牛初来临?NFT交易所竞争格局有哪些变化?

原文作者:defioasis

原文编辑:Colin Wu

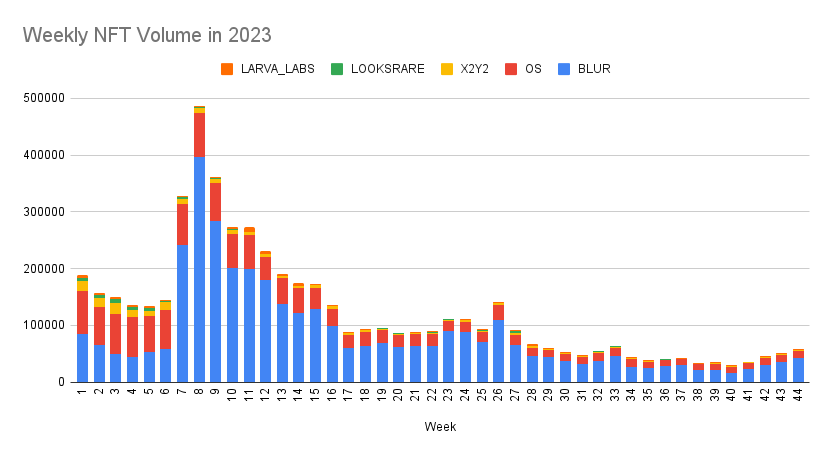

在过去一个月里,随着 Crypto 市场的整体回暖,主流 NFT 交易市场迎来本年度下半年的首次连续 4 周交易量正增长(上一次出现在今年的 1 月末至 2 月中旬),交易量几乎翻了一番。这种增长要显著高于 ETH 价值的上涨,这意味着 ETH 交易量的增多。另一方面,蓝筹价格也出现回升,BAYC 一度重回 30 ETH 上方,Azuki 近一个月涨超 17% 等。(注:如无特别说明,下文所述交易量均不含 wash-trade)

数据来源:https://x.com/punk9059/status/1720431770804371564?s=20

在当前 ETH 涨幅竞争不过 BTC 的行情下,ETH 持有者不愿以此换仓为 BTC,在不加显性杠杆的情况下,投资于 NFT 市场成为了较佳选择。不仅投资者所期许的获得币本位和 E 本位的双增长,同时也让 NFT 交易市场看到了牛市将即的曙光。

值得感慨的是,NFT 交易市场的坚韧,尽管行情艰难,也未有大型交易市场倒下;对于 NFT 这种新兴资产的坚守,如果从更长远的未来来看,获得的回报可能不亚于今日的 CEX。

笔者曾在今年 4 月对 NFT 交易市场竞争格局和策略进行了分析,如今回首,格局并未出现根本性变化,Blur 仍展现出了强大的统治力,但也出现了更多的新生力量,如 OKX NFT Marketplace 和 Flooring Protocol。另外,一些主流交易市场的策略为了应对市场变化也进行了许多有意思的变动。

推倒重建,OpenSea 经验主义的失败 & Blur 的从容

就在 11 月初,OpenSea 宣布裁员 50% ,以调整团队和减少中层管理,从头构建运营文化、产品和技术,打造 OpenSea 2.0 。OpenSea CEO Devin Finzer 表示,OpenSea 2.0 将会从底层技术、可靠性、速度、质量和用户体验多个方面进行重塑,并且将会有一个与用户直接联系的团队。

OpenSea 此次裁员本质是为了应对市场份额持续下滑所带来的营收持续减少而不得不做出的策略调整,而推倒重建的 OpenSea 2.0 则有点像是为了夺回市场份额而做出的孤注一掷。

