In-depth analysis of Cancun upgrade: data and investment perspective

Original author:@0x Johnsons

tutor:@CryptoScott_ETH, @Zou_Block

TL;DR

1. First of all, the Dencun upgrade corresponds to The Surge part of Ethereum’s development plan. It aims to improve the scalability and modularity of Ethereum, enhance the security functions of the Ethereum network, and improve the overall usability:

The core of the upgrade is the introduction of EIP-4844, significantly reducing Ethereum Layer 2 transaction fees and improving transaction throughput, while preparing for the full implementation of Danksharding;

introduced aNew data storage structure - Blob,It is specially used to store the transaction data submitted by L2 to L1, which is also the core reason for the current overall decrease in L2 Gas;

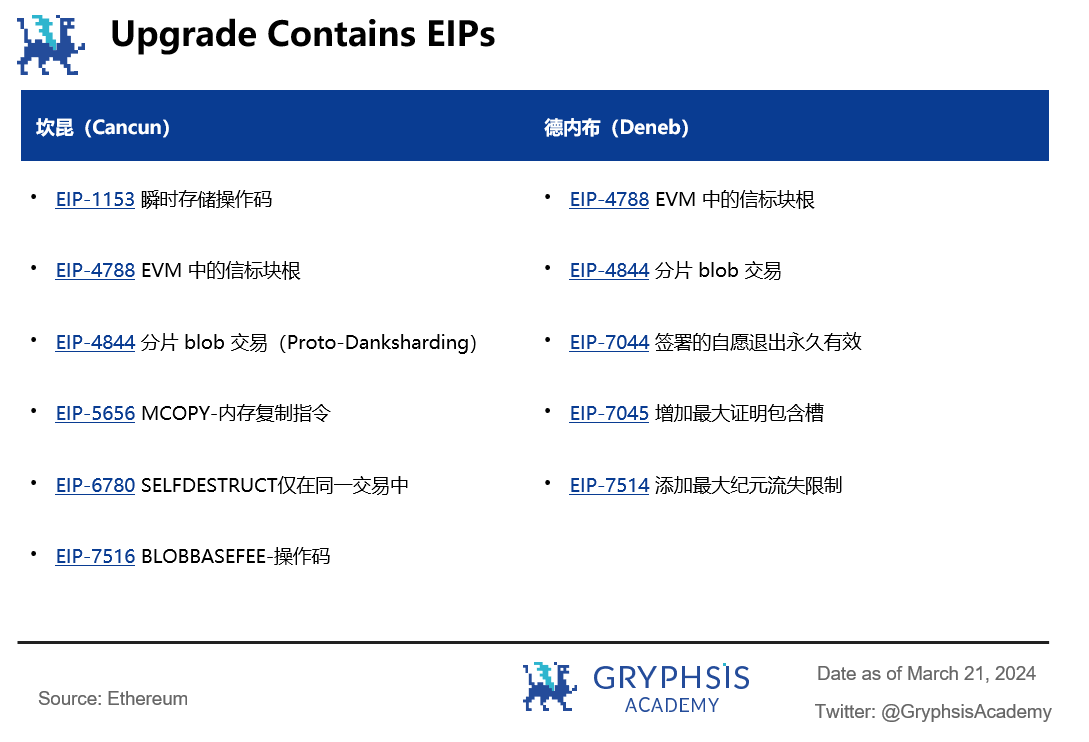

EIP-1153 transient storage opcode reduces storage costs and Gas consumption, EIP-4788 implements interoperability between EVM and beacon chain in a minimal trust manner, and EIP-5656s MCOPY instruction fills the gap in the current method of copying memory in EVM Blank, EIP-6780 limits the function of the operation code SELFDESTRUCT, improving the development stability of Ethereum.

2. Secondly, compare the effects before and after the upgrade from the data level:

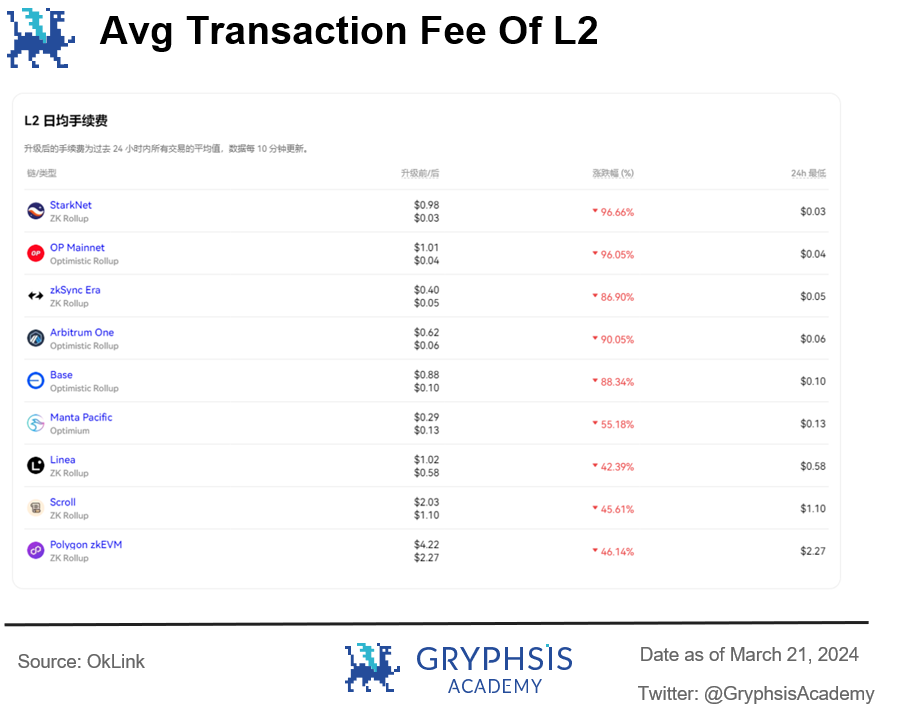

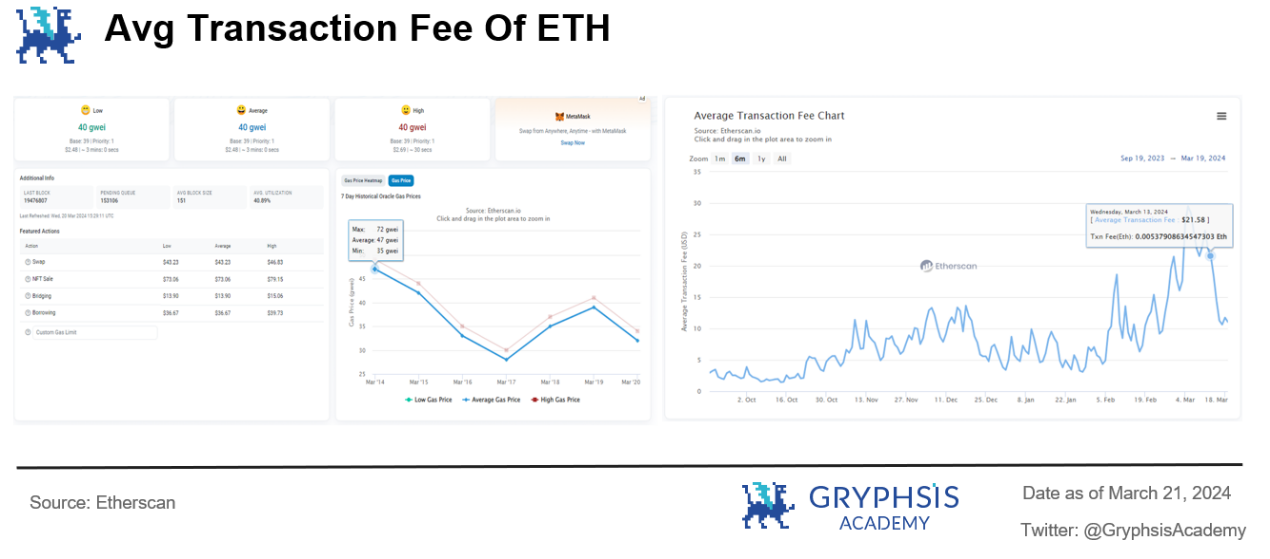

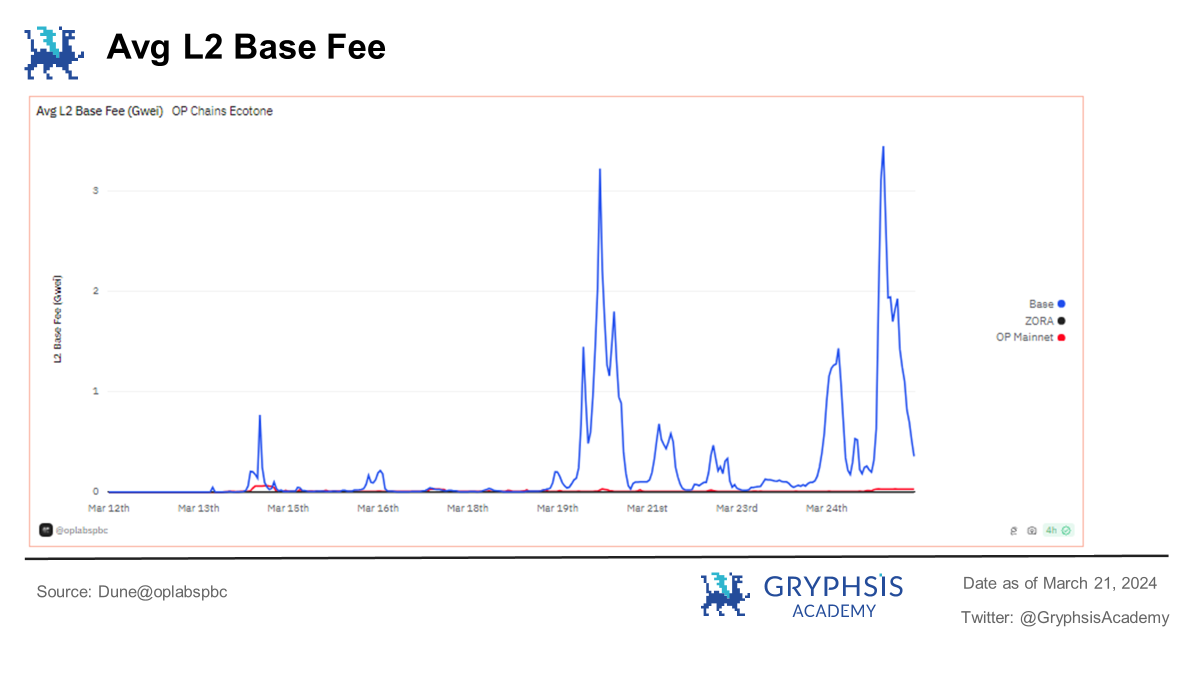

Gas fee level,The L2 Gas fee reduction effect is significant.Basically in line with the expectation that Layer 2 handling fees will be reduced by 90% before the upgrade; andEthereum Gas fee has been reduced, but not significantly.There is actually no change in user experience during actual use;

