LD Capital赛道周报(2023/12/5)

借贷

Aave

GHO 流动性委员会提交的最新报告中表示,自与 Maverick 合作以来,相比 Uniswap 等流动性平台,稳定币 GHO 自八月以来首次接近与美元完全锚定。Maverick Pools 在设计和编程流动性方面具有决定性优势。

12 月 2 日,AAVE 大户持有者@luggisdoteth 向币安存入 2.37 万枚 AAVE。自 2020 年 11 月以来,该地址一直在持续购买 AAVE,这是其第一次向币安存币,目前该地址仍持有 7.83 万枚 AAVE。

Venus

据 Arkham 监测,VBTC 巨鲸地址(0x1E7 开头)在 11 月 2 日向 Venus Protocol 存入 1400 万美元 BTCb,使其总存款超过 2800 万美元。

该地址是第四大 VBTC 持有者,在该协议拥有超过 7.5 亿美元的交易量。就在两天前,该地址借入了 500 万美元的 USDT,并立即将其存入币安。

LSD

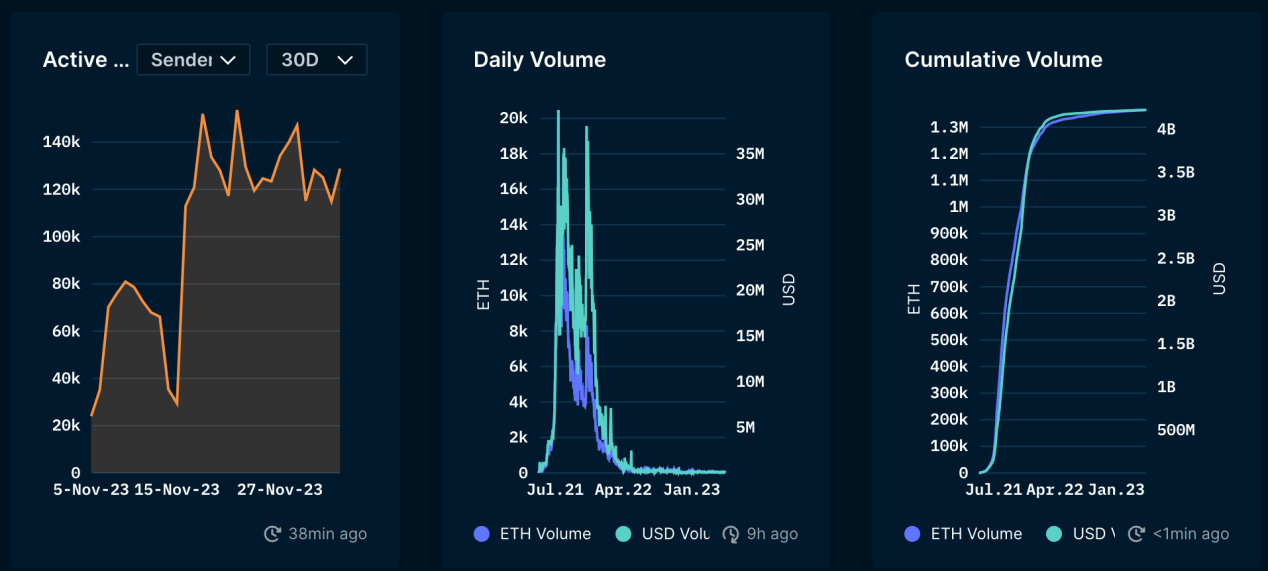

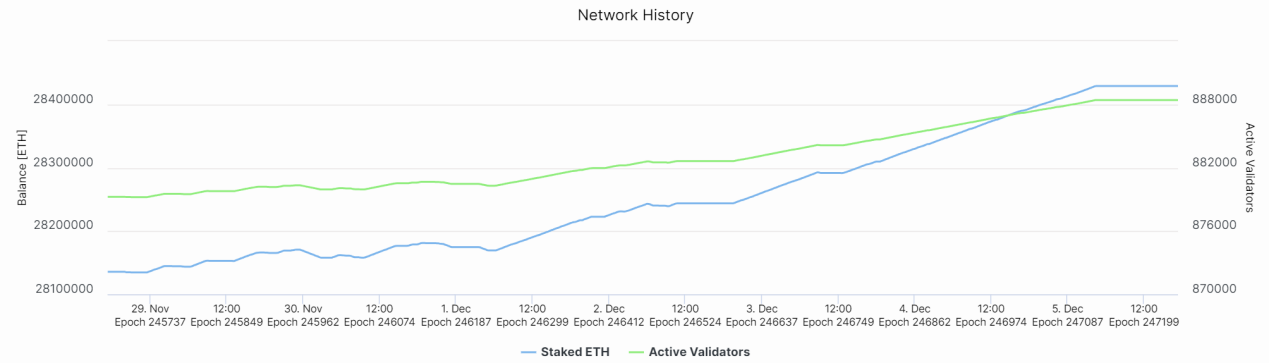

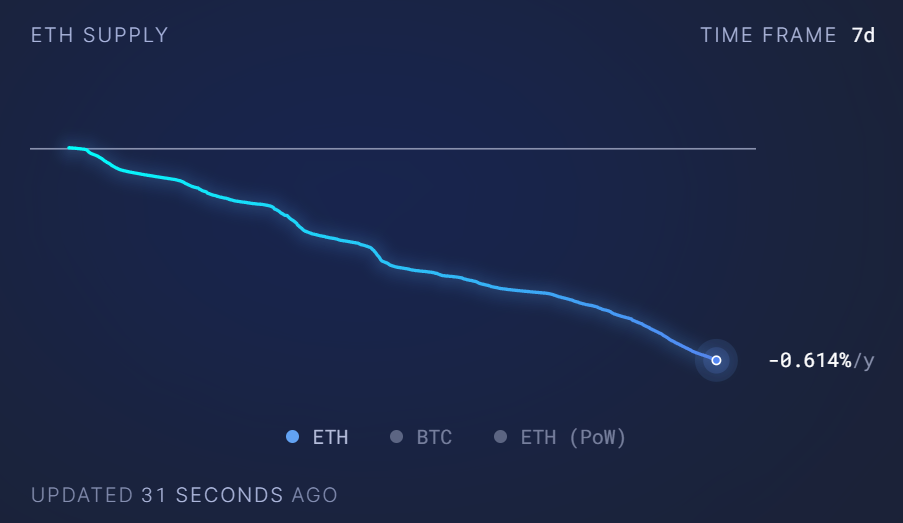

上周有 2878 万枚 ETH 锁定在信标链中,对应质押率 23.94% ,环比增长 0.2% ;其中活跃验证节点 88.84 万个,环比上涨 1.02% 。本周 ETH 质押收益 3.84% ,ETH 年化通胀-0.61% ;Uniswap、Maestro 与 BananaGun 是燃烧 Gas 前三名的 Defi。

