SignalPlus 매크로 연구 보고서 특별판: 소원을 빌 때 주의하세요

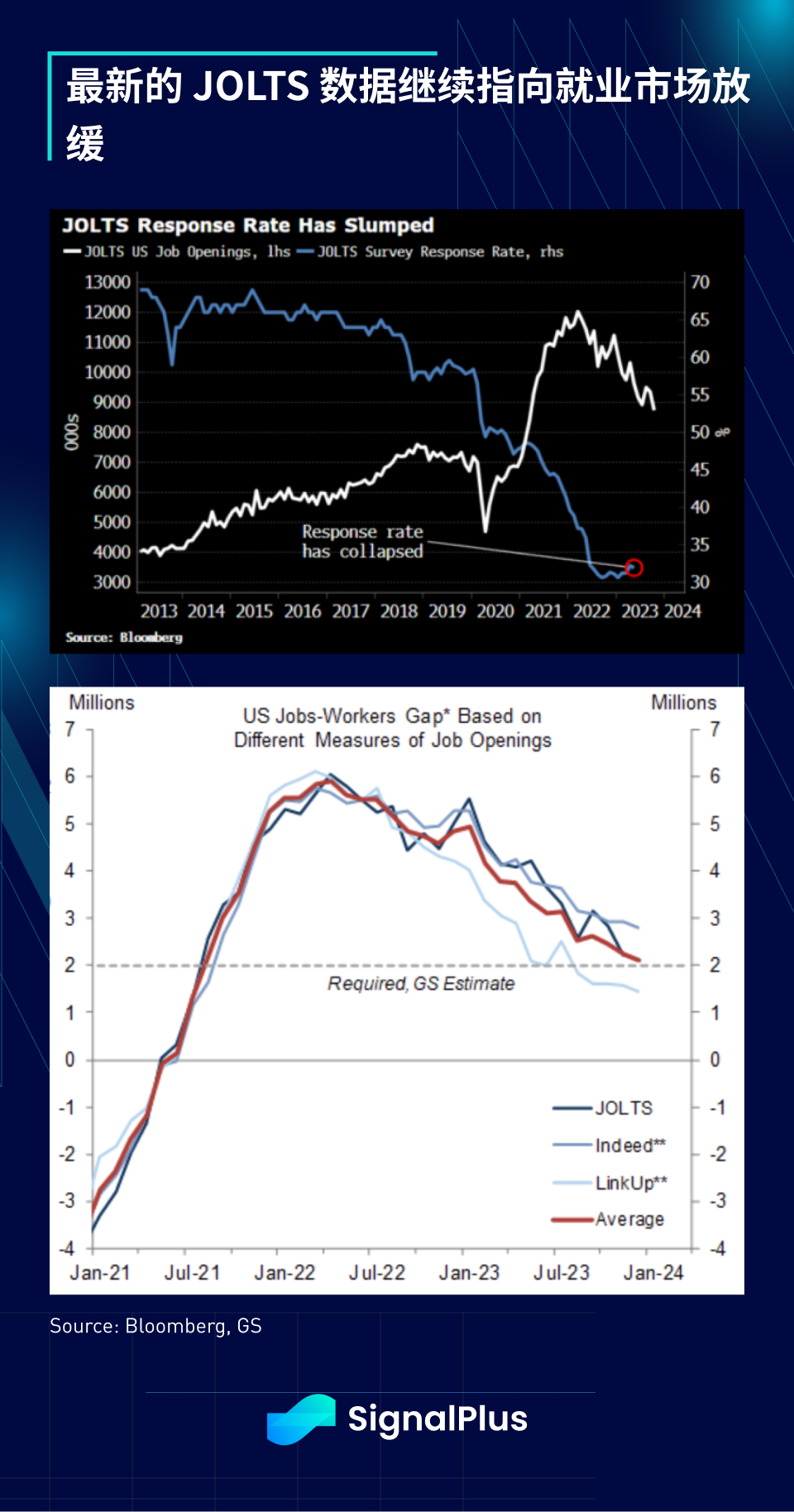

어제 발표된 JOLTS의 일자리 수는 10월에 617,000개 감소한 873만3,000개로 시장 예상보다 낮았습니다. 이전 수치도 하향 조정되었으며, 실업자 대비 일자리 비율도 1.3(전염병 전 1.2=적음)으로 떨어졌습니다. 꽉), 이는 정상화된 고용 시장에 대한 연준의 오랜 표준에 가깝습니다. 일부 시장 관찰자들은 예상보다 낮은 JOLTS 데이터를 낮은 응답률의 원인으로 여길 수도 있지만, 빈도가 높은 다른 고용 지표에서는 비슷한 둔화를 보였습니다. , 경제학자들은 현재 수준이 고용 시장의 균형을 재조정하고 인플레이션을 2% 범위로 되돌리는 데 필요한 임계값일 뿐이라고 추정합니다.