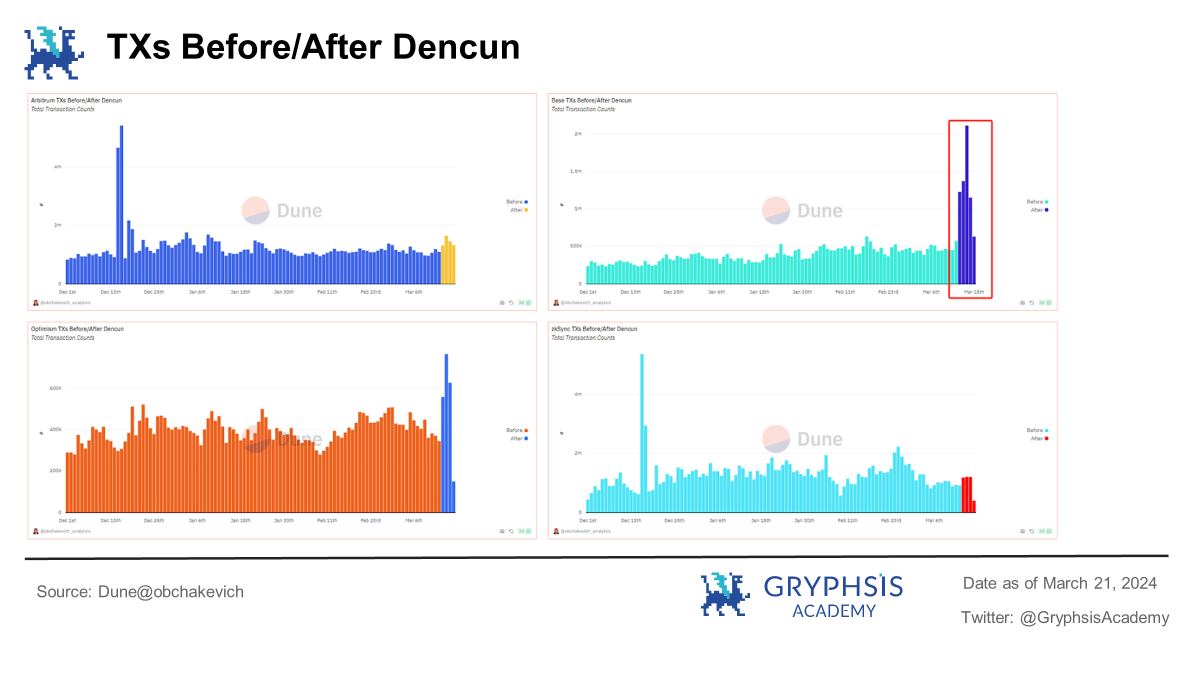

In terms of transaction volume, the transaction volume of each L2 has increased after the upgrade, the most obvious of which is Base, which has suddenly increased from 500,000 to 2 million, and the upgrade has benefited most obviously;

At the TPS (throughput) level, each L2 TPS has increased after the upgrade, but it is not as obvious as the transaction volume. However, from the perspective of industry development, this upgrade is also laying the foundation for the future. It also echoes the development expectations of Ethereum and reaches 100,000+ TPS;

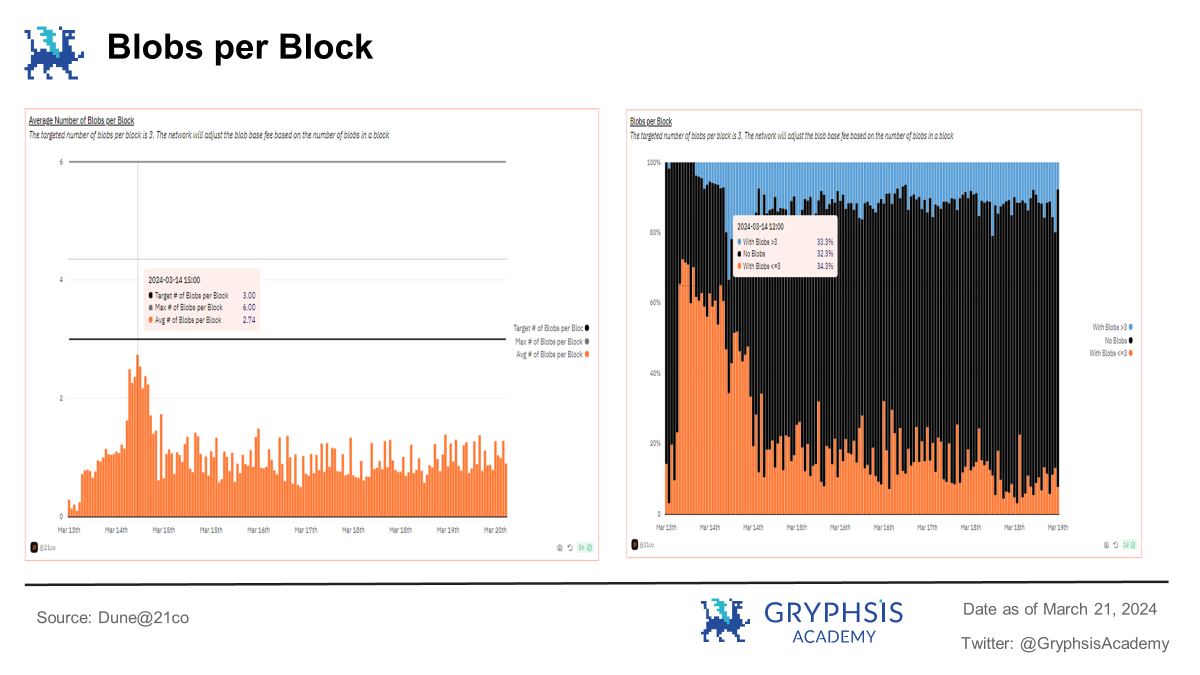

In terms of Blob quantity usage, after the upgrade, the Blob usage rate is average and has not reached the expected target value of 3. However, it can be intuitively seen that the data cost of using L1 in the average transaction cost of L2 is significantly reduced.

3. Finally, the investment impact of Dencun upgrade on Ethereum and L2 is explored:

The author believes that this upgrade for Ethereum mainly lays the foundation for future development, making it closer toBecome a fully scalable and accessible global trading platform.For ETH, as the native token of the platform, combined with the ETH-ETF narrative, the futureIt exists more as a global asset allocation, just like the current role change of BTC,More suitable for long-term investment;

L2 leadingArbitrum and OptimismIt is particularly noteworthy that both are currently developing well and have their own moats. At the same time, in the future, it is speculated that this upgrade may increase the profit margins of both, which will benefit the user level and form a positive cycle for their ecological construction;

Another more inclined focus in L2 isBase , backed by Coinbase, it naturally has large-scale users and funds, and its recent data performance is very outstanding, and the market is also hot. After the upgrade, there may be good Alpha opportunities;

forL2 that has not yet issued coinsWe should continue to pay attention. The upgrade will cause a significant drop in interaction costs, and more users will be willing to participate in ecological interactions, such as ZKsync, Blast, etc.

Preface

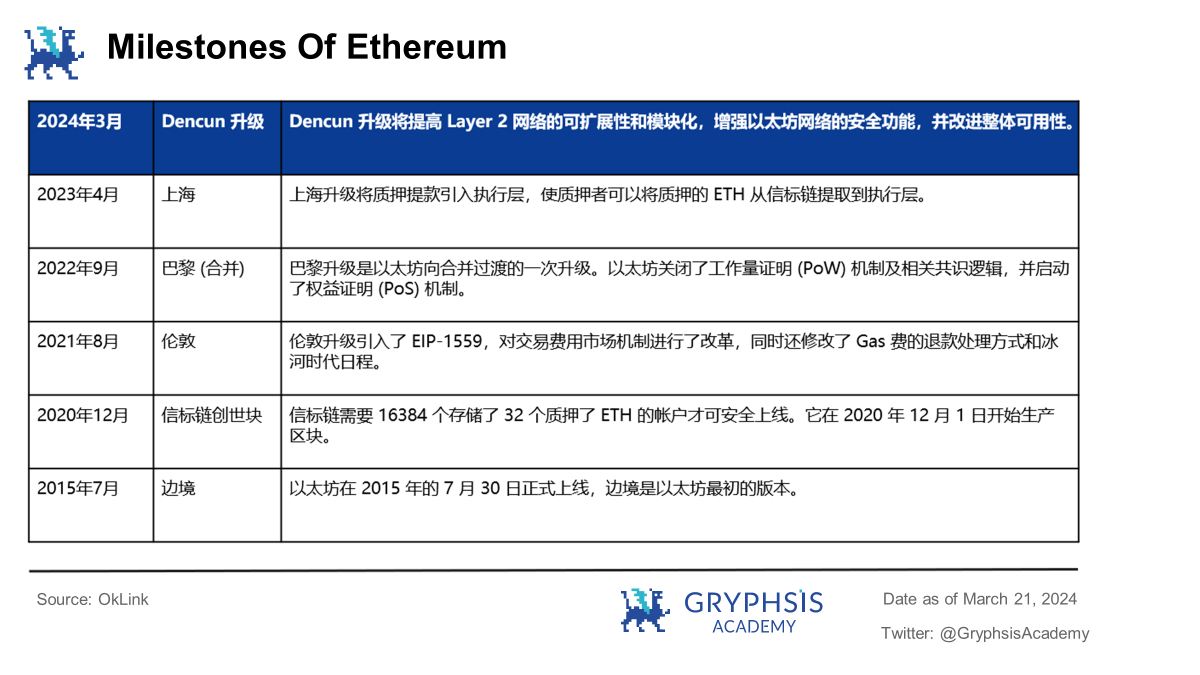

Because Ethereum introduced the concept of smart contracts, it created the subsequent prosperity of the blockchain ecosystem. Since Ethereum was officially launched on July 30, 2015, it has had 12 upgrades, and each upgrade has attracted much attention.

The main goal of this Ethereum Cancun-Dencun upgrade (Dencun upgrade) is to improve the scalability and modularity of the Layer 2 network, enhance the security features of the Ethereum network, and improve overall usability.