本周 ETH 质押数量环比增长 1.02%

来源:Beaconcha.in,LD Capital

本周 ETH 质押收益率 3.84%

来源:LD Capital

ETH 年化通胀下降至 0.61%

来源:ultrasound,LD Capital

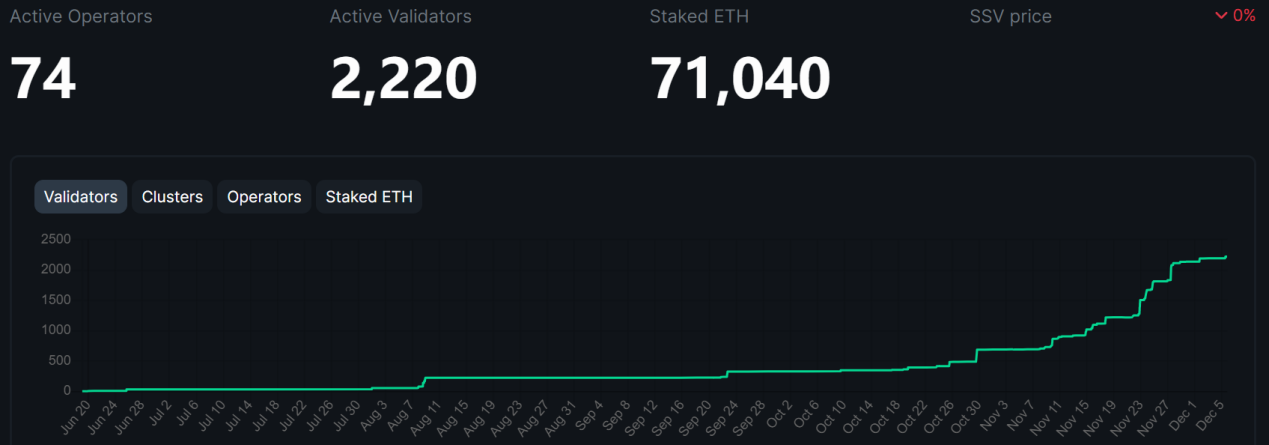

三大 LSD 协议中,从价格表现来看,LDO 一周上涨 2.3% ,RPL 上涨 14.5% ,FXS 上涨 21.7% ;从 ETH 质押量角度来看,Lido 一周上涨 0.78% ,Rocket Pool 上涨 0.39% ,Frax 上涨 1.19% ;FXS 受益于 FRAX CR 的提升、BAMM 与 Fraxchain 的即将上线实现了上周最大涨幅;RPL 由于其抵押 RPL 质押 ETH 的机制使得 RPL 一定程度上锚定 ETH 的价格,目前 RPL 质押率 50.89% ,有效质押率 94.14% ,存款池余额 18092 枚 ETH;Dragonfly Capita 上周抛售 450 万美元 LDO;SSV 无许可的主网升级投票票通过,TVL 达到 71000 枚 ETH。

目前 SSV TVL 达到 71000 枚 ETH

来源:SSV Scan,LD Capital

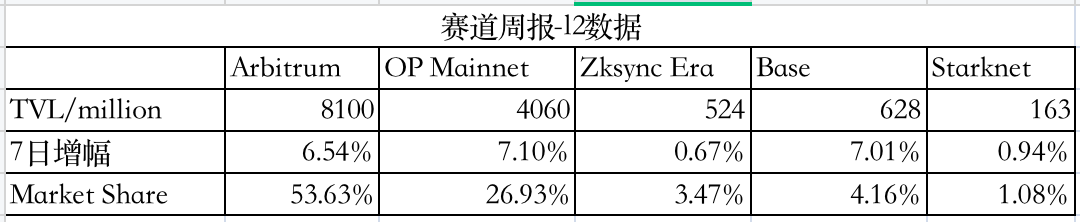

以太坊L2

TVL

Layer 2 TVL 总量为 151.1 亿美元,近 7 日整体 TVL 上涨 6.91% 。

来源:L 2b eat, LD Captial

ACDC 会议

11.30 日 123 次 ACDC 会议主要分享了 Cancun/Deneb 的测试更新

1、推出 Devnet #12 :Cancun/Deneb 升级已于 11 月 30 日星期三在 Devnet #12 上激活。当前正在运行的三个 CL 客户端没有发现重大问题,但最受欢迎的 CL 客户端 Prysm 尚未加入,Prysm 团队预计在两到三周内将他们的软件准备好在最新的 Devnet 上进行测试。预计今年年底前的某个时间推出 Goerli 影子分叉。

2、Devnet #11 上的验证器退出问题:开发人员发现 Devnet #11 上的验证器退出问题,Nimbus 客户端团队正在解决该问题。Devnet #11 将保持正常运行,直到问题得到解决

3、网络规范澄清:开发人员讨论了澄清“BlockByRoot”和“BlobSidecarsByRoot”请求的规范,以明确提及 CL 节点是否应按特定顺序响应这些请求