미국 국채 수익률은 강세 움직임으로 전반적으로 5~10bp 하락했습니다. 이는 뉴욕의 오전 데이터 이전에 이미 시작된 반등이라고 유럽중앙은행(ECB)의 유명한 매파 관료인 슈나벨은 다음과 같이 말했습니다. 인플레이션이 상당한 감소하면 금리 인상 옵션이 제거될 수 있습니다. 그녀는 원래 유럽 중앙 은행의 가장 보수적인 구성원 중 한 명으로 간주되었지만 이제 그녀의 태도가 크게 바뀌었습니다. 불과 한 달 전에 그녀는 다음과 같이 주장했습니다. 인플레이션과 맞서기 위한 마지막 마일이라며 금리를 계속 인상해야 한다. 길은 종종 가장 어려운 곳이다. 이러한 변화에 대해 그녀는 케인즈의 유명한 명언인 사실이 바뀌면 나는 간다를 인용했다. 내 마음이 바뀔까요, 당신은요? 그녀는 3회 연속 예상치 못한 양호한 인플레이션 데이터 이후 자신의 입장이 바뀌어 추가 금리 인상 가능성이 상당히 희박해졌다고 지적했습니다.

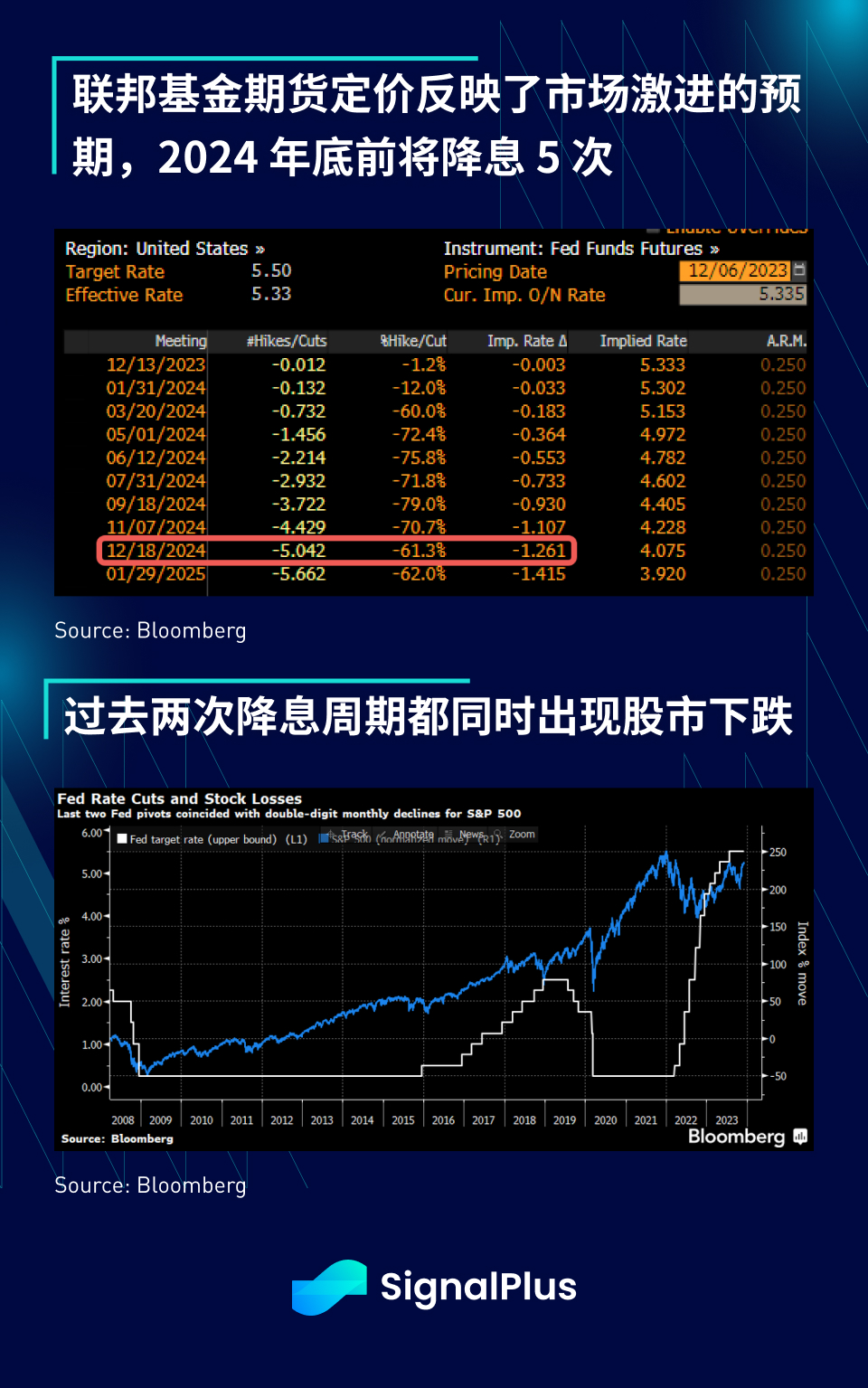

시장이 전반적으로 비둘기파적으로 변하면서(2024년에 5번 이상의 금리 인하로 가격이 책정됨) 이전 금리 인하는 종종 위험 심리의 하락을 동반했다는 점을 잊지 마십시오. 지난 두 번의 금리 인하 주기로 인해 SPX 지수가 움직였습니다. 금리 인하는 일반적으로 경제와 관련되어 있기 때문에 급격히 낮아집니다. 상당한 경기 침체가 동시에 발생하거나 아직 알려지지 않은 예상치 못한 위기가 발생하면 위험 자산 시장은 당분간 나쁜 소식은 좋은 소식이다라는 주문을 계속 수용할 수 있지만 우리가 천천히 전환점에 접근하고 있을 가능성이 있으며, 그 이후에는 나쁜 소식이 위험에 부정적인 영향을 미칠 수 있습니다.