1. What is Dencun upgrade?

1.1 Upgrade introduction

1.1.1 Origin of the name

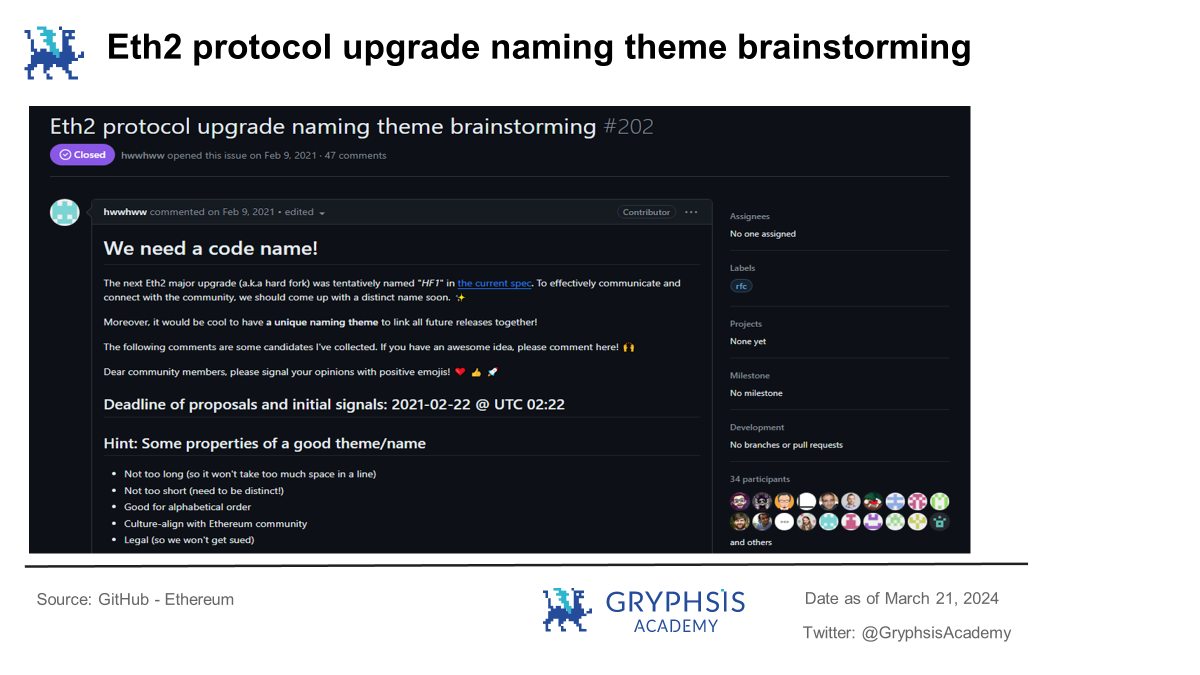

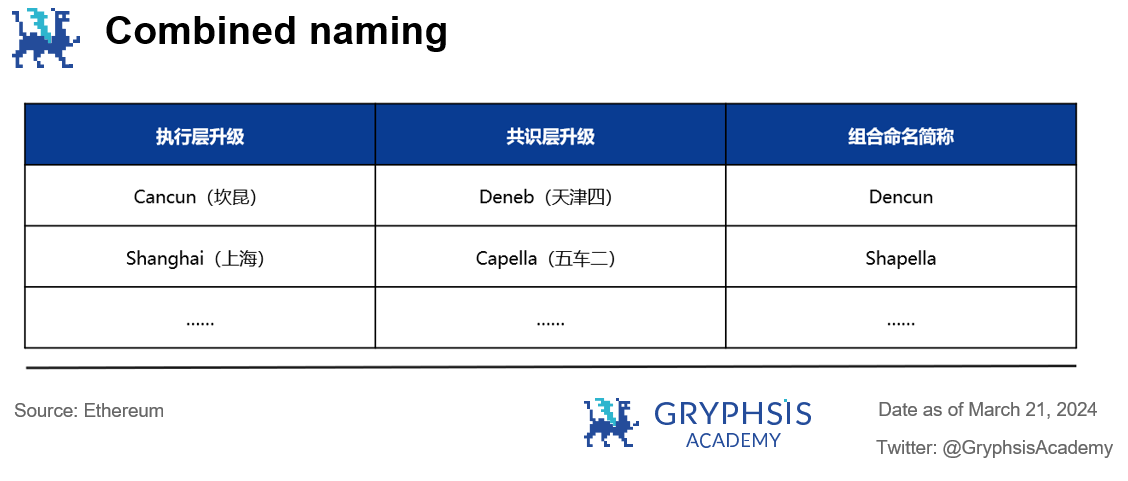

The bottom layer of Ethereum is composed of two parts, namely the execution layer and the consensus layer. The two parts have different naming rules.

The execution layer upgrade naming rules will be named by the city where Devcon (Ethereum Developers Conference) is held starting from 2021. For example, Berlin upgrade, London upgrade, Shanghai upgrade, etc.

The naming rules for consensus layer upgrades are named after celestial bodies in alphabetical order since the launch of the beacon chain. For example, Altair, Bellatrix, Capella, etc.

The name of each upgrade of Ethereum is a combination of the two different upgrade names to form an overall upgrade naming. Since this Devcon is held in Cancun, Mexico, and the consensus layer is upgraded to Deneb, this Ethereum upgrade is referred to as the Dencun upgrade.

1.1.2 Upgrade background

1.1.2 Upgrade background

The background of Dencun upgrade is based on the long-term plan for the development of Ethereum, and the other core is to improve the experience of Ethereum, and ultimately achieve aA permissionless, decentralized, censorship-resistant, open source ecosystem.

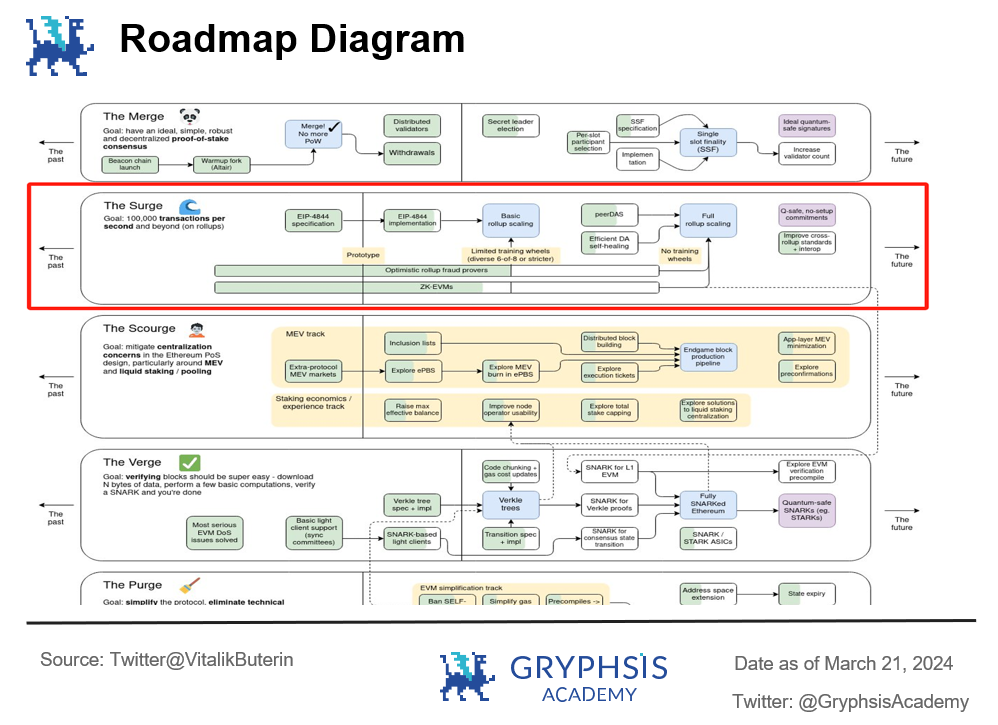

On the one hand, according to the planning map released by Ethereum founder Vitalik Buterin on December 31, 2023, the Dencun upgrade corresponds to the surge part, and begins to put user experience first (such as increasing transaction speed, reducing gas fees ), the purpose is to improve the efficiency of the network, reduce transaction costs, and lay a solid foundation for future development.

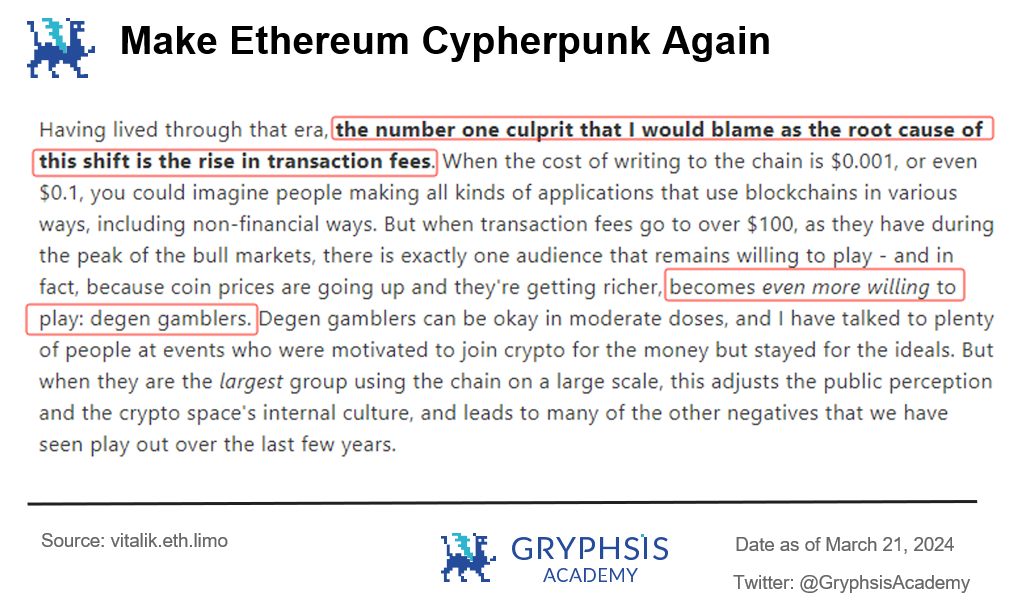

On the other hand, from Vitalik Buterin’s article published on December 28, 2023 “Make Ethereum Cypherpunk AgainIt can be seen that Vitalik believes that one of the core reasons why blockchain is increasingly limited to asset speculation is thatRising transaction fees, which makes Degen Gamblers Becoming a mainstream group is not conducive to realizing the application value of blockchain, so transaction fees must be reduced.