Arbitrum

1、 12 月 3 日,Arbitrum DAO 已批准一项 2110 万枚 ARB 代币(约合 2354 万美元)的一次性备用资金,以支持错过第一轮拨款的 26 个项目。获得此次拨款的 26 个项目包括 Gains Network(450 万枚 ARB)、Stargate Finance(200 万枚)、Synapse(200 万枚)、PancakeSwap(200 万枚)、Wormhole(180 万枚)、Magpie(125 万枚)、RabbitHole(100 万枚)、dForce(100 万枚)、Vela(100 万枚)等

2、 12 月 5 日,多链借贷协议 Radiant Capital 针对 200 万枚 ARB 的空投计划发布更新,资格期于 2024 年 2 月 16 日之前结束。新的 6 – 12 个月 dLP 在第一次快照(区块 147753665)之后和第二次快照(未来 30 – 90 天内)之前在 Arbitrum 上锁定或重新锁定才符合空投条件,且 12 个月的锁定比 6 个月的锁定收到更多的 ARB

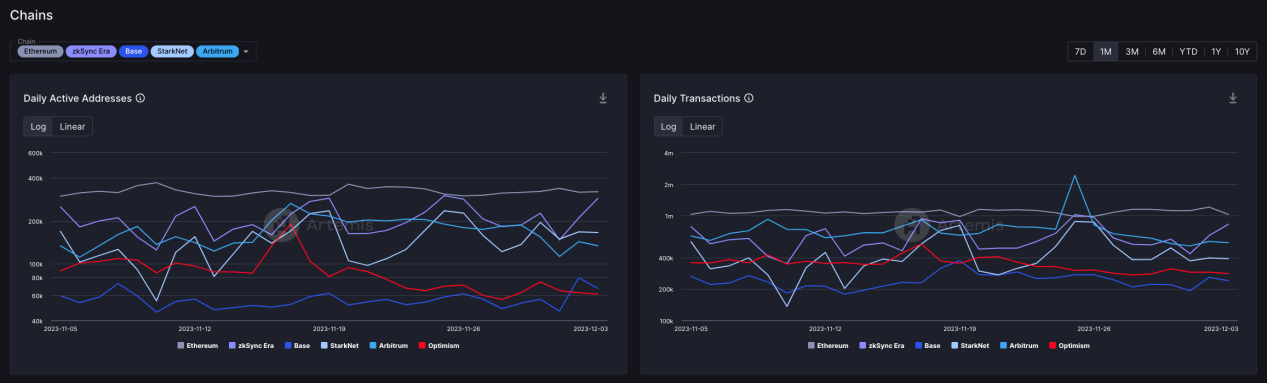

链上活跃度

来源:Artemis

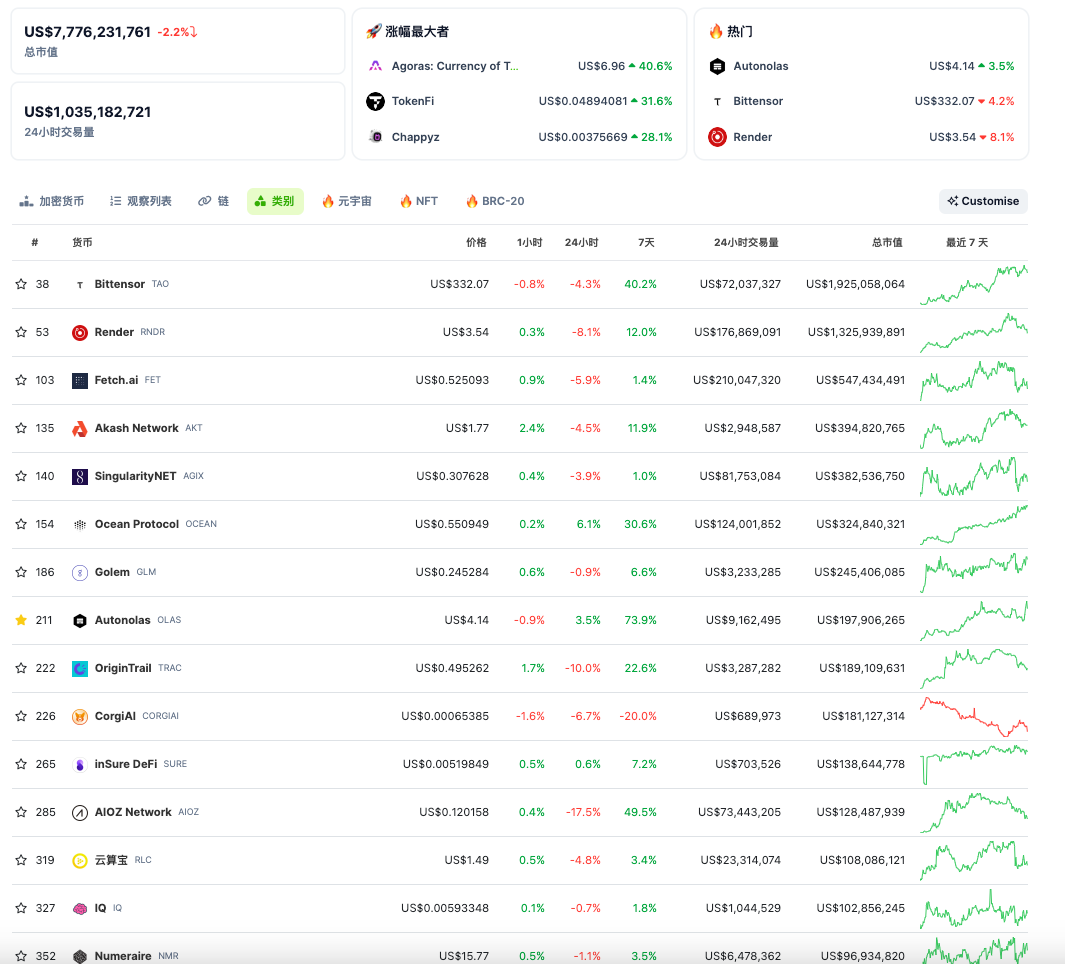

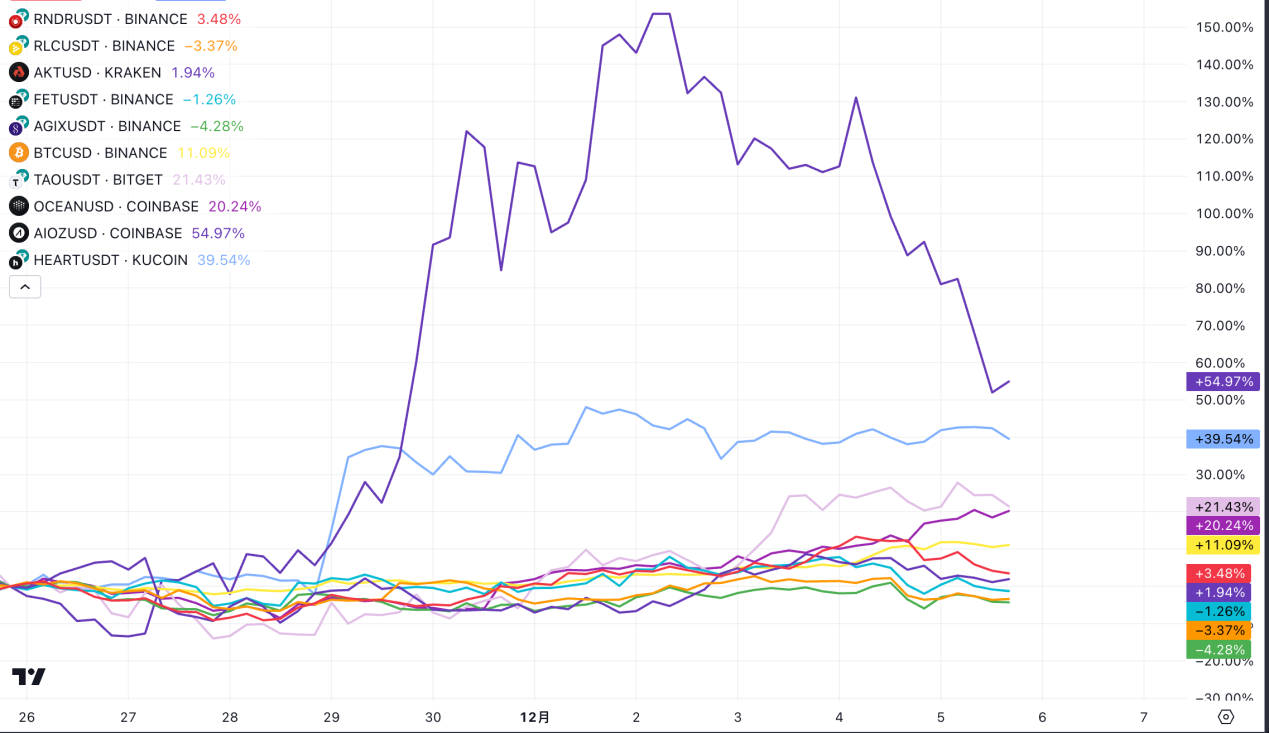

AI

过去一周 AI 板块代币价格跟随大盘不同幅度上涨,但仅有少部分项目跑赢 BTC 涨幅,表现较好的有 TAO, OCEAN, OLAS, AIOZ, HEART, AGRS

来源:Coingecko

来源:Tradingview

AI 会议与科技公司

1、纽约人工智能峰会将在 12 月 6 日-12 月 7 日在 Javits Center 举行,部分Web3项目参会赞助并发言。

来源:AI Business

2、 12 月 3 日,据 The Information 援引两位知情人士报道,谷歌已将人工智能模型 Gemini 的发布时间推迟到 2024 年 1 月份。

3、 11 月 26 日,Elon Musk 发推称,几周后将在 X(原 Twitter)推文下添加「Grok,analysis」按钮

TAU