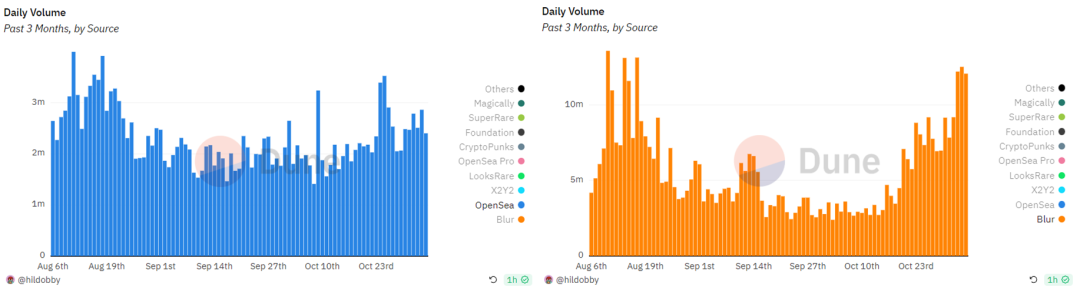

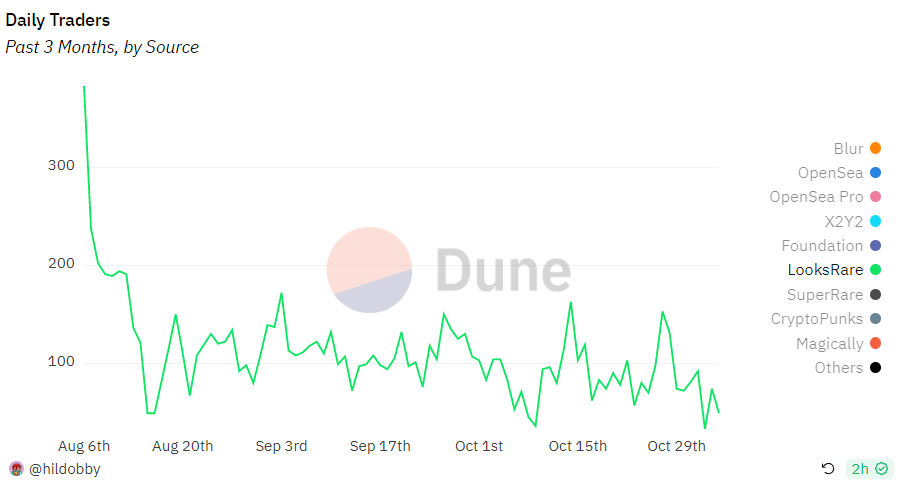

OpenSea 被人诟病的点可以主要划分为两种:产品难用,更新缓慢;中心化运营,社区声音不在意。不过这些在外人较为关注的点,可能在其内部没有被真正意识到。以 OpenSea 如今的裁员来推测,从 2017 年存活至今,OpenSea 会有一套适应生存的经验主义,整体上会是偏保守以及等待契机。这套经验与 2017-2020 间漫长的寂静期,以及 2021 年 NFT 交易的突然爆发紧密相关。虽然不能说有什么错误,但也因此让其不断地被 Blur 侵蚀市场份额。特别是,在不限于 NFT 的整个 Crypto 行情的回暖阶段,能明显看到 Blur 的反弹势头要比 OpenSea 强劲许多,且曾 2 倍领先的交易者差距也在迅速缩小,这对于 OpenSea 是直击过往经验主义的冲击。OpenSea 意识且怀疑到,过往的经验不管用了。

数据来源:https://dune.com/hildobby/NFTs

虽然为了应对 Blur 的冲击,OpenSea 也做出了一些产品回应和社区回馈,比如也效仿 Blur Bid Pool 推出了更为简洁的 Offer Wall,以及在 Gem 的基础上推出了 OpenSea Pro 聚合器,并面向 Gem 历史用户空投 NFT,但很可惜的是,这些产品和社区策略更像是独立地被动式回应,而没有串联在一起且缺乏持续性,这套用 NFT Drop 作项目启动并回馈社区的方式仅仅只被 OpenSea 使用了此一次。

相反,尽管团队保持了长时间的社交媒体静默以专注开发,但 Blur 这个产品却仍在有条不紊地持续运转着。那这里不得不谈到 Blur 的核心护城河:个人做市商,也是 OpenSea 经验主义失效的根本。在 Blur Bid Pool 诞生后,Blur 引入个人做市商带来了强大的流动性,而积分和潜在空投则对该行为进行着持续激励。Blur 的个人做市商主要是由 NFT OG 玩家、NFT 蓝筹顶级持有者和 NFT KOL 担任,他们不仅有很强的资产实力也有很大的社区话语权,他们的链上行为、社交媒体在潜移默化地影响着 NFT 玩家,比如 Machi Big Brother、hanwe.eth 和曾经的 BAYC 巨鲸 Franklin 等。他们提供流动性并从围绕资产真实价格的价差中获利,所提供的流动性使 NFT 交易变的更加效率并为创作者带来更多的收入。产品可以模仿,但收买人心的筹码会越来越昂贵。