1.1.3 Upgrade time

1.1.3 Upgrade time

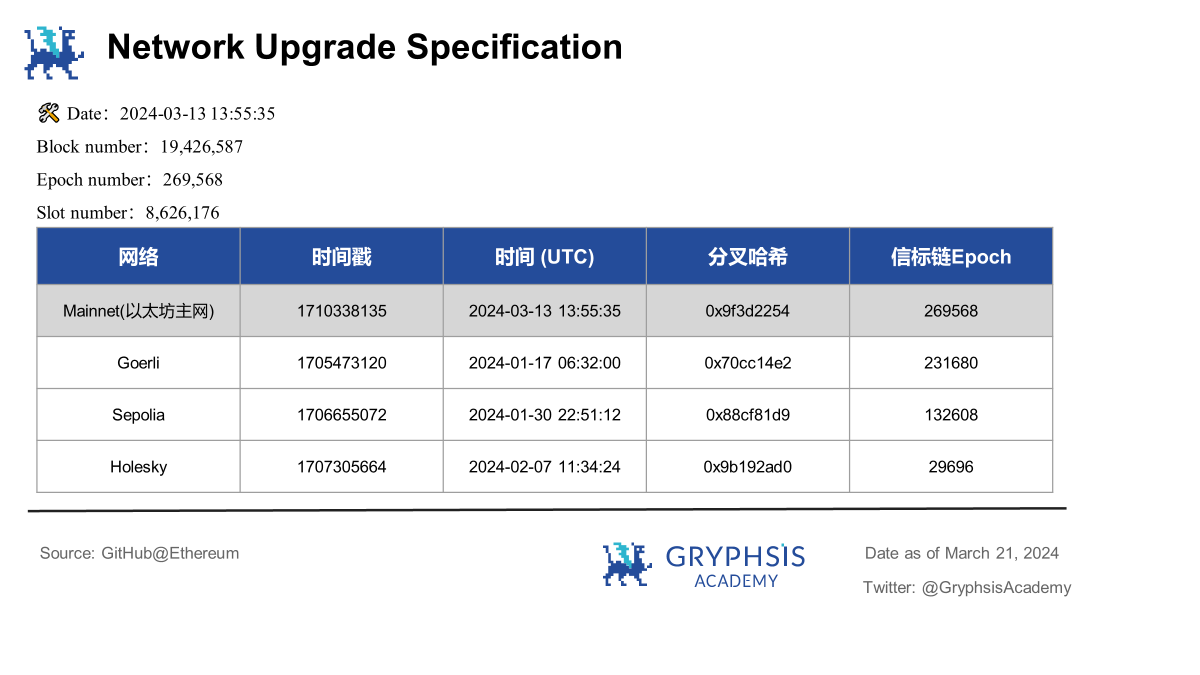

According to the Ethereum plan, the upgrade time and activation information are:

1.1.4 Content involved

1.1.4 Content involved

EthereumCancun-Denebl made a series of improvements to the execution layer and consensus layer respectively, Cancun (Cancun) completes the executive layer (EL), Deneb (Deneb) enhances the consensus layer (CL) and incorporates a series of EIPs (Ethereum Improvement Proposals) that are critical to the development of the Ethereum network. There are 9 EIPs in total, and we will introduce the key EIPs later.

1.2 Key points of Dencun upgrade

Through the above understanding, we know that the Dencun upgrade is mainly to improve Ethereum, and the specific implementation plan is centered around a series of EIPs. The following will analyze the core EIPs involved.

1.2.1 EIP-4844 Sharded Blob Transaction (Proto-Danksharding)

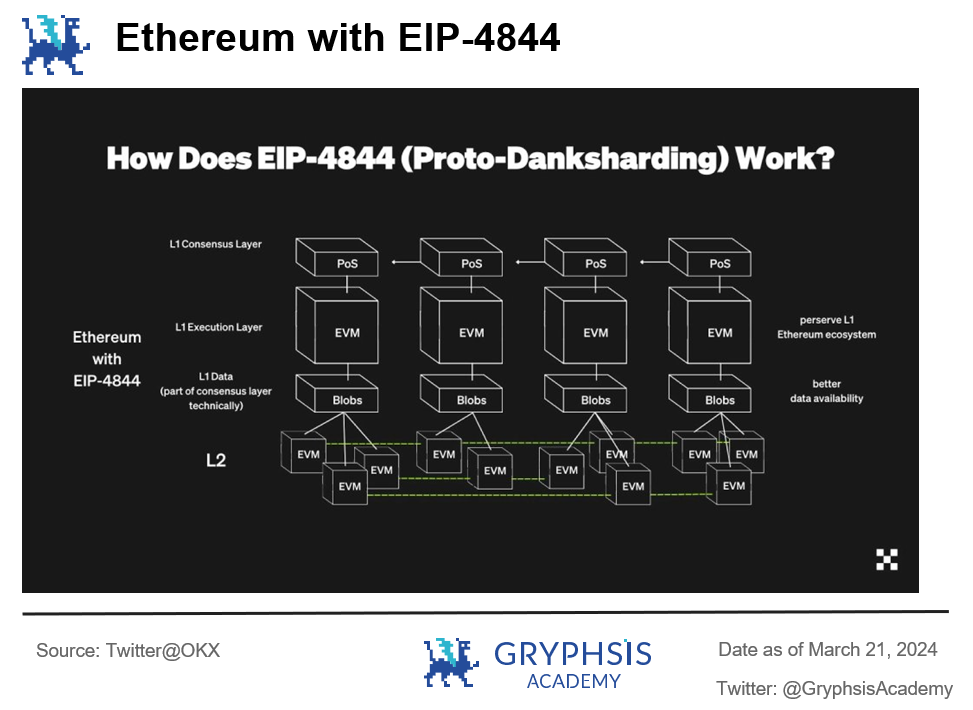

EIP-4844 is the biggest highlight of this upgrade, aiming to reduce handling fees and increase transaction throughput (TPS) and scalability. Its essence is a transitional upgrade to prepare for the future to achieve full Danksharding (the last part of Ethereums quiet phase upgrade). Proto-Danksharding is laying the foundation for Danksharding.

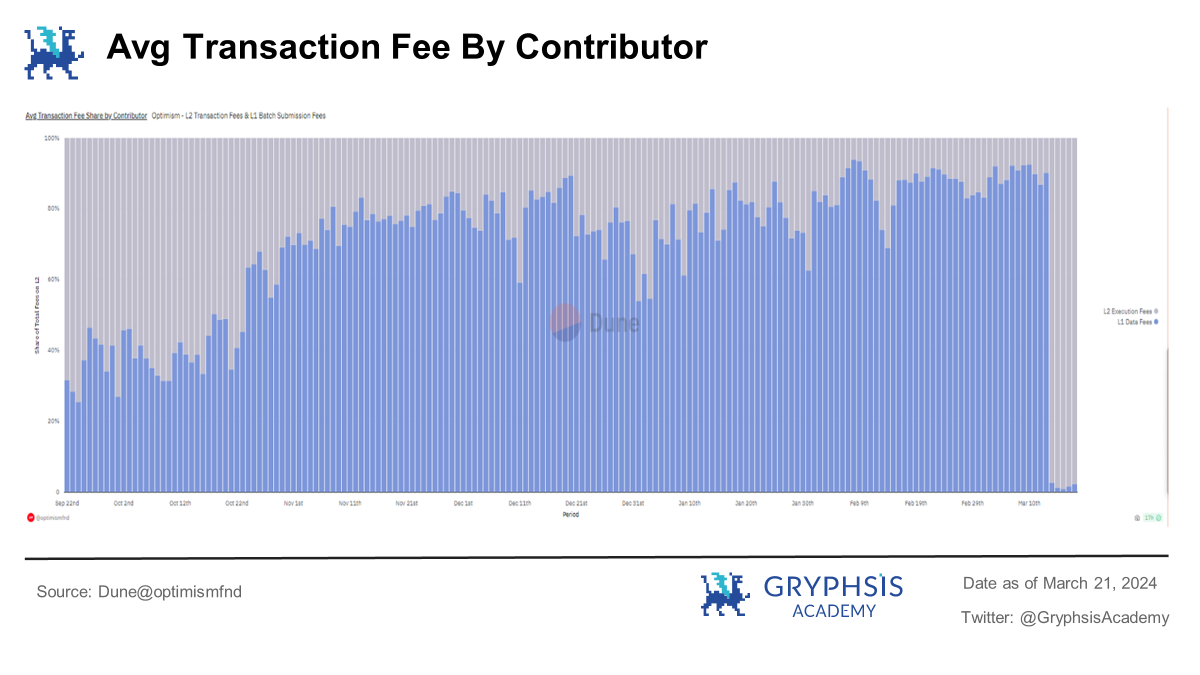

The data availability provided on the Ethereum main chain is Calldata (which can be understood as the data generated in contract transaction calls), and the data returned by Layer 2 to Layer 1 is stored in Calldata. In addition, for the sake of security, each step of Calldata requires Gas. This results in a large gas cost. However, the transaction data in Calldata does not have much use after verification. Long-term data can also be downloaded and verified, and it does not even need to be transmitted to the execution layer. Taking the average transaction fee history of the Layer 2-OP chain as an example, you can see arriveNearly 80% of the cost comes from L1 data charges.

Therefore, EIP-4844 introduces a new data storage structure - Blob, which is specially used to store transaction data submitted by L2 to L1. After the introduction, L2 transaction data is directly submitted to Blob for storage, which can be fully downloaded by the consensus node and can be deleted after only a short delay, reducing unnecessary storage burden. This means that the introduction of Blob will greatly reduce L2 transaction fees. At the same time, Blob is equivalent to additional block space expansion for L2, and L2 transaction throughput will also be significantly improved.