11 月 29 日 TAU 在推特宣布最近获得了一项名为“对匿名互联网用户进行任意认证的方法和系统”的美国临时专利,该专利将在五个方面提升 Tau Net 的优势:

(1)增强的用户验证:专利中引入的系统可以在保持匿名的同时验证用户信息。

(2)稳健的治理框架:专利系统支撑着 Tau Net 的治理,确保民主、透明的决策,反映社区共识。

(3)预防机器人影响:该专利解决了去中心化网络中的一个关键问题,确保了稳健的验证过程,防止机器人驱动的操纵或控制。

(4)现实世界应用:该系统允许用户验证各种声明,例如专业证书,可以链接到他们的数字身份,从而增强在线交互的信任

(5)用户隐私授权:该专利尊重用户隐私,不要求个人信息与公钥关联,从而在保护用户身份的同时赋予用户网络治理的权力

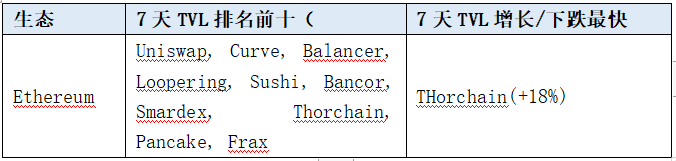

DEX

Dex combined TVL 13.3 billion,较上周增加了 0.62 billion。Dex 24 小时交易量 4.4 billion, 7 天交易量 21 billion, 较上周减少 1 billion。