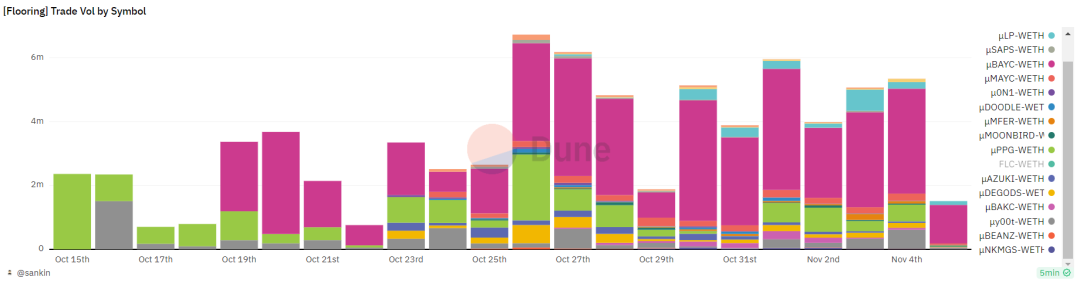

也正是因为个人做市商的存在,Blur 在面对新的后来着 Flooring Protocol 的挑战时显得十分从容。Flooring Protocol 是将 NFT 碎片化成为 ERC-20 μToken 的流动性解决方案,由 NFT OG 玩家 FreeLunchCapital 所推出。配合着 FLC 的激励,Flooring 的日均交易量约在 400 万至 600 万美元间(不含 FLC,仅包括 NFT 碎片化后的 μToken)。

数据来源:https://dune.com/queries/3151047/5268010

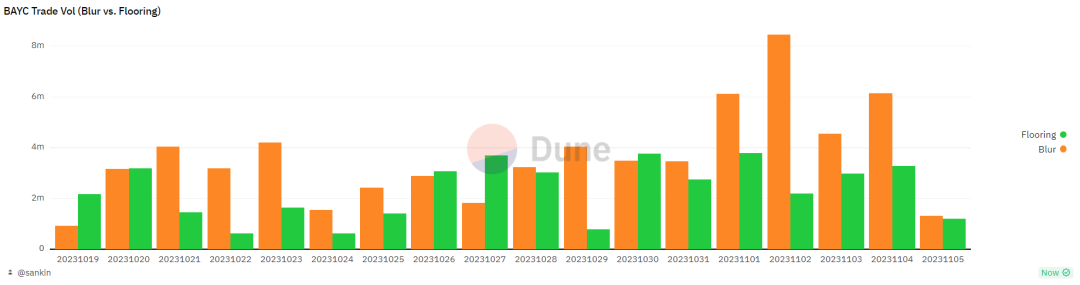

由于不完全适用于长尾资产,Flooring 因而实行的是类白名单的许可准入制。以交易量最大的 BYAC 作为对比,可以发现 Blur 的 Bid Pool 和个人做市商所引导的流动性与交易量并不逊色于应用在 AMM Pool 的 μToken。不过,Flooring 引入的 Safebox 模型对于稀有 NFT 资产价格发现能力有较大的提升,这点 Blur 尚不能有效实现。

数据来源:https://dune.com/queries/3172383/5295405

LooksRare&X2Y2 逐渐落幕的交易挖矿

在今年 9 月末,LooksRare 率先对代币经济学进行调整,结束了长达 1 年多的交易挖矿模型。从 10 月 1 日起,从 LooksRare Game:YOLO 和 Raffles 以及其他即将推出的游戏的所产生的费用, 50% 用于二级市场回顾 LOOKS, 10% 添加进 LooksRare 协议奖励可供赚取, 40% 被发送至国库。这也意味着,虽然交易挖矿结束了,但对于 LOOKS 质押者来说,除了可以继续享受到平台交易费用外,还能享受到 LookRare Game 的 10% 费用奖励。截至 9 月 29 日发布代币经济学修改通告时,已回购了 180 万 LOOKS 进入国库。