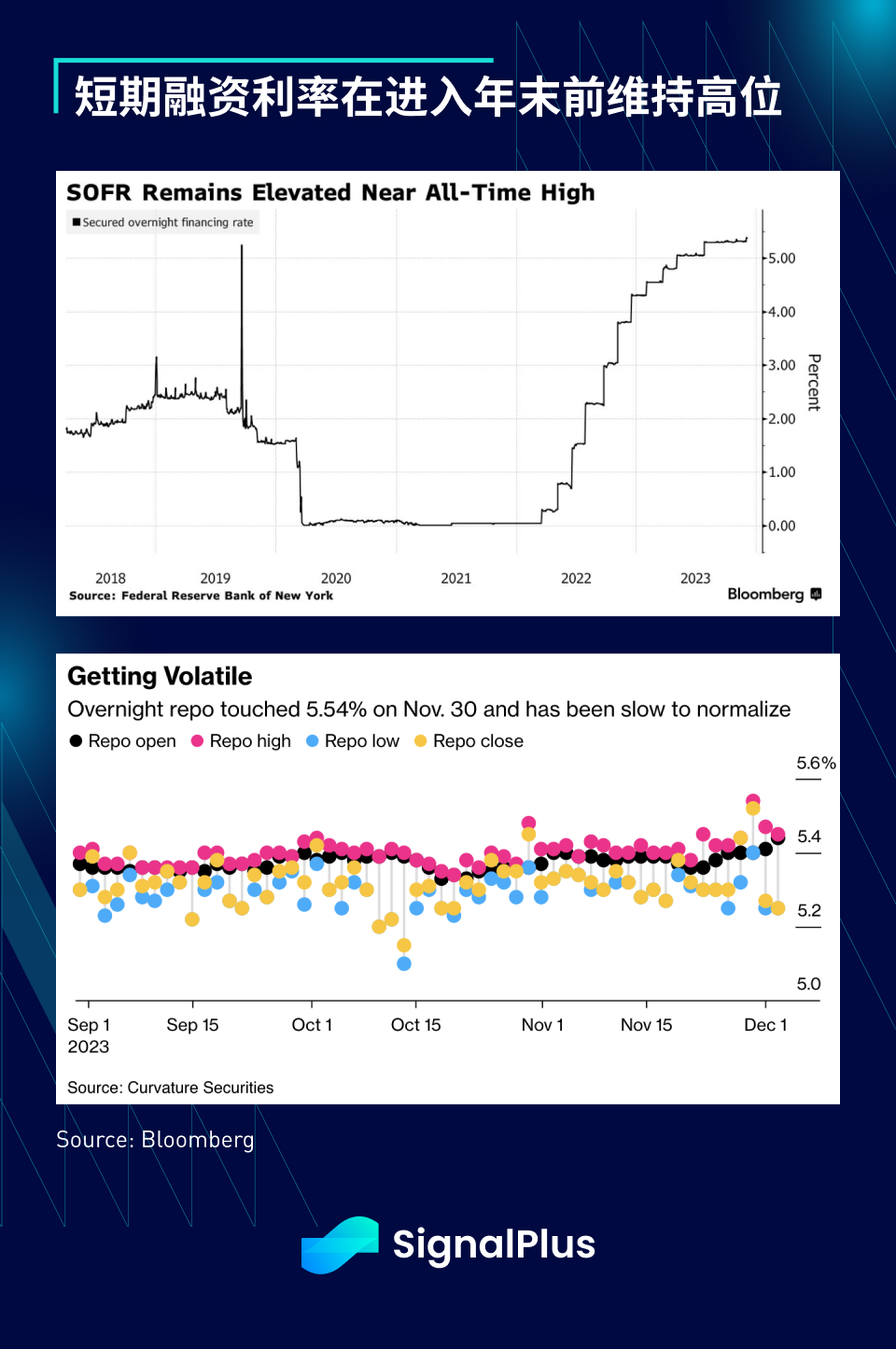

연말 연시가 다가오면서 금융기관들은 대차대조표 관리에 신중을 기하고 있고, 연준의 지속적인 양적 긴축과 역환매 소진으로 인해 시스템 전반의 유동성이 통제되고 있습니다. 다만, 연말에 단기 자금조달 금리가 더욱 급등해 전체적인 리스크 노출도가 낮아지고 예상치 못한 리스크 포지션이 축소될 수도 있다는 점은 어느 정도 주목해볼 수 있다.

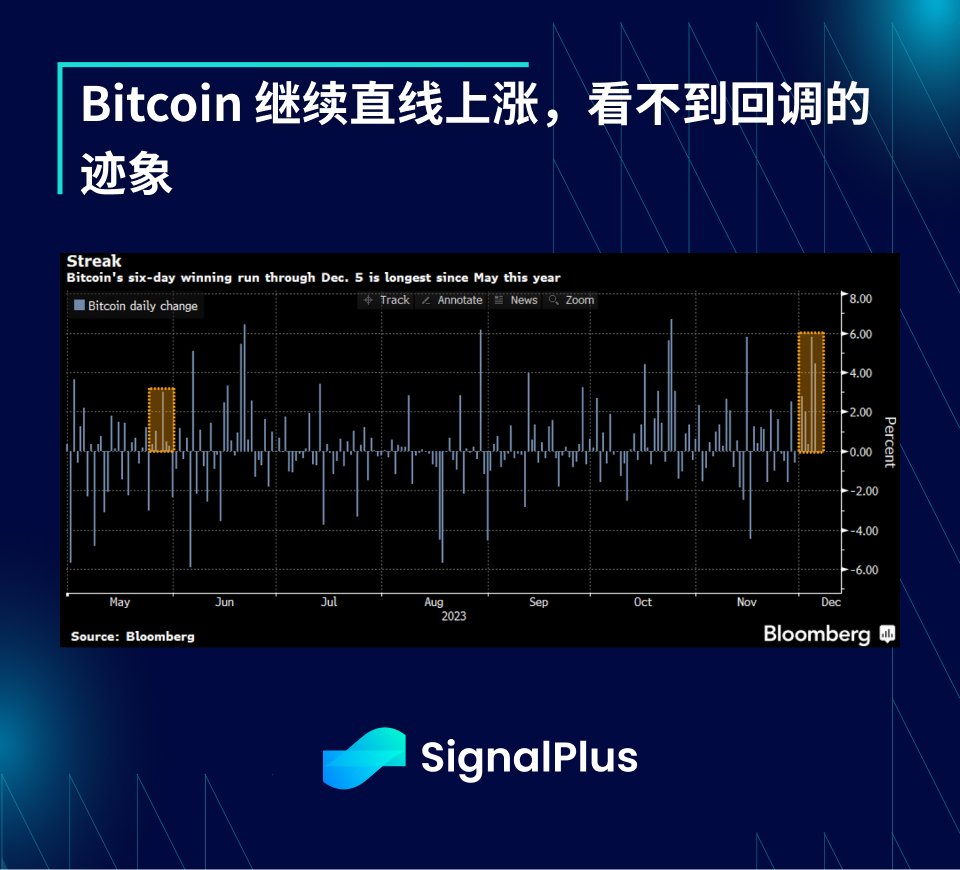

암호화폐 측면에서는 크리스마스 파티가 계속되고 있으며 BTC는 현재 올해 5월 이후 가장 긴 랠리를 보이고 있으며 가격은 44,000달러에 육박하고 ETH도 2,300달러에 접근하고 있으며 DeFi 공간, TVL 등 모든 곳에서 FOMO 징후가 나타나고 있습니다. 최근 저점 대비 150억 달러, 주요 프로토콜 토큰은 두 자릿수 상승세를 보이고 있으며, 검증되지 않은 프로토콜이 빠르게 대량의 TVL을 축적하고 있다는 이야기가 나오기 시작했습니다.암호화폐가 이러한 회복세를 계속 누리고 있는 가운데, 모두가 안전에 주의해야 한다는 점을 상기시켜주세요!

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: xdengalin), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요.

SignalPlus Official Website:https://www.signalplus.com