1.2.2 EIP-1153 Transient Storage Opcode

1.2.2 EIP-1153 Transient Storage Opcode

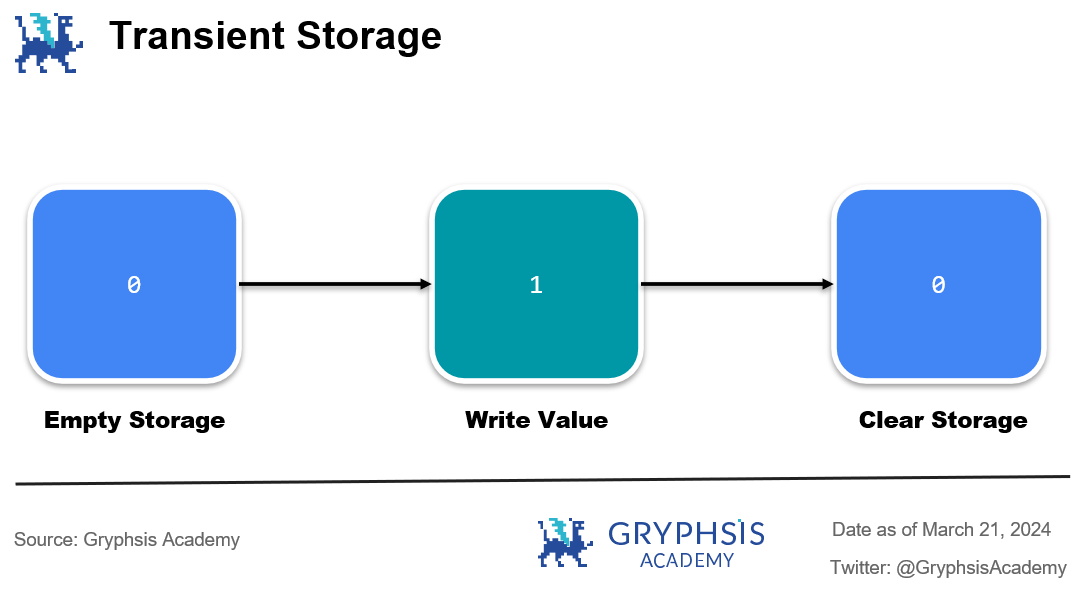

The main purpose of EIP-1153 is to save storage space and storage costs. Transient storage is discarded after every transaction, therefore, temporary storage is cheaper because it does not require disk access.

EIP-1153 is more friendly to Dapp developers. It introduces new opcodes TSTORE and TLOAD in the EVM. The Gas cost of calling these opcodes is about 100 Gas each, which is 95% cheaper than traditional storage calls (SLOAD and SSTORE). . At the same time, once the complete transaction execution is completed, this part of the storage will be cleared, thereby reducing storage costs and Gas consumption. For example, new DeFi contracts may save Gas in the future.

1.2.3 EIP-4788 Beacon block root in EVM

EIP-4788 will implement communication between EVM (Ethereum Virtual Machine) and the beacon chain (Beacon). This feature supports various use cases and can improve staking pools, restaking constructions, smart contract bridges, MEV, etc.

Previously, EVM could not directly access Beacons data and status, and could only capture the status through an external trusted oracle. Therefore, it is proposed to place a parent beacon block root (parent_beacon_block_root) in each EVM block, so that when the Beacon is updated, accurate information can be obtained immediately on the EVM.

The parent beacon block root will be stored in the ring buffer and will only be kept for about 1 day. Once the new parent beacon block root enters and the buffer capacity reaches the critical value, the oldest parent beacon block root will be overwritten, thus Implement efficient and limited consensus storage. In this way, communication is achieved in a trust-minimized manner, and the risk of external oracle failure and maliciousness is eliminated, increasing security.

1.2.4 EIP-5656 MCOPY - Memory Copy Instruction

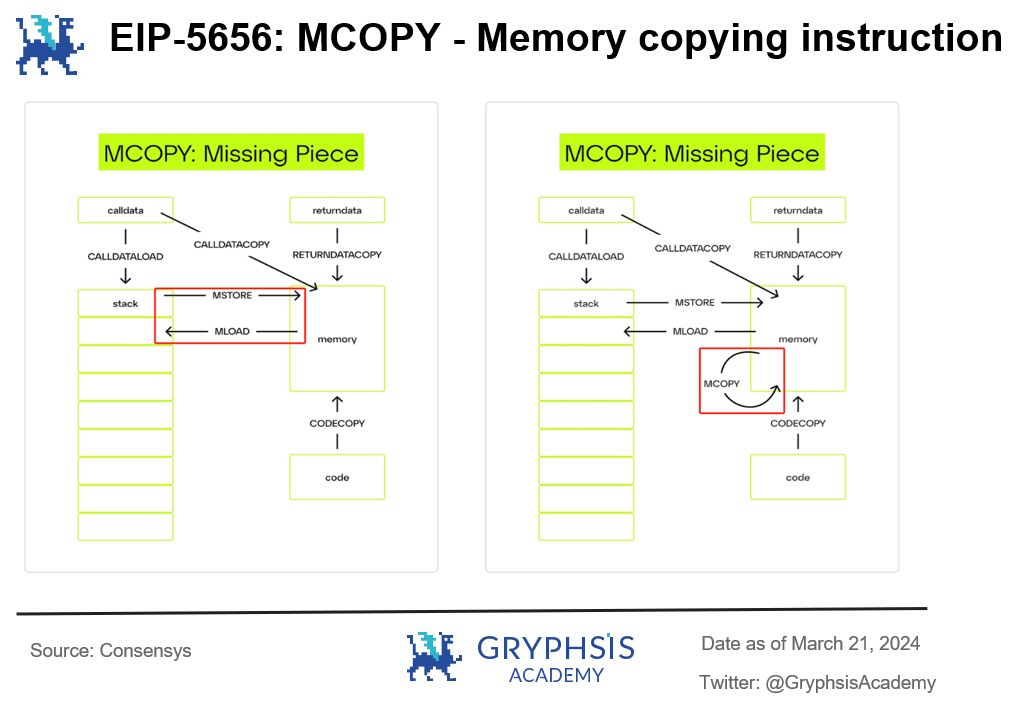

EIP-5656 optimizes the cost of copying memory areas by introducing a new EVM instruction MCOPY, thereby improving the efficiency of data movement in the EVM.

Memory copying is a basic operation, but implementing it on the EVM comes with overhead. Taking copying 256 bytes of memory data as an example, developers can significantly reduce the cost from the previous 96 Gas (using MLOAD and MSTORE) to 27 Gas through the MCOPY opcode. It is expected that most developers will use MCOPY instead of MSTORE/MLOAD in the future, and more efficient Gas contracts will eventually benefit end users.

At the same time, MCOPY fills the missing gaps in the current methods of copying memory in the EVM.

1.2.5 EIP-6780 SELFDESTRUCT only in the same transaction

1.2.5 EIP-6780 SELFDESTRUCT only in the same transaction

EIP-6780 limits the operation code SELFDESTRUCT function. The new function only sends all funds in the account to the target, but does not affect the code, storage and other information. It also prepares for subsequent Verkle tree upgrades.

Prior to EIP-6780, if the SELFDESTRUCT opcode was referenced in contract creation, funds could be sent to the target, but the code, storage, and other information would be deleted. However, this feature would have certain dangers and unintended consequences. After EIP-6780, this will not be affected and developers can better manage the project, resulting in a more stable and predictable blockchain.

2. Impact on data level after upgrade

2.1 Impact of Gas Fees

The core of this upgrade, and what everyone is most concerned about, is the change in gas fees. Due to the introduction of EIP-4844, the most significant benefit is Layer 2. The reduction in gas fees is very obvious, and the user experience is improved. Basically in line with the expectation that Layer 2 handling fees will be reduced by 90% before the upgrade.

For Layer 1 (Ethereum itself), the gas fee has been reduced after the upgrade, but it is not significant. In fact, users experience no change in actual use.

2.2 Impact of trading volume

In addition to reducing Gas, the upgrade also aims to increase throughput, which is also the focus of Ethereums expansion development plan.

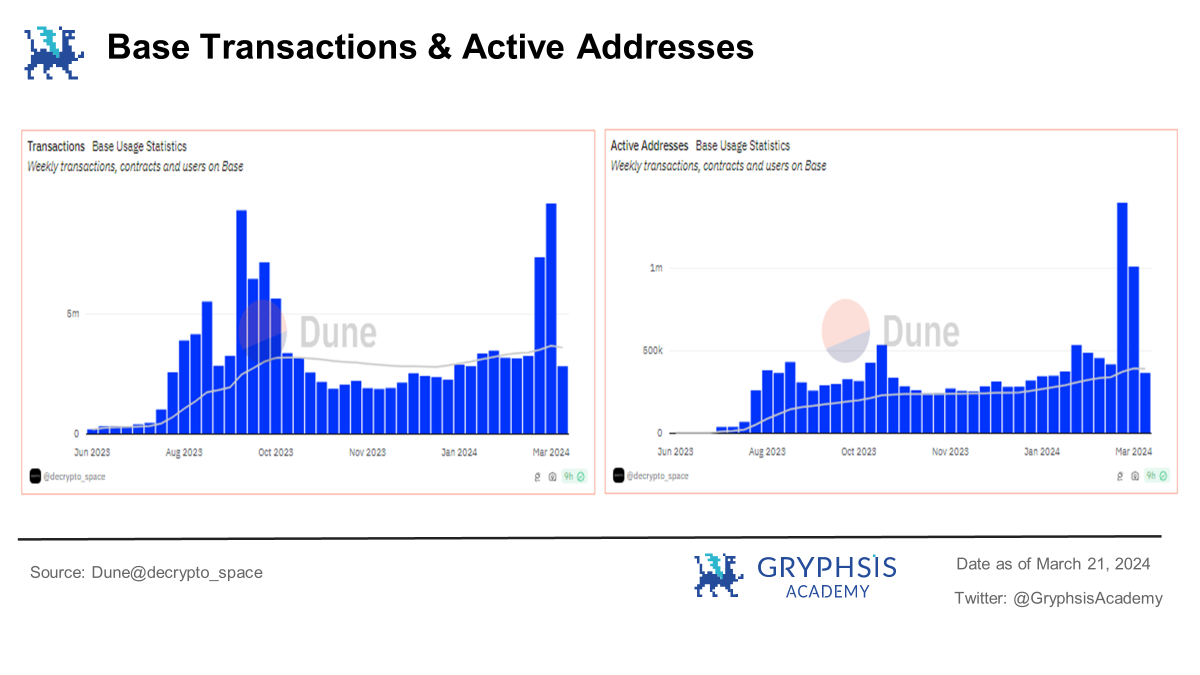

After the upgrade was completed, Bases transaction volume was the first to surge and break through the original bottleneck, from the previous 500,000 to 2 million, which means that EIP-4844 had a direct impact on it and benefited most obviously.

2.3 Impact of TPS

Optimization of TPS (transactions per second) means developers have greater flexibility when building and deploying dApps, which is expected to lead to more complex, data-intensive applications that will attract a wider user base.

After the upgrade is completed, the TPS of each Layer 2 has basically increased, but the maximum does not exceed 30 transactions/second.