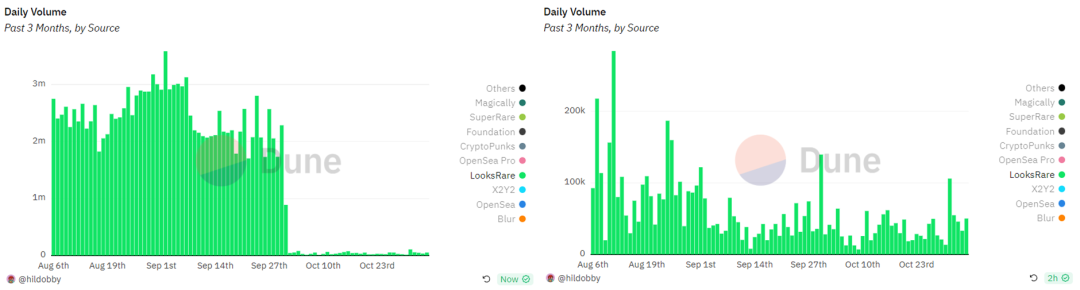

从结果来看,LooksRare 交易挖矿的结束使得该平台虚假交易量(如下左图)骤降接近零,对真实交易量(如下右图)的影响则相对有限。另一方面,从交易者数量变化来看,LooksRare 交易者在 8 月初便有较大的下滑,而待交易挖矿结束后,交易者数量却仍在同一个区间内波动,这似乎在说明,在 8 月至 9 月末这段交易挖矿即将结束的后期阶段,所进行交易挖矿的用户仍在交易挖苦结束后(10 月)留存。这样的变化可能反应在 LooksRare 存在一批忠实用户,或存在团队下场交易的可能。

数据来源:https://dune.com/hildobby/NFTs?Wash+Trading+Filter_e106ea=

虽然无法完全确认事实如何,但依托于 LooksRare Game 的创新运营方式为用户的留存创造了条件,如 Yolo 融入了 Gambling 元素,Raffles 则是以 NFT 为奖励的抽奖。LooksRare 会提供任务,让用户去参与这些小游戏以达成任务条件获得宝石,而宝石能兑换为 LOOKS。在这个过程中,会有一些与 NFT 交易相关的任务,以此达到刺激平台交易量的目的。交易量越大,或参与游戏的资金越大,能获得的宝石就越多。不过,就目前来看,用户似乎并不太愿意为此付出大量的资金。

另一个平台 X2Y2,尽管仍保留交易挖矿,但也在迈入 11 月的第一天宣布从 11 月 7 日起代币每日排放量减产 50% 。在 4 月份时,笔者曾指出,LooksRare 更加专注于平台本身功能的内扩,X2Y2 走的则是基于 NFT 全金融生态的外拓之道。现在来看,亦仍是如此。与代币减产一同宣布的还有即将推出跨链聚合器,以及宣称孵化的 NFT 交易市场 Dew 获得了 Polygon NFT 的 30% 的市场份额。基于想要构建的更广泛的 NFT 生态,想必未来 X2Y2 代币经济学还会迎来更多的调整。随着 X2Y2 代币完全产出日期(2024 年 4 月 3 日)的逐渐逼近,NFT 交易挖矿时代也将迎来落幕。

对于 X2Y2,有个有意思的小插曲是,在 9 月末,Yuga Labs 旗下 Otherside 游戏 Legends Of The Mara 上线时,由于其他 NFT 交易市场无法提供强制版税的交易而被拉入黑名单,X2Y2 因此也被 Yuga Labs 作为官方首选 Mara NFT 交易推荐市场。这个小插曲无意之间让 X2Y2 拥有了一个独特的优势,不过同时也为 Yuga Labs 打造合约约束的强制版税市场埋下伏笔。

多链与聚合

避开了 Ethereum 上的直接竞争,偏安一隅的平台走多链或聚合路线大多也能获得一定的发展,其中走多链兼聚合路线的佼佼者是 OKX NFT Marketplace,多链路线走在前列的还有 Magic Eden。另外,Element 和 Zonic 等小平台在新兴公链上亦有不错的流量支持。