Ethereum

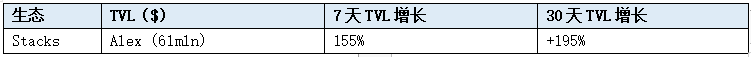

ETH L2/sidechain

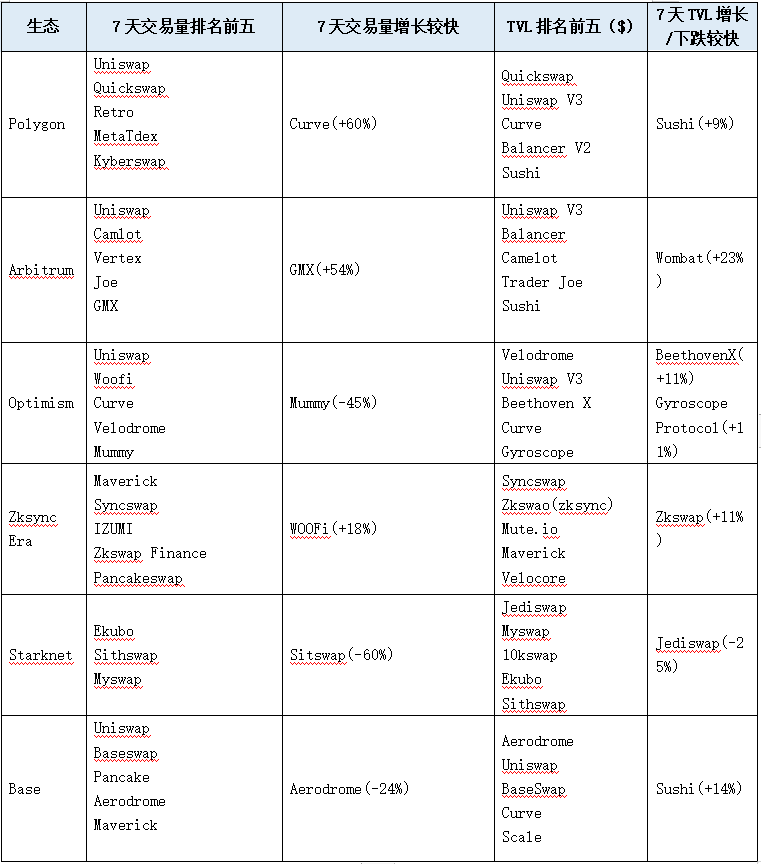

BTC L2/Sidechain

BTC 生态普升,STX 上的 BRC 20 一周 TVL 翻了三倍,从 24 mln 增长至 61 mln

Alt L1

Cosmos

本周 IBC volume 净流入排名前十的项目为:Osmosis, Axelar, Cosmos hub, Kujira, Noble, Celestia, Neutron, Stride, Akash 和 Terra。

Cosmos hub 发起分配 90 万 ATOM 到 Osmosis stATOM/ATOM 池的投票,该提案旨在通过向此池分配 900 k atom 来增加 atom 的流通资金。BTC 行情如果持续,预期 Cosmos 生态的 ATOM,RUNE,NTRN 继续保持良好上涨趋势。

衍生品 DEX

上周,BTC 突破 38000 的阻力位,站上了 40000 。这带来了持仓量的增长,当前合约持仓达到了 394 亿美元,比此前上涨了大约 40 亿美元。持仓量已经恢复到 2022 年上半年的水平。

过去一周,合约仍然维持着较高的交易量。不过,这一次 BTC 突破 40000 ,没有像突破 32 K 的时候,形成超高的交易额。

衍生品 DEX 赛道格局不变,交易量依然是 DYDX 处于第一梯队,GMX/SNX 处于第二梯队。不过,衍生品 DEX 交易量本周相较于前两周有较大幅度的降低。

DYDX 在 12 月 1 日解锁了团队和投资人的所持有的大约 30% 的代币,占代币总量的 15% 左右。解锁前流通市值占比约为 19% ,解锁后 38% ,流通市值相当于增长了一倍。在解锁当天,Amber group 将解锁的大约 570 万枚代币存入币安进行卖出,代币价格下跌约 6% 左右。伴随潜在抛压的释放,DYDX 短期利空得到了消化。