Low TPS is a common phenomenon in the current Web3 industry, which is different from the high TPS characteristics of the traditional Web2 industry. The highest TPS of Layer 2 does not exceed 500, but from the perspective of industry development, this upgrade is also laying the foundation for the future, and also echoes the development expectations of Ethereum - reaching 100,000+ TPS.

2.4 Blob usage

The main reason for the overall decrease in Layer 2 transaction fees is the introduction of the Blob type. The more Blobs involved in a transaction, the greater the overall throughput will be, which also lays the foundation for subsequent Ethereum upgrades.

It was initially expected that if the average target of 3 Blobs per block is achieved, the throughput of L2 will be improved by nearly 2 times. If the goal of adding 64 blobs to a block is finally achieved, the throughput of L2 will be increased by nearly 40 times. The maximum limit for this upgrade is 6 blobs.

Judging from the current situation, Blobs have begun to be used in transactions, but the overall usage rate is not high. The peak occurred when the upgrade was just completed, and then gradually fell back, and has not yet reached the estimated average target of 3 Blobs.

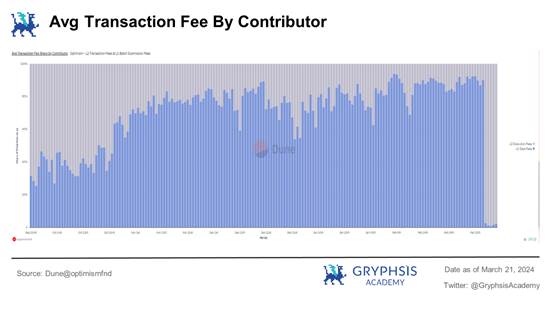

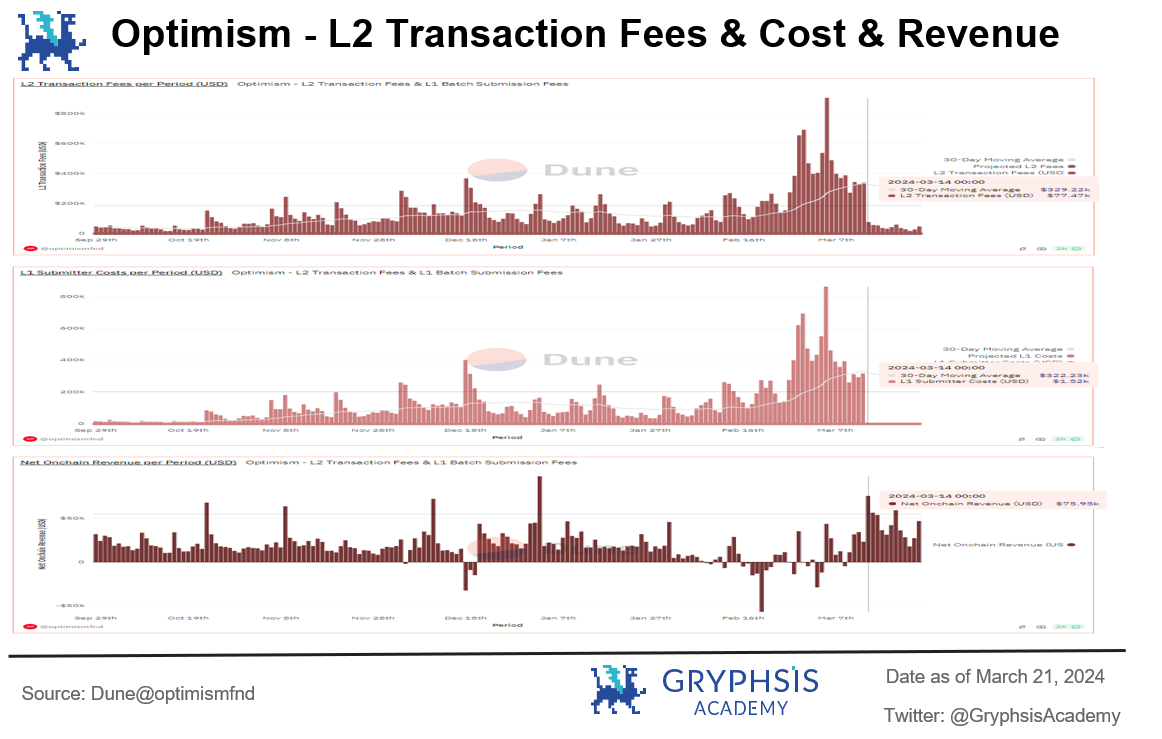

However, the introduction of the Blob type has actually significantly improved the data costs of Layer 2 on Layer 1. From the OP chain example mentioned above, we can intuitively feel that the data cost of using L1 in the average transaction cost of Layer 2 is significantly reduced and almost eliminated. This also speculates from another aspect that the profit margin of Layer 2 may be improved.

The profit model of L2 is relatively simple and clear, and can basically be summarized as: on-chain profit = L2 transaction fee - L1 payment cost; taking the OP chain as an example, although the upgrade reduces both L2 transaction fees and L1 payment costs, due to the transaction The volume and user base have increased, and the declines in the two are not at the same order of magnitude. Transaction fees have been reduced from hundreds of thousands to tens of thousands, while payment costs have been reduced from hundreds of thousands to less than 1k, and on-chain profits have also increased since the upgrade.

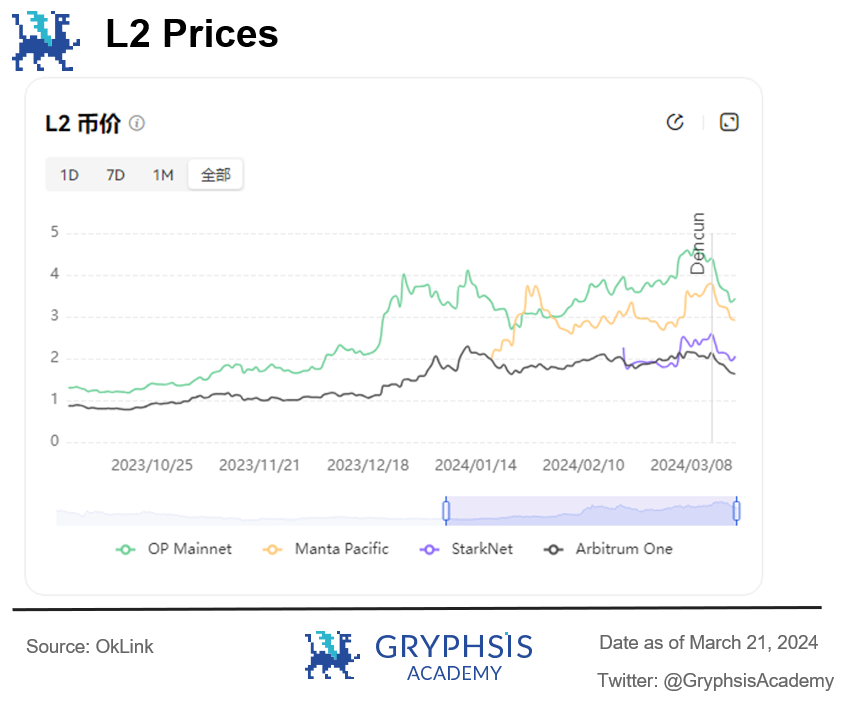

2.5 Price impact

For this upgrade, users are most concerned about whether the on-chain experience has been improved, and the second most concerned thing is the price of each L2s native token. It can be seen that after the upgrade of Layer 2 that has issued coins, the currency prices have begun to fall. This is also related to the characteristics of the industry, and the good news has turned into bad news. The actual market has been speculating on the concept of Ethereum upgrades since 2023. Judging from the rise in currency prices during this period, this upgrade can be considered a good thing.

3. Impact on investment value

Dencun upgrade has been the focus of attention in the past 23-24 years, and the public has also made investment judgments around a series of concepts of Dencun upgrade. This upgrade is destined to have an impact on the subsequent investment value of Ethereum and L2.

3.1 Ethereum baton handover L2

The vision of Ethereum is to become more scalable and secure while being decentralized.

In order to get rid of the trilemma (the Impossible Trilemma proposed by Vitalik Buterin), in the previous upgrade, Ethereum was converted from POW to POS in order to improve security. In terms of scalability, L2s Rollup solution is also clearly adopted, with the purpose of increasing Ethereums throughput while greatly reducing user fees.

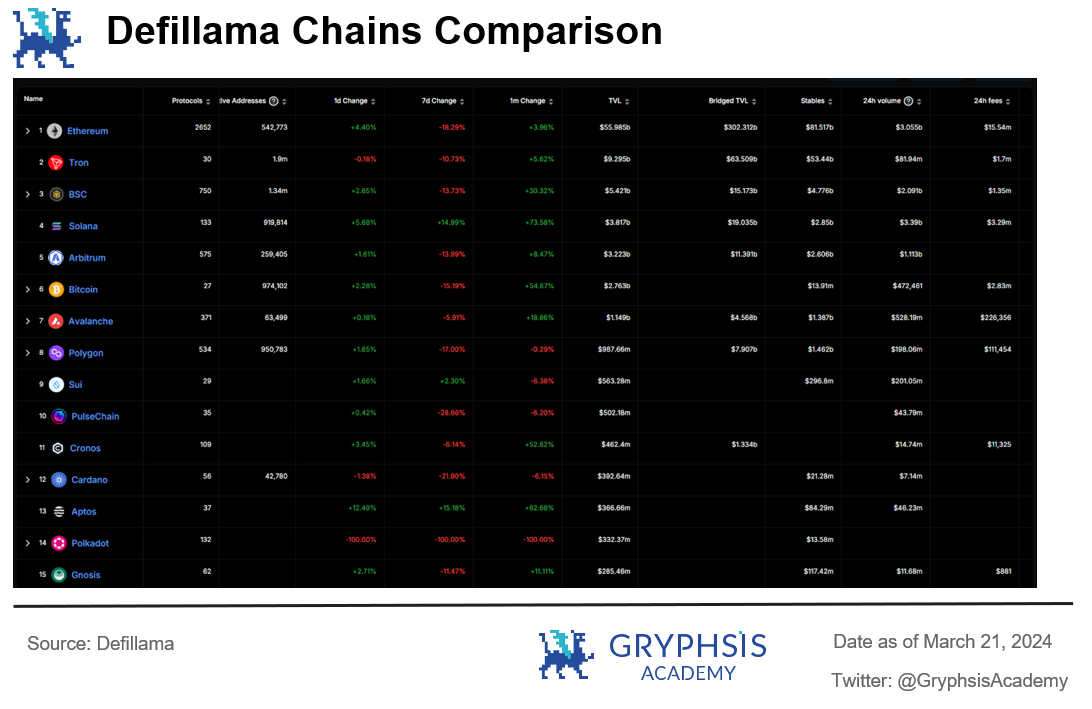

Although Ethereums TVL is still at the top, other L1 public chains have a big impact on it. For example, Solanas transaction volume has exceeded that of Ethereum. In terms of active addresses, Ethereum only ranks 6th.

