prime deal is Azure Tide, a digital asset lender whose clients include many traditional family offices and institutions.

After the institution is certified, it can apply for a borrowing line without collateral, and users can also provide funds as a Supplyer to obtain APY income. Clearpool further meets the compliance needs of institutional market participants for digital asset lending, while liquidity providers can earn attractive mining ($CPOOL) returns.

In addition, Clearpool is currently funded by 150,000 $OP from the Optimism Foundation, and the agreement will use this fund to generate liquidity mining revenue on the OP mainnet.

$CPOOL’s oracle voting is equivalent to its governance rights giving back, and is a core competitive factor in participating in the Cuvrve War. $CPOOL’s governance rights also have vote-buying value, further enhancing the demand for tokens.

In summary, we see that Clearpool has taken steps in the compliance and application aspects of RWA lending, becoming an important milestone in bridging the gap between traditional private credit and DeFi; it ranks in the top 3 of permissionless lending protocols and has received a large amount from Optimism Grant, liquidity pool incentives are abundant; finally, the governance rights of its token $CPOOL, mining incentives and token repurchase and other economic models are all powerfully beneficial to Clearpools future development.

Gryphsis Research Focus

Welcome to this week’s Gryphsis Research Spotlight, where we share the latest insights from our team. Our dedicated research team continues to explore the most cutting-edge trends, developments and breakthroughs in the crypto space. This week, we’re excited to share our newly released report, so let’s dive in!

TL;DR:

Analysoor is the first Meta Protocol on the Solana chain, adopting a unique approach to creating and distributing NFTs and tokens. It provides users with the casting mechanism of Fair Launch by using the block hash value as a random number generator and selecting a winner on each block. This mechanism has currently proven to be successful, effectively eliminating the impact of Bots in the minting of $ZERO and Index ONE NFTs.

Fairness and liquidity guidance are the core value supports of Fair Launch. Under this mechanism, there are no pre-sales and whitelists, no team allocation, and no GAS fee front-running transactions. Everyone is on the same starting line, and the gap in capital volume cannot bring about competitive advantages in the casting process. The fees generated by minting will not flow to the wallets of the project parties or miners, but will all be used to create liquidity, feed back the ecology and community, and form a positive flywheel.

Analysoor is forming a strong community consensus, and its value and potential are being realized and recognized by more and more people. At the same time, its developers are constantly using more innovative methods to further combat potential Bot behaviors so that fairness can be maintained and guaranteed in the long term. Among them, the application of AI algorithms and machine learning will be what we are most likely to see next.

Compared with the market value of mainstream Lanchpad projects on other public chains such as Auction, Turt, and Bake, Analysoors current market value may be seriously underestimated. Considering that there is currently no leading Launchpad protocol in the Solana ecosystem, Analysoor is very likely to play this role and has huge room for value growth in the future.

The markets demand for fairness and transparency is growing day by day, and the mechanism of Fair Launch will become an inevitable trend. Therefore, 2024 may be the year when Meta Protocol explodes (especially on high-performance public chains like Solana), and Analysoor as The pioneer of Fair Launch on the Solana chain has huge potential and a very strong vision. We may see it being taken to more diverse tracks in the future and becoming a multi-functional Launchpad, not just MEME coins and Minting of NFTs.

Full report:https://link.medium.com/kqHC6S6bXFb

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Eclipse Fi

Eclipse Fi is a modular issuance and liquidity solution that supports innovation on Cosmos and other blockchains. Eclipse Fi provides a comprehensive modular solution to meet token and liquidity needs. Projects can master the entire token issuance process from the beginning and customize their issuance methods and processes according to their distribution and liquidity needs.

https://finance.yahoo.com/news/eclipse-fi-raises-1-9-162000033.html?guccounter=1

Tonka Finance

Tonka Finance is a lending platform focused on improving the functionality and liquidity of Inscription Track assets. By leveraging advanced lending mechanisms, diverse mortgage options, and seamless cross-chain interactions to enhance the functionality, viability, liquidity, and accessibility of Bitcoin Inscription and other digital assets, and gain advantages over traditional Experience using the loan agreement. In the future, Tonka Finance will continue to provide effective solutions in terms of liquidity and financial utility for new digital assets.

https://www.chaincatcher.com/article/2110006

BRC 20.com

BRC 20.com is a Bitcoin-based DeFi protocol designed to provide critical infrastructure for the BRC 20 ecosystem. BRC 20.com integrates advanced BRC 20 features: mobile wallet, cross-chain bridge, multi-minting, marketplace, staking, and more. The BRC 20.com API provides built-in discovery tools for discovering popular mints and alpha discovery of popular coins.

https://x.com/BRC20com/status/1740396107962671237?s=20

protocol event

Thunder Terminal hacked for 86.5 ETH: ZachXBT

PancakeSwap community approves removing 300 million tokens from supply

zkSync outpaces Ethereum in monthly transaction volume, propelled by inscription activity