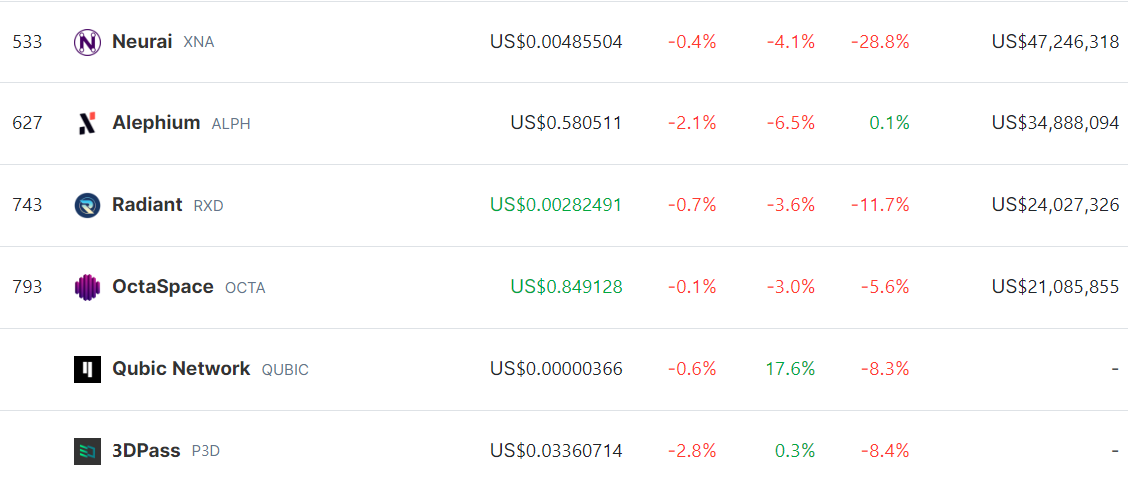

POW

POW 概念代币出现分化。旧的 POW 概念代币,伴随 BTC 突破 40000 ,出现上涨。新的 POW 概念币龙头 KAS、TAO 仍维持震荡上涨的状态。除了 CLORE 外,市值在 1 亿美元以下的 POW 新代币,则依然处于回调之中。主要原因在于,这些小市值代币此前上涨幅度较大,以及部分项目长期发展不明朗,获利盘退出。TAO 和 CLORE,不仅仅受益于 POW 概念,也受益于 AI 概念。AI 赛道在过于一周整体上涨。

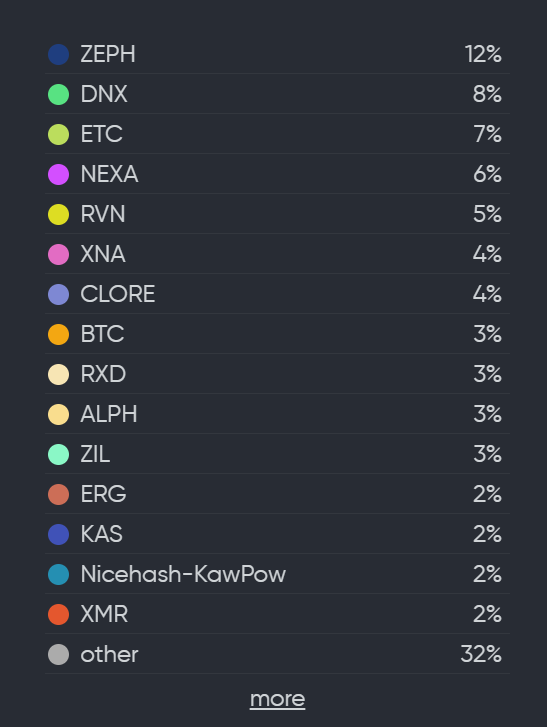

从 GPU/CPU 的算力来看,ZEPH 继续保持算力的增长。虽然价格离最高点回调了 40% 左右,但算力依然在增长。CLORE 的算力从上周的 3% 上涨了约 4% 。DNX 的算力被新发展的项目吞噬,下降到不足 10% 。

GameFi

本周,游戏板块总体比较冷淡。自 11 月 28 至 12 月 5 日中,Gamefi 板块中价格涨幅最高代币为 BIGTIME。MEME 次之,RON 随后。Bigtime 和 Meme 近期并无太多营销动作和游戏进展,而 Ronin Network 则由于 pixels 游戏进场,整体活跃人数有所上涨。但目前 Ronin 链上主要资产仍为 Axie Infinity,流入 Ronin 的资金量暂无明显增加。

(注:由于 Gamefi 项目过多,只收录部分项目。)