Another example is the outbreak of Sui and the recent hot BTC L2 concept, which will cause users to continuously flow out of Ethereum. When the user and developer base is reduced, its value will usually decrease. But this does not mean that Ethereum will go downhill, but that its development trajectory will change.

Ethereum was released in 2015 and ushered in the Web3 era. Its development to this day has contributed to the prosperity of the industry. The most typical one is the emergence of L2. Many L2s provide solutions for the expansion of Ethereum, and the focus of Dencuns upgrade is on L2. , in the future Ethereum upgrade will also involve a number of things related to L2. The two are increasingly closely connected and complement each other.

The author believes that this upgrade for Ethereum mainly lays the foundation for future development, making it closer toBecome a fully scalable and accessible global trading platform.For ETH, as the native token of the platform, combined with the ETH-ETF narrative, the futureIt exists more as a global asset allocation.Just like the current role change of BTC,More suitable for long-term investment,Alpha opportunities will definitely appear in L2 in the future, and Ethereum will gradually hand over the baton of expanding its territory to the hands of L2 to complete its role change. Therefore, more investment focus should be placed on L2 and other tracks.

3.2 L2 ecological explosion

There is no doubt that the biggest and most direct impact of the Dencun upgrade is Layer 2. From the above data, we know that L2 transaction fees have generally been significantly reduced and throughput has also been improved. This allows L2 to pass through at a cheaper price. , higher performance to attract users into the ecosystem, forming further competition with other L1s.

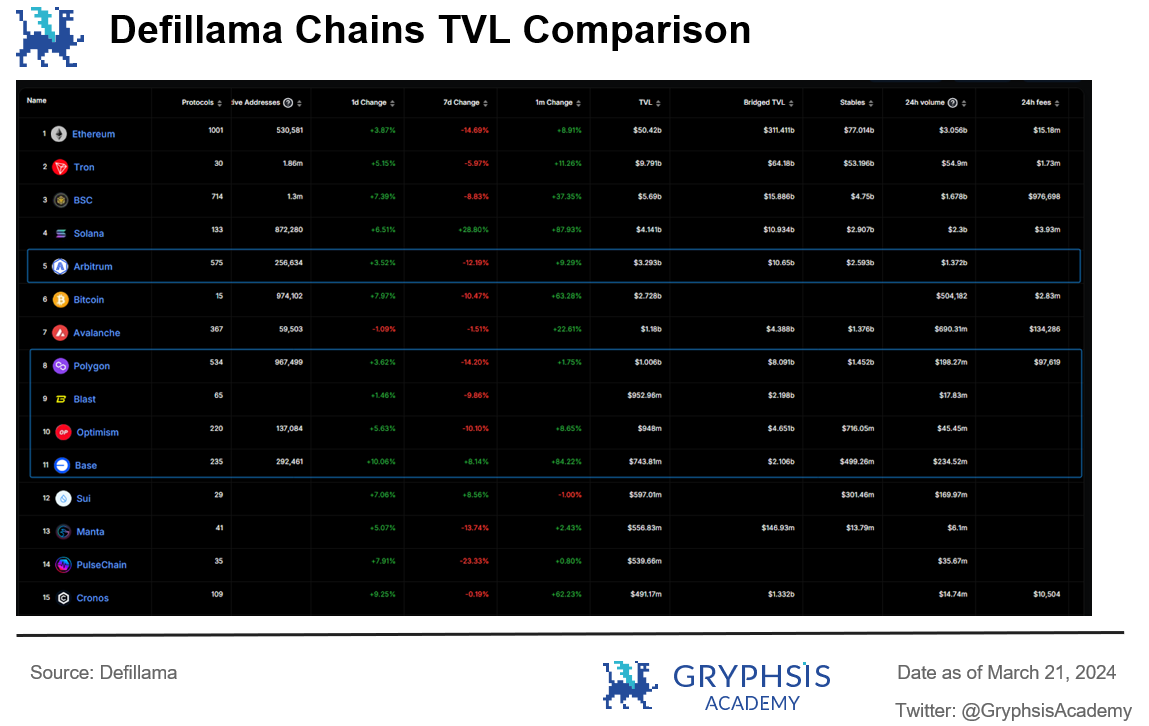

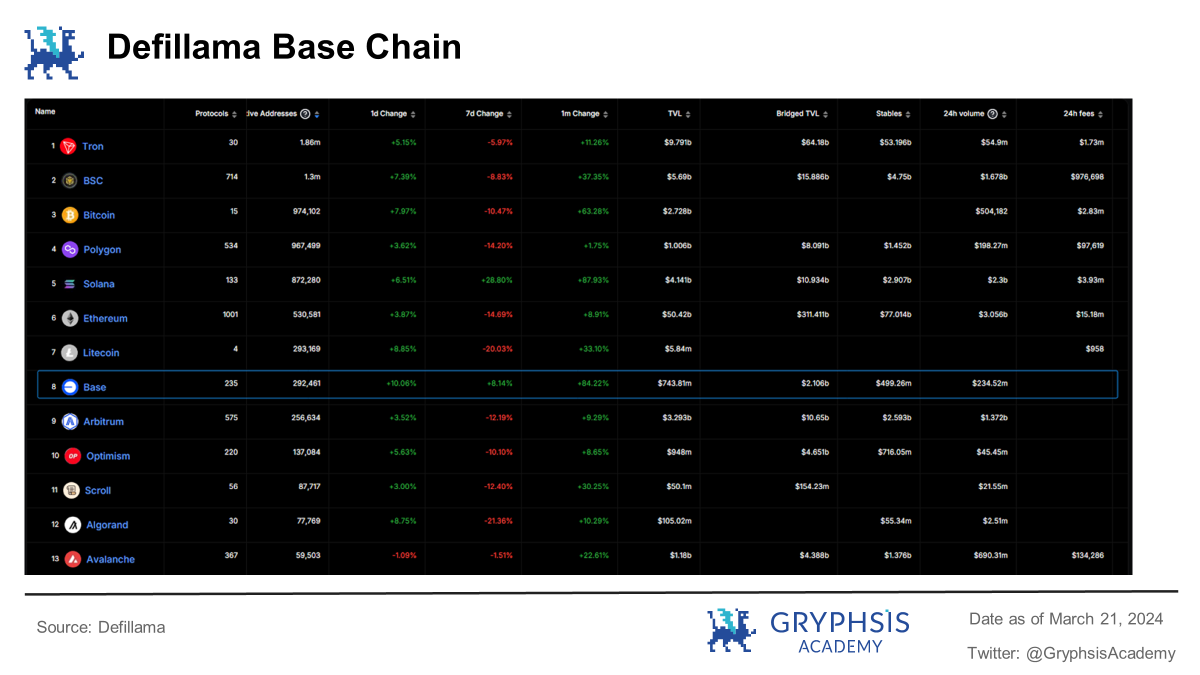

According to DeFiLlama statistics, there are 4 L2s in the top 10 of TVL (Polygon is technically a side chain, but it also has a corresponding ZK Layer 2 solution and is beginning to gradually embrace ETH L2), among which Arbitrum is second only to BSC and Solana Ranked 4th, there will be rising stars in L2 in the future, such as Blast, which is popular for airdrops, and Base, which is backed by Coinbases abundant resources. These L2s with huge development potential need to be focused on.

For Layer 2, Dencun has actually reduced its own costs after upgrading, so there is a chance that profit margins will increase in the future. As the current L2 leaders, Arbitrum and Optimism, it is very likely that this part of the profits due to the impact of the upgrade will be reduced. By building its own ecosystem and increasing activity, users will also benefit from it. In other words, as L2s own profitability increases, the value of its tokens will also rise, which is unanimously recognized by the market. Although the current upgrade expectations have been realized and the prices of $arb and $op have dropped somewhat, judging from their respective transaction volumes and active users, the market still maintains expectations.