Levana Protocol exploited for over $ 1 million on Osmosis blockchain

Worldcoin launches in Singapore after pausing in India

Industry updates

South Korea to disclose top public officials’ crypto holdings next year

Bitcoin faces risk of protocol-level censorship as miners under increasing regulatory pressure

Canadian crypto exchange Catalyx ceases all trading following security breach

India's Financial Intelligence Unit issues compliance notices to offshore crypto exchanges including Binance, Kraken

Hong Kong proposes licenses should be required for stablecoin issuers

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/TheDeFISaint/status/1740677681635586388?s=20

https://x.com/0x elonmoney/status/1740406788204515630? s= 20

https://x.com/milesdeutscher/status/1740403535030989041?s=20

https://x.com/0x AndrewMoh/status/1740455735832768517? s= 20

https://x.com/KingWilliamDefi/status/1740408717546520596?s=20

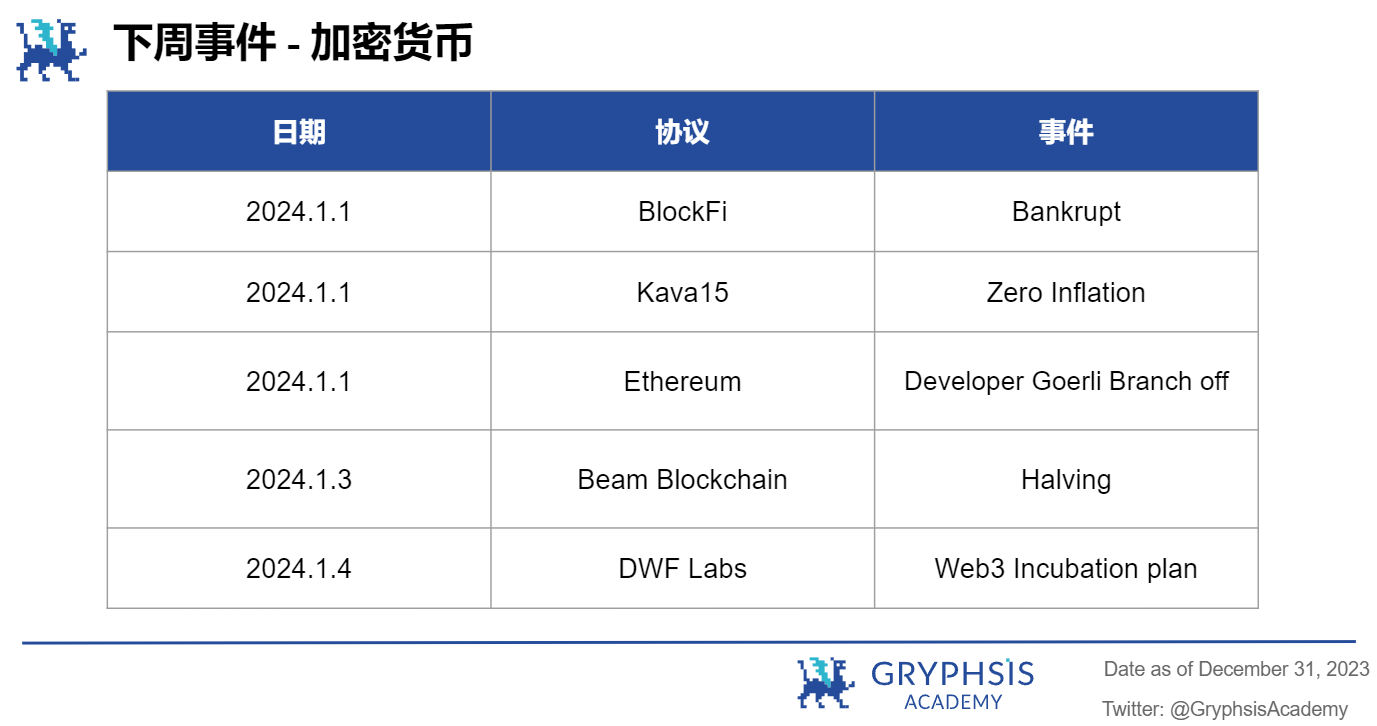

next week events

news source:

https://www.theblock.co/post/269276/south-korea-to-disclose-top-public-officials-crypto-holdings-next-year

https://www.theblock.co/post/269269/on-chain-trading-platform-thunder-terminal-hacked-for-86-5-eth-zachxbt

https://www.theblock.co/post/267759/bitcoin-faces-risk-of-protocol-level-censorship-as-miners-under-increasing-regulatory-pressure

https://www.theblock.co/post/269619/pancakeswap-community-approves-removing-300-million-cake-tokens-from-supply

https://www.theblock.co/post/269590/canada-catalyx-ceases-trading-security-breach

https://www.theblock.co/post/269590/canada-catalyx-ceases-trading-security-breach

https://www.theblock.co/post/269551/indias-financial-intelligence-unit-issues-compliance-notices-to-offshore-crypto-exchanges-including-binance-kraken

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.