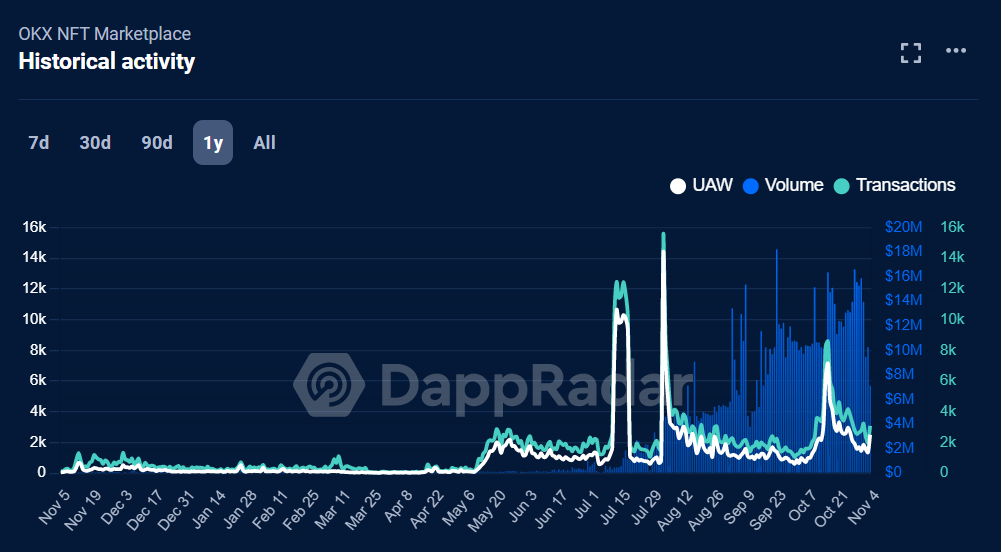

内置于交易所的 Web3 钱包带来的流量红利,终于在今年下半年迎来爆发,OKX NFT Marketplace 交易量和用户迎来爆炸式增长。目前 OKX NFT Marketplace 支持 17 条公链,聚合 6 大交易市场的流动性。目前 OKX NFT Marketplace 的每日聚合交易量约在 700 万至 1500 万美元之间,不过自有市场交易量仍较少,相当于 OKX 利用 CEX 转化成的链上用户流量也造福了其所聚合的流动市场。

数据来源:https://dappradar.com/dapp/okx-nft-marketplace?range-ha=30d

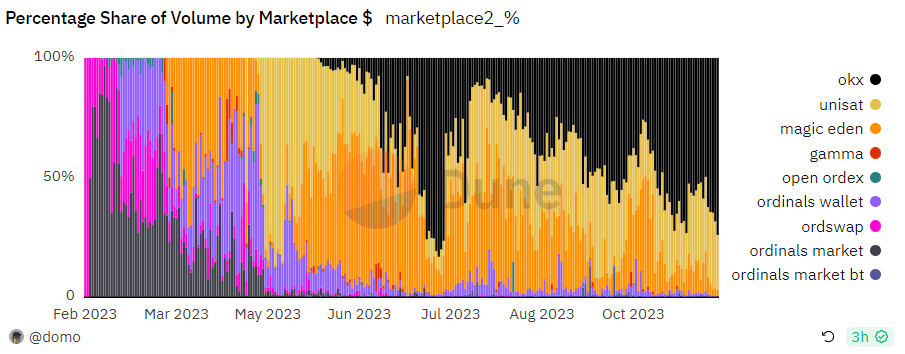

经历过 Solana 生态崩溃的 Magic Eden 在多链市场上的发力依旧不容小觑, 6 月末与 Helio 合作推出了多链 NFT 预售平台, 8 月在 Polygon 上推出 100 万美元创作者基金, 9 月上线 Solana cNFT, 11 月宣布与 Yuga Labs 合作推出受合约约束保护创作者版税的 Ethereum NFT 交易市场。基本每个月都有多链布局的大动作。不过,如果从现在回头看,Magic Eden 在 10 月份宣布暂停 BRC-20 交易似乎不是一个明智的选择,其在 Ordinals 的市场份额也从曾经的超过 50% 下降至不足 5% ,取而代之的是 OKX。

数据来源:https://dune.com/domo/ordinals-marketplaces

多链市场 Element 和 Zonic 思路相似,在一键发链的大背景下,以最短的上线时间迎合新兴 L2 的发展,争夺撸毛用户,在 zkSync Era、Base、Linea 和 Scroll 等 L2 上活跃地址位居头部,但 L2 NFT 社区发展尚处于雏形,所贡献的交易量十分有限,活跃度也容易受到和空投潜在相关活动的影响。

注: 4 月份时的文章可以参考该线程:

https://x.com/defioasis/status/1651123667248758785?s=20