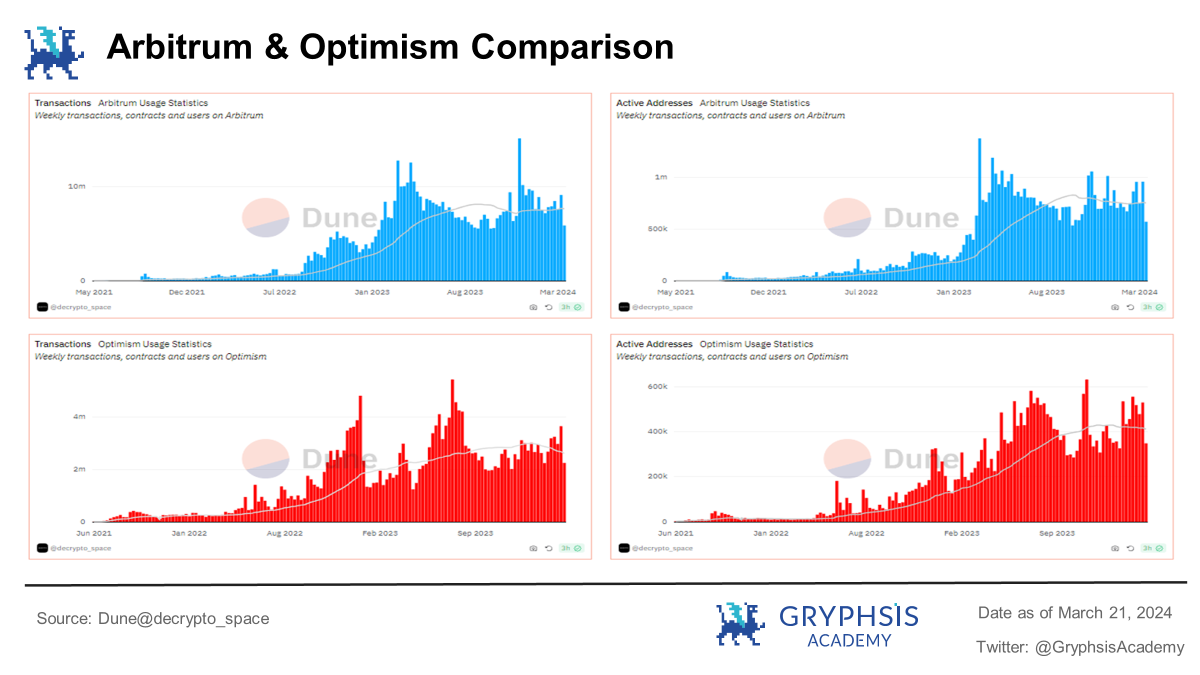

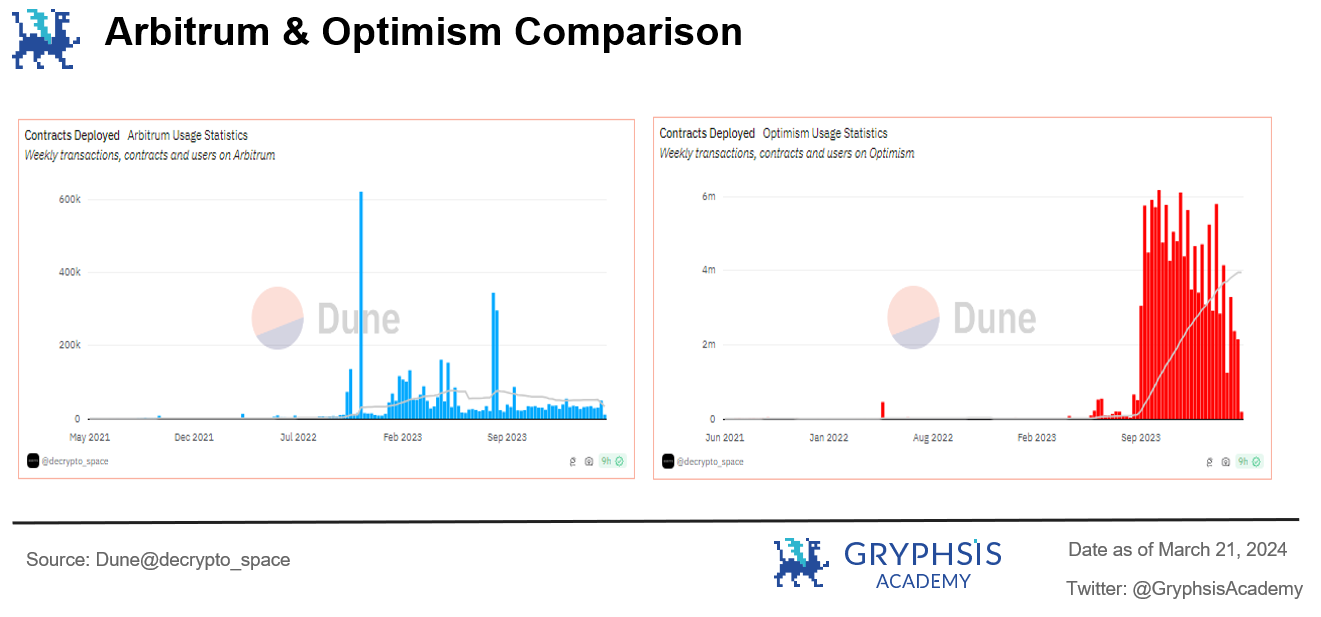

aboutArbitrum and OptimismWe can understand the ecological construction of each from their respective contract deployments. The growth of Arbitrums contract deployment is lower than that of Optimism, but Arbitrum is still the most abundant L2 protocol. According to DeFiLlama statistics, the current number of Arbitrum protocols is 575, which is much larger than other The number of L2 protocols, and TVL is also at the top of many L2s. Since the launch of Arbitrunm, various data have been relatively excellent.

Optimism proposed the Superchain strategy in 2023 and began to promote the OP stack (an open source L2 technology stack), which means that other projects that want to run their own L2 can use it for free, and due to the consistency of the technical architecture, they can compete with each other. It can realize safe, efficient, atomic-level communication and interaction of information and assets. It was first adopted by Coinbase and launched the Base chain. In addition, there are Binances opBNB, NFT project ZORA, the well-known on-chain data dashboard Debank, etc.

Arbitrum and Optimism, as the L2 at the head of TVL and user volume, combined with the current ecological prosperity, have formed their own moats. They are also the core L2 that has the most direct impact of this upgrade. They have natural first-mover advantages. You can focus on both itself and the head protocols within the ecosystem.

And another L2 worthy of attention isBase , TVL has grown by more than 80% in the past month. Based on active addresses, Base has surpassed all L2s, second only to Ethereum. In terms of the number of ecological protocols, it has surpassed OP and jumped to 7th place.

Similarly, Base is also one of the L2s most directly affected by the upgrade. Both transaction volume and users have increased significantly after the upgrade, and market discussions have also increased, such as SocialFi (friend.tech) and DeFi (Perennial) on Base. , memecoin and other markets have always been hotly discussed;

Base itself has a strong binding relationship with Coinbase, so Base will naturally have a certain scale of users and funds. With the emergence of the friend.tech project, the market attention has been drawn back to the SocialFi track, and SocialFi itself The core requirements are high interaction frequency, low interaction cost, and a large number of users. Related applications have higher performance requirements. This coincides with the benefits brought by the Dencun upgrade. Perhaps there will be a phenomenon-level correlation on Base in the future. project.

In addition, there are more L2s such as Blast and Zksync that have not yet issued coins and are still gathering momentum. Dencun upgrade can greatly reduce the cost of user interaction and may further promote the prosperity of such L2 chain activities.

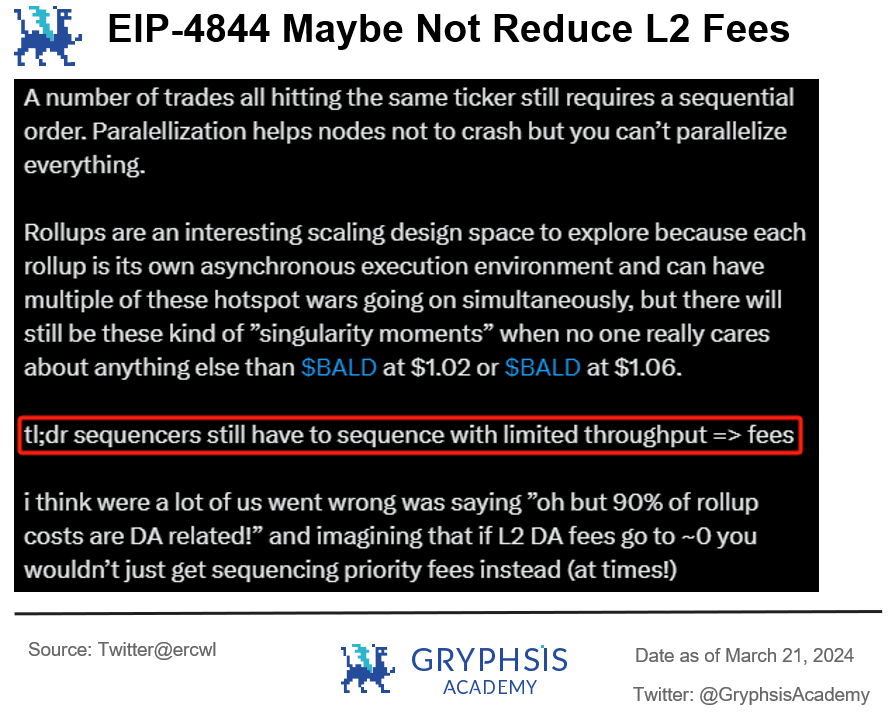

But on the other hand,Although EIP-4844 brings about a reduction in L2 transaction fees, it does not always ensure that L2 fees are low. Taking the Base chain as an example, during the period after the upgrade was completed, as the popularity of memecoin on Base increased, transaction fees also increased sharply and remained at a high level.

Eric Wall, co-founder of Taproot Wizards, gave an example of the emergence of this phenomenon on Twitter. For details, you can read the original article through the link. To put it simply, the L2-DA capacity space brought by EIP-4844 is not unlimited. When a large number of centralized transactions occur (TPS increases), in order to achieve priority transactions, Blob Space fees will compete and increase, L2 The sorter fee will also increase accordingly, which will affect the increase in transaction fees. The sorter can still only prioritize within a limited TPS.In other words, when a large number of concurrent transactions occur on the same chain, transaction fees will also become higher.

Source:https://twitter.com/ercwl/status/1771156029121663082

4. Conclusion and outlook

Dencun upgrade effect is significant, significantly reducing the transaction costs of L2, and basically realizing the expectation of reducing L2 transaction costs by 90%.However, the transaction fee reduction effect of Ethereum itself is not as good as L2.At the same time, the throughput of L2 has been improved to varying degrees after the upgrade, and the most outstanding performance is the Base chain. On the other hand,If a large number of concurrent transactions occur on the same chain, transaction fees will still become higher.

This upgrade is in Ethereumscalability dimensionThere has been further development, and the introduction of the new Blob data structure has laid the foundation for facing high concurrency situations in the future;

Dencun upgrade will furtherDrive the prosperity of L2 ecology,As the current L2 leaderArbitrum and OptimismParticularly worthy of attention,ArbitrumIt has the most abundant types of protocols and its data performance has always been good.OptimismThe Superchain strategy will be networked into an OP series. At the same time, this upgrade may increase the profit margins of both companies in the future. It is very likely to benefit the user level in the future and form a positive cycle for its ecological construction;

L2 Rising StarBaseAlso need attention,Backed by Coinbase, it naturally has large-scale users and capital volume.At the same time, the data performance is outstanding. In the past month, TVL has increased by more than 80%, the number of active addresses ranks first in L2, and the number of protocols exceeds OP. The development of ecological projects on this chain deserves attention;

The most obvious user experience after the upgrade is that the interaction costs of each L2 have been significantly reduced, which makes users more willing to interact, which in turn brings about a positive cycle of ecology, and can continue to pay attention to some L2 projects that have not yet issued tokens, such as Blast , Zksync, etc., the reduction of interaction costs will allow more users to participate.

[Statement] This report is produced by@GryphsisAcademys student@0x JohnsonsCompleted original work, tutored by Gryphsis Academy@CryptoScott_ETHand@Zou_BlockGive suggestions for modifications. The authors are solely responsible for all content, which does not necessarily reflect the views of Gryphsis Academy, nor the views of the organization that commissioned the report. Editorial content and decisions are not influenced by readers. Please be aware that the author may own the cryptocurrencies mentioned in this report. This document is for informational purposes only and should not be relied upon for investment decisions. It is strongly recommended that you conduct your own research and consult with an unbiased financial, tax or legal advisor before making any investment decisions. Remember, the past performance of any asset does not guarantee future returns.